IoT-Enabled Packaging Market Share, Growth Forecast, Segmentation, Regional Outlook, Manufacturers & Suppliers Data, and Competitive Landscape

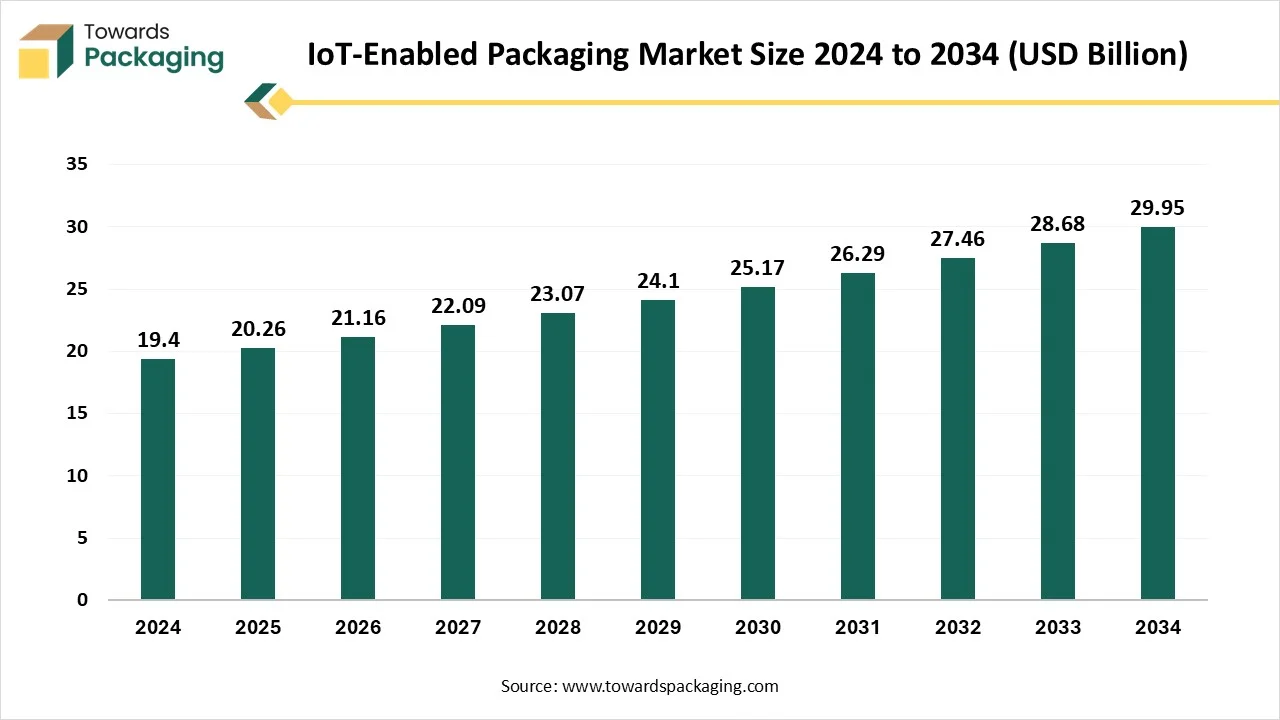

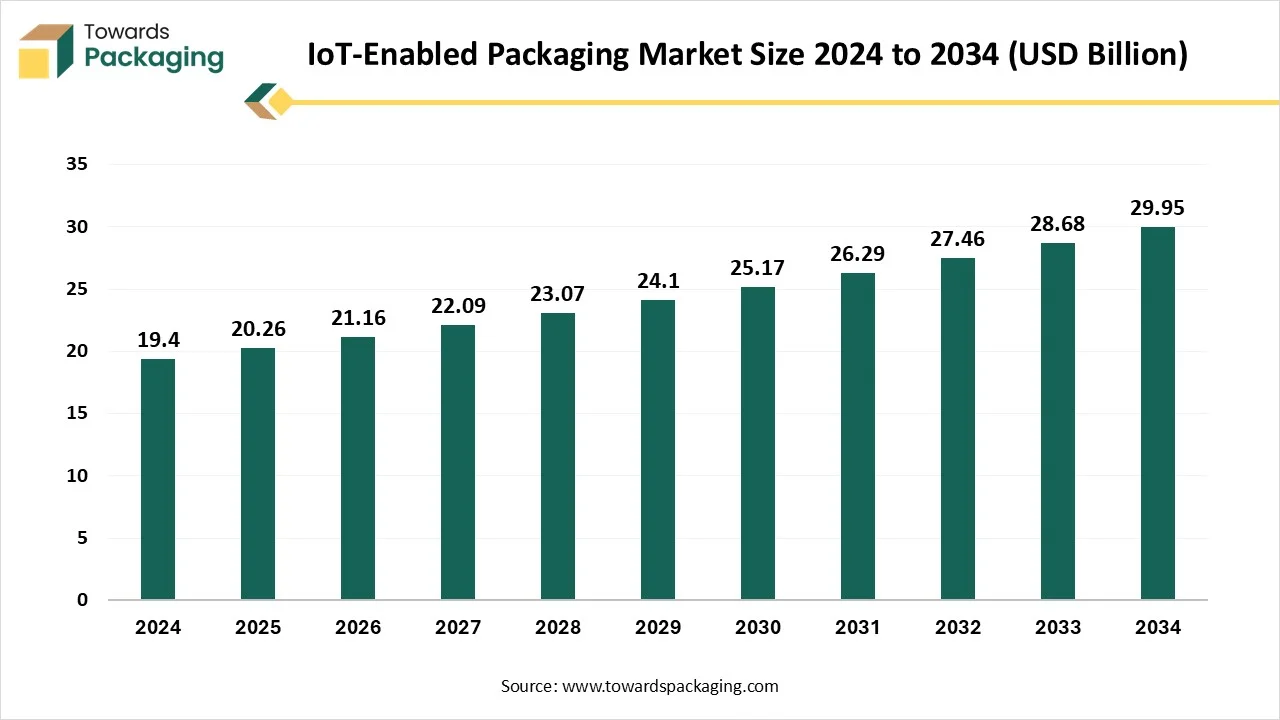

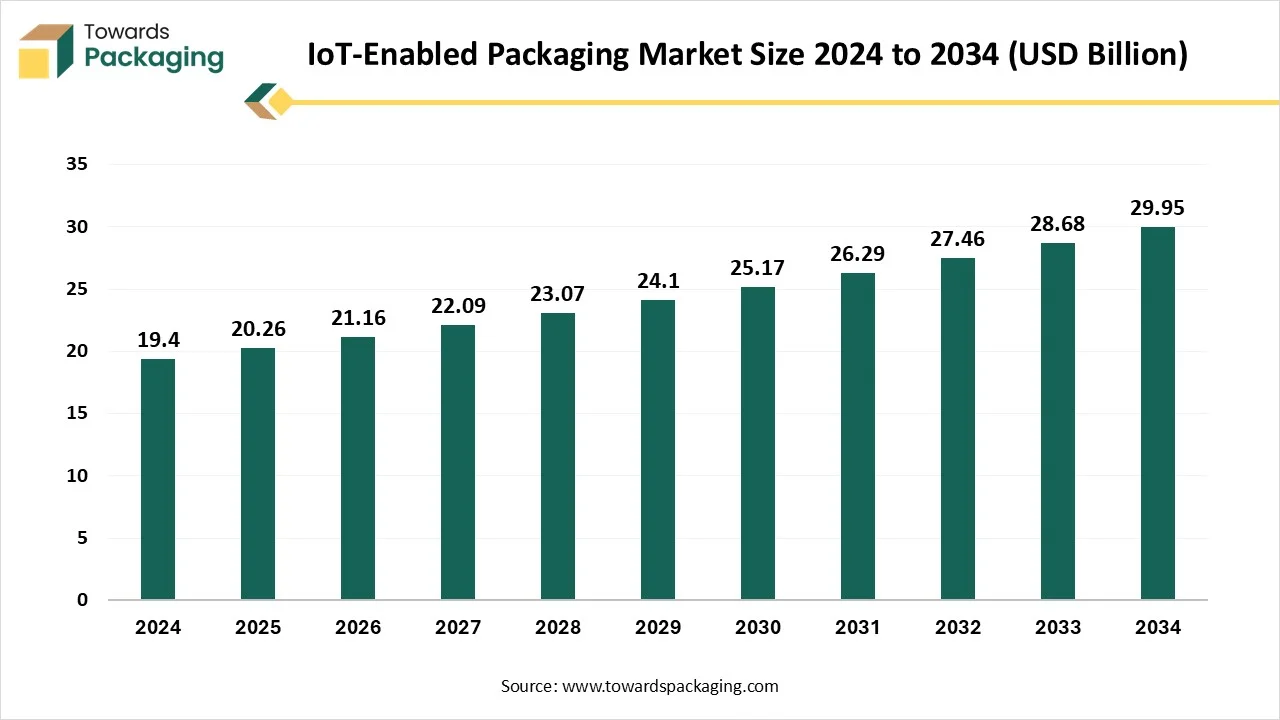

The IoT-enabled packaging market is forecasted to expand from USD 21.16 billion in 2026 to USD 31.29 billion by 2035, growing at a CAGR of 4.44% from 2026 to 2035. The report includes full segmentation by components, technologies, functionalities, packaging types, and end-use industries, supported with statistical charts.

It delivers in-depth regional data for North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, along with competitive analysis of major companies, supply chain and value chain structure, import–export statistics, manufacturing landscape, and supplier ecosystem intelligence.

Key Insights

- In terms of revenue, the market is valued at USD 20.26 billion in 2025.

- The market is projected to reach USD 31.29 billion by 2035.

- Rapid growth at a CAGR of 4.44% will be observed in the period between 2025 and 2034.

- Asia Pacific dominated the global IoT-enabled packaging market in 2025.

- North America is expected to grow at a significant CAGR during the forecast period.

- The European market is expected to grow at a notable CAGR in the foreseeable future.

- By component, the hardware segment dominated the market with the largest revenue share of 63.2% in 2024.

- By component, the software segment is expected to grow at the fastest CAGR during the forecast period of 2025 to 2034.

- By technology, the radio-frequency identification (RFID) segment dominated the market in 2024.

- By technology, the smart sensors segment is expected to grow at the fastest CAGR in the forecast period.

- By functionality, the track and trace segment held a revenue share of 41.7% in 2024.

- By functionality, the condition monitoring segment is expected to grow at the fastest CAGR during the forecast period of 2025 to 2034.

- By packaging type, the secondary packaging segment dominated the market in 2024.

- By packaging type, the primary packaging segment is expected to grow at the fastest CAGR in the forecast period.

- By end-use industry, the food and beverages segment dominated the market in 2024.

- By end-use industry, the pharmaceuticals and healthcare segment is expected to grow at the fastest CAGR during the forecast period of 2025 to 2034.

- By deployment mode, the cloud-based segment dominated the market in 2024.

- By deployment mode, the hybrid segment is expected to grow at the fastest CAGR in the forecast period.

Market Overview

Internet of Things (IoT)-enabled packaging refers to the integration of smart technologies such as sensors, RFID tags, QR codes, NFC, and cloud connectivity into packaging systems to collect, transmit, and analyze data in real time. This intelligent packaging goes beyond traditional functions by enabling monitoring, tracking, and interaction throughout the product's lifecycle. In industries like food, pharmaceuticals, and logistics, IoT-enabled packaging ensures real-time condition monitoring, helping maintain product quality and regulatory compliance. It enhances supply chain transparency, minimizes waste, and improves operational efficiency by enabling predictive maintenance and automated inventory tracking.

For consumers, IoT offers interactive features such as product authentication, traceability, and usage instructions through smart labels. Businesses benefit from data-driven insights that support demand forecasting and reduce losses. As connectivity technologies advance and costs decrease, IoT-enabled packaging is becoming a key innovation in smart logistics, sustainable practices, and enhanced customer engagement across various sectors.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 20.26 Billion |

| Projected Market Size in 2035 |

USD 31.29 Billion |

| CAGR (2026 - 2035) |

4.44% |

| Leading Region |

Asia Pacific |

| Market Segmentation |

By Component, By Technology, By Functionality , By Packaging Type, By End-Use Industry and By Region |

| Top Key Players |

Avery Dennison Corporation, Smartrac Technology GmbH, Identiv, Inc., Thin Film Electronics ASA, Zebra Technologies Corporation, Impinj Inc., Toppan Inc. |

What Are the Newest Trends Shaping the IoT-Enabled Packaging Market?

Battery-free and Thin-film Smart Packaging

- Cutting-edge battery-less, stretchable packaging integrates NFC antennas and sensors to monitor freshness and even release active compounds like antimicrobials when needed, extending shelf life and reducing waste.

QR/NFC and AR-enhanced Consumer Engagement

- QR codes, NFC tags, and augmented reality are being embedded in packaging to offer consumers detailed product data, interactive experiences, and brand storytelling.

Blockchain for Transparency and Anti-Counterfeiting

- Blockchain is being used to create immutable supply chain records, ensuring product authenticity and traceability, especially for food and pharma.

AI + Edge Analytics Integration

- Edge computing paired with AI enables real-time anomaly detection like temperature alarms while the cloud manages long-term analytics, boosting efficiency and responsiveness.

Printed Electronics and Recyclable Soft Sensors

- Innovations in printable electronics yield recyclable, flexible circuits and sensors for both product condition monitoring and environmental sustainability.

Ambient IoT and Ultra‑Thin Labels

- Ambient IoT technologies harvest energy from radio, light, or motion to power ultra-thin, battery-free shipping labels that track location and condition.

Touchless and Smart Cold Chain Management

- Non-contact temperature monitoring, especially in food and pharmaceuticals, ensures compliance and quality while minimizing contamination risks.

How Can AI Improve the IoT-Enabled Packaging Market?

AI integration significantly enhances the market by transforming sensor data into intelligent, actionable insights. It enables predictive analytics to optimize supply chains, forecast demand, and reduce inventory costs. AI also facilitates real-time monitoring by analyzing data from sensors to detect anomalies like temperature fluctuations, tampering, or shocks, triggering instant alerts to protect sensitive products. In manufacturing, it improves quality control by identifying packaging defects and ensuring regulatory compliance. AI enhances consumer engagement by analyzing interactions through QR codes or NFC tags, enabling personalized promotions and product information. Additionally, it supports sustainability by optimizing material use and reducing waste based on real-time usage and shelf-life data. AI also automates packaging processes by adjusting conditions in real time, improving operational efficiency and reducing the need for manual intervention. Overall, AI brings intelligence and automation to IoT-enabled packaging, making it smarter, more secure, and responsive across various industries.

Market Dynamics

Driver

Strict Regulatory Compliance

Regulations around food safety (e.g., HACCP), pharmaceutical traceability (e.g., FDA DSCSA, EU FMD), and anti-counterfeiting are pushing companies to adopt smart packaging that can meet traceability and monitoring requirements. For instance, the Food Safety and Standards Authority of India (FSSAI) formally published the updated Food Safety and Standards (Packaging) Regulations, 2025, stating that specific types of recycled plastics that adhere to stringent safety requirements may be used in food packaging. With the implementation of the new rules on March 28, 2025, India took a major step in striking a balance between food safety and environmental preservation and offering legislative support for the food sector’s shift to a circular economy.

- In February 2025, the Packaging Waste Regulation goes into effect by taking new steps to address the environmental issues brought on by excessive packaging. In the packaging business, it will drastically reduce greenhouse gas emissions, water consumption, and environmental expenses. Simultaneously, the regulation will generate prospects for the recycling and sustainability sectors. It is a significant milestone in the EU’s transition to a more sustainable, competitive, and circular economy.

Restraint

Complex Integration with Existing Systems and Lack of Standardization

The key players operating in the market are facing restrictions due to a lack of standardization and complex integration with existing systems. Integrating IoT components with legacy packaging lines and supply chain systems can be technically challenging and time-consuming and time-consuming, requiring skilled labor and customized infrastructure. The absence of globally unified standards for IoT-enabled packaging components and data protocols can result in compatibility issues between systems, devices, and platforms.

What are the Opportunities for the Growth of the IoT-Enabled Packaging Market?

Growth in E-Commerce and Smart Logistics Demand

The continued rise of e-commerce creates a need for real-life shipment tracking, condition monitoring, and inventory automation, driving the adoption of IoT packaging in warehousing and last-mile delivery.

Growth in Personalized Consumer Engagement

Smart Packaging that offers consumers interactive experiences (e.g., via NFC/QR codes) opens up opportunities for brands to enhance loyalty, deliver promotions, and gather usage insights.

Segmental Insights

Why Does the Hardware Segment Dominate the IoT-Enabled Packaging Market?

The hardware segment dominates the market due to the essential role of physical devices in enabling real-time data collection, tracking, and communication. Components such as RFID tags, sensors, smart labels, and GPS modules are critical for monitoring product conditions like temperature, humidity, and location throughout the supply chain. These devices enhance transparency, reduce losses, and improve inventory management. The growing adoption of connected packaging in industries like food, pharmaceuticals, and logistics further drives demand for advanced hardware solutions. Additionally, advancements in miniaturization and cost reduction make hardware components more accessible, reinforcing their dominance in IoT-enabled packaging systems.

The software-by-component segment is the fastest-growing in the IoT-enabled packaging market due to several compelling drivers: IoT packaging relies heavily on robust cloud- and edge-based software for real-time tracking, analytics, and decision-making. Cloud platforms and SaaS solutions enable scalable data management and seamless device integration, offering flexibility and lower IT costs. The integration of AI and machine learning enhances predictive insights, enabling proactive quality control and supply chain optimization. Blockchain and secure distributed ledgers ensure product authenticity and traceability, which is essential in sectors like food and pharmaceuticals. Additionally, improved 5G and mobile network connectivity support fast communication and remote monitoring. These software advancements empower smarter, data-driven, and secure packaging ecosystems.

Which Technology Dominated the IoT-Enabled Packaging Market in 2024?

The radio frequency identification (RFID) segment dominates the market due to its ability to enable real-time tracking, inventory management, and anti-counterfeiting measures. RFID tags provide accurate, non-line-of-sight data transmission, making them ideal for supply chain visibility and automation. Their integration with smart packaging enhances operational efficiency across industries such as retail, logistics, and pharmaceuticals. Additionally, declining costs of RFID components and improved scalability have made the technology widely accessible, reinforcing its leading position in the market.

Smart sensors are the fastest-growing segment in the IoT-enabled packaging market, driven by several key factors. Tiny, low-power sensors enable real-time monitoring of environmental conditions such as temperature, humidity, and shock across the supply chain, enhancing product quality and reducing spoilage. Technological advancements in sensor miniaturization and cost reduction make them more accessible for widespread deployment. Integration with AI and analytics allows for predictive insights and automated decision-making, improving inventory control and logistics efficiency. Additionally, heightened demand for transparency, traceability, and sustainability, especially in food, pharma, and logistics, boosts the adoption of smart-sensor solutions in packaging.

Why Does the Track and Trace Segment Dominate the IoT-Enabled Packaging Market?

The track and stress segment leads the market because it provides comprehensive protection by monitoring environmental and mechanical conditions throughout the supply chain. Sensors detect parameters like shock, vibration, and acceleration, helping identify mishandling and preventing product damage during transit. With real-time stress data, companies can improve packaging design, enhance quality assurance, and reduce losses. This functionality is especially vital for fragile, high-value, or perishable goods. Moreover, declining sensor costs and advances in miniaturization enable broader adoption across logistics and manufacturing, reinforcing its dominant position.

The condition monitoring functionality is the fastest-growing segment in IoT-enabled packaging due to its critical role in ensuring product safety and compliance. It uses embedded sensors to continuously monitor key environmental conditions such as temperature, humidity, light, and pressure throughout the supply chain, providing real-time alerts to prevent spoilage or damage. This capability is essential for sensitive industries like pharmaceuticals and food, which require strict regulatory adherence and quality assurance. Advances in sensor accuracy, miniaturization, and cost reduction have made condition monitoring both feasible and scalable, driving rapid adoption across packaging applications.

Which Packaging Type Dominated the IoT-Enabled Packaging Market in 2024?

Secondary packaging is the dominant packaging-type segment in the Internet of Things (IoT)-enabled packaging market due to its central role in logistics, storage, and bulk transportation. It serves as the outer layer that groups primary packages, making it ideal for embedding IoT components like RFID tags and sensors without interfering with product integrity. This layer enables real-time tracking, environmental monitoring, and anti-tampering measures across the supply chain. Its large surface area supports smart labeling and connectivity features, facilitating better inventory management and traceability. Additionally, secondary packaging is cost-effective for integrating IoT technology at scale, enhancing operational efficiency for manufacturers and retailers.

Primary packaging is the fastest-growing segment in the IoT-enabled packaging market because it directly interacts with the product and delivers critical consumer and logistical benefits. Embedded technologies like QR codes, NFC tags, temperature-sensitive labels, and freshness indicators provide real‑time data on product condition, authenticity, and consumer interaction. This enhances safety, extends shelf life, and enables traceability, especially vital in food, pharmaceuticals, and personal care. Consumer engagement via interactive packaging and the integration of active packaging agents like oxygen scavengers further boosts its appeal. Advances in miniaturization, connectivity, and cost reduction are making smart primary packaging more accessible, fueling rapid market adoption.

Why Does the Food and Beverage Segment Dominate the IoT-enabled Packaging Market?

The food and beverage segment dominates the market because of critical needs around safety, traceability, and quality control. Embedded technologies such as temperature, humidity, and freshness sensors help ensure compliance with strict food safety regulations and extend shelf life, reducing spoilage and waste. Real-time monitoring and alerts throughout the cold chain enhance consumer trust and operational efficiency. There is a growing consumer demand for transparency regarding product origin and handling, while interactive features like QR codes and smart labels engage users and strengthen brand loyalty.

The pharmaceuticals and healthcare segment is the fastest-growing end-use industry in the IoT-enabled packaging market due to its strict requirements around patient safety, regulatory compliance, and product integrity. Embedded sensors continuously monitor temperature, humidity, and other environmental conditions to ensure efficacy of sensitive drugs especially biologics and vaccines throughout the supply chain. IoT-enabled packaging also aids in counterfeiting prevention, dose tracking, and medication adherence, addressing stringent standards set by agencies like the FDA and EMA. Advances in sensor accuracy, miniaturization, and cost reductions, combined with rising investments in healthcare IoT, are rapidly accelerating adoption in the pharmaceutical sector.

Which Deployment Mode Dominated the IoT-Enabled Packaging Market in 2024?

Cloud-based deployment dominates the market due to its unmatched scalability, flexibility, and cost-efficiency. Cloud platforms allow businesses to easily scale up or down based on fluctuating demand without heavy upfront infrastructure investment an attractive pay‑as‑you‑go model for SMEs and large enterprises alike. They provide real-time data processing, advanced analytics, and AI/ML tools essential for rapid insights and decision‑making. Moreover, cloud services simplify integration across devices and support global access and remote monitoring, enhancing reliability and accessibility. These advantages collectively make cloud the dominant deployment mode in IoT-enabled packaging.

The hybrid deployment mode is the fastest-growing segment in the IoT-enabled packaging market because it combines the best of both cloud and edge computing. By processing time-critical data at the edge, such as temperature alarms or anti-tamper alerts, while syncing historical and analytics data to the cloud, hybrid systems ensure low-latency response, offline reliability, and real-time decision-making. This model also supports data privacy compliance, adaptability to variable network conditions, and cost-efficient scaling. These advantages make hybrid deployment ideal for complex supply chains in industries like pharmaceuticals, food, and high-value logistics.

Regional Insight

Which Region Dominated the IoT-Enabled Packaging Market in 2024?

Asia Pacific dominates the Internet of Things-enabled packaging market due to rapid industrialization, urbanization, and the expansion of manufacturing hubs in countries like China, India, and Japan. The region's booming e-commerce sector, coupled with increasing demand for smart logistics and supply chain transparency, drives the adoption of IoT-enabled packaging. Government initiatives supporting digitalization and smart infrastructure further accelerate market growth. Additionally, the presence of major electronics, pharmaceutical, and food industries boosts demand for intelligent packaging solutions, while advancements in sensor technology and lower production costs support large-scale deployment across various applications.

China Market Trends

China leads the regional market due to its massive manufacturing base, strong government support for smart technologies, and rapid digital transformation. The country’s dominance in electronics, pharmaceuticals, and e-commerce fuels high demand for smart packaging solutions like RFID tags and real-time condition monitoring.

India Market Trends

India is experiencing fast growth driven by its expanding food and pharmaceutical industries, rising e-commerce adoption, and government initiatives such as “Digital India” and “Make in India.” Local demand for traceability and counterfeit prevention is also pushing IoT-enabled packaging in sectors like healthcare and FMCG.

Japan Market Trends

Japan’s focus on precision, automation, and advanced technologies makes it a key market for IoT-enabled packaging. The country's mature pharmaceutical and electronics sectors prioritize product safety and efficiency, driving the adoption of smart packaging with embedded sensors and anti-tamper features.

What Promotes the Growth of the North America IoT-Enabled Packaging Market?

North America is the fastest-growing region in the IoT-enabled packaging market due to several converging strengths. Its advanced technological infrastructure bolstered by widespread 5G deployment, AI, and edge computing enables real-time monitoring and smart decision-making. The region’s mature food, pharmaceutical, retail, and e-commerce sectors demand high traceability, quality control, and anti-counterfeit measures, driving IoT packaging adoption. Major retailers (e.g., Amazon, Walmart) and packaging innovators (like 3M, Avery Dennison) actively deploy RFID tags, smart labels, and cloud analytics to enhance logistics efficiency and consumer engagement. Robust government support and regulatory frameworks (FDA, DSCSA) further accelerate demand for compliant, intelligent packaging solutions.

U.S. Market Trends

The U.S. is the dominant force in the North American market, driven by its advanced technological ecosystem, widespread 5G and IoT infrastructure, and strong presence of leading packaging, logistics, and retail companies. The country sees high adoption in sectors like pharmaceuticals, food, and e-commerce, where real-time tracking, condition monitoring, and anti-counterfeiting are critical. Regulatory frameworks such as the FDA’s Drug Supply Chain Security Act (DSCSA) further accelerate smart packaging deployment in healthcare and logistics.

Canada Market Trends

Canada is witnessing the growing adoption of IoT-enabled packaging due to the rising demand for sustainable, traceable packaging in the food and pharmaceutical industries. Government initiatives promoting smart supply chains and digital innovation, combined with consumer demand for product transparency and safety, are boosting the integration of technologies like RFID, NFC, and smart sensors into packaging

Europe’s Restrict Regulations to Promote Steady Growth

The European market is experiencing notable growth driven by several strong factors. Stringent EU regulations such as the Digital Product Passport, food safety mandates, and pharmaceutical traceability laws are compelling manufacturers to implement smart packaging solutions for compliance and transparency. High environmental awareness across the region fuels demand for sustainability-focused smart packaging, including biodegradable sensors and recyclable labels. Moreover, Europe’s advanced technological landscape, characterized by extensive 5G rollout, robust edge/cloud infrastructure, and well-established R&D networks, supports widespread deployment of IoT packaging innovations, with strong manufacturing, food, pharmaceutical, and luxury goods industries notably in Germany, the UK, France, and Italy. Actively implementing real-time tracking, anti-counterfeiting, and freshness-monitoring solutions, Europe is poised for continued IoT packaging market expansion.

Top Players in the IoT-Enabled Packaging Market

Hardware Providers

- Avery Dennison Corporation

- Smartrac Technology GmbH

- Identiv, Inc.

- Thin Film Electronics ASA

- Zebra Technologies Corporation

- Impinj Inc.

- Toppan Inc.

- Stora Enso

- Timestrip UK Ltd.

- NXP Semiconductors

- Other Players

Software Providers

- Kezzler AS

- EVRYTHNG (A Digimarc company)

- Wiliot Ltd.

- SAP SE

- Microsoft Corporation

- IBM Corporation

- Zebra Technologies

- SML Group

- Other Players

Services Providers

Latest Announcements by Industry Leaders

- In June 2025, Thomas Rödding, CEO of Narravero, stated that the Digital Product Passport, which gives businesses, consumers, and authorities easily accessible information about materials, sustainability, repair, and recycling choices, is quickly becoming the standard for smart, sustainable products. A partner ecosystem involving organizations like Identiv and their LoT experience is essential because the PP is a cross-departmental and cross-disciplinary endeavor for businesses. With its NFC and BLE-enabled inlays, tags, and labels, Identiv, a pioneer in smart packaging for PP deployments, gives tangible goods digital identities that facilitate thorough supply chain visibility. (Source: Label Andnarrow Web)

New Advancements in the Market

- In January 2025, the G+D Smart Label, a cutting-edge and creative tracking solution from Giesecke+Devrient (G+D), will have the ability to completely disrupt asset tracking, supply chain management, and logistics by turning almost any item into a fully working IoT device. One of the most portable tracking devices on the market, this innovative technology is incredibly thin just millimeters thick and only marginally bigger than a typical credit card. (Source: Launched)

- In May 2025, the TA Series of Sunfort dry film photoresist is a new product from Asahi Kasei, created to meet the growing demand for sophisticated semiconductor packages used in applications such as artificial intelligence (AI) servers. In the Material segment of Asahi Kasei, this product is positioned as a strategic offering with the goal of enhancing the company's presence in the quickly expanding next-generation chip packaging industry. (Source: Asahi Kasei)

Global IoT-Enabled Packaging Market Segments

- By Component

- Hardware

- RFID tags

- NFC chips

- Sensors

- Temperature

- Pressure

- Humidity

- Shock

- Others

- Bluetooth modules

- Printed electronics

- Displays (E-ink, LED)

- Software

- Data analytics platforms

- Integration software (ERP, SCM)

- Cloud-based monitoring solutions

- Mobile applications

- Services

- Integration and deployment services

- Consulting and customization

- Maintenance and support

- Managed services

- By Technology

- Radio-frequency identification (RFID)

- Near field communication (NFC)

- Bluetooth low energy (BLE)

- Wi-Fi and cellular connectivity

- QR codes/Barcodes

- Smart sensors (IoT-based)

- Printed sensors (conductive inks)

- Embedded displays

- Others (GPS and Geo-fencing, etc.)

- By Functionality

- Track and Trace

- Real-time location tracking

- Chain of custody records

- Condition Monitoring

- Temperature/humidity/shock alerts

- Vibration and light exposure

- Authentication and Anti-Counterfeiting

- Tamper-evidence

- Digital identity validation

- Consumer Engagement

- Smart labels with QR/NFC for promotions

- App-based loyalty integration

- Inventory Management

- Automated inventory updates

- Expiry and stock alerts

- By Packaging Type

- Primary Packaging

- Bottles

- Blisters

- Sachets

- Pouches

- Secondary Packaging

- Boxes and cartons

- Wraps and films

- Shrink packaging

- Tertiary Packaging

- Crates

- Pallets

- Containers

- By End-Use Industry

- Food and Beverages

- Perishable goods

- Beverages

- Dairy and frozen products

- Pharmaceuticals and Healthcare

- Biologics and vaccines

- Temperature-sensitive drugs

- Medical devices

- Consumer Electronics

- Retail and E-Commerce

- Branded and luxury goods

- Direct-to-consumer packaging

- Logistics and Transportation

- Condition-sensitive freight

- Container-level tracking

- Cosmetics and Personal Care

- Premium packaging

- Usage tracking and authentication

- Industrial and Chemical

- Hazardous materials monitoring

- Tamper and spill detection

- Others

- By Deployment Mode

- Cloud-Based

- On-Premises

- Hybrid

- By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait