Rice Paper Packaging Market Size, Share, Trends and Forecast Analysis

The rice paper packaging market is projected to grow from USD 177.29 million in 2026 to USD 324.58 million by 2035, reflecting a CAGR of 6.95% from 2026 to 2035. This market includes both edible and non-edible rice paper products used in food packaging, specialty items, and consumer convenience. The Asia Pacific region leads with a dominant share, while Europe is expected to experience significant growth. The market also sees rising demand for eco-friendly, biodegradable materials driven by regulatory pressures on single-use plastics.

Key Highlights

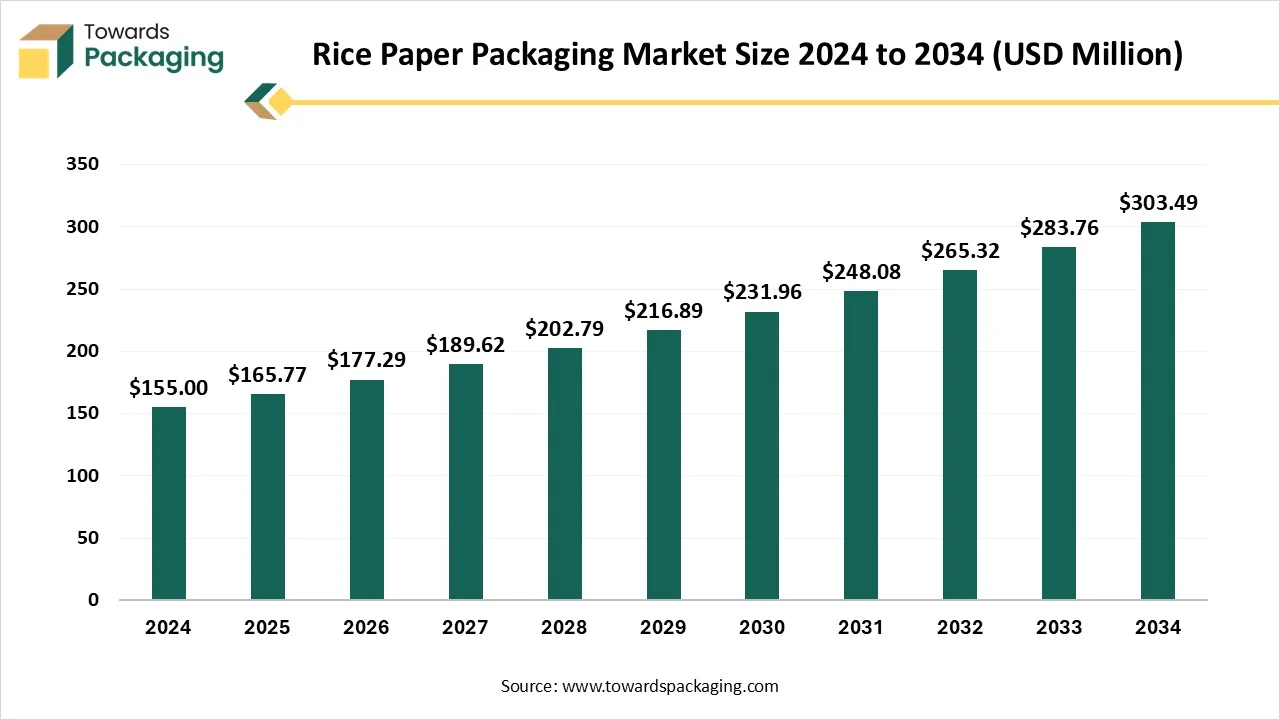

- In terms of revenue, the market is valued at USD 155 Million in 2024.

- The market is predicted to reach USD 303.49 Million by the year 2034.

- Rapid growth at a CAGR of 6.95% will be officially experienced between 2025 and 2034.

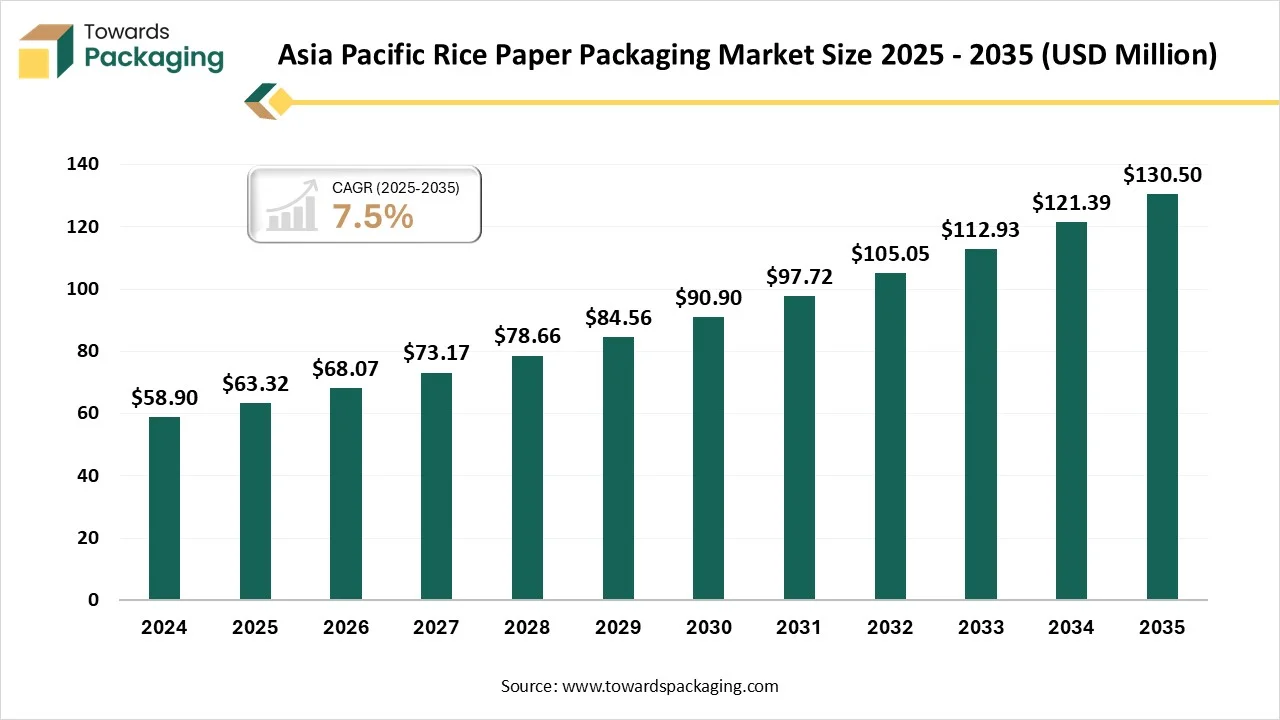

- By region, Asia Pacific dominated the market with the biggest share in 2024.

- By region, Europe is expected to rise at a notable CAGR between 2025 and 2034.

- By product type, edible rice paper segment has dominated the market with the largest share of 65% in 2024.

- By product type, non-edible paper segment is predicted to grow at a notable CAGR of 22% between 2025 and 2034.

- By application, food packaging segment dominated the market with the largest share of 55% in 2024.

- By application, ready-to-eat meals packaging segment is expected to rise at a notable CAGR between 2025 and 2034.

- By end-use industry, the food and beverages segment has dominated the market with the largest share of 60% in 2024.

- By end-use industry, retail and e-commerce packaging segment are predicted to grow at a notable CAGR of 20% between 2025 and 2034.

- By form, sheets and films segment dominated the market with the biggest share of 18% in 2024.

- By form, laminated and coated films segment are expected to rise at a notable CAGR of 18% between 2025 and 2034.

- By distribution channel, direct sales segment dominated the market with the biggest share of 58% in 2024.

- By distribution channel, e-commerce and online platforms segment are expected to rise at a notable CAGR of 22% between 2025 and 2034.

What Do You Mean By The Rice Paper Packaging Market?

The rice paper packaging market includes the production and commercialization of edible and non-edible rice paper films used for food wrapping, specialty packaging, and consumer convenience. Rice paper packaging is made from rice flour, tapioca starch, and water, forming thin, flexible sheets that are biodegradable, compostable, and sustainable. It is widely applied in ready-to-eat foods, confectionery, bakery, and frozen products.

Key stakeholders include food manufacturers, packaging converters, and retailers, with supply chains incorporating extrusion, drying, and lamination processes, along with coating technologies to improve moisture resistance and mechanical strength.

Key Metrics and Overview

| Metric |

Details |

| Key Growth Drivers |

Rising consumer awareness of sustainable packaging, government restrictions on single-use plastics, demand for clean-label products, and preference for lightweight and transparent packaging |

| Leading Region |

Asia Pacific |

| Market Segmentation |

By Product Type, By Application, By End-Use Industry, By Form, By Distribution Channel and By Region |

| Top Key Players |

Huakang Paper & Packaging, AEP Industries, Futamura Group, Paix Packaging, Oji Holdings Corporation, Anhui Yinghua Food Packaging, Shanghai Sun Paper Products |

Rice Paper Packaging Market Outlook

- Industry Growth overview: Rising consumer environmental alertness and rigid regulations on single-use plastics are boosting the urge for eco-friendly alternatives like rice paper. It is being driven by the sustainable and health-conscious items for both packaging and culinary uses.

- Sustainability Trends: Rice paper decomposes naturally, which lowers the long-term environmental impact due to non-biodegradable plastic. Also, the initial advantage ingredient in rice flour, rice paper, is a renewable resource just like petroleum-based plastics.

- Global Expansion: The overall industry for rice paper is experiencing rapid expansion, driven by developing consumer demand for healthy and sustainable food products, the growing popularity of Asian Cuisine, and innovations in packaging.

- Major Investors: By the year 2025, it is predicted that the market will move along with vendors driven by sustainability urges and technological growth. Acquisitions and mergers are likely as organizations seek to expand product lines and global reach. Pricing trends may remain constant as supply chains mature.

Key Technological Shifts in the Rice Paper Packaging Market

Current users expect more from producers and packaging design than just protection or aesthetics. They find smooth packaging that matches their values -specifically around environmental convenience and responsibility. This has driven manufacturers and companies to invest in smart packaging that mixes digital features like sensors, QR codes, and NFC tags that develop the user experience through traceability, interactivity, and real-time information.

Trade Analysis of Packaging for Rice Paper Packaging Market: Import and Export

As per the global data, Rice paper packaging from May 2024 to April 2025, the exports done by 332 exporters to 661 buyers, marking a development rate of 39% as compared to the preceding twelve months.

During this period, in April 2025, I was single. 601 rice paper packaging has exported shipments that were created with 60% growth as compared to April 2024, and a 0% series growth from March 2025.

Majorly the rice paper packaging exports from the world go to Ukraine, Vietnam, and South Korea. Globally, the top three exporters of rice paper packaging are the European Union, Vietnam, and Ukraine.

Value Chain Analysis of the Rice Paper Packaging Market

- Material Processing and Conversion: Processing and updating rice materials for the packaging specifically includes using agricultural waste like rice husks or rice straw in order to make eco-friendly products. Just like the edible spring rolls used for translucent rice paper, this strong packaging material is an industrial subproduct that is used again for sustainable applications.

- Package Design and Prototyping: Rice paper packaging is very different from regular edible rice paper. It is an eco-friendly and evergreen material which are made from plant fibres, such as hemp, mulberry bark, rice straw, and bamboo too. The pattern and prototyping for this sustainable alteration involves many key steps to ensure a functional and visually appealing outcome product.

- Logistics and Distribution: The logistics and distribution of the rice paper packaging need tailored handling due to its sensitivity and reliability to moisture, which pose initial challenges to its honesty. The supply chain depends heavily on manufacturing hubs in Asia, which must show direction for complicated global routes to reach the rising markets in Europe and North America.

| Material |

Advantages |

Disadvantages |

| Polypropylene (Woven) |

Strong, lightweight, cost-effective, moisture and pest-resistant |

Not biodegradable, limited printability, can degrade under sunlight |

| Jute/Cotton (Fabric) |

Biodegradable, eco-friendly, reusable, naturally breathable |

Poor moisture barrier, relatively heavy, may need liner |

| Laminated (BOPP) |

Excellent barrier protection, attractive printed surface, durable |

Higher cost, multi-layer structure makes recycling difficult |

| Paper/Cardboard with Inner Liner |

Good for branding, recyclable if dry, lightweight |

Weak barrier against humidity, liner-dependent durability |

| Multi-layer Plastic (PE/PET) |

Superior sealing, moisture-proof, customizable with transparent windows |

Not eco-friendly, vulnerable if seal breaks, harder to recycle |

Emerging Trends in the Rice Paper Packaging Market

- Recyclable Packaging: Recyclable packaging is made from materials that can be reused and updated into the latest products. This is why it lowered the demand for current raw materials. Hence, not all recyclable materials are actually recycled, a it relies on the availability of recycling facilities and accurate waste collection systems.

- Compostable packaging: Compostable packaging is crafted in order to break down in a composting environment that turns into natural compost, which can be utilised as fertiliser for farms and gardens. This procedure happens through microorganisms like fungi and bacteria, which break down the material under particular conditions, such as the right levels of humidity, temperature, and oxygen.

- Biodegradable packaging: Biodegradable packaging is similar to compostable packaging, but with some differences. The term "biodegradable" does not mention how long it takes for the material to break down or what surroundings are required for it to be completely decomposed.

- Enhanced Brand Image and Customer experience: Tailored paper rice boxes can be printed with brand logos, logos, or other Codes that enable organisations to develop their brand image. Furthermore, their lightweight and luxury feel contributed to a positive customer experience during takeout or delivery.

- Appealing finishes and textures: The smooth or transparent texture of rice paper serves a natural and luxurious feel, which appeals to brands that give importance to developing aesthetics and sustainability.

- Edible Packaging: Next-generation solutions should go beyond compostability by serving edible wrappers and films created from rice and other plant-based materials. These can be mixed directly into the food items, which leads to zero wastage.

Product type Insights

How Has The Edible Rice Paper Segment Dominated The Rice Paper Packaging Market?

The edible rice paper segment has dominated the rice paper packaging market with a 65% share in 2024, as edible rice paper packaging, which is made from biodegradable and frequently food-grade materials, serves as an exciting, eco-friendly alternative to regular plastics. Imagine a packaging that not only delivers its aim of protecting products but can also be used or composted without leaving toxic waste behind. From seaweed-based wrappers for snacks to rice-paper containers for beverages, edible rice paper packaging is developing as one of the most inventive and actual solutions to the worldwide plastic crisis.

The non-edible rice paper is expected to be the fastest in the market with 2% share during the forecast period. Non-edible rice paper, which is different from the edible version utilised for the spring rolls, has become famous in packaging due to rising environmental issues and growth in production technology. Producers developed the latest materials and procedures to make an aper with the reliability and protection needed for the packaging.

Eleven inventions have stretched non-edible rice paper, utilising rice paper beyond basic wraps and bags. The current manufacturing procedure develops its functionality, which makes it perfect for a variety of demanding uses.

Application Insights

How Has The Food Packaging Segment Dominated The Rice Paper Packaging Market?

The food packaging segment has dominated the market with a 55% share in 2024, as most regular packaging materials are non-recyclable. To align with consumer demand, producers have to make new compostable packages from the start, which leads to a decrease in greenhouse gases in the air.

Also, rice paper is created from a plant named the Tetrapanax papyrifer. This plant is technically processed along with other renewable materials like rice straw pulp and bamboo, too. These raw materials need fewer resources in order to track, and some can be regenerated to solve the rising demand.

The ready-to-eat meals packaging segment is predicted to be the fastest-growing segment in the market with a 25% share during the forecast period. Rice paper has become heavily famous in kitchens globally, serving as an evergreen and healthy alternative to regular wrappers. From sensitive Vietnamese spring rolls to inventive current making, rice paper serves as the accurate basis for both regular and contemporary dishes. The thin, translucent sheets created from water and rice flour serve a neutral flavor that praises any filling while serving an elegant presentation.

End-Use Industry Insights

How Did The Food And Beverages Segment Dominate The Rice Paper Packaging Market?

The food and beverages segment has dominated the market with a 60% share in 2024, as rice paper sheets should be accurately made before you start using spring rolls; otherwise, he spring rolls may not hold together and could fall apart. Dissolving the rice paper sheets in the warm water is necessary to make them pliable and soft, too. Dip the rice paper into the water for a few seconds until it becomes flexible but still constant enough to hold its shape.

The water utilised to soak the rice paper should be warm but not too hot. A perfect rule of thumb is to utilise water which is comfortably warm to the touch, similar to the temperature of bath water, to make sure the rice paper softens correctly.

The retail and e-commerce segment packaging is expected to be the fastest in the market with a 20% share during the forecast period. Rice paper is initially used in retail and e-commerce as a sustainable and aesthetically pleasing alternative to plastic packaging. It assists Barbados in reducing its environmental footprint while catering to eco-conscious users. Edible rice paper is utilised to package coffee, candies, snacks, and other minute food items that serve as a biodegradable and natural option. A durable and paintable material, rice paper is being sold for crafts and arts, including decoupage and mixed media art. The transparent, natural texture of the rice paper appeals to organizations that concentrate on zero-waste and wellness. It is used to cover items like bath bombs and soap bars.

How Did The Sheets And Films Segment Dominated The Rice Paper Packaging Market?

The sheets and films segment has dominated the market with a 50% share in 2024 as rice paper sheets are brittle and sensitive, so their packaging must protect them from toxic and moisture too. Many of the retail packaging includes an inner plastic food inside a paperboard or strong plastic box, while professional and heavy packaging may use big films or bags.

This is the most prevalent form of inner packaging and makes a necessary moisture barrier for the sheets. The packaging should be handled with care as the brittle sheets can conveniently crack.

Laminated and coated films segment are predicted to be the fastest in the market with an 18% share during the forecast period. Laminated and coated films became famous in rice paper packaging as they mainly develop the material's protective properties. That stretches the shelf life of the food products and improves marketability. While regular rice appears to be biodegradable and aesthetically appealing, it lacks enough barrier protection against oxygen, moisture, and other pollutants. Current films solve these shortcomings, which shift rice paper into a highly regular and durable packaging solution.

Distribution Channel Insights

How Did Direct Sales Segment Dominated The Rice Paper Packaging Market?

The direct sales segment has dominated the rice paper packaging market with a 58% share in 2024, as rice paper packaging can be bought directly from producers, online distributors, and wholesalers. The urge for their biodegradable packaging is rapidly developing as a sustainable alternative to plastic, particularly in the food and beverage and retail industries. Buying directly from the producers is perfect for big-volume orders and tailored solutions. We demand that packaging organisations meet to discuss elements and smaller order quantities.

The e-commerce and online retail segment is predicted to be the fastest-growing in the market with a 22% share during the forecast period. E-commerce sales of rice paper packaging are witnessing fast development, which is being driven by the developing consumer demand for sustainable alternatives to plastic, stricter environmental regulations, and innovations in product customization. Besides food, e-commerce brands are utilising sustainable packaging and retail packaging. The materials' natural tone serves a high-end feeling that appeals to a luxury market.

The biggest application for the rice paper packaging is in the food and beverage sector, which accounted for over 53% of the industry share in the year 2024.

Regional Insights

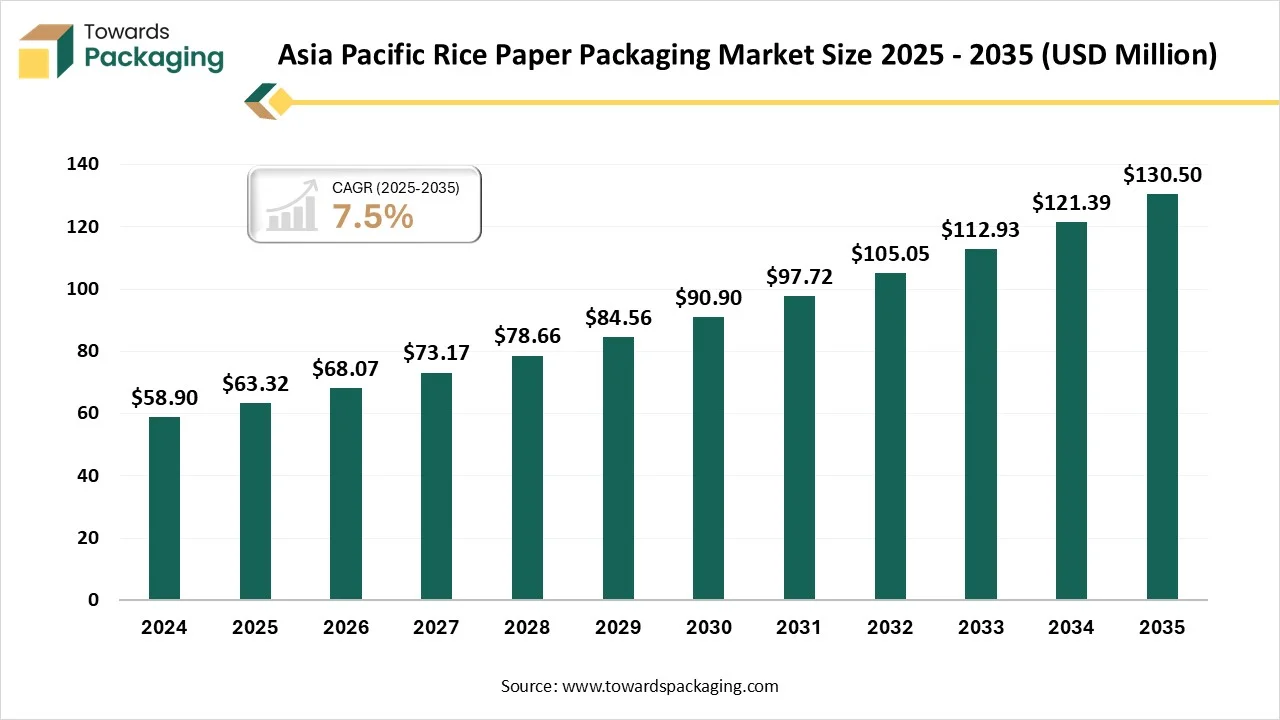

How Has The Asia Pacific Dominated The Rice Paper Packaging Market?

Asia Pacific dominated the rice paper packaging market share of 45% in 2024, as this region is a center for rich and varied culinary traditions, which continue to dominate the edible rice paper industry. As the birthplace of the product, countries such as Vietnam, China, and Thailand have long been the initial suppliers and manufacturers of rice. Hence, the industry is now stretching beyond its regular core, with growing markets such as Indonesia, India, and Malaysia experiencing growing usage due to movement in dietary habits and the developing popularity of Asian Cuisine.

Top India Insights For Rice Paper Packaging Market

The urge for rice paper packaging in India is witnessing strong development, which is being driven by the growing user choice for eco-friendly packaging and supportive government regulations. A main and rising segment of Indian users is becoming more aware of the environmental issues and actively finding sustainable products.

The food and beverage industry is the biggest user segment for rice paper packaging. The growth of online food delivery and e-commerce is driving the demand for cutting-edge, smooth, and lightweight packaging solutions.

The Europe is predicted to be the fastest-growing market with 28% share during the forecast period. European countries, specifically in western countries like the UK and Germany, are increasingly willing to pay more for eco-friendly products. The food service and delivery industries are quickly accepting rice paper packaging as a sustainable alternative to plastic containers for snacks, wraps, and takeaway items. The developing popularity of European and health-conscious cuisines also fulfills the urge for specialist food covers. The urge for natural rice paper packaging in Europe is growing and developing, which is directly driven by the regulations for single-use plastics and the powerful industry's huge development towards sustainable and eco-friendly alternatives.

Top Germany Insights for the Rice Paper Packaging Market

The Germany region rice paper industry is witnessing a notable move towards plant-based diets and health-conscious consumers with developing urges across foodservice, retail, and other channels. The gluten-free and vegan segments are growing rapidly, driven by user awareness of dietary restrictions and sustainable consumption habits.

Innovations in biodegradable and extrusion technology packaging materials are setting the latest standards for product classification. Northern Germany develops greater market entry, which is being driven by the acceptance and health, in which rural regions show slow development, which presents tailored expansion opportunities.

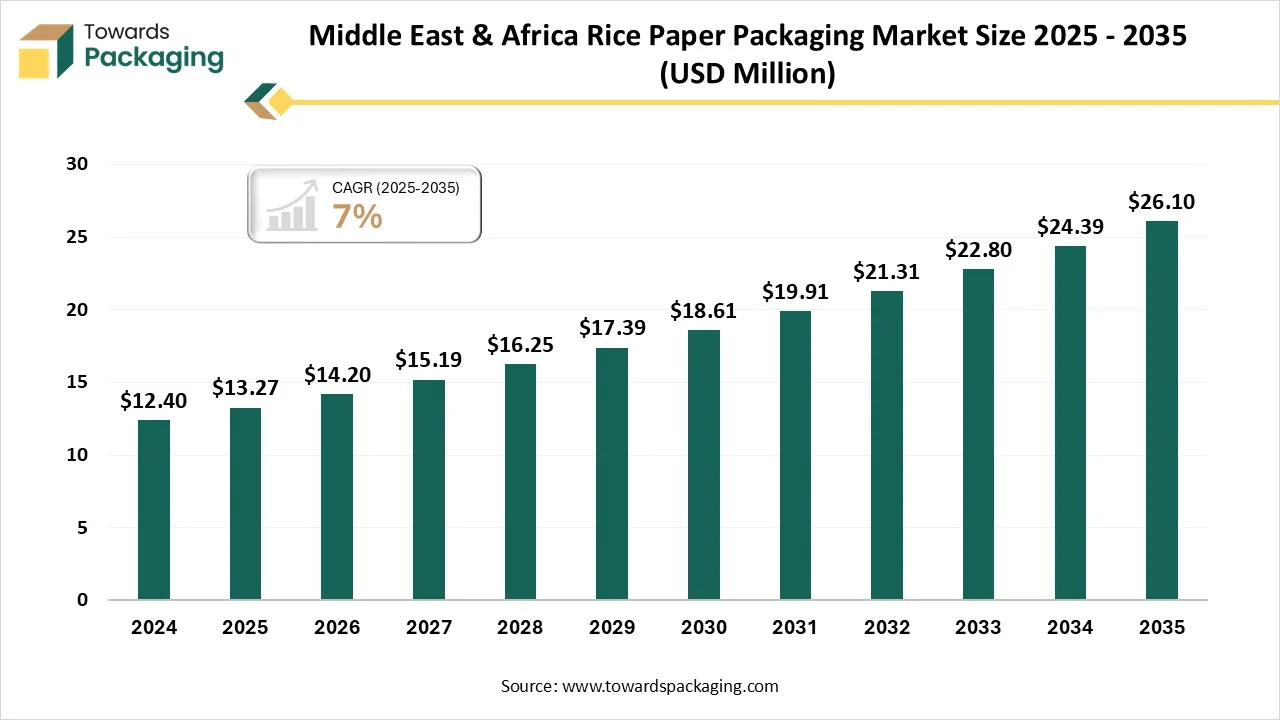

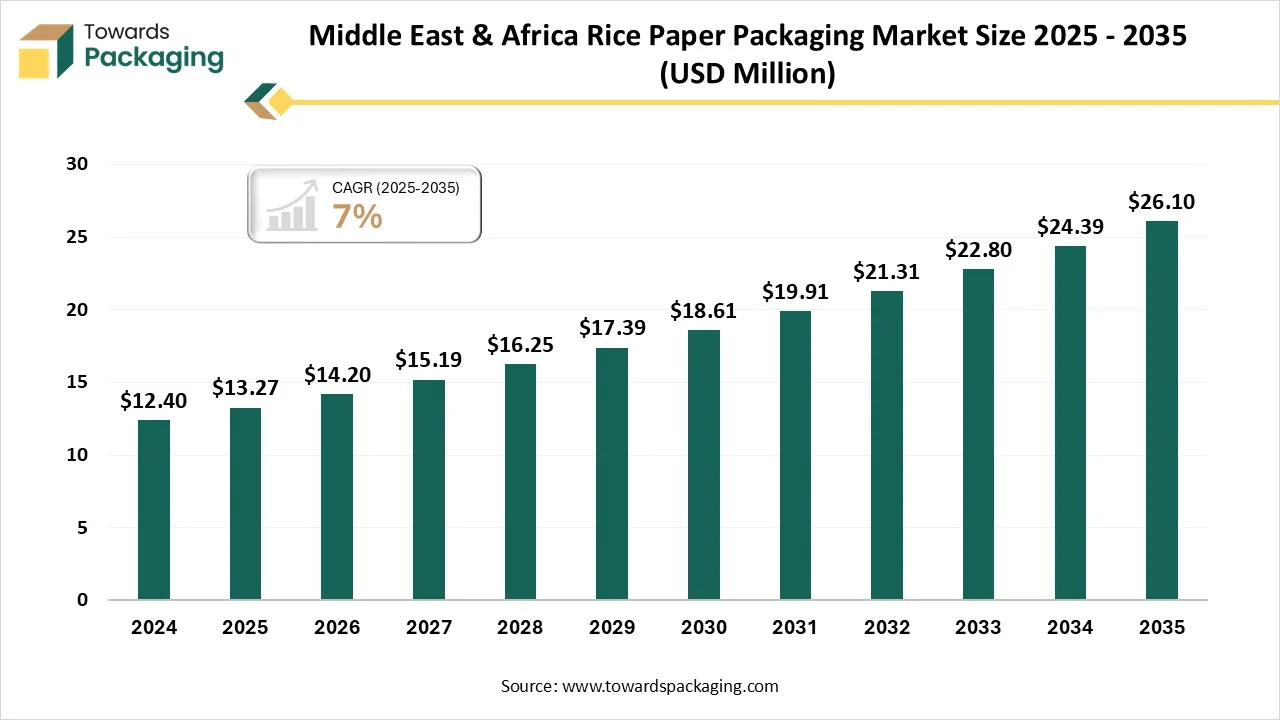

Middle East & Africa Rice Paper Packaging Market Size 2025 - 2035 (USD Million)

Country-Level Investments & Funding Trends for Rice Paper Packaging Market

The demand for rice paper coffee packaging has been developing for years, and the industry for it continues to rise, in line with the industry’s demand for more sustainable packaging alternatives. Though paper bags for coffee are by no means the latest, rice and kraft paper with PLA have become considerably more popular among roasters in recent years.

Oryzite, which is a Spanish invention company, has launched a sustainable packaging material that comes from rice husks, delivering an alternative to regular fossil-based plastics. Through a universally patented procedure, Oryzite updates rice husks, which are an agricultural by-product, into an evergreen thermoplastic material called Oryval.

- In March 2025, Dang Khnah Duy, who is the CEO of Tan Nhein Ltd, experienced local cassava resources to make rice paper without the demand for soaking in water, which is officially exported to many demanding markets globally, including South Korea and Japan.

Recent Development

- In May 2025, Snacks, the brand known for its tasty and nourishing snacks, revealed its first nearside recyclable paper wrapper pilot in the U.S region. This sector's top invention marks a milestone in receiving a recycle-ready cover for the bars category while the organisation continues to develop towards its goal of making sure all packaging is crafted for recyclability by 2030.

Top Vendors In The Rice Paper Packaging Market And Their Offerings

- Huakang Paper & Packaging: At Huakang Packaging Technology Co., Ktd, invention is at the center of our runs. They are proud of any in-house R&D team that constantly works on maintaining new products and developing manufacturing procedures.

- AEP Industries: AEP Industries Pvt Ltd is a certified company that is a part of the AEP group of companies. The group started business in the year 1976 as a fastener manufacturing organization under the name of the AEP Company, which was later renamed to AECOM Fasteners Pvt Ltd.

- Futamura Group: It was established in Japan in 1950 and currently has an overall operation of 6 producing divisions delivering to users around the globe. We can find further information and links to every division below.

- Paix Packaging: Shanghai Paixie Packaging MACHINERY Co.,lTD is situated in Pujiang town, Minhang area, Shanghai City, China. Shanghai Paixie Packing Machinery is a producer of bottle feeding machines. Filling machine for the bottles, filling machine for the machine toys and bottles.

- 14. Oji Holdings Corporation: Oji Holdings is a Japanese producer of paper products. In the year 2012, the company was the third largest company in the global paper, forest, and packaging sector. The organization's stock is then listed on the Tokyo Stock Exchange and is a constituent of the Nikkei 225 stock index.

Anhui Yinghua Food Packaging:

- Shanghai Sun Paper Products

- NatureFlex / Innovia Films

- Huhtamaki

- Tetra Pak

- Berry Global

- Stora Enso

- Mondi Group

- Winpak Ltd.

Rice Paper Packaging Market Segmentation

By Product Type

- Edible Rice Paper

- Non-Edible Rice Paper

By Application

- Food Packaging

- Ready-to-Eat Meals

- Bakery & Confectionery

- Frozen Foods

- Retail & Consumer Convenience

- Specialty Packaging (Gift & Decorative)

By End-Use Industry

- Food & Beverages

- Confectionery & Bakery

- Retail / E-commerce Packaging

- Hospitality / Catering

By Form

- Sheets / Films

- Rolls / Continuous Films

- Laminated / Coated Films

By Distribution Channel

- Direct Sales (B2B)

- Distributors / Wholesalers

- E-commerce / Online Platforms

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait