Corrugated Open-head Drums Market Size, Share, Trends and Growth Forecast

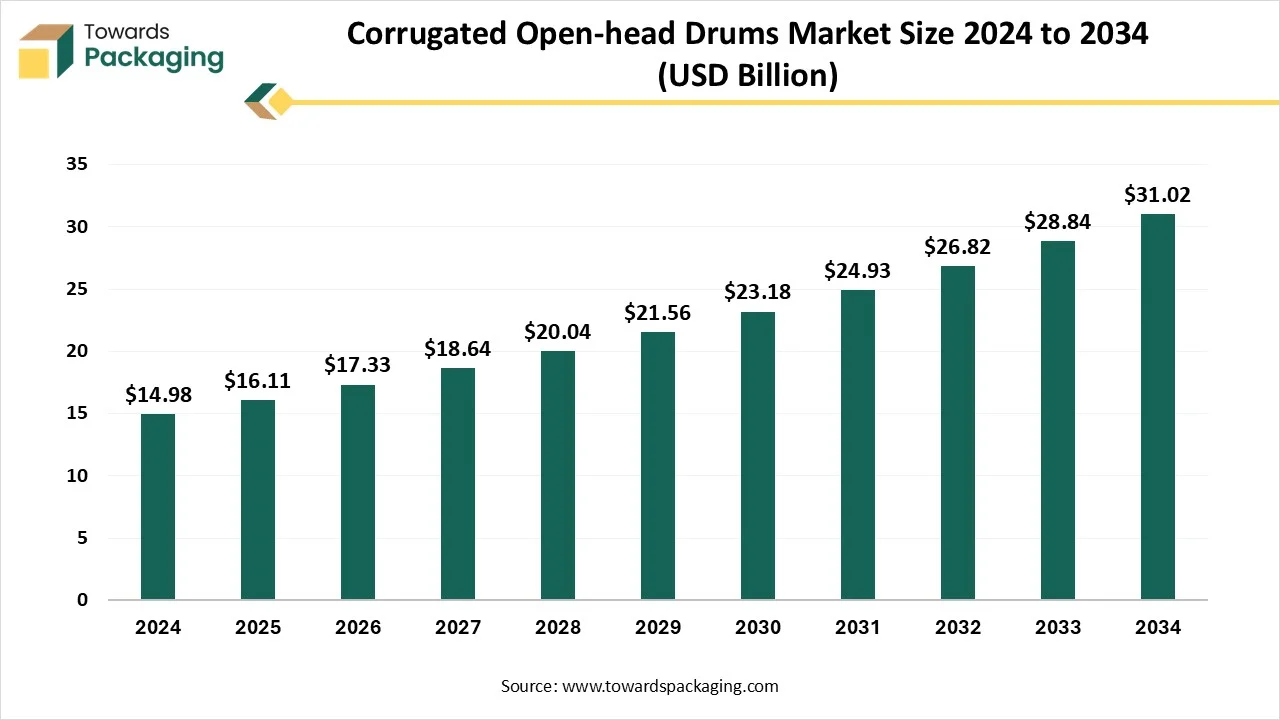

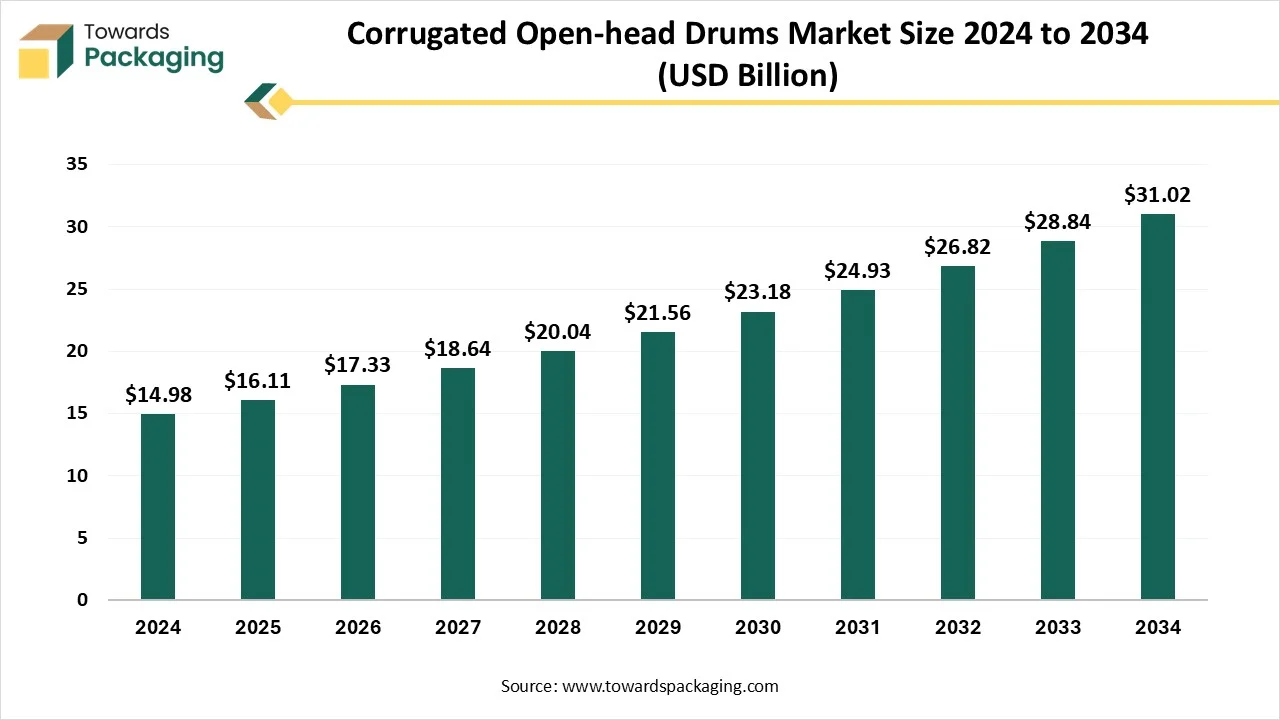

The corrugated open-head drums market is predicted to expand from USD 17.33 billion in 2026 to USD 33.36 billion by 2035, growing at a CAGR of 7.55% during the forecast period from 2026 to 2035. There is growing demand for corrugated open-head drums due to their eco-friendly nature, cost, and being perfect for different industries like agriculture, food, and chemicals, delivering secure and reliable solutions for transporting powders and liquids.

Key Highlights

- In terms of revenue, the market is valued at USD 17.33 billion in 2026.

- The market is predicted to reach USD 33.36 billion by 2035.

- Rapid growth at a CAGR of 7.55% will be officially experienced between 2025 and 2034.

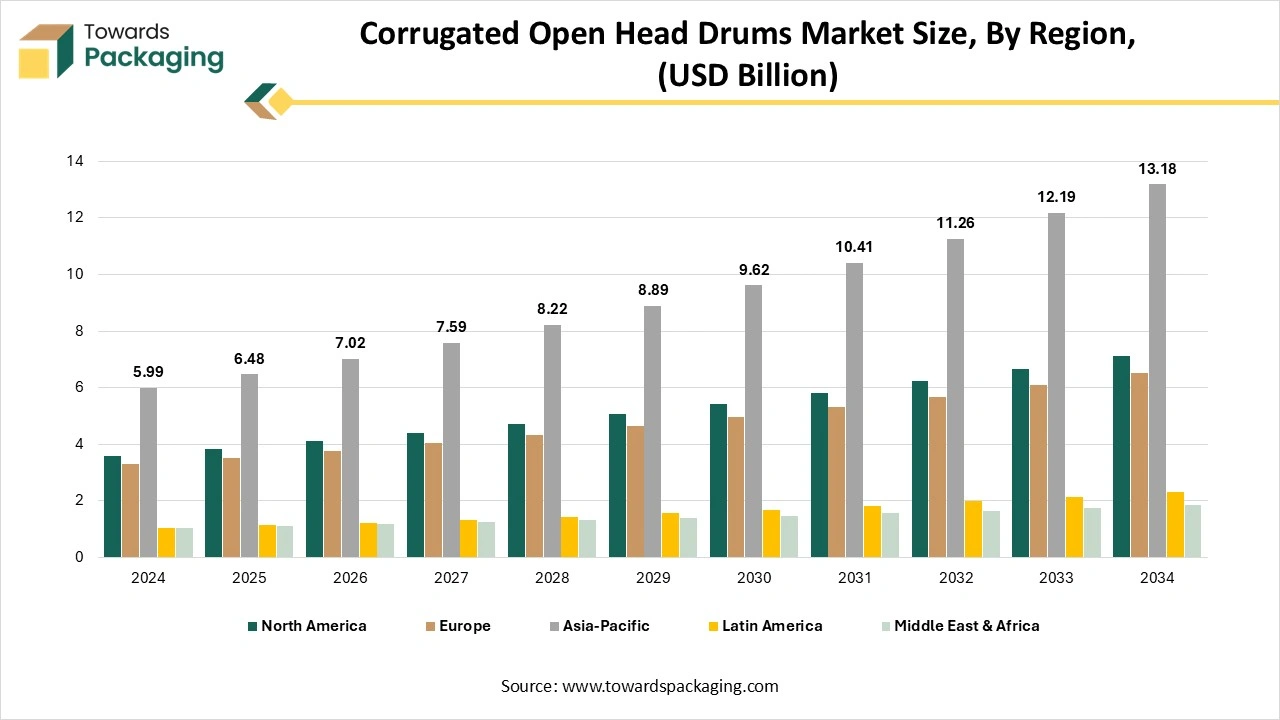

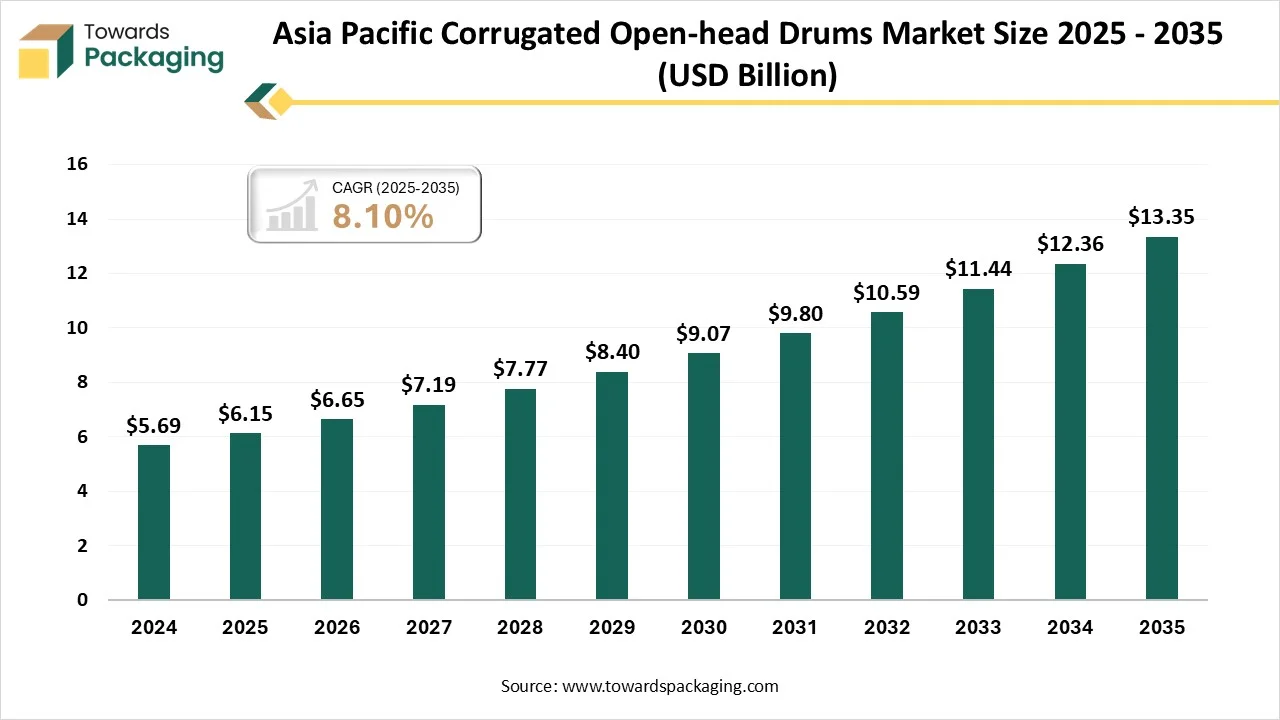

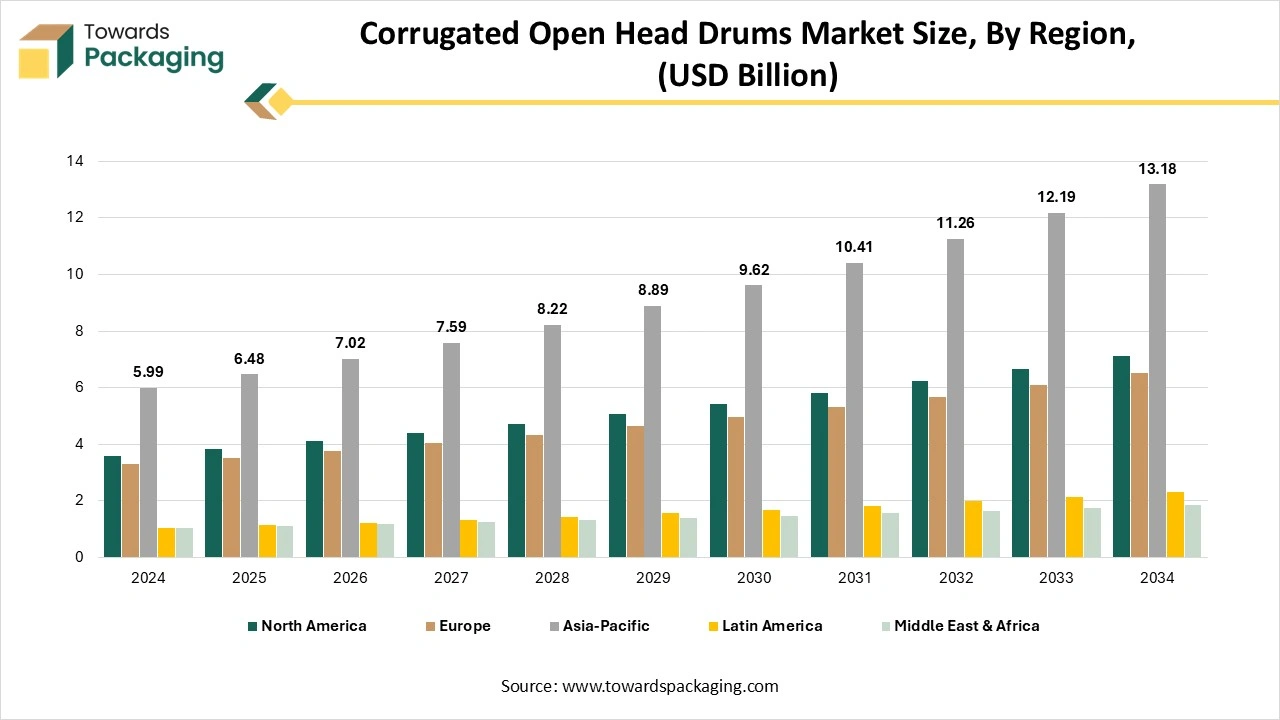

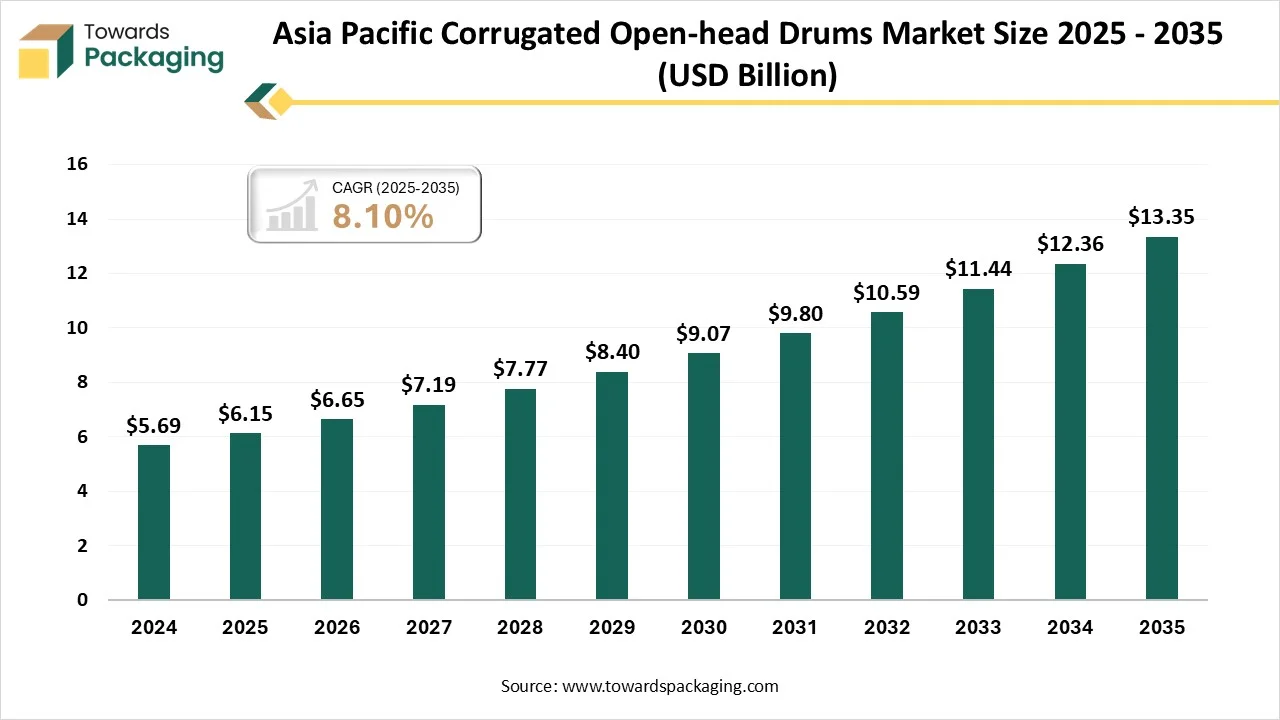

- By region, Asia Pacific contributed the largest share in 2024.

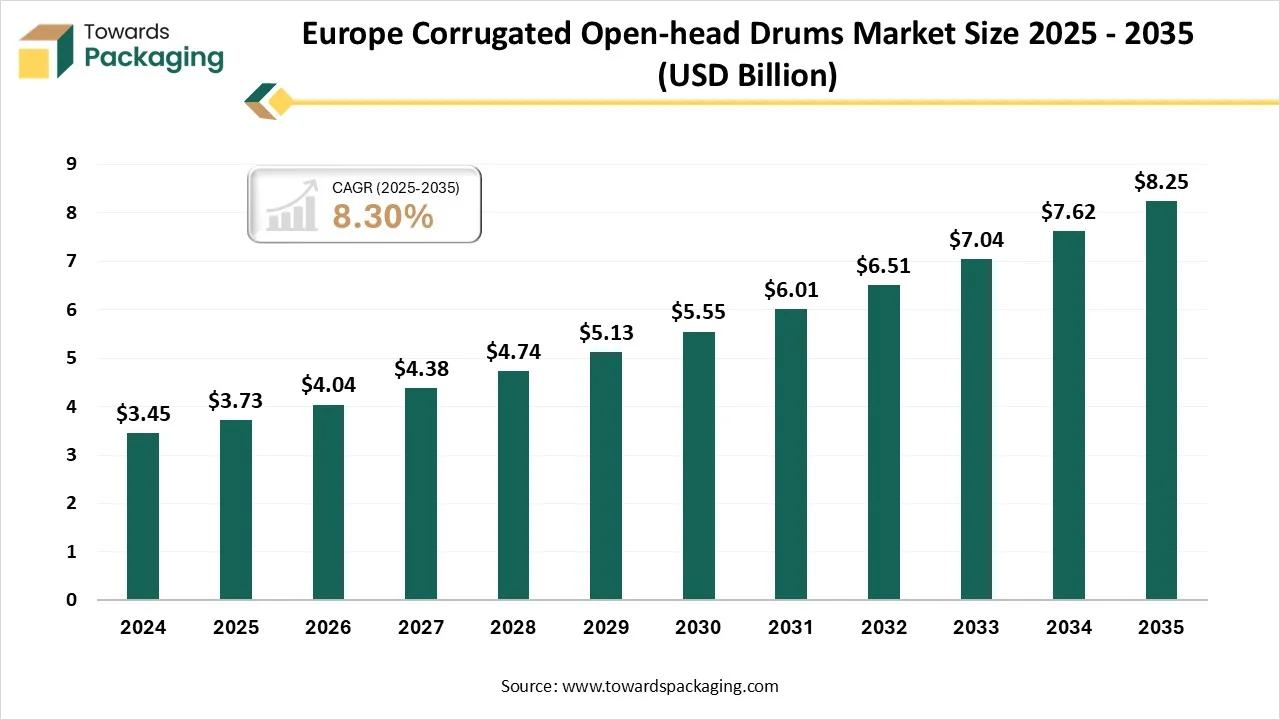

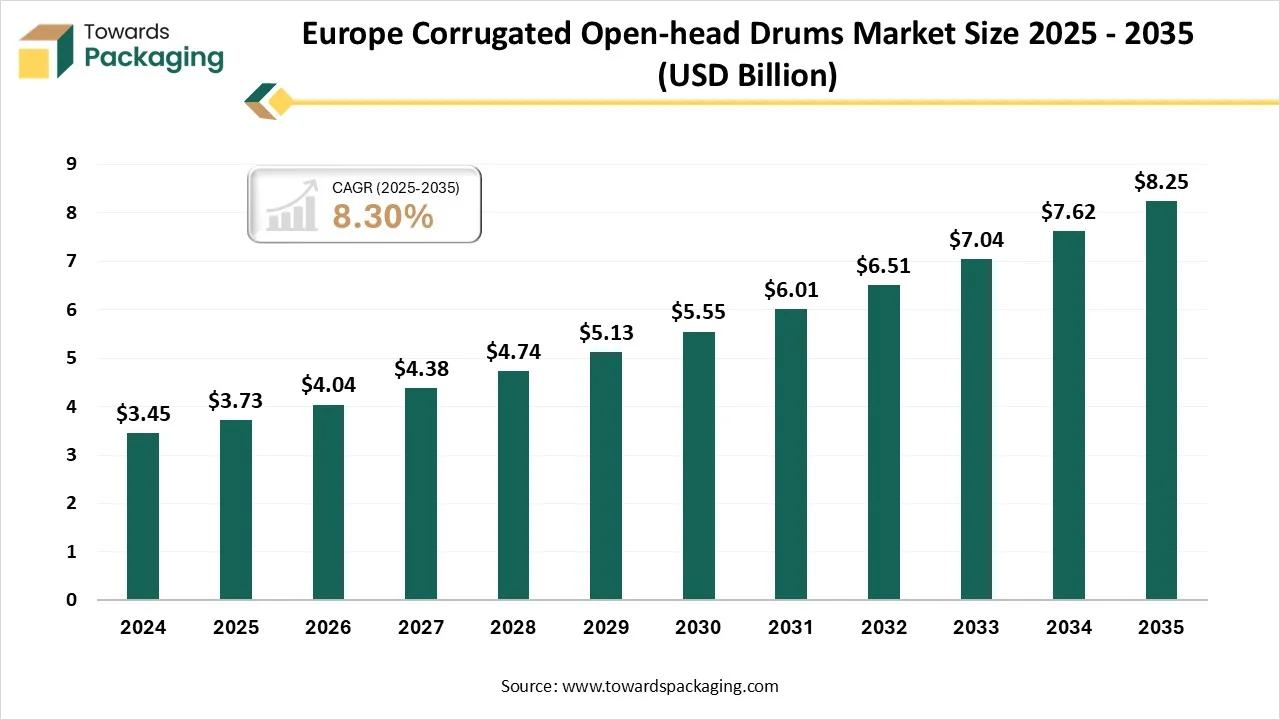

- By region, Europe is expected to rise at a notable CAGR between 2025 and 2034.

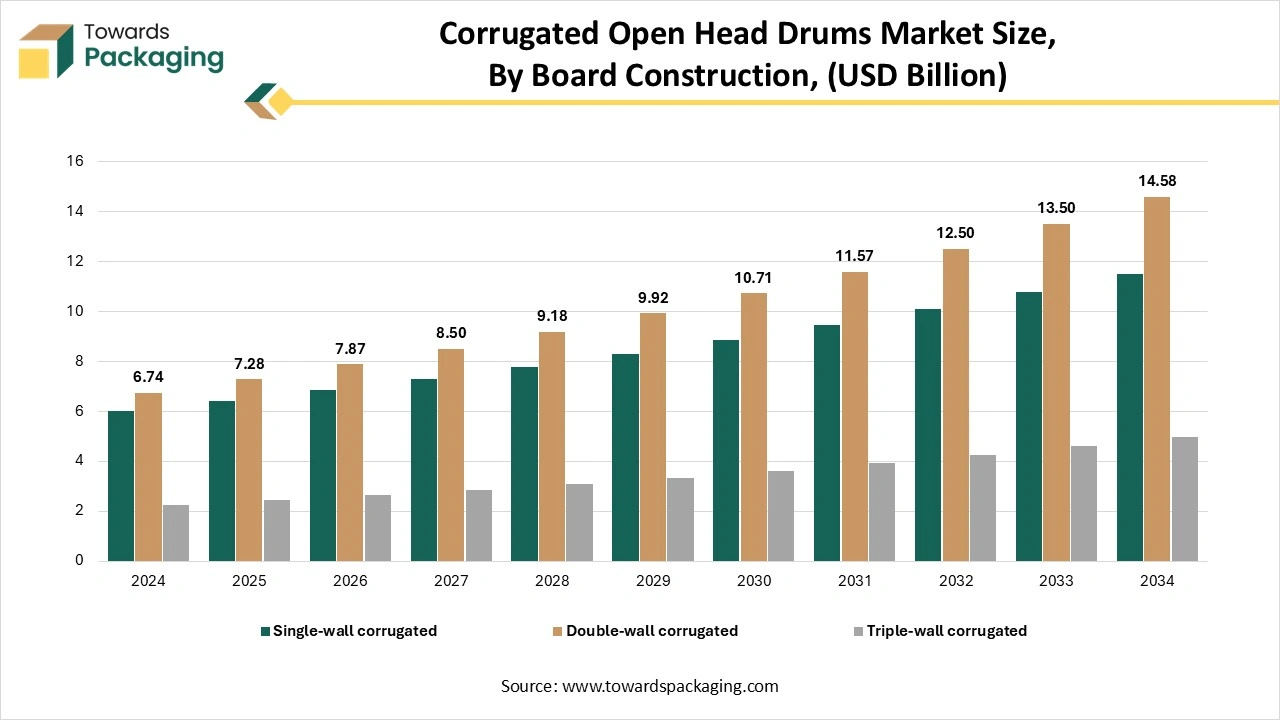

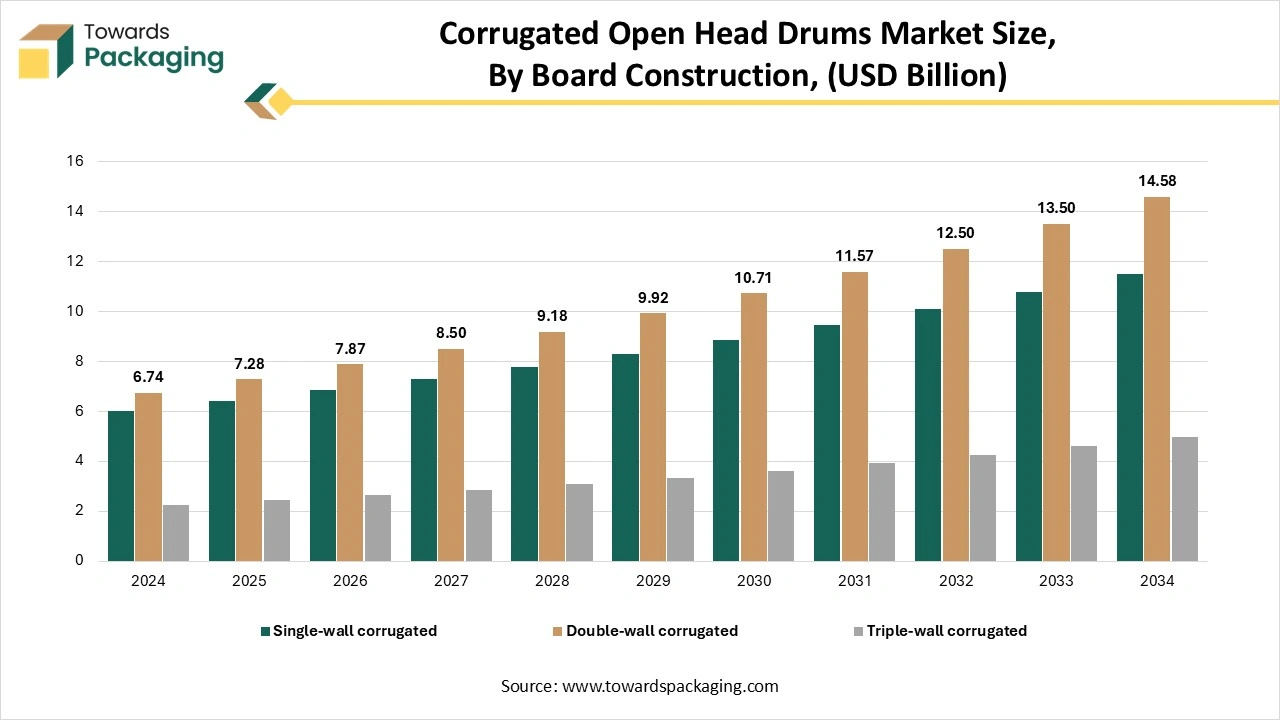

- By board construction, the double-wall corrugated segment has contributed to the largest share of 45% in 2024.

- By board construction, the triple-wall corrugated segment expected to grow at a notable CAGR between 2025 and 2034.

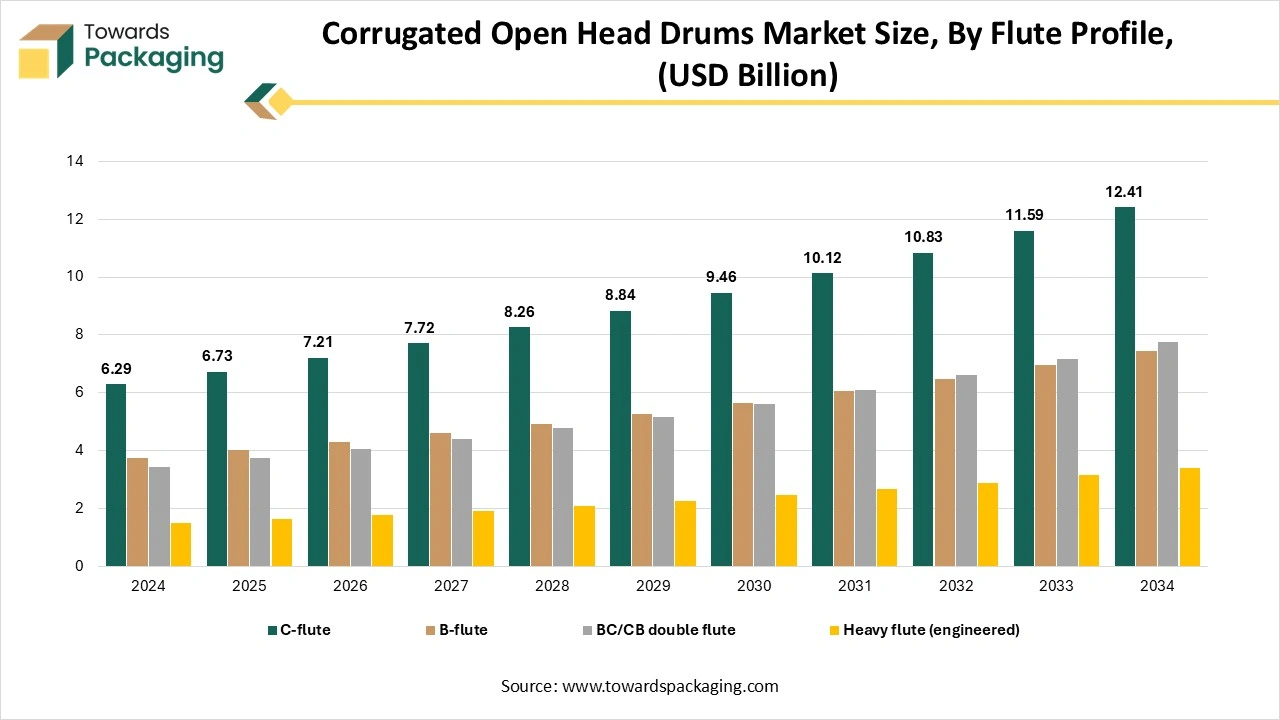

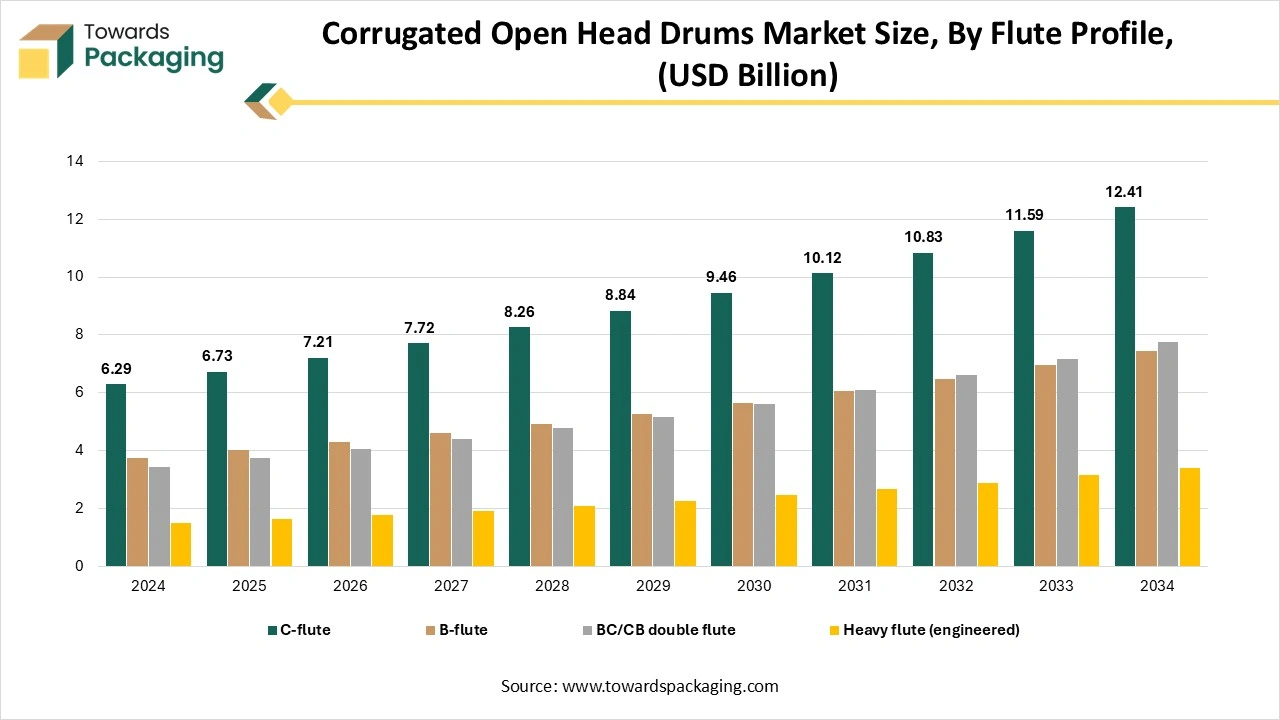

- By flute profile, the c-flute segment contributed to the largest share of 50% in 2024.

- By flute profile, the BC/CB double flute segment will grow at a notable CAGR between 2025 and 2034.

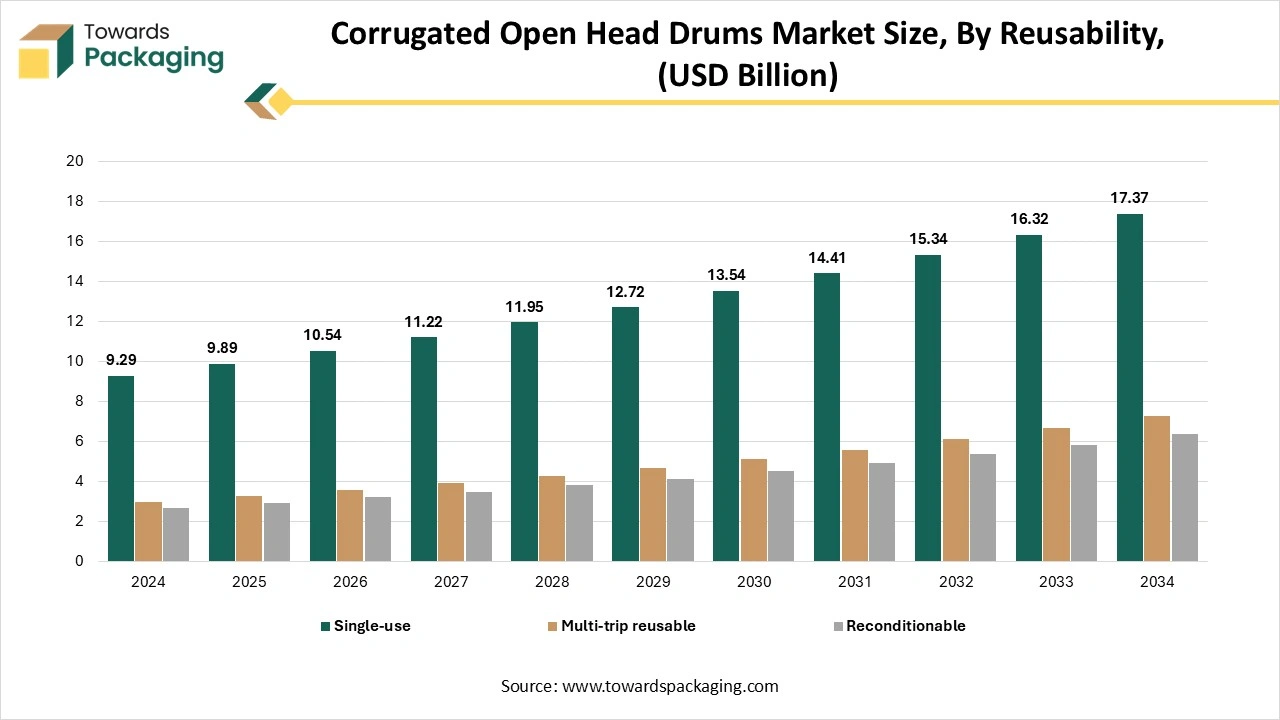

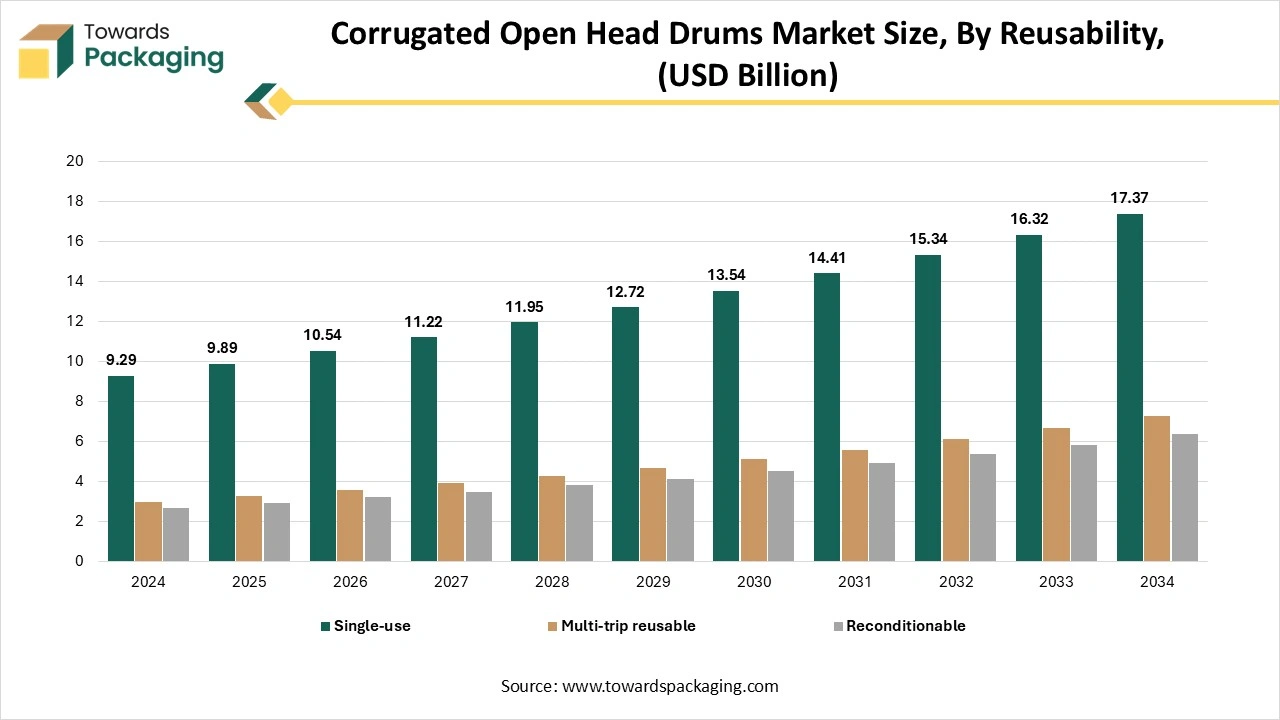

- By reusability, the single-use segment contributed to the largest market share of 60% in 2024.

- By reusability, the multi-trip reusable segment expected to grow at a notable CAGR between 2025 and 2034.

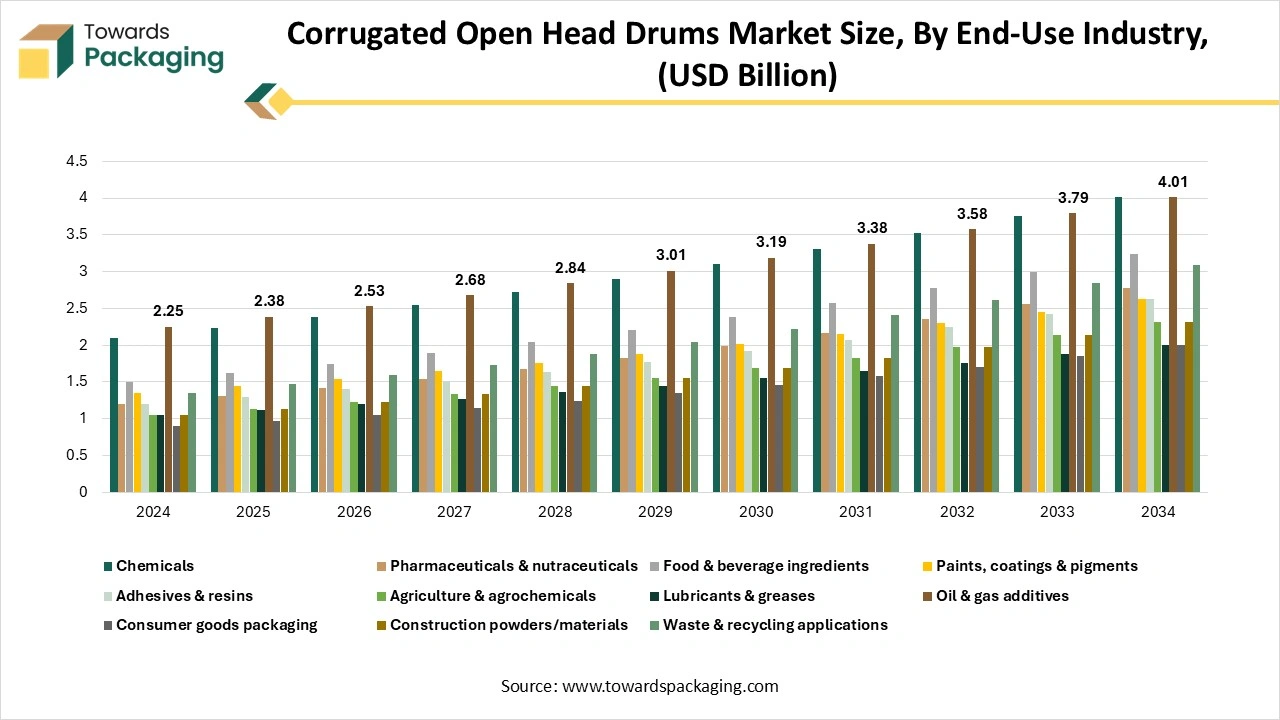

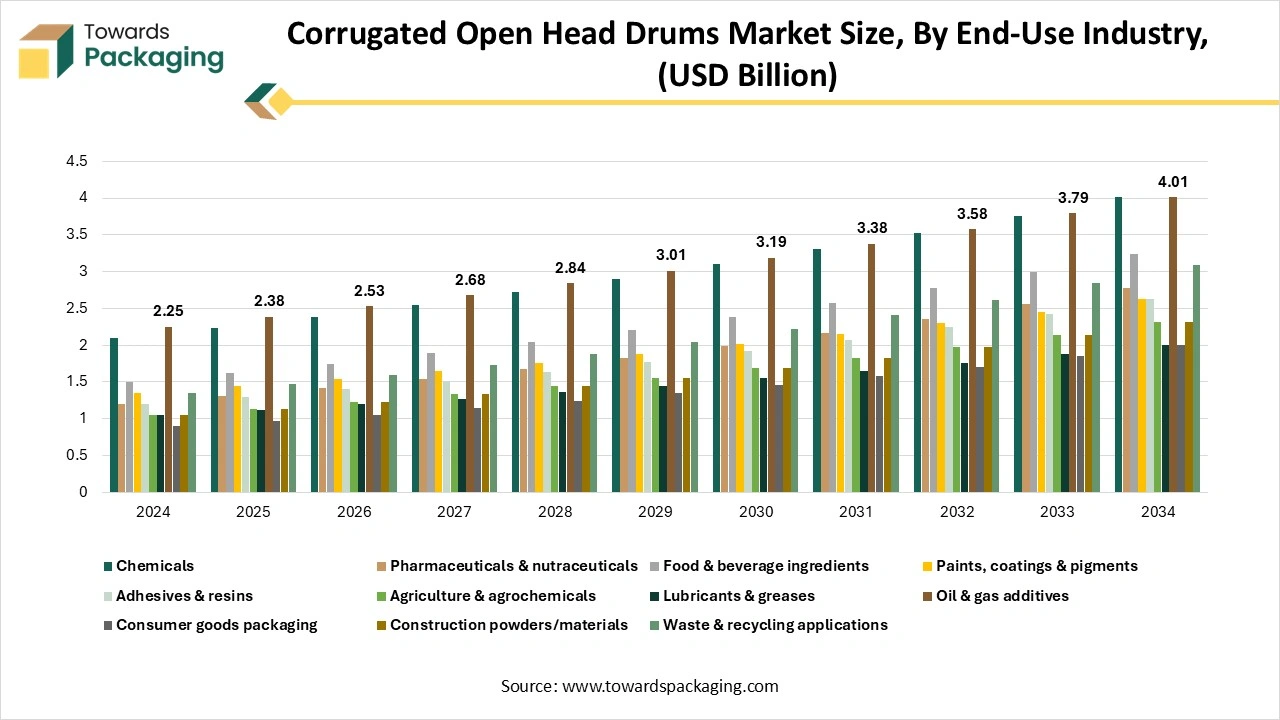

- By end-user industry, the oil and gas segment contributed the largest share in 2024.

- By end-user industry, the chemicals segment expected to grow at a notable CAGR between 2025 and 2034.

Market Overview

Corrugated open-head drums are cylindrical fibre/corrugated board containers with removable lids secured by clamps or rings, used for storing and transporting dry, semi-solid, and liquid products across industries.

Also, it is a kind of drum made from fibre material having a removed top, enabling easy access in order to fill its empty stomach and its contents. These drums are ideal for storing the solids, semi-solids, and other materials like food-grade products and chemicals, too, because of their durable and lightweight nature, though they generally have less moisture opposition than plastic or metal drums.

Future Demands

- Demand will increase due to the need for cheaper, lighter, and recyclable bulk packaging.

- Industries like chemicals, food, pharma, and agriculture will drive higher usage.

- Companies want packaging that reduces freight cost and supports sustainability goals.

- Exporters will prefer these drums because they are stackable, safe, and suitable for long shipments.

- Growth will benefit from tightening global waste regulations and pushing eco-friendly alternatives.

- Manufacturers will focus on custom sizing and protective coatings to widen industrial applications.

- Demand will improve in developing markets that lack metal drum infrastructure.

- Suppliers will target e-commerce B2B buyers with quick-turn, low-volume shipping options.

Emerging Technologies

- High-strength fiber engineering produces drums that match metal durability with lower weight.

- Water-resistant and chemical-resistant coatings that allow use in harsh industrial environments.

- Automated folding and assembly systems that reduce labor costs and improve quality consistency.

- Digital structural simulation tools to optimize stacking strength and reduce material usage.

- Eco adhesives and water-based inks are replacing petroleum-based condition monitoring.

- Custom fit manufacturing systems for small batch, SKU-specific industrial containers.

Emerging Trends In The Corrugated Open-Head Drums Market

- E-commerce driving packaging demand: The growing, complicated logistics chain for direct-to-consumer directly points to packages being carried out many times in corrugated drum packaging, which makes a compulsion for cost-effective and durable packaging. This move has been accepted by brands to use corrugated drum packaging as it protects the content and forces their brand image directly in users’ homes, growing the urge for good-quality graphic designs and shippers.

- Sustainability and lightweighting: Sustainability remains a main factor in corrugated packaging. With the growth in user awareness around surrounding issues, corrugated open-head drums are heavily used for their loyalty and environmentally friendly nature. The paper and pulp industry sticks to recycling corrugated drums into the latest containerboard, lowering the dependency on virgin materials. While the lightweighting lowers the shipping costs, particularly with the logistics sector’s development in dimensional weight acceptance.

- Fit-to-product and box-on-demand technology: E-commerce has also stimulated inventions like fit-to-product packaging, which personalises the tailor-made boxes to the accurate size of the products, avoiding the demand for excess filler materials. This specifically advantages organisations like Amazon, which need the customized packaging for different product sizes and shapes.

- Advancements in Digital Printing: The rising acceptance of digital printing on corrugated open-head drums has opened the gate for the latest opportunities for personalization and customization. Digital printing offers flexibility in the long term, lower setup costs, and the potential to tailor packaging for particular regions, individual customers, and stores, too.

- AI Design: Artificial intelligence is changing the path of corrugated packaging for open-head rums that are being crafted. By developing AI algorithms, companies can make inventive designs personalised to particular demands. For example, AI can track product dimensions, consumer selections, and shipping demands to generate custom-fit, visually appealing packaging that is effective too.

Sustainability and Compliance

The corrugated open-head drums market is increasingly shaped by sustainability objectives, with producers switching to recyclable lightweight fiberboard materials to lower transportation emissions and carbon footprints. In order to adhere to more stringent packaging waste and extended producer responsibility (EPR) regulations, businesses are implementing FSC-certified paper, water-based coatings, and biodegradable adhesives. Through life-cycle assessments and environmental labeling, governments are pressuring producers to show traceability, safer disposal, and lower hazardous content. In response, companies are integrating recycled fiber content without sacrificing durability, strengthening drums and standardizing packaging performance in order to comply with corporate ESG commitments and global sustainability benchmarks.

The industry is also witnessing a shift toward closed-loop recycling models to reduce waste generation. Companies are introducing modular designs and reusable structures to improve product longevity. Business buyers are increasingly prioritizing suppliers that can provide carbon footprint data and certifications. Many manufacturers are also investing in green energy and automation to increase production efficiency.

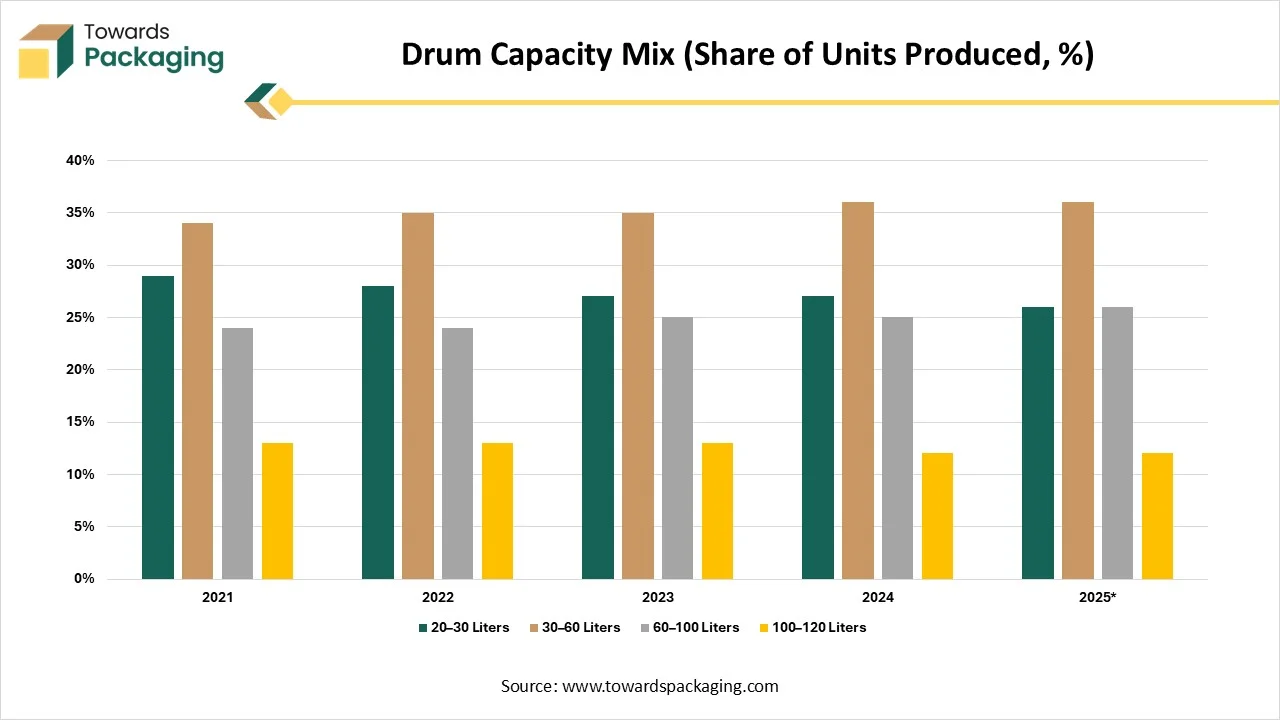

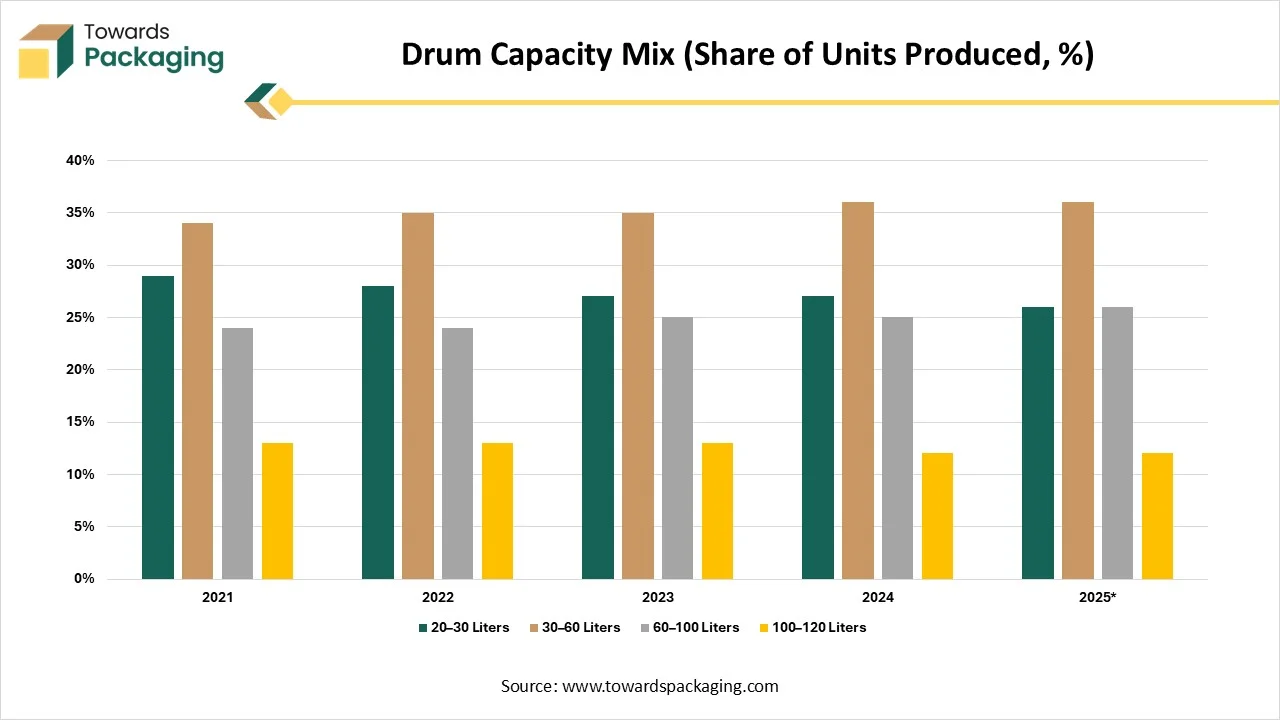

Drum Capacity Mix (Share of Units Produced, %)

| Drum Capacity |

2021 |

2022 |

2023 |

2024 |

2025 |

| 20–30 Liters |

29% |

28% |

27% |

27% |

26% |

| 30–60 Liters |

34% |

35% |

35% |

36% |

36% |

| 60–100 Liters |

24% |

24% |

25% |

25% |

26% |

| 100–120 Liters |

13% |

13% |

13% |

12% |

12% |

Market Dynamics

Market Driver

Recycling And Sustainability Solutions Are Perfect

Corrugated open-head drums are a unique kind of industrial packaging as they are an environmentally and sustainably choice. It is made from recycled materials, because they display several options like organizations seeking to develop the sustainability credentials or lower their environmental footprint. Also, the fiberboard material of corrugated open-head rums makes them ideal and exceptionally cost-effective. They can be purchased again at a main lower price point as compared to alternative storage solutions like plastic drums or steel ones. These kinds of drums are developed with internal and external liners in order to develop their performance and versatility. For added strength and security, they are regularly packaged with steel combs that can be conveniently removed using the de-chamber when it's time for recycling.

Market Restraint

Pollution Is The Problem

Corrugated open-head drums are a kind of industrial packaging utilised for the transport and storage of liquid and solid materials. Instead of being generated using recyclable fiber, the drums are generally disposed of in landfills and at the end of life. There is a possibility to develop the environmental and economic effects of these fiber drums by providing recycling services.

Market Opportunity

Diverse Uses Drives The Corrugated Market

Corrugated board is one of the most widely utilised materials in the worldwide packaging industry, particularly in the sector of presentation and product transport. Its different properties, such as mechanical strength, lightness, and shock absorption potential, make it a perfect material for preserving the goods during transport. Corrugated board can be conveniently personalised to different shapes and sizes, which makes it highly evergreen for every large transport packaging and smaller shelf-ready packaging. Also, the value chain of the corrugated open-head drums packaging consists of many stages, beginning from the manufacturing of raw materials, through packaging production, usage, and finally the end-of-life stage, in which it is either recycled or disposed of.

How Is Artificial Intelligence Being Used In The Corrugated Open-Head Drums Market?

Artificial Intelligence can easily activate the data that corrugated plants can utilise to update the pattern, experience machine failures, and protect supply chain bottlenecks, but there are steps for the box that make the AI’s potential possible. The buzz of Artificial intelligence in corrugated open-head drums is around the capability of machine learning. Machine learning is a subset of artificial intelligence that uses training algorithms to choose patterns and make decisions with less human intervention. Furthermore, the AI-powered design tools allow product designers to utilize the huge amounts of data to analyse results, update design elements, and tailor the products to choices.

Board Construction Insights

How Did The Double-Wall Corrugated Segment Dominate The Corrugated Open-Head Drums Market?

The double-wall corrugated segment dominated the corrugated open-head drums market in 2024 as it is a kind of packaging created from corrugated cardboard, which is crafted to deliver extra power and security for the contents present inside the drum. It is prevalently used for shipping and storage of bulky products. The drum is being made by fitting the inner surface of corrugated material between two outer layers, making two walls on the top and sides of the box. The fluted interior layer is created from arched, paper-dependent corrugations which serve to further assistance and strengthen the box.

Double-walled corrugated open-head drums are manufactured from eco-friendly materials and sustainable options, created from renewable resources, and can be conveniently recycled, lowering the waste in the surrounding environment. The drums are made available in different sizes and shapes, which makes them perfect for various applications. They are also relatively costly, which makes them a cost-effective solution for individuals and organisations too.

The triple-wall corrugated segment is expected to be the fastest in the market during the forecast period. They are an unequalled champion, designed with three corrugated plastic layers and four liners too. Its exceptional power enables it to overcome opponent wooden crates, frequently working for traveling with heavy loads like chemical drums. The triple-wall corrugated open-head drums securely transport our sensitive products from one place to another, such as pumpkins, watermelons, and sweet corn.

Flute Profile Insights

How Has The C-Flute Segment Dominated The Corrugated Open-Head Drums Market?

The C-flute segment dominated the market in 2024 because it is the most widely utilised flute due to its ideal balance and versatility characteristics. It has the integrated elements of cushioning, durability, and stacking power, making it a perfect shock absorber and serving as perfect crush opposition too. C-flute profile is much thicker than B-flute, but it is less thick than A-flute. This creates it less bulky as compared to A-flute and is commonly used for corrugated open-head drums for wholesale and retail, and or for e-commerce and shipping too.

Because of its highly anticipated power, the C-flute pattern assists the transformation of bulky items as compared to the B-flute. It is particularly perfect for when boxes are being stacked upon each other because of its perfect crush opposition characteristics.

The BC/CB Double flute segment is predicted to be the fastest in the market during the forecast period. Utilising the double-walled material, producers combine one or more flutes to make a grade, such as “EB” or “BC” flute. Integrating one or more material flutes can have many aims that include developing the exterior look of a printing surface and making a strong surface that is ideal for most substantial products. Material flutes are frequently utilised and produced from completely recycled waste-dependent fluting, but they can also be designed from semi-chem (SC) fluting material. While the BC flute is double walled integration of B and C flutes, which creates it to the thickest flute and that is ideal for heavy items and on the other side which gives the perfect all-around performance, that makes it prevalent for generating shipping boxes that serve higher level of transit protection and the CB flute is also double walled and combination of C and B flute flutes that serves the advantages between finish, power and security.

Reusability Insights

How Did The Single-Use Segment Dominate The Corrugated Open-Head Drums Market?

The single–use segment dominated the corrugated open-head drums market in 2024, as the main benefit of corrugated drums is their reusability. Just like single-use packaging options, corrugated open-head drums can be utilised several times with accurate maintenance and reconditioning, too. This not only lowers the waste but also produces cost savings over the long term. They are made from good quality, rigid materials, as they serve perfect strength, making them perfect for transporting products that need dependable protection. Just like other packaging types, corrugated drums are highly resistant to cracks, punctures, and high pressure.

The multi-trip reusable segment is expected to be the fastest in the market during the forecast period. The crucial benefit of multi-triple reusable corrugated open-head drums is that they can be nested and accumulated whenever it is empty, making them space-saving storage element for materials. Thai lessens the logistics costs and the depository. The parallel lid units are being unitized either distinguishingly or together, having the drums on the pallet, catering to the customer demands. These containers are ideally suited for the usage of secondary packaging material in the huge industrial field. On a sophisticated level of standard, the multi-drip reusable corrugated open-head drums are filled with locking rings with external stage closure. A jet-ring closing system for fully automated closure is available for chosen container sizes.

End-Use Industry Insights

How Did The Oil And Gas Segment Dominate The Corrugated Open-Head Drums Market?

The oil and gas segment dominated the corrugated open-head drums in 2024 because they generally transport and keep liquids, such as oil, gasoline, and food products. These drums are being created from heavy-duty material and are crafted to be resistant and durable to corrosion. They particularly have the potential with a removable top and bottom opening for the dispensing or drawing of the products. Corrugated open-head drums are often utilised in sectors such as petroleum refining, chemical production, and agriculture, too. They are also utilised for storing and shipping toxic materials, and are needed to align with strict safety standards.

The chemicals segment is predicted to be the fastest in the market during the forecast period. Corrugated open-head drums are a kind of cylindrical drums created from High-Density Polyethylene ( HDPE) and can be handled anywhere between 50 and 250 litres. They are utilised to keep and store chemicals in bulk packaging. Drums are being crafted to withstand corrosive substances, internal pressure, and rough handling, too. Many of these drums are reusable and stackable, which makes them perfect for large-scale operations in several industries. On the other hand, fibre drums can securely keep the chemical products whenever fitted with an accurate solution and an additional protective layer within the drum. Several of the corrugated drum patterns are UN-certified to Packaging Group-1 for the transport of toxic solids.

Regional Insights

How Has The Asia Pacific Dominated The Corrugated Open-Head Drums Market?

Asia Pacific dominated the corrugated open-head drums market in 2024 as the manufacturing and production of corrugated open-head drums is growing steadily, driven by rising demand from the chemicals, food and beverages, agriculture, and pharmaceutical industries. These drums are greatly used for storing and transporting liquids, powders, and semi-solid products due to their reusability, strength, and eco-friendly design. Manufacturers in countries like China, India, South Korea, and Japan are top producers of cost-effective raw materials, which are highly drum-forming machinery and compliance with international safety standards. Additionally, the growing focus on sustainable packaging has pushed producers to use recyclable materials and lightweight designs, creating corrugated open head drums a preferred choice for bulk packaging in the space.

Trend of Corrugated Open-head Drums in Japan

The move towards more smooth, sustainable, and cost-effective packaging solutions is increasing the usage of corrugated open-head fiber drums in Japan. On the other hand, the drums are not as reliable as regular steel drums and experience competition from both plastic and metal containers.

The Japanese producers are rising more eco-friendly and sustainable packaging, which includes the corrugated open-head drums, which are recyclable, biodegradable, and created from renewable resources too.

Trend of Corrugated Open-head Drums in India

The trend of the corrugated open-head drum in India is classified by main development, which is being driven by the packaging sector and a developing importance on sustainable and cost-effective solutions. Corrugated fiber drums are gaining attention as an environmentally friendly alternative to plastic metal drums, specifically for bulk storage and logistics of solid and semi-solid goods.

Crucial factors in India, which include pharmaceuticals, chemicals, food and beverage, and agriculture, are driving the urge for heavy packaging solutions. The corrugated open-head drums are utilised for shifting and keeping a large range of products, from minute chemicals and powders to food ingredients and agricultural products too.

Such drums are usually more economical than their plastic or metal counterparts that serve a comfortable return or the funding for the businesses. Their lightweight nature also assists in lowering the transportation costs, which makes them an attention-grabbing option for organisations that concentrate on lowering the logistics expenses.

Europe is predicted to be the fastest in the market during the forecast period. In this region, the production of corrugated open-head drums is strong; it is influenced by strict environmental regulations, quality standards, and safety compliance. Countries like Italy, Germany, and France lead the industry with high-level production facilities that give importance to recyclability, sustainability, and lightweight designs. The European packaging sector puts high emphasis on circular economy goals, encouraging manufacturers to accept eco-friendly raw materials and inventive drum technologies. Demand is specifically strong from the pharmaceutical, chemicals, and agricultural industries.

Demand for Corrugated Open-Head Drums in Germany

In Germany, the industry for the corrugated open-head drums is witnessing development, which is being driven by the rigid importance of sustainability and a strong production sector, too. White steel options have a strong industry presence; the trend is shifting towards developing demand for the eco-friendly fiber drums as a recyclable and lightweight alternative to bigger metal and plastic drums.

Germany’s high-level industrial designs, specifically in the pharmaceutical and chemical sectors, drive a demand for the high-power fiber drums. Producers utilise these containers to ship toxic and specialized chemicals privately and securely.

Plastic Jar Export Volumes by Major Countries (Thousand Units)

| Country |

2021 |

2022 |

2023 |

2024 |

2025 |

| China |

41.2 |

43.8 |

46.1 |

48.5 |

51.3 |

| India |

19.6 |

20.7 |

21.9 |

23.1 |

24.5 |

| Germany |

17.2 |

18 |

18.7 |

19.5 |

20.4 |

| United States |

15.4 |

16 |

16.6 |

17.3 |

18 |

| Turkey |

11.8 |

12.2 |

12.7 |

13.3 |

13.9 |

| Mexico |

8.6 |

9.1 |

9.4 |

9.8 |

10.3 |

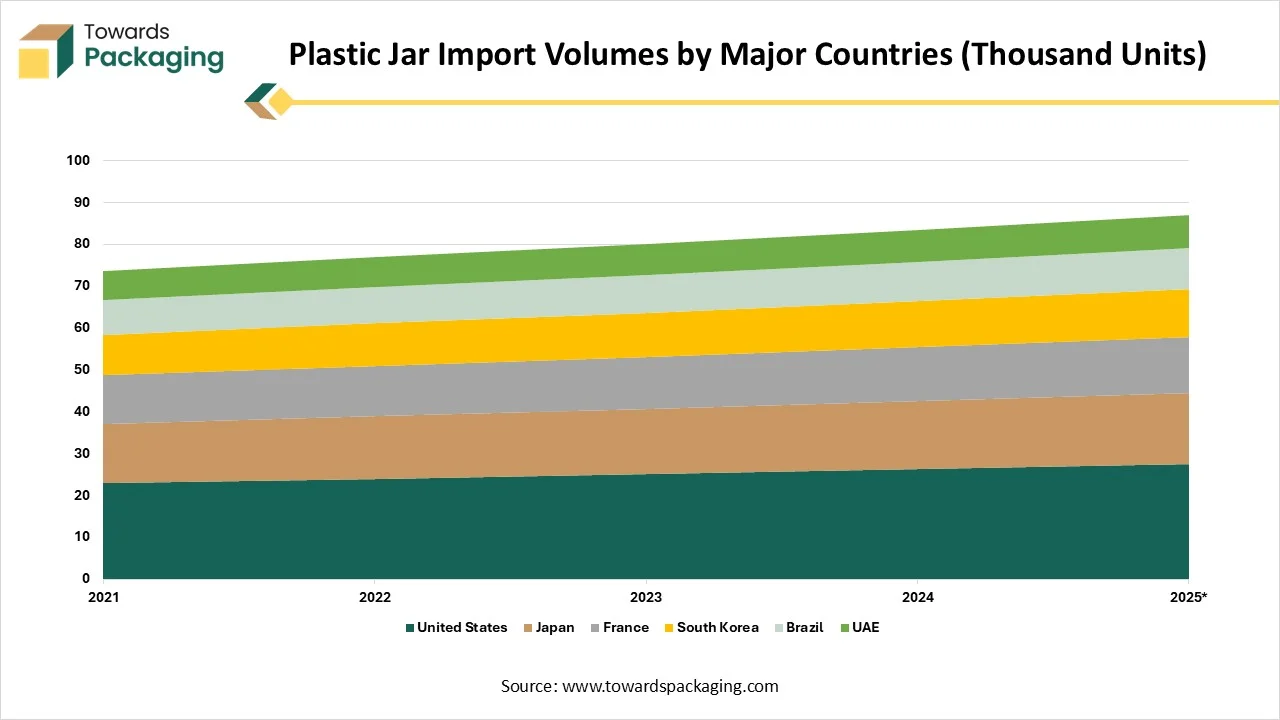

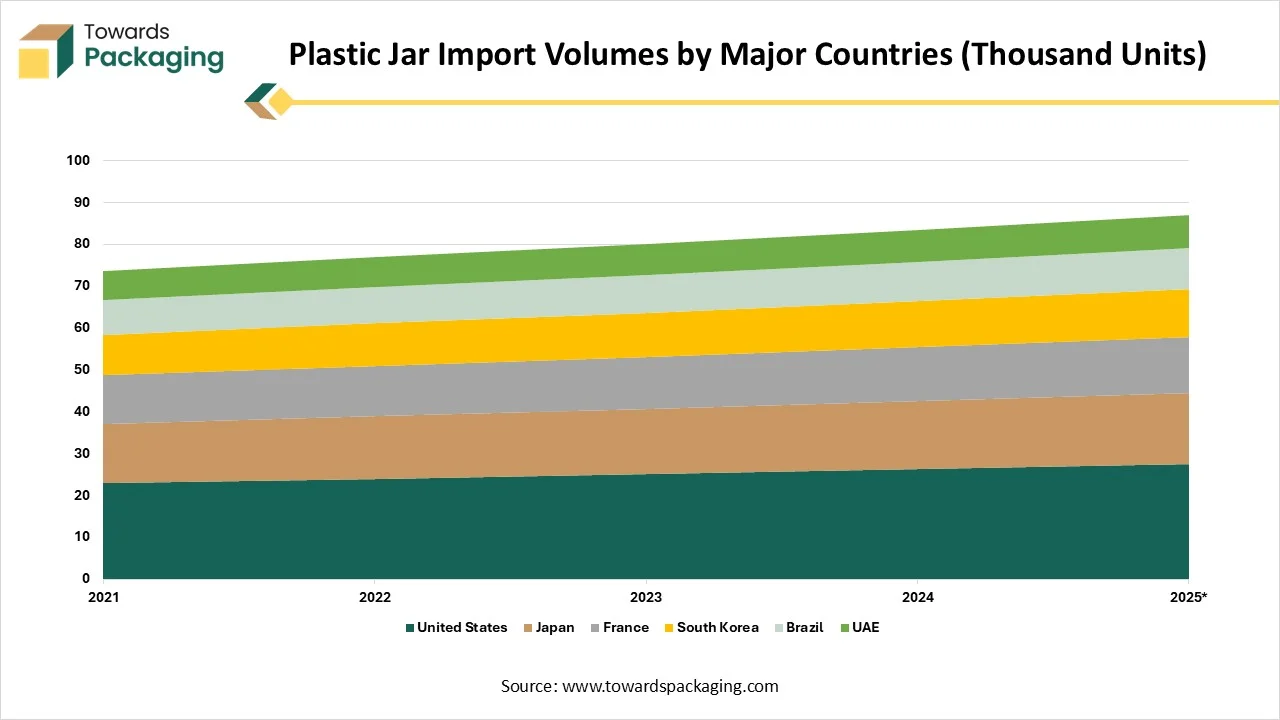

Plastic Jar Import Volumes by Major Countries (Thousand Units)

| Country |

2021 |

2022 |

2023 |

2024 |

2025 |

| United States |

22.9 |

24 |

25.1 |

26.3 |

27.5 |

| Japan |

14.2 |

14.9 |

15.5 |

16.2 |

16.9 |

| France |

11.6 |

12 |

12.4 |

12.9 |

13.4 |

| South Korea |

9.7 |

10.2 |

10.6 |

11 |

11.5 |

| Brazil |

8.3 |

8.7 |

9 |

9.3 |

9.7 |

| UAE |

6.9 |

7.1 |

7.4 |

7.6 |

7.9 |

Corrugated Open-Head Drums Market - Value Chain Analysis

Material Processing and Conversion: The materials processing and conversion stage plays an important role in the manufacturing of corrugated open-head drums. In this procedure, kraft paper and linerboard are the initial raw materials that experience pulping, refining, and coating to receive the needed strength and durability. High-level corrugation techniques are applied, in which the medium is fluted and bonded between liners to create a strong, lightweight, and impact-resistant pattern.

Package Design and Prototyping: Package design and prototyping for a crucial stages in the growth of corrugated open head drums, ensuring the functionality, safety, and compliance with international standards. In this procedure, engineers and designers make prototypes that replicate the outcome product to test structural integrity, load-bearing capacity, stacking power, and opposition to moisture or chemicals.

Logistics and Distribution: Logistics and distribution play a crucial role in the corrugated open head drums market ,as these packaging solutions are widely used for transporting bulk goods across industries such as food, chemicals and pharmaceuticals. The lightweight yet durable structure of corrugated drums makes them cost-effective for long -distance shipping while making sure product safety.

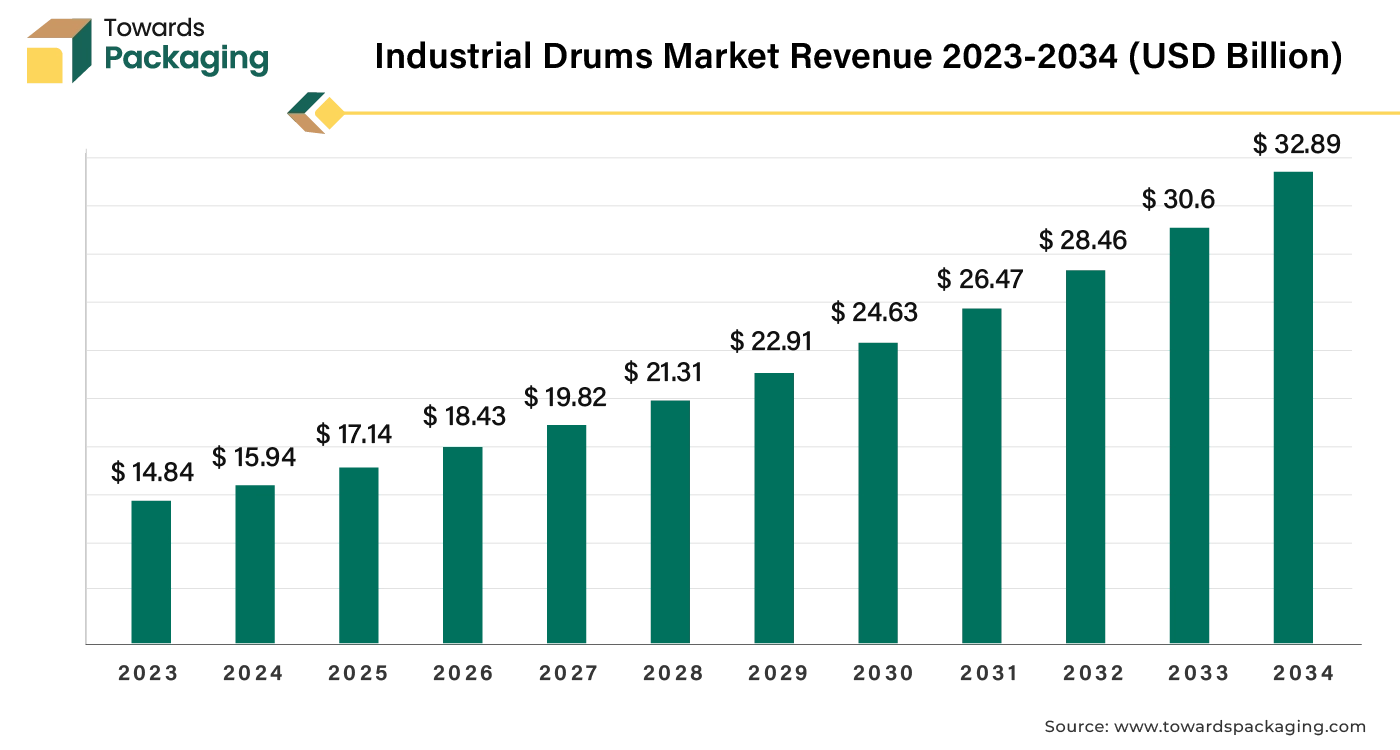

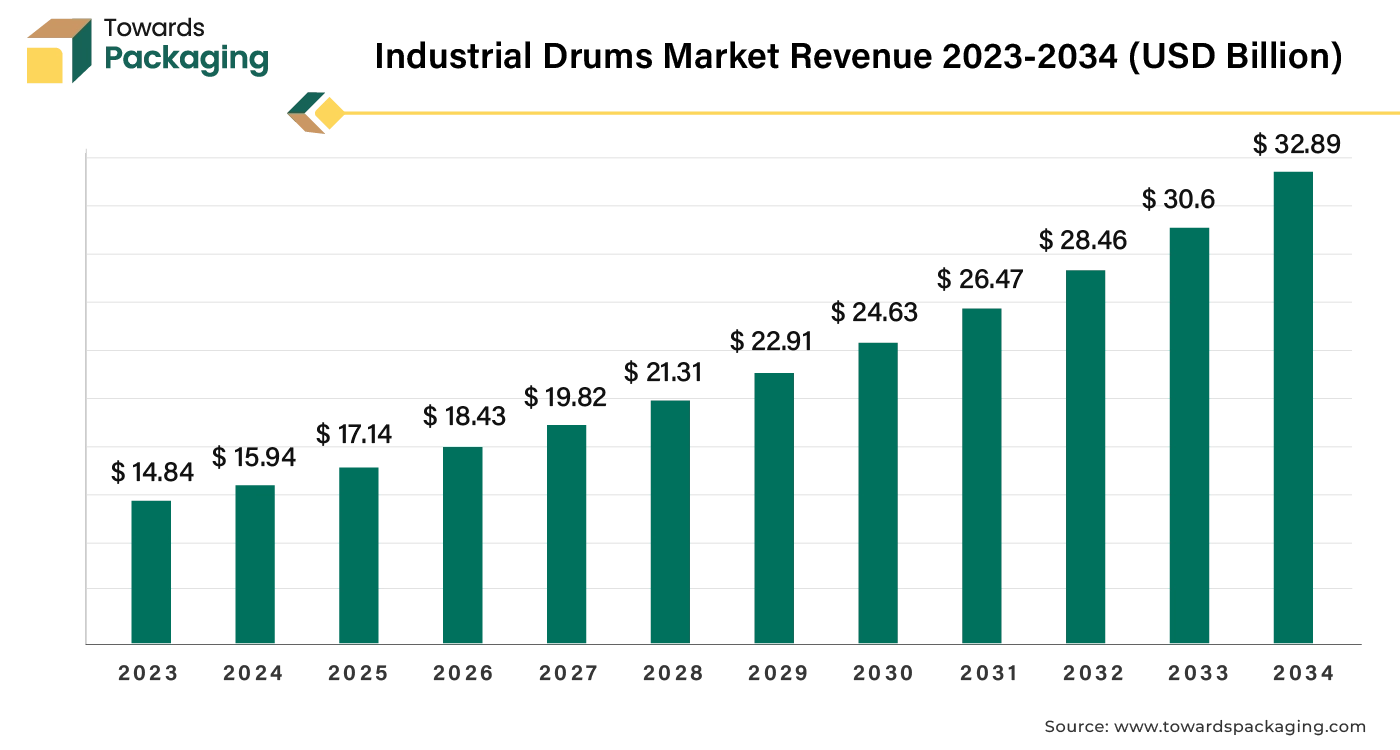

Industrial Drums Market Intelligence Report, Key Trends, Innovations & Market Dynamics

The industrial drums market covers complete sizing and forecasts from USD 17.14 billion in 2025 to USD 32.89 billion by 2034 (7.35% CAGR), with full segment data by product (steel, plastic, fiber), capacity (<100, 100–250, 251–500, >500 L), and end use (chemicals, F&B, petroleum & lubes, pharma, paints/inks/dyes, others). We provide regional statistics for North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, noting APAC’s 2024 lead, North America’s fastest growth, and steel drums and 100–250 L capacity dominance in 2024. The study includes company profiles and shares (Greif, Mauser, Schütz, Balmer Lawrie, Time Technoplast, TPL Plastech, Snyder, and more), competitive analysis, value chain and cost structure, plus trade flows, import/export prices, and manufacturer–supplier databases, with all tables, charts, and growth drivers/risks quantified.

Corrugated Packaging Market Investment Opportunities & Competitive Benchmarking

The global corrugated packaging market is expected to grow from USD 309.86 billion in 2025 to USD 444.85 billion by 2034, at a CAGR of 4.10%. This growth is driven by the rise of e-commerce, where corrugated packaging plays a crucial role in product shipping and protection. The market’s expansion is also fueled by the increasing adoption of eco-friendly alternatives, with sustainability becoming a key driver. Additionally, the growing demand for customized, fit-to-product packaging to optimize logistics and reduce waste is reshaping the industry. Rapid expansion in online retail and the need for sturdy, cost-effective shipping solutions drive strong demand. Growing environmental regulations also push companies to adopt eco-friendly alternatives, fueling market growth.

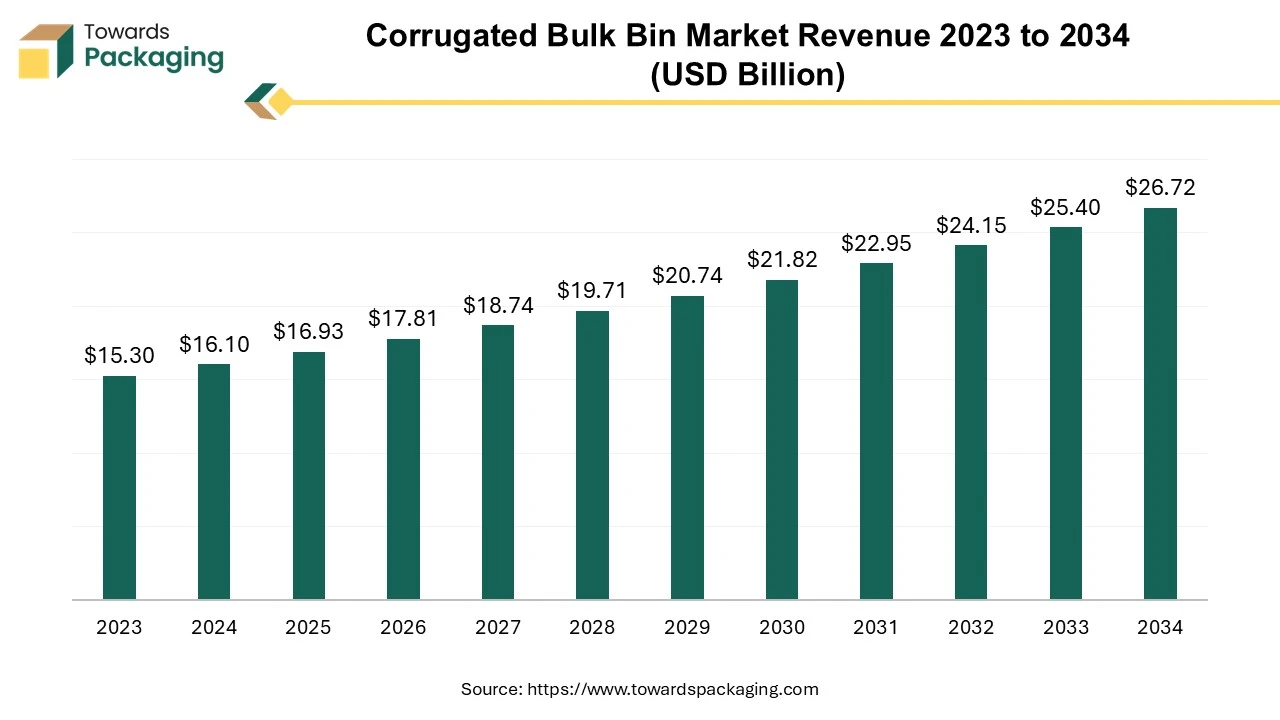

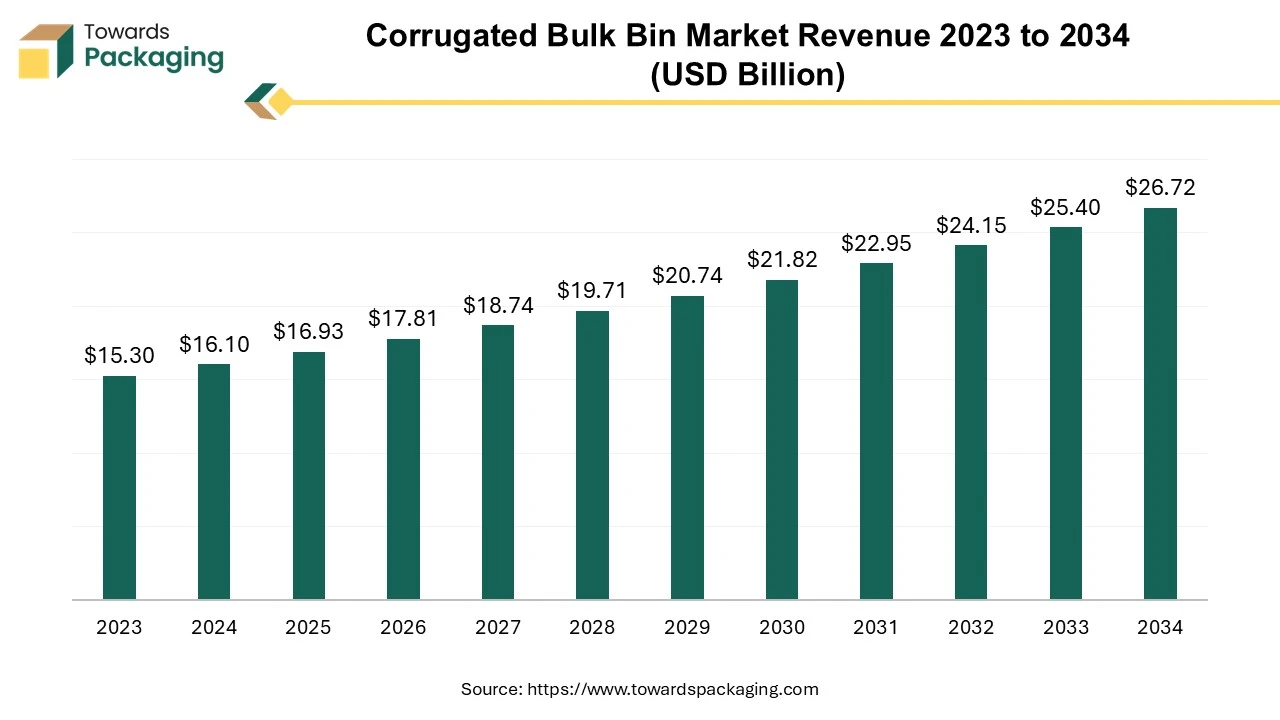

Corrugated Bulk Bin Market Playbook, Growth Opportunities & Trends

The corrugated bulk bin market is expected to grow from USD 16.93 billion in 2025 to USD 26.72 billion by 2034, with a CAGR of 5.2% throughout the forecast period from 2025 to 2034.

Growing regulations around environmental sustainability and waste reduction encourage the adoption of recyclable packaging materials. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing corrugated bulk bin which is estimated to drive the global corrugated bulk bin market over the forecast period.

Leading Companies in the Corrugated Open-Head Drums Market

- Greif

- Sonoco Products Company

- WestRock Company

- International Paper Company

- Smurfit Kappa Group

- Mondi Group

- Mauser Packaging Solutions

- Time Technoplast Ltd.

- DS Smith plc

- Pratt Industries

- Visy Industries

- Orora Limited

- Sealed Air Corporation

- Berry Global Group, Inc.

- Huhtamäki Oyj

- Graphic Packaging International

- Crown Holdings, Inc.

- Fabriano Packaging (example regional specialist)

- Rondo (Rondo Ganahl / Rondo Group)

- Koehler Paper Group

Corrugated Open-Head Drums Market Segmentation

By Board Construction

- Single-wall corrugated

- Double-wall corrugated

- Triple-wall corrugated

By Flute Profile

- C-flute

- B-flute

- BC/CB double flute

- Heavy flute (engineered)

By Reusability

- Single-use

- Multi-trip reusable

- Reconditionable

By End-Use Industry

- Chemicals

- Pharmaceuticals & nutraceuticals

- Food & beverage ingredients

- Paints, coatings & pigments

- Adhesives & resins

- Agriculture & agrochemicals

- Lubricants & greases

- Oil & gas additives

- Consumer goods packaging

- Construction powders/materials

- Waste & recycling applications

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait