The Business-to-Business (B2B) Packaging market covers a complete evaluation of global market size, demand trends, and competitive forces shaping the industry. This report includes detailed segmentation by material type, packaging format, application, and end-use industry, supported by numeric market share and forecast data. It further delivers regional insights across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, showcasing revenue distribution, growth opportunities, and trade patterns. The study also maps key manufacturers, supplier networks, pricing trends, logistics performance, and value chain structures, offering an end-to-end statistical overview of the global B2B packaging ecosystem.

The Business-to-Business (B2B) Packaging Market focuses on providing packaging solutions and services from one business to another. Unlike consumer packaging (B2C) designed for direct retail appeal, B2B packaging prioritizes functionality, protection, efficiency in logistics, and compliance with industry standards. It encompasses a wide range of materials and formats used for shipping, storing, and transporting products throughout the supply chain, often involving bulk quantities, industrial goods, components, and inter-company transfers rather than direct consumer sales.

Business-to-business packaging is a different idea as compared to Business-to-Consumer packaging. The huge difference comes down to its aim and audience. B2B Packaging is all about the practical things. You are crafting for other businesses, not everyday users, so the concentration is on things like product protection, keeping costs lower, which makes shipping as effective as possible. This kind of packaging is not attention-grabbing on the surface, but careful consideration should still be paid. It's incredibly crucial for protecting products from damage during travelling, and attention must be paid.

| Metric | Details |

| Key Market Drivers | E-commerce growth, global trade, supply chain optimization, sustainability, smart packaging |

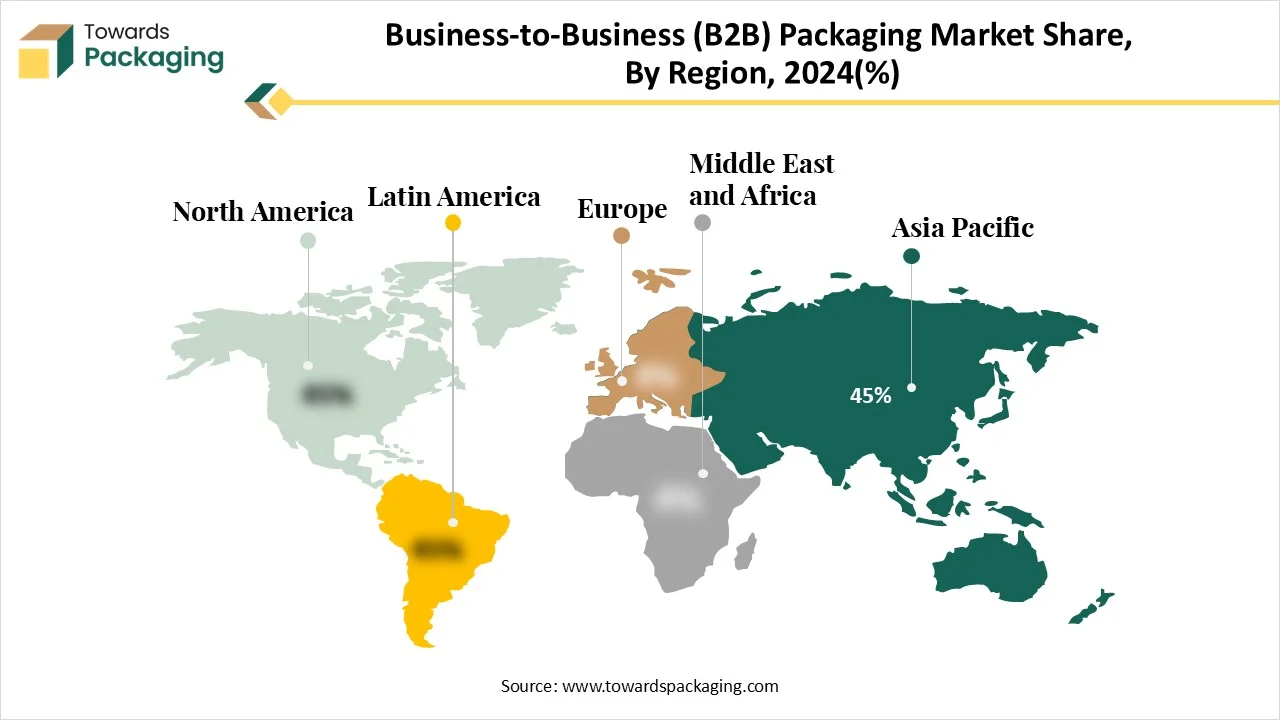

| Leading Region | Asia Pacific |

| Market Segmentation | By Material Type, By Packaging Format, By Application, By End-Use Industry, Food & Beverage (Industrial/Bulk) and By Region |

| Top Key Players | Amcor Plc, Mondi Group, Smurfit Kappa Group Plc, International Paper Company, Berry Global Group, Inc., DS Smith Plc, Greif, Inc. |

AI has changed the packaging design procedure. Intelligent software utilising machine learning and predictive algorithms can test many of the design variants in minutes, quickly examining the most effective solutions in terms of weight, durability, and sustainability. In packaging machinery maintenance, AI assists in predicting failures and exceptions before they arise. Remote monitoring systems and smart sensors, already accepted by main packaging line producers, detect problems like vibration, abnormal temperature, and energy consumption, too. Allowing proactive interference.

AI has also firmly affected packaging logistics. Intelligent packaging and transportation management tools can now examine supply chain data in real time, updating inventory levels and distribution routes. AI is an influential supporter in the ecological intervention of packaging. Smart software can quickly assess the Life Cycle Assessments (LCA) of materials, examining the most environmentally friendly options.

User packaging for security with a decent design is among the successful elements of the new-generation B2B ideas. It is no longer adaptable for packaging to only protect the product, but it has to do more, which develops the value. This is how inventive and sustainable B2B packaging solutions intend to perform. It protects the product during travelling while at the same time sending a message about the product via the usability and design of the material. For instance, smart packaging that an expert in labeling can interact with the customers with real-time information, or even diversion. Another growth that has occurred in the business-to-business packaging is the inclusion of labelling automation. Automated systems not only make labelling more effective but also standardized, and free from blunders too.

Poor business-to-business packaging can impact anyone's business reputation. After all, packaging is a reflection of a brand's identity. If users link your brand with cheap-looking or insufficient packaging, they might feel your products are inferior, despite their actual quality. Even unacceptable, poor business-to-business packaging can result in long-term damage to your brand. If any packaging fails to protect the products, users are likely to phone in their displeasure online. Negative feedback can be spent quickly on e-commerce platforms and social media, damaging any brand's reputation and dissuading capable buyers. With rising environmental issues, users are increasingly giving importance to sustainability. Packaging plays an important role in this move towards eco-conscious consumption. Businesses that fail to accept this trend risk angering environmentally conscious users.

In the future packaging pattern, less is more. There is a rising demand for solutions that solve and address the issue of overpackaging. This is displayed by the actions and suggestions of environmental groups, users, and legislators. With businesses passionate about climate change, substituting fossil-based materials in packaging remains a rising trend. Packaging craftsmen who lower environmental harm while tracking functionality and performance. Selecting non-fossil options is getting closer. For users, the move towards non-fossil materials does not need a change in behaviour. For instance, both bio-attributed plastic in behaviour. For instance, both bio-attributed plastic and barrier papers can be recycled in the current recycling streams.

The paper and paperboard packaging sector includes generating and supplying different types of products made from paper material. The field has experienced constant growth because of rising sustainable and eco-friendly packaging solutions. Paperboard created from renewable resources, crafted to be recyclable, compostable, and biodegradable, is considered to be a more sustainable and environmentally friendly option compared to other packaging options. The paper and paperboard packaging selections are more adaptable as they can be easily folded, cut, and shaped too to match different products and sectors. This kind of packaging even benefits in serving high-quality surfaces for branding and printing, which can help products stand out on shelves and grow brand recognition.

The growing demand for recycled and biodegradable packaging was caused by its regulatory, environmental, and consumer issues. Organizations are becoming more aware of the significance of sustainability; similarly, eco-friendly packaging can now play a big part in a business's direct needs for packaging solutions. Grown awareness toward surrounding degradation, especially plastic waste, has been one of the biggest driving forces for this trend. On the other hand, recyclable packaging is a material that can be collected, separated, or recovered and made for reuse or recycling as a secondary raw material.

Flexible packaging is gaining attention across different industries, which serves a mixture of sustainability, convenience, and cost-efficiency. As users select and brands find inventive solutions, this packaging design is becoming a driving element in the sector. Many main factors are pushing the growth of flexible packaging. One of the main drivers is its affordability. As compared to rigid packaging, flexible options need less raw material and power to generate. Sustainability is another crucial factor as several producers are now including post-consumer recycled content and creating compostable films to align with environmental regulations and consumer growth.

Reusable packaging systems, which include pallets, heavy-duty containers, crates, and bulk bins, are crafted to resist several shipments, lowering the demand for continuous substitution. The encouragement for greener operations and official pressures on waste management have increased the acceptance of reusable packaging. Organizations currently see these systems not only as a way to reduce environmental effects but also as a strategic investment in supply chain strength, by utilising reusable packaging, enterprises lower raw material usage and waste trash costs, while developing effectiveness and product security.

Tertiary packaging, also known as transportation packaging, is crafted for producers, logistics, and warehouses. Just like primary and secondary packaging, its look is not important. This kind of packaging is often crafted to lower storage space while maximizing protection. Some brands, specifically in e-commerce, also combine secondary and tertiary packaging to reduce the materials used. Transport packaging is only used for protection, carrying, and identification. Users do not come across this surface of product packaging in retail stores. Hence, for e-commerce users, this is the first layer of packaging that they experience, watching primary or secondary packaging.

This is the stock of product packaging that is in direct contact with the product. It protects the product from exposure, adulteration, and damage. This kind of primary packaging relies on the product and its application. This layer also counts product packaging that has important information regarding the product and its uses. The primary packaging is also crucial for marketing and product identification. It displays the name of the product, tagline, and brand logo. Product packaging design also includes elements that convey the nature and values of the brand and product. For several products, primary packaging remains in use along with the product. This is especially true for liquid products and food items.

E-commerce businesses must embrace inventive techniques for folding products into smaller shapes to reduce the size of the packaging needed for each product. Food and grocery delivery services can avoid using several covers and wraps per item and discover the capability of avoiding sending single-use cutlery, sachets, and straws to customers. It is crucial to have this exercise without negotiating packaging recyclability, functionality, and product manufacturing, too. For instance, lightweighting can lead to lower material consumption, but can affect its post-consumer recyclability and may affect the security served to the product packaged.

The initial aim of business-to-business packaging in pharmaceutical and cold chain logistics is for brand awareness as well as the handling of products. As an instance, secondary packaging can be the branded boxes utilised to showcase products. Secondary packaging is specifically found in the design of bespoke products. Not only are they easily tailored, assisting the brand awareness, but they also provide perfect security and can be recycled. When solved precisely, pharmaceutical packaging can have several advantages.

Asia Pacific dominated the market in 2024, and the region is expected to sustain its position during the forecast period. This region has emerged as the fastest-growing segment for business-to-business packaging, driven by growth in urbanization, e-commerce, and heightened environmental awareness. India, in particular, is leading this regional development. Organizations like EcoPack India and current initiatives by the Indian government are fulfilling the industry's momentum. China, India, and Indonesia will constantly play crucial roles in driving demand. Users in these nations are heavily ready to invest in environmentally friendly products. , with specific issues about pollution and resource depletion. Hence, infrastructure limitations for waste management and recycling continue to pose challenges.

By Material Type

By Packaging Format

By Application

By End-Use Industry

Food & Beverage (Industrial/Bulk)

By Region

January 2026

January 2026

January 2026

January 2026