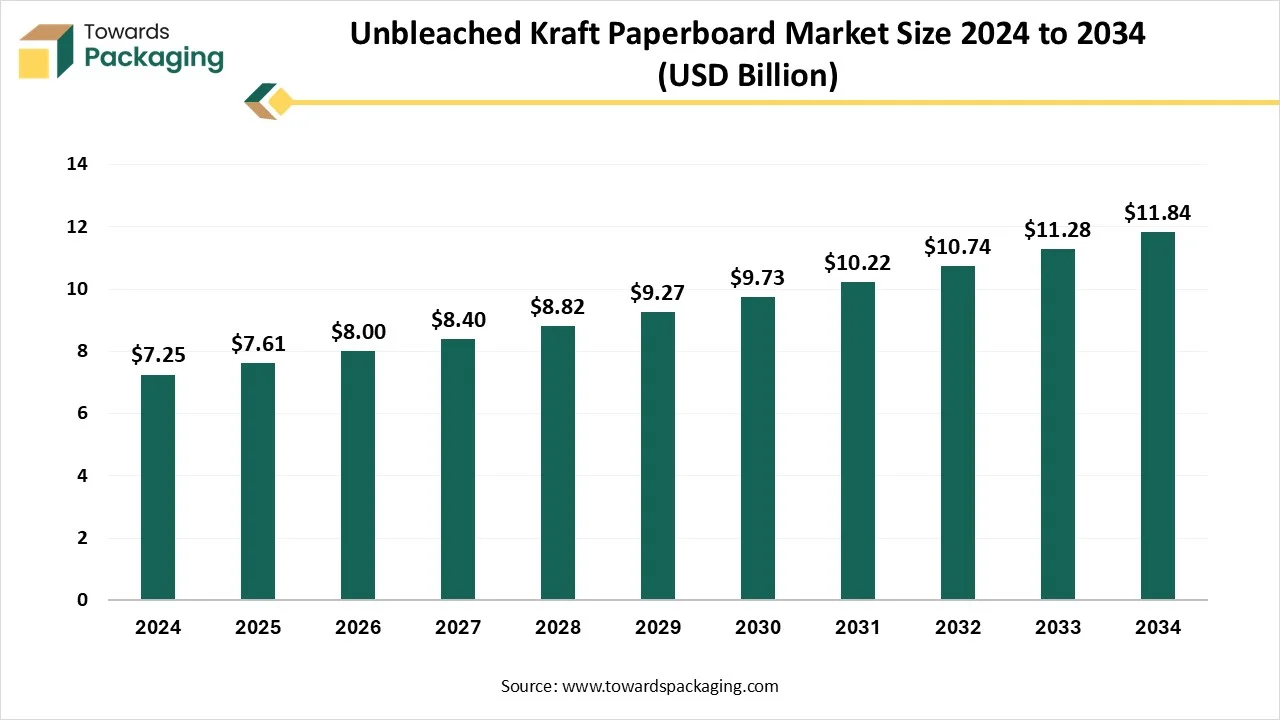

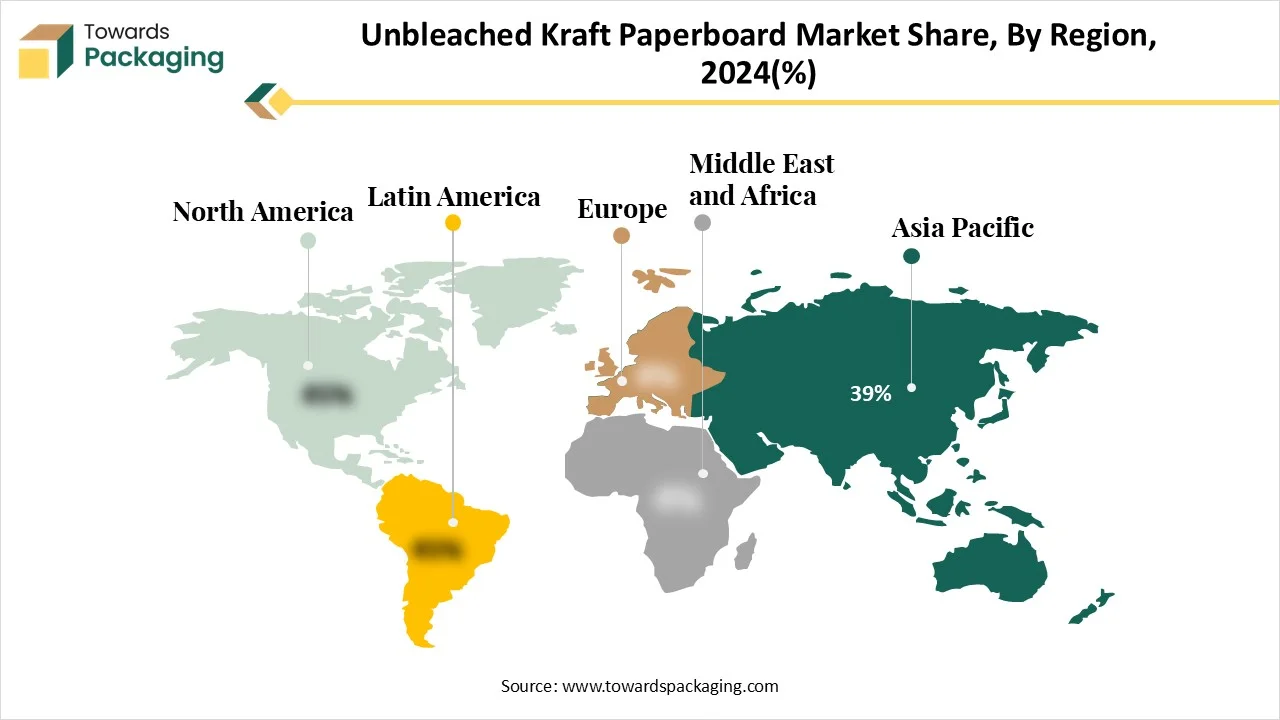

The unbleached kraft paperboard market is projected to grow from USD 7.61 billion in 2025 to USD 11.84 billion by 2034, exhibiting a steady CAGR of 5.03%. This report covers detailed market trends, growth drivers, restraints, and opportunities, along with complete segmentation by grade type, thickness, product type, packaging type, end-use industry, and distribution channel. It provides an in-depth regional analysis covering North America, Europe, Asia Pacific, Latin America, and MEA, where Asia Pacific leads with a 39% market share (2024).

The study also includes value chain assessment, trade data, competitive landscape, and profiling of leading companies such as WestRock, International Paper, Smurfit Kappa, Mondi, Sappi, Stora Enso, and more.

Unbleached Kraft paperboard is a type of paperboard manufactured from wood pulp produced via the kraft process, which is not subjected to a bleaching stage. This retains its natural brown colour, resulting in a product known for its high strength, durability, recyclability, and eco-friendly profile. It is extensively used in packaging applications where strength and sustainability are critical, including corrugated boxes, folding cartons, and protective packaging.

Unbleached Kraft paperboard is renowned for its distinctive brown color and raw, natural appearance. The manufacturing process utilizes unbleached kraft pulp, which is derived from spruce and pine trees. These trees are selected for their eco-friendliness and durability, making unbleached kraft paper a sustainable choice. Unbleached kraft paperboard is classified from bleached kraft paper in that it does not undergo a bleaching procedure. Bleached kraft paper is intended to be bleached to achieve a lighter appearance, a soft surface, and enhanced printability. On the other hand, unbleached kraft paper retains the natural brown color and a slightly rougher texture.

| Metric | Details |

| Market Size in 2025 | USD 7.61 Billion |

| Projected Market Size in 2034 | USD 11.84 Billion |

| CAGR (2025 - 2034) | 5.03% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Grade, By Thickness / Basis Weight, By Product Type, By Packaging Type, By End-use Industry, By Distribution Channel and By Region |

| Top Key Players | WestRock Company, International Paper, Smurfit Kappa Group, Mondi Group, Sappi Limited, Stora Enso Oyj, Georgia-Pacific LLC, Billerud AB |

AI contributes to predictive maintenance systems that can identify potential issues before they occur, reducing the risk of equipment failures and unexpected downtime. In the near future, both OEMs and consumer packaged goods companies anticipate that predictive maintenance will play a crucial role. AI-powered vision systems can rapidly and precisely inspect packaging to meet quality standards, detecting defects like scratches, dents, or printing errors in real time. This largely reduces the chance of faulty products reaching consumers. AI-driven robots are revolutionizing packaging by boosting both accuracy and speed, automating repetitive tasks such as placing, picking, and packing items, which allows human workers to focus on more complex activities. Advanced AI algorithms are capable of adapting to different packaging environments.

The e-commerce growth has created new possibilities for Kraft generators. Industry trends display that corrugated boxes are being substituted with kraft paper bags layered with bubble wrap in the United States. A main competitor for Kraft and other regular packaging materials has been plastic. Hence, the last years were classified by the demonstration that was beginning to appear. To solve the toxic effects of plastics and place a heavier responsibility on preventing environmental damage, efforts have begun all over the globe to take action against plastic.

One main challenge in terms of unbleached kraft paperboard is its poor resistance to moisture. Unless particular laminated or treated, it is not waterproof, which limits its usage in surroundings where exposure to humidity and water is likely. This challenge can be for uses such as food packaging, shipping materials, and outdoor storage that may experience wet conditions. The uncovered and textured surface does not carry ink as efficiently as blanketed or soft papers. Due to this, logos, printed designs, or images may lack brightness and accuracy. These elements can be a drawback for organizations whose goal is to make high-quality and attention-grabbing branding or promotional materials.

The unbleached kraft paper is completely compostable and biodegradable, breaking down naturally without touching the environment. This makes it a perfect alternative to materials like plastic that reside in landfills for years. By selecting unbleached kraft paper, particular businesses invest in lowering pollution and marketing a greener planet. One of the main features of Kraft paper is its recyclability. It can be recycled many times before its fibres weaken, specifically reducing waste and conserving natural resources. This circularity aligns with sustainable practices and assists eco-conscious lifestyles. Furthermore, because of its earthy tones and natural texture, unbleached kraft paper meets the latest minimalist design and eco-friendly nature trends. Its rustic look develops the request for handcrafted and craftsman products, while its neutral colour palette serves as an accurate canvas for customisation and branding.

Coated unbleached Kraft (CUK) paperboard is widely recognized in the packaging sector as an eco-friendly paperboard grades that offer a more natural appearance and aesthetic. These paperboard grades are produced from recyclable materials such as unbleached wood pulp. Utilising unbleached recycled and pulp materials makes CUK and SUS a perfect choice for organizations seeking sustainable packaging solutions, as the uncoated papers also make this material very easy to recycle. One of the main elements of these paperboard grades is its natural brown colour, which gives an apparent aesthetic look. Hence, this natural colour can also be limited, as it may not be perfect for products that need darker colours. The CUK and SUS serve several benefits, which make them a selected choice for different packaging uses.

Linerboard is a kind of paperboard utilised for the outer facing of a corrugated box. Kraft linerboard is created from wood fiber that comes from the kraft procedure and specifically contains not more than 20% recycled materials. Testliner or recycled paper can be made of 100% five recycled material. And it is akin to material created from 805 virgin wood fiber, which makes it a perfect choice for custom corrugated packaging and POP shows. It serves an organic appearance. This serves an organic appearance because of a natural effect, while also being 100 % biodegradable and recyclable at the current time, which makes it a perfect choice for an eco-friendly packaging solution. This paperboard option is evergreen and rigid, suitable for different types of printing such as litho lamination and flexographic, embossing, die-cutting, and hot foil stamping too.

Folding boxboard is a kind of paperboard utilised for packaging, classified by its stalwart yet lightweight combination. It is created from a mixture of chemical and mechanical pulp, and it has a soft surface perfect for good-quality printing, making it perfect for graphics and branding. Prevalently used in food packaging, consumer goods, and pharmaceuticals, it can be easily folded and created in different forms and shapes, developing its versatility in various uses. Folding box board is linked to different concepts. It's popular for its printability and power; folding cartons can be created from different paperboard materials, including folding cartonboard.

In terms of corrugated boxes, the inner linear layer is a kind of sheet using kraft paper, which forms the surface of the box. It creates a soft surface for the content or product and assists the overall infrastructure, power, and toughness of the box. White custom corrugated cartons are generated with the outer layers of linerboard sheets and fluted sheets between the linerboard sheets. They are produced in several styles and thicknesses to provide huge structural assistance to the weighty and heavy products of our brand. Corrugated crayons are relatively more protective and durable than folding cartons. This is because they are manufactured with more protective layers of linerboard and the fluted layers fused between the two. While folding cartons just demand one surface of packaging materials and do not need any additional inserts for the protection of products.

Folding cartons are designed from a single piece of paperboard, which is accurately scored, boarded, and then folded into a box shape. A main characteristic is that they are specifically stored and shipped flat, which makes them incredibly effective before assembly. Prevalent materials used for cosmetics packaging boxes are those with lower material costs as compared to the thicker chipboard utilised in the rigid boxes. The production procedure for folding cartons is frequently more updated, which leads to lower production costs. They assist a huge array of luxurious finishing options such as UV coating for protection and glass, hot foil stamping for metallic accents, and lamination, matte or gloss for durability and tactile feel.

Unbleached kraft paper is increasingly popular in the food packaging sector due to its eco-friendly nature and versatility. Created from chemical pulp generated in the kraft procedure, this paper is known for its high tensile strength, which makes it perfect for packaging a variety of food items, including baked goods, fast food, snacks, and dry foods. Kraft paper is available in both unbleached and bleached formats, with the latter being more cost-effective and sustainable. It is often utilised to produce warps, paper bags, cartons, and pouches. Furthermore, Kraft paper can be laminated or coated with food-safe barriers to improve its resistance to grease, moisture, and oil, making it suitable for direct food contact. It's a printable surface that also allows for effective branding and labelling.

The fastest developing e-commerce sector not only generates a lot of waste but also needs an aesthetic and protective look from its packaging. Kraft paper is the ideal solution in this landscape, given its protective nature and sustainable and rustic brown kraft paper appeal. While the Kraft paper serves the ultimate rigid exterior, we can crumple Kraft paper as buffering inside the box as an alternative to bubble wrap and foam. We can create an elusive unboxing experience utilising branded mailers or tailored-printed wrapping sheets. The soft presentation of unbleached kraft paper is ideal for covering sensitive high-end products such as cosmetics, apparel, and even handmade goods.

Direct sales of unbleached kraft paper have experienced constant growth, specifically driven by the growing demand for sustainable and biodegradable packaging solutions across different industries, especially in the food and retail sectors. Unbleached kraft paper, known for its natural brown colour, power and eco-friendliness, is prevalently sold directly by producers and paper mills to converters, end-users and packaging companies too. The cost-effectiveness of unbleached kraft paper, integrated with its recyclability and minimal processing, makes it attractive for huge buyers finding environmentally responsible packaging alternatives. Direct sales also assist in reducing supply chain costs, developing lead times, and ensuring constant quality, which is important for industrial and commercial uses.

Brown Kraft paper is one of the most adaptable and flexible kinds of packaging. One can conveniently discontinue in whatever size we need, scrunch it, or fit it to any infill demand. Kraft paper is totally recyclable. It takes lower chemical input to create kraft paper than to make bleached white paper products. On the other hand, online shops delight in unbleached kraft paper packaging. It is strong, rigid, and easy to ship. This assists in creating trust with the users. The huge logo on the front of the package is approximately as crucial as the protective nature of the package itself. Brands are enabled to convey their story using unbleached kraft paper.

Asia Pacific dominated the market in 2024, and the region is expected to sustain its position during the forecast period. Countries like China, India, Indonesia, and Vietnam are the main contributors to both the usage and production of kraft paper in the region. The push toward lowering single-use plastics has grown the move to unbleached kraft paperboard for packaging uses, specifically in retail, food, and logistics sectors. India and China, in particular, are witnessing a surge in demand due to fast urbanization, population growth, and government initiatives assisting sustainable packaging. Kraft paper mills in these countries are stretching capacity and updating technology to align with the growing requirements for both unbleached and bleached varieties. Furthermore, exports of kraft paper from Asian producers are growing, supplying global markets with cost-effective and sustainable packaging material.

By Grade

By Thickness / Basis Weight

By Product Type

By Packaging Type

By End-use Industry

By Distribution Channel

By Region

December 2025

November 2025

November 2025

January 2026