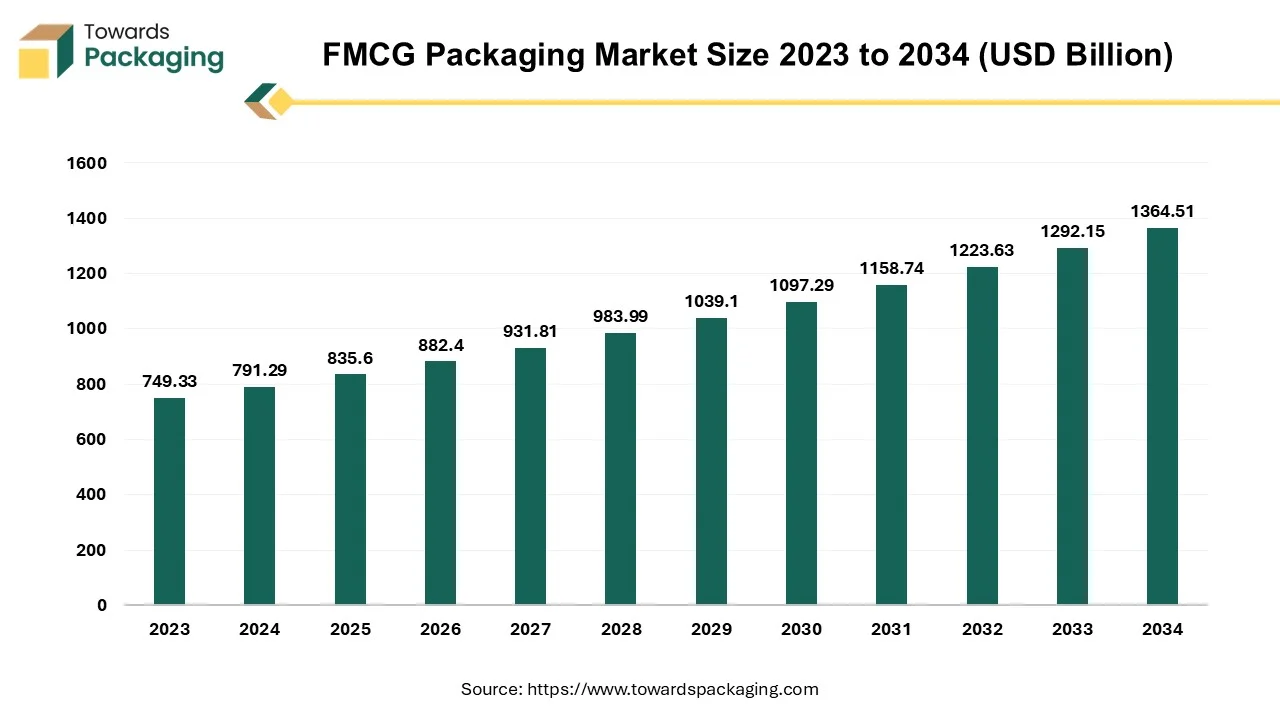

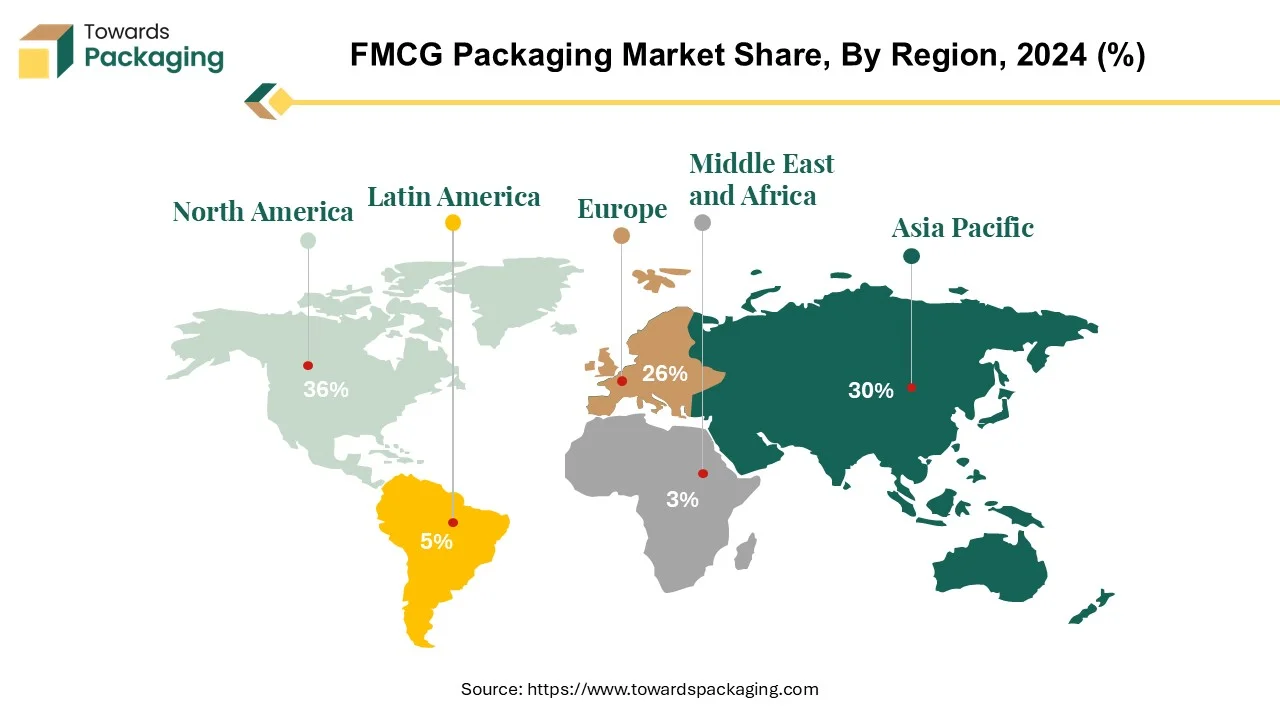

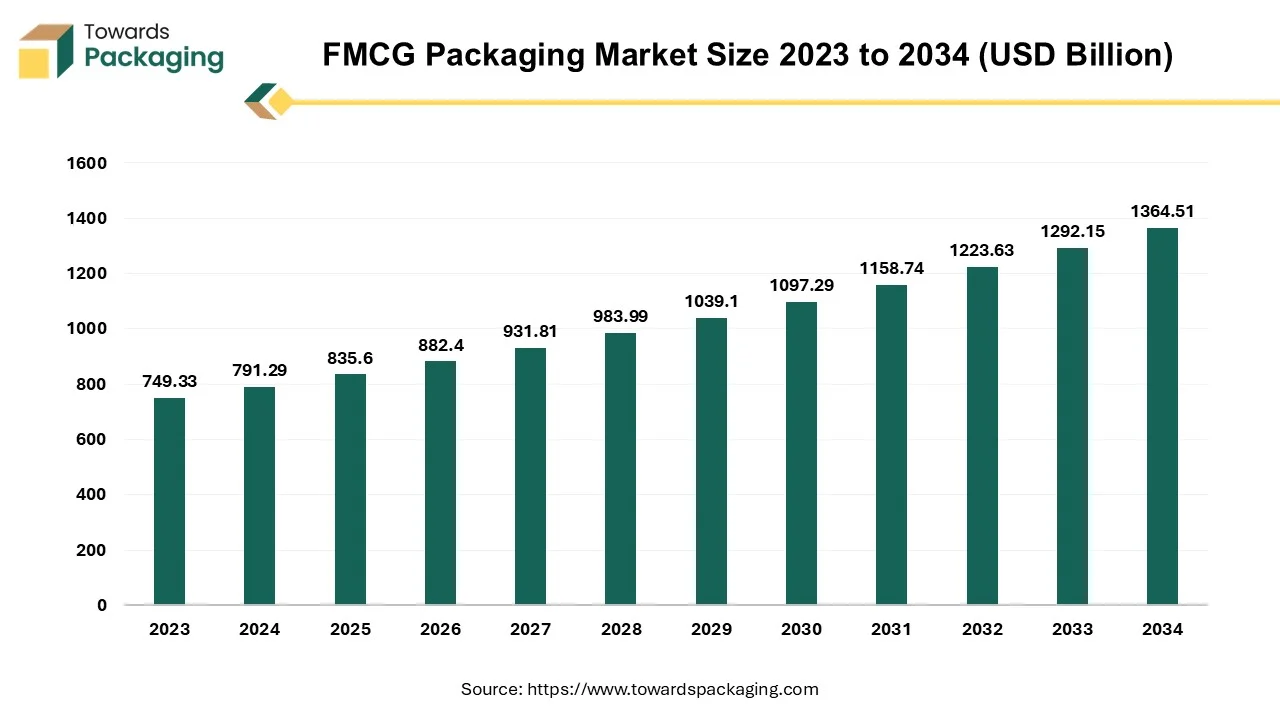

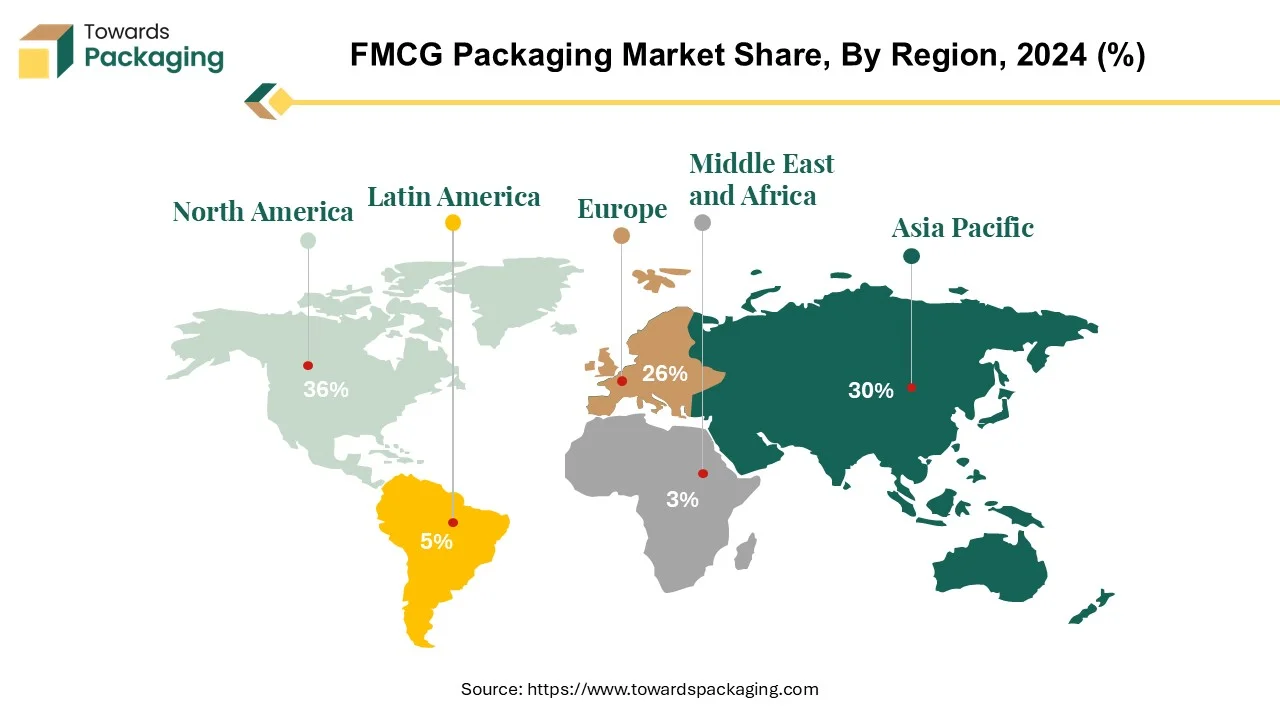

The FMCG packaging market is forecasted to expand from USD 882.40 billion in 2026 to USD 1,440.92 billion by 2035, growing at a CAGR of 5.6% from 2026 to 2035. The report delivers a detailed analysis across material segments such as plastic, paper & paperboard, glass, and metal, as well as product categories like bags, boxes, pouches, bottles, and sachets. It highlights regional insights covering North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, with Asia Pacific leading due to e-commerce-driven consumption.

The study also features comprehensive value chain mapping, trade flow statistics, and supplier/manufacturer data including top players like Unilever, L’Oréal, DS Smith, and Nestlé, along with a detailed competitive benchmarking and profitability analysis.

FMCG sector is a difficult area of competition between different product groups, such as ready-to-eat foods, beverages, hygiene products, cosmetics and cleaning agents. Big brands that are able to spend large dollars on advertising, trending influencers with a vast following, and innovative companies with exciting new features and formulations all compete for visibility. In light of these fierce competitive circumstances, it is essential for FMCG brands to pay attention to packaging design in order to distinguish their products from competitors and attract consumers’ interest, which greatly impacts purchase intention.

One of the major drivers of the growth of the sustainable tourism product market is the rise in the awareness of sustainability. Also, packaging that can withstand the challenges of shipping due to online sales is surging encouraging maturation of market.

The packaging design is an important part of the selection process for the consumers as it catches their attention and influences their buying decision. When it comes just to buyers’ package without having graphic details and messaging 72% of them are influenced by this. The transition of the FMCG businesses to eco-friendly packaging can be said to be a direct repercussion of both the growing consumer and government concerns. The total 53% of the consumers deem the minimal or eco-friendly packaging to be the must have for the products sustainability, the 31% of others just factors that in.

The FMCG packaging market is highly competitive, as brands are struggling to get noticed through the mechanism of design packaging. Through meeting consumer and regulator expectations in the implementation of eco-friendly packaging brand will be able not only to adapt to rapidly changing matters but also to ensure their long-term success.

Asia Pacific is the biggest packaging market in FMCG revealing the highest share of overall volume. These supremacies are fueled by various causes, with the e-commerce one being the most prominent. Web commerce in the region currently represents over 19% of the FMCG trading sales, which is now the second biggest channel after traditional trade. On the same note, Korea and China are at the forefront in the e-commerce sales performance in the region with online commerce accounting for over 30% of overall FMCG sales in both countries.

Asian consumers' purchasing patterns in turn determine the nature of FMCG packaging in Asia Pacific. February 2022 survey gave rise to a fact that the half of consumers within this area give preference to price when it comes to online purchase. However, such focus on affordability brings brands to consider how they will cope with the rent when the competitors are offering the similar but much cheaper prices.

As the largest market for this plastic, the status of Asia is related to the FMCG packaging sector therefore. As well versatile, economical and convenient, the use of packing made of plastic is still so widespread. Increased environmental burdens of green development raise demands for ecologically compliant options.

The market expansion follows its own growth path, which may be signified by various indicators. Rising e-commerce are, in combination, with changing customer tastes, make a market for modern packaging development. As brands adapt to competitive market place and face environmental issues there is a chance to make improvements in the field of package design, materials and technology among many others.

The FMCG packaging market in the Asia Pacific region is thriving because of e-commerce’s growing popularity, changing consumer preferences, and ongoing search to develop cost-effective and environmentally friendly packaging. The area presents the dynamics of a diverse and rapidly changing market and, therefore, it calls for the stakeholders to be flexible and innovative so they can, on one hand, take advantage of the opportunities and on the other hand manage the challenges which are still evolving.

For Instance,

The North American FMCG packaging sector is of vital importance due to intense growth and intricate trends tends. Beyond the expansion of the local market, several crucial factors are pushing the region forward. In North America both advanced economy and strong consumers who mostly wish to go to the store and buy FMCG products feature, so, the consumers will appreciate an efficient and attractive packaging. Amid consumers' ever-increasing inclination towards convenience and sustainability, companies are upgrading their packaging solutions to cater to changing customer behavioural patterns. The U.S. produces much of the world’s honey supply, putting American businesses at a significant advantage for this FMCG. By keeping up with your local beekeeper, you’ll gain access to a vital source of packaged food revenue locally.

The E-Commerce upheaval has rearranged the retail packaging scene in North America. We can see that online retail sales have increased greatly in the last few years. Sustainable manufacturing materials as well as practices in FMCG materials are increasingly adopted because of consumer demands for eco-friendly packaging in North America. Brand companies progressively start using materials of recycling, composting and biodegrading type to reduce pollution and to meet expectation of the consumers who want more deeply care for environment. Technology is among the leading factors which positively affect the growth of the FMCG packaging market in the USA. There is a variety of smart packaging innovations that streamline product performance and are interactively designed to involve the consumers in the development of the sector.

North America’s FMCG packaging sector has shown healthy development induced by factors including improvement of economic conditions, expansion of e-commerce activities, focus on sustainability, and technological advancement. With brands that continue to adapt to new consumer choice and dynamics, there will be possibilities for growth and innovation in the FMCG package sector.

The plastic manufacturing operation all over the world has recorded an increase from 460 metric tons and sees twice the amount of plastic waste being thus generated as compared to the last two decades with poor recycling, which has its rate standing at only 9%. The responsibility of a plastic bottle manufacturer in the FMCG industry can be considered as more than producing in the plant films cabinets. However, this group of manufacturers is at the core of producing the everyday products that consumers rely on, and, subsequently, there are multiple repercussions including preferences of design and environmental sustainability.

The CTB classes of plastic bottle manufacturers and their impacts over different stages of product development and the consumer decision making. Innovations that occur within the FMCG plastic packaging industry, are responsible for ensuring the advancing of the industry as the manufacturers also explore new materials and technologies that could improve either the product-performance or the product-sustainability.

Plastic packaging particularly brought about forms of packaging that are both lightweight and durable. It also introduced eco-friendly package alternatives that make use of plastics which were recycled to make bottles. This offers ultimate convenience to consumers, apart from safety and environmental-friendly packaging. The packaging staple has helped the beverages and food companies worldwide to meet their sustainability goals; such as reduction of virgin plastics in the consumer goods supply chain. But, the aspect of real-life implementation and adoption of suitable or scalable solutions still remains a problem and depends mostly on the fast advancement in technologies, research and innovation.

Plastics make the grand total at 3.4% of the overall global greenhouse gas emissions which indicates that getting plastics out of the packaging techniques becomes a crucial step on the worldwide reductive path of carbon emissions. To bring this about, several prominent FMCG enterprises like Kraft Heinz, PepsiCo and Coca-Cola have set up aims with regard to fewer virgin plastics and to increase the utilisation of recycled plastics in the production line. With more and more manufacturers coming with such recycled and reusable plastic, is the less harmful to the environment.

FMCG packaging market is a complex monster which exists of multitude solutions that cannot be ignored or substituted with bags that fastens the branded products. In this case, the plastic ones constitute the biggest part of sales. Bags have long played an important role in a wide range of the products packaging efforts owing to the ease that they offer in carrying things around and also helping preserve the inner contents in a better way. These offer the busy consumer portability and convenience features such as single-serve snack packs, re-sealable pouches for beverages, and have come a long way from the typical travel kit with room for only travel-sized toiletries. Among all common packaging options available, two products stand out in the FMCG industry: Secure Courier packaging consisting of Paper Mailer Bags and Tamper-Proof Courier Bags.

The bags come with various features such as resealable zippers and barrier films that help full of freshness and quality of the products and thus, decreased amount of food wastes along with satisfied buyers. Bags offer a platform for brand segmentation and promotion through custom designed and fancy graphics that have the ability to catch the consumer attention and boost the sales.

As the demand for the eco-friendly packing solutions increase, the rate of adoption of bags made from recyclable, compostable or biotechnical materials which often are favored by consumers who are keen on the sustainability agenda. The bags perform well at the online sales because of their compression and lightness and this convinces the FMCG market which makes the FMCG packaging famous. The critical role of bags in the FMCG Industry is the innovation in packaging and growth of the market by having different functions and adaptability of the bags.

The FMCG packaging in the food and beverage industry is one of the biggest sectors in the FMCG market that have faced high growth rates and great ability to adapt itself to the needs and preferences of the modern consumers. The packaging in the food and beverage segment performs different significant tasks including preserving the product freshness, maintaining the safety and hygiene of the product, as well as conveying the brand and marketing messages of the concerned product.

Nowadays, the rise of sustainability, convenience, and portability has become an important factor causing the change in the FMCG packaging to match those preferences. There are a number of key factors which drive the development of FMCG packaging in food and beverage. One example of a new innovation in packaging is a resealable pouch, which is single-serving and comes ready for on-the-go options. Packaging innovations, such as modified atmosphere packaging or active packaging technologies, are the main reasons why perishables have a longer shelf life during transit, therefore reducing food waste and improving overall product quality.

The adoption of sustainable packaging materials and practices has been a focal point of food and beverage industry in recent days. Brands are finding ways of incorporating recyclable, compostable, and bio-degradable packages to minimize the environmental impact and match consumer perception for environmentally friendly products.

The growth of the internet market resulted in the emergence of appropriate packaging that is specially designed for online retail operations. Each day, 1.8 m Coca-Cola drinks are bought. Packaging designs that emphasize products protection, simplicity during transportation, and enjoyment when consumers are unboxing the product help in effective growth of FMCG packaging in the food and beverage sector. The FMCG packaging in the food and beverage industry stays so vibrant because of continuous development, sustainability and adaptation to changing consumer requirements, which in turn stirs up the production and leads to the aggressive and creative market environment.

The competitive landscape of the FMCG packaging market is dominated by established industry giants such as Berry Global Inc., Crown Holdings, and WestRock Company are prominent players in the packaging industry. Sealed Air Corporation, Sonoco Products Company, and Silgan are also key contenders. Additionally, Coveris, PepsiCo, and Unilever contribute significantly to the market. Loreal, DS Smith, and Nestle are also noteworthy participants. Reproflex, Parksons, and Ball Corporation are involved in packaging solutions. Kimberly-Clark Corporation, Mondi Plc, and Huhtamaki Oyj are influential players. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

Unilever has shifted its emphasis on sustainable packaging solutions to decrease environmental problems. Use our AI to write for you about any topic! Enjoy our trial version below. Research and development become a field of investment for brands which allows to come up with new, less plastic and packaging designs that are both recyclable and biodegradable.

Given a L'Oréal guiding concept of top tier packaging design to increase the brand image and draw the attention of luxury consumers. While they give focus on aesthetic and usability by putting in some innovative features to grab shelf space, they achieve product differentiation.

DS Smith is committed to being the best provider of sustainable FMCG packaging materials by offering solutions based on recycling, circular economy and sustainability. They work together with clients in designing and producing the packaging that could achieve an environmentally friendly process avoiding over-packaging but still providing enough efficiency and protection in comparison to previous items.

Nestlé applies a holistic approach to the packaging and the priority is to cut waste and also educate the public on recycling. They continually develop these lightweight and recyclable packaging by as well as programs that educate consumers on the right disposal methods in a way that by 2050, zero net greenhouse gas would have been realized.

By Material

By Product

By End User

By Region

February 2026

February 2026

February 2026

February 2026