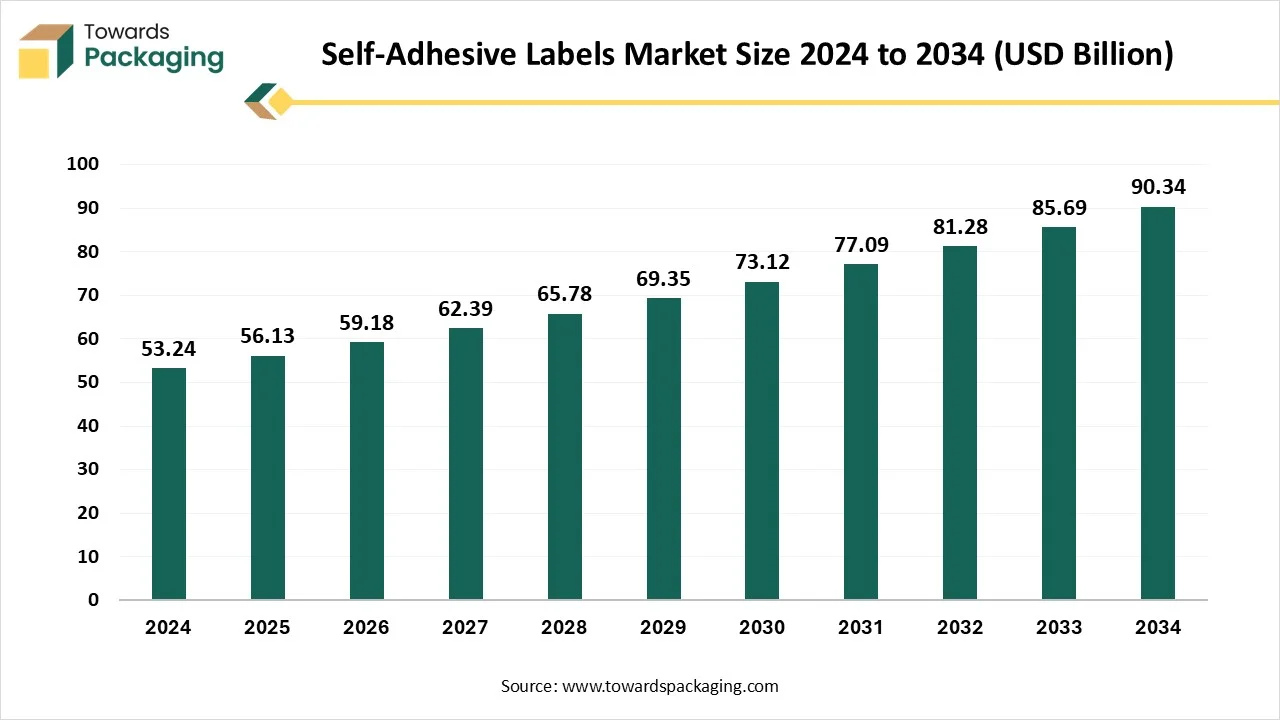

The self-adhesive labels market is forecasted to expand from USD 59.18 billion in 2026 to USD 95.25 billion by 2035, growing at a CAGR of 5.43% from 2026 to 2035. This market report covers detailed market size and growth trends, full segment analysis by composition (facestock, paper, plastic, hot melt, acrylic), type (release liner, linerless), technology (flexography, digital, letterpress, screen, gravure, offset), nature (permanent, removable, repositionable) and application (food & beverages, pharmaceuticals, consumer durables, home & personal care, others).

It includes regional data for North America, Europe, Asia Pacific, Latin America, and MEA, highlighting North America’s 2024 dominance and Asia Pacific’s fastest growth. The study maps key companies and competitive analysis (3M, Avery Dennison, LINTEC, Mondi, UPM, Optimum Group, HERMA, AKO GROUP, Advance Marks & Labels and others), along with value chain analysis, global trade data, and detailed manufacturer and supplier profiles, plus coverage of e-commerce-driven demand, smart labels, AR barcoding, regulatory impact, and sustainability trends.

| Metric | Details |

| Market Size in 2025 | USD 56.13 Billion |

| Projected Market Size in 2035 | USD 95.25 Billion |

| CAGR (2025 - 2035) | 5.43% |

| Leading Region | North America |

| Market Segmentation | By Composition, By Type, By Technology, By Nature, By Application and By Region |

| Top Key Players | 3M, Avery Dennison Corporation, LINTEC Corporation, Mondi, UPM, Optimum Group, HERMA, AKO GROUP, Advance Marks & Labels Pvt Ltd. |

The self-adhesive labels market refers to the industry involved in the production, distribution, and sale of labels that have a pre-applied adhesive backing. These labels stick to surfaces without the need for water, heat, or other external agents. They are widely used in various industries, such as packaging, logistics, healthcare, retail, and manufacturing.

A face material (paper, plastic, or other materials) that is printed on. An adhesive layer that ensures the label sticks to the desired surface. A release liner (usually silicone-coated paper or film) that protects the adhesive until the label is applied. Self-Adhesive labels are easy to apply. Versatile and suitable for various materials like metal, plastic, glass, and wood. Available in a variety of sizes, designs, and adhesive types (permanent, removable, repositionable).

AI integration can significantly enhance the self-adhesive labels industry by improving quality, efficiency, and customization throughout the value chain. AI tools can analyze customer preferences, market trends, and competitor designs to develop appealing, customized label designs. AI can enable businesses to produce labels tailored for specific customer segments or even individual consumers.

AI-powered vision systems can detect printing errors, misalignments, or adhesive issues in real-time during production. AI can identify potential quality issues before they occur, reducing waste and improving output consistency. AI can monitor machinery for signs of wear and predict when maintenance is needed, minimizing downtime. Process Automation: AI can automate repetitive tasks like cutting, printing, and applying labels, improving efficiency.

The integration of artificial intelligence makes smarter inventory management. AI can predict material requirements based on historical data, reducing overstocking or shortages. AI algorithms can manage inventory in real-time, ensuring materials are always available for production.

The integration of artificial intelligence improved the customer experience. AI can generate 3D previews of how labels will look on products, helping clients visualize designs before production. AI-enabled smart labels can provide real-time product information, usage instructions, or marketing messages when scanned. AI can simulate different label designs and materials to test durability, aesthetics, and functionality without the need for physical prototypes.

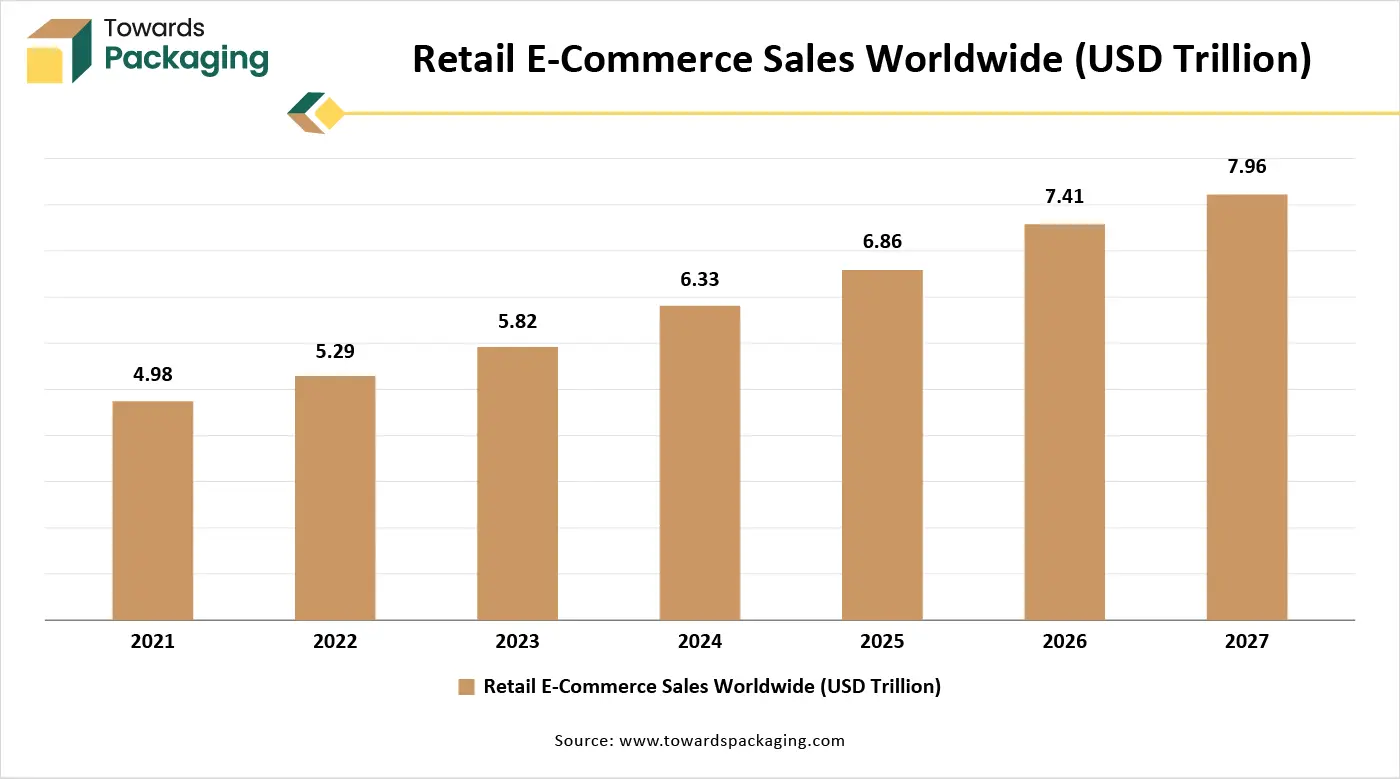

Increased online shopping has led to higher demand for shipping labels. Global trade growth requires efficient labeling for logistics and compliance with international standards. The increase in online shopping leads to higher demand for packaging materials, including labels, as products require to be securely labeled for tracking, identification, and branding. Self-adhesive labels provide flexibility in design, enabling brands to personalize packaging and enhance the unboxing experience, a critical factor in e-commerce. Self-adhesive labels with QR codes, barcodes, and RFID technology are essential for inventory control, efficient tracking, and logistics management in global trade. These labels are designed to withstand varying conditions during shipping, making them ideal for international and domestic e-commerce deliveries.

The global reach of e-commerce introduces a diverse range of products, each requiring unique labeling solutions to comply with regional regulations and consumer preferences. Self-adhesive labels are crucial for displaying legally mandated information, such as origin, nutritional content, and safety warnings. Integration of technologies like RFID and NFC in self-adhesive labels allows for better product interaction, authentication, and tracking, which are increasingly in demand in e-commerce and global trade. As e-commerce companies scale operations, automated labeling systems using self-adhesive labels become essential, further driving self-adhesive labels market growth.

Globally, over 33% of consumers make purchases online. The commerce industry is currently worth US$6 trillion and is predicted to reach US$8 trillion by 2027. 2.71 billion people make purchases online using specialized commerce platforms or social media retailers worldwide.

The key players operating are facing issue from alternative materials and economic instability, which may restrict the growth of the self-adhesive labels market over the forecast period. Increasing use of direct printing, shrink sleeves, and in-mold labeling provides stiff competition to self-adhesive labels. A competitive market often results in price wars, reducing profit margins for manufacturers. Self-adhesive labels may not adhere effectively to certain surfaces, such as oily, rough, or extremely hot and cold materials, limiting their application. In extreme environmental conditions (e.g., high humidity, UV exposure), labels may fail, affecting their reliability. Economic slowdowns, trade restrictions, and geopolitical tensions can impact the global supply chain and demand for self-adhesive labels. Dependence on the retail, e-commerce, and industrial sectors ties the label market's growth to broader economic conditions.

Smart labels embedded with NFC and RFID technology offer real-time tracking, inventory management, and anti-counterfeiting solutions. Opportunities exist to develop labels that interact with IoT ecosystems, providing product details and consumer engagement features.

For instance, Avery Dennison, adhesive manufacturing company presented its most recent labeling technology advancements at Labelexpo Americas 2024, which will take place from September 10–12. The business will showcase how it is bridging the digital and physical worlds to open up new opportunities for the labeling sector in Chicago this year. Along with taking part in stimulating conversations at the WA Label Release Liner and Smart Labeling Seminars, Avery Dennison will also investigate the future of linerless labels on the innovation stage.

The adhesive segment held a dominant presence in the self-adhesive labels market in 2024. Smooth surfaces (e.g., metal or glass) require less aggressive adhesives, while rough or porous surfaces (e.g., cardboard or wood) need stronger adhesive formulations. Adhesive compatibility with the substrate material (e.g., metal, plastic, paper) is essential to ensure proper bonding. Labels applied to curved or irregular surfaces may require flexible or repositionable adhesives. High-heat environments (e.g., industrial settings) require heat-resistant adhesives. Cold environments (e.g., refrigeration) demand low-temperature adhesives. Water-resistant or waterproof adhesives are essential for applications exposed to moisture or humidity, such as food packaging or outdoor labeling. Adhesives must be resistant to chemicals (e.g., solvents, oils) in specific industries like healthcare or automotive.

High-speed production lines can benefit from the strong bonding properties and fast setting periods of hot melt adhesives. The fastest-growing CAGR is being observed by acrylic adhesives because of their excellent performance and versatility in a range of environmental circumstances, including resistance to chemicals and UV radiation. Paper-based Facestock is expanding at the quickest rate because of its affordability and adaptability. Several businesses, particularly retail and food and beverage, make extensive use of it. Another factor driving plastic facestock is its strength and visual appeal. In household and personal care goods, it is very well-liked.

The release liners segment led the global self-adhesive labels market. Release liners protect the adhesive layer until the label is ready for application, ensuring ease of use and preventing premature sticking. They help maintain the adhesive’s integrity and uniformity, critical for consistent label performance. Release liners facilitate quick and precise label application, especially in automated systems. Release liners are essential for high-speed labeling processes in industries like food, beverages, pharmaceuticals, and logistics. Their ability to easily separate from the adhesive allows seamless integration with automated machinery, improving productivity.

Release liners are available in various materials (e.g., paper, film) tailored for different applications, enhancing their adaptability. The utilization of silicone-coated liners ensures easy release, even for labels with aggressive adhesives. Release liners protect the adhesive layer during manufacturing, storage, and transport, preventing contamination or damage. They shield the printed label from external factors like dust, moisture, and physical damage before application.

The flexography segment registered its dominance over the global self-adhesive labels market in 2024. Flexography can print on a wide range of materials, including paper, films, foils, and synthetic substrates commonly used in self-adhesive labels. Flexographic printing presses operate at high speeds, making them ideal for large-scale label production with short turnaround times. Flexo uses low-cost consumables such as fast-drying inks and lightweight plates, reducing production costs, especially for high-volume printing. Flexo can use a variety of inks (water-based, solvent-based, and UV-curable), enabling precise adhesion and print quality on different adhesive label materials.

Flexo presses often include inline processes such as laminating, die-cutting, varnishing, and embossing. These capabilities are essential for creating finished self-adhesive labels in a single pass. Flexo presses allow easy customization for different label designs, sizes, and applications, making them suitable for diverse industries, from food and beverages to pharmaceuticals.

The permanent segment dominated the self-adhesive labels market globally. Permanent labels are widely utilized in the market due to their ability to provide reliable, long-lasting identification and branding across various industries. Permanent labels have adhesives designed to bond securely to an extensive range of surfaces, ensuring they remain in place throughout the product's lifecycle. These labels are resistant to environmental factors such as moisture, heat, chemicals, and abrasion, making them suitable for harsh conditions and long-term applications.

Permanent labels often leave residue or damage the surface when removed, providing tamper-evident functionality. This feature is essential for products requiring security, such as pharmaceuticals and electronics. Many industries, like beverages, food, and healthcare, mandate permanent labeling to ensure important information such as expiration dates, ingredients, or safety instructions is always visible. Permanent labels are used across various sectors, including consumer goods, logistics, industrial equipment, and retail, for purposes such as product identification, barcoding, and instructional labeling.

The food & beverage segment registered its dominance over the global self-adhesive labels market in 2023. The food and beverage industry constantly introduces new products, flavors, and variants. Each product requires unique labels for branding, ingredient listing, and compliance, driving demand for self-adhesive labels. Regulations regarding labeling in the food and beverage sector (e.g., nutritional information, allergens, expiration dates) necessitate high-quality, durable, and legible labels. Self-adhesive labels meet these requirements efficiently. As consumer preferences shift toward ready-to-eat, frozen, and packaged foods, the demand for flexible and reliable labeling solutions grows.

Self-adhesive labels offer versatility and durability suitable for various packaging types. Online sales of food and beverages require labels that can endure shipping, handling, and varying environmental conditions. Self-adhesive labels provide durability and tamper-evident options. As the food and beverage industry expands and evolves, the demand for efficient, versatile, and visually appealing labeling solutions continues to grow, making self-adhesive labels an essential component in this sector.

The pharmaceutical segment is expected to grow at the fastest rate in the self-adhesive labels market during the forecast period of 2024 to 2034. Pharmaceutical products require detailed labeling, including dosage instructions, manufacturing dates, expiration dates, batch numbers, and barcodes, to comply with strict regulations. Self-adhesive labels provide the precision and reliability needed to meet these requirements. The global rise in demand for medicines, driven by population growth, aging demographics, and increased healthcare awareness, leads to higher production volumes, boosting the need for reliable and efficient labeling solutions. Self-adhesive labels can incorporate security features like tamper-evident seals, holograms, and serialized barcodes, helping combat counterfeit medicines and ensuring product authenticity.

Pharmaceuticals are packaged in various forms, such as vials, blister packs, bottles, and boxes. Self-adhesive labels can adhere to different materials and surfaces, making them ideal for diverse packaging requirements. With the rise of personalized medicine and small-batch production, pharmaceutical companies need flexible and customizable labeling solutions, which self-adhesive labels can efficiently provide.

North America region held a significant share of the self-adhesive labels market in 2024. Regulatory bodies like the Food and Drug Administration (FDA) and the United States Department of Agriculture (USDA) require detailed and accurate product information on labels, including nutritional facts, ingredients, allergen warnings, and manufacturing details. Self-adhesive labels are ideal for providing the required clarity and precision. In pharmaceuticals, regulations mandate labels to include critical details such as dosage, batch numbers, expiration dates, and tamper-evident features.

Self-adhesive labels meet these needs with high durability and security options, supporting the sector's compliance efforts. Labeling requirements under acts like the Food Safety Modernization Act (FSMA) demand traceability and clear consumer information. Self-adhesive labels, with the ability to incorporate QR codes, barcodes, and RFID tags, help companies comply with these regulations. Regulations often require multilingual labeling to cater to North America's diverse population. Self-adhesive labels can accommodate additional information without compromising design or functionality.

Asia Pacific region is anticipated to grow at the fastest rate in the self-adhesive labels market during the forecast period. The Asia Pacific region, especially countries like China, India, and Japan, has experienced rapid economic growth and industrialization. This growth has led to an increase in consumer goods, packaging, and labeling needs, fueling demand for self-adhesive labels. The rising middle class, urbanization, and shifting consumer preferences in Asia have driven the demand for packaged goods, which require high-quality labeling. Self-adhesive labels are widely used in sectors like food and beverages, personal care, and pharmaceuticals.

The Asia Pacific region offers cost advantages in manufacturing, particularly in countries like China and India, where labor and production costs are relatively lower. This makes it an attractive region for self-adhesive label production, allowing companies to maintain competitive pricing. Countries like Japan and South Korea are leaders in technological innovation, including advancements in printing technology, materials, and adhesives. These innovations have improved the quality, durability, and customization options of self-adhesive labels, increasing their appeal in the region.

By Composition

By Type

By Technology

By Nature

By Application

By Region

January 2026

January 2026

January 2026

January 2026