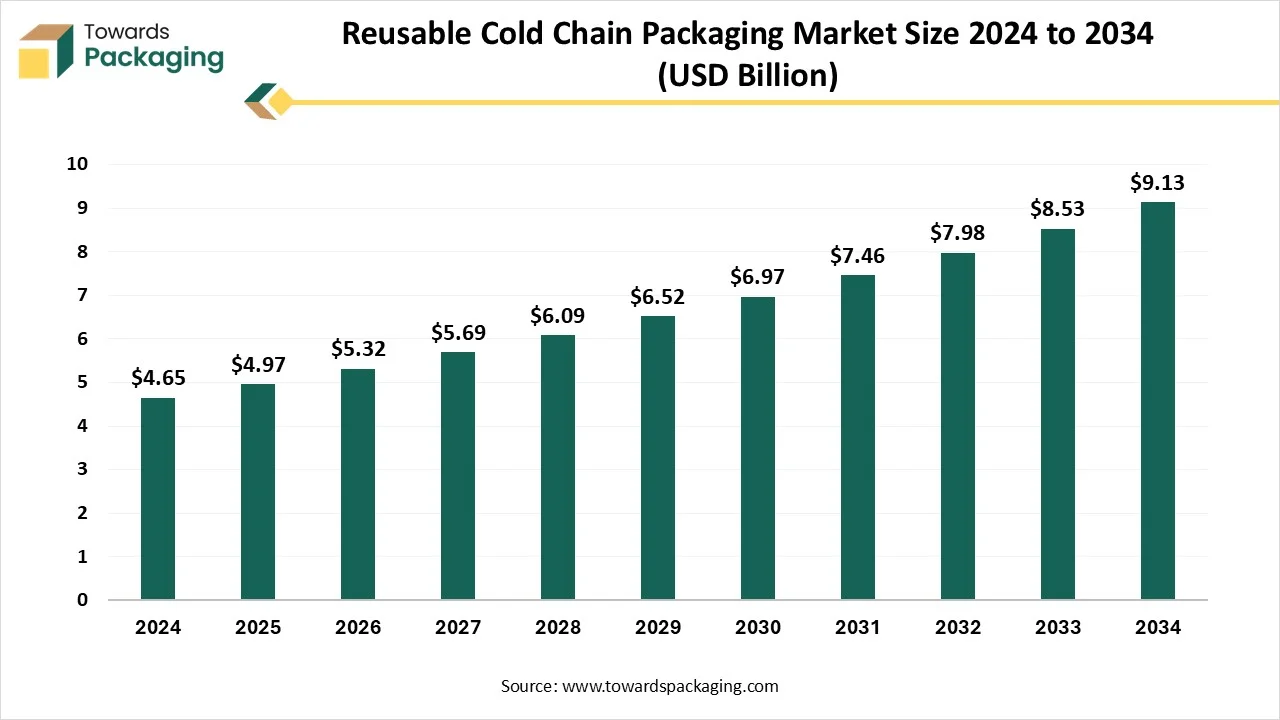

The reusable cold chain packaging market is forecasted to expand from USD 5.32 billion in 2026 to USD 9.77 billion by 2035, growing at a CAGR of 6.98% from 2026 to 2035. This report covers in detail how sustainability pressures, rising pharma and biologics shipments, and temperature-controlled food and beverage e-commerce are shaping demand. It provides full statistical coverage of market size and growth, granular segment data by product type (reusable insulated boxes & containers, pallet shippers, VIP containers, PCM packs, thermal blankets/covers), material type (plastic, metal, composites, wood), add-on features (IoT, PCM, sensors, tamper-evident, bio-based insulation), and applications (pharmaceuticals & healthcare, food & beverage, e-commerce & meal kits, industrial chemicals, clinical research & biotech).

Reusable cold chain packaging refers to temperature-controlled packaging solutions that are specifically designed to be used multiple times for the safe transportation and storage of perishable or temperature-sensitive products such as pharmaceuticals, biologics, fresh food, dairy, and seafood. These packaging systems maintain a consistent internal temperature over a defined period by utilizing advanced insulation materials, such as phase change materials (PCMs), vacuum-insulated panels (VIPs), and gel packs.

Unlike single-use packaging, reusable systems are built with durable, hygienic, and easy-to-clean materials to withstand repeated use across logistics cycles. They often include features like real-time temperature tracking, tamper resistance, and modular designs for efficient storage and transport. Reusable cold chain packaging contributes to environmental sustainability by reducing packaging waste and lowering carbon emissions. It also offers cost benefits in the long run by minimizing the need for constant repurchasing and reducing spoilage losses.

There’s a marked shift toward reusable and pooled packaging systems companies and consumers are increasingly demanding alternatives to single‑use materials to minimize environmental impacts. Closed‑loop models (e.g., RPC pooling like IFCO SmartCycle) that emphasize reuse, return, cleaning, repair, and redistribution are gaining traction in fresh produce and other perishables. Operators are exploring biodegradable and plant‑based insulation materials (e.g., bio‑PCMs, biopolymers, dairy‑protein films) to reduce carbon footprint and comply with tightening ESG and regulatory demands.

IoT‑enabled reusable packaging is emerging smart shippers now include temperature, humidity, GPS/location sensors, and RFID for real‑time tracking and transparency. Breakthroughs like Ember’s Cube, a reusable, self‑refrigerated, sensor‑enabled shipping box that can maintain precise temperatures for over 72 hours while transmitting live data, illustrate commercial deployment of these capabilities. Active packaging innovations (e.g., antimicrobial films, oxygen/ethylene scavengers, thermochromic inks, NFC/RFID labels) are being integrated into cold chain containers to extend shelf life, monitor spoilage, and secure product integrity.

Advanced insulation materials phase change materials (PCMs), vacuum-insulated panels (VIPs), and reusable gel packs, are being optimized for better thermal performance, lightweight design, and reusability.

Battery-powered and thermoelectric containers (e.g., Ember Cube) are revolutionizing the space by eliminating the need for dry ice or gel packs. They maintain precise temperature ranges (e.g., 2–8°C) for 48–72+ hours and include IoT sensors that track temperature, light, tilt, and location. Ideal for high-value pharma or biologics where integrity must be digitally proven at every step.

Companies are adopting shared, standardized reusable containers like reusable plastic crates (RPCs), bins, and totes used in circular logistics models. Providers like IFCO and Tosca enable "crate pooling" to deliver, retrieve, sanitize, and reuse across industries like produce, dairy, meat, and even meal kits. Cuts down packaging waste and logistics costs, while aligning with corporate ESG goals.

A major shift is happening from EPS (expanded polystyrene) to bio-foam, starch blends, wool-based liners, and plant-derived PCMs (phase change materials). These materials match thermal efficiency while being compostable, making them suitable for last-mile delivery of groceries or seafood. Examples include TemperPack’s ClimaCell and Green Cell Foam.

New containers are being designed to carry products with different temperature needs in a single unit, especially for mixed cold-chain loads. This is particularly useful in the food industry (e.g., frozen fish + fresh vegetables), as well as pharma (e.g., biologics + room-temp diagnostics).

Integration of NFC, RFID, Bluetooth Low Energy (BLE), and GPS sensors to log real-time data on temperature excursions, location, and humidity. Some are adopting blockchain to create tamper-proof cold chain logs, especially for vaccine compliance (WHO, FDA). Startups and platforms like Tive, Roambee, and Sensitech are driving this tech forward.

The rise of automated guided vehicles (AGVs) and robotic picking systems demands cold chain containers that are machine-compatible, stackable, and modular. Reusable totes and shippers are being re-engineered for standard size formats, uniform bases, and RFID tags for seamless scanning. Drives efficiency in large-scale cold storage and fulfillment centers (e.g., Amazon Fresh, Ocado).

As personalized medicine grows, there’s high demand for high-precision, small-batch, reusable cold chain shippers used in trial samples and therapies. These containers offer tight control (2–8°C, CRT, -20°C, or even cryo temps) with digital logging and multiple reuses over months. Vendors like Cryoport and Pelican BioThermal are innovating in this niche.

New reusable cold chain containers are modular and collapsible, allowing for compact return logistics and flexible configuration. Stackability and space optimization are key for reducing transport volume, especially in global vaccine shipments or cross-border food exports.

Security is being embedded into cold chain containers through tamper-evident seals, geofencing, smart locks, and sensor-triggered alerts. Ensures regulatory compliance for sensitive shipments (e.g., narcotics, COVID/HPV vaccines, monoclonal antibodies).

Logistics players are introducing “return logistics as a service” for cold chain packaging handling, container returns, cleaning, refurbishment, and redistribution. Companies like UPS Healthcare and DHL SmartSensor offer full cold chain lifecycle services for pharma and diagnostics customers. Promotes reuse rates of 20–40 cycles, reducing total cost of ownership and landfill waste.

Cold chain packages now feature thermochromic inks, spoilage indicators, or irreversible time-temperature indicators (TTIs). These provide visual assurance that goods remained within safe temperature ranges, even when not connected to digital systems.

Cold chain packaging systems are getting AI-powered analytics dashboards for predictive maintenance, usage planning, and risk alerts. Digital twins simulate real-world usage of shippers, allowing brands to optimize container choice and plan more efficient reuse cycles.

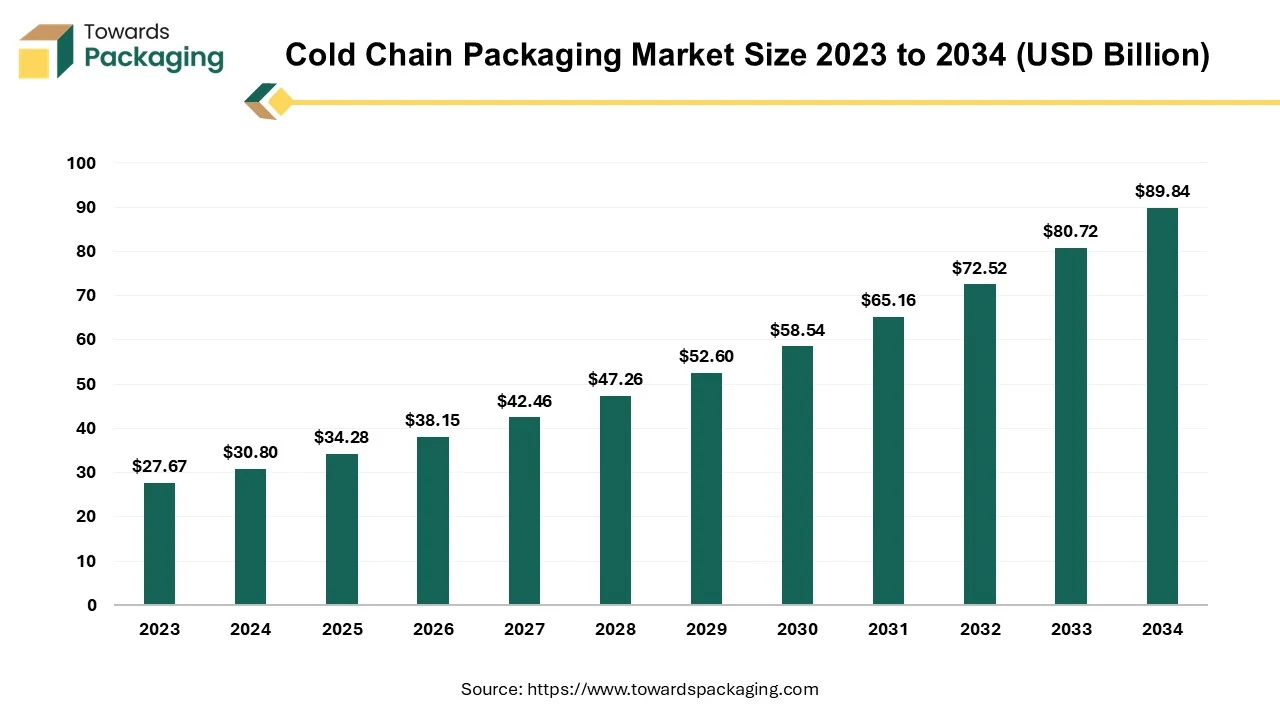

The cold chain packaging market size reached USD 34.28 billion in 2024 and is projected to reach USD 89.84 billion by 2034, with a CAGR of 11.3%. The reason behind this growth is the increasing global demand for safe transportation and storage of perishable goods and temperature-sensitive pharmaceuticals. Additionally, advancements in smart packaging technologies and sustainable materials are improving efficiency and reliability across supply chains.

Cold chain packaging is known as specialized temperature-controlled packaging designed to maintain the safety, freshness, and stability of perishable goods during transportation and storage. It is an important part of the cold supply chain, ensuring that products such as food, vaccines, pharmaceuticals, and biologics remain within specific temperature ranges to prevent spoilage or degradation.

The cold chain packaging maintains temperatures from frozen (-20°C to -80°C), refrigerated (2°C to 8°C), or controlled room temperature (15°C to 25°C). The cold chain packaging uses materials like polystyrene, polyurethane foam, vacuum-insulated panels, and seaweed-based bioplastics to prevent heat transfer. The cold chain packaging has special gels or liquids that absorb and release heat to stabilize temperature inside the packaging.

AI integration is significantly enhancing the reusable cold chain packaging market by improving efficiency, sustainability, and shipment integrity. One of the key applications is predictive analytics, where AI analyzes real-time and historical sensor data such as temperature, humidity, and shock to anticipate and prevent temperature excursions. This ensures the safe delivery of perishable or sensitive goods. Additionally, AI-powered logistics systems optimize delivery routes by considering factors like traffic, weather, and customs delays, enabling dynamic rerouting and minimizing the risk of spoilage.

Computer vision technologies powered by AI are being used for quality assurance, detecting damage, contamination, or tampering during both the dispatch and return processes. In terms of thermal efficiency, AI helps optimize the use and placement of phase change materials (PCMs), ensuring accurate temperature control while reducing energy waste. Furthermore, AI supports inventory and pooling management by forecasting demand and automating container redistribution across storage hubs, avoiding shortages or bottlenecks.

On the regulatory front, AI simplifies compliance by generating accurate temperature logs, audit reports, and chain-of-custody documentation. This builds trust with clients and ensures adherence to industry standards, especially in pharmaceuticals and food logistics. Sustainability efforts are also strengthened, as AI conducts lifecycle assessments to monitor carbon emissions and recommends environmentally friendly materials and designs. Finally, the adoption of digital twin technology allows companies to simulate real-world performance of packaging systems, test reuse cycles, and refine their operations before physical deployment.

Rising Focus on Sustainability and Waste Reduction

Industries are increasingly adopting eco-friendly and circular packaging systems to reduce single-use plastic waste. Reusable packaging aligns with global ESG goals, government regulations (like Extended Producer Responsibility), and brand image improvement. It helps companies meet zero-waste goals by minimizing landfill contributions from traditional cold chain materials like EPS and Styrofoam.

Complexity in Reverse Logistics & Lack of Standardization Across Industries

The key players operating in the market are facing issues due to a lack of standardization across industries and complexity in reverse logistics. Effective reuse requires a reliable reverse logistics system to collect, clean, inspect, and redistribute used containers. In regions with poor logistics infrastructure, this process is costly, inefficient, or unavailable, reducing the feasibility of reuse. The absence of uniform standards for reusable container sizes, materials, labeling, and sensor technologies creates incompatibilities across supply chains.

Companies often stick to their own packaging models, limiting shared use and economies of scale. Emerging economies often lack the infrastructure, digital capabilities, and regulatory enforcement required for reusable cold chain systems. Lack of awareness and limited skilled labor further restricts adoption. Example: In India or Sub-Saharan Africa, many rural areas still rely on ice boxes or non-insulated containers.

The rise of personalized medicine, biologics, cell and gene therapies, and temperature-sensitive vaccines requires high-performance cold chain packaging that ensures security, traceability, and compliance. These products often have narrow thermal margins and are shipped globally perfect for smart, reusable containers with sensors. Design high-value reusable packaging for healthcare and pharma clients demanding regulatory-compliant, trackable logistics.

Consumers increasingly order perishable items like dairy, meats, seafood, frozen foods, and meal kits online, necessitating cost-effective, durable, and insulated packaging. Reusable packaging reduces per-order cost over time and enhances brand sustainability. Partner with online grocers, quick commerce firms, and meal delivery brands to provide reusable, returnable cold packaging solutions.

Companies are moving toward packaging-as-a-service (PaaS) or cold-chain-as-a-service, where the provider handles not only the packaging but also return logistics, cleaning, and maintenance. This lowers the barrier for clients and encourages adoption. Build subscription-based or rental models for reusable containers with tracking, cleaning, and lifecycle support.

Smart reusable packaging with temperature sensors, GPS, RFID, and predictive analytics is gaining demand in pharma, food, and logistics. These platforms offer real-time alerts, digital compliance records, and risk mitigation. Develop or integrate with AI-enabled platforms that provide end-to-end monitoring and optimize reuse cycles.

Warehouse automation and robotic fulfillment centers (used by Amazon, Ocado, etc.) require standardized, stackable, and machine-readable containers. Reusable packaging designed for automation boosts speed and efficiency in cold storage and distribution. Design reusable containers that integrate with automated cold chain systems and AGVs (automated guided vehicles).

Reusable insulated boxes and containers are the dominant product type in the reusable cold chain packaging market due to their versatility, durability, and high thermal performance. These containers are designed to maintain stable temperatures for extended periods, making them ideal for transporting temperature-sensitive goods such as pharmaceuticals, fresh produce, and dairy products. Their sturdy construction supports multiple reuse cycles, reducing packaging waste and offering long-term cost savings. Additionally, they are easy to handle, stack, and clean, making them suitable for both short- and long-distance logistics. The rising demand for sustainable, efficient, and regulatory-compliant packaging solutions further strengthens their widespread adoption across industries.

Reusable pallet shippers are the fastest-growing product type segment in the reusable cold chain packaging market due to their ability to handle large-volume, temperature-sensitive shipments efficiently across industries like pharmaceuticals, e-commerce, and food logistics. Their advanced insulation, often using phase-change materials and vacuum panels, ensures extended cold retention for long-distance transport. These pallet-sized solutions are highly durable, stackable, and compatible with automation systems, making them ideal for streamlined supply chains. Additionally, features such as IoT-enabled tracking, real-time temperature monitoring, and modular designs enhance visibility and compliance. The growing demand for sustainable, cost-effective, and returnable packaging solutions further accelerates their adoption in closed-loop logistics systems.

The plastic segment holds dominance in the reusable cold chain packaging market due to its superior durability, lightweight nature, and cost-effectiveness. Plastics such as polypropylene and polyethylene offer excellent insulation properties and resistance to moisture, chemicals, and physical impacts, making them ideal for preserving product integrity during transit. Their reusability, easy moldability into various packaging formats, and compatibility with temperature-sensitive goods, especially in the pharmaceutical and food industries, further enhance their preference. Additionally, plastic packaging solutions are easier to clean and sanitize, supporting hygiene standards. The growing development of recyclable and sustainable plastic options also contributes to their continued market dominance.

The composite or metal-based containers segment is the fastest-growing material-type segment in the reusable cold chain packaging market due to its exceptional strength, durability, and long service life. These materials offer superior thermal insulation, corrosion resistance, and structural integrity, which are critical for transporting high-value or highly sensitive products such as pharmaceuticals, biologics, and specialty chemicals. Unlike traditional materials, composite or metal containers can withstand extreme temperatures and rough handling, reducing the risk of product spoilage or damage. Additionally, their robust construction supports multiple reuse cycles, aligning with sustainability goals and reducing long-term costs. The increasing demand for high-performance packaging in global logistics and stringent regulatory standards for cold chain compliance further drive the rapid adoption of this segment.

The PCM (Phase Change Material) PACS segment is the dominant add-on feature in the reusable cold chain packaging market due to its superior ability to maintain precise temperature ranges over extended durations. PCM PACS absorb and release thermal energy during phase transitions, ensuring consistent internal temperatures even in fluctuating external environments. This makes them ideal for highly sensitive products like vaccines, biologics, and perishable foods. Their reusability, non-toxic nature, and compatibility with various container types enhance operational efficiency. As regulatory standards tighten and demand for ultra-cold and controlled room temperature shipping increases, PCM PACS offers a reliable, energy-efficient, and cost-effective cold chain solution.

Internet of Things (IoT)-enabled tracking containers are the fastest-growing add-on features segment in the reusable cold chain packaging market due to their ability to provide real-time monitoring of temperature, humidity, location, and shock during transit. This enhanced visibility helps ensure product integrity, especially for sensitive pharmaceuticals, biologics, and perishable foods. IoT solutions support compliance with stringent regulatory requirements and enable quicker response to any deviations, reducing spoilage and losses. Additionally, the data generated improves supply chain transparency, efficiency, and predictive maintenance. As industries shift toward smarter logistics and traceability, the demand for IoT-integrated packaging solutions continues to accelerate rapidly.

The pharmaceutical and healthcare segment dominates the reusable cold chain packaging market due to the critical need for temperature-sensitive transportation of vaccines, biologics, insulin, blood products, and other life-saving drugs. Strict regulatory requirements from agencies like the FDA and WHO mandate consistent temperature control, which reusable cold chain solutions effectively provide. These packaging systems ensure product efficacy, reduce spoilage, and support long-distance shipments with minimal risk. Additionally, the rise in global vaccination programs, clinical trials, and biopharmaceutical innovations increases the demand for reliable cold chain logistics. The reusability aspect also supports sustainability goals and cost-efficiency, making it the preferred choice for healthcare logistics.

The e‑commerce and meal kit delivery segment is the fastest‑growing in the reusable cold chain packaging market due to several key drivers. First, the explosive expansion of online grocery and meal‑kit services has created high demand for temperature‑controlled packaging tailored to small, diverse orders from single meals to full-box kits while maintaining product freshness. Second, companies are investing in innovative modular, multi‑compartment designs and dynamic insulation systems that can adapt to varying contents and transit times, increasing efficiency and reducing waste. Third, consumer pressure for sustainable, reusable, and returnable solutions has pushed brands to launch reverse‑logistics programs and eco‑friendly cold pack materials. Finally, real‑time IoT thermal monitoring enables better quality control and fewer spoilage losses, making reusable systems cost‑effective at scale.

North America dominates the reusable cold chain packaging market due to its well-established cold chain infrastructure, high adoption of advanced logistics technologies, and strong regulatory compliance across key industries such as pharmaceuticals, food, and biotechnology. The region benefits from the widespread implementation of IoT-enabled smart packaging solutions, which enable real-time tracking and enhanced product safety.

The presence of major players offering reusable packaging-as-a-service and reverse logistics systems supports scalable reuse models. Growing demand from online grocery, meal-kit delivery, and temperature-sensitive biologics further accelerates adoption. Environmental regulations and a strong emphasis on sustainability also drive the shift from single-use to durable, eco-friendly cold chain packaging solutions.

U.S. Market Trends

The U.S. is the largest and most dominant market in North America due to its robust cold chain infrastructure, technological innovation, and strict regulatory standards for pharmaceuticals and food safety. High demand from sectors such as biotech, specialty pharmaceuticals, online grocery, and food export drives reusable packaging adoption. Strong presence of global vendors like Sonoco ThermoSafe, Pelican BioThermal, and Cold Chain Technologies ensures availability of smart, reusable systems. Increasing emphasis on ESG goals, waste reduction, and FDA/CDC compliance further propels the shift to reusable formats.

Canada Market Trends

Canada is experiencing steady growth in reusable cold chain packaging, primarily driven by its strong environmental regulations, eco-conscious consumers, and growing pharmaceutical and food exports. Federal and provincial waste reduction initiatives are pushing logistics and food companies to adopt reusable containers. Expansion in meal-kit services, cross-border cold shipments, and temperature-sensitive vaccine logistics supports further market development. Government support for sustainable packaging innovation is also boosting local startups and cold chain infrastructure investment.

The Asia-Pacific region is growing at the fastest rate in the reusable cold chain packaging market due to rapid industrialization, rising demand for temperature-sensitive pharmaceuticals, and increasing exports of perishable food products such as seafood, fruits, and dairy. Countries like China, India, and Japan are investing heavily in cold chain infrastructure, supported by government initiatives and foreign direct investments. The expansion of e-commerce grocery delivery and urbanization is driving the need for reliable, cost-efficient cold logistics. Additionally, growing environmental awareness and regulations are encouraging the shift from single-use to reusable solutions, making Asia-Pacific a key growth hub for sustainable cold chain packaging.

China Market Trends

China leads the Asia-Pacific region due to its massive food processing industry, biopharma production, and export-driven economy. The government’s "Cold Chain Logistics Development Plan (2021–2025)" is accelerating infrastructure upgrades. Rapid growth in fresh e-commerce, dairy, and seafood exports drives demand for reusable and insulated packaging. Major logistics providers are adopting smart, reusable containers for better traceability and temperature control. Rising environmental regulations also push the transition from disposable to multi-use packaging.

India Market Trends

India is experiencing significant momentum due to its booming pharma exports, agri-food supply chain, and growing cold storage capacity. Government programs like PM Gati Shakti and PLI schemes are promoting cold chain development. Increasing adoption of vaccines, specialty drugs, and frozen foods creates a strong case for reusable packaging. Startups and logistics firms are exploring low-cost reusable containers to cut per-trip packaging waste. Challenges in reverse logistics remain, but urban hubs like Mumbai, Delhi, and Bengaluru are showing early adoption.

Japan Market Trends

Japan has a mature cold chain ecosystem with high standards for food safety, pharma logistics, and precision agriculture. The country is embracing smart reusable packaging with embedded IoT for traceability. Consumer demand for fresh, minimally processed food and eco-conscious packaging is fueling innovation. Government incentives for sustainable logistics practices support the reusable transition.

South Korea Market Trends

South Korea is emerging as a hub for tech-enabled cold logistics, driven by its strong pharmaceutical and e-commerce sectors. Investment in AI, robotics, and smart packaging enables efficient reuse cycles. High digital readiness and sustainability goals are encouraging businesses to adopt connected, reusable containers. Major food exporters and K-pharma players are driving demand for cold chain consistency and packaging innovation.

Australia Market Trends

Australia’s cold chain demand is growing due to its exports of meat, dairy, seafood, and wine. Reusable packaging is being adopted to meet international shipping standards and reduce single-use plastics. Cold chain players are experimenting with modular, collapsible, and insulated reusable packaging for regional and international logistics.

Europe’s Stringent Regulatory Laws to Promote Notable Growth

Europe is growing at a notable rate in the reusable cold chain packaging market due to its strong regulatory framework, emphasis on sustainability, and advanced logistics infrastructure. The European Union’s strict regulations on packaging waste and single-use plastics, combined with its circular economy policies, are encouraging companies to shift toward reusable solutions. Additionally, rising demand for temperature-sensitive pharmaceuticals, biologics, and specialty foods across the region is fueling the adoption of durable, insulated, and trackable cold chain containers.

Countries like Germany, France, and the Netherlands are leading in cold chain innovation, supported by public-private partnerships and investment in smart logistics technologies. The region's consumer preference for eco-friendly packaging and increasing e-commerce penetration also contribute significantly to market growth.

By Product Type

By Material Type

By Add-On Features

By Application

By Region

February 2026

February 2026

February 2026

February 2026