Folding Cartons Market Outlook Scenario Planning & Strategic Insights for 2034

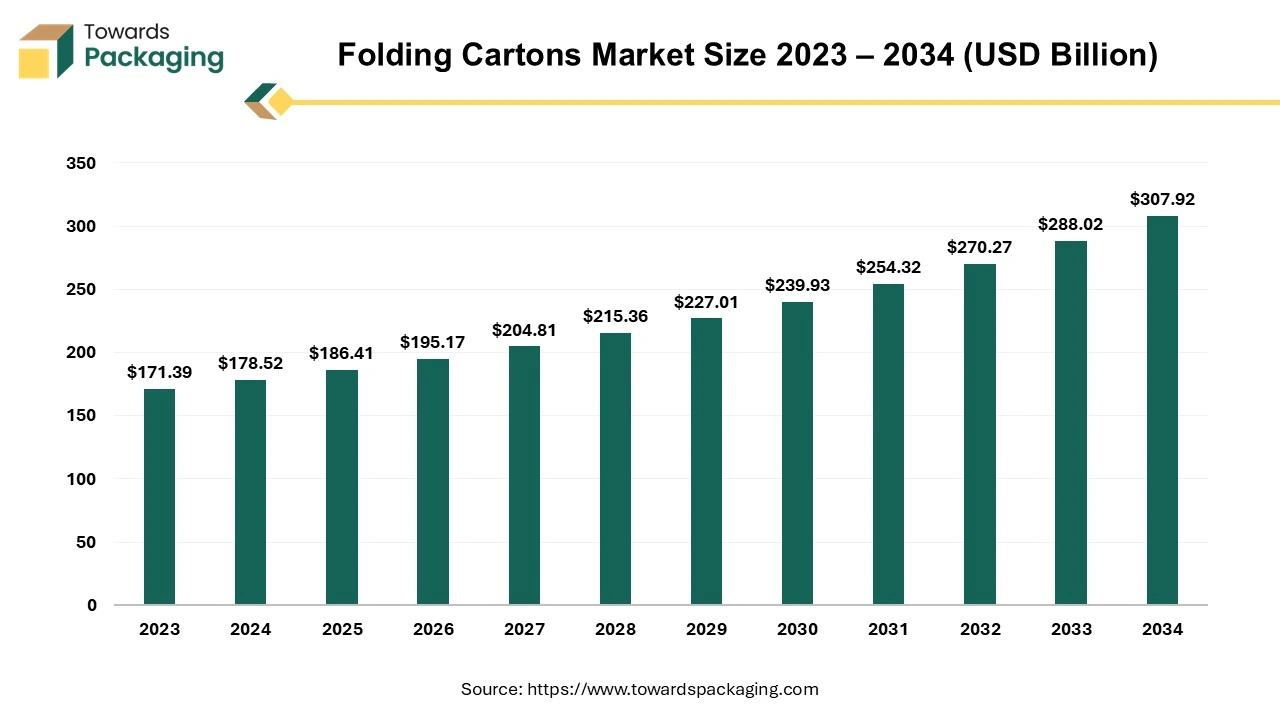

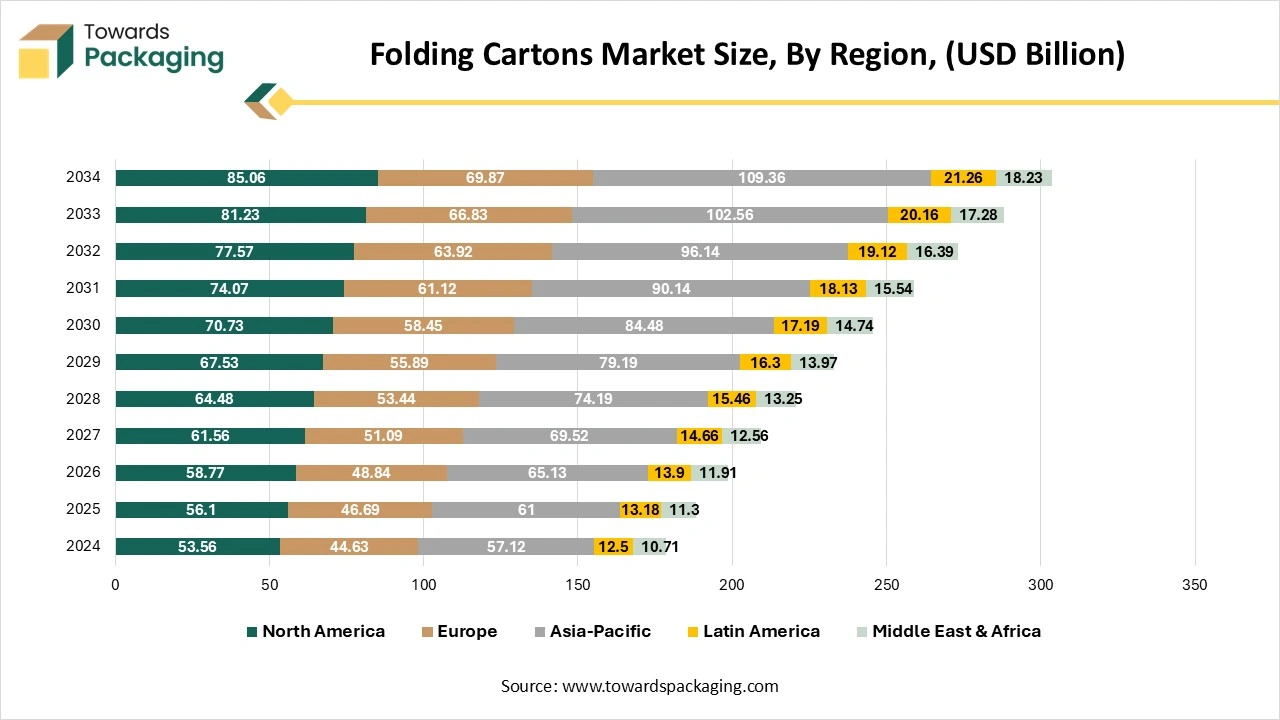

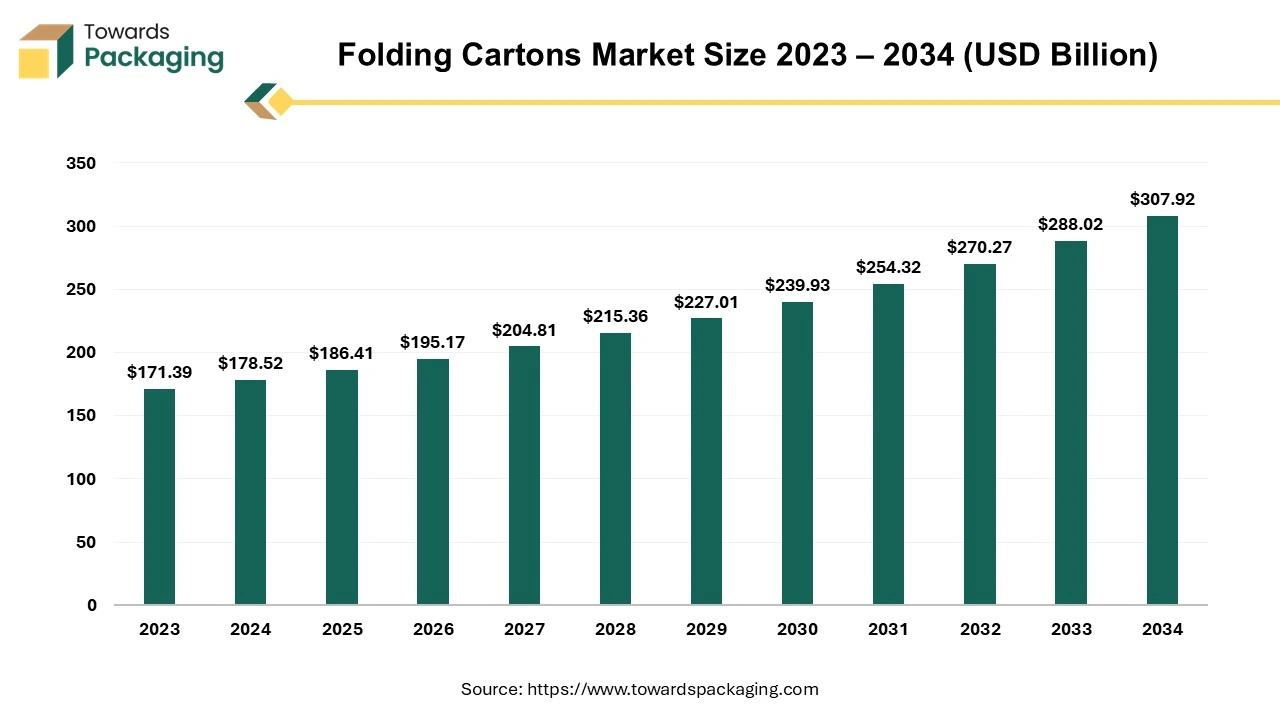

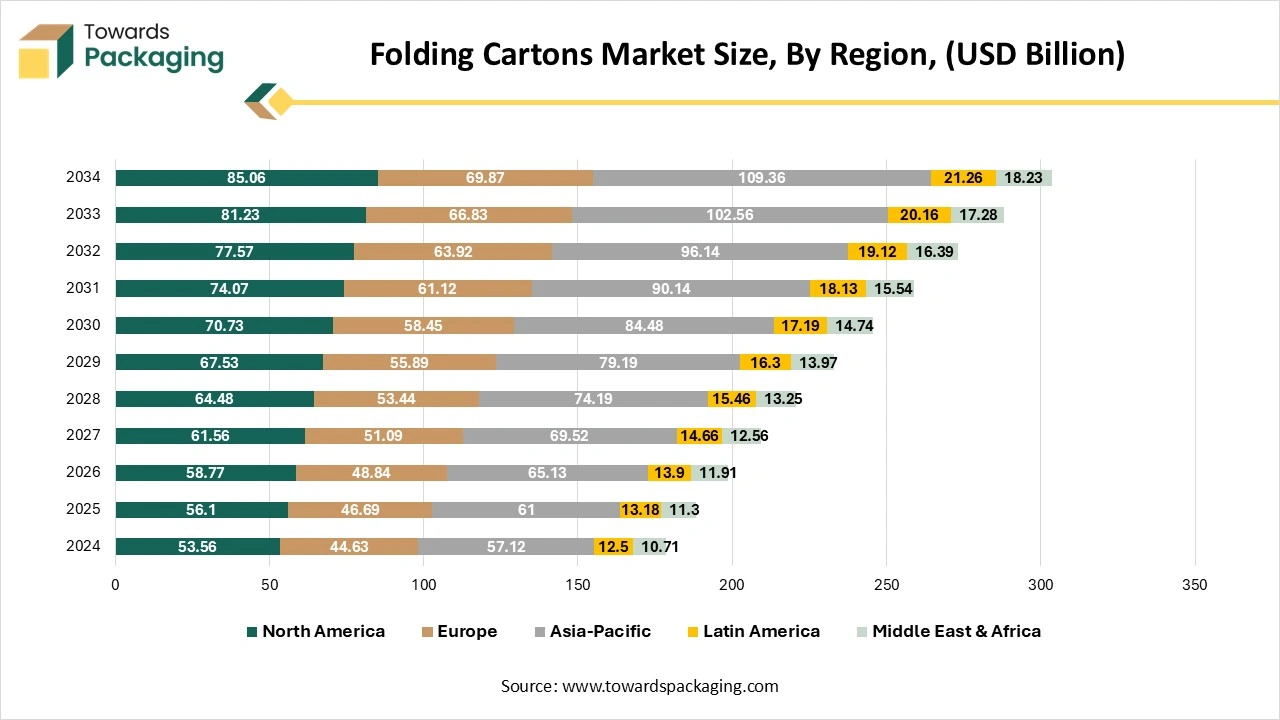

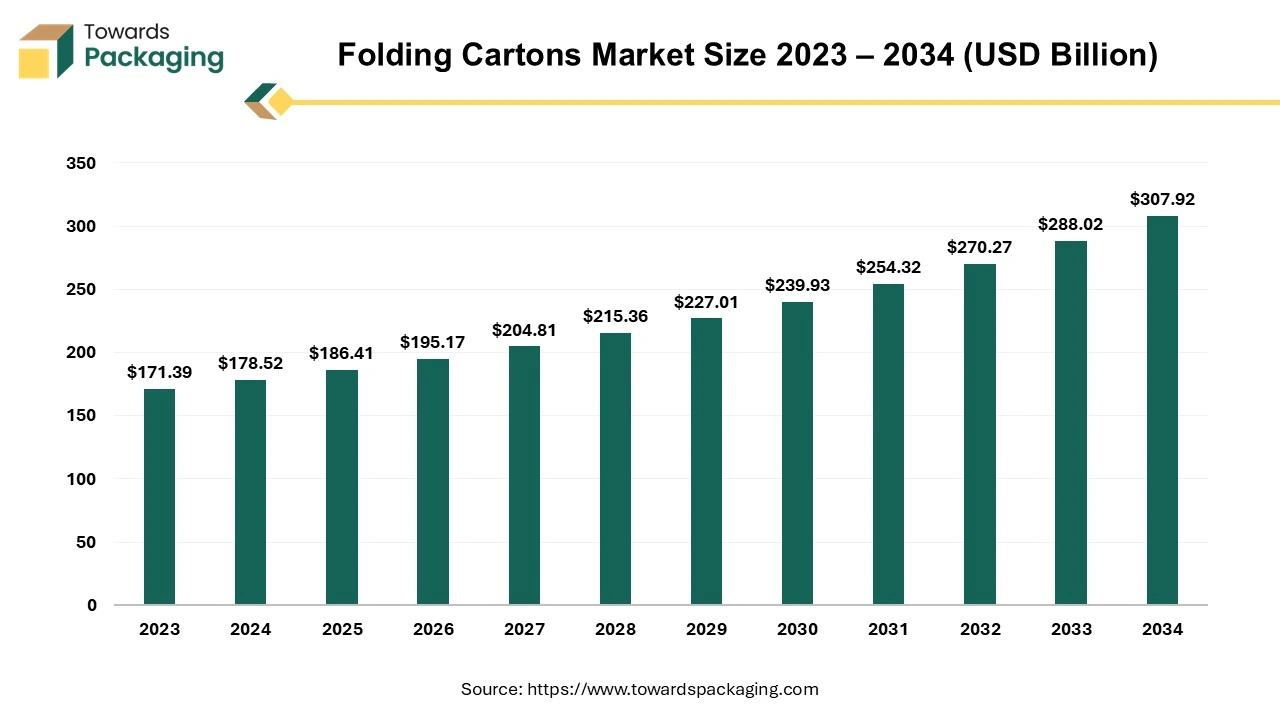

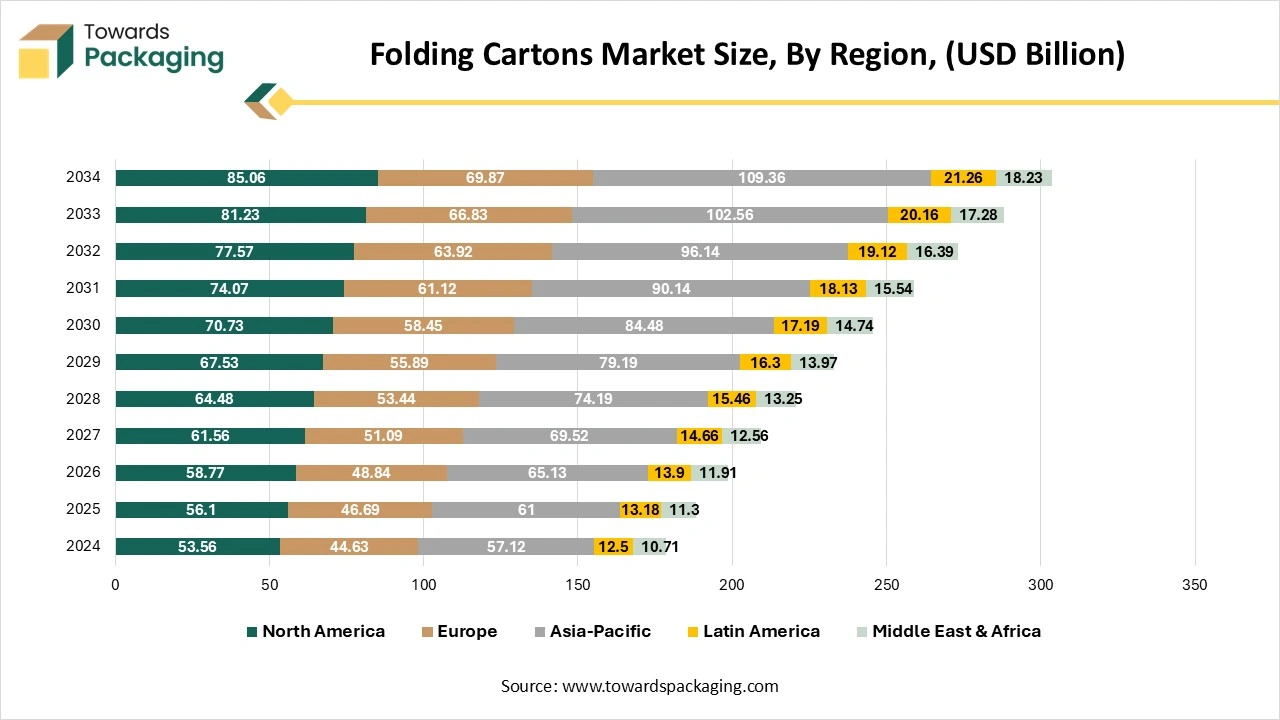

The folding cartons market is forecasted to expand from USD 198.55 billion in 2026 to USD 320.37 billion by 2035, growing at a CAGR of 5.46% from 2026 to 2035. Regional statistics highlight North America holding 28.92% share in 2024, while Asia-Pacific led with 38.25% share and is the fastest-growing region at 7.22% CAGR.

The report maps top companies whose combined share accounts for about 17–20% of global revenue, offering competitive benchmarking and value chain analysis across raw materials, converters, brand owners, and retailers. It incorporates global trade figures, production-consumption balances, pricing patterns, and a structured dataset of leading manufacturers and suppliers for strategic decision-making.

The folding cartons market is likely to register impressive growth during the projected forecast period. One of the most often used product packaging formats nowadays is the folding carton, which may be utilized for transporting almost anything. Products like electronics, food, and cosmetics are all packaged in folding cartons. Folding cartons are boxes or box sleeves developed with either single-ply paperboard or corrugated cardboard and are manufactured with the help of special machine in the required shape and size. Foldable cartons have many advantages as compared to the other methods of packaging. They can be customized to meet specific needs and are available in nearly any size and form imaginable. Additionally, they can be imprinted with unique images and writing and are available in a range of finishes. They are inexpensive to make as paperboard, a reasonably priced material, is used to make them. Also, folding cartons ship flat, this minimizes the cost of handling and shipping.

The rapid expansion of the e-commerce sector along with the growing environmental awareness that has led brands and consumers to prioritize recyclable packaging is expected to augment the growth of the folding cartons market during the forecast period. Furthermore, the improvements in the printing technology as well as the adoption of the eco-friendly coatings/adhesives are also anticipated to augment the growth of the market. Additionally, the rise in the demand for ready-to-eat foods along with the increasing focus of the brands on premium, innovative packaging options for the cosmetics and personal care products is also projected to contribute to the growth of the market in the near future.

Key Trends and Findings

- Renewable packaging materials are becoming popular. Since paperboard packaging is recyclable as well as renewable, many companies are utilizing it. Many studies also indicate that consumer demand for sustainable items is rising. As per the Consumer Sustainability Survey by Blue Yonder, 78% of the participants claimed that sustainability issues are extremely or moderately important to them when deciding whether to purchase a product or shop at a store, indicating that consumers continue to place a high value on the sustainability.

- Another major advancement is the rise of digital printing for folding cartons. More flexibility and shorter print runs are now possible due to the digital print technology. Substantial storage and tied-up capital reductions are achieved with shorter runs. Through improved consumer attraction and conversion, improved personalization also increases the effectiveness of the product packaging in both offline and online retail settings. Organizations are able to customize packaging with variable data. Coca-Cola, which began printing consumer names on the bottles and cans, is a well-known example.

- Organizations could reduce the expenses and material waste by improving the design of their folding cartons. Right-size packaging design aims to minimize the material usage without compromising branding or product protection. Reputable packaging enterprises, like Clear Print, does this through utilizing structural design tools and offering free CAD-cut prototypes to make sure the carton can accommodate the product and adequately protect it. In addition to increasing the customer satisfaction and attractiveness, an optimized design minimizes expenses associated with printing, shipping and fulfillment.

- Designers are becoming more interested in the textured printing, not only because it conveys quality but also for its visual impact and the sense of interaction it creates when a box is picked up. Folding cartons provides product protection with its ability to engage customers with a multimodal experience while giving goods a luxurious feel. It offers a chance to fulfill customers' need for small indulgences while also honoring their own ideals.

- North America held considerable market share of 28.92% in 2024. This is due to the established industries and strong demand for sustainable packaging options as brands look for eco-friendly options to meet the stringent regulations as well as consumer expectations.

- Asia-Pacific is expected to grow at a fastest CAGR of 7.22% during the forecast period owing to the urbanization, rising disposable incomes and the increasing consumption of the packaged products.

Folding Cartons Market Leading Manufacturers Shares (2024)

| Rank |

Manufacturer |

2024 Share (%, est.) |

How this was derived (one-line basis) |

| 1 |

Graphic Packaging International (GPI) |

≈ 5.0% |

FY-2024 net sales $8.81B largely from carton converting ÷ global folding-carton market $176.99B. |

| 2 |

WestRock (Consumer Packaging) |

~ 2.5–3.5% |

Consumer Packaging is a major WestRock segment in 2024; range benchmarks segment scale to global market (exact split not fully broken out). |

| 3 |

Mayr-Melnhof (MM) — Packaging divisions |

~ 1.3–1.7% |

MM Group 2024 sales €4.08B with Packaging split (Food & Premium; Pharma & Healthcare); carton-converting share estimated vs. global market. |

| 4 |

Huhtamaki (carton-converting scope) |

~ 0.6–1.0% |

2024 net sales €4.13B across flexible/foodservice/fiber; folding-carton portion estimated conservatively. |

| 5 |

Georgia-Pacific (GP) Packaging |

~ 0.8–1.2% |

Private company; GP does convert folding cartons in N. America; share inferred from industry rankings vs. global base. |

| – |

Top-5 combined |

≈ 17–20% |

Aligns with industry analysis that the top five players hold “over 17%”. |

Who these players are (and why they lead)

- Graphic Packaging International (≈ 5.0%)

- Pure-play global leader in paperboard/folding-carton converting across food, beverage, and consumer goods; 2024 sales $8.81B.

- Scale is strengthened by prior AR Packaging acquisition and beverage multipack systems.

- WestRock (≈ 2.5–3.5%)

- A top North American converter with a sizable Consumer Packaging segment (cartons for beverages, food, pharma/personal care).

- 2024 materials show active consumer-segment focus and margin improvements. (Note: WestRock combined with Smurfit Kappa to form Smurfit WestRock, but corrugated dominates there.)

- Mayr-Melnhof (≈ 1.3–1.7%)

- Europe-centric folding-carton converter, 2024 re-organized into Food & Premium Packaging and Pharma & Healthcare Packaging; strong pharma/CPG positioning.

- Huhtamaki (≈ 0.6–1.0%)

- Global packaging group (foodservice, flexible, fiber). Folding-carton exposure is smaller but present in select categories; 2024 net sales €4.13B.

- Georgia-Pacific (≈ 0.8–1.2%)

- Koch-owned; operates folding-carton converting in North America alongside containerboard/tissue. Private disclosures are limited, but industry roundups keep GP in the leadership mix.

Market Drivers

Global Surge in Online Shopping

The global surge in the online shopping is expected to fuel the growth of the folding cartons market during the projected timeframe. This is owing to the convenience, increased internet accessibility and changing consumer preferences. As per the Mobile Economy 2024 report by the GSM Association, mobile internet usage accounted for 58% of the global population at the end of 2023, with 4.7 billion users, up 2.1 billion compared to 2015. This number is expected to reach 5.5 billion by 2030 that is almost 65% of the population. As the mobile internet access becomes more widespread, consumers can shop online conveniently from their smartphones, fueling growth in the e-commerce activity. This shift creates a demand for secure, durable and customizable packaging, like folding cartons that can protect the products during transport and provide a high-quality unboxing experience.

The reality is that physical retail has begun to die off and the only companies that have the ability to look to the future with hope are those who have successfully established a multi-channel web platform alongside their physical operation. Online retail is expected to continue to grow rapidly in the near future, according to all estimates. Buyers on the internet are concerned and attentive regarding the product freshness, quality, delivery, choice and trustworthy service—all that packaging labels and folding cartons need to deliver. The folding carton serves as the primary brand representative in addition to being the most necessary product protection option, whether it is seen at e-commerce site, on the shelf, or with the customer at home. The most popular packing material for online retailers are folding cartons crafted from cardboard or corrugated paper since they are easy to visualize in the online store, satisfy logistical needs and they are one of the most eco-friendly packaging material.

Market Restraints

Competition from Substitute Packaging Options

The competition from alternative packaging choices is expected to hamper the market growth within the estimated timeframe. Flexible packaging options such as plastic pouches and bags act as strong substitutes that attract the manufacturers and consumers alike. One of the key emerging packaging options in a variety of industries is pouch packaging, specifically stand-up pouches. Pouches are normally made from a range of flexible materials, which facilitates convenient storage over the span of their lifetime. All of the pouches weigh less than other materials like cardboard or glass. Due to this, they are less expensive to transport and use less fuel when being moved. Also, the branding and messaging of the business are displayed on the pouch's printing surfaces. A customer will undoubtedly be drawn to the attractive packaging while looking for a specific food item and want to buy it.

Furthermore, another popular alternative in the retail, cosmetic, and pharmaceutical sectors is blister packaging, however it is also becoming more prominent in other areas. The packaging is visually appealing and protects the items since each item inside the blisters has its own space. The fact that blister packing makes products visible to customers is among its most important advantages. Customers can check whether every item is there and in good condition owing to the plastic front. Additionally, retailers can alter this type of packaging to make their products more aesthetically pleasing, which improves the perceived worth of the item. Thus, brands may opt for these packaging choices over folding cartons to gain a competitive edge in terms of cost efficiency and product protection, challenging the market share of the traditional folding cartons.

Market Opportunities

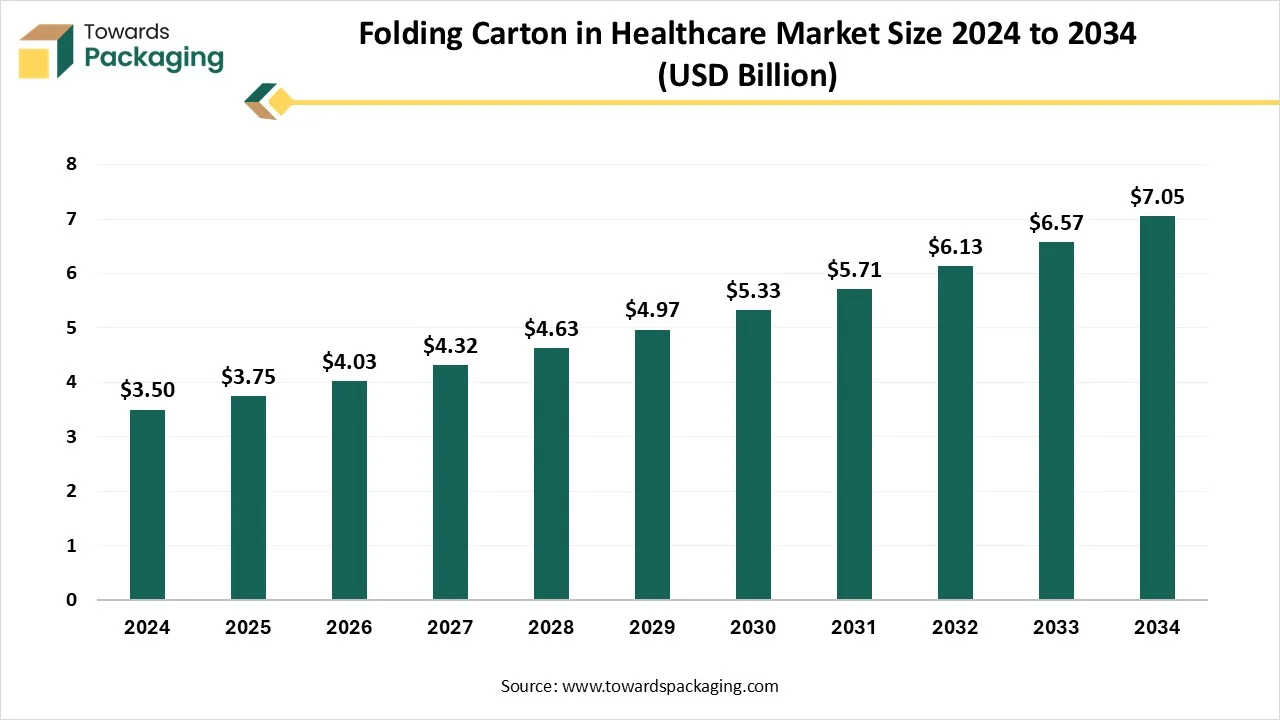

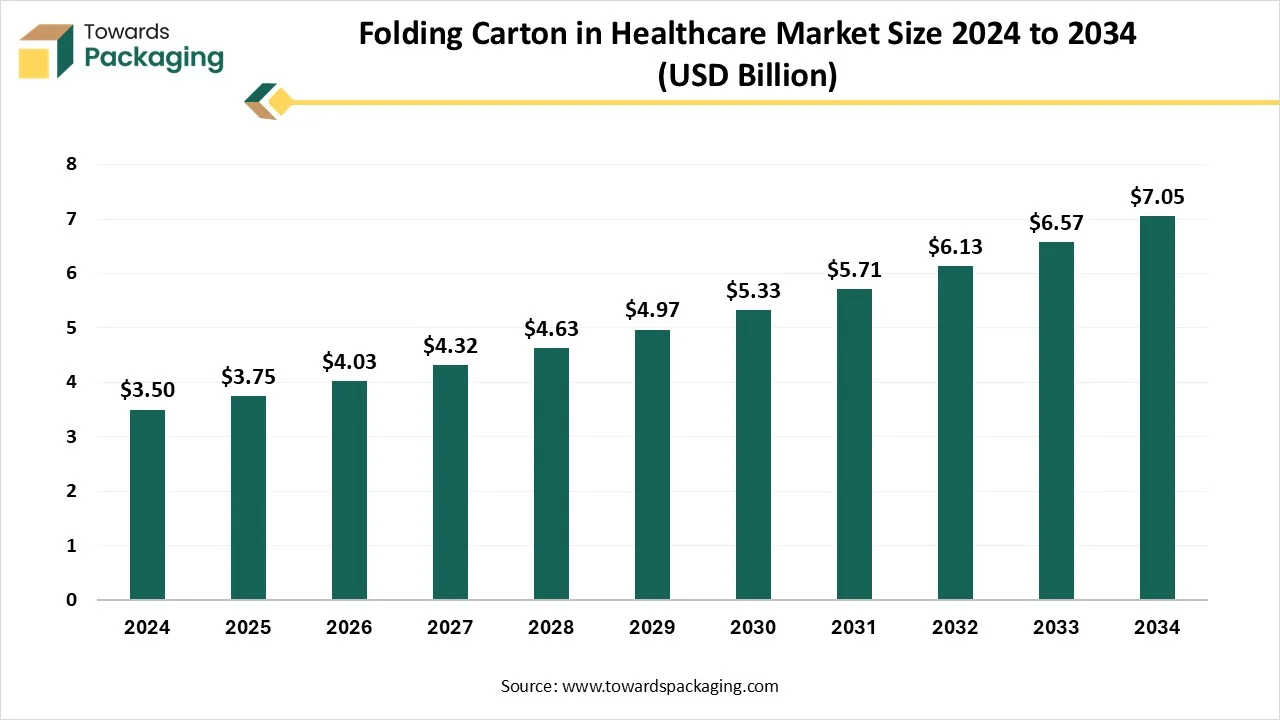

Expansion of the Healthcare and Pharmaceutical Industries

The expansion of the healthcare and pharmaceutical industries are projected to fuel the growth of the folding cartons market in the years to come. This is owing to the aging populations, rising prevalence of chronic diseases and increased healthcare spending. In a developing global economy, the research-based pharmaceutical sector helps to ensure future competitiveness and restore global prosperity. According to the European Federation of Pharmaceutical Industries and Associations, R&D expenditures in Europe were anticipated to be €50,000 million in 2023. In the developing economies like India, China and Brazil the market and the research landscape is been growing substantially. North America made up 53.3% of the global pharmaceutical sales in 2023, while Europe made up 22.7%. As reported by IQVIA (MIDAS May 2024), the US market accounted for 67.1% of sales of the newly introduced medications during the 2018–2023 period, while the European market accounted for 15.8%.

Folding cartons are mainly utilized as exterior packaging for liquid, solid, and semi-solid medical products in the healthcare and pharmaceutical industries. They are also used to pack medicinal supplies. Cardboard packaging is subject to strict requirements from the pharmaceutical business. Due to their exceptional printability, which is important for regulatory compliance and capacity to satisfy these precise specifications, folding cartons are the perfect option for pharmaceutical packaging. The requirements consist of bending, whiteness, sturdiness, thickness, creasability, and codability. Companies take extra precautions to guarantee that every product complies with FDA and GMP requirements as well as ECMA Best Practice Guidelines. Thus, this presents a strong growth opportunity for the manufacturers in this sector as they meet the rising demand for health-related products.

Key Segment Analysis

Material Segment Analysis Preview

The paperboard segment held considerable market share of 79.61% in 2024. Over the past few years, paperboard folding cartons have consistently been the most commonly utilized packaging material and they continue to do so today. Paperboard is a lightweight, adaptable material that offers the resilience and strength required for packaging. Since it's typically manufactured from recycled fibers or wood pulp, it's a popular option for organizations that care about the environment. Recycled paper is becoming popular as a raw material as sustainability becomes a top concern. It minimizes the need for the virgin fibers and lowers the negative effects of packing on the environment. Many coatings and inks are applied to folding cartons to improve their look and performance. These can include UV and water-based coatings as well as biodegradable inks, all of which improves the carton's appearance while guaranteeing that it satisfies industry requirements. The rise in the awareness about the plastic pollution has further pushed brands to adopt paperboard over plastic materials, predominantly in the food and beverage and personal care sectors.

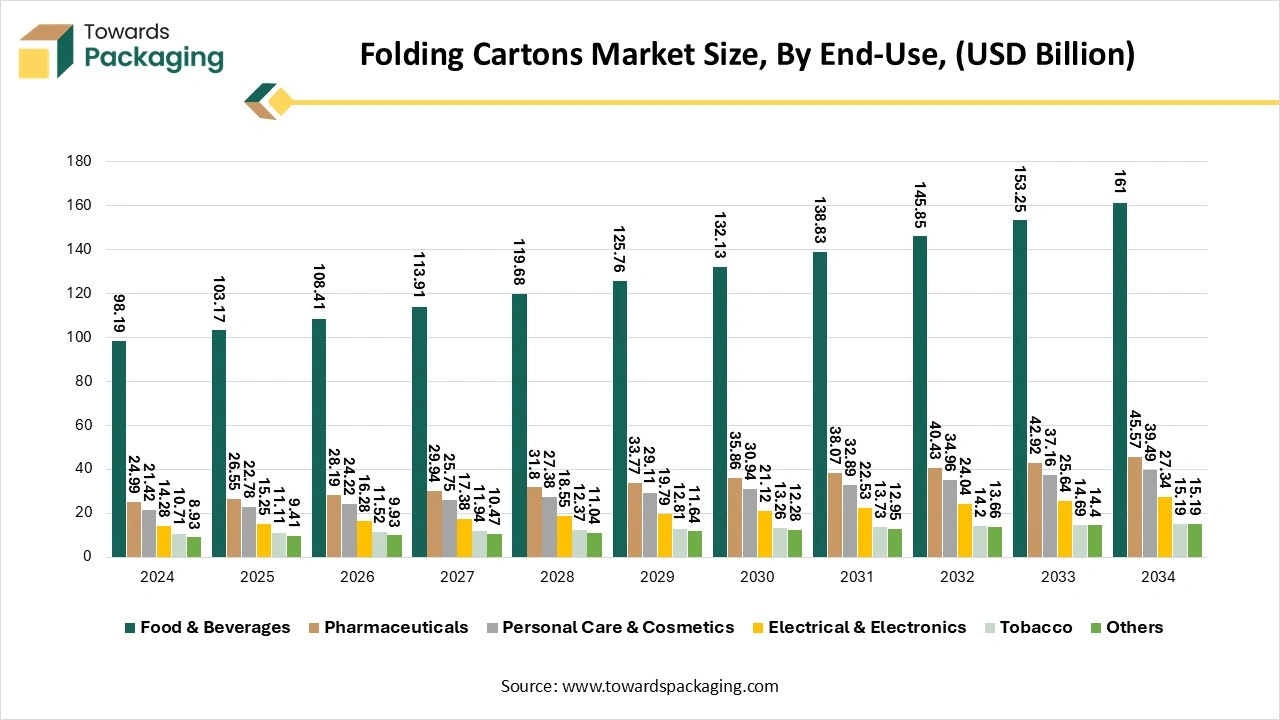

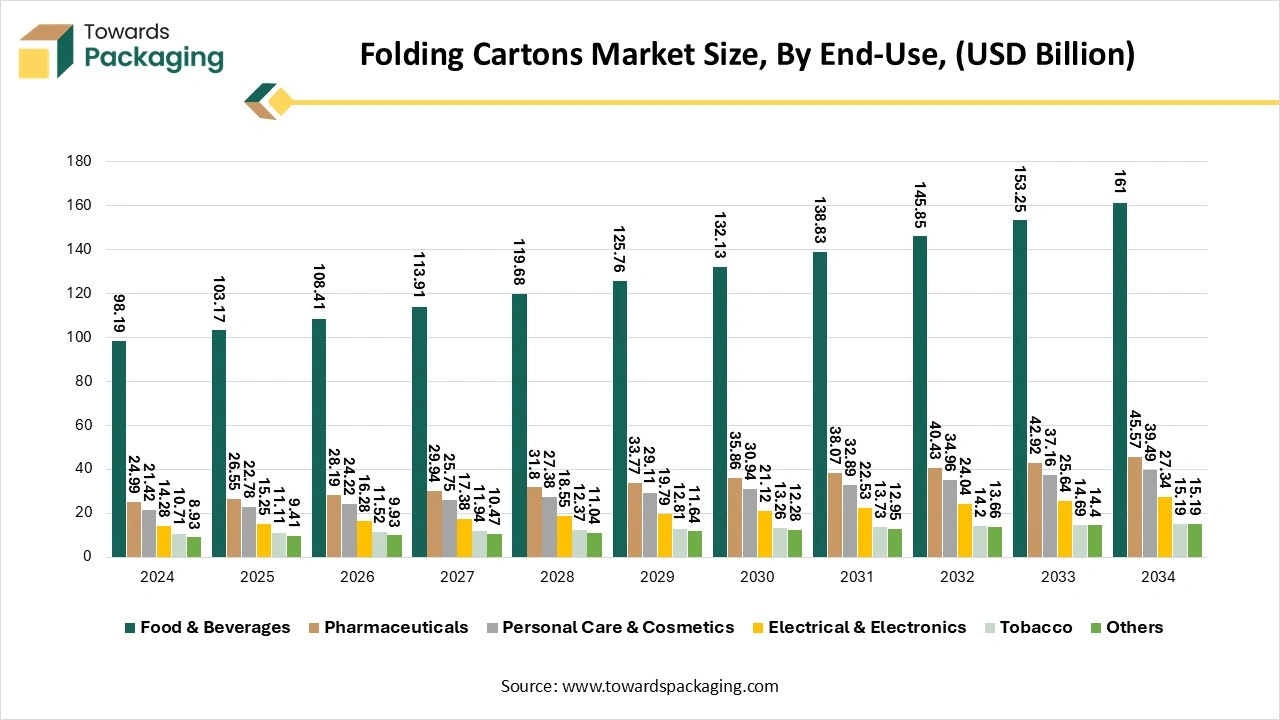

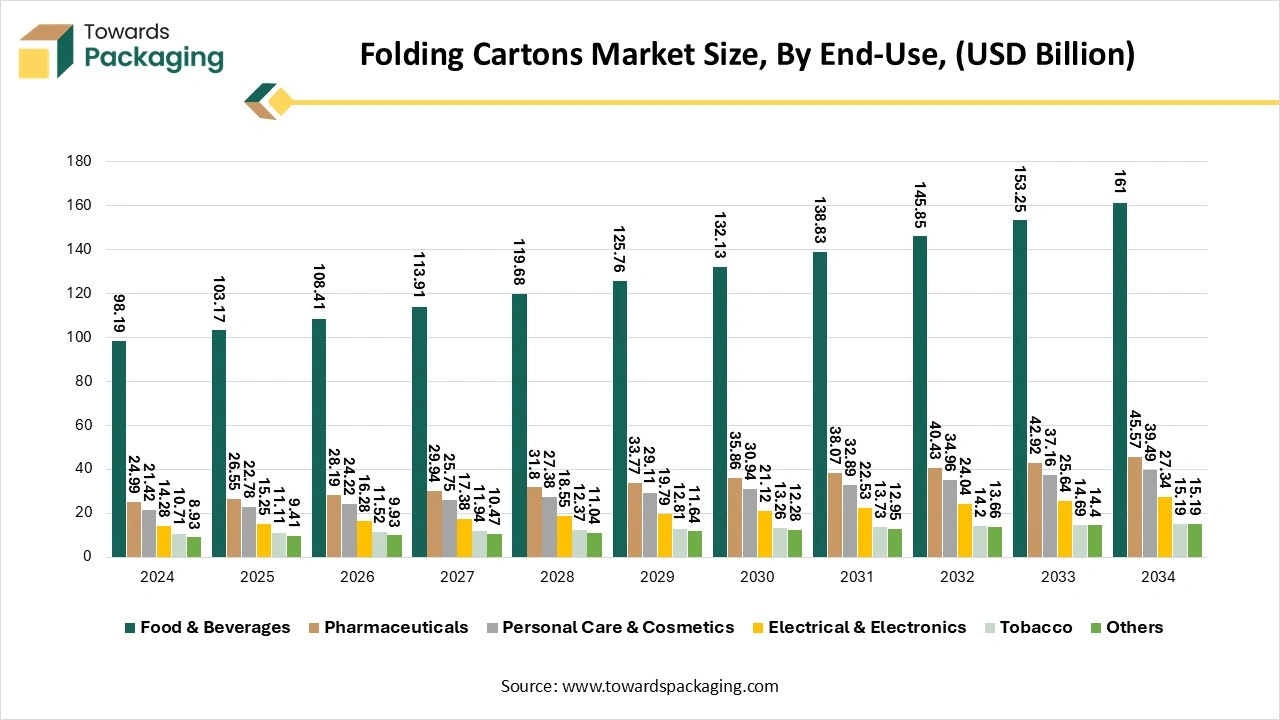

End-Use Industry Segment Analysis Preview

The food & beverages segment held the largest market share of 60.59% in 2024. This is owing to the consumer shift towards packaged and ready-to-eat foods mostly in the urban areas. Folding cartons are particularly suited for a wide variety of food products such as frozen foods, baked goods, confectionery and snacks, as they provide structural stability and can be customized to improve the brand visibility on the store shelves. Specific beverage applications consist of beer bottle, coffee, ice cream and juices. Also, the increased focus on the food safety and hygiene, mainly post-pandemic, has further elevated the need for reliable and tamper-evident packaging solutions, which folding cartons effectively provide. These factors combined are likely to contribute to the growth of the segment during the estimated timeframe.

Regional Insights

Asia Pacific held the largest market share of 38.25% in 2024. This is due to the increasing urban populations and rising incomes across the region. Also, the expansion of e-commerce and retail sectors is likely to contribute to the regional growth of the market. As per the E-commerce Market Survey by the Japan’s Ministry of Economy, Trade and Industry (“METI”), in 2022, the B2C (business-to-consumer) e-commerce sector was estimated to be worth $162.4 billion, with a 5.37 percent increase in sales of goods over the previous year. Also, in 2022, Japanese customers spent $2.5 billion on cross-border purchases made online from U.S. retailers, a 5.9% increase over the year before. Furthermore, the growing healthcare infrastructure and rising pharmaceutical production is also expected to contribute to the regional growth of the market.

North America is likely to grow at considerable CAGR of 4.13% during the forecast period. This is owing to the strong presence of the pharmaceutical industry along with the growth in the personal care and cosmetics market across the region. According to the U.S. Census data, cosmetics generated over $43 billion in revenues in the United States in 2021, with several thousand of cosmetic formulations and items available for purchase. Also, as per the data by the International Trade Administration, the Canadian cosmetics industry generated in about USD 1.24 billion in 2021. By 2024, industry income is predicted to increase by 1.45% a year to reach USD 1.8 billion. Additionally, the advancements in the printing and design technologies as well as the growing awareness of environmental issues are also anticipated to promote the growth of the market in the region in the near future.

Latin America

The growing demand for folding cartons in Latin America is rooted in a convergence of user expectations and packaging innovation. As e-commerce continues to grow, brands are shifting away from generic packaging supplied by third parties and turning to personalized, retail-ready folding cartons that develop unboxing and brand recall. Small-to-medium enterprises are now bypassing lower order quantities thanks to digital printing, allowing shirt runs with bright graphics and even variable data like QR codes for traceability. The market is also shaped by a rising premiumization trend-cosmetics, gourmet foods, and wellness products, which are increasingly packed in folding cartons with soft-touch coatings, window patches, and embossed finishes to appeal to discerning shoppers.

Middle East and Africa

The folding carton in the Middle East and Africa is rapidly growing, shaped by evolving retail dynamics, sustainability mandates, and user choice, for luxury packaging. In Saudi Arabia, Vision 2030’s broader economic reforms are fueling packaging demand across pharma, food, and personal care sectors, propelling the demand for folding carton urge. Meanwhile, South Africa leads in manufacturing, with its urban population urging eco-consciousness designs -especially in e-commerce and food packaging, while local players innovate with anti-counterfeit features like RFID and cellulose.

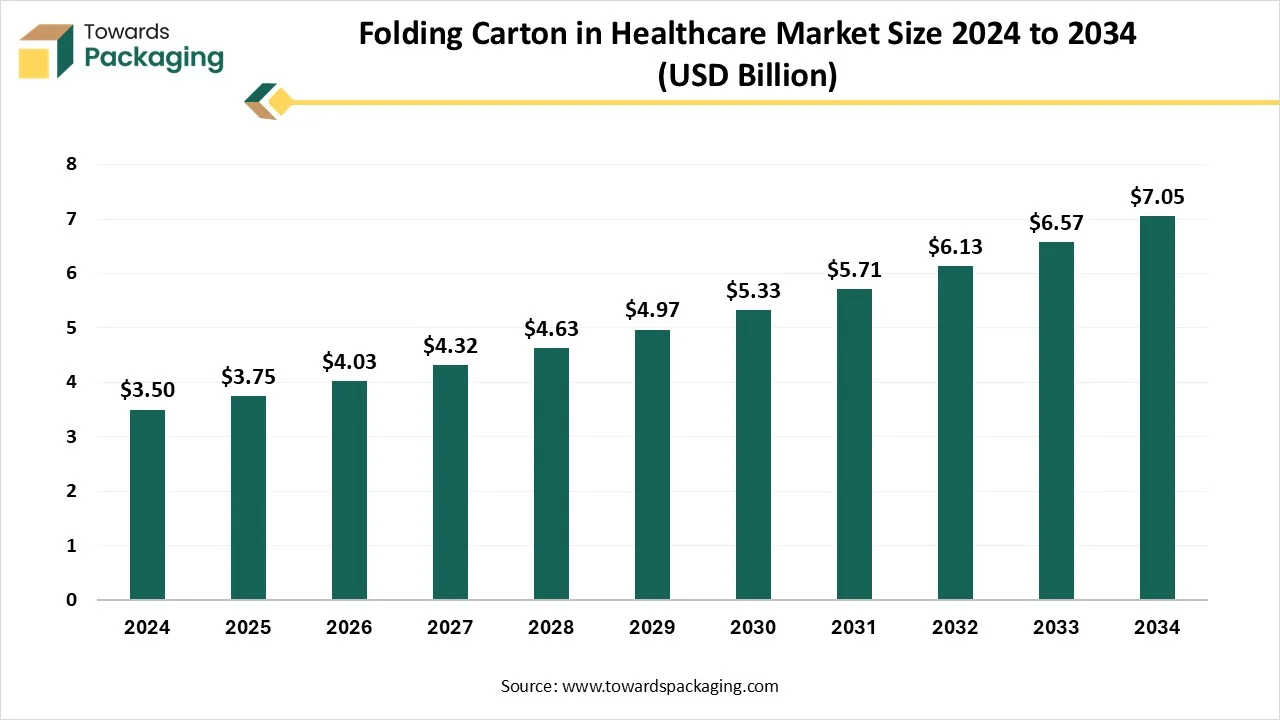

Future of Folding Carton in Healthcare Market

The folding carton in healthcare market is expected to increase from USD 3.75 billion in 2025 to USD 7.05 billion by 2034, growing at a CAGR of 7.25% throughout the forecast period from 2025 to 2034. The demand is due to growth in chronic diseases, and the aging population is encouraging the demand for over-the-counter and prescription drugs, which promotes the demand for folding carton packaging in the healthcare industry.

Asia Pacific holds the greatest share in 2024, and North America is the fastest-growing region. The market is expanding quickly. The most common application type was pharmaceutical products, but nutraceuticals are predicted to rise significantly. Standard folding cartons were dominated by product type, and the market for specialty folding cartons will grow considerably. The paperboard (coated) accounted for the largest material type, while the recycled paperboard is set to grow quickly. By printing technology, offset printing has dominated the folding carton in healthcare market, while the digital printing segment is the fastest growing. By end-use industry, the pharmaceutical industry is the dominating one, while medical device packaging is the fastest-growing segment.

Folding Cartons in Healthcare are paperboard packaging solutions that are folded into various shapes to store, protect, and transport pharmaceutical products, medical devices, personal care items, and other healthcare-related products. These cartons are designed to maintain the integrity of the contents, ensuring product safety and compliance with regulatory standards. They are widely used due to their cost-effectiveness, eco-friendliness, and customizable design options.

Future of Carton Packaging Market

The carton packaging market is expected to increase from USD 213.03 billion in 2025 to USD 353.84 billion by 2034, growing at a CAGR of 5.8% throughout the forecast period from 2025 to 2034.

The carton packaging sector has significance to many sectors because it provides flexible, sustainable, and cost-effective different packaging options. Carton packing is the use of cardboard or paperboard to make containers, cartons, and other forms of packaging. This market comprises a wide range of items, including corrugated boxes, folding cartons, and liquid packaging cartons, and serves sectors such as food and beverage, pharmaceuticals, cosmetics, and consumer goods.

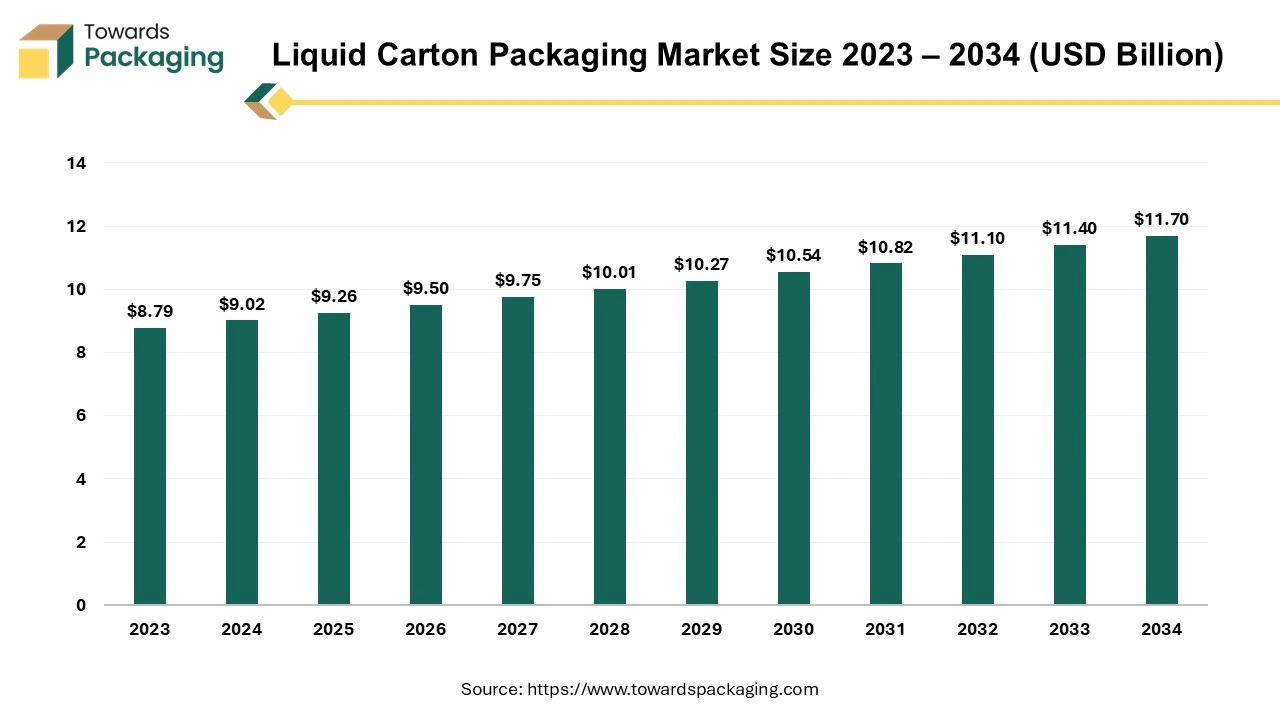

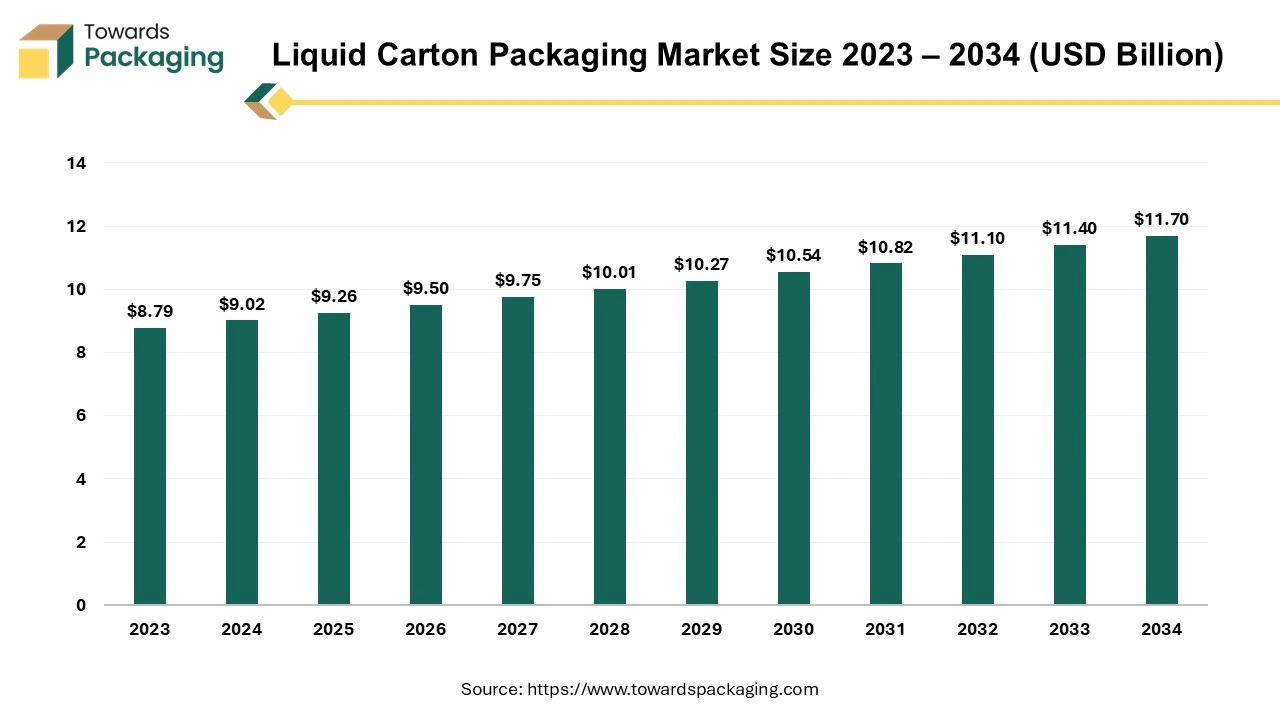

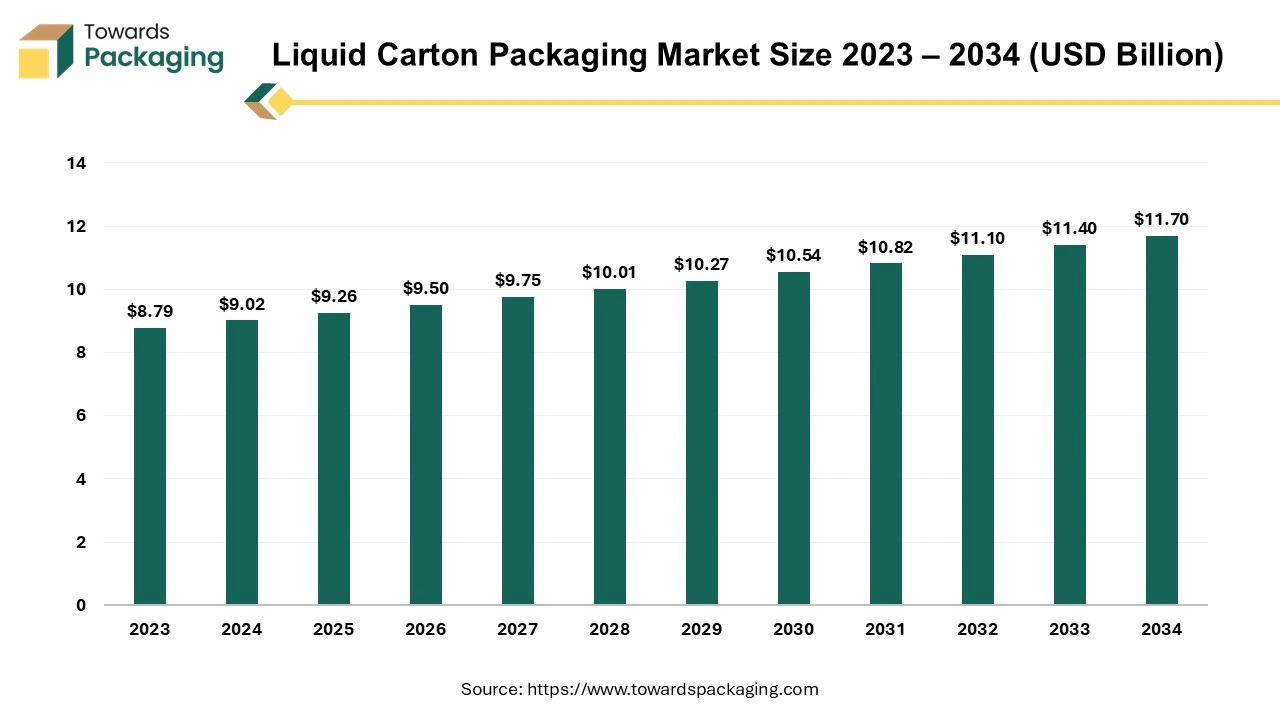

Future of Liquid Carton Packaging Market

The global liquid carton packaging market was valued at USD 9.02 billion in 2024 and is projected to reach approximately USD 11.70 billion by 2034, growing at a CAGR of 2.63% during the forecast period from 2025 to 2034

Owing to the region's altering cultural patterns and social conventions, growing urbanization, population growth, and youth beer obsession has risen the demand for the liquid beverages has boosted. Hence, due to the risen demand for the liquid beverages the key players operating in the market are focused on increasing the production of the liquid carton packaging with longer shelf life which is estimated to drive the growth of the liquid carton packaging market over the forecast period.

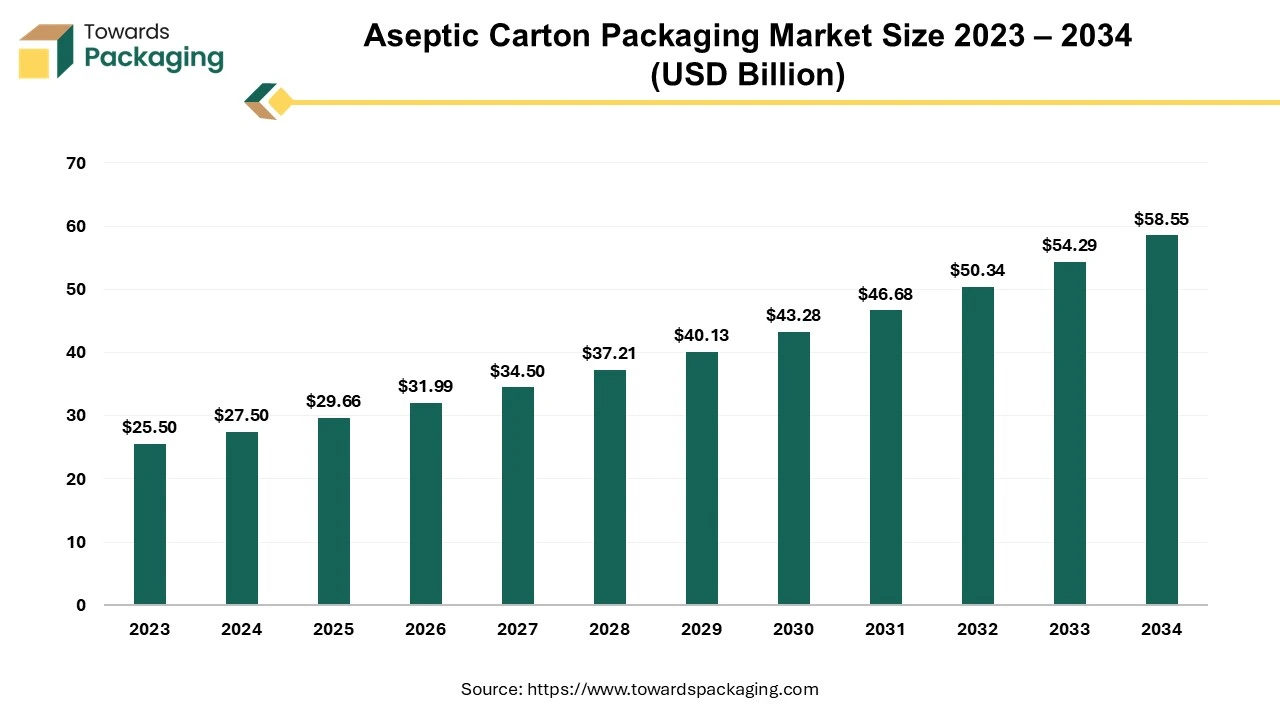

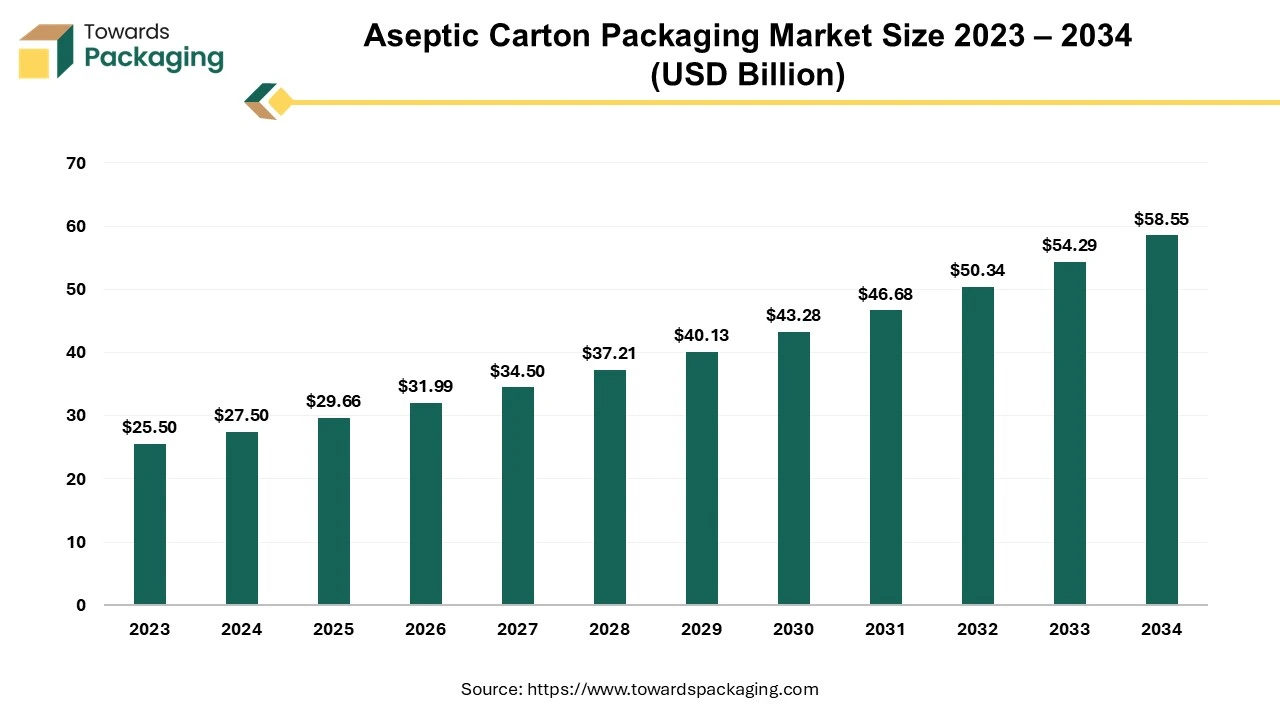

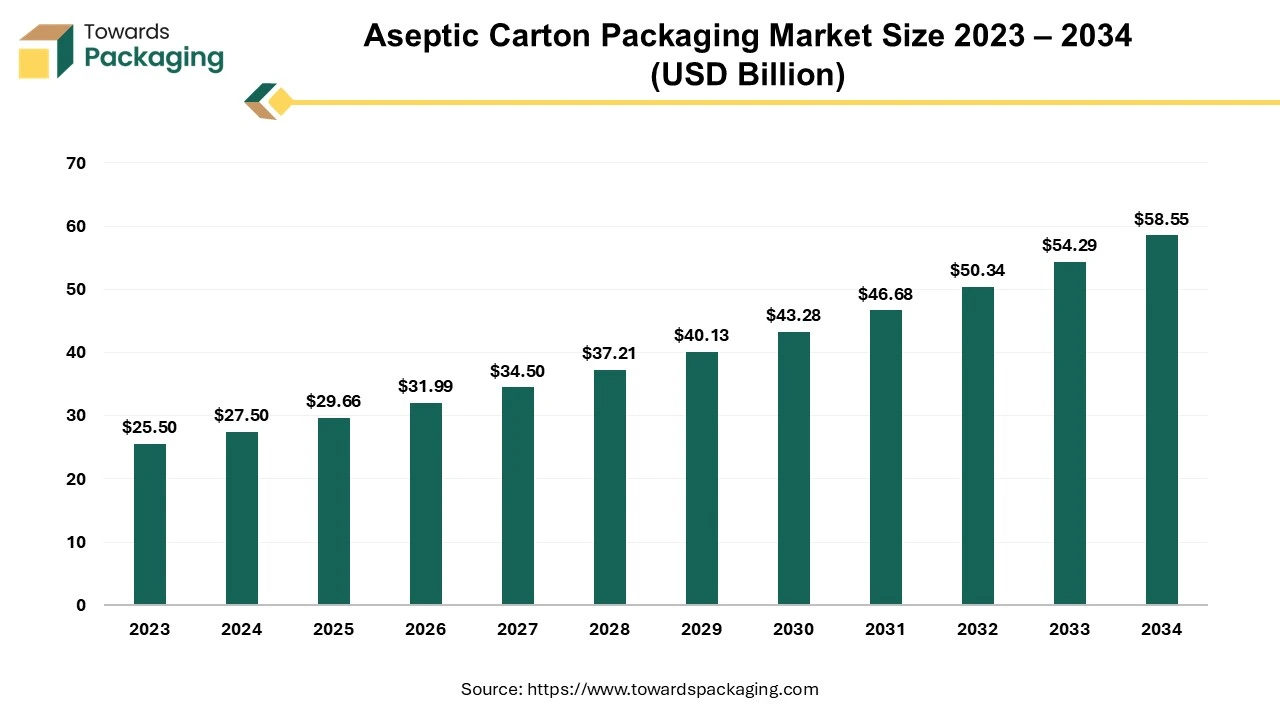

Future of Aseptic Carton Packaging Market

The aseptic carton packaging market is forecasted to expand from USD 29.66 billion in 2025 to USD 58.55 billion by 2034, growing at a CAGR of 7.85% from 2025 to 2034.

It is observed to grow due to the growing demand for non-alcoholic beverages and dairy products market. The rising trend for packaging according to the convenience of the customers contributes profoundly to the growth of the market.

Aseptic carton packaging is a convenient form of packaging which is widely used in industries such as food and beverages. In this process of packaging sterilization of products and cartons is done and sealed in a sterilized environment to avoid any kind of contamination. With this the shelf life of the product increases which makes this process of packaging more preferable for the safety of beverages. Aseptic carton packaged products need not to stored in refrigerators due to which it is widely acceptable mainly in adverse conditions. The growing demand for products with enhanced shelf life majorly driving the aseptic carton packaging market. This type of packaged product can be stored for months without any refrigerator facility, some of the products such as milk, soup, and juice. Mainly people who are health conscious increase the demand for such products with extended shelf life.

Recent Developments by Key Market Players

- In June 2025, Heidelberger Druckmaschinen will add a cartoon muster CX145 in the design of class 6 for its profile, with a particular focus on long-time folding carton printing for beverage, food, and consumer packaging. By launching the new Cartonmaster CX 145, Heidelberg is plugging the gap between its Speedmaster portfolio and the Boardmaster

- In June 2025, Pratham’s pharmaceutical leaflet folding machine, as the name suggests, folds the leaflet into an accurate format for medicine packing. It examines the print on the sheet by vision inspection, which involves the leaflet folding machine, and in numerous steps automatically collects them for packing.

- In October 2024, Al-Medan Project Factory for Carton (MPFC) revealed the gradual opening of its second modern printing press, the Rams Al-Tatour folding carton facility. The press is outfitted with state-of-the-art technology from Koenig & Bauer, and its sole supplier is Al-Kharafi Co. for Paper & Printing Equipment, located in Riyadh. Rams Al-Tatour is anticipated to revolutionize folding carton line packaging by providing all-inclusive luxury solutions with a distinctive workflow that reduces costs and maximizes flexibility across the production chain.

- In August 2024, BW Papersystems introduced an innovative product, the Mercury, a 1400 mm web-fed platen die cutter designed for highly effective folding carton production. This innovative machine was created especially for high-volume folding carton producers who require fast job changes so they may increase their market share with smaller orders. When paired with a state-of-the-art printing press, whether it be offset, digital, or flexo, the Mercury web-fed platen die cutter drastically lowers the number of processes needed to create folding cartons.

Folding Cartons Market Key Market Players

Global Folding Cartons Market Segments

By Material

- Paperboard

- Solid bleached board/sulphate (SBB/S)

- Solid unbleached board/sulphate (SUB/S)

- Folding boxboard (FBB)

- Coated recycled board (CRB)/white-lined chipboard (WLC)

- Uncoated recycled board (URB)

- Others

By Type

- Straight Tuck End

- Reverse Tuck End

- Auto-lock Bottom Box

- Snap Bottom Lock Box

- Others

By End-Use

- Food & Beverages

- Pharmaceuticals

- Personal Care & Cosmetics

- Electrical & Electronics

- Tobacco

- Others

By Region

- North America

- Mexico

- Europe

- U.K.

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-East Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East & Africa