Paper and Paperboard Packaging Market Intelligence Report, Key Trends, Innovations & Market Dynamics

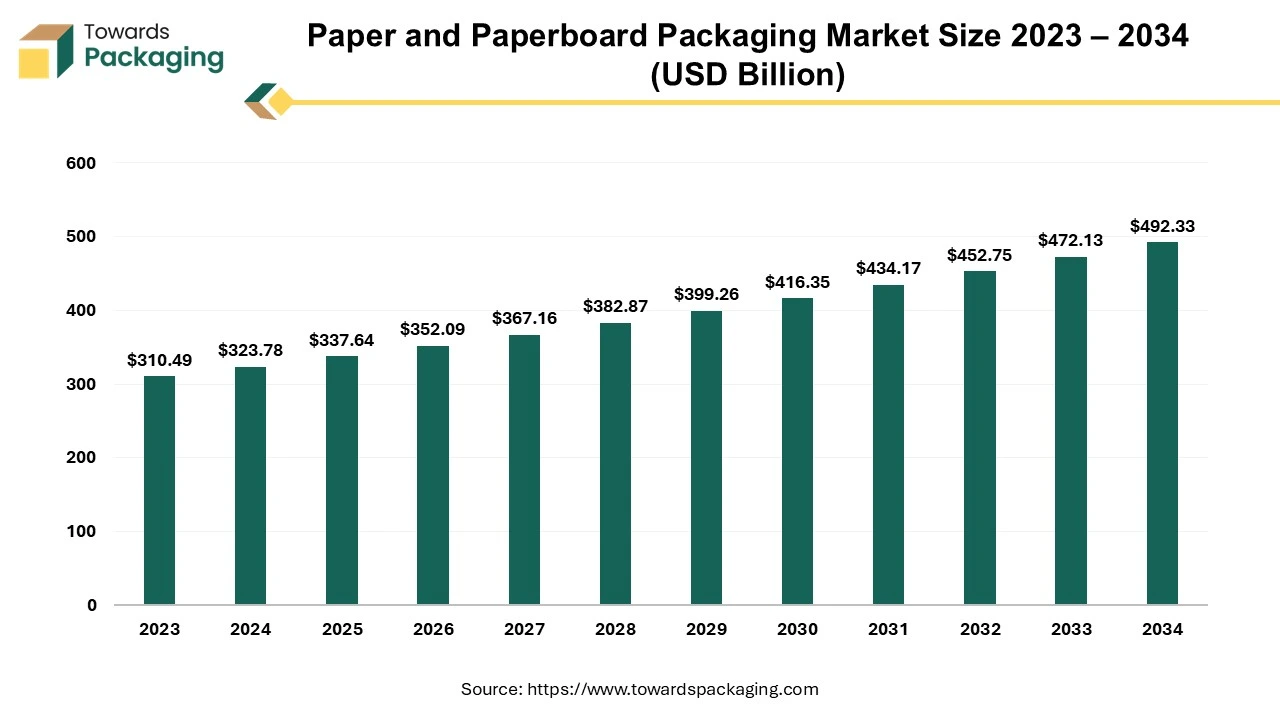

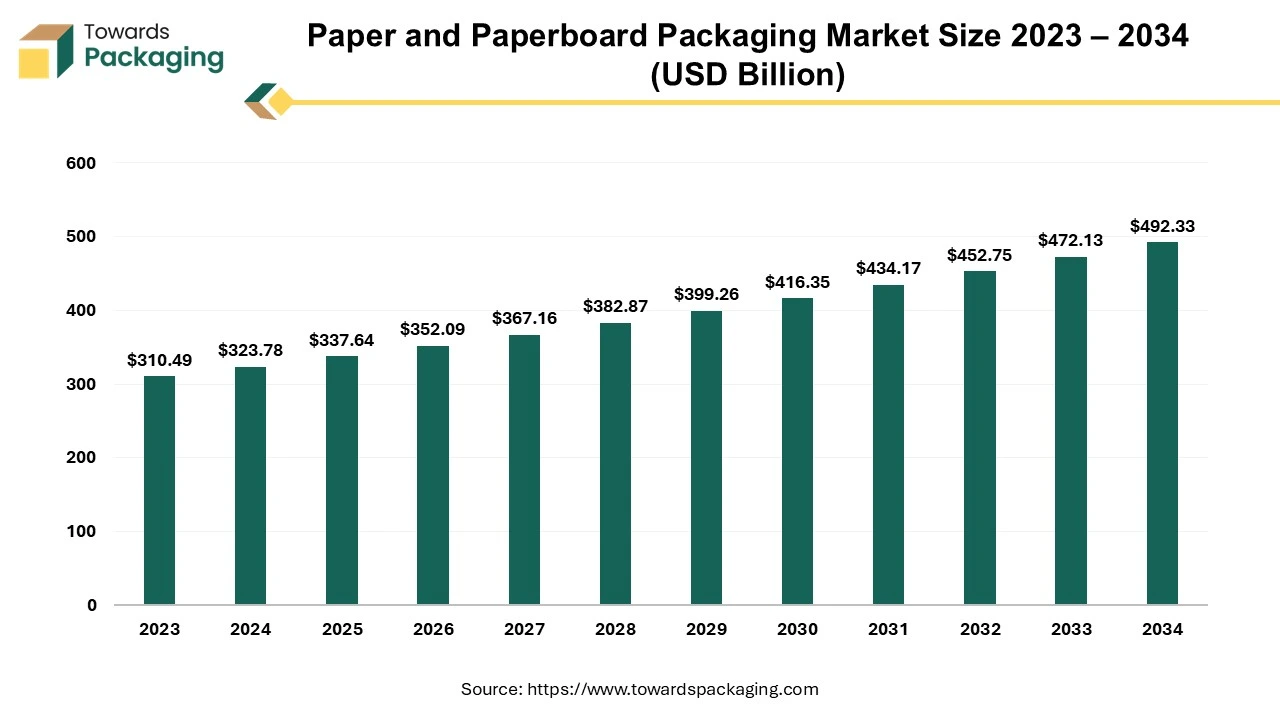

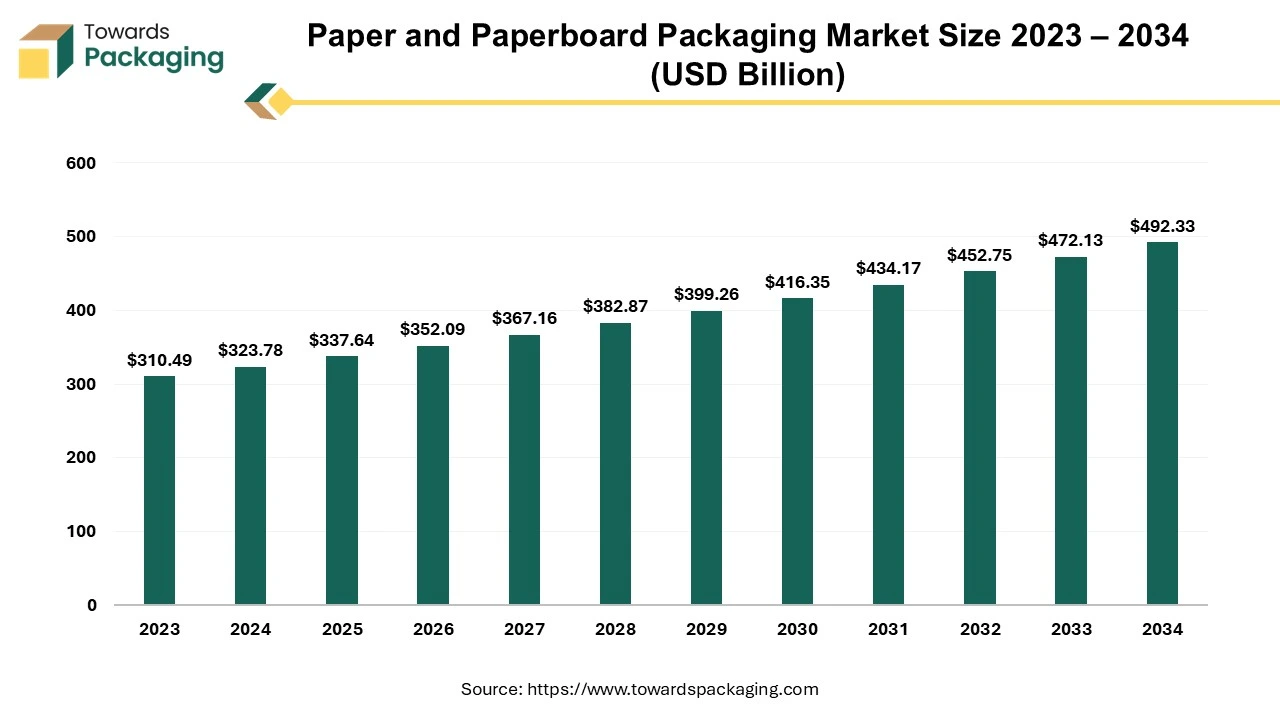

The paper and paperboard packaging market is forecasted to expand from USD 352.09 billion in 2026 to USD 513.41 billion by 2035, growing at a CAGR of 4.28% from 2026 to 2035. This market is segmented by product types such as folding cartons, corrugated boxes, and boxboards, as well as packaging types including paper bags, cups, and containers. Regional data highlights North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with significant insights into leading manufacturers such as Smurfit WestRock, International Paper, and DS Smith.

Report Highlights: Important Revelations

- Global paper and paperboard packaging sector is poised for growth, starting at a value of USD 297.89 billion in 2022.

- The market is expected to surge, reaching an estimated value of USD 352.09 billion in 2026.

- This expansion is growing at CAGR of 4.28% over the period from 2025 to 2035.

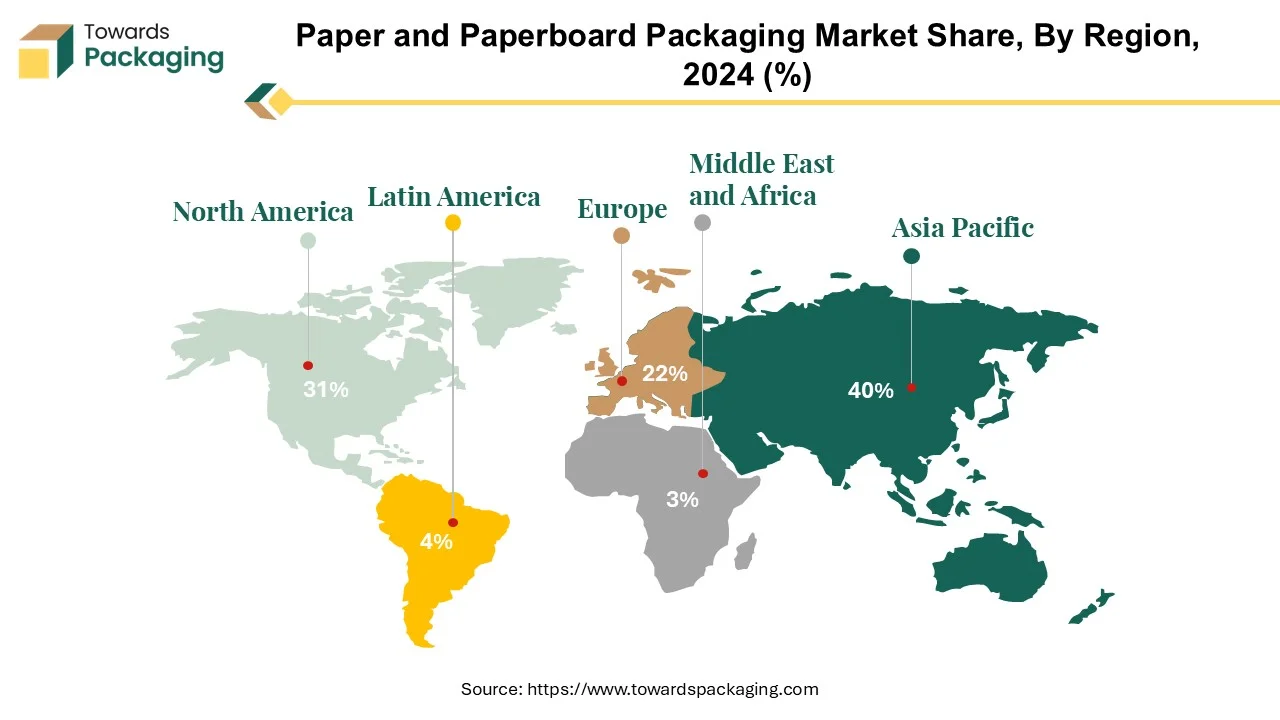

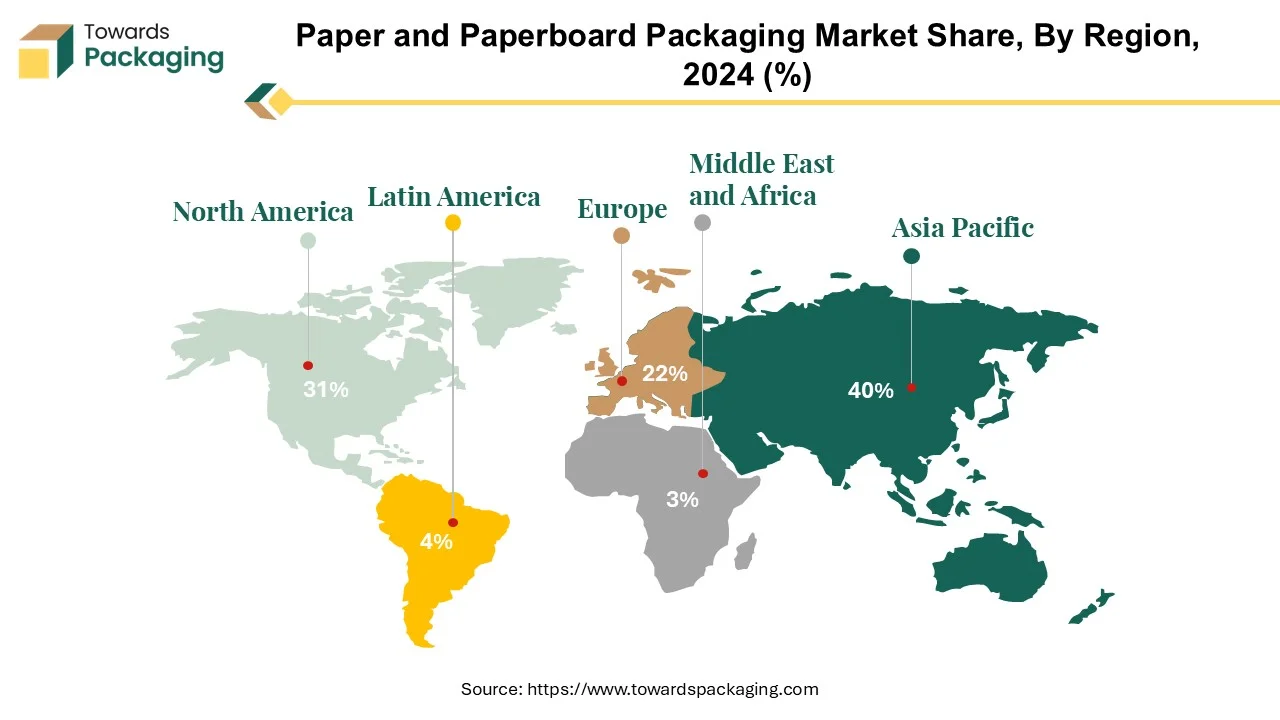

- The dominance of the Asia Pacific region in the paper and paperboard packaging industry.

- Increasing need for paper and paperboard products in North America.

- Utilization of folding cartons across diverse sectors.

- Growing requirement for paper and paperboard in the food and beverage industry.

- Benefits of paper bags compared to plastic for sustainable packaging.

Paper and paperboard-based materials comprise some of among the earliest and most widely used types of packaging. Their adaptability can be seen in a variety of uses, from the fragile, infusible tissues found in tea and coffee sachets to the robust boards that are essential for distribution. Over one-third of the packaging market is made up of these materials, which are utilised extensively in all phases of production, distribution, marketing, and consumption. Primary packaging at the place of sale, secondary packaging for distribution and storage, and other applications are all covered by their purposes.

Paper and paperboard, made of interwoven cellulose fibres, have versatile qualities that allow printing and manipulation into rigid or flexible packaging utilising methods including cutting, creasing, folding, and securing. Among the noteworthy developments are the 12.5% increase in paper production that occurred in January 2023, totalling 67,100 tonnes, and the 6.7% increase in paper production that occurred cumulatively between April 2022 and January 2023, totalling 5,553,900 tonnes in November 2022, there was an 11.1% increase in the production of paper goods.

Supermarkets, retail stores, traditional markets, mail-order services, pharmacies, hospitals, fast-food restaurants, catering services, and entertainment venues are just a few places where paper and paperboard packaging is frequently encountered. Paper and paperboard packaging is able to endure exposure to high temperatures when boiling, heating in a microwave, and using a conventional oven, as well as freezing temperatures for storing food. Because paperboard packaging is essentially recyclable, renewable, and sustainable, it equally helps the environment and the economy and reflects the values of today's eco-conscious consumers.

For Instance,

- In August 2023, Graphic Packaging, a packaging firm based in fiber, introduced its latest product, coated recycled paperboard (CRB), designed for use in commercial packaging.

Growth Factors

- Recyclable and biodegradable materials: Rising demand for eco-conscious packaging solutions is driving the growth of recyclable and biodegradable options. Paper-based alternatives are rising and gaining attention due to their less environmental impact.

- Advancements in technology: Innovation is changing the paper and packaging industry. Smart packaging solutions, including QR Codes, IoT sensors, and RFID Tags, are growing supply chain efficiency, efficiency, and consumer engagement.

- Customization and personalisation: With the growth of digital printing, brands are growing and offering personalized packaging to grow consumer engagement. This trend is changing packaging from a functional demand into a powerful marketing tool.

- Cost-effective customization: Digital printing technologies allow high-quality, tailored packaging at competitive costs that make personalized solutions available to businesses of all sizes.

- Automation in packaging lines: Automation is changing packaging operations as it drives faster manufacturing rates, lower labor costs, and improved accuracy. Automated systems can handle high amounts while maintaining precision, perfect for industrial manufacturers that come in contact with large orders.

- Advanced protective packaging technologies: New patterns in protective packaging will serve to increase durability without increasing material waste. These should series from collapsible heavy containers to eco-friendly alternatives for hazardous material storage.

Paper and Paperboard Packaging Market Trends

- The market for paper and paperboard packaging is placing an increasing amount of attention on environmental sustainability. As an attempt to reduce their influence on the environment, manufacturers are steadily implementing environmentally friendly production methods, recycled fibres, and sustainable forestry techniques.

- Packaging made of paper and paperboard is adaptable and customisable for a variety of goods and uses.

- Technological developments in paper and paperboard packaging have encouraged the development of innovative approaches that promote product sustainability, functionality, and protection.

- The need for paper and paperboard packaging materials appropriate for online retail distribution has grown as e-commerce has expanded.

Asia Pacific's Leadership in the Paper and Paperboard Packaging Sector

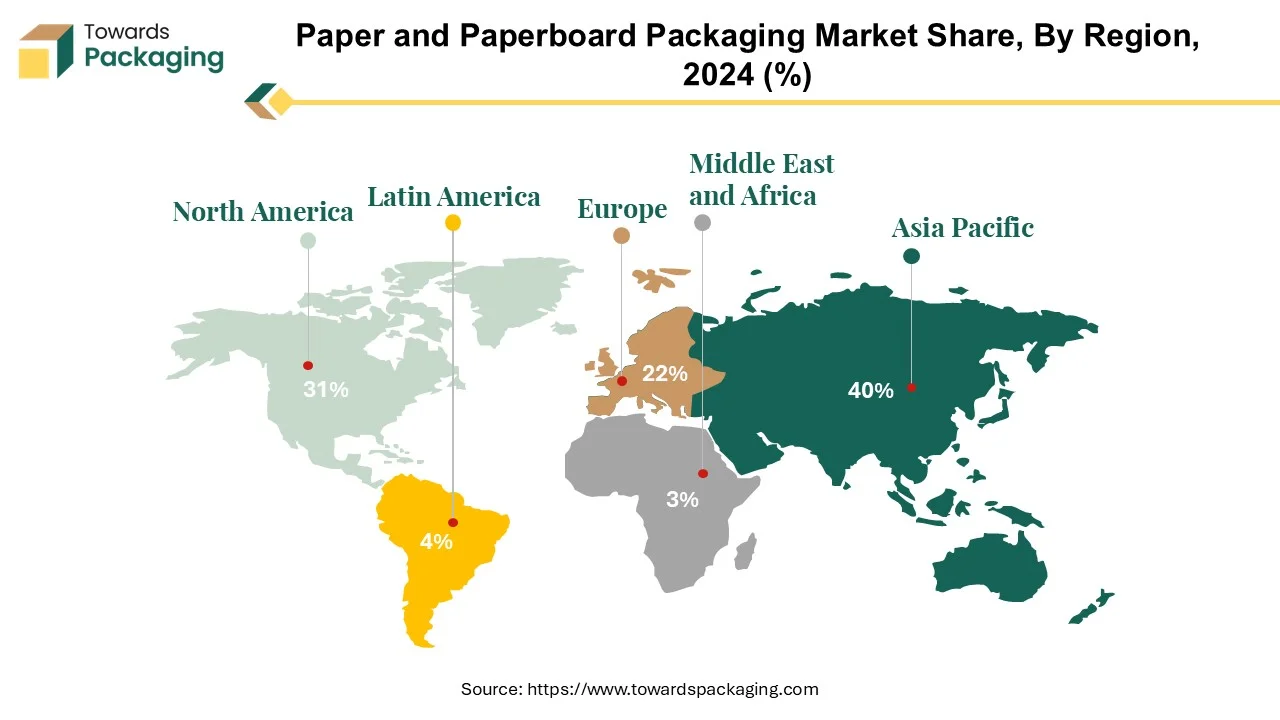

Asia pacific region is taking over the packaging sector with their leading market shares in India and China. This surge is fuelled by three key factors, growing populations, rising disposable incomes, and a growing preference for packaged goods, especially food, as traditional markets shift towards packaged consumerism. China a global leader in packaging sector contribute 48% in packaging market alone, on the other hand India is growing at 8.5% rate by 2022.

This trend may be clearly observed in China's paper and packaging business. A 2022 estimate stated that the nation produced an astounding 283.91 million tonnes of pulp, paper, and related materials. The packaging industry in India is growing in tandem with this boom, driven by a number of factors including strong domestic demand, a thriving industrial base, and an expanding market for paper products such as tissue, filters, tea bags, and lightweight online packaging materials. The market for premium packaging is being driven by well-organized retail chains.

In the newsprint market, an opposing tendency is beginning to emerge amid this expansion. Over the last ten years, newsprint imports and output have both drastically decreased, despite a slow decline in consumption. Nearly 70% of the newsprint imported into India comes from Russia and Canada. The newsprint business is facing challenges as a result of the recent conflict between these countries, which has further disrupted supply chains and raised prices.

For Instance,

- In April 2023, Omya reported that it will be investing in the production of calcium carbonate for its long-term paper and board sector partners in seven locations in Asia Pacific.

Rise in Demand for Paper and Paperboard Goods in North America

North America appears as the second-largest market for paper and paperboard packaging, with a notable consumption trend. Although the average worldwide is 55 kg per person annually, North American consumers significantly exceed this, with a four-fold increase in consumption. Notably, in North America, the use of writing and printing paper has significantly decreased. This category, which by volume makes up around 25% of all paper usage global, has seen significant declines in utilization.

One significant effect of this change in consumption habits is that formerly underserved people now have more access to paper markets. This accessibility has consequently led to a continuous rise in the demand for paper goods. Paper sector adaptations to meet changing customer demands and preferences have been made as conventional North American consumption habits change, characterised by less reliance on printing and writing paper. As a result, the need for paper and paperboard packaging keeps growing due to a combination of conventional uses and the changing needs of various consumer groups in the North American market.

This trend underscores the dynamic nature of the paper and paperboard packaging industry within the region, as it navigates shifting consumer This development emphasises the dynamic nature of the region's paper and paperboard packaging business, which navigates altering consumption habits and adapts to meet consumers' shifting desires patterns and adapts to meet the evolving needs of consumers.

For Instance,

- In June 2021, the five businesses that Nippon Paper has targeted for growth are packaging, chemicals, energy, wood, and domestic paper and healthcare. Paper is being reevaluated as an environmentally beneficial material, especially in the packaging industry.

Paper and Paperboard Packaging Market, DRO

Demand:

Restraint:

- Paper and paperboard packaging might offer fewer effective properties than other materials, specifically in the field of barrier features and durability.

Opportunity:

- Embracing circular economy ideas opens up possibilities for closed-loop systems of recycling and sustainable packaging approaches.

Application of Folding Cartons in Various Industries

Folding cartons are a common type of paper and cardboard packaging because they offer a variety of flexibility and utility. Made of paperboard, they offer an almost limitless canvas for intricate physical patterns and decorative accents, all the while maintaining the durability necessary to safeguard your goods during transportation and exhibition.

Radio frequency identification (RFID) technology is becoming an asset in many retail sectors, and folding cartons work well with it. RFID technology interoperability enhances supply chain visibility, streamlines inventory management, and boosts an organization's overall operational effectiveness. Mid-market expansion projections indicate that 70 million tonnes will be employed globally by 2028; assuming unaltered pricing in 2022, that amounts to over $200 billion. The market for folding cartons is expected to increase by more than $15 billion by 2028, assuming prices remain the same as they did in 2022.

For Instance,

10 million tonnes more material will ultimately enter the carton board sector as a consequence of these improvements, meeting the anticipated increase of demand for folding carton packaging.

Rising Demand for Paper and Paperboard in Food and Beverage Sector

The food and beverage industry stands as the largest end-user within the paper and paperboard packaging market, experiencing significant growth driven by various factors. This growth is primarily propelled by the development of the country's logistics sector, increasing urbanization, and the expanding penetration of organized online retail, leading to heightened growth in fast-moving consumer goods (FMCG), pharmaceutical, and processed food industries. Within this segment, the demand for value-added boxes is particularly pronounced, contributing to the dominance of the food and beverage segment in the global corrugated box packaging market.

The global demand for frozen meals, which are commonly packaged in paperboard cartons, is expected to exceed $312 billion by 2025.This increase can be attributed to people all around the world looking for frozen foods to meet their busy lifestyles and save time. Fresh, organic, and unprocessed foods are becoming more and more popular along with this trend because they are seen to be healthier and more environmentally friendly. This counter-trend may eventually reduce demand for folding carton packaging.

Amazon, the global shipping company, is a prime example of this changing environment. It just declared that it will be using paper-based insulated bags for its food delivery service, Fresh, in the USA, beginning in November of last year. This action highlights how adaptable the sector is to shifting customer demands and sustainability issues, suggesting a move in the direction of more environmentally friendly packaging options.

For Instance,

Advantages of Paper Bags Over Plastic in Sustainable Packaging

Paper bags are the leading product used in paper and paperboard packaging market. On a large-scale paper bag used in food and beverage products such as snacks, juice and others, also used as shopping bags.

For Instance,

- In January 2024, the sandwich bag that Louis Vuitton launched shocked the internet with its price. The bag features a blue closure to store sandwiches or other valuables, along with the iconic Louis Vuitton lettering.

The global trend towards sustainability and environmentally friendly solutions has significantly impacted various industries, with packaging being no exception. Increasing concerns about plastic pollution and environmental degradation have led consumers and businesses to seek alternative packaging options. Paper bags provide a number of advantages over plastic bags. Firstly, they are biodegradable and compostable, which means they decay naturally without leaving hazardous residue.

For Instance,

UK Consumers Favor Paper and Cardboard Packaging for Environmental Benefits, Survey Finds

In the ongoing debate about reducing plastic waste and embracing a circular economy, a recent snap poll reveals a clear preference among UK consumers for paper and cardboard packaging. The survey, which sampled 500 UK adults, highlights that paper and cardboard are favored for their environmental benefits, recyclability, and practicality.

When asked about their preferred packaging material—glass, metal, paper and cardboard, or plastic—respondents rated paper and cardboard highest across several criteria. These materials were praised for being environmentally friendly, easier to recycle, and more practical in everyday use. Paper and cardboard packaging were seen as lighter, simpler to open and close, and safer to handle.

Specific environmental benefits of paper and cardboard packaging also stood out:

- 78% of respondents appreciate paper and cardboard for its biodegradability.

- 73% value the use of recycled materials in paper and cardboard packaging.

- 64% like that paper and cardboard are made from renewable wood fiber.

The survey also uncovered widespread concerns about packaging:

- 85% of respondents believe packaging is a major source of litter.

- 84% see over-packaging as a significant problem.

- 71% think packaging has a negative impact on the environment.

Items like coffee cups, plastic bottles, chocolate bar wrappers, crisp packets, and takeaway containers were identified as major contributors to litter.

As the UK strives towards a regenerative, circular economy, paper and cardboard packaging, known for its durability, renewability, and recyclability, will play a crucial role in achieving these environmental goals, in line with the UK Government’s 25 Year Environment Plan.

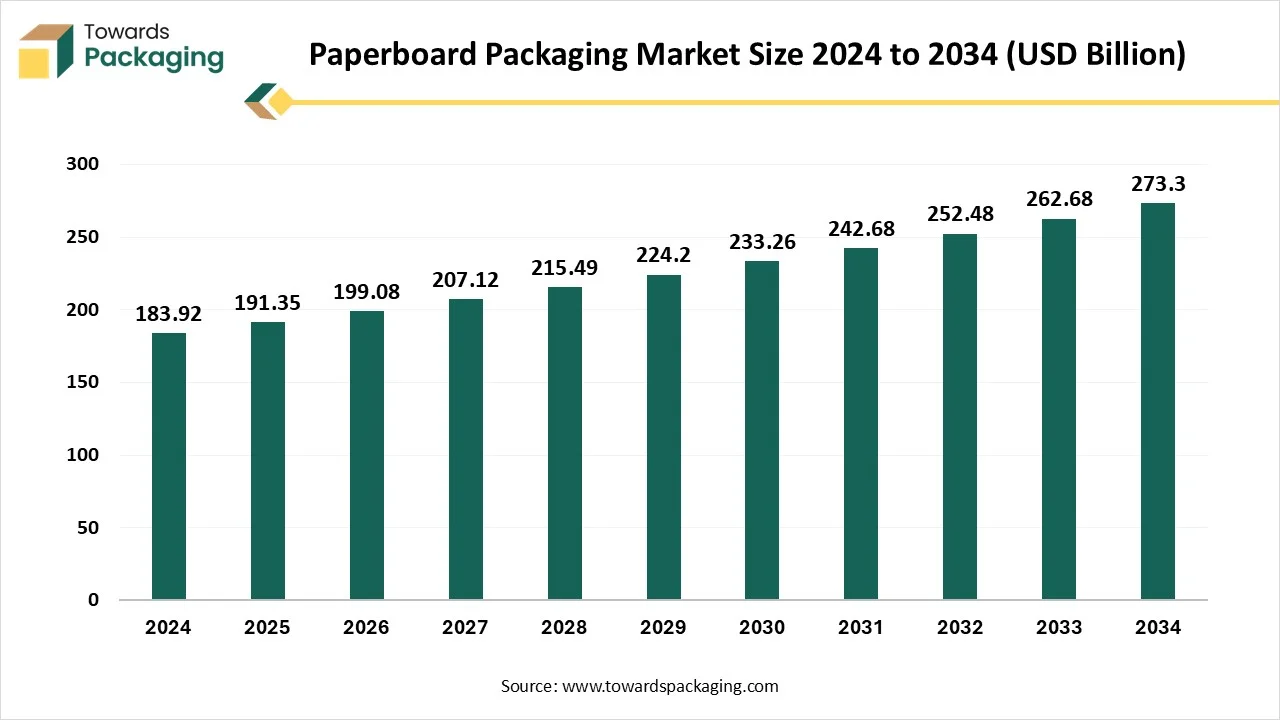

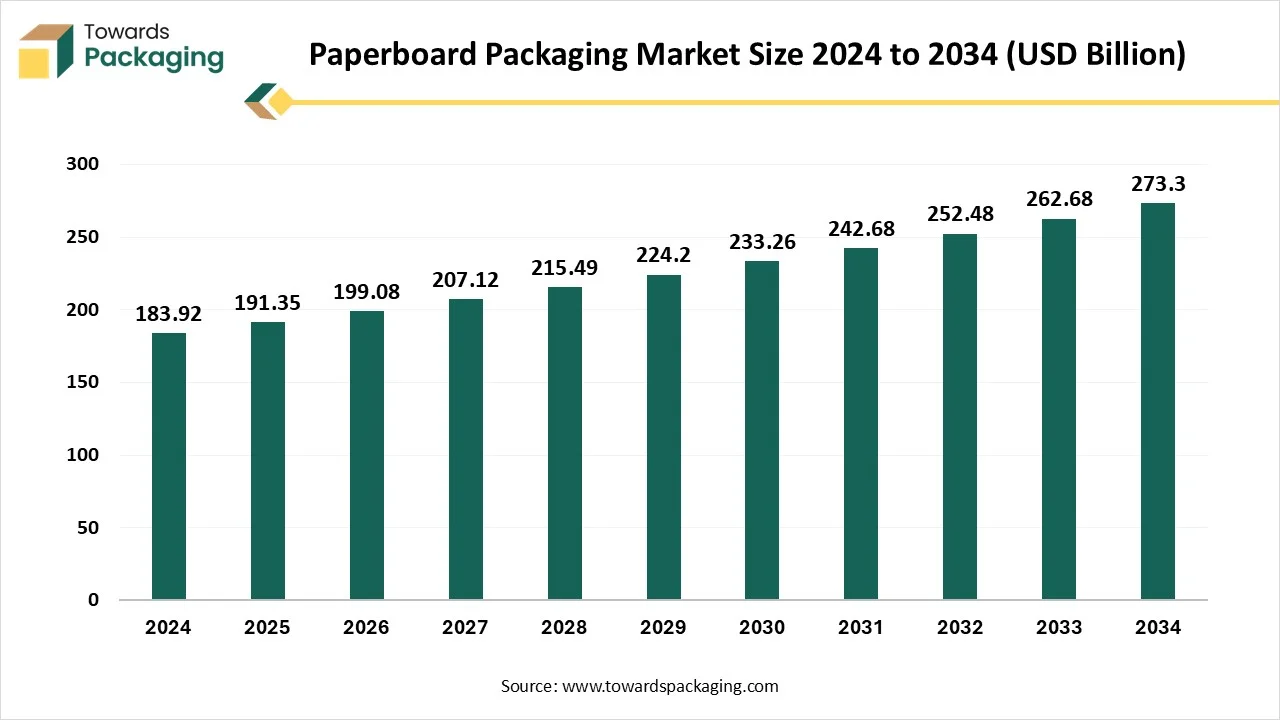

Future of Paperboard Packaging Market

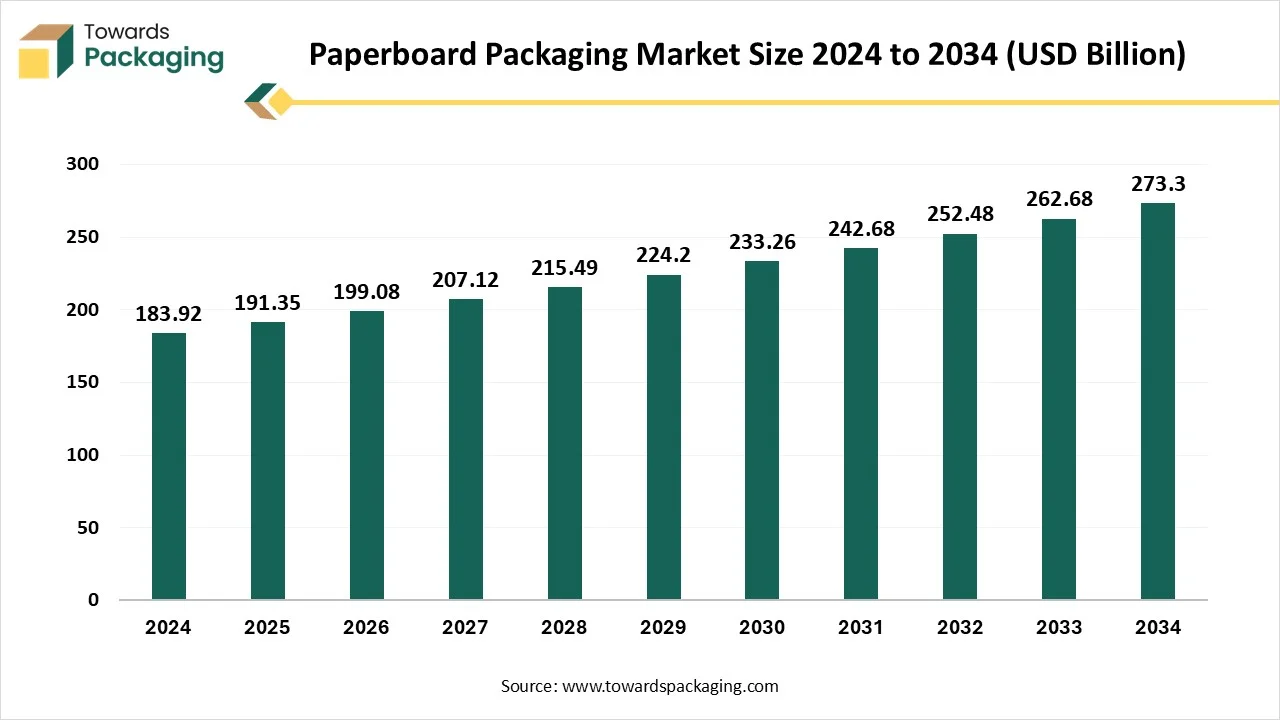

The paperboard packaging market is anticipated to grow from USD 191.35 billion in 2025 to USD 273.30 billion by 2034, with a compound annual growth rate (CAGR) of 4.04% during the forecast period from 2025 to 2034. The growing demand for packaged products, the rising e-commerce industry, and ongoing trends are the major factors influencing the demand for the paperboard packaging market. The increasing ecological consciousness among consumers has boosted the market development.

The paperboard packaging market plays a significant role in the product packaging industry due to its eco-friendly properties. The rising consumption of packaged food, the expansion of miniature electronics products, and the rising consciousness about the sustainability of the product packaging. The growing online orders of all categories required safety while transporting products over longer distances.

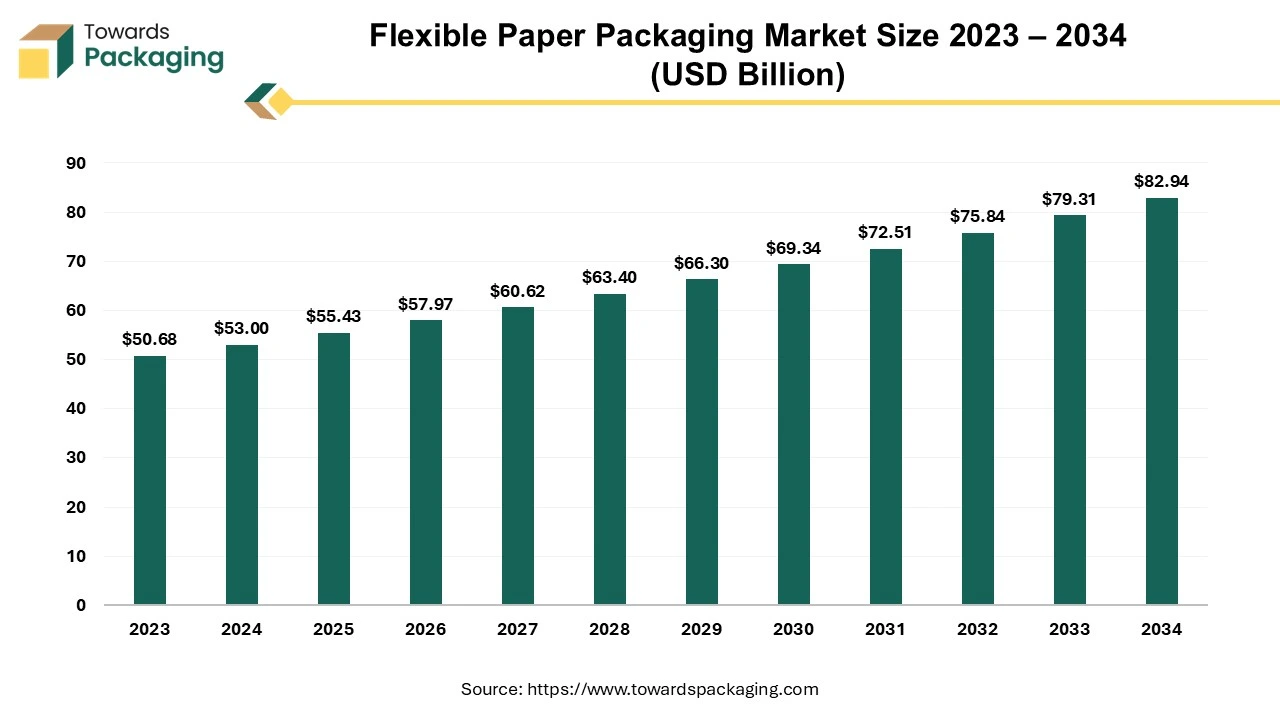

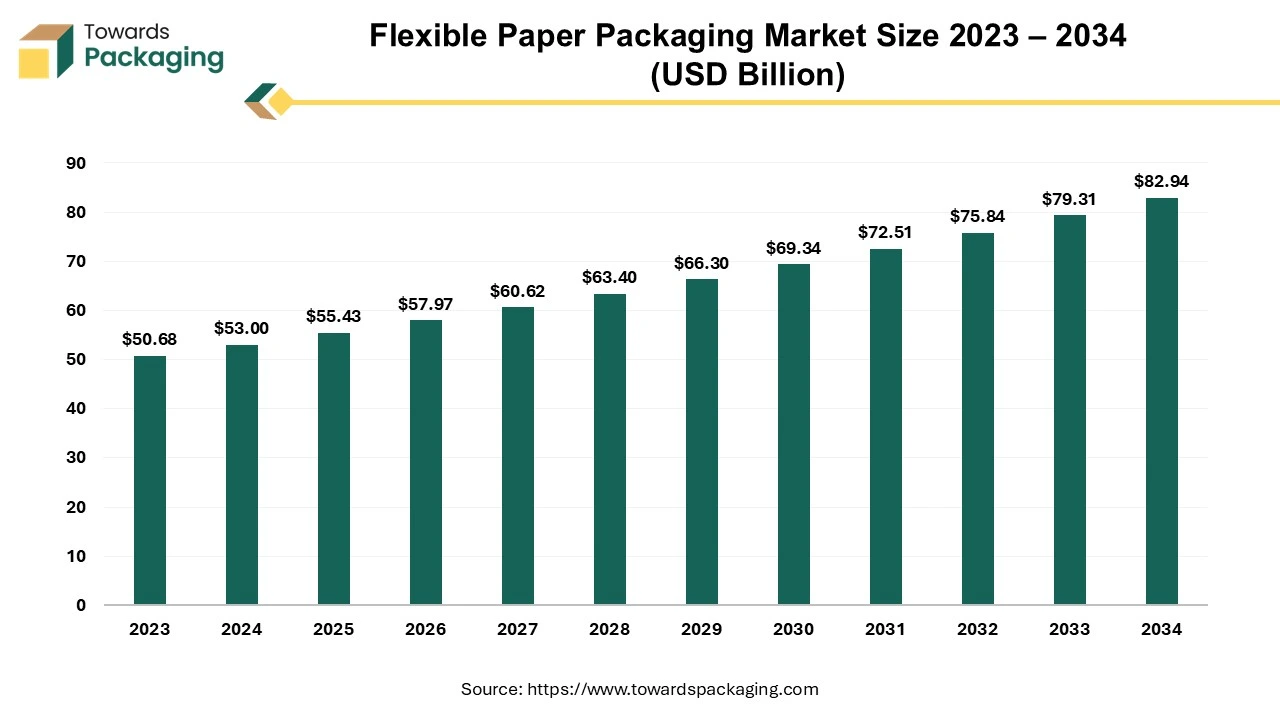

Future of Flexible Paper Packaging Market

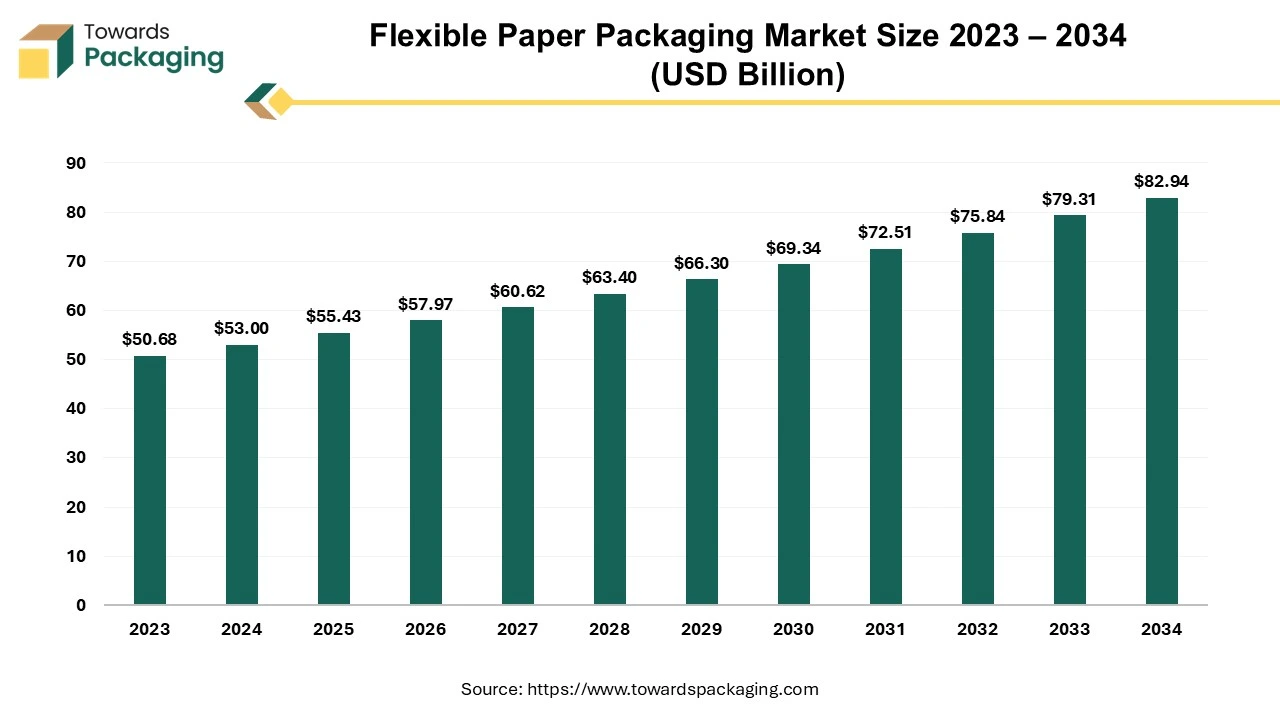

The global flexible paper packaging market size is estimated to reach USD 82.94 billion by 2034, up from USD 53 billion in 2024, at a compound annual growth rate (CAGR) of 4.58% from 2024 to 2034.

The protective purpose of the flexible paper packaging is the same as that of traditional, plastic packaging, but it is composed of renewable, fossil-free materials. Flexible papers are free of silicone, glassine, laminations and labels, and their weight is lower than 100 grams per square meter. Flexible paper packaging has several applications including the chocolates, pet food, meals and personal hygiene. Fibrous materials can be used to create any type of flexible packaging like bags, flow wraps, pouches and so on.

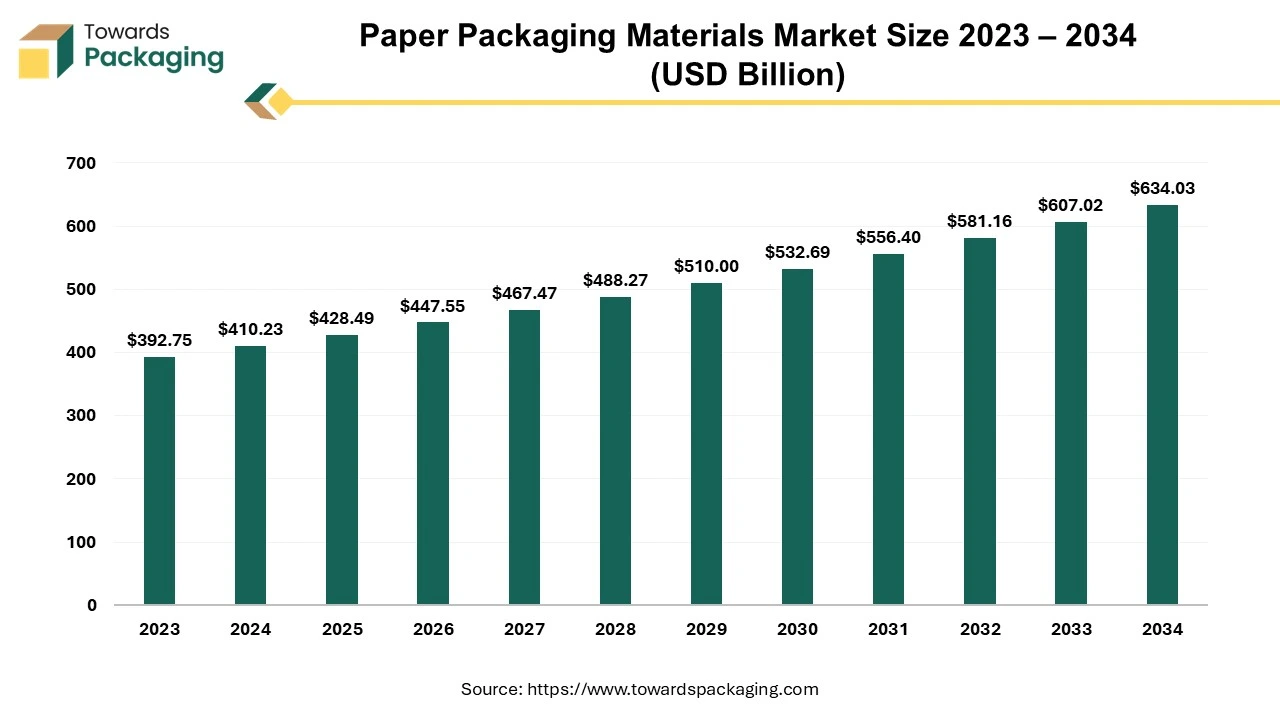

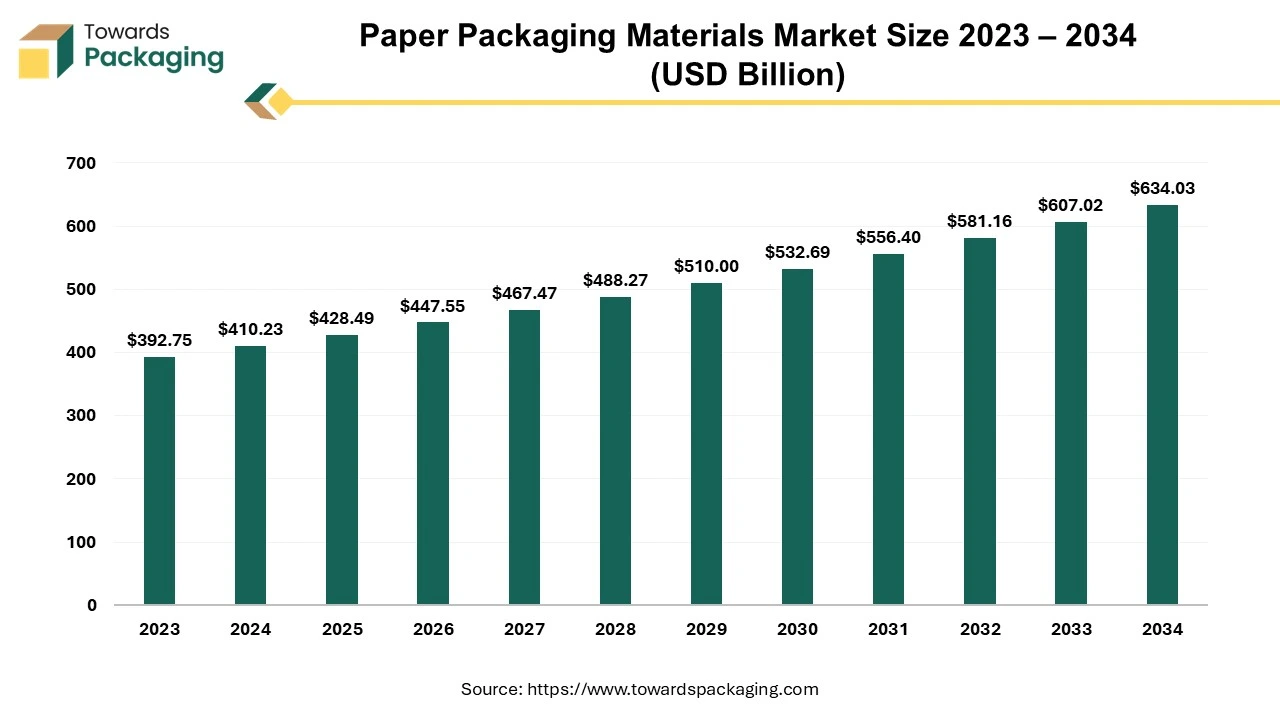

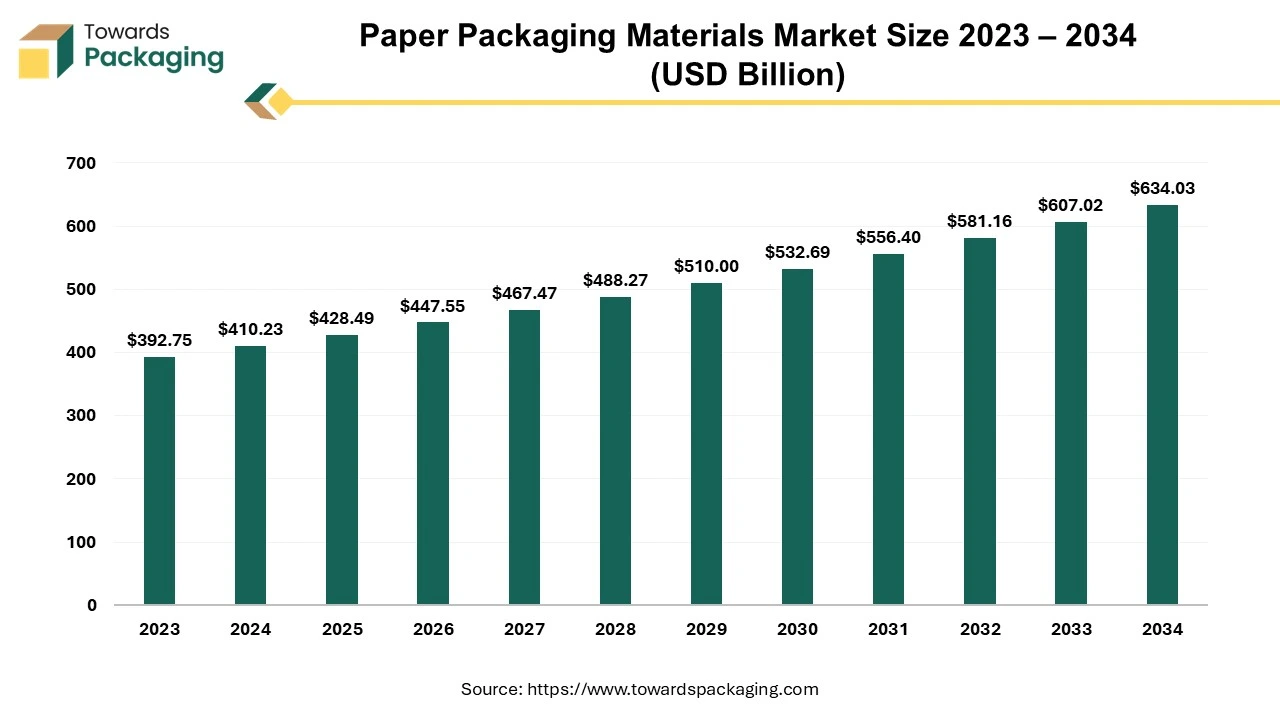

Future of Paper Packaging Materials Market

The global paper packaging materials market size reached US$ 410.23 billion in 2024 and is projected to hit around US$ 634.03 billion by 2034, expanding at a CAGR of 4.45% during the forecast period from 2024 to 2034.

The market is driven by booming e-commerce sector and shift of consumers towards sustainable packaging solution. The paper packaging material is utilized in the transportation of products due to its cost-effective, sustainable, and durable properties. Along with these qualities, preserving the freshness and providing an easy opening maneuver of the product to the consumer are the leading objectives of the market. The awareness among the consumers has increased the environmental consciousness and the consequence demands sustainability, that is, paper-based solutions.

Key Players and Competitive Dynamics in the Paper and Paperboard Packaging Market

The market for paper and paperboard packaging is extremely competitive, with well-known leaders in the sector such International Paper Company, Clearwater Paper Corporation, Shandong Bohui Paper Company Ltd, Mondi Group, ITC Ltd, DS Smith Plc, Smurfit Kappa Group Plc, WestRock Company, Svenska Cellulosa Aktiebolaget, Oji Holdings Corporation, Nippon Paper Industries Co. Ltd, South Africa Pulp and Paper Industries Ltd, and Oji Holdings Corporation. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

Transforming organic matter into sustainable pulp, fiber-based goods, and packaging is something International Paper excels at doing globally. In addition to printing paper, they also provide kraft paper bags, corrugated cardboard boxes, and other options. Products such as envelopes, packaging materials, specialty paper, and printer/copier paper are all part of their range.

For Instance,

- In May 2021, Graphic Packaging has bought the remaining shares owned by International Paper in the firms' packaging merger, completing its acquisition of Graphic Packaging International Partners. The arrangement, which gives Graphic Packaging 100% ownership of the merger, brings the company's collaboration with International Paper to an end.

WestRock offers a wide range of paper and packaging goods. Global leader in fibre-based packaging solutions that are sustainable. has a large assortment of coated and uncoated virgin and recycled paperboard goods available. stresses how crucial paper-based packaging is as a recycled and renewable energy source for cutting down on pollution and waste.

For Instance,

- In December 2022, the remaining stake in Grupo Gondi was acquired by WestRock Company for $970 million in addition to the assumption of debt. Subject to standard purchase price allocations, the acquisition is immediately accretive to earnings.

Recent Developments

- On 20 June 2024, Saica Group, which is one of the main companies in terms of packaging solutions, and Mondelez, a fast-moving consumer goods producer, partnered with forces to reveal new paper-based products focused on multipacks -products for the biscuits, confectionery, and chocolate markets. (Source: Packaging strategies)

- On 19 September 2024, Marigold Health Foods partnered with Sonoco to reveal its fully recyclable packaging for different plant-based, natural food products that include sauces, stock cubes, and meat and fish alternatives. (Source: Packaging Europe)

- On 9 September 2024, Nestle disclosed its canisters for its Vital Proteins brand in the United States. This packaging equipment and pattern transformation result in a 90% plastic reduction from past packaging. (Source: Packaging South Asia)

Paper and Paperboard Packaging Market Players

Paper and Paperboard Packaging Market Segments

By Product Type

- Folding Cartons

- Corrugated box

- Boxboard

- Others

By Packaging Type

- Paper Bags

- Paper cups

- Pouches

- Containers

- Others

By End Use

- Food & Beverage

- Healthcare

- Personal Care

- Industrial

By Region

- Asia Pacific

- North America

- Europe

- LA

- MEA