Packaging Printing Market Sizing, Segment & Regional Deep-Dive (NA, EU, APAC, LA, MEA), Leading Companies, Competitive & Value Chain Analysis, Import–Export and Supplier/Manufacturer Coverage, 2024-2034

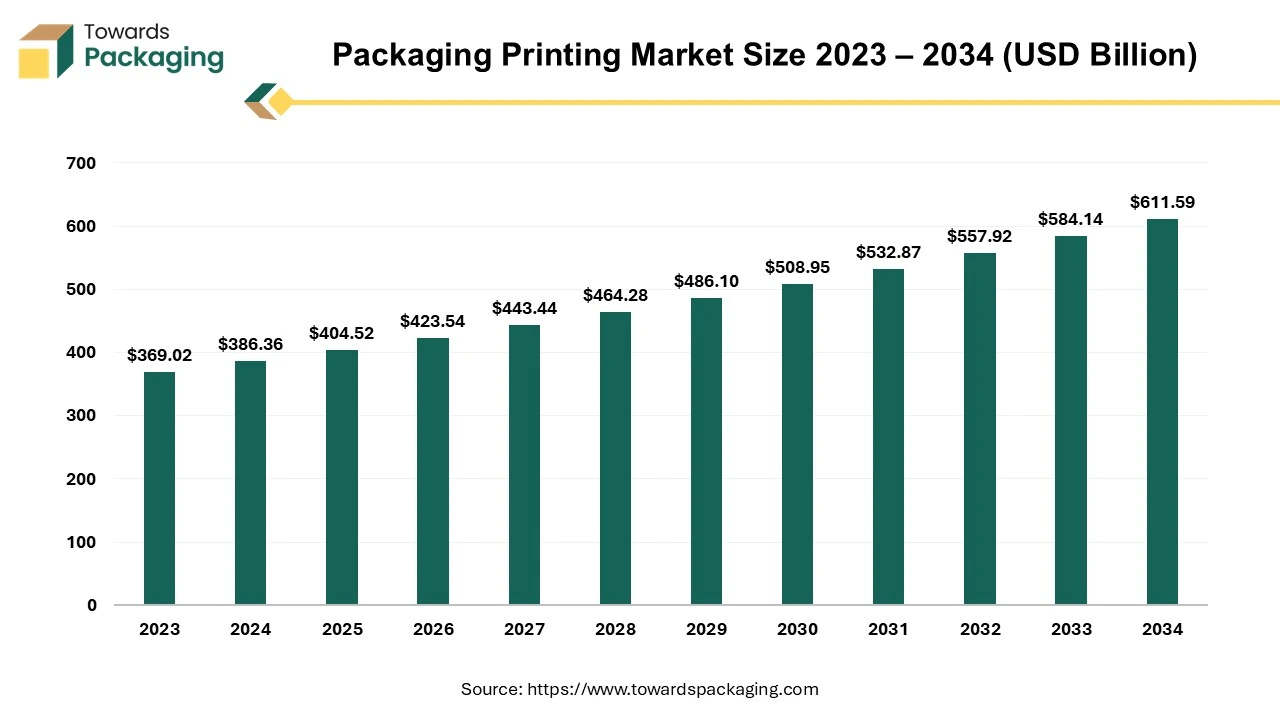

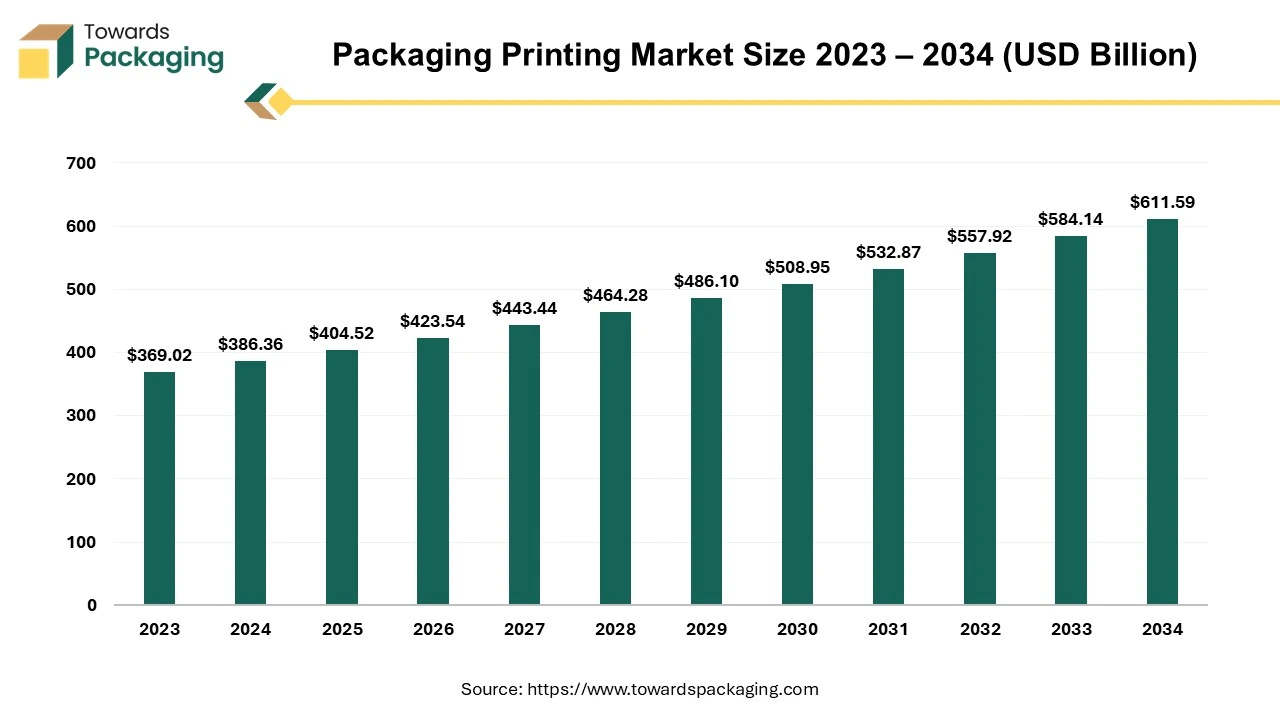

The packaging printing market is forecasted to expand from USD 423.53 billion in 2026 to USD 640.33 billion by 2035, growing at a CAGR of 4.7% from 2026 to 2035. Coverage spans segments by packaging type (paper, plastic, metal, glass, others), printing technology (flexography, digital, gravure, offset, screen, hybrid), and end use (food & beverage, pharmaceutical, personal care & cosmetics, electronics, industrial, others).

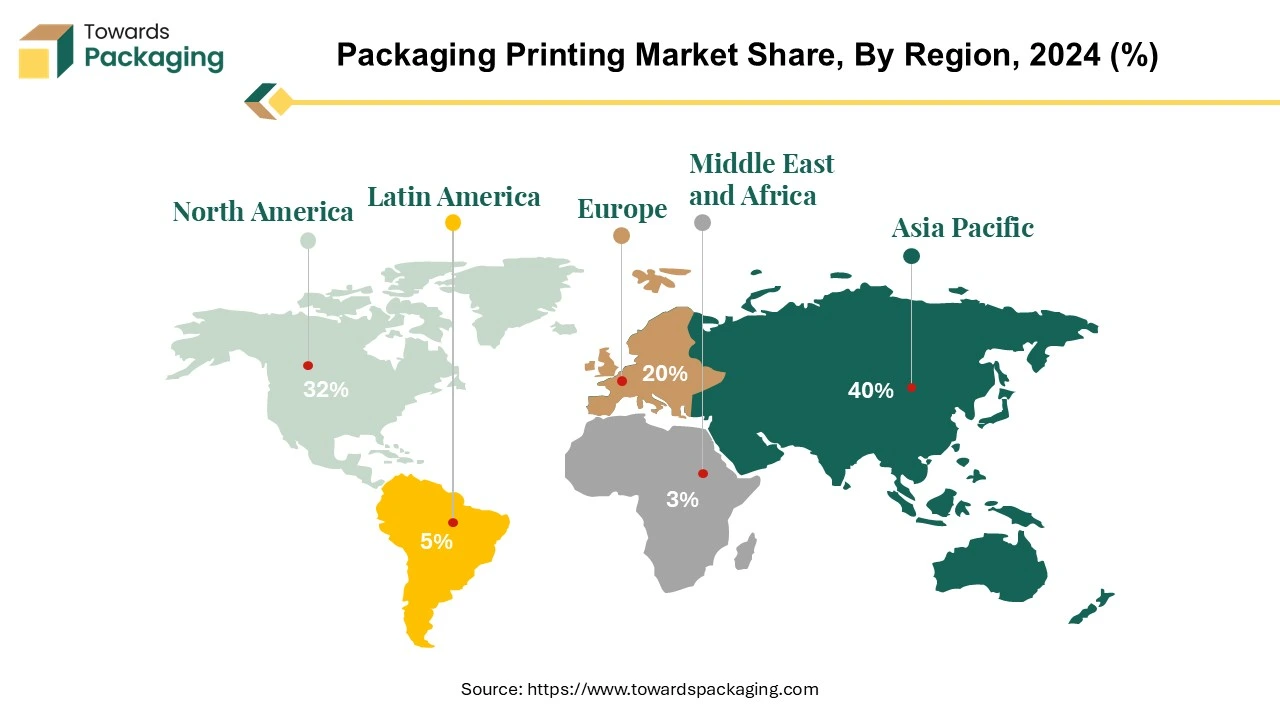

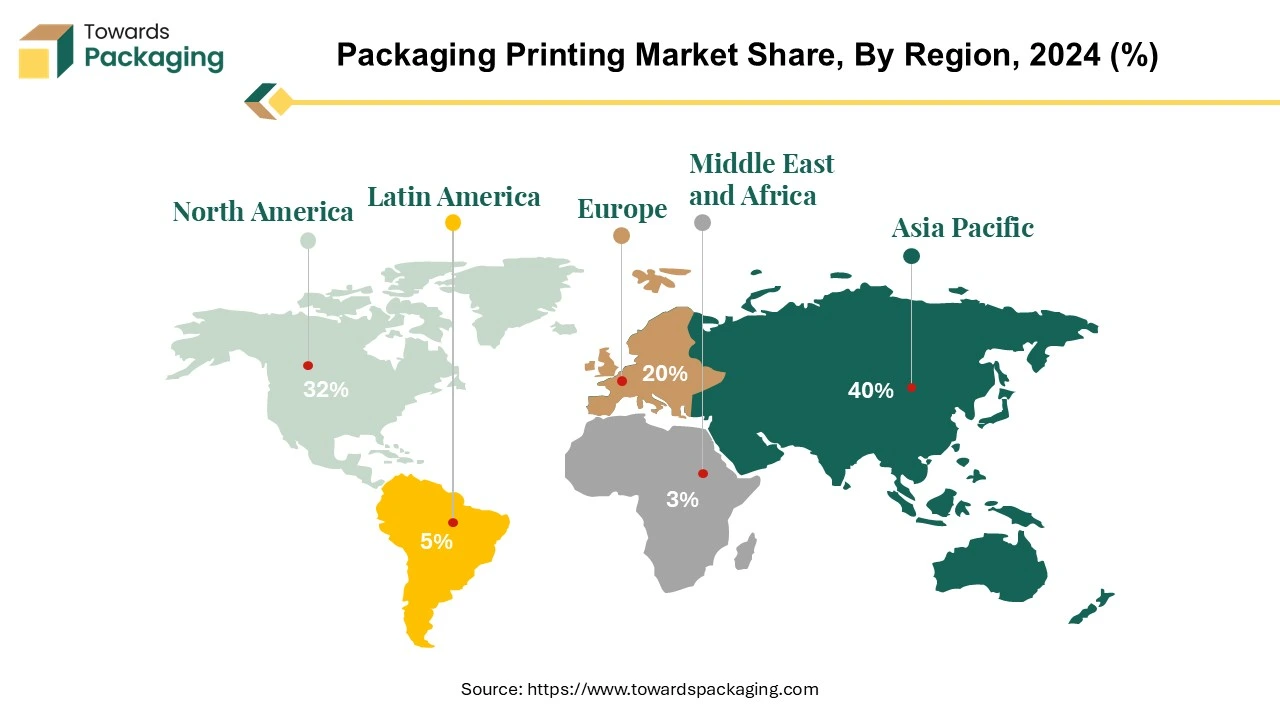

Regional data quantify NA, EU, APAC, LA, and MEA, with Asia-Pacific leading and North America remaining strong. The study benchmarks companies such as HP Inc., Eastman Kodak, Xeikon, Mondi, Ahlstrom-Munksjö, Amcor, Smurfit Kappa, DS Smith, WestRock, and others; maps the value chain from substrates/inks/plates to converters and brands; and provides trade statistics (imports/exports), manufacturer and supplier listings, and pricing/capacity insights. Trends include digital and smart packaging, sustainability, and flexography’s ~40% share with ~5% annual growth in use.

Report Highlights: Important Revelations

- Market Growth: The global packaging printing market is projected to grow at a CAGR of 4.7% from 2025 to 2034, driven by increasing demand for packaged goods and the need for innovative packaging solutions.

- Key Trends: Digital printing, sustainability, and smart packaging are emerging as key trends in the packaging printing industry.

- Regional Insights: Asia-Pacific dominates the market, while North America holds a strong position.

- Key Players: Major players include HP Inc., Eastman Kodak Company, Xeikon N.V., Mondi PLC, and Ahlstrom-Munksjo Oyj.

- Market Drivers: Increasing demand for packaged goods, brand differentiation, and growing emphasis on sustainability are driving market growth.

- Market Restraints: Technical challenges and cost pressures can pose challenges to market growth.

- Opportunities: Speciality printing finishes, exploring new market segments, and leveraging technological advancements offer significant growth opportunities.

The market for packaging printing, which includes techniques like rotogravure and flexographic printing, has been expanding significantly as due to of various factors. Flexographic printing is currently used in around 40% of all printed packaging used worldwide, and its use is growing at a pace of about 5% per year. The increasing demand for packaged goods across a range of industries accounts for this growth. A major supermarket often has over 40,000 packaged products on the shelves, all competing for the attention of consumers. When it involves attracting in customers and influencing their decisions for purchase, packaging is important. Packaging provides primarily for goods other than keep them together in place. It helps to properly exhibit, preserve, and safeguard goods.

Packaging producers have to implement innovative techniques to meet environmental sustainability goals and also improving the visual impact of their products in the extremely competitive present consumer marketplaces. This means that best procedures for design, conversion, and printing need to be observed. For packing producers, productivity and quality are essential factors. Regulating humidity turns out to be essential to guaranteeing ideal production circumstances. In printing and packaging facilities, maintaining the proper humidity levels is crucial to increasing productivity, minimising material waste, and reducing energy use.

The employment of environmentally friendly technologies in packaging manufacturing processes is growing increasingly important. This involves utilising less water and power while also adding more recycled materials into the mix. The industry's adoption of sustainable practices continues to be accelerated by consumer preferences and regulatory requirements.

The market for packaging printing is expanding rapidly due to the need to meet customer needs, improve product visibility, and adopt sustainable practices. Eco-friendly initiatives and efficient humidity management are essential for package production facilities to continue being viable and competitive in the face of changing market conditions.

For Instance,

- In September 2023, Stretchtape Inc., a major supplier of converted polyethylene and polypropylene films as well as custom printing solutions for BOPP packaging films, was acquired by Adherex Group ("Adherex or the "Company"), a leading manufacturer of highly efficient adhesion technology and specialty-engineered options, announced.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 404.52 Billion |

| Projected Market Size in 2035 |

USD 640.33 Billion |

| CAGR (2026 - 2035) |

4.7% |

| Leading Region |

Asia-Pacific |

| Market Segmentation |

By Packaging Type, By Printing Technology, By End Use and By Region |

| Top Key Players |

HP Inc., Eastman Kodak Company, Xeikon N.V., Mondi PLC, Ahlstrom-Munksjo Oyj |

How is Artificial Intelligence used in the Packaging Printing Market?

AI-powered design tools make it convenient to make evergreen graphics and layouts. These tools can track design trends, analyze user choices, and even suggest design elements. Personized designs, such as arranging images and text or making the templates, are now being carried out by Artificial Intelligence. The most prevalently used Artificial Intelligence in this context is Midjourney and Wall-E. Hence, Thai time is serving more and more designs in the AI to light. Apart from these, AI can track and control a huge amount of user data to make highly tailored printing materials, from direct mail to brochures and even customized catalogs.

Packaging Printing Market Trends

- The packaging printing industry is undergoing a change thanks to digital printing technology, which offers benefits including faster turnaround times, shorter print runs, and customisation options.

- Flexographic printing remains the leading technology in the packaging printing business, because to continual advances in press technology, ink formulas, and plate materials.

- The packaging printing industry is adopting eco-friendly printing techniques and materials due to concerns about sustainability.

- Packaging printing has been transformed into a platform for collaborative consumer engagement and product information dissemination through the integration of smart packaging technology and QR codes.

Asia-Pacific's Growing Influence in the Global Packaging Printing Market

The Asia-Pacific region is a prominent player in the global packaging printing market, with many countries contributing to its growth and development. This region has experienced increasing industrialization, urbanisation, and economic expansion, which is boosting demand for packaged goods across a variety of industries.

China is a dominant player in the Asia-Pacific packaging printing market. Its enormous customer base and rising manufacturing sector generate a significant demand for packaging materials and printing services. The country's emphasis on technological improvements and innovation in packaging solutions drives market expansion.

India is another significant market in the region, having a growing population and rising disposable incomes. The country's rapid consumer goods (FMCG), pharmaceutical, and retail industries are increasing demand for high-quality packaging printing solutions. The market for package printing in India is growing as a result of the increase of printing ink exports, which provide high-quality inks for packaging materials and satisfy the growing need for vivid and long-lasting prints on a range of packaging items. Government activities promoting sustainable packaging practices impact market trends and promote the adoption of recyclable resources and printing techniques.

Other Asia-Pacific countries, including Japan, South Korea, and Southeast Asian states, contribute substantial contributions to the packaging printing market. These countries have distinct consumer preferences and industrial landscapes, leading to a wide range of packaging needs. Increased investments in infrastructural development, along with a better understanding of product safety and branding, contribute to regional market expansion.

The package printing market in the Asia-Pacific region is expected to increase significantly due to various factors like increasing legislative frameworks supporting sustainable packaging practices, shifting consumer lifestyles, and expanding industries. A dynamic market environment that is conducive to innovation and strategic alliances is created by the region's diverse countries' demands and preferences.

For Instance,

- In February 2024, The Gallus One inkjet press from Heidelberg has been introduced to the Asia Pacific market as the company's first completely digital label press.

North America's Role and Trends in the Global Packaging Printing Market

North America has a prominent position in the global packaging printing industry because of its advanced technology, exacting quality standards, and wide range of applications across various sectors. The primary suppliers of packaging printing in the region are the United States and Canada. A variety of factors including the existence of a strong industrial sector, extensive retail networks, and an expanding e-commerce industry, drive the packaging printing market in the United States. The package printing industry in the US expanded by 5% in 2023, following the global trend that was fuelled by the rise in e-commerce and the need for eco-friendly packaging options. The food and beverage, pharmaceutical, personal care, and consumer goods industries are among those with a significant demand for innovative and visually appealing packaging solutions. The adoption of innovative printing techniques and supplies is enhanced with the focus on recognition of brands and product differentiation.

The package printing market in North America is changing due to technical innovations like flexible packaging, digital printing, and smart packaging solutions. Thanks to these advancements, manufacturers can now create personalised packaging designs, increase the effectiveness of the supply chain, and promote customer engagement.

Packaging printing procedures during the region are impacted by regulatory initiatives that promote food safety, product labelling, and environmental sustainability. Investments in printing technologies that assure product integrity and traceability throughout the supply chain are driven by compliance with rules and standards.

The packaging printing industry in North America is robust and competitive, including a focus on quality-driven manufacturing, innovation, and a dedication to meeting changing customer needs and regulatory requirements.

U.S. Market Trends

U.S. packaging printing market is driven by the growing food & beverage industry as well as advancement in infrastructure. The U.S. has a large, diverse, and mature consumer base with high demand for packaged goods, especially in food, beverages, pharmaceuticals, and personal care. The U.S. leads in adopting advanced printing technologies such as digital printing, flexography, and sustainable packaging solutions, improving efficiency and customization. The U.S. has one of the world's largest packaging industries, supported by major multinational corporations and a vast supply chain infrastructure. Growing environmental awareness and regulatory pressures drive innovation in eco-friendly and recyclable packaging, positioning U.S. companies as leaders in sustainable printing solutions. U.S. packaging and printing companies often export their products, expanding their market share beyond North America.

For Instance,

- In November 2021, the acquisition of Hart Print, a pioneer in digital printing services for the beverage industry and the first company to offer digitally printed cans in the North American market, was announced by Ardagh Metal Packaging (AMP).

Europe’s Strict Regulatory Norms to Project Steady Growth

Europe region is seen to grow at a notable rate in the foreseeable future. Europe has some of the strictest environmental laws, pushing companies to adopt sustainable, recyclable, and eco-friendly packaging solutions. This fuels innovation in sustainable printing technologies. European consumers place high value on aesthetics and quality, driving demand for high-end packaging and advanced printing techniques like digital, gravure, and offset printing. Europe has a robust fast-moving consumer goods (FMCG) and pharmaceutical sector, both of which require high volumes of printed packaging with precise labeling and compliance.

The EU promotes a circular economy, encouraging the use of biodegradable materials and sustainable inks, positioning Europe as a leader in green packaging printing. European companies are at the forefront of developing and adopting cutting-edge printing technologies, including hybrid presses and smart packaging (e.g., QR codes, RFID). European packaging printing companies often serve global markets, especially luxury goods, contributing to their global market share. European governments and industry associations provide significant support for innovation, sustainability, and digital transformation in packaging.

Latin America

Sustainability imperatives are updating the operational highlights for the plastic packaging transformers and digital print service providers. Nations like Colombia and Chile are accepting Extended Producer Responsibility (EPR) frameworks, integrating producers to move towards more effective digital printing workflows. The World Bank’s plastic reduction Program has highlighted that over 80% of plastic waste in Latin America is presently mismanaged, prompting the regulatory bodies to champion recyclable, reusable, and biodegradable plastic substrates. In feedback, the digital printing solutions are accepting low-VOC water-based inks, allowing substrate compatibility with recycling fields.

Middle East and Africa

Packaging printing demand in the Middle East and Africa is due to the region’s growing e-commerce platforms. A crucial participant in the Middle East and Africa has grown in the United Arab Emirates-based platform, and print-on-demand is a kind of business procedure in which copies of books or other documents are not created until the company gets an official agreement. This makes it impossible for just one copy or a few copies. At the same time, other sectors created the “build-to-order”, “print-to-demand” concept, which existed until digital printing, which came along with high costs in order to make a single copy because of regular printing methods like letterpress and offset printing.

Key Demand, Restraints, and Opportunities in the Packaging Printing Market

Demand:

- Printing on packaging provides companies an opportunity to communicate important product information including ingredients, usage guidelines, safety alerts, and regulatory compliance information.

Restraint:

- Printing on particular surfaces, develops, and packaging materials can provide technical challenges when it comes to print registration accuracy, colour uniformity, and ink adhesion.

Opportunity:

- Packaging printers can offer their products greater significance and distinction by using speciality printing finishes including textured coatings, metallic foils, and holographic effects.

Growth of Paper-Based Packaging Printing

Paper has remained one of the most prominent substrates for packaging printing owing to its adaptability, affordability, and environmental benefits. The market for packaging printing on paper is expanding significantly due to a wide range of applications in different industries. Paper-based packaging is frequently employed in the food and beverage industry for products including cereals, snacks, candies, and beverages. Paper packaging printing has significant potential for product distinctiveness, branding, and informing customers of pertinent information. Improvements in printing technologies make it viable to produce attractive designs and excellent graphics, which improve shelf appeal and increase customer interaction.

The market for package printing is growing as a result of the rising demand for printing services and packaging materials brought about by the rising use of writing and printing paper. Paper-based packaging is widely used in the pharmaceutical industry due to its regulatory compliance, protection, and tamper evidence capacity. Printing packaging on paper primarily provides a platform for branding and educational materials, but it also ensures the safe and secure transportation of medications. Paper-based packaging is widely used in the personal care and cosmetics industry for products including toiletries, skincare products, and makeup. Through attractive designs and package structures, companies may effectively exhibit their products, communicate their brand values, and attract in customers with packaging printing on paper.

Paper-based package printing is becoming growing in prominence primarily an effect of the growing trend towards sustainable packaging solutions. Paper is widely used for environmentally friendly brands and consumers because it is renewable, recyclable, and biodegradable. There is a growth in the market for paper-based packaging printing when it involves eco-friendly materials, printing methods, and creative packaging designs.

Paper-based packaging printing has several uses in a wide range of industries and continues to grow as companies include consumer involvement, brand uniqueness, and sustainability into their packaging strategies.

For Instance,

- In February 2022, HP Inc. recently bought Choose Packaging, a packaging development companies that invented the world's only commercially accessible zero-plastic paper bottle.

How Package Printers are Leveraging Technology for Growth

In an era of rapid industry convergence, printing companies across various sectors are exploring new ways to enhance their offerings. Package printers, in particular, are keen to use technology to expand beyond their traditional capabilities and enter new markets.

One of the significant attributes driving the adoption of digital printing is its ability to offer variable, customizable, and personalized printing solutions. While not the primary motivator, 69% of respondents identified this feature as a crucial factor in their decision to acquire digital printing technology.

On the other hand, conventional printing still holds its ground, with 28% of respondents investing in conventional methods to penetrate new market segments. Additionally, 22% are looking to add new products through these investments.

To stay competitive, package printers must continually seek growth opportunities beyond their existing operations. Embracing the latest technologies can serve as a vital bridge to new offerings, ensuring they remain at the forefront of the industry.

Flexographic Printing for Cost-Effective and Efficient High-Volume Package Printing

Flexographic printing, often known as flexo printing, is an incredibly widespread method used in the package printing sector. This technique uses flexible relief plates, typically constructed of rubber or polymer, that are connected to revolving cylinders. These plates transfer ink on packaging materials, producing high-quality prints. Flexo printing is ideal for high-volume production, with prevalent uses including labels, corrugated boxes, and flexible packaging. It offers brilliant shades, rapid printing rates, and cost-effectiveness for large print runs.

Flexography uses a light-sensitive polymer to create a 3D relief on a roller, as opposed to standard lithography, which uses flat plates. This differentiation helps to cut printing costs and drastically lower tooling costs. Preparation is simplified because only the plate must be readied. Flexo printing enables faster turnaround and the application of both water-based and oil-based inks.

Flexography's cost-effectiveness per unit, because to lower tooling costs, allows for potential savings that can be passed on to end users. Its fast-processing times in packaging printing procedures outperform those of competing printing methods. Flexo printing is an effective substitute in the packaging company for printing graphics, text, and images on non-porous materials, which are widely used in food packaging applications.

For Instance,

- In November 2023, Data-Mail, an established manufacturer of integrated advertising solutions, announced the formation of a new Data-Mail affiliate firm, Graphic Packaging Group LLC (GPG).

Food and Beverage Packaging Printing Driving Market Growth Through Innovation and Sustainability

The food and beverage industry accounts for a sizable percentage of the packaging printing market, with consistent growth driven by a variety of indicates and applications. Packaging printing is important in the food and beverage industry since it primarily protects and contains products, but it also serves as a potent instrument for branding, information distribution, and customer involvement.

Packaging printing for food and beverage goods includes a wide range of formats and materials. Pouches, sachets, and wrappers are popular flexible packaging options for snacks, sauces, and beverages. These packaging formats provide adaptability, convenience, and increased product visibility on store shelves. Furthermore, labels and stickers are frequently utilised for product identification, branding, and regulatory compliance in a variety of packaged food and beverage products.

The food and beverage industry's packaging printing market is expanding as the outcome of multiple factors. The market is driven by shifting customer tastes and lifestyles, which increases the need for innovative packaging designs and materials that improve the convenience and appeal of products. The implementation of sustainable materials and printing techniques in packaging printing is influenced by regulatory requirements pertaining to food safety, nutritional labelling, and sustainability.

Rapid product introductions, shorter print runs, and customisation are made possible by developments in printing technologies including digital printing and flexible packaging. These factors support the market's expansion. With the use of these technologies, food and beverage companies may customise container designs, seasonal variants, and respond rapidly to market requests. The packaging printing market's food and beverage segment is expected to increase at a steady rate due to factors like consumer trends, regulatory dynamics, and technical advancements that promote efficiency, sustainability, and distinctiveness in packaging solutions.

For Instance,

- In March 2022, A brand-new printed carton service from AA Labels is targeted at small to medium-sized food and beverage companies that want reasonably priced packaging for brief print runs with fast turnaround times.

Strategic Insights and Competitive Landscape

The competitive landscape of the packaging printing market is dominated by established industry giants such as HP Inc., Eastman Kodak Company, Xeikon N.V. Mondi PLC, Ahlstrom-Munksjo Oyj, Autajon CS, Huhtamaki Flexible Packaging (Huhtamaki Oyj), Avery Dennison Corporation, CCL Industries Inc., Clondalkin Group Holdings BV, Constantia Flexibles Group GmbH, Amcor PLC, Smurfit Kappa Group PLC, DS Smith PLC, Georgia-Pacific LLC, International Paper Company, Sealed Air Corporation, WestRock Company, Stora Enso Oyj, Sonoco Products Company, Trustpack UAB, Mayr-Melnhof Karton AG, and Duncan Printing Group. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

HP Inc. prioritises diversification and innovation in the printing sector. They make significant investments in R&D to develop innovative printing technologies, including digital printing solutions for a range of uses such labels, packaging, and commercial printing.

For Instance,

- In February 2022, HP Inc. has acquired of Choose Packaging, a packaging the development company that is the designer of the world's only commercially accessible zero-plastic paper bottle.

The Eastman Kodak Company aims to adjust to shifting market trends by utilising its knowledge of image and printing technology. They specialise in offering services, software, and solutions for digital printing to publishing, packaging, and commercial printing companies.

For Instance,

- In June 2023, Kodak purchased Graphic Systems Inc, which sells offset web presses, web inkjet presses transport systems, and other print-related components and technical services.

Digital printing solutions for the packaging and labelling sectors are the area of expertise for Xeikon N.V. Their approach centres on providing digital printing presses and workflow solutions that are both affordable and of excellent quality, specifically designed to meet the requirements of packaging converters and brand owners. Xeikon prioritises ongoing innovation and client cooperation to successfully meet changing market demands.

For Instance,

- In August 2023, Leading producer of heat-sealed flexible packaging sheets with built-in barriers and integrated barriers, Sappi has partnered with pioneer of digital printing Xeikon in a collaborative effort.

Leader in the global market of paper and packaging solutions is Mondi PLC. Their approach places a high priority on innovation, sustainability, and customer relationships. Mondi makes research and development investments to develop innovative packaging solutions that satisfy consumer demands for performance, branding, and cost-effectiveness while also fulfilling sustainability targets.

For Instance,

- In February 2024, The Hinton Pulp mill in Alberta, Canada, was purchased by Mondi Group, a major participant in the world market for sustainable packaging and paper, from West Fraser Timber Co. Ltd. for a total consideration of $5 million.

New Advancements in Pharmaceutical Packaging Equipment Industry

- In February 2025, At PrintPack India 2025, Monotech Systems Ltd., a world leader in printing and packaging technology, is excited to introduce their revolutionary PixelGlow Vertex. India's first completely autonomous, B2-sized, multi-pass Digital UV and Foiling System, created and developed by Monotech Systems in India, will make its premiere at the India Expo Centre in Greater Noida from February 1 to 5, 2025.

- In January 2025, Konica Minolta will introduce its AccurioPress 14010S at PrintPack 2025 along with a wide range of digital printing products aimed at revolutionizing the label, packaging, and commercial printing sectors. The show will take place in the India Expo Centre & Mart in Greater Noida, Delhi NCR, from February 1–5, 2025. The Konica Minolta stand at PrintPack 2025 will feature live demonstrations of these state-of-the-art printing technologies.

- In April 2025, At FESPA Global Print Expo 2025 in Berlin, Germany, AstroNova, Inc., a pioneer in digital print technology, announced the introduction of two new high-performance digital label presses and a direct-to-package printer, setting a new benchmark for speed, flexibility, and cost-effectiveness in the light to medium production market. With the release of the QL-425 (A4 wide) and QL-435 (A3 wide) professional label printers, AstroNova's flagship QuickLabel brand expands its light production area of digital label printing. Additionally, the company will unveil the VP-800, its newest printing solution for eco-friendly packaging materials like wood, die-cut boxes, padded or plain envelopes, paper bags, and corrugated cardboard.

- In February 2025, At the 16th Printpack India 2025, imaging technology leader FUJIFILM India unveiled cutting-edge product lines. The high-performance Apeos 4620 SX/SZ multifunction devices and the adaptable Revoria Press family were among the new products. Four mid- to mid-high range production presses, including the four-color EC2100 and SC285 models and the five-color EC2100S and SC285S models, were added to the Revoria Press roster. These presses feature high-quality printing, remarkable speed, and compact designs. The Peos 4620 SX/SZ monochrome devices, on the other hand, offer remarkable performance at 46 pages per minute and are made for effective A4 service counter operations.

Packaging Printing Industry Leaders and Innovators

- HP Inc.

- Eastman Kodak Company

- Xeikon N.V.

- Mondi PLC

- Ahlstrom-Munksjo Oyj

- Autajon CS

- Huhtamaki Flexible Packaging (Huhtamaki Oyj)

- Avery Dennison Corporation

- CCL Industries Inc.

- Clondalkin Group Holdings BV

- Constantia Flexibles Group GmbH

- Amcor PLC

- Smurfit Kappa Group PLC

- DS Smith PLC

- Georgia-Pacific LLC

- International Paper Company

- Sealed Air Corporation

- WestRock Company

- Stora Enso Oyj

- Sonoco Products Company

- Trustpack UAB

- Mayr-Melnhof Karton AG

- Duncan Printing Group

Market Segmentation for Packaging Printing

By Packaging Type

- Paper

- Plastic

- Metal

- Glass

- Others

By Printing Technology

- Flexography

- Digital Printing

- Gravure

- Offset Printing

- Screen Printing

- Hybrid Printing

By End Use

- Food and Beverage

- Pharmaceutical

- Personal Care & Cosmetics

- Electronics

- Industrial

- Others

By Region

- Asia Pacific

- North America

- Europe

- LA

- MEA