Carbonated Soft Drinks Packaging Market Size, Growth Trends, Segments, Regional Outlook, Companies, Manufacturers & Trade Statistics

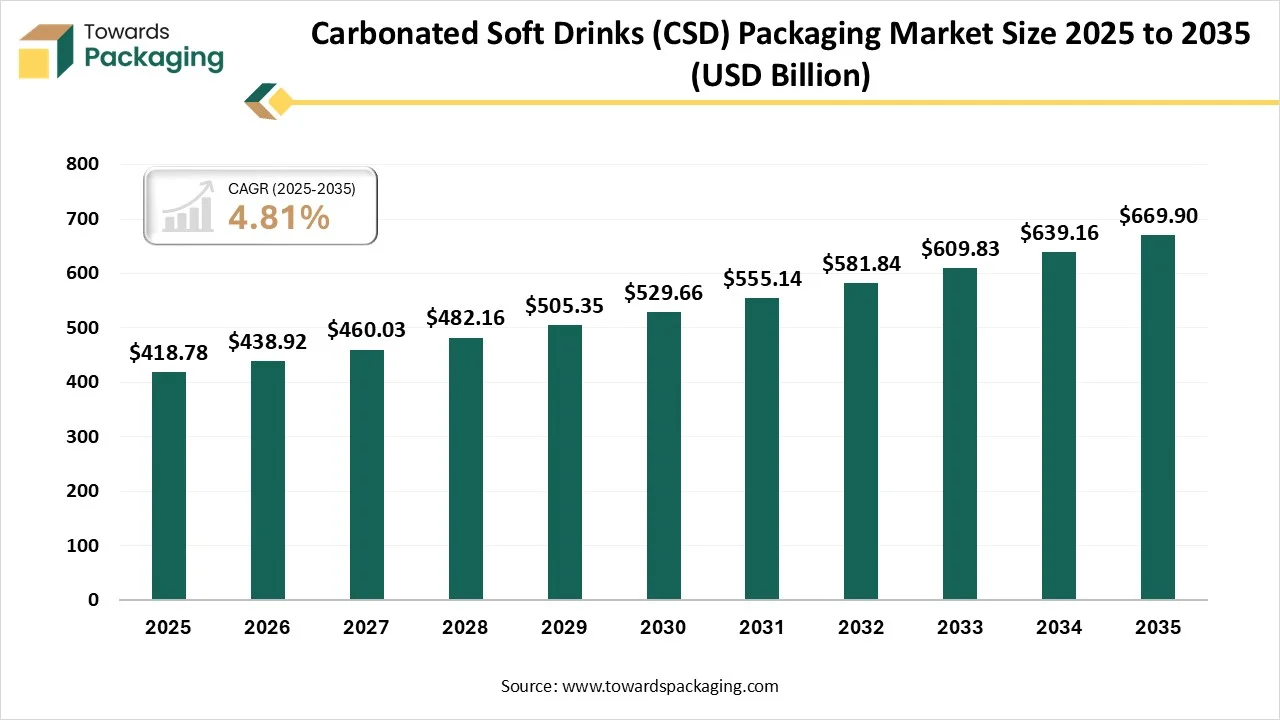

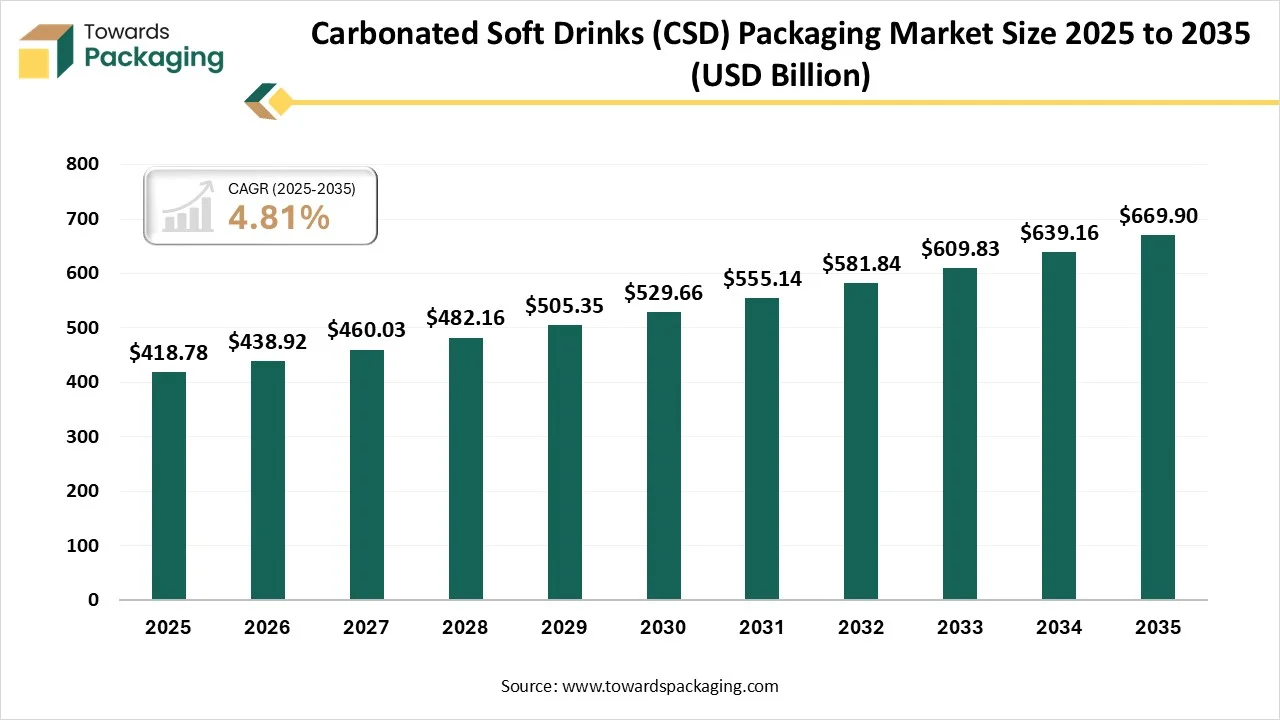

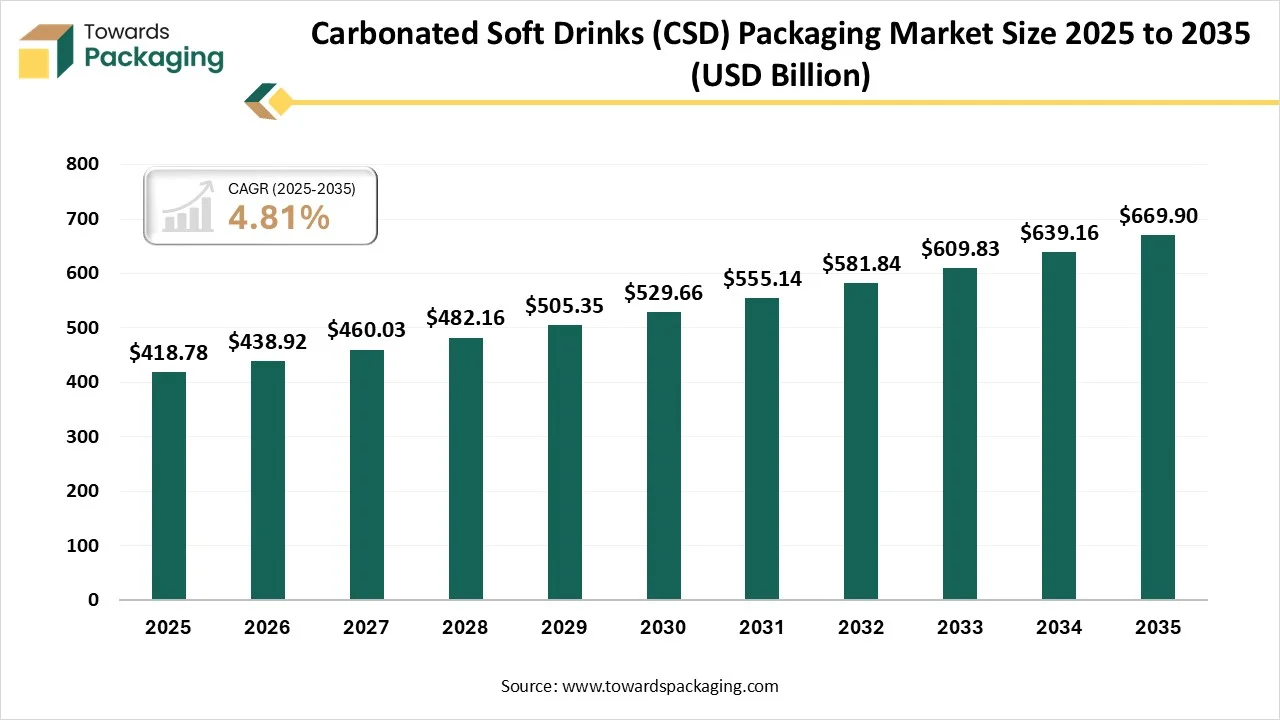

The Carbonated Soft Drinks (CSD) Packaging market is forecasted to expand from USD 438.92 billion in 2026 to USD 669.90 billion by 2035, growing at a CAGR of 4.81% from 2026 to 2035. This report covers full market statistics including size, growth trends, segmentation by material (metal, plastic, glass, carton) and packaging type (cans, bottles, cartons), along with regional insights for North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

Key Takeaways

- In terms of revenue, the market is valued at USD 418.78 Billion in 2025.

- The market is predicted to reach USD 669.90 Billion by the year 2035.

- Rapid growth at a CAGR OF 4.81% will be experienced between 2025 and 2034.

- By region, North America dominated the global market, having the biggest share of 32-35% in 2024.

- By region, Asia Pacific is expected to grow at a notable CAGR between 2025 and 2034.

- By material, metal segment contributed to the largest share of 42% in 2024.

- By material, the plastic segment will expand at a significant CAGR between 2025 and 2034.

- By packaging type, the cans segment has contributed to the largest share of 45% in 2024.

- By packaging type, the bottles segment will expand at a significant CAGR between 2025 and 2034.

Market Overview

The carbonated soft drinks (CSD) packaging market encompasses all packaging formats such as PET bottles, aluminum cans, glass bottles, cartons, and paper-based packages used specifically to contain, preserve, and deliver carbonated soft drinks. It includes packaging materials, formats, and technologies designed for shelf appeal, product integrity (e.g., carbonation retention), convenience (resealability, portability), and sustainability.

Carbonated soft drinks are non-alcoholic beverages created from carbonated water and flavoring and sweetening with sugar or a non-nutritive sweetener. CSD is a kind of beverage that adds carbon dioxide to give it an effective taste. It is further classified as non-colas, colas, and diet soft drinks, and regular swift drinks too. It also utilises cola nuts from the African trees, cola acuminata and cola nitida, as flavouring agents. Due to phosphoric acid, which can expand the acidity, it is prevalently used as an acidulant in the cola-flavoured carbonated beverages. Phosphoric acid has the same element as cola flavours, which is dry and sometimes balsamic. They account for a sizeable space of the worldwide soft drink sector.

Emerging Trends in Carbonated Soft Drinks (CSD) Packaging Market

- Balancing seltzer and Regular Sodas: One different beverage that industrial action is a balance between seltzer and regular sodas which is gaining attention. They are sweetened with fruit juice, and it has no refined sugar or high-intensity sweeteners. Additionally, it counts billions of CFUs (colony-forming units) of live prebiotics at the time of canning, which makes it a healthier soda option. These inventive drinks serve a flavourful and refreshing alternative while assisting digestive health.

- Probiotic-enriched carbonated beverages: Probiotic-enriched carbonated beverages are crafted to assist digestive health by developing a balanced gut microbiome. These drinks are filled with live bacteria, available in different drinks, serving as a healthier alternative to soft drinks. The purpose of the prebiotic goal is to develop the drinks’ functional benefits, catering to health-conscious users.

- THC and CBD Seltzers: THC and CBD seltzers are a kind of non-alcoholic beverage filled with Tetrahydrocannabinol (THC) and Cannabidiol ( CBD), elements that come from cannabis. THC is the initial psychoactive compound, while on the other hand, the non-psychoactive compound is linked with capable therapeutic effects like chronic pain and reducing anxiety.

- Genetically Engineered Prebiotic Drinks: It is being established by PhD microbiologists, a different probiotic drink that is a usually differentiated formula. This drink is a crafted formula. This kind of drink is designed to metabolize acetaldehyde, which is a byproduct of alcohol, that is frequently the reason for unacceptable symptoms the next day after alcohol consumption.

How Artificial Intelligence Has Benefitted The Carbonated Soft Drinks (CSD) Packaging Market?

Artificial Intelligence can assist drink brands in forecasting and planning. AI’s potential to process huge amounts of data and check patterns and exceptions is being used to determine market trends for the most searched product series and range, to the most regular locations, along with competitor activity. It can also track data to analyse and forecast user trends, utilising this to identify or even suggest new formulations and ingredient combinations. Data sets could also count consumer choice, nutritional profiles, and flavourful combinations.

Furthermore, AI can also deliver personalised product recommendations to drinkers, both in-person and online. Online, AI can personalize product suggestions depending on the browser's buying habits and purchases created by others like them. This counts as suggesting drinks to pair with specific dishes or cuisine, for instance. This can be personalised by the user themselves too, to include favourite flavour zones, allergy information, and nutritional demands. AI can also be utilised during production. Functions of artificial intelligence like robotics, automation, and machine learning can all be allied by the producer of drinks, performing repetitive tasks accurately and speedily, such as classifying produce or packaging, to lower labour costs and develop efficiencies.

Market Dynamics

Market Driver

Health-Focused Drinks Are The Preferred Choice

Consumers are urging for more for their daily drinkables, seeking ingredients that develop their mood, hydration, gut health, and more. At the same time, wellness mixers and beverages frequently cost more than famous sugary soda brands, but users find an eagerness to pay for them. For them, hydration is the main goal, but wellness mixtures like protein powders and prebiotics are developing. Despite having economic issues, retail sales data display constant development in the beverage industry, which highlights important user spending. Apart from these, Gen Z is driving the urge for easy, flavourful, and non-alcoholic drinks that can be consumed socially or on the go, so no mix-ins are demanded.

The quickest developing category features a huge flavour range from sweet to savoury -that includes the energy drinks, bottled water, soft drinks, sports drinks, CBD-infused options, and kombucha too.

Market Restraint

Limitations of The Human Body Acceptance

Carbonated soft drinks have many limitations, like a heavy risk of chronic diseases such as type 2 diabetes, obesity, and heart disease due to their high sugar and calorie content. They are also responsible for dental issues, like enamel erosion and excessive sugar, which can lead to weakened bones by interfering with calcium absorption, and their caffeine content, too, which can cause sleep problems and addiction. Additionally, they contribute to dehydration and can negatively affect behaviour and brain function, especially in children.

Market Opportunity

Low-Sugar Games Win The Carbonated Soft Drinks (CSD) Packaging Market

The future possibilities in the carbonated soft drink industry are being shaped by growing consumer preferences, health trends, and sustainability goals. With rising health consciousness, companies are concentrating on low-sugar, sugar-free, and functional CSDs that count added vitamins, probiotics, or natural ingredients to attract health-oriented consumers. Flavoured sparkling water and premium craft sodas are gaining popularity as alternatives to traditional colas. Sustainability is another strong driver, with brands increasingly investing in eco-friendly packaging such as recycled PET. Aluminum cans and biodegradable materials.

Segmental Insights

Material Insights

How Did The Metal Segment Dominate The Carbonated Soft Drinks (CSD) Packaging Market?

The metal segment dominated the market in 2024 as it is the most widely used packaging solution in the carbonated soft drinks industry due to its lightweight, strong nature, and excellent barrier properties that preserve carbonation and flavour. They are highly preferred for their portability, convenience, and recyclability, making them a sustainable choice in the current eco-conscious market. With increasing focus on the circular economy, the demand for aluminum cans in CSD packaging is rising. They can be recycled infinitely without losing quality. This makes them ideal for convenience, product safety, and sustainability, too, which is very crucial for everything.

Plastic segments are predicted to be the fastest in the market during the forecast period. Plastic bottles like PET (Polyethylene Terephthalate) and recycled PET are extensively used due to their lightweight, shatter-resistant, and cost-effective nature. PET bottles offer excellent clarity and the power to carry carbonation, while rPET is gaining momentum as brands shift toward sustainability and reducing plastic waste. Increasing recycling technologies and regulatory support are driving the use of rPET, helping companies lower their carbon footprint while maintaining product quality and safety.

Packaging Type Insights

How Can Segment Dominate The Carbonated Soft Drinks (CSD) Packaging Market?

The can segment dominated the carbonated soft drinks (CSD) packaging market in 2024 due to its ideal ability to preserve carbonation, freshness, and shelf life of the product. They are lightweight in nature, stackable, and highly portable, making them convenient for both consumers and retailers. Cans, in particular, are widely used because they are 100% recyclable, without having a loss of global encouragement toward sustainability. Additionally, cans serve strong barrier properties against light and oxygen, ensuring taste consistency . With increasing consumer selection for eco-friendly packaging, and on-the-consumption, cans remain a main and growing segment in CSD packaging.

Bottles segment are expected to be the fastest in the market during the forecast period. They play a major role in the carbonated soft drinks sector, being the most common due to their cost-effectiveness and lightweight nature. They are easy to transport, resealable, and available in multiple sizes. Catering to both individual and family consumption. Glass bottles. Though less dominant currently, they are still valued for their luxury feel, strong carbonation and retention, and recyclability, often used by niche heritage brands. With growing demand for sustainability, the industry is increasingly accepting rPET bottles to reduce plastic waste and meet environmental goals, making bottles a versatile yet evolving solution in CSD packaging.

Regional Insights

How Did The North America Region Dominate The Carbonated Soft Drinks (CSD) Packaging Market?

North America dominated the carbonated soft drinks (CSD) packaging market in 2024, industry because it is growing steadily, driven by consumer choices, sustainability initiatives, and growth in packaging technologies. PET bottles, aluminium cans and glass bottles remain the primary formats, with PET bottles leading due to their durability, lightweight and convenience properties. However, rising environmental concerns are boosting the acceptance of recycled PET bottles and cans as both meet the circular economy rules and regulations. Additionally, growth in the ready-to-drink market, e-commerce, and on-the-go consumption has further accelerated the need for innovative packaging formats that balance sustainability, ease, and comfort, too, with carbonated soft drink packaging demands.

Asia Pacific is expected to grow in the market during the forecast period. The demand and production of carbonated soft drinks in the Pacific region are witnessing a dynamic shift fueled by innovation, sustainability, and evolving consumer behavior. It has come up as the fastest-growing region globally for CSD packaging, spurred by rapid urbanization, expanding middle-class populations, and shifting taste choices-particularly toward low-sugar, health-oriented, and on-the-go choices. Brands are feeding back by rolling out intelligent and portable designs, with PET bottles that track cost-efficiency and ease.

Carbonated Soft Drinks (CSD) Packaging Market Value Chain Analysis

Material Processing and Conversion: The material processing and conversion of CSD packaging count on transforming raw materials like PET, rPET, and aluminium cans and paperboard into functional beverage containers. PET and rPET experience polymerization, extrusion, and blow molding to generate shatter-resistant bottles. Aluminum is rolled into sheets, printed, and deep-drawn into smooth cans, valued for their recyclability and product protection.

Package Design and Prototyping: Package design and prototyping in this kind of CSD packaging concentrate on creating a functional. Sustainable and visually appealing solutions that balance consumer convenience with brand identity. The design stage counts conceptualising shapes, sizes, and materials that develop shelf presence while maintaining durability and carbonation retention.

Logistics and Distribution: This space plays a crucial role in making sure beverages reach retailers and consumers efficiently while tracking product quality. The procedure counts on optimised warehousing, palletization, and transportation strategies to handle high volumes of bottles, cans, or glass containers. Packaging is crafted for durability, stackability, and space efficiency, reducing the risk of leakage, breakage, or loss of carbonation during transit.

Leading Companies In Carbonated Soft Drinks (CSD) Packaging Market

- Crown Holdings

- Ball Corporation

- Graham Packaging

- Silgan Plastics

- Owens-Illinois (O-I)

- Ardagh Group

- Tetra Pak

- Owens Battery (part of O-I)

- Smurfit Kappa (carton focus)

- Plastipak Holdings

- ARCA Continental (packaging)

- Berlin Packaging

- International Beverage Packaging (Sealed Air)

- Gerresheimer (glass)

- Consol Glass

- Ball Aerocan Holdings (darts)

- Smurfit Kappa Group

- DS Smith (corrugated multi-pack)

- WestRock (multi-pack/carton)

- Amcor

Latest Announcements by Industry Leader

- Twelium Industrial Company, which is West Africa’s largest manufacturing company, had collaborated with Sidel with a current ultra-modern facility located in Kumasi, Ghana, a green field project housing two complete rPET Packaging lines for constant and carbonated beverages.

- In May 2025, Coca-Cola, which is India’s favourite flavourful beverage company, Fanta had committed its position as the uncontrovertible leader in the orange-flavored carbonated soft drink space, commanding over 50% market share.

Recent Developments

- In March 2025, Evocus, which is one of the inventive beverage brands, changed the drink experience completely by introducing the launch of its current creation, Black soda.

- In February 2025, Coca-Cola will be penetrating the market again with its latest displacement of “Simply Pop”, which is a prebiotic soda as it finds to enter consumer urge of gut-health-focused drinks, a rising but still main category as said by analysts.

Segmentation Of Carbonated Soft Drinks (CSD) Packaging Market

By Material

- Metal (mainly aluminum cans)

- Plastic (primarily PET and rPET bottles)

- Glass Bottles

- Paper / Carton

By Packaging Format / Type

- Cans

- Bottles (plastic, glass)

- Cartons / Cartons-on-the-go

- Others (e.g., eco-pouches, multi-packs)

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait