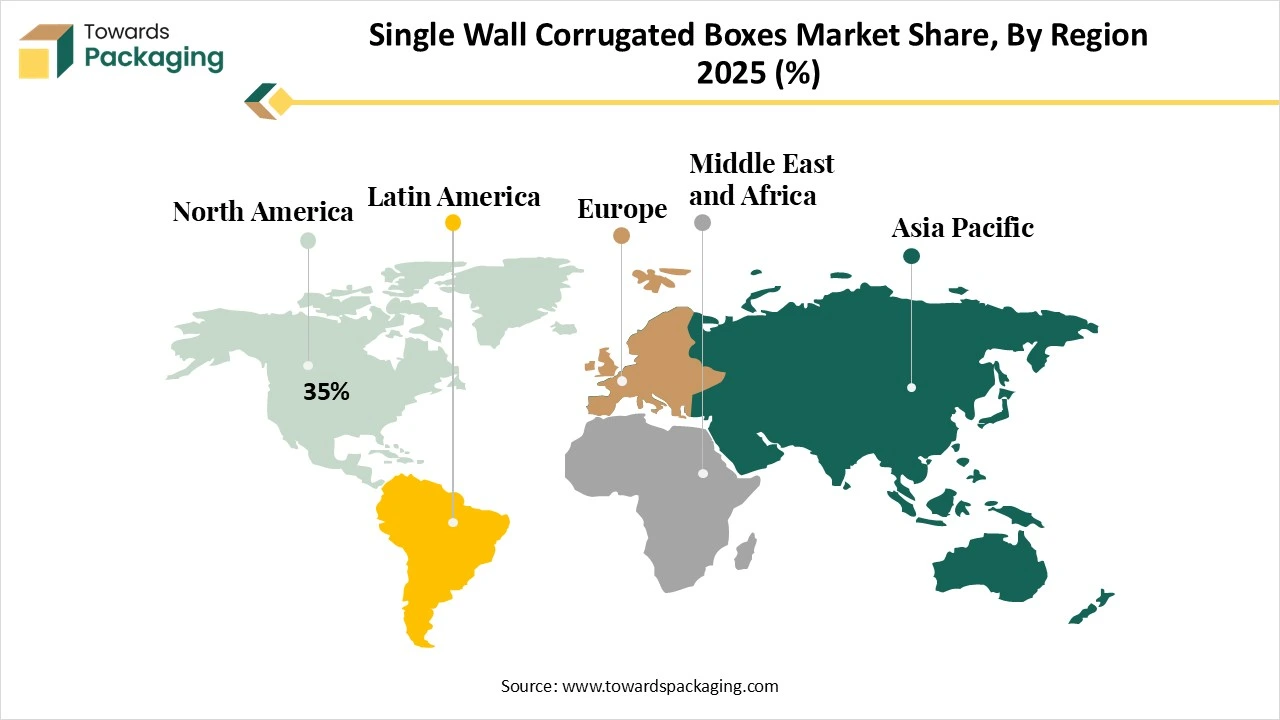

The Single Wall Corrugated Boxes market is booming, poised for a revenue surge into the hundreds of millions from 2026 to 2035, driving a revolution in sustainable transportation. This report provides in-depth coverage of market trends, key segments by material type, box type, and end-use industry, and regional insights across North America, Europe, Asia Pacific, Latin America, and MEA. North America dominated the market in 2024, while Europe is expected to witness significant growth due to stringent sustainability regulations. Key players such as Mondi Group, International Paper, WestRock Company, DS Smith, and Smurfit Kappa Group are profiled alongside competitive strategies, value chain analysis, trade data, and manufacturer insights.

In the packaging industry, Single-wall corrugated boxes are the most commonly used packaging solution, offering a good balance of cost-effectiveness and strength. Single-wall corrugated boxes generally consist of a single inner layer, a single outer layer, and a fluted medium sandwiched between the two. Single Wall Corrugated Boxes are widely used across various industries such as e-commerce and retail, food and beverage, consumer goods and electronics, and others. Single-wall boxes are lightweight and cheaper than double-wall or triple-wall boxes. They are well-suited for shipping lightweight or non-fragile items.

Single-wall corrugated boxes are extensively available in a wide range of sizes, with different combinations of outer and inner liners and grammages. Recycled materials, reprocessed from previously used products, to becoming a vital component in sustainable packaging. Businesses are increasingly shifting to recycled content to optimize manufacturing processes and minimize wastage, offering both economic and environmental benefits.

| Metric | Details |

| Key Driver | Rising demand for eco-friendly, lightweight, and cost-effective packaging |

| Leading Region | North America |

| Market Segmentation | By Material Type, By Box Type, By End-Use Industry and By Region |

| Top Key Players | Mondi Group, International Paper, WestRock Company, DS Smith, Smurfit Kappa Group, Rengo Co., Ltd. |

As AI technology continues to evolve, Artificial intelligence integration holds great potential to positively impact the growth of the non-cushioned mailers market. Machine learning (ML) algorithms can effectively analyze historical and real-time data to optimize production schedules, predict maintenance needs, and reduce wastage. The incorporation of AI is a strategic imperative for manufacturers seeking to stay competitive in a complex and dynamic landscape by optimizing production processes, enhancing precision, personalized packaging, and sustainability.

AI is revolutionising the way single-wall corrugated boxes are designed. AI algorithms assist businesses in creating innovative designs customised to the evolving specific needs. AI-powered predictive maintenance alerts responsible operators before any critical component fails, which reduces downtime. AI assists in controlling the quality by using computer vision to detect any defects in corrugated boxes or printing misalignments, which are often overlooked by the human eye. Leveraging the power of AI ensures that the corrugated box industry remains competitive, agile, and responsive to meet the evolving needs of the market.

Increasing Demand for Environmentally-Friendly Packaging

The rising need for environmentally friendly packaging is expected to boost the growth of the single-wall corrugated boxes market during the forecast period. The rising environmental concerns are reshaping the packaging landscape, and single-box corrugated materials are meeting these demands. The increasing awareness of circular economy models influences sustainable packaging practices. Single-wall corrugated boxes are the most popular and sustainable packaging solution globally. These boxes are reliable, strong, and made from mostly recycled materials, heightened focus on significantly lowering carbon emissions. Several efficient methods are being adopted by manufacturers, where corrugated single-wall boxes are recycled into new packaging at scale. Additionally, the rising environmental concerns are increasingly encouraging businesses to invest in eco-friendly and sustainable packaging solutions, driving the expansion of the market during the forecast period.

Fluctuating Raw Material Costs

The price volatility is anticipated to hinder the market's growth. The fluctuation in the price of raw materials, particularly paper and wood pulp, has led to an increasing production cost of single-wall corrugated boxes, which can adversely impact the profitability of manufacturers. In addition, the risk of structural damage may hinder the growth of the global single-wall corrugated boxes market during the forecast period. The rough handling or excessive exposure to moisture often weakens single-wall corrugated boxes, which results in a reduction of their ability to protect contents. Waterlogged boxes lose rigidity and become more prone to collapsing during transit.

How is the Expansion of the E-commerce Industry Impacting the Market Expansion?

The rapid expansion of the e-commerce industry is projected to offer lucrative growth opportunities to the single-wall corrugated boxes market in the coming years. In the e-commerce industry, single-wall corrugated boxes are used for numerous applications, including shipping, packaging, and storage. Single-wall corrugated boxes allow for shipping lightweight goods with durability and strength. These boxes assist in improving handling efficiencies, product protection, and reducing product damage, and offer an economical option for the e-commerce industry. Moreover, printing on packaging improves branding and seasonal references to enhance the customer’s unboxing experience.

The Kraft paper segment held a dominant presence in the single-wall corrugated boxes market in 2024, owing to its maximum strength and durability for shipping. Kraft fibers are widely used to produce the liner of single-wall corrugated boxes. Kraft paper is considered a sustainable material, mostly obtained from wood pulp. These boxes are recyclable, biodegradable, and compostable, assisting in promoting a circular economy. On the other hand, the recycled paperboard segment is expected to grow at a significant rate. The growth of the segment is attributed to the growing need for eco-friendly materials. These single-wall corrugated boxes are made out of recycled paper; they are highly durable and eco-friendly.

RSC is the most common box style and is considered a highly efficient design for several applications. RSC boxes are most commonly utilised for Appliances, Consumer goods, Electronics, Fragile items, Industrial products, and others. RSC corrugated box is widely utilised as a shipping carton, owing to its cost effectiveness, highly efficient and versatile design that creates minimal wastage. On the other hand, the die-cut boxes segment is growing at the fastest CAGR. Die-cut boxes can be customizable to fit any shape, size, or need. Die-cut boxes also allow businesses to create more customizable looks that can be printed with logos and instructions. To enhance customer experience, custom die-cut boxes are increasingly becoming a popular choice for luxury brands and higher-end items. Moreover, the die-cut boxes offer various benefits such as versatility, enhance brand awareness, lower shipping costs, and provide product protection.

The food and beverages industry segment accounted for a significant share of the single-wall corrugated boxes market in 2024, growing demand for single-wall corrugated boxes for food packaging in fresh produce, ready-to-eat meals, and frozen foods. Single-wall corrugated boxes play a crucial role in the food and beverages industry by offering protection, durability, affordability, versatility, and availability in a wide range of sizes and innovative designs. Moreover, increasing adoption of these boxes in the packaging of meat, dairy, and seafood is expected to fuel the segment’s expansion during the forecast period. On the other hand, the e-commerce segment is expected to witness remarkable growth during the forecast period, owing to the rising online shopping of groceries, consumer goods, consumer care and cosmetics, and others.

North America has a robust presence of food and beverages, pharmaceuticals, retail and ecommerce, personal care and cosmetics, and the apparel industry, which are all major users of single-wall corrugated boxes. The region has a high e-commerce penetration rate, with prominent e-commerce giants such as Amazon, Walmart, Apple, and eBay widely using single-wall corrugated packaging for their light-weightiness, high strength, high durability, and aesthetic value. The incorporation of smart technologies into corrugated packaging, such as QR codes, NFC tags, and RFID tags, allows for real-time tracking, authentication, and improved consumer engagement.

The rising consumer and business inclination towards sustainable packaging solutions is expected to drive the market’s revenue in the region. For instance, in June 2025, International Paper announced the plan to explore building a new sustainable packaging facility in Salt Lake City, Utah. The exploration of a prospective new facility is part of International Paper's strategic growth plans to expand manufacturing capabilities in the United States. This initiative is part of IP’s broader strategy to expand its manufacturing footprint in the country and better serve customers by meeting the growing demand for high-quality, sustainable packaging.

On the other hand, Europe is expected to grow at a significant rate in the market during the forecast period, owing to the increasing focus on improving recyclability, stricter environmental regulations, rising consumer inclination for personalized and customized packaging solutions, surge in online shopping, and increasing demand for lightweight and cost-effective packaging solutions from various industries. Several manufacturers are heavily investing in developing innovative packaging designs and printing on packaging to better connect with customers and stand out from the competition.

Europe’s government-led sustainability initiatives and stricter environmental regulations compel companies to adopt eco-friendly alternatives, boosting the market’ expansion. European countries such as the Netherlands, Spain, France, Germany, and the UK are leading with robust recycling measures and EPRs. Policies like the European Union’s Circular Economy Action Plan encourage companies to invest more in sustainable packaging solutions. Such factors are increasingly contributing to the increasing demand for single-wall corrugated boxes in the region.

The corrugated packaging market is expected to expand from USD 309.86 billion in 2025 to USD 444.85 billion by 2034, growing at a CAGR of 4.10% from 2025 to 2034. Rapid expansion in online retail and the need for sturdy, cost-effective shipping solutions drive strong demand. Growing environmental regulations also push companies to adopt eco-friendly alternatives, fueling market growth.

Corrugated packaging refers to a type of lightweight, durable, and eco-friendly packaging manufactured from corrugated fiberboard, which consists of a fluted (wavy) middle layer sandwiched between two flat linerboards. This structure provides strength, impact resistance, and cushioning, making it ideal for shipping, storage, and product protection. Corrugated fiberboard is made up of three main components: liner board, fluting (Medium), and adhesives. The key benefits of corrugated packaging have been mentioned here as follows: strength, durability, cost-effective, lightweight, and versatility.

The global corrugated boxes market is projected to reach USD 283.02 billion by 2034, expanding from USD 180.26 billion in 2025, at an annual growth rate of 5.14% during the forecast period from 2025 to 2034. Increasing trend towards sustainable packaging is significant factor anticipated to drive the growth of the corrugated boxes market over the forecast period.

A corrugated box is a disposable container with three layers of material on its sides an outside layer, an inner layer, and a middle layer. When weighted materials are placed inside a corrugated box, the intermediate layer, which is fluted is designed in stiff, wave-shaped arches that act as supports and cushions. The process of aligning corrugated plastic or fiberboard (also known as corrugated cardboard) design elements with the functional, processing, and end-use requirements is known as corrugated box design. Packaging engineers strive to keep overall system costs under control while satisfying a box's performance criteria.

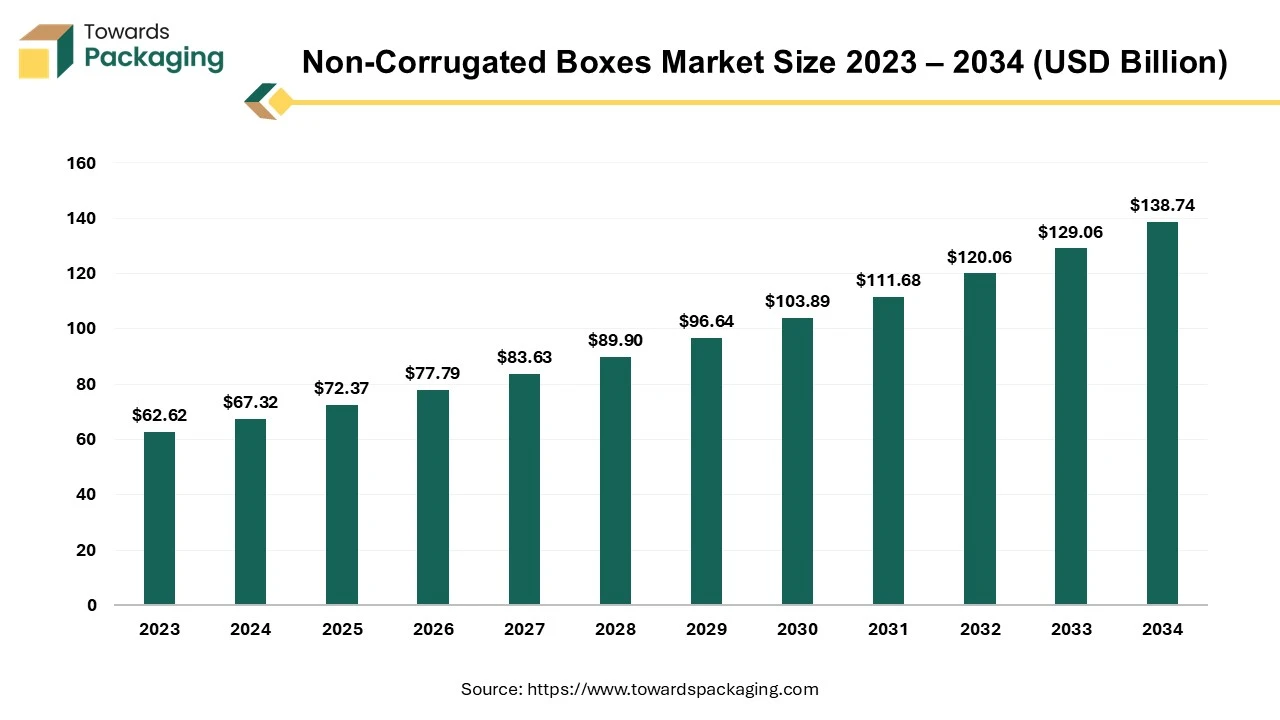

The non-corrugated boxes market is forecast to grow from USD 72.37 billion in 2025 to USD 138.74 billion by 2034, driven by a CAGR of 7.5% from 2025 to 2034. Due to rising trend of the fancy gift boxes the demand for the non-corrugated boxes increased which is estimated to drive the growth of the non-corrugated boxes market over the forecast period.

A non-corrugated box is a type of packaging box that does not have the fluted or ribbed layer found in corrugated boxes. Non-corrugated boxes are typically made from a single layer of material, such as cardboard, paperboard, or plastic. They lack the internal layer of fluted paper that corrugated boxes have. Common materials used for manufacturing non-corrugated boxes is paperboard, plastic, and cardboard among others. Plastic is in non-corrugated boxes manufacturing for meeting more durable and moisture-resistant packaging needs. Non-corrugated boxes are usually less durable than corrugated boxes because they lack the additional layer that provides cushioning and strength. They are often lighter, which can be beneficial for reducing shipping costs.

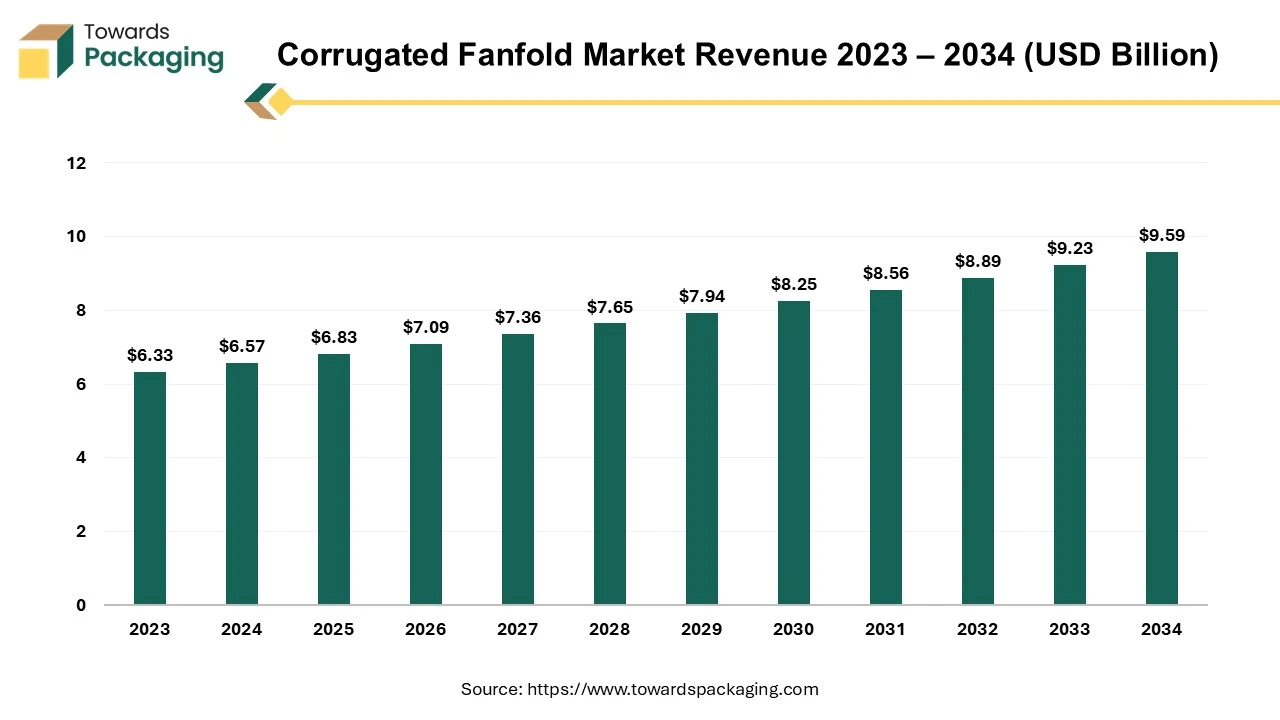

The global corrugated fanfold market is expected to grow from USD 6.83 billion in 2025 to USD 9.59 billion by 2034, registering a compound annual growth rate (CAGR) of 3.85% during the forecast period. This market expansion is primarily attributed to the rising demand for sustainable, cost-efficient, and customizable packaging particularly across e-commerce, logistics, and retail sectors. According to Smithers, the increasing shift toward on-demand packaging and right-sizing solutions continues to drive the adoption of corrugated fanfold among packaging manufacturers.

The market proliferates due to the rising e-commerce sector and the requirement of shipping & logistics where the safe and durable packaging of products is required. There is an increasing demand for sustainable packaging among consumers and strict government guidelines result in the growth of corrugated fanfold market development.

By Material Type

By Box Type

By End-Use Industry

By Region

November 2025

December 2025

November 2025

November 2025