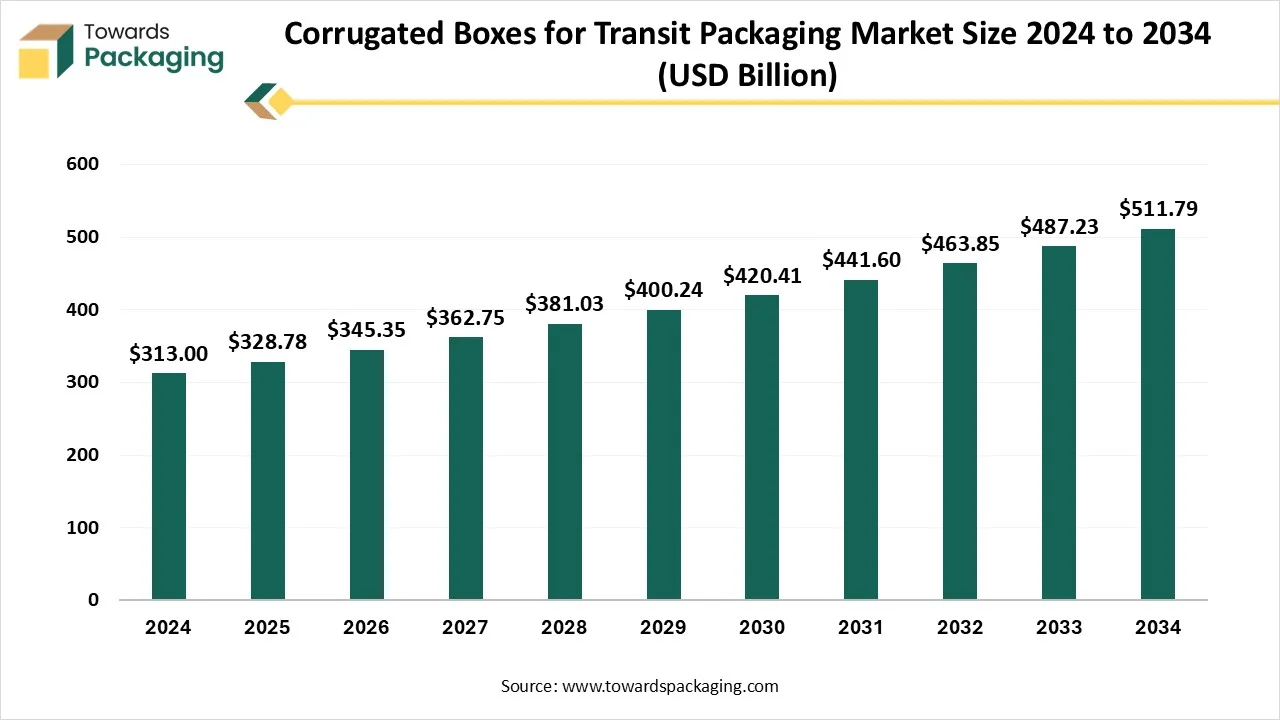

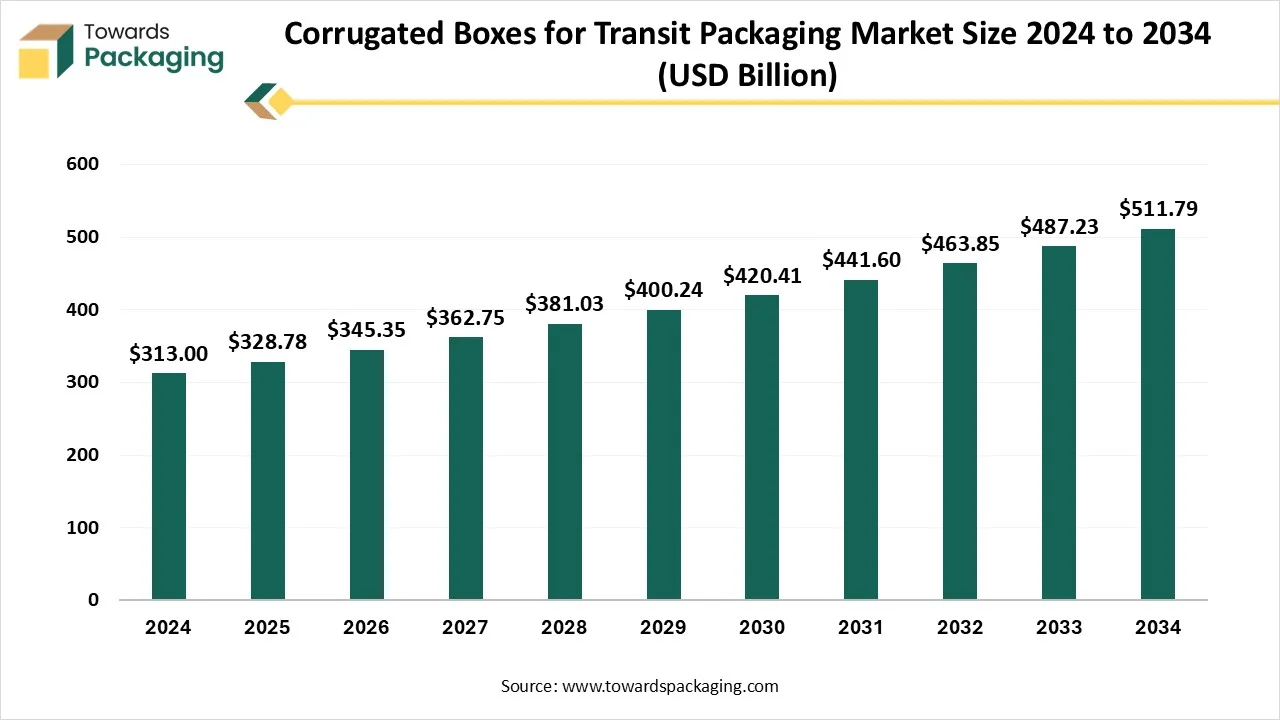

The corrugated boxes for transit packaging market is forecasted to expand from USD 345.35 billion in 2026 to USD 537.58 billion by 2035, growing at a CAGR of 5.04% from 2026 to 2035. This report covers full insights including market size, detailed segment data (material type, box type, end-user, application, distribution), regional performance across NA, EU, APAC, Latin America, MEA, and competitive profiling of major companies such as Amcor, DS Smith, Smurfit Kappa, International Paper, WestRock, Mondi, and Stora Enso.

It further includes an in-depth value chain analysis, raw material sourcing trends (kraft paper), logistics structure, trade analysis, and manufacturer & supplier mapping, highlighting APAC’s dominant 35% share in 2024 and North America’s fast-growing demand.

The global corrugated boxes for transit packaging market includes the production, sale, and distribution of corrugated boxes specifically designed for shipping and transportation of goods. These boxes are made from fluted corrugated sheets that provide strength, durability, and protection for products during transit. They are widely used across industries such as e-commerce, food & beverage, consumer goods, pharmaceuticals, electronics, and industrial goods. Growth is driven by increasing e-commerce shipments, global trade expansion, sustainable packaging trends, and rising demand for lightweight and recyclable packaging solutions.

The incorporation of AI technology in the corrugated boxes for transit packaging market plays a significant in enhancing the design of the boxes, improving quality, and maintaining supply chain process. Advanced technology such as AI, robotics, machine learning, and others support in developing designs with less material utilization. It helps in reducing delivery time as well as charges and optimize inventory management. Artificial intelligence support in minimizing the generation of waste material by enhancing the recycling process and efficiency of the packaging.

Rising Demand for Durable and Protective Packaging Drive the Growth in the Corrugated Boxes for Transit Packaging Market

The rising demand for durable and protective packaging for several sectors has driven the market. These boxes are adopted by various industries because of its potential of protecting products and strength. These are lightweight, provide cushioning, protection, and its strength enhance its adoption in various sectors. With the incorporation of advanced technology in this sector it assures timely delivery of products which enhance the demand for this market. The recyclability of corrugated boxes for transit packaging, accompanied by their lightweight properties, develop them as an appealing choice for industries seeking for decreased shipping charges and ecological influence.

Fluctuation in the Charges of Raw Materials has Hindered the Corrugated Boxes for Transit Packaging Market

The continuous fluctuation in the charges of raw materials has hindered the market. The instability in raw resources charges, mainly of kraft paper, which is a main element in the manufacturing of the corrugated boxes for transit packaging. Variations in the charges of wood pulp can straight influence production charges and, thus, estimating for end user. Moreover, the market is regularly categorized by high competition, with several players struggling for market stake.

Increasing Demand for Customized Packaging Enhanced the Opportunities of the Corrugated Boxes for Transit Packaging Market

The increasing demand for customized packaging in several industries such as automotive, pharmaceutical, food & beverages, e-commerce, and others has raised the opportunities in the market. Brands are progressively looking for unique patterns that shield their products and improve brand perceptibility. The incorporation of smart packaging skills, such as NFC tags and QR codes, into corrugated boxes for transit is another developing trend that can influence market development. This invention permits for enhanced traceability and customer engagement, aligning corrugated boxes for transit as a smart option for mode industries.

Why Single Wall Corrugated Board Segment Dominated the Corrugated Boxes for Transit Packaging Market In 2024?

The single wall corrugated board segment dominated the market in 2024 due to its cost-effectiveness, lightweight, flexibility, and customization option. This segment contributes profoundly to the rising e-commerce sector which influence the demand for lightweight packaging. These are considered as suitable for the delivery of small products. It provides cushioning effect which protect from vibrations at the time of transit. It provides flexibility for printing of graphics, brand logos, and many more.

The double & triple wall corrugated segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is widely accepted due to its durability which is considered as suitable for moderately heavy products. It offers enhanced resistance to firmness and impression which is suitable for fragile products. These packaging are designed for sensitive products as it provides protection against adverse ecological impact.

Why E-commerce & Retail Segment Dominated the Corrugated Boxes for Transit Packaging Market In 2024?

The e-commerce & retail segment held the largest share of the market in 2024 due to rising trend of online shopping. The e-commerce sector is experiencing significant expansion and enhance the usage of such corrugated boxes for transit production. Innovation in this market such as tamper-evident seals, return labels, and easy-open tabs influence the demand for these boxes. This packaging is widely accepted by industries such as personal care, fashion, cosmetics, sports, media, and toys.

The pharmaceuticals & healthcare segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing rapidly due to product protection and integrity. Several pharmaceutical products such as medical devices, medicines, and vaccines require sensitive packaging. These corrugated boxes for transit packaging offer cushioning, durability, and strength which enhance the reliability on the market.

Why Parcel & Shipment Packaging Segment Dominated the Corrugated Boxes for Transit Packaging Market In 2024?

The parcel & shipment packaging segment held the largest share of the market in 2024 due to changing consumer preferences. The enhanced reliability and cost-efficacy packaging solution demand for delivery and transit of products. This packaging plays an important role for transportation of fragile products. These packages are highly recyclable which enhance its adoption in various sectors.

The protective packaging segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing rapidly due to the assurance of undamaged product arrival. This segment comprises airbags, foam, and bubble wrap which protect products from vibrations, movement, and impact of transit. This segment is a safe and cost-efficient which increase its acceptance.

Why Regular Slotted Container (RSC) Segment Dominated the Corrugated Boxes for Transit Packaging Market In 2024?

The regular slotted container (RSC) suppliers segment held the largest share of the market in 2024 due to its adaptability and versatility. These can be easily customized in various shapes and sizes which make it convenient to utilize. It is widely accepted by sectors like industrial goods, food & beverage, and electronics. These containers provide durability and provide protection which is widely used for handling, shipping, and storage.

The die-cut & custom boxes segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing rapidly due to brand visibility, logistical efficiency, and product protection. It is important for high-value items, fragile, and irregularly shaped as it provide support and cushioning. Pharmaceuticals and food & beverages industry enhance the demand for this segment rapidly. These boxes decrease shipping charges by reducing the wastage and decrease the requirement for extra void fillers.

Why Direct Sales (B2B) Segment Dominated the Corrugated Boxes for Transit Packaging Market In 2024?

The direct sales (B2B) suppliers segment held the largest share of the market in 2024 due to its innovation with different shapes, and strong bond with providers and brands. It is further influenced by increasing focus towards sustainability and growing e-commerce business. It works by addressing particular challenges in the industry like specialized packaging and tamper-evident packaging. This segment is highly accepted by healthcare, food & beverages, e-commerce, and manufacturing industries.

The e-commerce packaging suppliers segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing due to increasing demand for sustainable packaging solution, cost-effectiveness, and durability. This market contributes with innovative designs, enhanced unboxing experience, and brandable packaging. Rising demand for eco-friendly packaging and increasing regulatory guidelines boost the development of this market.

Asia Pacific held the largest share of the corrugated boxes for transit packaging market in 2024, due to rising awareness towards ecology and increase in export business. These boxes provide high-quality protection during storage and transportation. Corrugated boxes mainly produced for transit are cost-efficient packaging resolution. Development of smart packaging such as incorporation of RFID tags and QR codes raise its adoption in several sectors. Expansion in the e-commerce sector has raised the demand for this market.

The major factors behind the growth of the market on Japan such as rising e-commerce sector, precision manufacturing, and sustainable practices. Introduction of stackable and compact designs which optimize transportation and logistics process. This market is growing in Japan due to increasing demand in healthcare, electronics, food, and cosmetics.

North America expects the significant growth in the corrugated boxes for transit packaging market during the forecast period. This market is growing significantly due to the presence of strong manufacturing base and industrial demand. This region is promoting eco-friendly and recycled packaging which enhance the impact of this market. Presence of well-established logistics infrastructures promote the development of transportation packaging.

The major raw materials used in this market are paperboard and paper, majorly recycled paper and kraft paper.

Components used in this market are crucial as it offers strong and versatile solutions.

Its versatility, protective qualities, and cost-effectiveness plays a significant role on the development of this market.

By Material Type

By End-User Industry

By Application

By Box Type

By Distribution Channel

By Region

February 2026

February 2026

February 2026

January 2026