Rigid Paper Packaging Market Outlook Growth Trends, Segmental Data, Regional Breakdown, Companies & Supply Chain Assessment

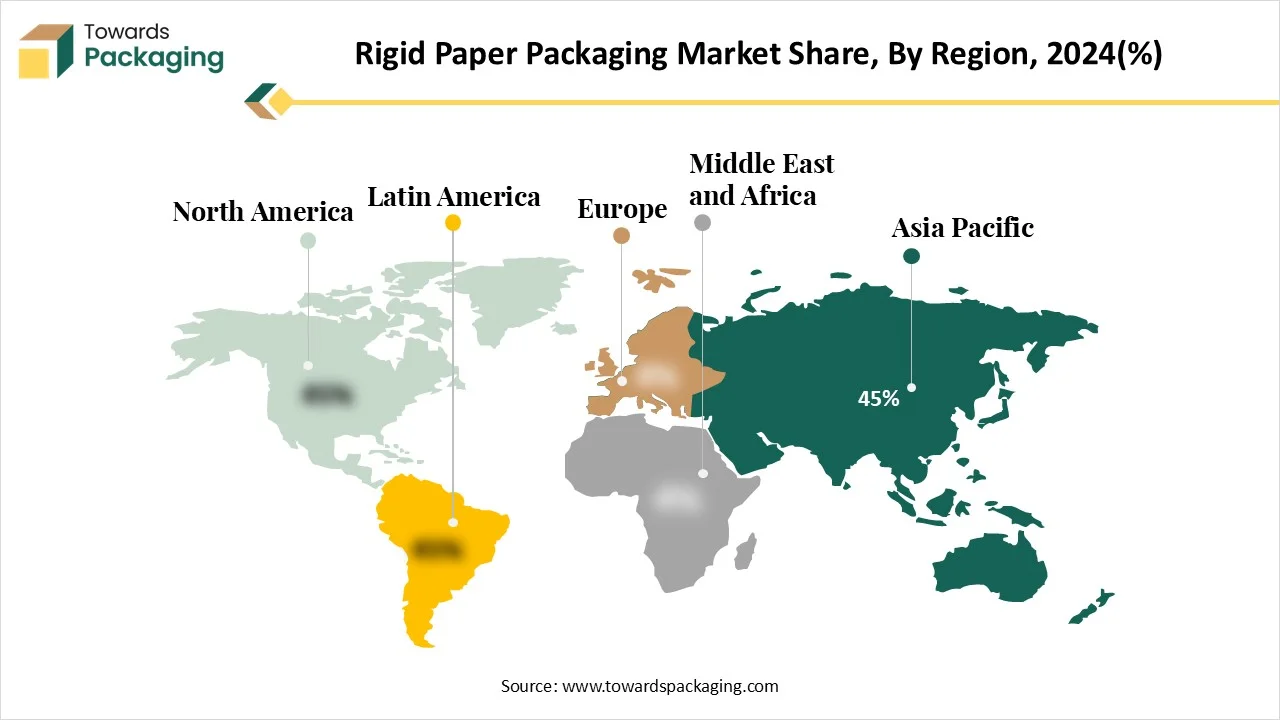

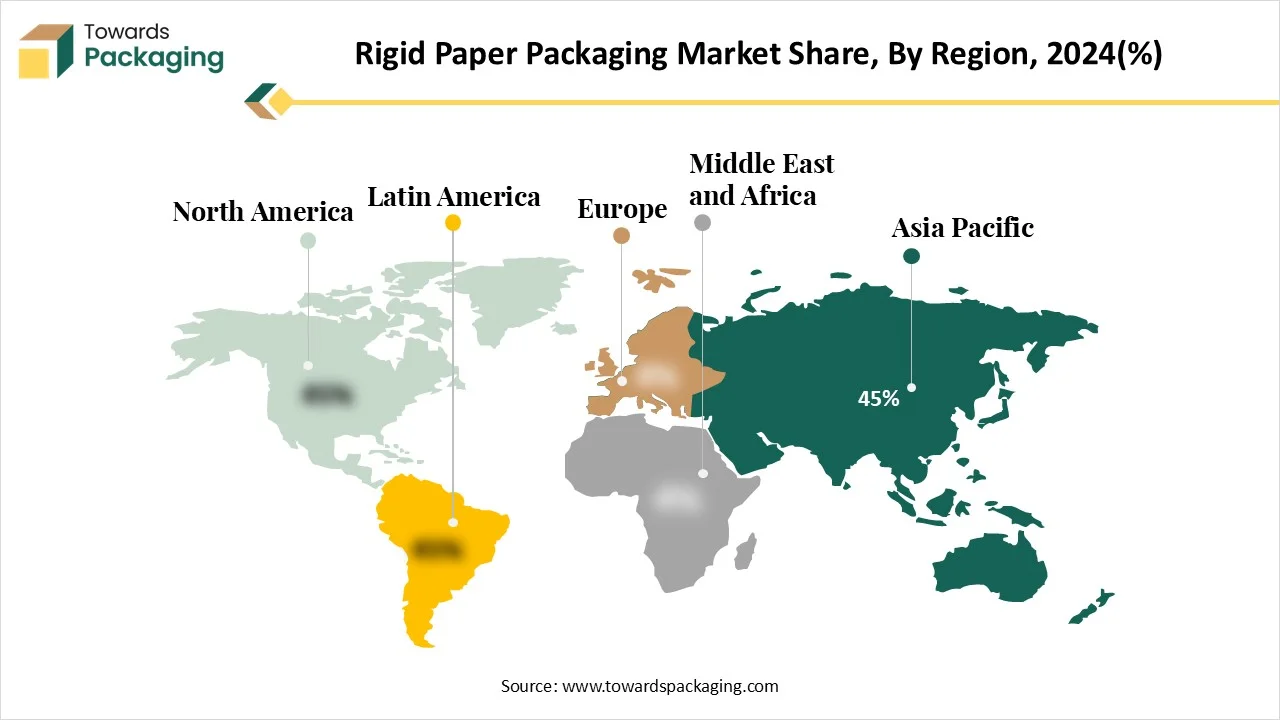

The rigid paper packaging market is expanding rapidly, supported by detailed coverage of market size, growth drivers, emerging trends, and segment-wise performance across material type, packaging formats, applications, and end-use industries. This report highlights regional dynamics across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, including APAC’s 45%+ dominance in 2024. It also incorporates comprehensive competitive analysis featuring major companies like International Paper, DS Smith, Mondi, Smurfit Kappa, and WestRock, alongside value chain mapping, trade flow details, manufacturing footprints, and supplier network insights.

Key Insights

- Asia Pacific dominated the global market by holding more than 45% of the market share in 2024.

- Asia Pacific dominated the global market with the largest share in 2024.

- Europe is expected to grow at a notable CAGR from 2025 to 2034.

- By material type, the corrugated fibreboard segment contributed the biggest market share of 50% in 2024.

- By material type, the moulded fibre segment will be expanding at a significant CAGR between 2025 and 2034.

- By packaging format, the boxes & cartons segment contributed the biggest market share of 60% in 2024.

- By packaging format, the tubes & cylinders segment is expected to expand at a significant CAGR between 2025 and 2034.

- By end-use industry, the food & beverage segment held the major market share of 35% in 2024.

- By end-use industry, the personal care & cosmetics segment is projected to grow at a CAGR between 2025 and 2034.

- By application, the secondary packaging segment contributed the biggest market share of 40% in 2024.

- By application, the primary packaging segment is expanding at a significant CAGR between 2025 and 2034.

Market Overview

The rigid paper packaging market involves paper-based packaging formats that retain their shape and offer durability, printability, and environmental sustainability. Used across industries from food & beverage to electronics and e-commerce, it is gaining popularity as a recyclable and biodegradable alternative to plastic and metal packaging.

Key Metrics and Overview

| Metric |

Details |

| Key Growth Drivers |

- Surge in e-commerce and food delivery demand

- Shift toward sustainable packaging

- Rise in AI integration in packaging design and production |

| Leading Region |

Asia Pacific |

| Market Segmentation |

By Material Type, By Packaging Format, By Application, By End-Use Industry and By Region |

| Top Key Players |

International Paper, Smurfit Kappa, DS Smith, Mondi Group, WestRock, PCA, Stora Enso |

What Are the New Trends in the Rigid Paper Packaging Market?

Rising Demand for Sustainable Packaging

Growing E-commerce Industries

- The growing e-commerce industry is supporting the growth of rigid paper packaging by providing protective and durable packaging.

Increasing Demand for Innovative Designs

- The increasing innovative designs have influenced the production of recyclable cardboard packaging.

How Can AI Improve the Rigid Paper Packaging Market?

The incorporation of AI in the rigid paper packaging market plays an important role in improving several factors from designing to the production process. Artificial intelligence is useful in the production of high-quality packages and fulfills the customization process of the industry. It is useful in the production of error-free packaging, which enhances the reliability of the industry. Rigid paper packaging acceptance has enhanced the demand for a huge quantity of packages has raised the incorporation of AI tools in the market. The operational integrity of rigid paper packaging permits complicated and visually tempting patterns, catering to top product sections.

Market Dynamics

Drivers

Rising Demand for Packaging Solutions in the Food Industry

The growing demand for enhanced technology packaging in the food industry has driven the rigid paper packaging market. Huge demand for convenience and ready-to-eat foods increases the requirement for more effective and cost-effective packing. The upsurge in the usage of rigid paper packaging is influenced by the development in the pharmaceutical sector as well. Growing ecological apprehensions and demand for environment-friendly resources inspire trades to accept rigid paper packaging as a sustainable substitute to plastic, auxiliary circular economy, and accountable feasting. Increasing online shopping raises the requirement for protective, durable, and lightweight rigid paper packaging solutions that safeguard product safety, improve consumer experience, and permit customization and marking potential.

Restraints

Environmental Issues

The rising environmental issues have hindered the demand for the rigid paper packaging market. There is a huge safety concern during the transportation of products has restricted the expansion of this industry. Strict packaging guidelines had also resulted in the restriction of the growth of the market. The strength of rigid paper packaging prevents it from effective defending against heavy, bulky products that require strong protective measures.

Opportunity

Rising Demand for Recyclable Packaging

Continuous demand among people for recyclable packaging has supported the development of the rigid paper packaging market. The rising initiatives of the government towards ecological awareness have evolved the packaging sector with innovative packaging technology. Rigid paper packaging gives opportunities for personalization and branding, which has now also become an essential part of consumer satisfaction and brand awareness in the period of online shopping. Rigid paper packaging has been the desirable choice because it provides the advantages of recyclability and the usage of renewable materials, and stands out as a top industry among corporations trying to comply with the guidelines while conserving the quality and demand of the packaging.

Segmental Insights

Why Corrugated Fibreboard Segment Dominated the market in 2024?

The corrugated fibreboard segment contributed a considerable share of the rigid paper packaging market in 2024 due to the rising demand for cost-efficient, versatile, and sustainable packaging. The corrugated fibreboard is available in several coatings, types, weights, and flame-resistant potentials. With the growing e-retail, the demand for corrugated fibreboards is anticipated for the growth of packaging, shipping, and storage purposes. Such favourable attributes of corrugated fibreboards are likely to boost this segment's development.

The moulded fibre segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This material for packaging is widely used due to its even color, strength, and surface roughness. Moulded fibre packaging material gives a cushioning effect and absorbs shock while transporting products, and raises the demand for such packages.

Why the Boxes & Cartons Segment Dominated the Market in 2024?

The boxes & cartons segment is expected to have a considerable share of the rigid paper packaging market in 2024 due to its biodegradability and recyclability. This type of packaging provides proper structure to the object and is are eco-friendly solution in the packaging sector. As there are available in several shapes such packaging is accepted by various industries and raising the demand for huge production. Branding is the primary concern of companies that require packaging that can be printed with unique designs, hence boosting this segment to extend. One of the noteworthy benefits of boxes & carton is their customization capability. Industries can effortlessly print their brand messages, logos, and designing, of the boxes, turning them into an advertising device. Modified boxes & cartons help to generate a proficient image and expand brand identity.

The tubes & cylinders segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. These have an enhanced surface finish, which increases the demand for this segment. The growing search for reliable and safe packaging has also boosted the growth of this segment. This type of packaging has a low risk of leakage, which increases the demand for such packaging.

Why the Food & Beverages Segment Dominated the Market in 2024?

The food & beverages segment is expected to have a considerable share of the rigid paper packaging market in 2024 due to the growing inclination towards environment-friendly and sustainable packaging resources. Rigid paper packaging resolutions that safeguard food safety and optimal shelf life while obeying strict supervisory morals are vital. All methods of packaging, starting from folding cartons to corrugated boxes, comprising paper-based flexible packing, will be personalized to the detailed necessity. Inventions in barricade technologies and sustainable packing solutions will additionally set demand for packing in the business, in harmoniousness with developing rigid paper packing market trends.

The personal care & cosmetics segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. The growing demand for packaging that preserves the quality of the products has influenced the demand for this type of packaging in the personal care & cosmetics sector. The rising demand for packages that can be reused and recycled has boosted the development of the segment.

Why the Secondary Packaging Segment Dominated the Market in 2024?

The secondary packaging segment is expected to have a considerable share of the rigid paper packaging market in 2024 due to its capacity for storage and handling. It supports transportation, stacking, and organization of several products. Secondary packaging is useful in branding as it allows brands to create unique patterns and use a variety of colours. It mainly focuses on protection and function, which adds value to this segment. This type of packaging is widely accepted in food & beverages, pharmaceuticals, consumer goods, electronics, automotive, and several other industries.

The primary packaging segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. Primary packaging is the first layer that provides protection to the packaged products. This market produces primary packaging that is biodegradable and recyclable, which influences the growth of the segment. There is a huge demand for primary packaging that does not react adversely with products inside.

Regional Insights

Rising Food & Beverages and E-Commerce Sector in the Asia Pacific Promote Dominance

Asia Pacific held the largest share of the rigid paper packaging market in 2024, due to the rising food & beverages and e-commerce sectors. The growing food & beverages and e-commerce industries increased the demand for packaging that is safe to maintain the integrity of the packaged products. The growing infrastructure of health & care industries in countries such as India, Japan, China, South Korea, and Thailand has influenced the demand for this market.

Europe’s Rising Recyclability Concerns Support Growth

Europe is estimated to grow at the fastest rate in the rigid paper packaging market during the forecast period. The increasing demand for recyclability of the products has influenced the growth of the market. The growing initiatives of the government towards ecological awareness have raised concerns about eco-friendly packaging. Advancements in recycling technology are also a major factor behind the growth of the market.

Top Companies in the Rigid Paper Packaging Market

Latest Announcements by Industry Leaders

- In June 2025, Elizabeth Rhue, vice president and general manager, Sonoco Rigid Paper Containers North America, expressed, “At Sonoco, we understand that food and beverage brands are increasingly seeking out packaging that reflects and backs up their wider commitment to sustainability and package circularity.” (Source: Quality Assurance & Food Safety)

New Advancements in the Market

- In June 2025, Sonoco Launches Paper Can with Paper Bottom in North America. (Source: Quality Assurance & Food Safety)

- In April 2025, the EPR launch will move financial responsibility for managing curbside recycling collection away from municipalities and onto producers, although the day-to-day operations of many curbside recycling programs will not change. (Source: Resource Recycling)

Rigid Paper Packaging Market Segments

By Material Type

- Corrugated Fibreboard

-

- Single wall

- Double-wall

- Triple-wall

- Paperboard

- Solid Bleached Sulfate (SBS)

- Coated Unbleached Kraft (CUK)

- Folding Box Board (FBB)

- Kraft Paper

- Virgin Kraft

- Recycled Kraft

- Moulded Fibre

- Specialty Papers

By Packaging Format

- Boxes & Cartons

- Folding Cartons

- Rigid Setup Boxes

- Telescoping Boxes

- Tubes & Cylinders

- Paper Canisters

- Spiral-wound Tubes

- Trays & Clamshells

- Moulded Fibre Packaging

- Others

- Sleeves

- Inserts & Dividers

By Application

- Primary Packaging

- Secondary Packaging

- Tertiary (Transport) Packaging

By End-Use Industry

- Food & Beverage

- Bakery

- Confectionery

- Dairy

- Ready Meals

- Personal Care & Cosmetics

- Consumer Electronics & Appliances

- Healthcare & Pharmaceuticals

- Industrial Goods

- Retail & Apparel

- E-commerce & Subscription Boxes

- Luxury & Premium Goods

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa