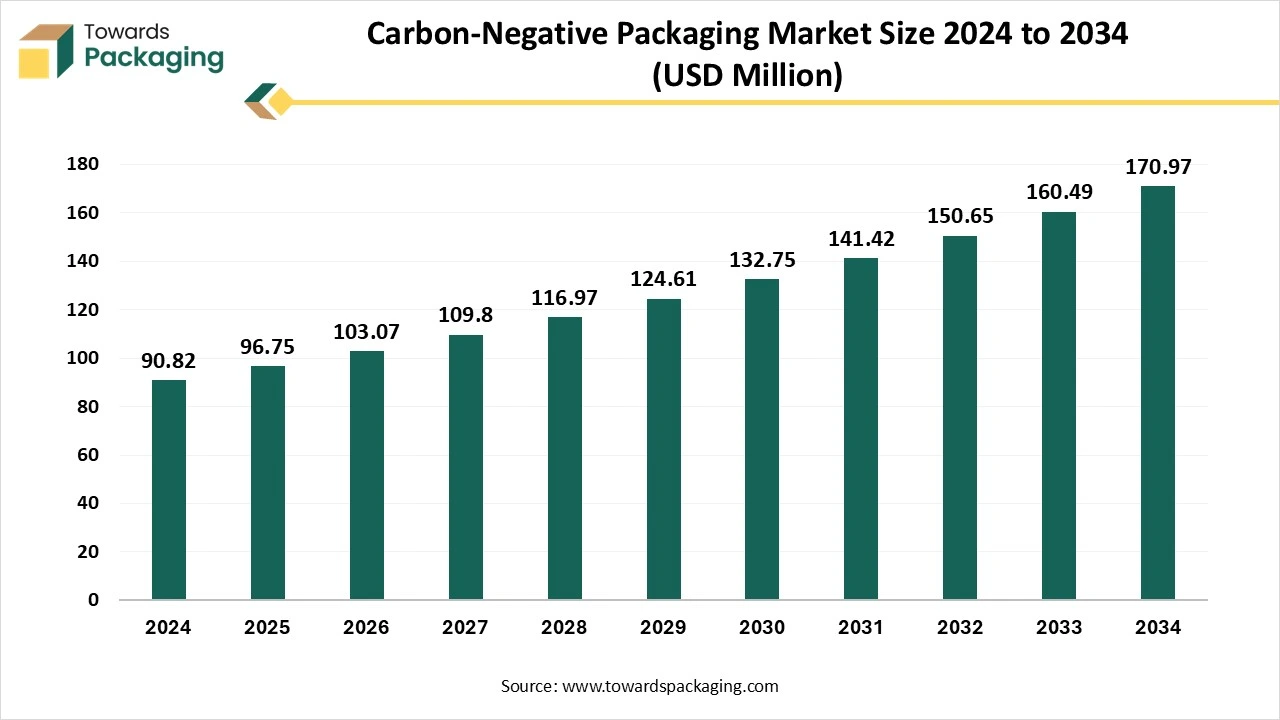

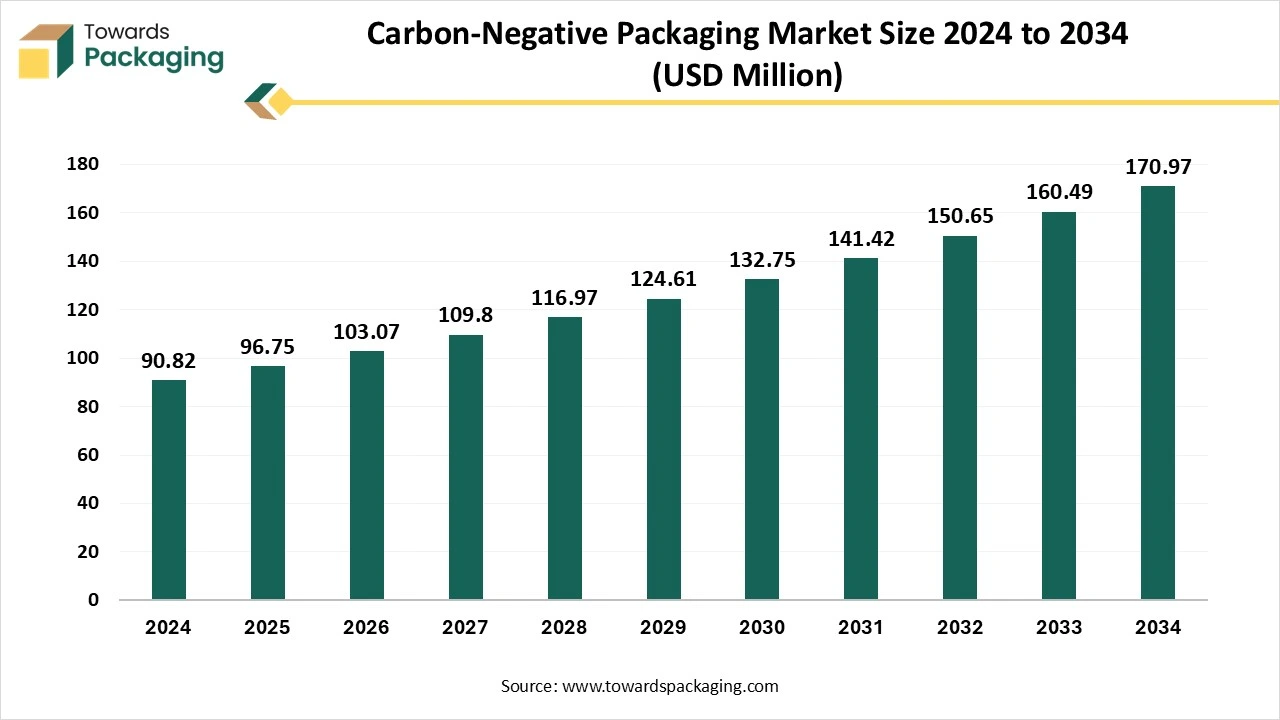

The carbon-negative packaging market is forecasted to expand from USD 103.07 million in 2026 to USD 182.13 million by 2035, growing at a CAGR of 6.53% from 2026 to 2035. This report provides a comprehensive analysis of market trends, growth drivers, and challenges, while covering material types such as bio-based (PLA & PHA), cellulose fibers, algae-based plastics, and recycled materials.

It includes detailed regional insights across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, alongside competitive analysis of top players such as Notpla Ltd., Lactips, Avani Eco, Footprint, and TIPA Corp Ltd., providing a complete view of the market’s current and future landscape.

Carbon-negative packaging refers to packaging solutions that sequester more carbon dioxide (CO₂) from the atmosphere than is emitted during their entire lifecycle (production, usage, and disposal). This is achieved through the use of bio-based, compostable, recycled, or engineered carbon capture materials, with a net negative greenhouse gas (GHG) footprint.

| Metric | Details |

| Market Size in 2025 | USD 96.75 Billion |

| Projected Market Size in 2035 | USD 182.13 Billion |

| CAGR (2026 - 2035) | 6.53% |

| Leading Region | Europe |

| Market Segmentation | By Material Type, By Packaging Type, By End-Use Industry, By Distribution Channel, By Technology and By Region |

| Top Key Players | Notpla Ltd., Lactips, Avani Eco, Footprint, Living Ink Technologies, Biome Bioplastics, Green Dot Bioplastics, Loliware Inc., TIPA Corp Ltd., CarbonCraft, Sulapac Ltd. |

The incorporation of AI in the carbon-negative packaging market has influenced the development of the market by supporting smart patterns, data-influenced sustainability tracking, and effective operations. It reduces the usage of resources and also maintains strength. AI optimizes the shape of the packages for effective transportation. With the adoption of advanced technology, it has become easy to predict carbon emissions from the product, which has boosted the development of this market. AI helps to optimize the supply chain process of the industry and supports in planning transportation routes and reducing footprints.

Demand for Eco-friendly Alternatives

The rising demand for eco-friendly packaging among consumers has enhanced the demand for the carbon-negative packaging market. Customers are progressively demanding environment-friendly substitutes, encouraging producers to revolutionize and accept carbon-negative packaging solutions. This change in customer choice is additionally maintained by strict government guidelines intended at decreasing carbon emissions and endorsing sustainable options across businesses. As a consequence, corporations are capitalizing heavily on study and expansion to generate packaging resources that not only decrease carbon footprints but also improve product functionality and shelf life.

Limited Scalability and High Production Charges

The high production cost associated with the carbon-negative packaging market has hindered its expansion. The growth of carbon-sequestering, biodegradable, and plant-based packaging resolutions often needs advanced technology and specific production procedures, making them more exclusive than old-style plastic packing. Many industries, mainly small and medium initiatives, fight to defend the extra charges, limiting extensive acceptance.

Rising Worldwide Focus on Sustainable Packaging

The carbon-negative packaging market shows noteworthy development opportunities influenced by the growing worldwide focus on sustainable packaging and carbon decreasing initiatives. As governments execute severe ecological guidelines and company sustainability aims become more determined, the growing demand for carbon-negative packaging solutions is increasing. Trades that capitalize on advanced packaging resources, such as carbon-sequestering resources, biodegradable polymers, and plant-based substitutes, can support this increasing market.

The progressions in carbon detention and operation technologies are generating new potential for incorporating apprehended carbon into packaging manufacture, additionally improving sustainability efforts. The rising circular economy model, which highlights waste decrease and resource efficiency, offers businesses opportunities to advance closed-loop arrangements that help the large-scale acceptance of carbon-negative packaging.

The bio-based (PLA & PHA) segment contributed a considerable share of the carbon-negative packaging market in 2024 due to its flexibility and durability. Bio-based (PLA & PHA), resulting from renewable resources like algae, cornstarch, and sugarcane, are getting widespread acceptance. These alternatives, comprising resources such as seaweed-based and mycelium packaging, are developing as advanced solutions with negligible ecological impact. Corporations are progressively capitalizing on research and development to improve the presentation and scalability of these resources, safeguarding cost-efficiency and extensive acceptance across businesses.

The algae-based plastics segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing rapidly due to its advanced performance and eco-friendly nature. These are derived from seaweed species and fast-growing microalgae that sequester large amounts of carbon dioxide at the time of cultivation. This is highly acceptable due to its high versatility, biodegradability, and low energy inputs.

The rigid packaging (Bottles & Containers) segment was dominant over the carbon-negative packaging market in 2024 due to the widespread usage of household products, food, beverages, and personal care. The major utilisation of resources such as hemp composites, captured carbon resources, algae plastics, and bio-based resins. Several brands are accepting such packaging now to attract a huge number of consumers, which enhances their development. These packages decrease emissions at the time of manufacturing. It also permits traceability technologies and smart labelling.

The flexible (pouches & films) segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. These are cost-efficient, lightweight, and widely applicable in several industries. These are made up of biochar-infused polymers, algae bioplastic, seaweed-based films, and hemp composites. Flexible formats need efficiently less resources and energy for the production as well as transportation processes.

The food & beverage segment held a considerable share of the carbon-negative packaging market in 2024 due to the high consumption capacities and supervisory pressure on the one-time usage of plastics. To fulfill company sustainability aims and meet customer requirements, industries are accepting environment-friendly packaging like carbon-sequestering vessels, biodegradable dishes, and compostable films. The carbon-negative packaging resources are decomposable and can help reduce the ecological impact of food & beverage packaging, improving segmented expansion.

The e-commerce & retail segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This is due to customer choices and business sustainability promises. As more trades identify the long-term profits of decreasing carbon releases, the demand for sustainable packaging resolutions is anticipated to grow, aligning carbon-negative packaging as a crucial section of upcoming packaging plans.

The direct sales (B2B) segment is expected to have a considerable share of the carbon-negative packaging market in 2024 due to the requirement for personalised packaging and eco-compliant resolution. Through this segment, several companies are gaining sustainable metrics, huge control over patterns, and resource selection. Furthermore, supervisory compressions and extended producer responsibility (EPR) directives are encouraging industries to pursue direct supplier association to safeguard compliance and traceability. The consciousness of this market grows, and as sustainability becomes an inexpensive discriminator, B2B sales will continue to dominate.

The e-commerce segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. It is expanding due to the rising number of online retails, rapid delivery models, and direct-to-consumer (DTC) brands. As the volume of shipments grows, which influences the ecological impact of packaging waste, encouraging brands and logistics to take action well. These resources deliver compostable, lightweight, and durable substitutes that decrease both transportation and production emissions, which are related to carbon footprints.

The carbon capture integrated segment accounts for a considerable share of the carbon-negative packaging market in 2024 due to the growing demand for environment-friendly packaging of products. This segment includes technologies that trap carbon dioxide directly from the market or the atmosphere. It utilizes captured carbon dioxide and decreases reliability on fossil-based inputs. Advanced technologies like algae-based carbon dioxide absorption process, carbon mineralization, and carbon dioxide polymerization.

The 3D printed bio-packaging segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This is due to its capability to offer personalized, environment-friendly, and lightweight resolutions while reducing waste. It allows precise control over material utilization, decreasing surplus production, and eliminating off-cuts. This technology is mainly helpful for branded packaging, protective packaging, and inserts in high-value segments such as specialty foods, cosmetics, and electronics.

Europe held the largest share of the carbon-negative packaging market in 2024, due to the strict government guidelines for the packaging industry. It majorly focuses on rising ecological issues and the accumulation of waste in landfills. In several countries, such as the UK, Germany, France, Italy, Spain, and several others, there is a strict stepwise checking process of the packaging that has influenced the production of packages that are carbon-negative. The huge demand for such packages in the food industry has also contributed significantly to the growth of this market.

Asia Pacific is estimated to grow at the fastest rate in the carbon-negative packaging market during the forecast period. The rapid expansion in the demand for green and sustainable packaging has led to the development of this market. Increasing industrialization and urbanization are generating a surge in demand for sustainable substitutes. Government-controlled inducements and grants for environment-friendly packaging producers are inspiring production. Governments in this region are also executing policies and enterprises to endorse sustainable choices, further boosting the development of this packaging market.

By Material Type

By Packaging Type

By End-Use Industry

By Distribution Channel

By Technology

By Region

February 2026

February 2026

February 2026

February 2026