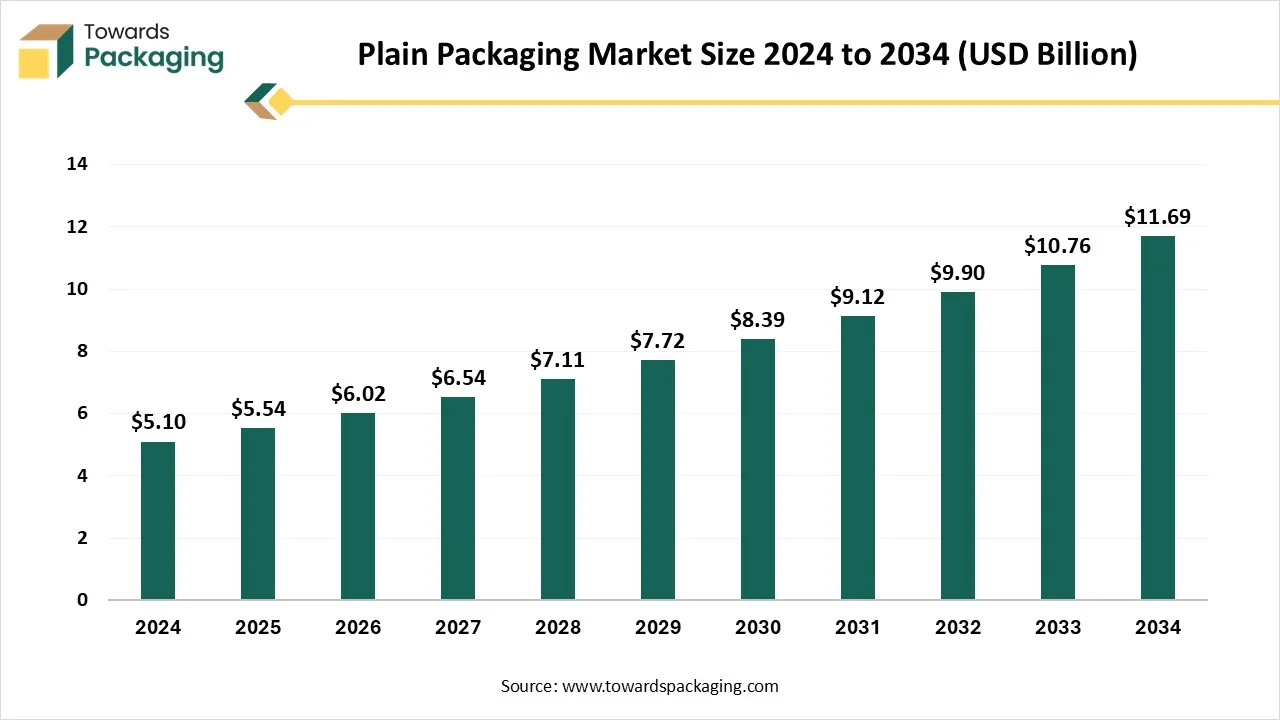

The plain packaging market is extensively analyzed in this report, covering global market size (USD 5.54 billion in 2025) and its projected expansion to USD 11.69 billion by 2034 at a CAGR of 8.65%. The study includes detailed segmentation by material type, product type, printing technology, compliance level, and end-use industry. It also provides complete regional insights across North America, Europe, Asia-Pacific, Latin America, and MEA, along with competitive analysis of major players, value chain assessment, trade flows, and detailed manufacturer–supplier data.

The plain packaging market refers to the global industry associated with the production, supply, and distribution of generic, standardized packaging products that exclude logos, colors, brand imagery, or promotional information. Plain packaging was first introduced by Australia in December 2012 to reduce the appeal of cigarettes and reduce smoking rates. Now, several countries around the world are implementing plain packaging laws. This market has gained momentum due to regulatory mandates in industries such as tobacco, cannabis, and pharmaceuticals, and is also expanding across FMCG, food & beverage, and private-label retail sectors.

Rising Public Health Awareness Regarding the Consumption of Harmful Products

The increasing consumer awareness is expected to boost the growth of the plain packaging market during the forecast period. The market has witnessed the growth of public health consciousness regarding the risks associated with potentially harmful products, especially tobacco, and plain packaging aligns with the regulations to deter smoking. Plain packaging, with its basic or unattractive design and alarming health warnings, results in reducing the appeal of tobacco, particularly among young people, and enhances the effectiveness of health warnings. Several studies have shown the transformative impact of plain packaging, such as reducing the appeal of tobacco, which further minimizes smoking rates.

Industry Objections and Legal Challenges

Industry resistance and legal challenges are anticipated to hinder the market’s growth. The market has witnessed the resistance and legal challenges posed by tobacco companies. Tobacco companies often legally challenge these regulations in the judicial system, stating that these regulations of the government violate intellectual property rights and trademarks. In addition, the lack of branding can often lead to more price-based competition, potentially affecting manufacturers' profits are likely to limit the expansion of the global plain packaging market.

How are the Rising Government Regulations Offering Growth Opportunities to the Plain Packaging Market?

The expansion of plain packaging regulations is projected to offer lucrative growth opportunities to the plain packaging market in the coming years. Several governments around the world are increasingly embracing plain packaging laws, particularly for tobacco, cannabis products, and other potentially harmful products such as sugary beverages, alcoholic beverages, and high-calorie snacks. The implementation of plain packaging discourages the consumption of such unhealthy products and assists in promoting public health. Many more countries are adopting plain packaging laws that are committed to combating tobacco use through innovative policies, which has led to an increasing demand for plain packaging solutions offering lucrative opportunities for manufacturers to expand their product offerings and geographical reach.

The paper & paperboard segment held a dominant presence in the plain packaging market in 2024, driven by the recyclability and biodegradability attributes. Paper and paperboard are most commonly used in the plain packaging market, owing versatility, strength, and eco-friendly properties. The dependency on recycled and biodegradable packaging materials results in optimized resource utilization and significantly lowers carbon emissions. Governments' stringent regulations on waste management practices compel businesses to adopt sustainable practices. On the other hand, the plastic segment is expected to grow at a notable rate. Plastics, plain packaging materials offer durability, versatility, cost-effectiveness, and excellent barrier properties, safeguarding the enclosed products from unfavourable environmental conditions.

By product type

The boxes & cartons segment accounted for the dominating share in 2024. Plain boxes and cartons are widely available in various sizes and shapes to suit different product needs. Boxes and cartons are increasingly becoming the common choices for plain packaging. Several companies are offering customized plain packaging solutions, allowing companies to specify material, size, and add basic logos or text within regulatory guidelines. The boxes & cartons are also designed to align with sustainable practices, reduce waste, and improve environmental sustainability.

On the other hand, the pouches & sachets packaging segment is expected to witness a significant share during the forecast period. Pouches and sachets are small, flexible, lightweight, and are generally made from materials like paper, plastic film, and foil. Pouches and sachets are commonly used in plain packaging, owing to their cost-effectiveness, portion control, convenience, and preservation attributes. They are particularly useful for single-use or sample-sized portions of products and find their application in packaging various tobacco products, including chewing tobacco, rolling tobacco, and snus.

The offset printing dominated the plain packaging market in 2024. Offset printing is gaining immense popularity in the plain packaging market, owing to its various benefits such as cost-effectiveness, high quality, and versatility. Offset printing is particularly well-suited for printing large quantities of packaging. This offset printing ensures high-quality prints and consistency, crucial for maintaining plain packaging. On the other hand, the reusable loop containers segment is expected to grow at a notable rate during the forecast period. The growth of the segment is mainly driven by the growing demand for personalized and sustainable packaging solutions. Digital printing technology for plain packaging can handle short print runs and personalization.

By Compliance

The regulated plain packaging segment accounted for the highest revenue share in 2024. The expansion of plain packaging regulations for tobacco, cannabis, and potentially harmful goods like alcohol, sugary beverages, and others. The regulatory measure removes all promotional, marketing, and advertising features and replaces them with graphic health warnings, standardized fonts for brand names, and various other government-mandated information. Several governments have increased the size of the health warnings, along with the introduction of plain packaging solutions. On the other hand, the voluntary minimalist branding segment is expected to grow at a significant rate. The voluntary minimalist branding emphasizes removing logos, brand images, promotional information, and only distinctive colors. These packages come in a standard font, large graphic health warning, and a shift away from overly branded or complex packaging.

The tobacco segment is expected to dominate the plain packaging market. The growth of the segment is primarily driven by the rising expansion of plain packaging in the tobacco industry. Plain packaging of tobacco products removes branding elements such as no colours, no logos, no glamour, and replaces them with graphic health warnings. Plain packaging laws aim to reduce the allure of tobacco products, especially among the young generation and and reduce the impact of branding on consumer choices. Several countries across the globe have implemented plain packaging laws to discourage the consumption of tobacco.

Europe held the largest share of the plain packaging market in 2024. Europe has well-established packaging practices and the presence of a stringent regulatory framework. Government regulations are aimed at combating tobacco consumption and promoting healthier lifestyles, particularly among the young generation. Plain packaging laws limit the appeal of tobacco products by standardizing packaging, removing the promotional, marketing, and advertising features, and leaving the health warnings as mandated by the government. This region represents potential for the plain packaging market owing to the various combinations of factors such as rising demand from the tobacco industry, rising focus on reducing brand influence, increasing sustainability concerns, and a surge in public health initiatives.

The expansion of FMCG, food & beverage, and private-label retail sectors is expected to fuel the market’s expansion. This combination of factors is expected to propel the market expansion in the region. On the other hand, Asia Pacific is anticipated to grow at the fastest rate in the plain packaging market during the forecast period. The growth of the region is driven by the stricter government regulations, increasing awareness about potential health risks associated with tobacco consumption, the rising expansion of online & private-label retail sectors, and increasing focus on reducing the brand influence through packaging.

Governments and health organizations in the region are increasingly recognizing the health impact of tobacco consumption and implementing various stringent regulations aimed at reducing the demand for harmful products, particularly tobacco. The continuous research and development efforts by prominent players to improve the properties of plain packaging materials, accelerating the revenue growth of the regional market. Moreover, government-led sustainability initiatives have significantly increased the adoption of eco-friendly packaging materials, recyclable, reusable, and biodegradable, propelling the market’ expansion in the Asia Pacific region during the forecast period.

By Material Type

By Product Type

By Printing Technology

By Compliance Level

By End-Use Industry

By Region

January 2026

January 2026

January 2026

January 2026