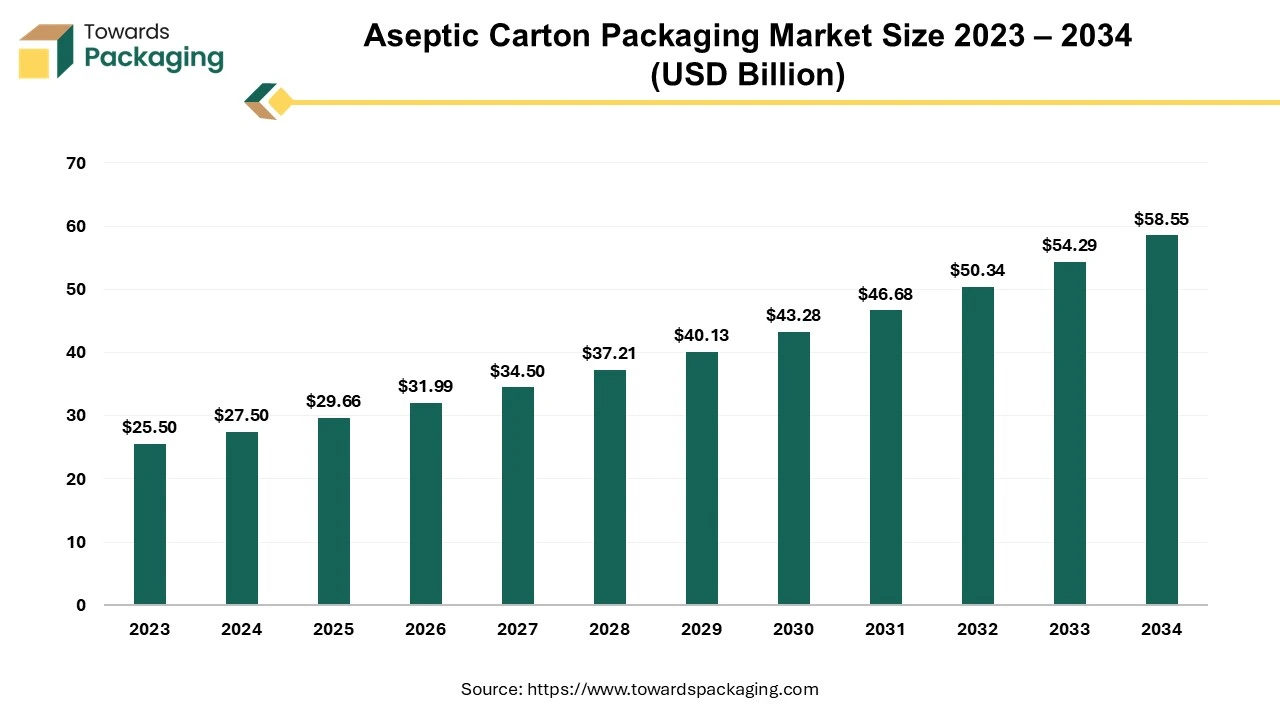

The aseptic carton packaging market is forecasted to expand from USD 31.99 billion in 2026 to USD 63.15 billion by 2035, growing at a CAGR of 7.85% from 2026 to 2035. There is a huge demand for ready-to-eat food, extended shelf life, and decreased food waste which has enhanced the development process of the market. It is widely utilized to enhance the shelf-life of the products, growth of pharmaceuticals industry, sustainability, and environment-friendly trends which fuelled the market.

Aseptic cartons refer to multi-layered packing for liquid food & beverages that sanitizes the product and packing distinctly before closing them together under sterile situations. It is permitting the contents to be kept at room temperature for prolonged periods without preservatives or refrigeration.

The growing demand for sustainable as well as renewable packaging has influenced innovation in the manufacturing technology of the market. Aluminum-free cartons, enhanced recyclability, and plant-based polymers are widely accepted by several industries and enhance its production process. Improved barrier technology, smart packaging, and digitalization has evolved this market significantly.

The major raw materials utilized in this market are plastic, paperboard, and aluminum.

The component manufacturing in this market comprises polyethylene plastics, aluminum foil, and paperboard.

This segment comprises enhanced storage as well as transportation services.

The standard rectangular cartons segment dominated the market with highest share in 2024 due to logistical efficiency and sustainability. Their long-standup utilization in the juice and dairy industries manufacture them an acquainted and reliable sight for customers. Aseptic skill permits goods in such cartons to be shelf-firm for several months without preservatives or refrigeration, attracting to health-aware customers and useful in regions with undersized cold chains. Mainly manufactured from renewable paperboard, they bring into line with the rising customer preference for environment-friendly packaging resolutions in comparison to glass or plastic substitutes.

The shaped cartons segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to increasing trend for premium branding. These aseptic cartons have a sleek and compact pattern, making them widespread for one-time serve of beverages, flavored milk, and health drinks. This shape is enhanced for on-the-go eating and ease. Aseptic cartons are alternative different shape, frequently utilized for bigger formats or focused goods.

The paperboard segment dominated the market with highest share in 2024 due to its structural integrity and recyclability. Paperboard is recyclable and biodegradable, positioning with the increasing customer and industry drive for ecologically friendly packaging. It offers the essential strength and rigidity for aseptic cartons, and it is important for shielding the sterilized containers and encompassing shelf life without requirement for refrigeration. Major companies are capitalizing profoundly in paperboard aseptic packaging options, with a specific focus on decreasing the carbon footprint of such packaging.

The plastic (polyethylene) segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to its protective properties against contamination. Polyethylene layers are utilized on the outer and inner edges of the carton to stop moisture from damaging and support in maintaining the integrity of the goods and packaging. It offers a barrier that shield the goods from corruption and oxygen, encompassing shelf life.

Aluminum foil is the fastest-growing in the aseptic cartons market, as it includes superior-quality prevention and resource compatibility. Aluminum foil offers superior barrier against aromas, light, moisture, and oxygen that can damage the quality of a product. By protect against several aspects, foil laminates plays a significant role in aseptic cartons for protecting the quality and integrity of the products from pharmaceuticals, confectionery, and bakery sector.

The 250–500 ml cartons segment dominated the market with highest share in 2024 due to increased demand for portable and convenient packaging. It is anticipated to be the largest, bookkeeping for a noteworthy portion of the marketplace's revenue. It supplies to the rising demand for one-time serving shares, portability, and suitability for feeding away from home. It is utilized for a wide range of goods, comprising water, flavored milk, juices, and dairy drinks.

The >1000 ml cartons (family-size) segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to its cost-effectiveness and convenience demand among consumers. The main influencer is the demand for multi-assist and at-home drinking of daily staples such as juices, milk, and plant-based beverages. Brands favour this size cartons for shelf efficacy and cost-operative delivery across retail networks. Rising urban lifestyle and huge demand for portable packaging has enhanced the demand for this segment.

The <250 ml cartons is the fastest-growing in the aseptic cartons market, as it includes portion controlled and single-use packaging. The increasing demand for personalized treatment has influenced the demand for such small packages where there is a need for single-dose. Changing dietary habits and increasing travel for multiple purposes enhance the demand for such convenient packaging. This size is considered as convenient, portable, and safe packaging size for food and beverages which enhance the demand for this segment.

The dairy products (milk, flavored milk, yogurt drinks) segment dominated the market with highest share in 2024 due to necessity for long-term storage of products. Aseptic cartons sterilize both the package and the product individually, allowing dairy products to endure fresh for longer period. The growth of busy, urban routines and single-individual households boosts demand for resealable, portable, and single-serve arrangements which aseptic cartons offer effectively. These cartons are mainly manufactured from renewable resources and are alleged as environment-friendly than several plastic substitutes. Brands are emphasizing on utilizing aluminum-free barriers and bio-based polymers to decrease their carbon footprint, attracting to ecologically aware customers.

The beverages (juices, energy drinks, plant-based drinks) segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to huge demand for convenient and shelf-stable products packaging. The rising demand for plant-based and healthy drinks has enhanced the market for these aseptic cartons. It confirms goods are safe and sterile by filling purified goods into sterilized ampules in a disinfected setting. Producers are emphasizing on new products promotion in healthy juice alternatives and increasing into developing markets to fulfil rising feeding.

The food products (soups, sauces, broths) is the fastest-growing in the aseptic cartons market, as it includes innovative packaging products. These are extensively utilized for the packaging of liquid foods like purees, soups, sauces, and broths. These is a huge demand for convenient, on-the-go packaging of the food products which has enhanced such packaging need. The rising awareness towards nutritional content of the food products has influenced this market.

Asia Pacific held the largest share in the aseptic cartons market in 2024, due to rapid growth of pharmaceutical industries. The escalating pharmaceutical industry in the area is a major contributor towards the development for aseptic cartons. There is a robust focus on food safety and integrity, and customers look products which maintain safety and freshness over prolonged periods. Supportive government strategies and progressions in local production competences further hasten the acceptance of aseptic cartons.

Rapid change in the lifestyle of individual has raised the demand for convenient and hygienic packaging in China. Continuous innovation in the market has fuelled the demand for among consumers. A huge population united with growing disposable earnings has resulted in a noteworthy demand for packed, safe, and enduring food & beverage goods. Increasing customer and government emphasis on food security and superiority values has influenced the acceptance of advanced aseptic cartons.

Rising concern towards usage of healthy products with extended shelf life has raised the demand for market. A rising preference for less processed and protective-free products fuels the acceptance of aseptic cartons. Continuous inventions in filling technology and enhancements in aseptic cartons materials are improving market development. The beverage industry is a significant driver in this region due to high consumption of a huge variety of beverages.

Increasing production of consumable beverages has raised the demand for premium packaging and pushed innovation in the market. A robust emphasis on recyclable and sustainable packaging options is driving acceptance of these packages. Progressions in packing technology and resources are fuelling the expansion. Government guidelines endorsing sustainability and food safety are inspiring the evolution to aseptic cartons. Busy and changing lifestyle has enhanced the need for beverage packaging that needs to be convenient and portable.

The major factors influencing the growth of market are consumer trends, sustainability, and innovation. Rising demand for vaccines and biologics in the pharmaceutical sector and a customer preference for environment-friendly choices such as paper-based aseptic cartons. Fundings for new technologies, like digital printing and high-pressure handing out, are improving the sustainability and functionality of aseptic cartons packaging.

Germany is rapidly utilizing aseptic cartons due to the presence of strict ecological guidelines which has influenced the growth of the market. Major market players have high targets for recycling of product packaging which influence the adoption of aseptic packages. These are lightweight, easy-to-transport, and stack effectual cartons which is adopted by a huge variety of industry. Technological support in this industry has boost the demand for these packaging.

The major factors influencing the growth of the aseptic cartons market in Middle East & Africa is rising awareness among consumers towards food safety and health issues. There is a huge demand for details ingredient as well as clear nutritional details on the packaging. Aseptic cartons eradicate the requirement for an expensive and cultured refrigerated supply chain at the time of transportation and distribution, which profoundly decreases logistics charges for producers and retailers. The extension of the food & beverage industry in this region, mainly the dairy, and plant-based beverage sectors, is a major driver for this market.

Rise of urban lifestyle has raised the demand for aseptic cartons market with the increasing need for ready-to-eat and on-the-go packaging of products. The increasing demand for compact and handy products with safe packaging has raised innovation as well as customization in this market. Huge transportation required low-weight, easy-to-transport, and durable packaging has influenced the development of this market.

The Latin American market for aseptic cartons is seeing strong momentum, driven by rising consumer demand for shelf-stable beverages and dairy, increased urbanization and disposable incomes, and growing emphasis on food safety and sustainability. Key markets like Brazil and Mexico are leading this trend, supported by investment in packaging infrastructure, growing processed food & beverage production, and regulatory push toward longer-shelf-life formats.

The aseptic cartons market in Brazil is experiencing steady growth, driven by rising demand for shelf-stable beverages and dairy products such as UHT milk and fruit juices. Increasing urbanization, higher disposable incomes, and a growing preference for convenient, long-life food options are fueling this expansion. Investments in local manufacturing, advanced filling technologies, and sustainability initiatives like recycling and eco-friendly materials are further strengthening Brazil’s position as a key aseptic packaging hub in Latin America.

Sustainability / circulareconomy push: Tetra Pak has heavily emphasized moving towards renewable and recycled materials in its packaging and building recycling infrastructure. For example, a “paperbased barrier” replacing the aluminum layer in aseptic cartons, and investments of ~€40100 million annually in recycling infrastructure.

Localization and capacity expansion: In regions such as South Africa, Tetra Pak upgraded its facility (Pinetown) such that it now meets 80–90 % of domestic aseptic packaging demand. This reduces imports, shortens lead times, and lowers carbon footprint.

By Type

By Material

By Volume Capacity

By Application

By Region

January 2026

January 2026

January 2026

January 2026