Track and Trace Packaging Market Technology & Application Segments, Value Chain & Trade Analysis

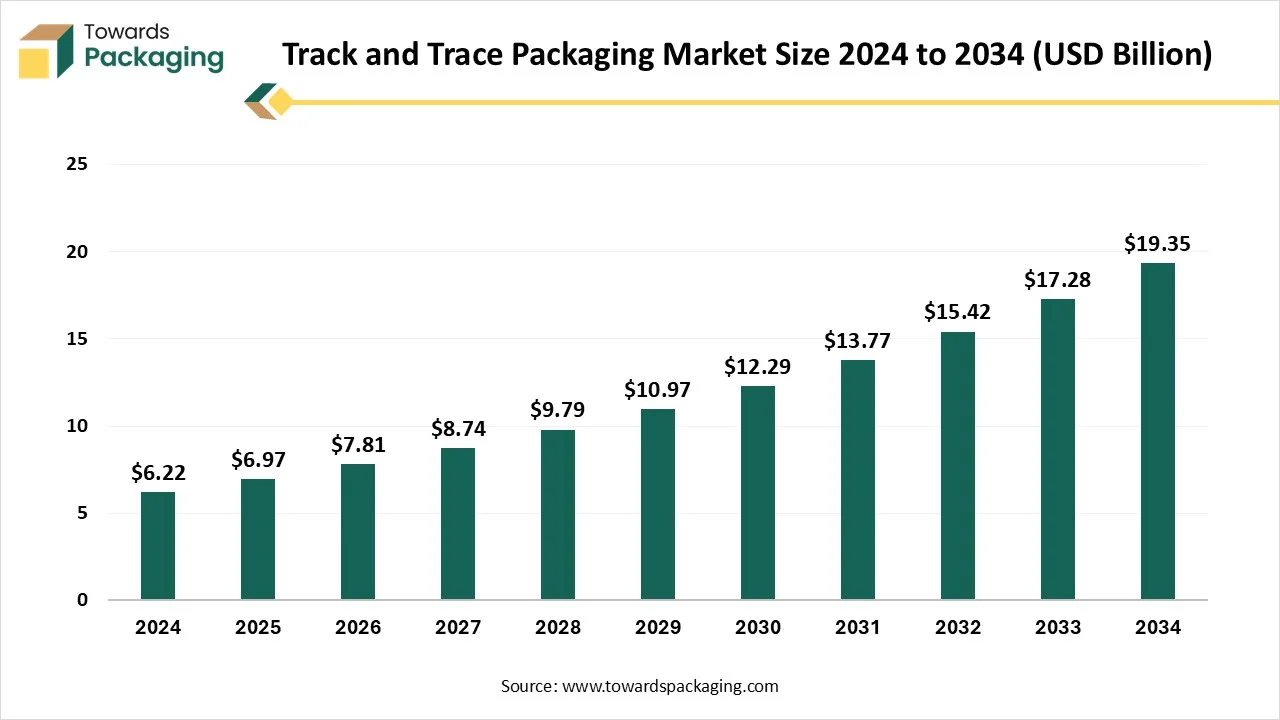

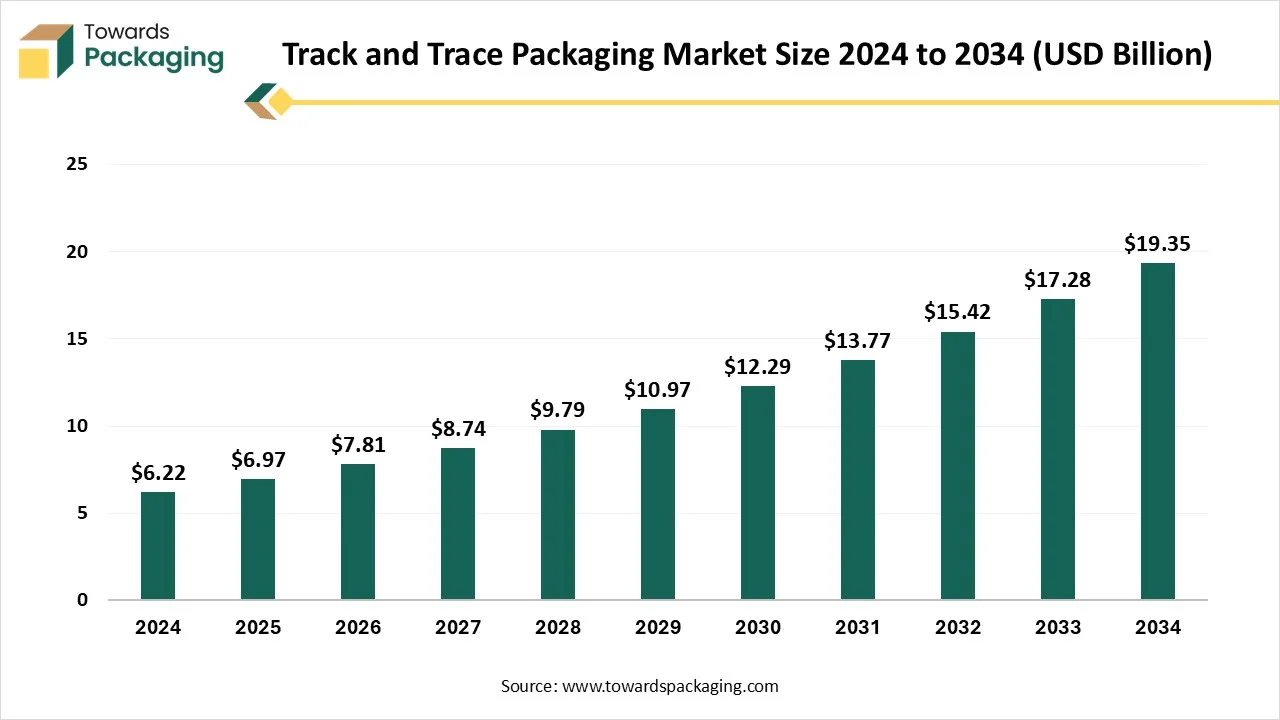

The track and trace packaging market is analyzed in detail in this report, covering global market size, historical performance, and forecasts from USD 6.97 billion in 2025 to USD 19.35 billion by 2034 at a CAGR of 12.02%. It provides quantified data on technology segments (barcode, RFID, NFC, QR, blockchain, IoT/smart sensors), product types (labels & tags, cartons & boxes with IDs, RFID-embedded packaging, tamper-evident and serialization-enabled solutions), and packaging levels (primary, secondary, tertiary), along with application-wise statistics for pharmaceuticals & healthcare, food & beverages, logistics, consumer goods, electronics, automotive, and retail/e-commerce.

The study delivers full regional and country-level numbers for North America, Europe, Asia Pacific, Latin America, and MEA, supported by company market shares, competitive benchmarking, value chain and margin analysis, trade flow and export–import data, plus quantitative profiles of key manufacturers and suppliers across the global supply network.

Key Insights

- In terms of revenue, the market is valued at USD 6.97 billion in 2025.

- The market is projected to reach USD 19.35 billion by 2034.

- Rapid growth at a CAGR of 12.02% will be observed in the period between 2025 and 2034.

- North America dominated the global track and trace packaging market in 2024.

- Asia Pacific is expected to grow at a significant CAGR in the market during the forecast period.

- The European market is expected to grow at a notable CAGR in the foreseeable future.

- By technology, the barcode (1D & 2D) segment dominated the market with the largest share in 2024.

- By technology, the blockchain-based traceability segment is expected to grow at the fastest CAGR during the forecast period of 2024 to 2034.

- By product type, the labels & tags segment dominated the market in 2024.

- By product type, the RFID-embedded packaging segment is expected to grow at the fastest CAGR in the forecast period.

- By packaging level, the secondary packaging segment dominated the market in 2024.

- By packaging level, the primary packaging segment is expected to grow at the fastest CAGR in the forecast period.

- By application, the pharmaceuticals & healthcare segment dominated the market with the largest share in 2024.

- By application, the e-commerce / retail segment is expected to grow at the fastest CAGR during the forecast period of 2024 to 2034.

Market Overview

Track and trace packaging refers to a system that enables the monitoring and recording of a product’s journey throughout the supply chain using unique identifiers such as barcodes, QR codes, RFID tags, or serialization numbers. This type of packaging helps manufacturers, distributors, and retailers track the movement of goods from production to end-user, ensuring transparency, authenticity, and real-time visibility. It is widely used in industries like pharmaceuticals, food and beverage, electronics, and luxury goods to prevent counterfeiting, reduce theft, streamline recalls, and improve inventory management.

With increasing concerns over product safety and regulatory compliance, track and trace solutions have become essential tools for quality control and supply chain integrity. Advanced technologies such as blockchain and IoT further enhance the capabilities of track and trace packaging by enabling secure data sharing and remote monitoring. Ultimately, it strengthens consumer trust by ensuring that products are genuine, safely handled, and delivered through verified distribution channels.

What are the Latest Trends in the Track and Trace Packaging Market?

Sustainability & Regulation Driving Innovation

- Governments are expanding Extended Producer Responsibility (EPR) schemes (e.g., the upcoming UK rollout) that hold companies accountable for packaging waste, incentivizing recyclable and compostable materials. There’s growing regulatory scrutiny on bioplastics: not all are truly compostable or non-toxic, prompting calls for tighter standards and verification of eco‑credentials.

Biodegradable, Compostable, and Agro‑waste Materials

- Bioplastics derived from seaweed, sugarcane, orange peel, mushroom mycelium, barley, and corn are on the rise as eco‑friendly alternatives. In India, the KMF Nandini milk packets using biodegradable plant‑based materials are being rolled out in Bengaluru, capable of decomposing in 90 days and converting into organic fertilizer.

Reusable and Returnable Packaging Systems

- Refillable and returnable packaging models (e.g., returnable glass bottles, kegs, or canvas wraps) are gaining traction globally, especially in food, beverage, and retail sectors. Closed‑loop reuse systems, for example, disinfecting and reusing bl packaging, are reducing material usage and operational costs.

Smart Packaging & Data‑driven Waste Management

- Trash and packaging markets are integrating smart sensors, QR codes/NFC, RFID, and IoT to track materials, optimize collection, enable interactive labeling, and enhance consumer guidance. Waste‑management operators are using AI and analytics for route optimization, fill‑level sensing, predictive maintenance, and improved recycling throughput.

Circular Economy & Local Decentralized Systems

- Local recycling hubs, community composting, mobile collection units, and waste‑to‑energy projects enable decentralized and lower‑emission waste processing. Companies like UBQ Materials in India are converting unsorted household waste into thermoplastic composites, a form of circular polymer reuse.

Consumer Pressure & Minimalist Packaging Design

- Studies show a significant proportion of shoppers decline to buy products with excessive/non-eco packaging, 37 % in North America and 42 % in Europe. Brands are responding with minimal, right-sized packaging, using water‑based inks, transparent eco-labeling, and clear recycling instructions.

How Can AI Improve the Track and Trace Packaging Industry?

AI integration significantly enhances the track and trace packaging industry by enabling smarter, faster, and more accurate monitoring of products across the supply chain. Through advanced algorithms and machine learning, AI can analyze vast amounts of data from barcodes, RFID tags, sensors, and GPS in real time to detect anomalies, optimize inventory flow, and predict disruptions before they occur. It enables automated quality control by identifying damaged or counterfeit products through image recognition and data validation.

AI-powered predictive analytics help forecast demand, prevent overstocking or shortages, and streamline logistics by optimizing transportation routes. Furthermore, AI enhances transparency and compliance by maintaining secure and tamper-proof records using blockchain integration. It also improves customer experience by providing real-time updates on product location and condition. Overall, AI transforms traditional track and trace systems into intelligent networks, reducing errors, enhancing efficiency, lowering operational costs, and building trust between brands, distributors, and consumers.

Market Dynamics

Drivers

Rising Counterfeiting Concerns

The global rise in counterfeit goods, particularly in pharmaceuticals, electronics, and luxury products, has led manufacturers to adopt track and trace systems. These solutions ensure product authenticity, reduce economic losses, and protect consumer health and brand reputation.

Stringent Government Regulations and Compliance Mandates

Regulatory frameworks such as the U.S. DSCSA, EU Falsified Medicines Directive (FMD), and various international food safety laws require serialization and traceability for better product control. These mandates compel industries to invest in robust packaging technologies.

Increasing demand for Supply Chain Visibility and Real-Time Tracking

Companies need complete visibility over their logistics operations to reduce theft, spoilage, and delays. Track and trace systems using RFID, GPS, and IoT enable real-time monitoring and proactive response to disruptions.

Restraint

Lack of Standardization & Complex Integration with Existing Systems

The key players operating in the market are facing issues due to complex integration with existing systems and a lack of standardization, which has restricted the growth of the market. Global inconsistency in serialization formats, data protocols, and regulatory requirements makes it difficult for companies to implement unified track and trace systems. The absence of harmonized standards complicates cross-border trade and creates challenges in interoperability across different regions and supply chains. Many companies rely on legacy systems for operations. Integrating new track and trace technologies with these older systems can be time-consuming and technically challenging.

Opportunity

Growth in E-commerce and Direct-to-Consumer Models

With the global rise of e-commerce, brands need to track shipments more accurately and ensure safe delivery to consumers. Track and trace packaging solutions can provide real-time updates, reduce returns, and improve customer satisfaction in this fast-growing channel.

Segmental Insights

Why does the Barcode Segment Dominate the Track and Trace Packaging Market?

Barcode technology is the dominant technology segment in the track and trace packaging market due to its simplicity, cost-effectiveness, and widespread compatibility across industries. Barcodes are easy to implement and require minimal infrastructure, making them ideal for both large-scale manufacturers and small businesses. They offer reliable product identification, inventory management, and real-time tracking, especially in sectors like retail, pharmaceuticals, and logistics. Additionally, barcode systems are supported globally, ensuring seamless integration across supply chains. Their proven accuracy, low error rates, and ease of scanning make them a preferred choice for traceability, especially in environments that do not require high-tech or complex solutions.

Blockchain-based Traceability Segment to Grow at Fastest Rate in 2024

Blockchain-based traceability is the fastest-growing technology segment in the track-and-trace packaging market due to its ability to provide secure, transparent, and tamper-proof tracking across complex supply chains. Unlike traditional systems, blockchain creates a decentralized ledger that records every transaction and movement of a product from source to end-user, ensuring data integrity and preventing counterfeiting. This is particularly valuable in sectors like pharmaceuticals, food, and luxury goods where product authenticity and regulatory compliance are critical. Blockchain also enables smart contracts, automating verification processes and reducing administrative costs.

As consumer demand for transparency and ethically sourced products rises, blockchain-based packaging allows users to instantly verify product origin and journey through QR codes or NFC tags. The growing adoption of digital technologies, increasing regulatory mandates, and collaborations among global tech leaders are further accelerating the implementation of blockchain in packaging, making it a key driver of innovation and trust in the track-and-trace ecosystem.

Which Product Type Dominated the Track and Trace Packaging Market in 2024?

The labels and tags segment is the dominant product type in the track and trace packaging market due to its versatility, ease of application, and cost-effectiveness. These components are essential for encoding data such as barcodes, QR codes, and RFID, enabling accurate tracking and real-time monitoring across supply chains. Labels and tags are widely used across various industries, including pharmaceuticals, food and beverages, electronics, and logistics, because they can be easily integrated into existing packaging systems without major modifications. Their ability to provide clear identification, ensure compliance with regulatory standards, and support both manual and automated scanning processes further strengthens their market leadership.

RFID-embedded packaging Segment to grow at the Fastest Rate in 2024

RFID‑embedded packaging is the fastest‑growing segment in the track‑and‑trace packaging market due to several compelling advantages. First, RFID tags allow real-time, automated tracking of multiple items concurrently without direct line of sight, boosting operational efficiency in complex and high-volume supply chains. Second, as RFID technology becomes more affordable, its cost‑effectiveness is improving, enabling broader adoption across industries.

RFID supports enhanced product visibility and authentication, helping companies fight counterfeiting and meet regulatory requirements in sensitive sectors like pharmaceuticals, food, and luxury goods. Fourth, demand for smart, interactive consumer packaging experiences using technologies like NFC and IoT is propelling the adoption of RFID‑enabled packaging that also enables traceability and engagement.

Which Product Type Dominated the Track and Trace Packaging Market in 2024?

The secondary packaging level is the dominant segment in the track-and-trace packaging market because it serves as the critical point for aggregation, labeling, and data capture across supply chains. Secondary packaging, such as cartons, boxes, or bundles, allows for easier application of barcodes, RFID tags, or QR codes without affecting the primary product. It facilitates batch-level tracking, making it highly efficient for inventory management, logistics, and compliance with serialization regulations, especially in industries like pharmaceuticals and food. This packaging level provides a balance between visibility and cost-effectiveness, enabling secure, traceable movement of products through distribution centers to retailers or end consumers.

Primary Packaging Segment to Grow at Fastest Rate in 2024

Primary packaging is the fastest‑growing packaging-level segment in the track‑and‑trace packaging market because it forms a direct interface with the product and delivers both logistical and consumer-facing benefits. Smart features such as integrated QR/NFC codes, RFID tags, freshness sensors, and temperature indicators are increasingly embedded at this level, enabling real‑time monitoring of product condition, provenance, and authenticity. This is particularly critical in sectors like food, pharmaceuticals, and personal care, where safety, traceability, and shelf‑life matters are paramount.

Enhanced consumer engagement is also driving adoption: primary packaging provides instant access to usage instructions, promotional content, or quality data through interactive codes. Improvements in miniaturization, cost reduction of sensors, and eco‑friendly materials further enable scalable deployment at the primary level, supporting its rapid market uptake.

Which Application Dominated the Track and Trace Packaging Market in 2024?

The pharmaceutical and healthcare segment is the dominant application in the track and trace packaging market due to stringent regulatory requirements and the critical need for product safety and authenticity. Governments worldwide, through laws like the U.S. DSCSA and EU FMD, mandate serialization and traceability to prevent counterfeiting and ensure drug integrity. Additionally, the sector deals with sensitive products that require accurate tracking across the supply chain. High-value medications, temperature-sensitive vaccines, and rising patient safety concerns further drive demand for advanced traceable packaging solutions.

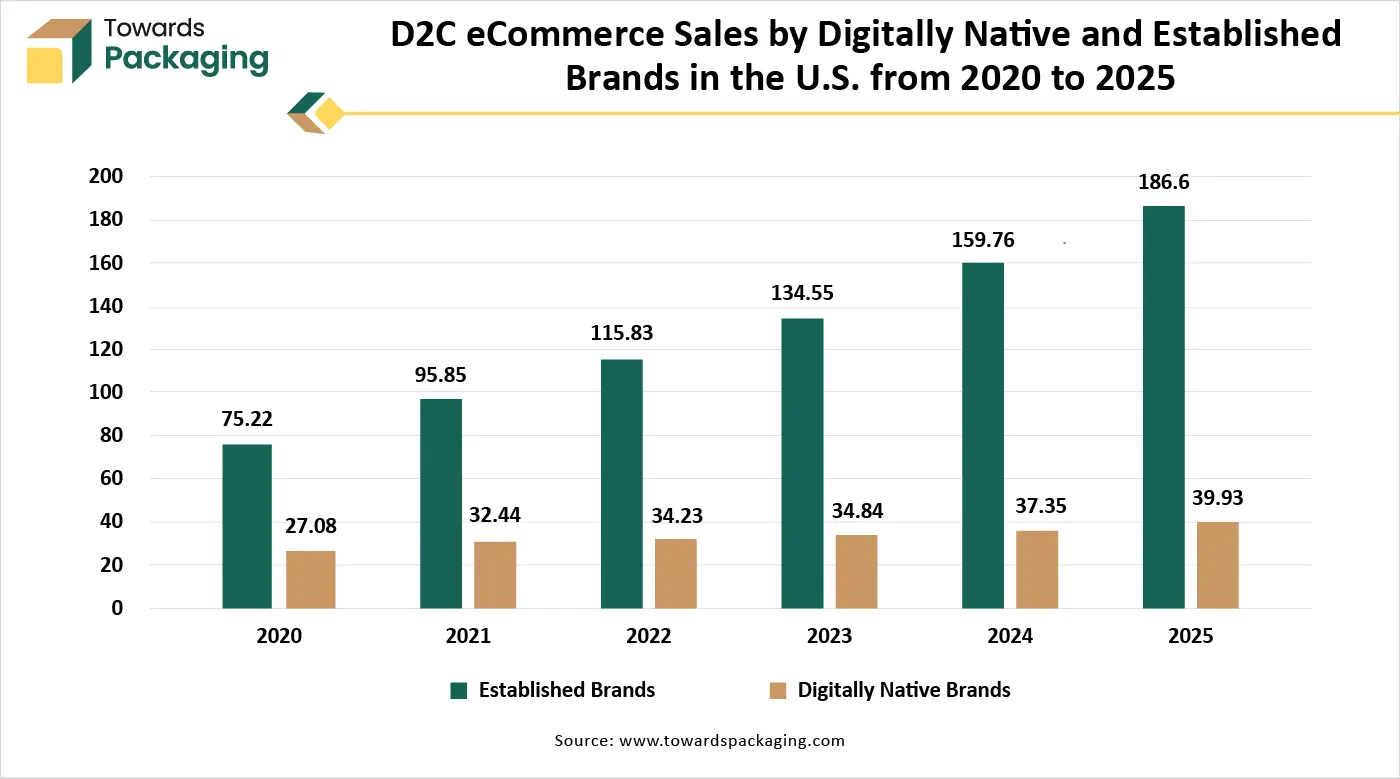

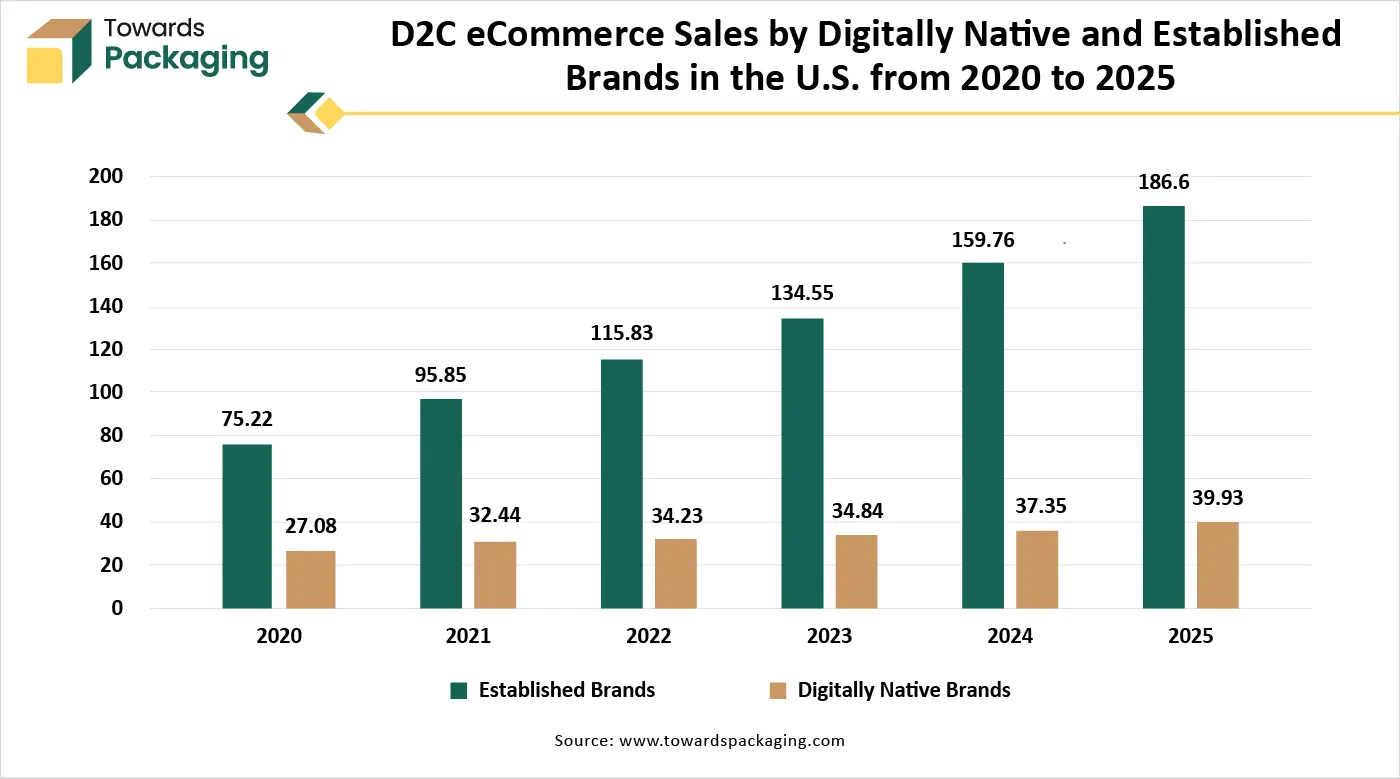

E-Commerce and Retail Application Segment to Grow at Fastest Rate in 2024

The e-commerce and retail application segment is the fastest‑growing in the track‑and‑trace packaging market due to the massive surge in online shopping and heightened demand for transparency and efficiency. With consumers expecting real‑time delivery updates, accurate order tracking, and seamless returns, businesses are turning to smart packaging technologies such as QR codes, NFC, RFID, and IoT to meet these demands and enhance customer engagement. Connected packaging not only improves inventory control and fraud prevention but also reduces errors during fulfillment. Furthermore, the rise of direct‑to‑consumer and DTC models compels brands to invest in unique unit-level serialization and real‑time shipment visibility.

Regional Insights

Which Region Dominated the Track and Trace Packaging Market in 2024?

North America holds a dominant position in the track and trace packaging market due to a combination of advanced technological infrastructure, stringent regulatory frameworks, and high adoption rates across key industries. The region is home to well-established pharmaceutical, food, and logistics sectors that are heavily regulated by bodies like the FDA and USDA, which mandate serialization and traceability for safety and compliance.

Strong investment in automation, AI, IoT, and blockchain technologies enhances the performance of track and trace systems. The presence of leading market players and solution providers in the U.S. and Canada further drives innovation and availability of advanced packaging solutions. Moreover, rising consumer demand for transparency, authenticity, and real-time tracking, especially in e-commerce and healthcare, supports continuous market expansion.

U.S. Market Trends

The U.S. is the largest contributor to the North American track and trace packaging market. Its dominance is driven by stringent regulations such as the Drug Supply Chain Security Act (DSCSA), which mandates serialization and traceability in the pharmaceutical sector. The U.S. also has a strong technological ecosystem, with widespread adoption of RFID, IoT, blockchain, and AI to enhance supply chain transparency. Major players in pharmaceuticals, food, electronics, and logistics operate from the U.S., further strengthening the demand for sophisticated track and trace solutions. Moreover, a growing e-commerce industry has increased the need for real-time package tracking and consumer engagement.

Canada Market Trends

Canada also plays a significant role in the region’s growth, supported by government initiatives to enhance food safety and pharmaceutical security. Canadian industries are increasingly adopting smart packaging technologies for quality assurance and compliance with international standards. The country's proactive stance on sustainability and digital transformation encourages businesses to implement advanced track and trace systems. While smaller in scale compared to the U.S., Canada’s stable regulatory environment and expanding healthcare and logistics sectors support steady market growth.

What Promotes the Growth of the Asia Pacific Track and Trace Packaging Market?

The Asia-Pacific region is witnessing the fastest growth in the track and trace (TREC and TRES) packaging market due to several key factors. Rapid industrialization, urbanization, and economic development across countries like China, India, Japan, and South Korea have significantly increased demand for efficient and secure supply chains. Governments in the region are implementing stricter regulations on pharmaceutical and food safety, pushing companies to adopt track and trace solutions for compliance and consumer protection.

The expansion of the e-commerce sector, especially in densely populated countries, has created a strong need for real-time tracking and smart packaging. The growing middle-class population is also demanding greater transparency and product authenticity, particularly in healthcare, cosmetics, and premium goods. Moreover, Asia-Pacific's strong manufacturing base and increasing investment in digital infrastructure, IoT, and automation technologies are accelerating the integration of traceable packaging solutions across industries. Cost-effective production capabilities further support widespread adoption, fueling rapid market growth.

China Market Trends

China is a major contributor to the Asia-Pacific market due to its massive manufacturing and export sectors. The government has enforced strict regulations, particularly in pharmaceuticals and food safety, encouraging companies to implement traceability systems. Additionally, the growth of e-commerce giants like Alibaba and JD.com fuels demand for real-time tracking and secure delivery systems. China's strong technological infrastructure, advancements in AI, IoT, and blockchain, along with heavy investment in smart logistics, further accelerate the adoption of track and trace packaging.

India Market Trends

India is experiencing rapid growth in the track and trace packaging market, driven by government mandates such as barcoding requirements for pharmaceutical exports and the push for food safety under FSSAI guidelines. The booming e-commerce and FMCG industries are adopting smart packaging solutions to meet consumer demand for transparency and timely delivery. With initiatives like “Digital India” and increasing investment in automation and smart logistics, India is emerging as a fast-growing market for traceable packaging.

Japan Market Trends

Japan’s growth is fuelled by its technologically advanced infrastructure and strong presence in the pharmaceutical, automotive, and electronics sectors. The country has long prioritized quality control and operational efficiency, making it a key adopter of smart track and trace technologies. With a highly regulated healthcare system and consumer expectations for precision and transparency, Japanese companies are increasingly integrating RFID, QR codes, and IoT-based packaging solutions.

South Korea Market Trends

South Korea is another fast-growing market, supported by a highly digitalized economy and advanced manufacturing capabilities. The government’s support for innovation and its strict policies on product safety and anti-counterfeiting, particularly in cosmetics and pharmaceuticals, are boosting demand for traceable packaging. Leading tech firms and startups are also contributing by developing AI and IoT-enabled traceability systems tailored for domestic and international use.

Europe’s Growing Sustainable Initiatives to Promote Notable Growth

Europe is experiencing notable growth in the track and trace packaging market due to strong regulatory enforcement, technological advancement, and high consumer awareness. The European Union’s Falsified Medicines Directive (FMD) and other stringent product safety laws require pharmaceutical, food, and cosmetics industries to implement serialization and traceability systems.

Europe's emphasis on sustainability and circular economy goals also drives demand for intelligent packaging that monitors product movement and waste reduction. Additionally, Europe’s advanced infrastructure, high digital literacy, and widespread adoption of technologies like RFID, blockchain, and IoT support the efficient rollout of traceable packaging. Rising concerns over counterfeit goods and growing e-commerce further fuel the adoption of smart, secure packaging solutions across various European countries.

Top Track and Trace Packaging Market Players

Latest Announcements by Industry Leaders

- In April 2025, Denise Mathieson, head of packaging design & delivery at Waitrose, stated that the company can make better decisions that promote a circular economy by using Polytag's technology to obtain previously unheard-of insights into how their packaging is recycled. This program supports a commitment to cutting down on single-use plastic waste and is consistent with the company’s ongoing sustainability initiatives. In order to bring about significant change at the industry level and eventually help the UK's recycling system become more open and efficient.(Source: AIPIA)

New Advancements in the Market

- In April 2025, Waitrose plans to monitor the amount of single-use plastic packaging that ends up in landfills by tracking it from its stores to recycling facilities. Packaging will be tagged with "invisible UV tags" in collaboration with AIPIA member Polytag. These tags will be read and recognized when the package is placed on a conveyor belt at one of the 12 Materials Recovery Facilities (MRFs) in the United Kingdom. (Source: AIPIA)

- In June 2025, at the AlPIA & AWA Smart Packaging World Congress 2025 in Amsterdam, June 23–24, 2025, Identiv, Inc., a leader in RFID and BLE-enabled Internet of Things (IoT) solutions, will showcase its most recent smart packaging solutions for supply chain intelligence and Digital Product Passports (DPPs). Brands are empowered to track product origin, support sustainability and regulatory compliance goals, and interact directly with consumers thanks to these NFC and BLE-enabled packaging solutions.

- In May 2025, Trackonomy, a leader in enterprise logistics innovation, announced the public launch of LastMile solutions, a revolutionary technology for logistics executives struggling with issues like missed deliveries, expensive manual scanning, blind handoffs to third-party contractors, blind handoffs, and lack of visibility, all of which impede efficient customer service. (Source: PR Newswire)

Track and Trace Packaging Market Segments

By Technology

- Barcode (1D & 2D)

- RFID (Radio Frequency Identification)

- NFC (Near Field Communication)

- QR Code Systems

- Blockchain-based Traceability

- IoT & Smart Sensors

By Product Type

- Labels & Tags

- Cartons & Boxes with Integrated IDs

- RFID-Embedded Packaging

- Tamper-Evident Seals

- Serialization-Enabled Packaging

By Packaging Level

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

By Application / End-Use Industry

- Pharmaceuticals & Healthcare

- Food & Beverages

- Logistics & Transportation

- Consumer Goods

- Electronics

- Automotive

- Retail / E-Commerce

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait