Europe Packaging Market Growth Outlook, Segment Breakdown, Value Chain & Manufacturers Overview

The Europe packaging market report provides a complete assessment of market size, demand outlook, and long-term trends, covering all statistical indicators across packaging types, materials, technologies, and end-use industries. It includes detailed segmentation data, growth rates, regional comparison across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. The study further evaluates major companies, competitive positioning, value chain structure, manufacturing ecosystem, supplier networks, and trade flow patterns to offer a holistic understanding of the industry.

Key Insights

- Western Europe dominated the market by holding more than 43% of the revenue share in 2024.

- Eastern Europe is expected to grow at a notable CAGR from 2025 to 2034.

- By packaging type, the rigid packaging (bottles & containers) segment contributed 28% revenue share in 2024.

- By packaging type, the flexible packaging (pouches) segment will be expanding at a significant CAGR between 2025 and 2034.

- By material, the plastic (PET) segment contributed the biggest revenue share of 32% in 2024.

- By packaging function, the primary packaging (direct contact with product) segment contributed the biggest revenue share of 50% in 2024.

- By packaging function, the tertiary packaging (bulk transport, pallets) segment is expected to expand at a significant CAGR between 2025 and 2034.

- By technology, the modified atmosphere packaging (MAP) segment contributed the biggest revenue share of 24% in 2024.

- By technology, the active & intelligent Packaging segment is expanding at a significant CAGR between 2025 and 2034.

- By sustainability type, the recyclable segment contributed the biggest market share of 47% in 2024.

- By sustainability type, the compostable segment will be expanding at a significant CAGR between 2025 and 2034.

- By end-use industry, the food & beverage segment held the major revenue share of 42% in 2024.

- By end-use industry, the e-commerce & retail segment is projected to grow at a rapid CAGR between 2025 and 2034.

Strict Regulations to Boost European Packaging Market

The Europe packaging market encompasses the production and distribution of materials and solutions used to contain, protect, transport, and present goods across industries, including food & beverage, healthcare, cosmetics, industrial, and consumer goods. This includes primary, secondary, and tertiary packaging, with innovations focusing on sustainability, lightweighting, and smart functionality driven by stringent EU regulations and shifting consumer behavior.

The ongoing innovations in glass packaging, paper & paperboard packaging, and food packaging solutions are driving the market expansion. The European manufacturers have a strong focus on safe, convenient, and more sustainable packaging solutions, bringing significant innovations to the market. Europe is continuously working on implementing and enhancing global standards for sustainable packaging.

- On February 11, 2025, the EU’s regulation (EU) 2025/40 on packaging and packaging waste came into force, marking a spectacular shift toward a circular economy by implementing novel rules and standards for packaging solutions across Europe. The regulation has set new packaging waste laws for recyclability, chemical safety, and reusability, and is fueling a shift in the global supply chain. This regulation is expected to be fully applicable from August 12, 2026.

What are the key Trends of the Europe Packaging Market?

Demand for Sustainable Solutions

- The demand for sustainable packaging solutions is wide in Europe, with a strong push in recyclable, biodegradable, and plastic-free packaging solutions, to bring significant innovation in the emerging market.

Lightweight and Flexible Packaging

Digital Printing and Smart Packaging

- Companies' heavy investments in cutting-edge technologies like digital packaging, automation, and smart packaging to improve efficiency, sustainability, and allow consumers to experience personalized experiences are fueling the market.

The Europe packaging market is witnessing significant expansion with the rising adoption of AI technology in manufacturing firms. The changing consumer lifestyles, growing unique demands, regulatory compliance, and companies' aim to reduce environmental impacts have shifted them toward the adoption of AI for more efficient, cost-effective, and sustainable packaging. AI is playing a crucial role in complying with regularity requirements by providing excellent control on quality, inspection, packaging designs, and supply chain optimization. The growing surge in customization and creation of smart packaging is leveraging robust opportunities for AI in the European packaging market. The liquid packaging segment is holding the largest traction in the European market.

Market Dynamics

Driver

Innovative Solutions for Modern Challenges

The rapid development of innovative solutions for modern challenges, including demand for lightweight and flexible packaging solutions, is the major driver of the market. This trend is fulfilling for rising consumer demand for cost-effective and more efficient solutions. European companies are focusing on the adoption of advanced eco-friendly materials and particles to reduce environmental footprints and meet modern packaging demands. Additionally, technological advancements in materials and manufacturing processes and bringing significant innovations to the regional market.

Restraint

Stringent Environmental Regulations

The strict environmental regulations, like recyclability requirements, extended producer responsibility, labeling requirements, minimum recycled content, and restrictions on single-use plastics, are the major challenges for European packaging manufacturers. Regional manufacturers are mandatory to use sustainable packaging materials to reduce plastic waste and reduce environmental impact. The European recycling target for various packaging solutions by 2030 further contributes to the market pressure.

Opportunity

Sustainability Trends

The changing consumer preference for recyclable, reusable, and biodegradable packaging solutions and strict environmental regulations are creating significant opportunities for local manufacturers to bring novel innovations in the emerging market. Companies are investing heavily in research and development to develop novel and innovative materials to meet sustainability demands. Additionally, growing consumer demand for eco-friendly and sustainable packaging solutions is encouraging manufacturers to adopt biodegradable and recyclable materials in their packaging solutions.

2025 European Regulations for Waste Management

- On October 1, 2025, Denmark will introduce extended producer responsibility (EPR) for packaging, highlighting a new era in waste management. Under these regulations, manufacturers will be mandatory to develop recyclable packaging solutions

- In January 2025, Spain implemented Royal Decree 1055/2022, new packaging regulations for labeling obligations to support the country's goal of better trash management and circular economy.

Segment Insights

Which Packaging Type Dominated the Europe Packaging Market in 2024?

In 2024, the rigid packaging segment dominated the market, due to the large adoption of rigid packaging solutions and industries like food and beverage, personal care, and pharmaceuticals. The rigid packaging includes bottles & jars, cans, trays & clamshells, boxes & containers, where the bottles & containers segment held a large market share in 2024, due to increased adoption of bottles and containers and the food and beverage and pharmaceutical industry, with a strong focus on sustainable and recyclable packaging.

The flexible packaging segment is the fastest-growing segment of the market, driven by increasing segment popularity for its efficiency, convenience, and sustainability. Flexible packaging solutions are more efficient and cost-effective. The flexible packaging segment involves pouches, sachets, wraps & films, and bags, where the pouches sub-segment leads the market with its lightweight nature, ideal for food & beverage, personal care, and pharmaceutical product packaging.

Import & Export Trade Summary EU28 Flexible Films & Primary Polymers

| Category |

Status |

Net Import / Export Volume |

Trade Balance (€M) |

Notes |

| LDPE (Primary Form) |

Net Exporter |

+330 Kt |

— |

EU exports exceed imports |

| LLDPE (Primary Form) |

Net Importer |

-720 Kt |

— |

Imports exceed exports |

| Combined LDPE + LLDPE |

Net Importer |

— |

-€200M |

Overall negative trade balance |

| Film & Sheet |

Net Exporter |

— |

+€950M |

Strong positive trade position |

| Sacks & Bags |

Net Importer |

— |

-€700M |

Major dependence on imports |

| LDPE/LLDPE import value vs export value |

— |

Imports +20% higher |

— |

For primary polymer trade |

| Film & sheet export value vs import value |

— |

Exports +25% higher |

— |

Value trade advantage |

| Sacks & bags import vs export volume |

— |

Imports 3× larger |

— |

Mostly virgin HDPE products |

| Main import source |

— |

Saudi Arabia |

— |

For primary polymer |

| Main export destinations |

— |

China & Turkey |

— |

EU outbound markets |

| Annual variation range (LLDPE) |

Net Imports |

600–1,000 Kt |

— |

Over last decade |

| Annual variation range (LDPE) |

Net Exports |

150–400 Kt |

— |

Over last decade |

| Countries with largest surplus |

— |

Belgium, Netherlands |

— |

Positive trade balances |

| Countries with largest deficit |

— |

Italy, Poland |

— |

Negative trade balances |

The EU28 is structurally dependent on imports of key flexible-film raw materials but strong in exports of finished film products. It imports far more LLDPE than it exports, with about 720 Kt per year of net imports, while it is a net exporter of LDPE, exporting about 330 Kt more than it imports. Combined, this results in a negative trade balance of around €200 million for primary polymer forms.

For finished products, the picture is different: The EU28 is a net exporter of film and sheet, generating a strong positive trade balance of around €950 million. However, it is a net importer of sacks and bags, mainly made from virgin HDPE, with imports three times larger than exports, leading to a negative contribution of €700 million.

Saudi Arabia is the largest supplier of imported primary polymer material, while China and Turkey are the biggest export destinations. Belgium and the Netherlands are the strongest trade surplus countries, whereas Italy and Poland experience the largest deficits. Overall, the EU28 shows raw-material import dependency but strong competitiveness in value-added processed films.

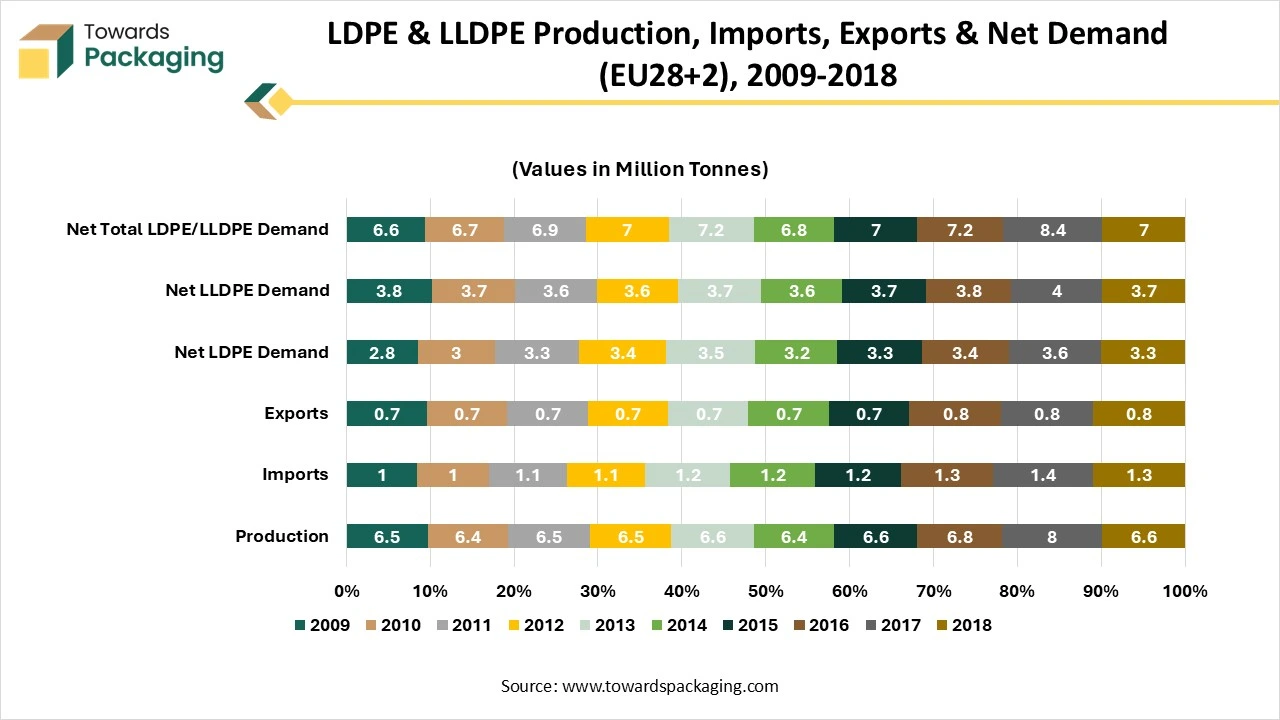

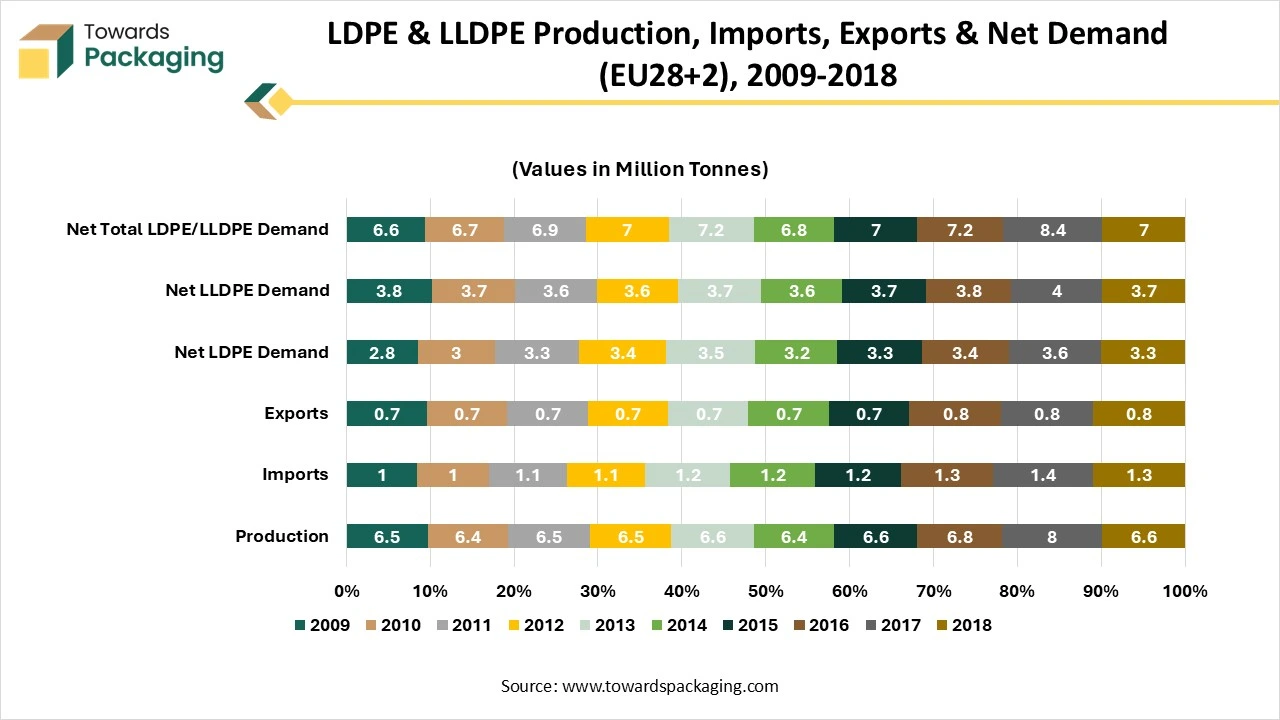

LDPE & LLDPE Production, Imports, Exports & Net Demand (EU28+2), 2009-2018

The data shows the trend in production and use of LDPE and LLDPE-the main polymers used in flexible packaging films—in the EU28+2 region over the past decade. Production levels remained relatively stable between 6.1 and 6.7 million tonnes, except for 2017, when production peaked at 8 million tonnes before returning to typical levels in 2018. Net demand for LDPE and LLDPE stayed steady between 6.5 and 7.1 million tonnes, exceeding production by about 0.5 million tonnes in 2018, which had to be covered through imports.

In 2018, the total demand for PE flexible films was estimated at 8.5–9 million tonnes, of which 1.2–1.3 million tonnes came from recycled material. When including other polymers such as PP, multilayer materials, PET, PVC and biodegradable plastics, the overall flexible film market reached 13–15 million tonnes. PP and multilayer films each accounted for 2–2.5 million tonnes.

What Made the Plastic Material Segment Dominant in the Europe Packaging Market?

The plastic segment dominated the market in 2024, due to the high durability, cost-effectiveness, and versatility of plastic materials. The technological advancements in plastic materials like bioplastics and recyclable plastics are contributing to the segment's growth. The PET is the largest sub-segment contributing to the market growth, due to increased demand for lightweight, recyclable, and transparent packaging solutions.

Plastics Used in Europe for Flexible Packaging (2010-2020)

The chart shows that flexible packaging plastics use in Europe increased steadily between 2010 and 2020.

Key trends:

- Usage rose from roughly 8.0 million tonnes in 2010 to a peak of about 9.3 million tonnes in 2018.

- Growth was gradual but consistent, reflecting rising consumption of packaged goods and increased use of lightweight flexible packaging formats.

- After 2018, there is a slight decline, reaching ~9.0 million tonnes by 2020 likely influenced by: market saturation, efficiency improvements and increased recycling or material substitution pressures.

- Overall, flexible packaging demand grew approximately 14-15% over the decade.

Which Packaging Function Segment Leads the Europe Packaging Market in 2024?

In 2024, the primary packaging (direct contact with product) segment led the market, due to increased demand for innovative, sustainable, and safe packaging solutions. Primary packaging offers a customized design with a focus on customization and great functionality. The rising need for aesthetic packaging solutions is supporting the segment's growth.

The tertiary packaging (bulk transport, pallets) segment is the second-largest segment, leading the market, due to the large need for tertiary packaging solutions in safe and efficient handling and transportation of products. The tertiary packaging offers strong protection to goods while shipping, distribution, and streamlining logistics. The growing logistics and warehousing activities are driving demand for tertiary packaging solutions.

Which Technology Segment Will Hold the Largest Revenue of the European Market in 2024?

The modified atmosphere packaging (MAP) segment holds the largest market revenue in 2024, due to its increased adoption and the packaging industry reducing packaging waste and extending shelf life, the demand for fresh and quality packaging has increased, especially in the food and beverage industry, contributing to this segment's growth. Additionally, with the focus on technological advancements like smart packaging and digital printing, the segment is expected to grow continuously in the market.

The active & intelligent packaging segment is expected to go fastest over the forecast period, due to increased demand for safe, convenient, and sustainable packaging. The increasing growth in demand for ready-to-eat meals and the expansion of e-commerce have increased the adoption of active and intelligent packaging technology. Food and beverage, healthcare, personal care and cosmetics, pharmaceutical industry, and consumer electronics are the major drivers of the segment.

What Made Recyclable Sustainability Type Lead the Europe Packaging Market?

The recyclable segment led the market in 2024, due to increased demand for eco-friendly packaging solutions and strict environmental regulations. The consumer preference for eco-friendly products has taken a significant place in Europe, driven by increased environmental awareness. The use of single-use plastic is reducing, and recyclable packaging is gaining traction in the European market, driven by countries' efforts in promoting circular economy practices. Moreover, the technological advancements in recyclable materials like PET and paper-based packaging are developing innovative solutions.

How Food & Beverages End-use Industry Dominated the Europe Packaging Market in 2024?

The food & beverage segment dominated the market in 2024, due to its high consumption of packaging solutions. The growth in consumption of shelf-stable food and beverages and demand for processed foods has increased the adoption of innovative packaging solutions. The European Food and beverage industry is experiencing high growth for sustainable, diverse, innovative, and eco-friendly packaging solutions, contributing to the market growth.

The e-commerce & retail segment is expected to lead the market over the forecast period, driven by changing consumer preferences and increasing online shopping activities. E-commerce and retail are major consumers of robust packaging solutions, which are essential for shipping and handling. The focus of e-commerce and the retail sector on providing customized and branding experiences is contributing to the adoption of aesthetic and customized packaging solutions.

With novel EU packaging regulations coming into force, the cross-border e-commerce business is facing challenges with logistics and compliance. However, companies' partnerships with professional logistics providers are projected to enhance the e-commerce industry.

Regional Insights

Western Europe Packaging Market

The western countries, including the UK, France, Netherlands, Germany, and Italy, dominated the European packaging market, due to countries robust packaging manufacturing base. The strong investments in sustainable practices and strong EU regulations are contributing to the market growth. Additionally, companies that focus on increasing manufacturing capabilities are supporting Western countries' position in the European market.

Eastern Europe Packaging Market

The eastern European countries, including Belarus, Ukraine, Hungary, Bulgaria, Romania, and Poland, are contributing to the Europe packaging market growth with countries' strong focus on sustainability and circular economy. The expanding e-commerce industry and demand for efficient packaging solutions are fueling the market growth. Additionally, with companies' focus on expanding their capabilities and strengthening their position in the market, it is expected to provide significant innovations and developments in the emerging market.

Europe Packaging Market Key Players

- Amcor plc

- Mondi Group

- Smurfit Kappa Group

- DS Smith Plc

- Huhtamaki Oyj

- Constantia Flexibles

- Berry Global Inc.

- Stora Enso Oyj

- Sonoco Products Company

- Tetra Pak International S.A.

- RPC Group (part of Berry)

- Sealed Air Corporation

- SIG Combibloc Group AG

- ALPLA Group

- AptarGroup, Inc.

- Greiner Packaging

- Winpak Ltd.

- Schur Flexibles Group

- Graphic Packaging International

- Coveris Holdings S.A.

Latest Announcements by Industry Leaders

- In May 2025, Tobias Acker, Market Product Manager for Beverages at Constantia Flexibles, gave statements on companies significant achievements that the company's latest EcoVerHighPlus packaging project highlights the positive influence of close collaborative approaches.

Recent Developments

- In June 2025, a global packaging solutions provider, Amcor, launched sustainable packaging solutions for Butterball’s turkey breast offerings. The packaging is anticipated to reduce the use of materials and enhance efficiency more than traditional methods.

- In May 2025, Constantia Flexibles implemented its innovative mono PP laminate, EcoVerHighPlus, for transforming coffee packaging, in collaboration with Delica AG, which belongs to the group Migros Industries AG.

Europe Packaging Market Segments

By Packaging Type

- Flexible Packaging

- Pouches (stand-up, flat)

- Sachets

- Wraps & Films

- Bags (retort, vacuum, shrink, zip lock)

- Rigid Packaging

-

- Bottles & Jars

- Cans

- Trays & Clamshells

- Boxes & Containers

- Semi-Rigid Packaging

- Blister Packs

- Trays

- Tubes

By Material

- Plastic

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polystyrene (PS)

- Bioplastics

- Paper & Paperboard

- Coated Paperboard

- Corrugated Board

- Kraft Paper

- Glass

- Metal

- Aluminum

- Steel (Tinplate, Tin-Free Steel)

- Others

- Textile (woven sacks, reusable bags)

By Packaging Function

- Primary Packaging (direct contact with product)

- Secondary Packaging (bundling, branding)

- Tertiary Packaging (bulk transport, pallets)

By End-Use Industry

- Food & Beverage

- Dairy

- Bakery & Confectionery

- Meat & Seafood

- Fruits & Vegetables

- Ready-to-eat

- Non-alcoholic Beverages

- Alcoholic Beverages

- Healthcare & Pharmaceuticals

- Prescription Drugs

- OTC Products

- Medical Devices

- Personal Care & Cosmetics

- Skincare

- Haircare

- Fragrance

- Household Products

-

- Cleaning Agents

- Laundry Products

- Industrial & Chemicals

- Lubricants

- Agrochemicals

- Paints & Coatings

- E-commerce & Retail

- Automotive & Electronics

By Technology

- Modified Atmosphere Packaging (MAP)

- Aseptic Packaging

- Active & Intelligent Packaging

- Vacuum Packaging

- Cold Chain Packaging

- Anti-Counterfeit Packaging (RFID, NFC)

By Sustainability Type

- Recyclable

- Reusable

- Compostable/Biodegradable

- Mono-material

- Lightweight Packaging

By Region

- Western Europe

- Eastern Europe

- Northern Europe

- Southern Europe

- Central Europe