Corrugated Automotive Packaging Market Growth Forecast, Segment Analysis, Trade & Value Chain Assessment, and Competitive Benchmarking of Key Companies

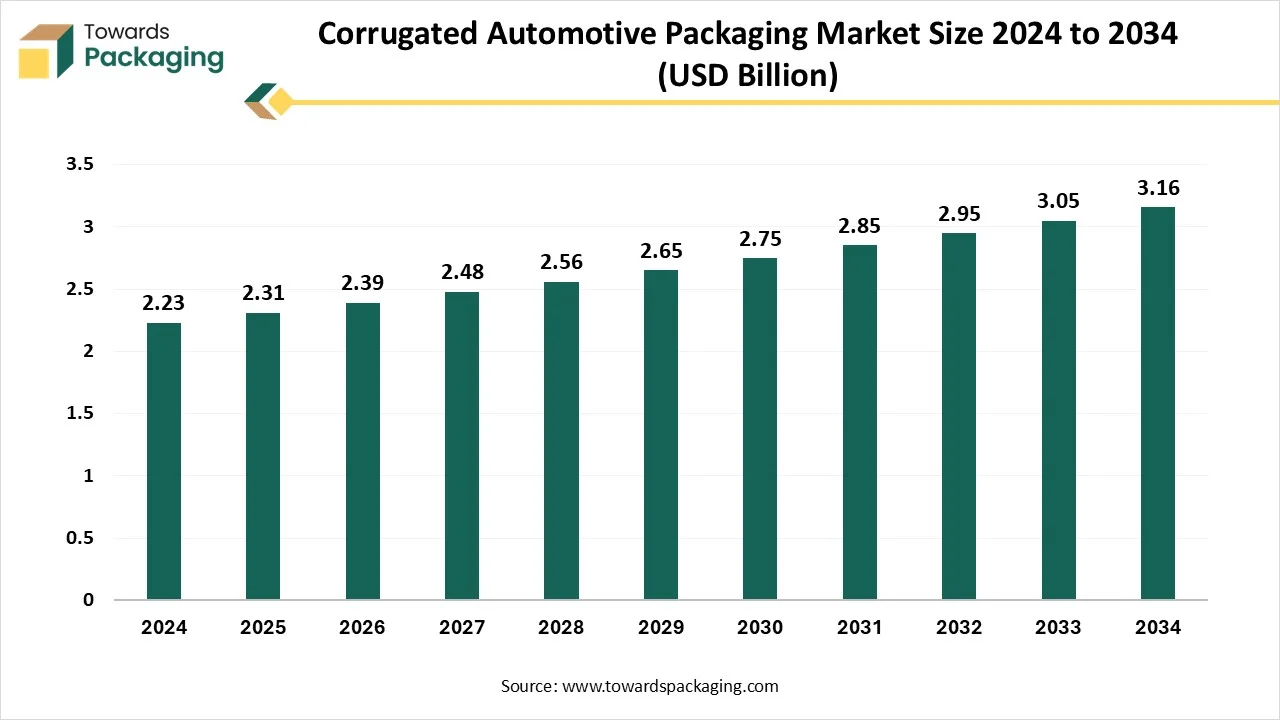

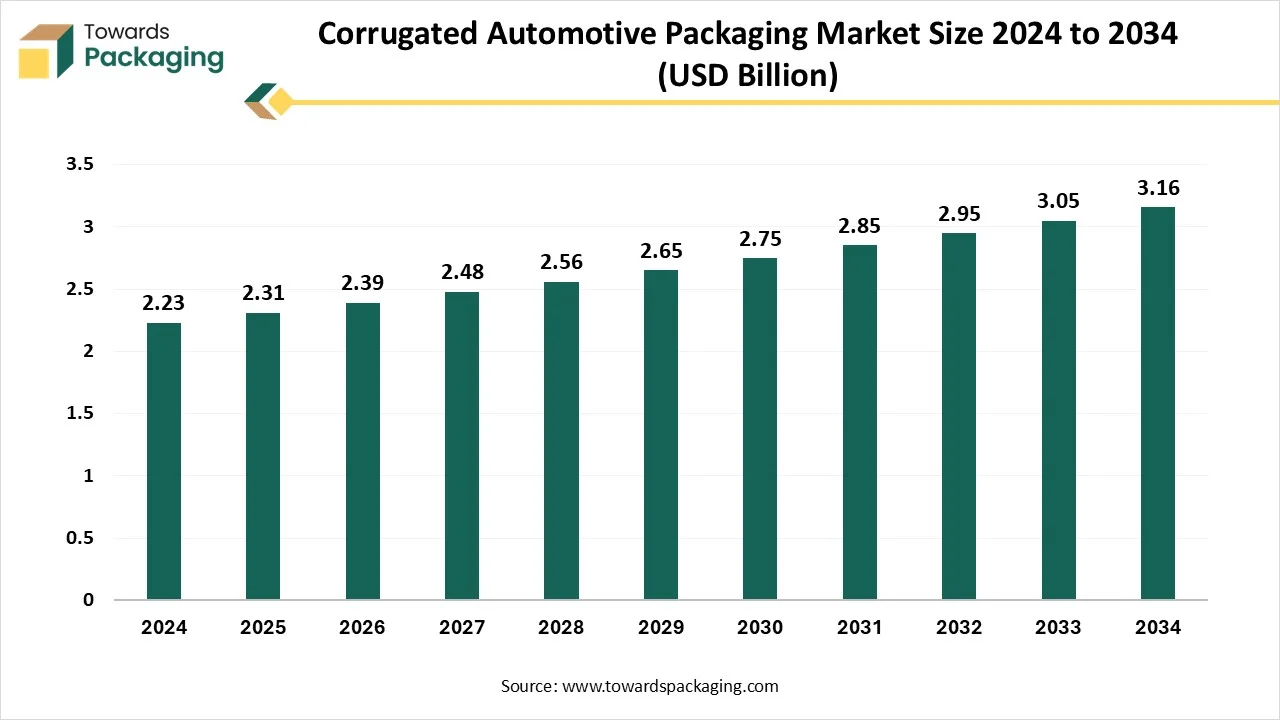

The corrugated automotive packaging market is valued at USD 2.31 billion in 2025 and is projected to reach USD 3.16 billion by 2034, growing at a CAGR of 3.55% between 2025 and 2034. This report covers detailed market size and growth trends by product type (with boxes holding 38% share in 2024 and partitions & inserts growing fastest), material type (double-wall corrugated leading with 42% share in 2024 and triple-wall posting strong growth), vehicle type (passenger vehicles dominating with 50% share in 2024, followed by commercial vehicles), application (engine components leading with 25% share, batteries & electrical components growing at a significant CAGR), and end-use (OEMs accounting for 63% share in 2024, with the aftermarket expanding rapidly).

Regional analysis spans North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, with Asia Pacific holding 41% share in 2024 and Europe expected to grow significantly, supported by EV expansion and sustainability regulations.

Key Takeaways

- In terms of revenue, the market is valued at USD 2.31 billion in 2025.

- The market is projected to reach USD 3.16 billion by 2034.

- Rapid growth at a CAGR of 3.55% will be observed in the period between 2025 and 2034.

- Asia Pacific dominated the corrugated automotive packaging market in 2024 with 41%.

- Europe is expected to grow at a significant CAGR in the market during the forecast period.

- By product type, the boxes segment held a dominant presence in the market in 2024, with 38%.

- By product type, the partitions & inserts segment accounted for considerable growth in the global corrugated automotive packaging market over the forecast period.

- By material type, the double-wall corrugated segment held the major market share of 42% in 2024.

- By material type, the triple-wall corrugated segment is projected to grow at a CAGR of between 2025 and 2034.

- By vehicle type, the passenger vehicles segment accounted for the dominating share of 50% in 2024

- By vehicle type, the commercial vehicles segment is expected to witness a significant share during the forecast period.

- By application, the engine components segment contributed the biggest market share of 25% in 2024.

- By application, the batteries & electrical components segment is expanding at a significant CAGR during the forecast period.

- By end-use, the OEMs (Original Equipment Manufacturers) segment registered its dominance with 63% over the global corrugated automotive packaging market in 2024.

- By end-use, the aftermarket segment is expected to experience significant growth during the forecast period.

Market Overview

The corrugated automotive packaging market includes the design and supply of corrugated packaging solutions tailored to safely transport and store various automotive parts. These packaging formats ensure durability, protection, ease of handling, and sustainability throughout the automotive supply chain. Corrugated boxes are the most commonly used packaging solution in the automotive industry, offering a good balance of cost-effectiveness and strength. These boxes are extensively available in a wide range of sizes, with different combinations of outer and inner liners and grammages.

What Are the Key Trends Driving the Growth of the Corrugated Automotive Packaging Market?

- The rising demand for cost-effective and durable packaging solutions is expected to propel the growth of the corrugated automotive packaging market.

- The surging investment in eco-friendly material innovation by key players, along with a rising government initiative to reduce carbon footprints, significantly contributes to the overall growth of the corrugated automotive packaging market.

- The surge in international trade and increasing focus of automotive businesses on better protection of goods during shipment of automotive parts are likely to drive the market’s revenue during the forecast period.

- The rapid expansion of the e-commerce sector, including online sales of automotive parts, is expected to spur the demand for corrugated packaging boxes, accelerating the market’s growth in the coming years.

- The growing demand for electric vehicles (EVs) is anticipated to fuel the market’s growth during the forecast period. Electric vehicles require specialized and protective packaging for batteries and other delicate components.

- The rising popularity of innovative packaging designs is projected to create immense growth opportunities for the corrugated automotive packaging market in the coming years. Automotive manufacturers are increasingly seeking customized packaging solutions to meet the evolving consumer expectations, as well as protect sensitive parts during transit.

How is Artificial Intelligence Integration Impacting the Growth of the Corrugated Automotive Packaging Market?

As AI technology continues to evolve, Artificial intelligence integration holds great potential to positively impact the growth of the corrugated automotive packaging market. AI-driven solutions can effectively analyze both historical and real-time data to optimize production schedules, minimize wastage, and predict maintenance needs. AI is significantly revolutionising the way corrugated automotive packaging boxes are designed. Machine learning (ML) algorithms, computer vision, and predictive analytics can optimize different stages of the packaging lifecycle, ranging from production and design to logistics and recycling.

The integration of AI assists key players to stay competitive in a complex and dynamic landscape by optimizing production processes, offering personalized packaging, enhancing precision, and aligning with principles of the circular economy. AI-powered solutions can control the quality by leveraging computer vision to detect any defects in automotive packaging, corrugated boxes, or any printing misalignments, which can often be overlooked by humans.

Market Dynamics

Driver

Surge in Automotive Vehicle Production

The rapid expansion of the automotive industry globally, with the rise in vehicle production and aftermarket sales, is expected to boost the growth of the corrugated automotive packaging market during the forecast period. Corrugated automotive packaging boxes offer a balance of cost-effectiveness and durability. These boxes assist in improving handling efficiencies, product protection, and reducing product damage, making them suitable for the transportation of automotive parts. The corrugated packaging for EV batteries, motors, and other crucial automotive components ensures safe and efficient transportation. Moreover, prominent market players are increasingly focusing on improving corrugated material design, strength, and printing on packaging to enhance both the functionality and appeal of corrugated boxes.

- According to the latest data released by the China Association of Automobile Manufacturers (CAAM) in January 2024, Car sales and production volumes across China reached 30.09 million and 30.16 million units last year, jumping by 12% and 11.6% respectively on year, or higher by 9.9 percentage points and 8.2 percentage points from 2022.

Restraint

Fluctuation in Raw Material Prices

The fluctuation in the price of raw materials is anticipated to hinder the market's growth. The price volatility, particularly of paper and wood pulp, has led to an increasing production cost of corrugated boxes, which can adversely impact the profitability of manufacturers. In addition, a high initial upfront investment is required to establish a corrugated packaging manufacturing facility for automotive parts, which can often be a barrier for smaller and medium-sized companies.

Opportunity

Increasing Demand for Environmentally-friendly Packaging

The rising need for environmentally friendly packaging is expected to boost the growth of the corrugated automotive packaging market during the forecast period. The increasing awareness of circular economy models influences sustainable packaging practices. Single-wall corrugated boxes are the most popular and sustainable packaging solution globally. These boxes are reliable, strong, and made from mostly recycled materials, heightened focus on significantly lowering carbon emissions. Several efficient methods are being adopted by manufacturers, where corrugated single-wall boxes are recycled into new packaging at scale.

Segmental Insights

By Product Type

The boxes (regular slotted containers, folding cartons, die-cut boxes) segment dominated the market with the largest share in 2024. Regular Slotted Containers, Folding Cartons, and Die-cut Boxes are most commonly utilised as a shipping carton, owing to their cost effectiveness, durability, and versatile design that creates minimal wastage. These boxes offer excellent protection against vibrations, impacts, and any other handling hazards that create the risk of damage to automotive parts. These boxes can also be customizable to fit any shape, size, or need to meet unique needs.

On the other hand, the partitions & inserts segment is growing at the fastest CAGR. Corrugated partitions and inserts play a crucial role in protecting automotive parts during handling and transit, as they prevent parts from colliding and reduce the risk of damage. Corrugated cardboard with custom-designed inserts ensures that automotive parts arrive undamaged, significantly contributing to efficient logistics and minimizing wastage.

How did Double-wall Corrugated Segments Dominate the Market in 2024?

The double-wall corrugated segment held a dominant presence in the corrugated automotive packaging market in 2024, owing to its cost-effectiveness, maximum strength, and durability for shipping. Double-wall corrugated packaging plays a vital role in the automotive industry's supply chain, offering robust protection for automotive parts during transit. In addition, a surge in e-commerce sales of automotive parts is expected to boost the growth of double-wall corrugated packaging as a sustainable packaging solution during the forecast period.

On the other hand, the triple-wall corrugated segment is expected to grow at a significant rate, owing to the increasing automotive vehicle production and aftermarket sales. Triple-wall corrugated packaging provides superior protection for heavy parts and components during transit. Triple-wall corrugated automotive packaging is biodegradable and recyclable, assisting in promoting a circular economy.

The Passenger Vehicles Segment Dominated the Market in 2024

The passenger vehicles segment accounted for the highest revenue share in 2024, owing to increasing production and sales of passenger vehicles around the world. In the passenger vehicles segment, the market is experiencing the increasing need for protective and cost-effective packaging to transport passenger vehicle parts, including the rise in overseas shipping, further propelling demand for corrugated packaging during the forecast period. Corrugated automotive packaging solutions offer cushioning, shock absorption, and structural support for crucial components of passenger vehicles during transit.

- According to the Society of Indian Automobile Manufacturers (SIAM), the total production of passenger vehicles, commercial vehicles, three-wheelers, two-wheelers, and quadricycles in April 2023 - March 2024 was 2,84,34,742 units. Passenger vehicle sales were 42,18,746 units in April–March 2024. From April 2022 to March 2023, passenger vehicle exports increased from 5,77,875 to 6,62,891 units.

On the other hand, the commercial vehicles segment is expected to grow at a significant rate, owing to the rising global automotive production and aftermarket sales of commercial vehicle parts. The surge in global trade is significantly contributing to the segment during the forecast period. Additionally, the increasing environmental awareness, surging demand for sustainable packaging solutions, and growing focus on aligning with circular economy principles are expected to increase the adoption of corrugated packaging in the commercial vehicles segment.

Which Segment Holds the Majority of the Revenue Share by Application?

The engine components segment accounted for the dominating share in 2024. Engine components encompass a wide range of parts, which include the engine block, fuel injectors, combustion chamber, cylinder head, pistons, camshaft, crankshaft, spark plugs, oil pan, piston rings, and others, which require safe and protective handling during transportation, which in turn bolsters the demand for corrugated packaging solutions. Corrugated boxes can be customized to fit specific engine components, optimizing space utilization and ensuring a secure packaging of crucial components.

On the other hand, the batteries & electrical components segment is expected to witness a significant share during the forecast period. Corrugated packaging offers protection to the batteries & electrical components against physical damage, moisture, and other environmental factors. The rising efforts of market players in the innovations of specialized design of the corrugated packaging for the handling and shipping of the batteries & electrical components are expected to boost the segment’s growth.

What Makes the OEMs (Original Equipment Manufacturers) Segment Dominate the Market?

The OEMs (Original Equipment Manufacturers) segment is expected to dominate the circular economy in the packaging market, owing to the rising need for durable, customized, and reliable packaging for automotive parts. OEMs (Original Equipment Manufacturers) heavily depend on corrugated packaging solutions to transport and provide robust protection for a wide range of components, from small parts to large assemblies. Additionally, rising concerns about environmental sustainability and increasing regulatory pressures are compelling OEMs to adopt corrugated automotive packaging as an eco-friendly packaging option to promote circularity and reduce packaging waste.

On the other hand, the aftermarket segment is growing at the fastest CAGR. The growth of the segment is attributed to the rising expansion of the automotive industry globally, along with the surge in aftermarket sales. The rapid expansion of the automotive industry has resulted in the rising production of both new vehicles and replacement parts, which substantially fuels the demand for corrugated packaging to transport and protect automotive components.

Regional Insights

Asia Pacific is dominating the Market with the Majority of the Market Share

Asia Pacific held the dominant share of the single-wall corrugated boxes in 2024. region has a robust presence of the automotive industry, particularly in countries like China, Japan, India, and South Korea, owing to increasing automotive vehicle production and sales. The implementation of smart packaging technologies such as RFID and sensors into corrugated packaging enables real-time tracking, enhances product security, and improves visibility throughout the supply chain. Moreover, the rising online shopping for automotive parts is expected to drive the market’s revenue in the region.

E-commerce platforms in the region are increasingly adopting corrugated packaging as a reliable and sustainable packaging solution to safeguard automotive parts during transit, especially for sensitive components. The region is also experiencing customized and protective packaging to meet the diverse needs of the automotive parts and improve customer experience. Recycled and biodegradable materials are gaining immense popularity in the market as sustainable packaging solutions. Automotive packaging businesses are increasingly shifting to recycled content to reduce wastage and optimize manufacturing processes, offering both economic and environmental benefits.

The key market players are also incorporating biodegradable and recycled-content packaging materials, fuelled by the implementation of the government's initiative for promoting sustainability in the environment. This combination of factors is expected to propel the corrugated automotive packaging market during the forecast period.

- In February 2025, Samvardhana Motherson International Limited entered into two joint ventures with Japan’s Sanko Co. Ltd. to develop sustainable packaging solutions in India and Europe. The collaborations will be executed through subsidiaries in India and Hungary, focusing on innovative material handling and cost-effective logistics solutions.

Regional Insights

Europe’s Sustainability Initiatives and Surge in EV Packaging Investment to Fuel the Region’s Growth

Europe is expected to grow at a remarkable rate in the corrugated automotive packaging market during the forecast period. Europe has an expanded capacity of vehicle production, particularly a surge in EV production and sales. The growth of the region is attributed to the increasing focus on improving recyclability, rising environmental awareness, rising inclination for personalized and customized packaging solutions, surge in online shopping of automotive parts, increasing demand for durable & cost-effective packaging solutions, and rapid technological innovation such as smart packaging technologies like RFID and printed sensors.

Corrugated boxes are increasingly gaining popularity as they offer an excellent balance of strength, cushioning, and cost-effectiveness, making them suitable for the demanding packaging requirements of automotive parts during transit. Several manufacturers in the European region are heavily investing in developing innovative and customized packaging designs and printing on packaging to stand ahead in the competitive market and better connect with customers.

European government-led sustainability initiatives and stricter environmental regulations compel automotive packaging companies to adopt eco-friendly alternative solutions, driving the expansion of the corrugated automotive packaging market during the forecast period. Policies like the European Union’s Circular Economy Action Plan encourage companies to invest heavily in sustainable packaging solutions.

- In March 2025, Saica Group, a European recycled paper and packaging company, announced its plans to construct a USD 110 million corrugated packaging plant in Anderson, Indiana, the Spain-based company’s second investment in a U.S. site.

- According to the article published in April 2024, parliament adopted new measures to make packaging more sustainable and reduce packaging waste in the EU. The regulation aims to tackle growing waste, harmonise internal market rules and boost the circular economy, was approved with 476 votes in favour, 129 against and 24 abstentions.

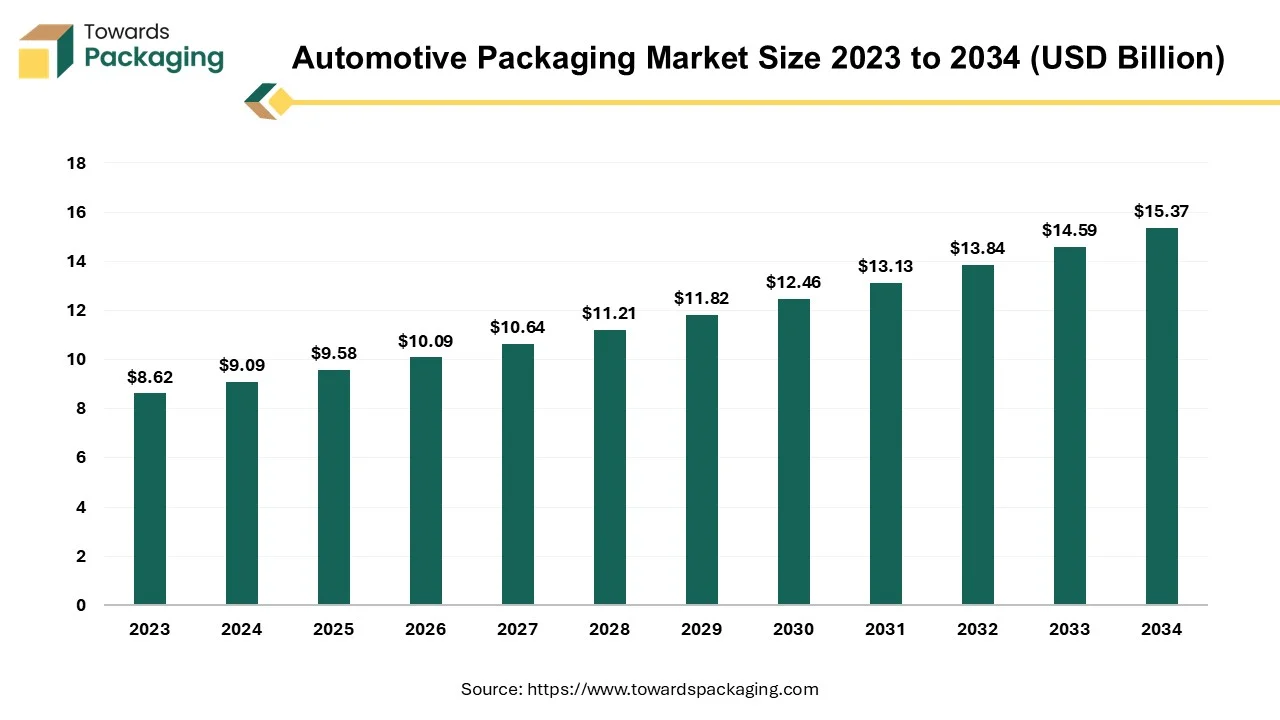

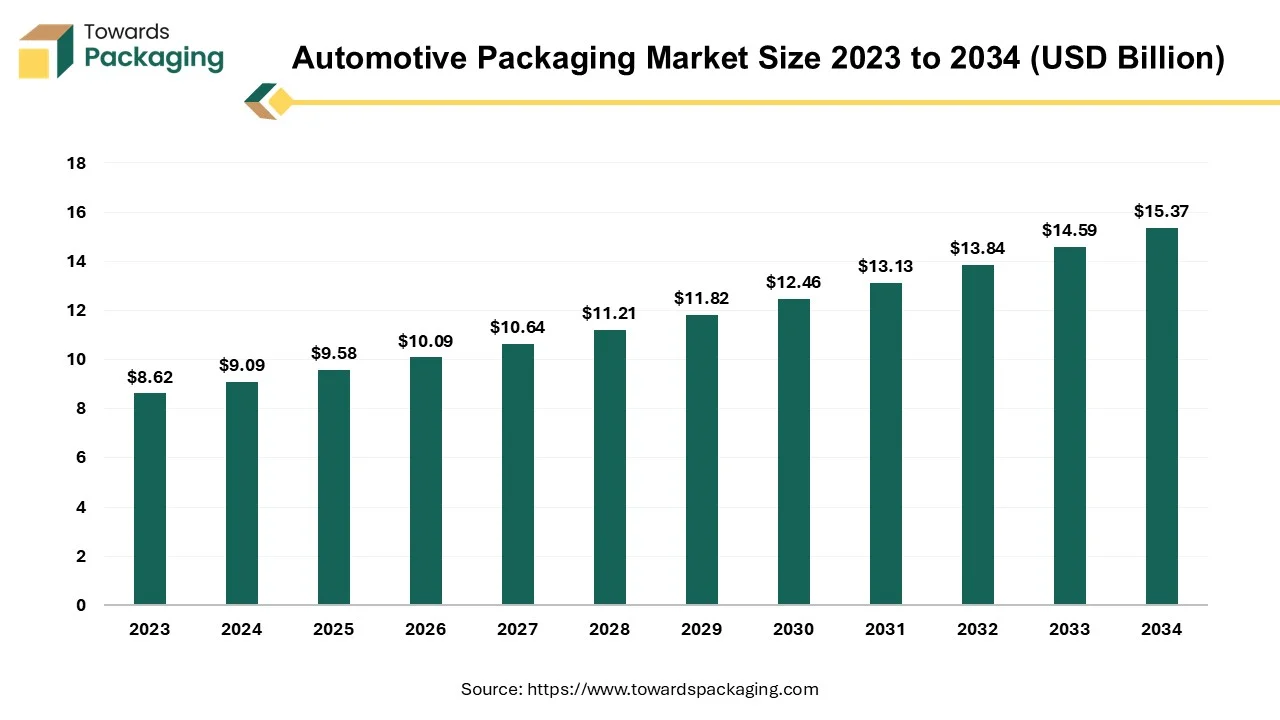

Future of Automotive Packaging Market

The automotive packaging market is projected to witness significant growth from 2025 to 2034. It will grow from USD 9.58 billion in 2025 to USD 15.37 billion by 2034, expanding at a CAGR of 5.4%. The rapid adoption of electric vehicles and advancements in autonomous technology are driving the need for specialized, durable, and sustainable packaging solutions. The expansion of global supply chains and stringent environmental regulations are pushing manufacturers to invest in efficient, reusable, and smart packaging systems.

Automotive packaging refers to the specialized packaging solutions utilized to protect, handle, store, and transport automotive components, parts, and sometimes even complete vehicles throughout the supply chain. It involves utilizing materials and designs that ensure high durability, security, and transit of automotive items. Packaging is engineered to safeguard sensitive or high-value parts (like engine components) against damage, contamination, or environmental factors. Packaging designs are often tailored to the specific dimensions, fragility, and requirements of the automotive parts being handled.

Future of Corrugated Packaging Market

The corrugated packaging market is expected to expand from USD 309.86 billion in 2025 to USD 444.85 billion by 2034, growing at a CAGR of 4.10% from 2025 to 2034. Rapid expansion in online retail and the need for sturdy, cost-effective shipping solutions drive strong demand. Growing environmental regulations also push companies to adopt eco-friendly alternatives, fueling market growth.

Corrugated packaging refers to a type of lightweight, durable, and eco-friendly packaging manufactured from corrugated fiberboard, which consists of a fluted (wavy) middle layer sandwiched between two flat linerboards. This structure provides strength, impact resistance, and cushioning, making it ideal for shipping, storage, and product protection. Corrugated fiberboard is made up of three main components: liner board, fluting (Medium), and adhesives. The key benefits of corrugated packaging have been mentioned here as follows: strength, durability, cost-effective, lightweight, and versatility.

Future of Corrugated Boxes Market

The global corrugated boxes market is projected to reach USD 283.02 billion by 2034, expanding from USD 180.26 billion in 2025, at an annual growth rate of 5.14% during the forecast period from 2025 to 2034. Increasing trend towards sustainable packaging is significant factor anticipated to drive the growth of the corrugated boxes market over the forecast period.

A corrugated box is a disposable container with three layers of material on its sides an outside layer, an inner layer, and a middle layer. When weighted materials are placed inside a corrugated box, the intermediate layer, which is fluted is designed in stiff, wave-shaped arches that act as supports and cushions. The process of aligning corrugated plastic or fiberboard (also known as corrugated cardboard) design elements with the functional, processing, and end-use requirements is known as corrugated box design. Packaging engineers strive to keep overall system costs under control while satisfying a box's performance criteria.

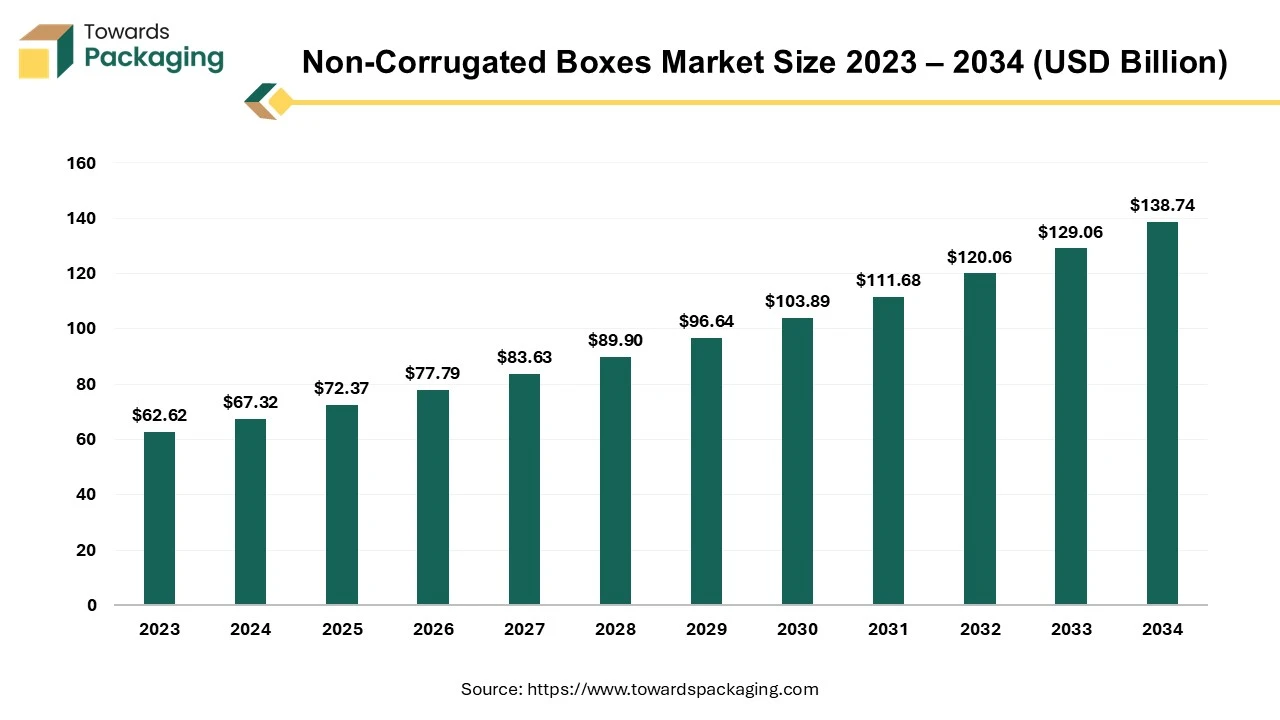

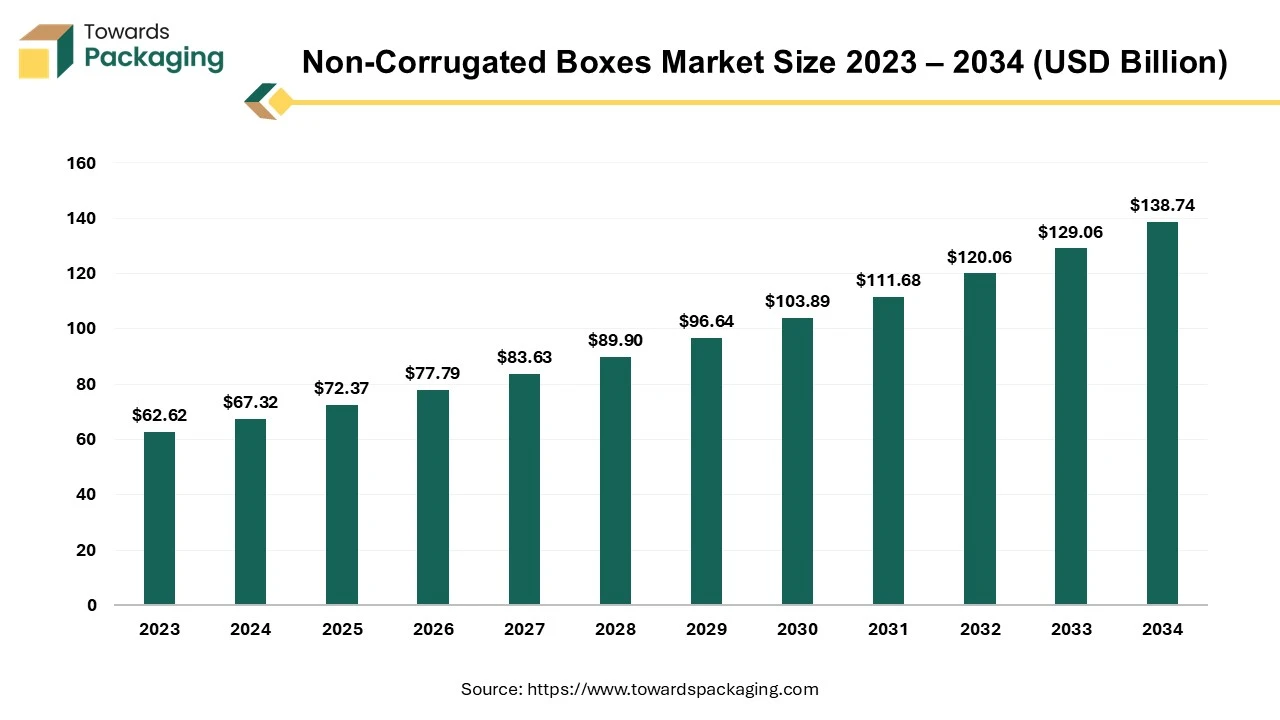

Future of Non-Corrugated Boxes Market

The non-corrugated boxes market is forecast to grow from USD 72.37 billion in 2025 to USD 138.74 billion by 2034, driven by a CAGR of 7.5% from 2025 to 2034. Due to rising trend of the fancy gift boxes the demand for the non-corrugated boxes increased which is estimated to drive the growth of the non-corrugated boxes market over the forecast period.

A non-corrugated box is a type of packaging box that does not have the fluted or ribbed layer found in corrugated boxes. Non-corrugated boxes are typically made from a single layer of material, such as cardboard, paperboard, or plastic. They lack the internal layer of fluted paper that corrugated boxes have. Common materials used for manufacturing non-corrugated boxes is paperboard, plastic, and cardboard among others. Plastic is in non-corrugated boxes manufacturing for meeting more durable and moisture-resistant packaging needs. Non-corrugated boxes are usually less durable than corrugated boxes because they lack the additional layer that provides cushioning and strength. They are often lighter, which can be beneficial for reducing shipping costs.

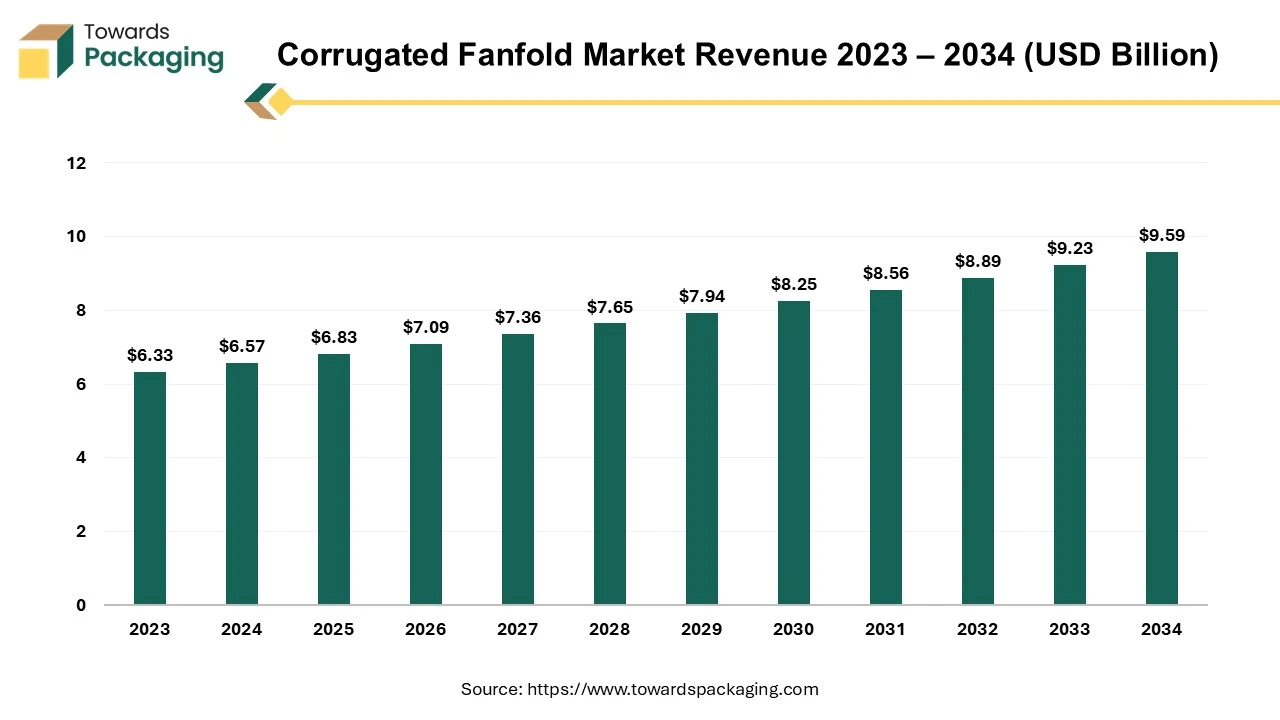

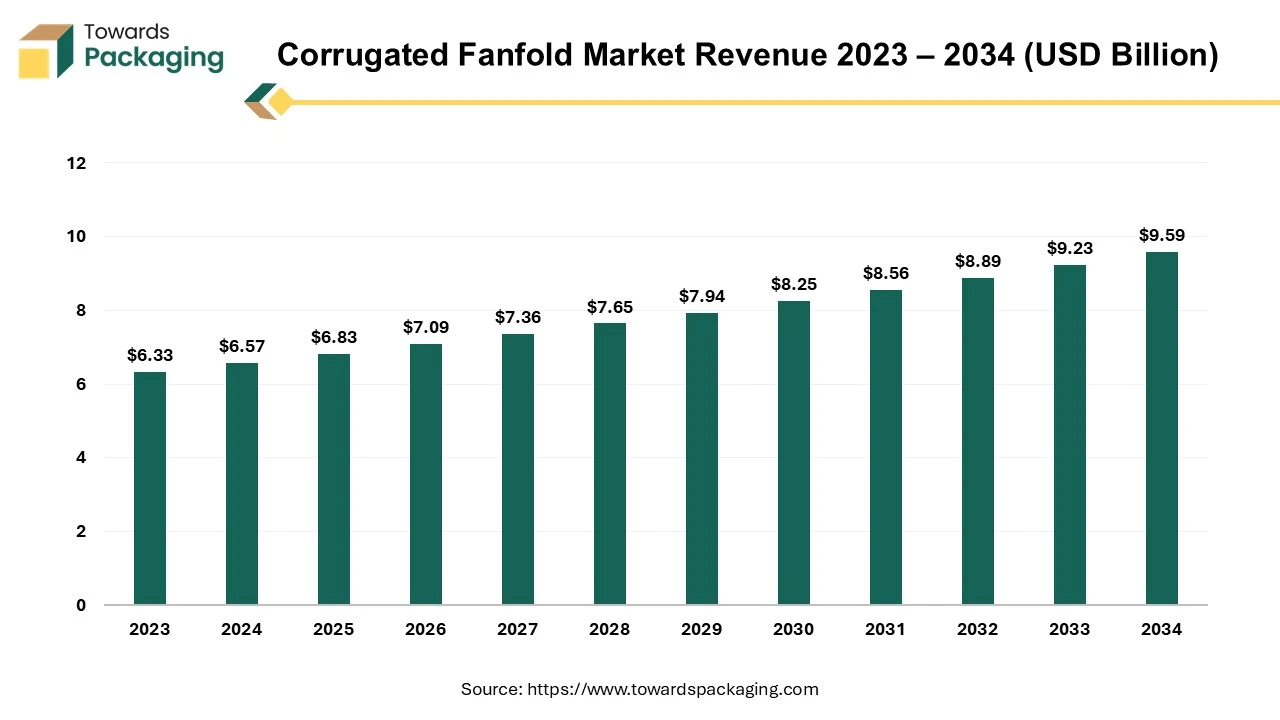

Future of Corrugated Fanfold Market

The global corrugated fanfold market is expected to grow from USD 6.83 billion in 2025 to USD 9.59 billion by 2034, registering a compound annual growth rate (CAGR) of 3.85% during the forecast period. This market expansion is primarily attributed to the rising demand for sustainable, cost-efficient, and customizable packaging particularly across e-commerce, logistics, and retail sectors. According to Smithers, the increasing shift toward on-demand packaging and right-sizing solutions continues to drive the adoption of corrugated fanfold among packaging manufacturers.

The market proliferates due to the rising e-commerce sector and the requirement of shipping & logistics where the safe and durable packaging of products is required. There is an increasing demand for sustainable packaging among consumers and strict government guidelines result in the growth of corrugated fanfold market development.

Top Corrugated Automotive Packaging Market Players

- International Paper Company

- Smurfit Kappa Group

- DS Smith Plc

- WestRock Company

- Mondi Group

- Packaging Corporation of America

- Menasha Corporation

- Georgia-Pacific LLC

- Pratt Industries

- Sealed Air Corporation

- Orora Packaging Solutions

- Cascades Inc.

- Stora Enso

- Rengo Co., Ltd.

- Westfalia Technologies

- Sonoco Products Company

- UFP Technologies

- Horizon Packs (India)

- TricorBraun

- American Carton Company

Latest Announcement by Industry Leader

- Oji India Packaging Pvt Ltd, a subsidiary of Japan’s Oji Group and a global leader in paper products, has inaugurated its fifth manufacturing facility in India at Sri City, Andhra Pradesh. This new 43,000-square-metre facility, the largest of its kind in South Asia, will specialize in corrugated boxes and packaging accessories, providing sustainable and high-quality packaging solutions to the South Indian market. (Source: The Machine Maker)

Recent Developments

- In July 2025, DS Smith Tecnicarton designed single-use corrugated cardboard trays to replace expanded polypropylene alternatives when transporting automotive products such as headlights. A double fingerprint die cut has been implemented for heavy and delicate automotive headlights, securing them in place from the top and bottom of the pack.

- In July 2024, WestRock, a U.S.-based corrugated packaging company, unveiled its plan to open a new corrugated box manufacturing facility in Pleasant Prairie, Wisconsin, to address the increasing demand from customers within the Great Lakes region. The project is being developed with an estimated investment of USD 140 million. It is expected to enhance WestRock’s production capabilities.

Corrugated Automotive Packaging Market Segments

By Product Type

- Boxes (RSC – Regular Slotted Containers, Folding Cartons, Die-cut Boxes)

- Crates

- Trays

- Pallets

- Partitions & Inserts

- Octabins

- PoP (Point-of-Purchase) Displays

By Material Type (Wall Construction)

- Single-face Corrugated

- Single-wall Corrugated

- Double-wall Corrugated

- Triple-wall Corrugated

By Application (Automotive Parts)

- Engine Components

- Batteries & Electrical Components

- Automotive Filters

- Lighting Components

- Cooling System Components

- Underbody Components

- Interior Components

- Exterior Components

- Transmission Parts

- Suspension Systems

By End-Use

- OEMs (Original Equipment Manufacturers)

- Aftermarket

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Two-Wheelers

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait