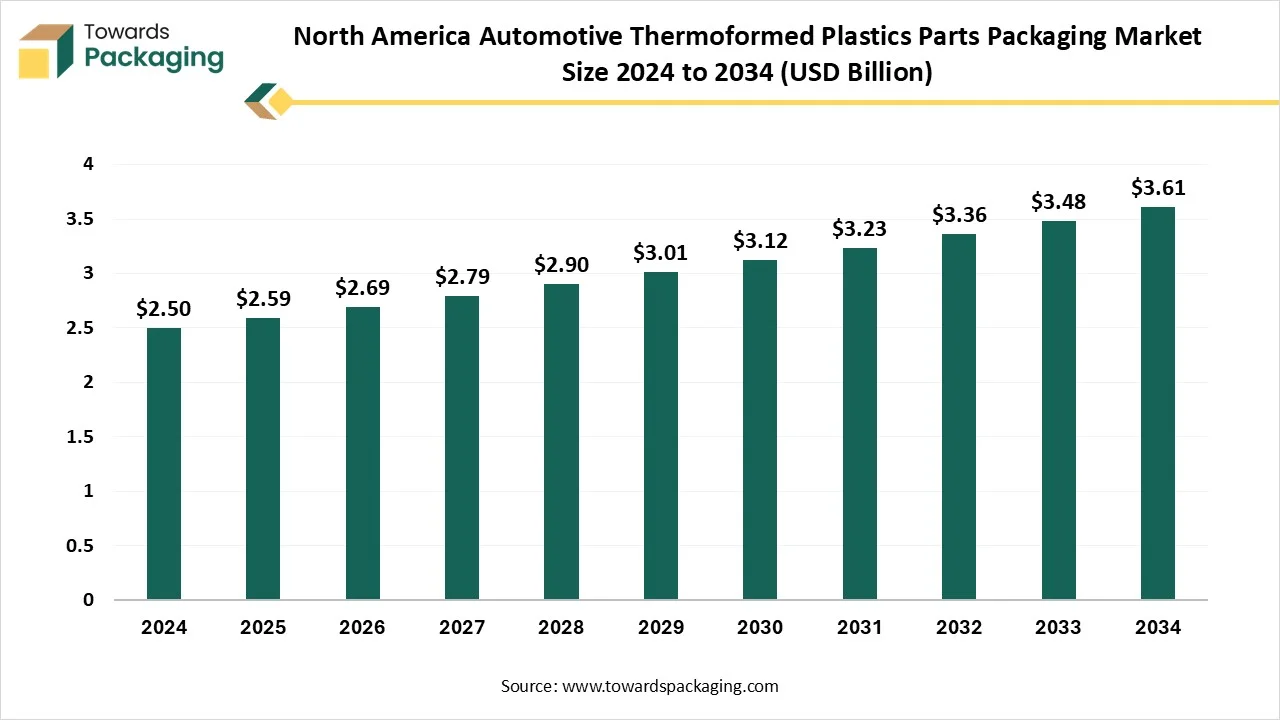

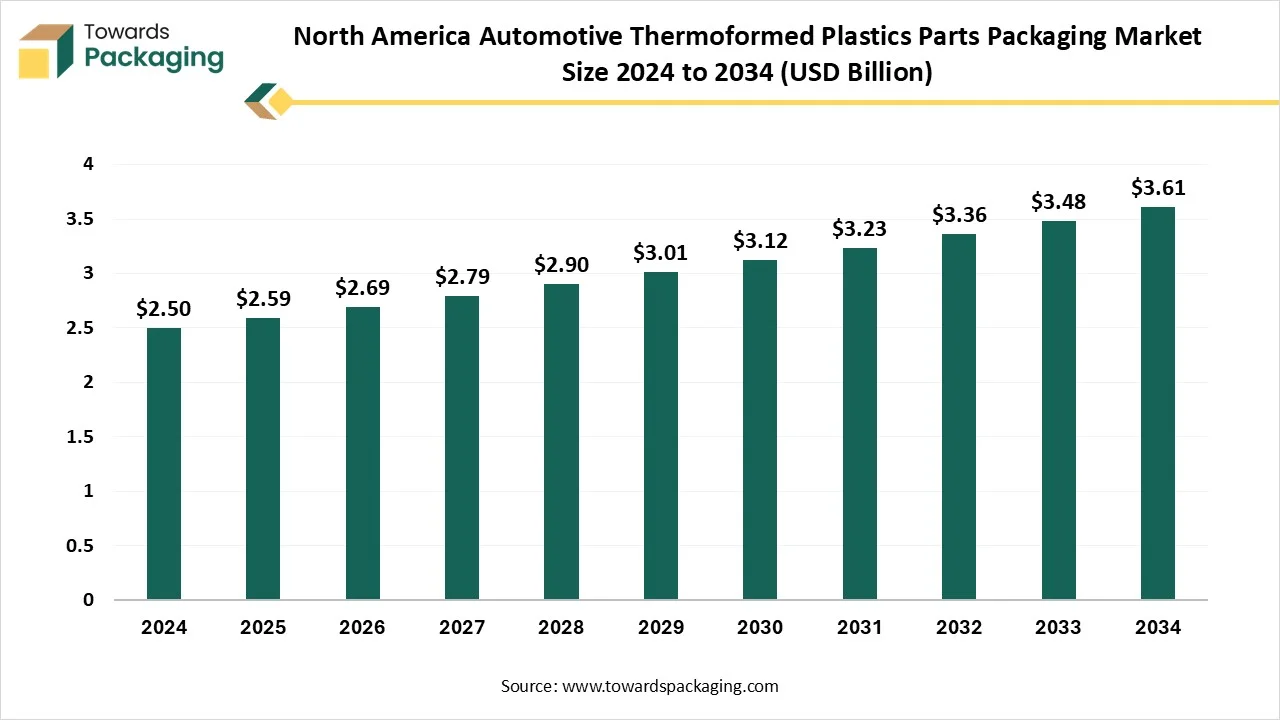

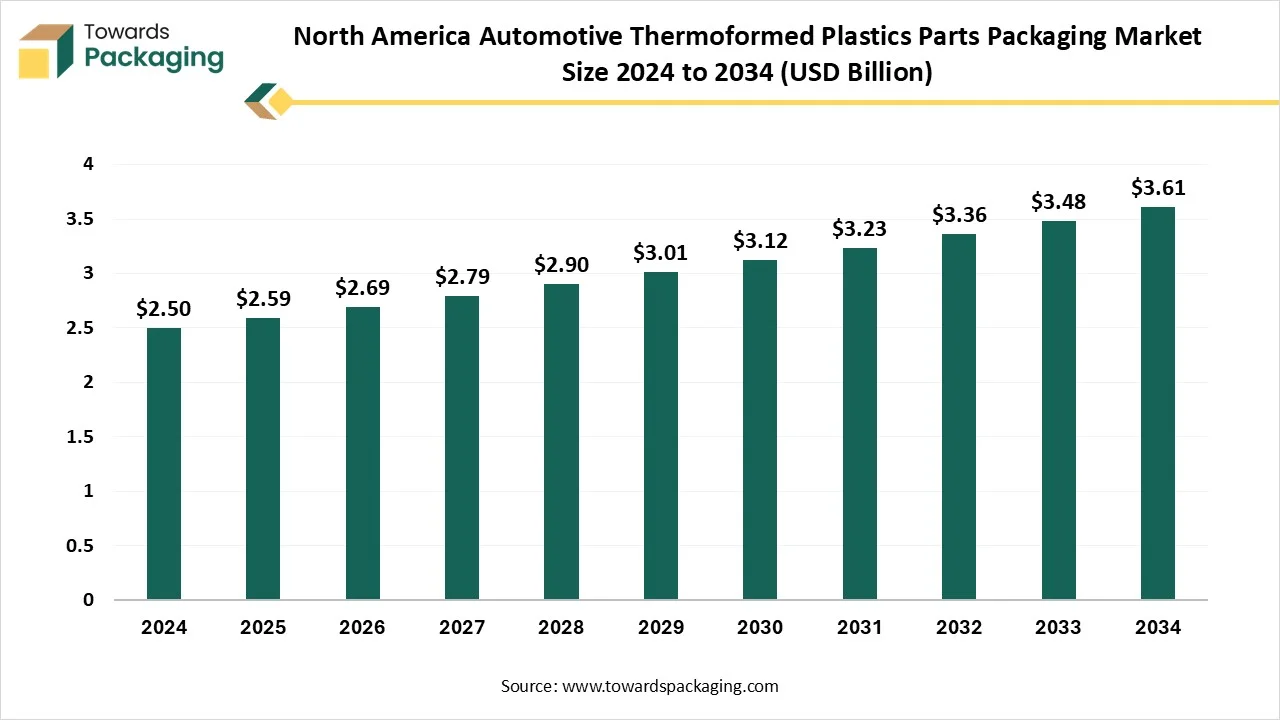

The North America automotive thermoformed plastic parts packaging market is projected to grow from USD 2.59 billion in 2025 to USD 3.61 billion by 2035, at a CAGR of 3.75%. This comprehensive report provides market size forecasts, segmentation by material type (PE, PP, PC, PVC), product type (bulk containers, trays, bags, etc.), and end-use applications like OEM and aftermarket. It also includes regional analysis for the U.S., Canada, and Mexico, with key insights into the competitive landscape, including companies such as Sonoco Products, Placon Corporation, and Schaefer Systems International. Detailed trade data and suppliers' performance add further depth to the market analysis.

- In terms of revenue, the market is valued at USD 2.59 billion in 2025.

- The market is projected to reach USD 3.61 billion by 2035.

- Rapid growth at a CAGR of 3.75% will be observed in the period between 2025 and 2034.

- By capacity type, the 20–200 liters segment contributed the biggest market share of 45% in 2024.

- By capacity type, the 5–20 liters segment will be expanding at a significant CAGR in between 2025 and 2034.

- By material, the plastic films (PE & EVOH) segment contributed the biggest market share of 55% in 2024.

- By material, the multilayer barrier films segment is expected to expand at a significant CAGR in between 2025 and 2034.

- By bag type, the with spout segment contributed the biggest market share of 60% in 2024.

- By bag type, the without spout segment is expanding at a significant CAGR in between 2025 and 2034.

- By filling technology, the aseptic filling segment contributed the biggest market share of 70% in 2024.

- By end-use industry, the food & beverage processing segment contributed the biggest market share of 50% in 2024.

- By end-use industry, the wineries & alcoholic beverage companies segment is expanding at a significant CAGR in between 2025 and 2034.

The North America automotive thermoformed plastic parts packaging market encompasses the design, manufacturing, and distribution of thermoformed plastic packaging solutions such as trays, containers, and pouches used for the storage, protection, and transportation of automotive parts and components. These packaging solutions are essential for safeguarding parts during manufacturing, assembly, and distribution processes, ensuring that components reach their destinations without damage.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 2.59 Billion |

| Projected Market Size in 2035 |

USD 3.61 Billion |

| CAGR (2026 - 2035) |

3.75% |

| Market Segmentation |

By Material Type, By Product Type, By Accessories Type, By End Use Application and By Geography |

| Top Key Players |

Sonoco Products Company, Placon Corporation, Tray-Pak Corporation, Schaefer Systems International, Inc., Packaging Corporation of America, Apex Plastics, Thermoform Engineered Quality LLC |

- Sustainable Materials Shift: The rising demand for eco-friendly packaging and strict packaging guidelines influenced the demand for innovation in the thermoformed plastic parts packaging in the North America.

- Reusable and Customizable Packaging: Availability of wide range of customization option for the protection of complex parts of the automotive industry.

- Increasing Electronics Products: The increasing usage of electronics products has influenced the demand of this sector for specialized packaging of the components.

- Startup Ecosystem: The major focus towards developing tech-focused and sustainable packaging for rising electrification in the automotive sector.

The North America automotive thermoformed plastic parts packaging market is experiencing major technological shift with the development of new materials for packaging such as Evolon fiber. Major market players are utilizing advanced CNC machining for tooling purpose. AI tools are also incorporated for the advancement of the production process and reduction in the wastage of materials. Development of chemical resistance and light weight packaging has enhanced this industry with the increasing automotive industry.

- Mexico is reported of importing plastic boxes thermoformed insert pieces and automotive partspallet plastic pallet

- Canada is recorded to export 40 shipments of molded plastic products from September 2023 to August 2024.

- U.S. exported plastic products of worth US$77.8 billion with its major trade partners Mexico, Canada, Brazil, Belgium, and China.

Battery Electric Vehicles Demand in the U.S

| Years |

BEV (in million) |

| 2021 |

0.5 |

| 2022 |

0.8 |

| 2023 |

1.1 |

| 2024 |

1.2 |

Raw Material Sourcing

The major raw materials utilized in this market are polyethylene terephthalate (PET), polyethylene (PE), and polypropylene (PP).

Component Manufacturing

The major components used in this market are thermoforming, and injection molding.

- Key Players: TriEnda Holdings, LLC, Sealed Air

Logistics and Distribution

This segment is highly focused towards networking and expanding supply chain distribution.

- Key Players: Deutsche Post DHL Group, FedEx Corporation

Material Type

The polyethylene (PE) segment dominated the market share in 2024 due to its cost-effectiveness and lightweight nature. It has properties such as low friction, chemical resistance, and impact resistance. This type of material is extensively utilized in the automotive sector because of its compatibility and lightweight properties. This material can be easily transformed into bags & pouches, rigid containers, and flexible films. With the expansion of automotive industry there is a huge upsurge in the adoption of this segment.

The polypropylene (PP) segment is expected to grow at the fastest CAGR during the forecast period of 2025 to 2034. This segment is growing due to its exceptional chemical resistance, stiffness, and cost-effectiveness. It has low density which make it appropriate for both flexible and rigid packaging options. Its lightweight enhanced the efficiency of the vehicles and decrease shipping charges. In automotive industry this segment is widely utilized in door panels, dashboard, and packaging components such as seat covers, bumpers, and fascia system.

Product Type

The bulk containers & cases segment dominated the market share in 2024 due to reusable and durable packaging. These are widely used in the primary, secondary, and tertiary packaging in both small as well as large scale automotive parts. Increasing vehicle population has influenced the demand for such product. The primary motive to reduce material wastage there is a huge production of bulk containers & cases. The presence of several e-commerce industries selling automotive parts has also enhanced the demand for this segment.

The trays & inserts segment is expected to grow at the fastest CAGR during the forecast period of 2025 to 2034. This segment is growing due to protective properties and customizability. The rising need for efficient and secure packaging has evolved the demand for this market. These can be customized into a wide range of dimensions, shapes, and weight. It maintains balance in organizing and storing systems such as glove box, enhance the demand for this segment.

Accessories Type

The engine components segment dominated the market share in 2024 due to rising demand for high-quality protection of products. It need protection from damage while transporting for longer distance. Thermoform plastics are utilized to generate custom-fit protective covers for the safety of the components in the engine of the vehicle. It protects these engine components against breakage, corrosion, and water seepage. Huge demand for reusable and sustainable packaging resolution.

The lighting components segment is expected to grow at the fastest CAGR during the forecast period of 2025 to 2034. This segment is growing due to the requirement of weather resistance and high impact resistance. These packaging plays an important role in protecting components at the time of storage and transport. The growing number of electric vehicles influence the demand for this segment.

End Use Application Type

The OEM segment dominated the market share in 2024 due to the huge requirement for advanced protective solutions. The demand for strong protection of sensitive and complex parts has fuelled the demand for this packaging market. The packaging is required to be lightweight in order to reduce the shipping charges of the components. These are custom fit packaging which has driven the growth of this market in automotive manufacturing industries.

The aftermarket segment is expected to grow at the fastest CAGR during the forecast period of 2025 to 2034. This segment is growing due to the necessity for packaging of a broader range of components. Major development factors include the usage of lightweight plastics for efficacy and increasing demand for eco-friendly packaging of the products. Complex components design of the vehicles has influenced the demand of this packaging sector. This segment comprises replacement, maintenance, and repair of components of vehicle.

Country-level Insights

Rapid Growth of E-commerce Sector in United States Promote Dominance

United States held the largest share of 75% in the North America automotive thermoformed plastic parts packaging market in 2024, due to rapid growth of e-commerce sector. Presence of major automotives as well as packaging market players influence the demand of this market in this country. Strong supply chain industry also supports in the expansion of the market rapidly.

Continuous innovation in the automotive sector has promoted the customization process of the packaging materials. Major automotives parts supplier such as Denso, Robert Bosh and many other enhanced the demand for this packaging sector for improved protection of the products.

Government Initiative Enhance the North America Automotive Thermoformed Plastic Parts Packaging Market in Mexico

Government initiatives have promoted the acceptance of the North America automotive thermoformed plastic parts packaging market. Increasing inclination towards electric vehicles market has influenced the growth of the innovation process in the packaging sector. Investment of several companies for innovation of the packaging to improve the safety assurance of the vehicle parts has boosted the growth of the market. Rapid growth in the electronics sector has contributed towards the improvement of the market. Continuous research and growth of local automotive manufactures have introduced innovation in the automotive sector which has upgrades the packaging sector as well.

Adoption of Electric Vehicles Boost the North America Automotive Thermoformed Plastic Parts Packaging Market in Mexico

Bulk adoption of e-vehicles has promoted the acceptance of the North America automotive thermoformed plastic parts packaging market. Usage of advanced automotive components has pushed the market to grow significantly. Constant initiatives of Government towards local automotive supply chain sector have expanded the market significantly. The rising development of sustainable packaging influenced the advancement of the market. The increasing adoption of advanced driver-assistance systems (ADAS) and electric vehicles created huge demand for customized plastic parts packaging.

- Sonoco Products Company: It is a packaging company which produce a huge variety of protective, consumer, and industrial packaging.

- Placon Corporation: It is a top most North American manufacturer and designer of custom and stock thermoformed plastic packaging.

- Tray-Pak Corporation: It emphasize on industrial application and customized trays.

- Schaefer Systems International, Inc.: It offers customized and special packaging solution for transportation and storage.

- Packaging Corporation of America: It involve in the automotive packaging sector is emphasized on dunnage and corrugated containers.

- Others: Apex Plastics, FormPak, Inc., Thermoform Engineered Quality LLC, Plastic Ingenuity, Inc., Custom-Pak, Inc., Plastic Technologies, Inc., The Plastic Forming Company, PendaForm Company, LLC, Kiva Container, Thermoform Engineered Quality LLC

Recent Developments

- In March 2025, Borealis is extending its thermoforming portfolio with the launch of HC609TF which is a high-toughness polypropylene (PP) homopolymer manufactured for packaging purposes. It offers processability, transparency, and improved stiffness to fulfil the demand for performance as well as aesthetic look of consumers. (Borealis Adds Transparent Thermoforming Material for Packaging Applications to Portfolio)

By Material Type

- Polyethylene (PE)

- Polypropylene (PP)

- Polycarbonate (PC)

- Polyvinyl Chloride (PVC)

By Product Type

- Bulk Containers & Cases

- Bags & Pouches

- Trays & Inserts

- Dunnage & Pallets

By Accessories Type

- Battery Components

- Cooling Systems

- Underbody Components

- Automotive Filters

- Engine Components

- Lighting Components

- Electrical Components

By End Use Application

- OEM (Original Equipment Manufacturer)

- Aftermarket

By Geography

- United States

- Canada

- Mexico