Sustainable Retail Packaging Market Size, Share, Trends and Forecast Analysis

The sustainable retail packaging market is expanding strongly, driven by consumer demand for eco-friendly materials, strict plastic regulations, and retailer ESG goals. In 2024, Europe led with 60% market share, while Asia Pacific is set for the fastest growth through 2034. Paper & paperboard dominated materials at 40%, and boxes & cartons led product categories at 35%. Primary and secondary formats accounted for 65% of demand, with food & beverages and e-commerce collectively holding 55% of end-use share. The market analysis includes trade flows Europe’s USD 5,800M imports and APAC’s 7,200M exports plus value chain insights from raw materials (45% cost share) to logistics and certification. Major companies include Amcor, Mondi, Smurfit Kappa, WestRock, Ball Corp., Crown Holdings, and Tetra Pak.

Key Takeaways

- By region, Europe dominated the market with having the major share of 60% in 2024.

- By region, Asia Pacific is expected to rise at a notable CAGR between 2025 and 2034.

- By material type, the paper and paperboard segment has contributed to the biggest share of approximately 40% in 2024.

- By material type, the bioplastics and plant-based plastics segment will grow at a notable CAGR between 2025 and 2034.

- By product type, the boxes and cartons segment has contributed to the largest share of approximately 35% in 2024.

- By product type, bags, pouches, and reusable packaging segments will grow at a notable CAGR between 2025 and 2034.

- By packaging format, the primary and secondary packaging segments have contributed to the largest share of approximately 65% in 2024.

- By packaging format, the tertiary packaging segment will grow at a notable CAGR between 2025 and 2034.

- By end-use industry, the food and beverage and e-commerce retail segment has contributed to the largest share of approximately 55% in 2024.

- By end-use industry, the personal care, cosmetics, and fashion segment will grow at a notable CAGR between 2025 and 2034.

What Is A Sustainable Retail Packaging Market?

Growth is driven by increasing consumer demand for environmentally responsible products, stricter government regulations on plastic waste, corporate sustainability goals, and innovation in biodegradable and renewable packaging materials.

The sustainable retail packaging market refers to the industry for eco-friendly, recyclable, compostable, and reusable packaging solutions used by retailers across sectors such as food & beverages, consumer goods, fashion, cosmetics, and e-commerce. These packaging materials aim to reduce environmental impact by minimizing single-use plastics, lowering carbon emissions, and supporting circular economy practices.

Key Metrics and Overview

| Metric |

Details |

| Market Drivers |

- Consumer demand for eco-friendly & reusable products.

- Stricter government policies on plastics.

- Corporate ESG & sustainability goals.

- Biodegradable & renewable material innovations. |

| Leading Region |

Europe |

| Market Segmentation |

By Material Type, By Product Type, By Packaging Format, By End-Use Industry and By Region |

| Top Key Players |

Amcor PLC, International Paper, Smurfit Kappa, WestRock, Ball Corp., Crown Holdings, Tetra Pak, Mondi Group. |

Emerging Trends in the Sustainable Retail Packaging Market

- Circular Design: Mono-Materials and Reuse Systems: Mono-Material packaging avoids the pollutant issues of mixed-material items. Fiber-dependent mono-material patterns, such as cardboard boxes having the moulded pulp inserts, make recycling straightforward for waste processors and users too.

- Material Invention: Compostable, bio-based, and Edible Options: The search for next-generation sustainable materials is gaining attention as mycelium-based packaging can substitute polystyrene foam. Also, seaweed and grain-based edible packaging is attracting attention in the main industries. Hence, while several rising materials experience scale and cost barriers, fiber-based packaging solutions -such as corrugated cardboard and molded pulp- are scalable and a practical selection for sustainable packaging.

- Lightweighting for lower CO2 emissions: Lowering the packaging weight cuts both transport emissions and materials usage. Updated corrugated cardboard designs can deliver strong protection with less fiber. Also, lighter loads mean lower fuel consumption and lower CO2 release. On the other hand, paper pulp packaging also serves a main transportation benefit. Because the molded pulp space can be fitted during assembly, up to 3 times more units fit on a pallet as compared to EPS.

- Zero-Waste and Reusability Models: Zero-waste packaging points to packaging solutions that are crafted to make less or no waste across their complete lifecycle. This means every component can be recycled, reused, and composted, making sure they stay within the circular economy and out of landfills.

- Smart, Traceable and Safe packaging: Reylon serves a complete range of these solutions, including the paper-based tamper-evident tape and labels. Paper-based options not only prevent product counterfeiting and tampering but also meet sustainability goals by using recyclable materials and lowering the dependency on plastics.

- Consumer & ESG Demands Shaping the Industry: Current research from McKinsey displays the recycled content, recyclability, and reusability, in which users leading packaging give importance to reusage. While bio-based materials are created from seaweed, plants, or mycelium attract interest, they currently encourage buying decisions less than proven recyclability.

How Is Artificial Intelligence Used In The Sustainable Retail Packaging Market?

Artificial intelligence urges for products with accurate precision, and automatically triggers order needs and demands to restock a product. It can also manage the allocation of the stocks across a network of warehouses and keep them in storage with expected future demand in the appropriate places. Intelligent algorithms can assist retailers in lowering the overload and lessening the demand for excess packaging, hence decreasing waste too.

Apart from this, the AI systems can check package materials and accuracy, which creates the design suggestions to lower the material usage, or push the usage of biodegradable or recyclable materials to market the sustainability in retail.

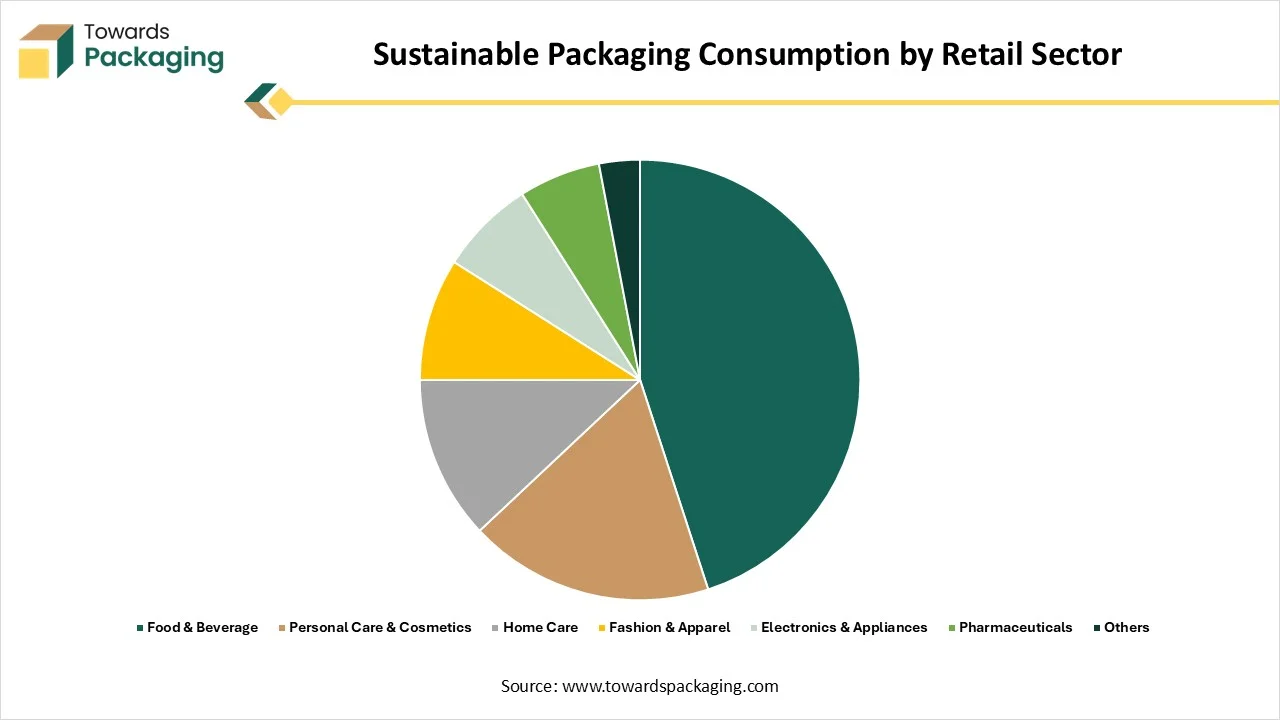

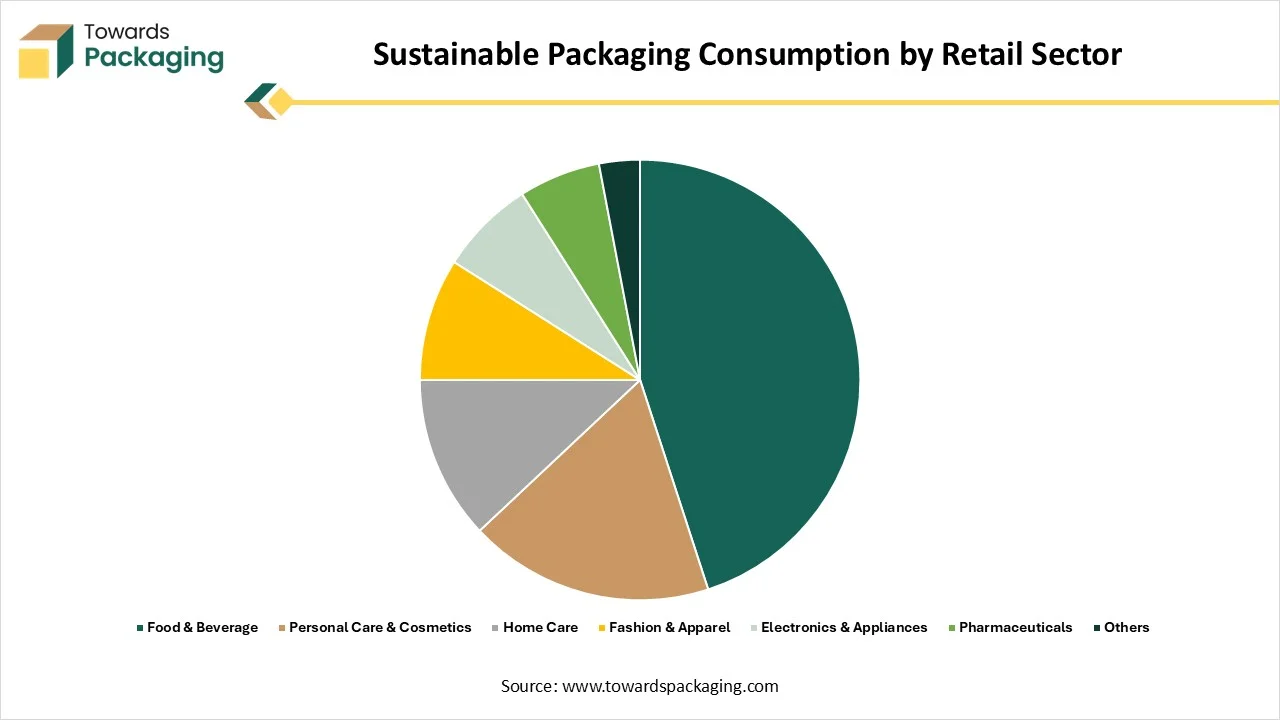

Sustainable Packaging Consumption by Retail Sector

| Retail Segment |

Share (%) |

| Food & Beverage |

45% |

| Personal Care & Cosmetics |

18% |

| Home Care |

12% |

| Fashion & Apparel |

9% |

| Electronics & Appliances |

7% |

| Pharmaceuticals |

6% |

| Others |

3% |

The food & beverage segment leads the retail market with a 45% share driven by high consumption frequency, strong demand for packaged foods, and continuous product innovation. Personal care & cosmetics account for 18%, supported by rising grooming awareness, premiumization trends, and the growing influence of social media and e-commerce. Home care holds 12%, fueled by increasing focus on hygiene, cleanliness, and sustainable household products. Fashion & apparel 9%, electronics & appliances 7%, and pharmaceuticals 6% reflect steady demand backed by lifestyle upgrades, technological adoption, and healthcare needs, while others 3% include niche retail categories with emerging growth potential.

Market Dynamics

Market Driver

Green Packaging Drives The Sustainable Retail Packaging

The urge for sustainable packaging is growing, encouraging manufacturers to concentrate on eco-friendly and recyclable materials. This demand also pushes the use of technology to make smart, multi-functional packaging. Current packaging materials need to be sustainable and align with food safety standards, meet regulations, and avoid toxic chemicals like PFAS and toluene, pollutants that are toxic to health and the environment.

On the other hand, researchers suggest that green packaging, which often consists of sustainable packaging or environmentally friendly packaging. Green packaging can be created from a variety of materials, including recycled paper, plant-based plastics, and biodegradable plastics. As well as lowering the urge for virgin material, green packaging aims to restrict packaging waste by substituting single-use materials with recyclable alternatives.

Market Restraint

Several Elements Is The Issue With This Market

In the Sustainable retail industry, its challenging to precisely display the organization's sustainability achievements, avoid greenwashing, and generate consumer trust in a cynical industry. Several users don’t care as consumers want sustainable selection, yet there remains an attitude-behaviour gap. Consumers make a selection depending on the assessment of product design, sustainability, quality, and price, too. Sustainability is a huge term. Retailers have to make investments currently to coordinate lasting business value. This is particularly challenging for discount /value end brands.

Market Opportunity

Rise of Compostable and Biodegradable Packaging

The users and brands at the same level become heavily aware of their environmental effect, and the future of sustainable retail packaging is poised to change how we shop and how products are delivered. The usage of compostable and biodegradable materials, such as plant-based plastics or cardboard. These types of materials break down much faster than regular plastics, lowering the waste and minimizing damage to the surroundings. Organizations are also witnessing materials like mushroom-based packaging and seaweed wraps, which not only decompose naturally but also leave a minimal ecological footprint.

Material Type Insights

How Have Paper And Paperboard Segment Dominated The Sustainable Retail Packaging Market?

The paper and paperboard segment dominated the sustainable retail packaging market with a CAGR of approximately 40% in 2024 as paper and paperboard are fundamental materials in the initiative for sustainable packaging solutions. Due to their renewable beginnings and high recyclability, these types of materials serve as eco-friendly alternatives to non-renewable resources, helping to lower the environmental impact while aligning with the urges of modern packaging. Sectors globally are including paper and paperboard into their packaging steps, examining their advantages in lowering the waste and preserving energy.

Paper and paperboard are derived from post-user or post-industrial wastage, that is, they are reused from scraped products rather than newly produced from raw materials. Their recycling procedure involves pulping, collecting, and remanufacturing these substances into current products, such as cartons, boxes, and inserts.

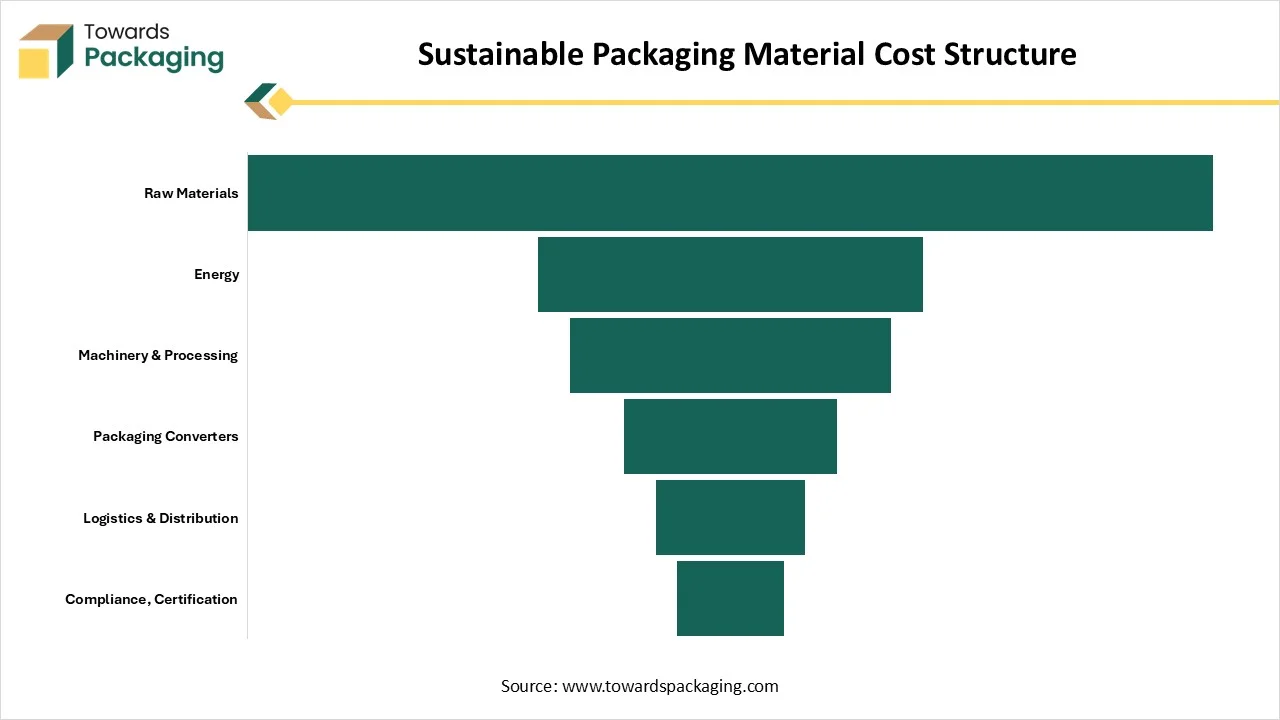

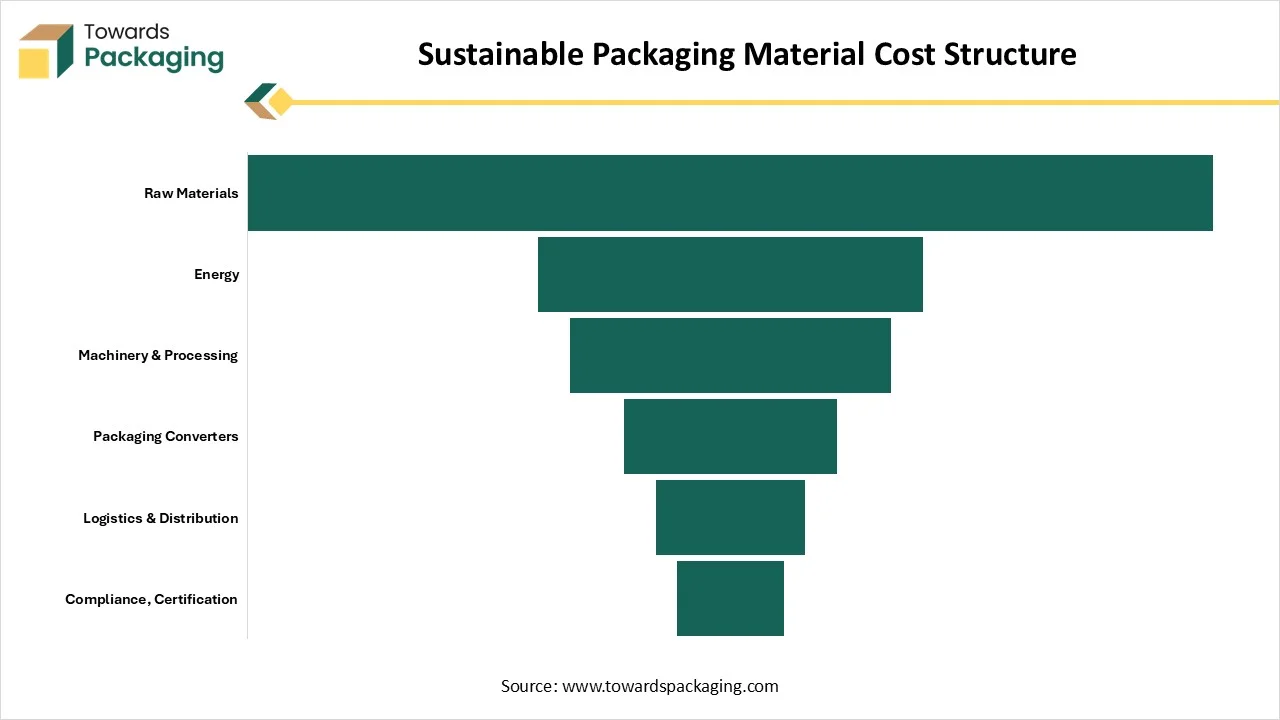

Sustainable Packaging Material Cost Structure

| Cost Item |

Cost Share (%) |

| Raw Materials |

45% |

| Energy |

18% |

| Machinery & Processing |

15% |

| Packaging Converters |

10% |

| Logistics & Distribution |

7% |

| Compliance, Certification |

5% |

The bioplastics and plant-based plastics segments expected to be the fastest-growing in the market during the forecast period. Bioplastics are obtained from renewable biological sources such as sugarcane, corn starch, cellulose, and or other plant-based materials. Just like regular plastics that are created from fossil fuels, bioplastics can be either compostable, biodegradable, or simply bio-based without the need for biodegradability.

Replaced packaging materials expand beyond bioplastics to include inventions such as mushroom-based packaging, paper composites, seaweed films, and even edible packaging. Plant-based plastics are materials made using biological substances instead of petroleum. Just like regular plastics, which are derived from non-renewable fossil fuels, plant-based plastics are generated from biomass, organic matter generated from plants, crops, and agricultural by-products.

The cost structure is heavily raw material driven, with 45% of total expenses tied to key inputs that are highly sensitive to price volatility. Energy costs 18% place strong pressure on margins, especially amid rising power and fuel prices. Machinery and processing 15% reflect continuous investments in advanced equipment, automation, and operational efficiency. Packaging converters 10% and logistics & distribution 7% add layers of value and reach but increase overall spend, while compliance and certification with 5% underline the growing cost of meeting stringent safety, quality, and sustainability regulations.

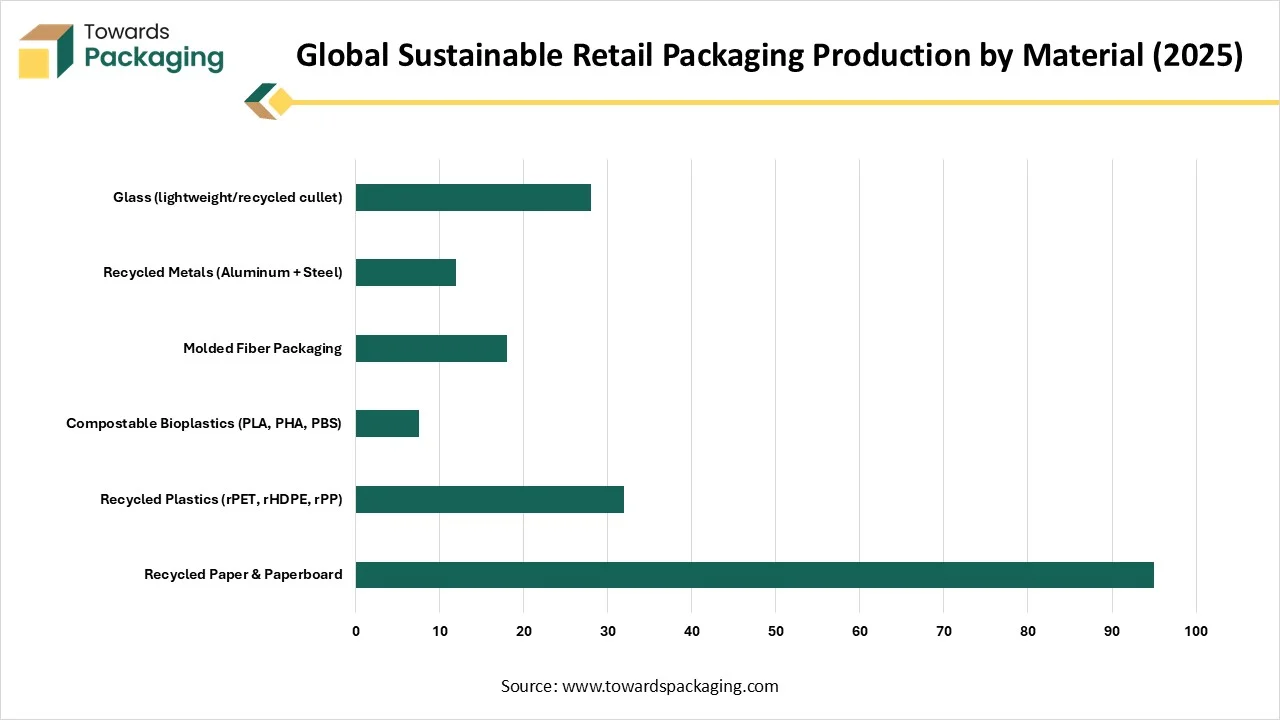

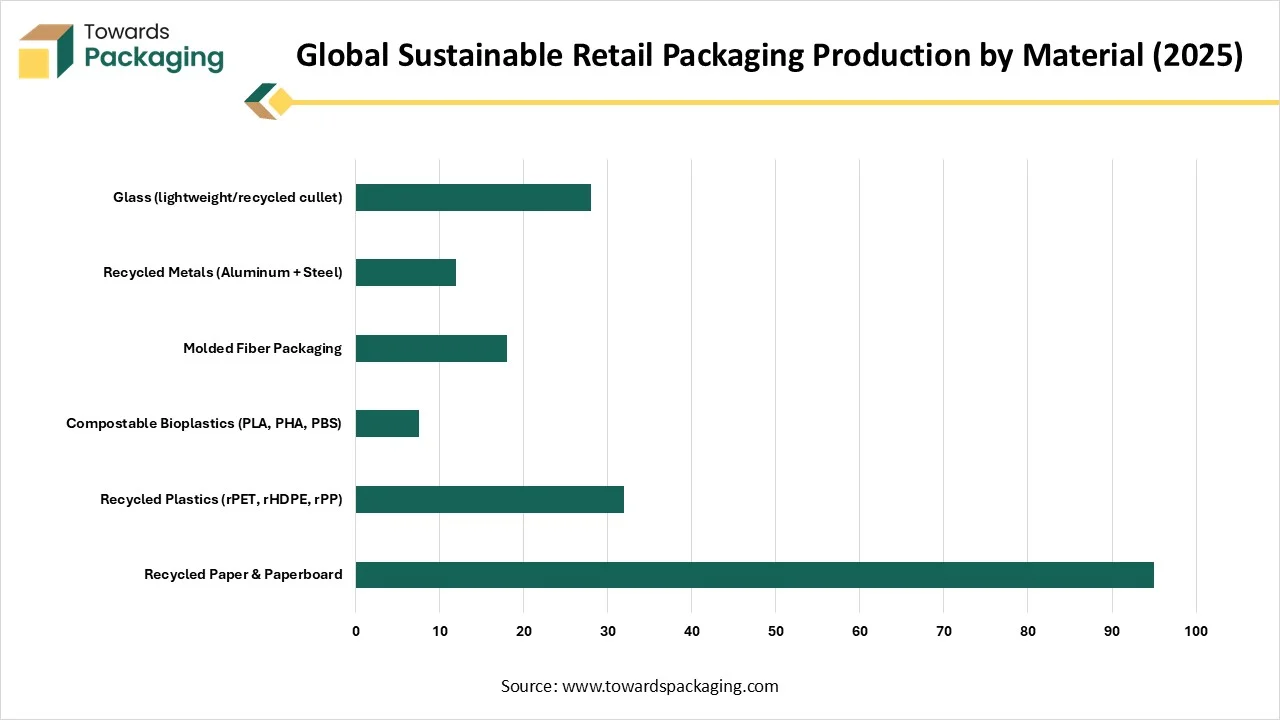

Global Sustainable Retail Packaging Production by Material (2025)

| Material Type |

Million Tonnes / Year |

| Recycled Paper & Paperboard |

95 |

| Recycled Plastics (rPET, rHDPE, rPP) |

32 |

| Compostable Bioplastics (PLA, PHA, PBS) |

7.5 |

| Molded Fiber Packaging |

18 |

| Recycled Metals (Aluminum + Steel) |

12 |

| Glass (lightweight/recycled cullet) |

28 |

Product Type Insights

How Did The Boxes And Cartons Segment Dominate The Sustainable Retail Packaging Market?

The boxes and cartons segment dominated the sustainable retail packaging market with an CAGR of approximately 35% in 2024 as, in the space of growing environmental awareness, boxes serve as a sustainable alternative to plastic or other non-biodegradable packaging selections. It is initially made from recycled paper; they are 100% biodegradable and recyclable. By selecting box packaging, any organization can mainly lower its environmental footprint. Sustainability has become a main priority for users, and more organizations are updating their packaging methods with green practices in order to align with the rising demand for environmentally friendly options.

The bags, pouches, and reusable packaging segments are predicted to be the fastest-growing in the market during the forecast period. The wood fibre-dependent carrier bags have come up as a perfect solution to the issues posed by regular plastic bags. These inventive shopping bags are designed from renewable resources, serving sustainable alterations that meet the principles of a circular economy. Accepting sustainable packaging solutions like wood-based carrier bags can mainly affect a brand's image and user point of view.

Sustainable laminate pouches are perfect for packaging single-use products like makeup sponges, dry goods, and small accessories, too. These environmentally-friendly pouches are crafted to break down in industrial composting facilities, serving as a sustainable alternative to regular plastic packaging, too.

How Have The Primary And Secondary Packaging Segment Dominated The Sustainable Retail Packaging Market?

The primary and secondary packaging segment dominated the sustainable retail packaging market with a CAGR of approximately 65% in 2024 as primary packaging is the primary layer that directly contacts the product. It is used to store products safely, ready for users, and fresh too. Perfect primary packaging protects pollutants, stretches the shelf life, and makes a fast visual effect on store shelves. Main materials used are flexible plastics, aluminium, and paper-based composites, too. Flexible packaging, like stand-up pouches and vacuum-sealed bags, has become heavily famous because it offers lightweight durability while being suitable for various sizes and shapes. Secondary packaging is the next surface, which collects multiple units of a product for convenient handling. Its main functions are to prevent the primary packages, put them in the proper way for support branding and distribution at the retail level.

The tertiary packaging segment is expected to be the fastest in the market during the forecast period Tertiary packaging makes the outcome a protective surface used in bulk storage and shipping. Prevalent examples include wooden pallets, large corrugated boxes, bulk containers, and shrink-wrapped pallet loads. Tertiary packaging must be difficult enough to carry, withstand stacking, temperature changes, transport vibrations, and the hardship of cross-country or international shipping. Whenever it is crafted thoughtfully, tertiary packaging prevents valuable inventory, develops logistics smoothness, and assists in warehouse optimization.

End-Use Industry Insights

How Did The Food And Beverages, E-Commerce, And Retail Segments Dominate The Sustainable Retail Packaging Market?

The food and beverages, e-commerce, and retail segments dominated the market with CAGR of approximately 55% in 2024 as branded bags serve an effective and environmentally friendly solution for marketing your brand, developing customer experience, and heavily visibility. By including the cotton and jute bags in your marketing process, food and beverage organisations can display their loyalty to sustainability, while serving customers with a regular product, as they can be used each day, everywhere. The idea of biodegradable packaging is that of a material that decomposes via the action of microorganisms. However, the time used in the procedure differs, depending on the surroundings. In contrast to plastic packaging, compostable packaging breaks down, and the addition of no toxins to the soil, they generate nutrients in it.

Strategic Designs: Upcoming Potential for the Market

| Design Element |

Message Conveyed |

Best For |

| Earth-Toned labels and textures |

Sustainability, eco-awareness |

Vegan spreads, plant-based beverages |

| Clean minimalist design |

Purity, modern health consciousness and transparency |

Wellness drinks ,low-sugar snacks and organic teas |

| Bold traditional colours |

Heritage ,trust and culture |

Pickles, ethnic snack packs and blends |

| Embossed glass or foil labels |

Luxury, craftsmanship and exclusivity |

Gourmet sauces, fine chocolates and premium oils |

| Matte Finish or soft touch |

Luxury feel, professional care and invention |

Nut butters, cold brews and grade condiments |

Personal care, cosmetics, and fashion segments are expected to be the fastest-growing segments in the market during the forecast period. Cosmetics and personal care products need smooth packaging to store products safely. Current inventive packaging solutions are utilising creative patterns, basic uses, latest materials, less material, and automated systems to develop sustainable efforts, while still maintaining the package's look and effectiveness. Types of plastic are well known for their toxic effects on the environment. Lowering plastic usage through cutting-edge or substituting with eco-friendly materials can greatly contribute to a healthier future. Apart from the sustainable and biodegradable beauty trend in the cosmetic industry, there are waterless beauty products which are being formulated without water, like shampoo, powdered cleansers, bars, and solid moisturizers, so waterless items do not need liquid-specific packaging, making it much convenient to keep in more sustainable packaging materials.

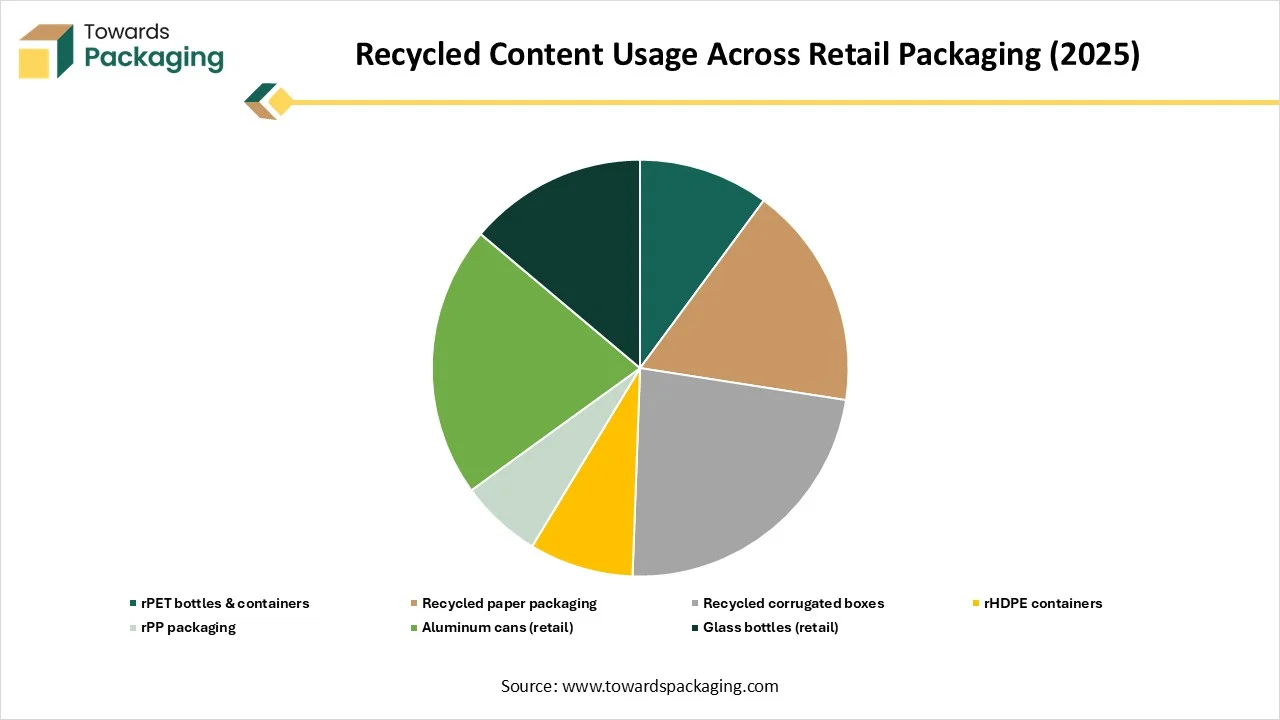

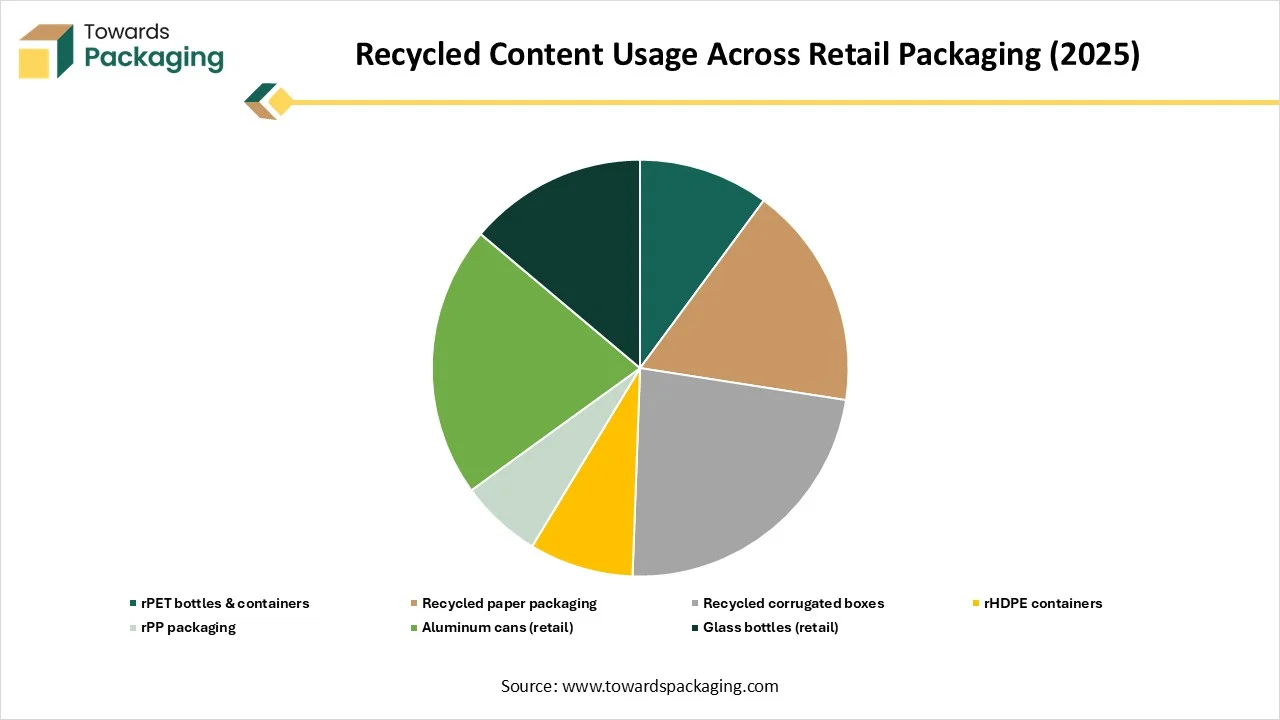

Recycled Content Usage Across Retail Packaging (2025)

| Material |

Average Recycled Content (%) |

| rPET bottles & containers |

35% |

| Recycled paper packaging |

60% |

| Recycled corrugated boxes |

80% |

| rHDPE containers |

28% |

| rPP packaging |

22% |

| Aluminum cans (retail) |

73% |

| Glass bottles (retail) |

48% |

The table highlights a strong shift toward recycled materials, with recycled materials with recycled corrugated boxes 80% and aluminum cans 73% leading due to well-established recycling streams and high recovery rates. Recycled paper packaging 60% and glass bottles 48% also show significant circularity supported by widespread collection and reuse infrastructure. In contrast, rPET bottles, 35% rHDPE containers, 28%, and rPP packaging 22% reflect gradual progress constrained by sorting contamination and supply limitations. Overall, the data underscores both maturity in fiber and metal recycling and untapped potential in plastic-based packaging.

Regional Insights

How Has The European Region Dominated The Sustainable Retail Packaging Market?

Europe dominated the sustainable retail packaging market with CAGR of 60% in 2024 as the encouragement for sustainable packaging in Europe is gaining attention, driven by an integration of user demand, regulatory pressure, and environmental awareness. European retailers urge to understand the current local policies and infrastructure, as well as EU rules for waste management, and the gaps that need to be solved. So, starting accepters of compostable packaging in the fashion, food, and dry goods industries have shown promising outcomes. However, to make a main effect and main packaging producers is to serve a rising array of inventive sustainable options, it's important for both small and large retailers to work together towards a greener and happier future.

UK Sustainable Retail Packaging Market Trends

The UK sustainable retail packaging market is driven by stringent government regulations that seek to promote the use of low-carbon materials, raise recycling rates, and decrease single-use plastics. To satisfy consumer expectations and regulatory requirements, retailers and brands are investing in lightweight packaging, compostable films, and paper-based substitutes. Companies are being forced to redesign packaging, optimize supply chains, and guarantee end-of-life recovery due to the growing demand for environmental transparency and eco-labeling. The UK's cutting-edge waste management infrastructure, which permits retail brands to implement circular packaging systems at scale, further supports the market.

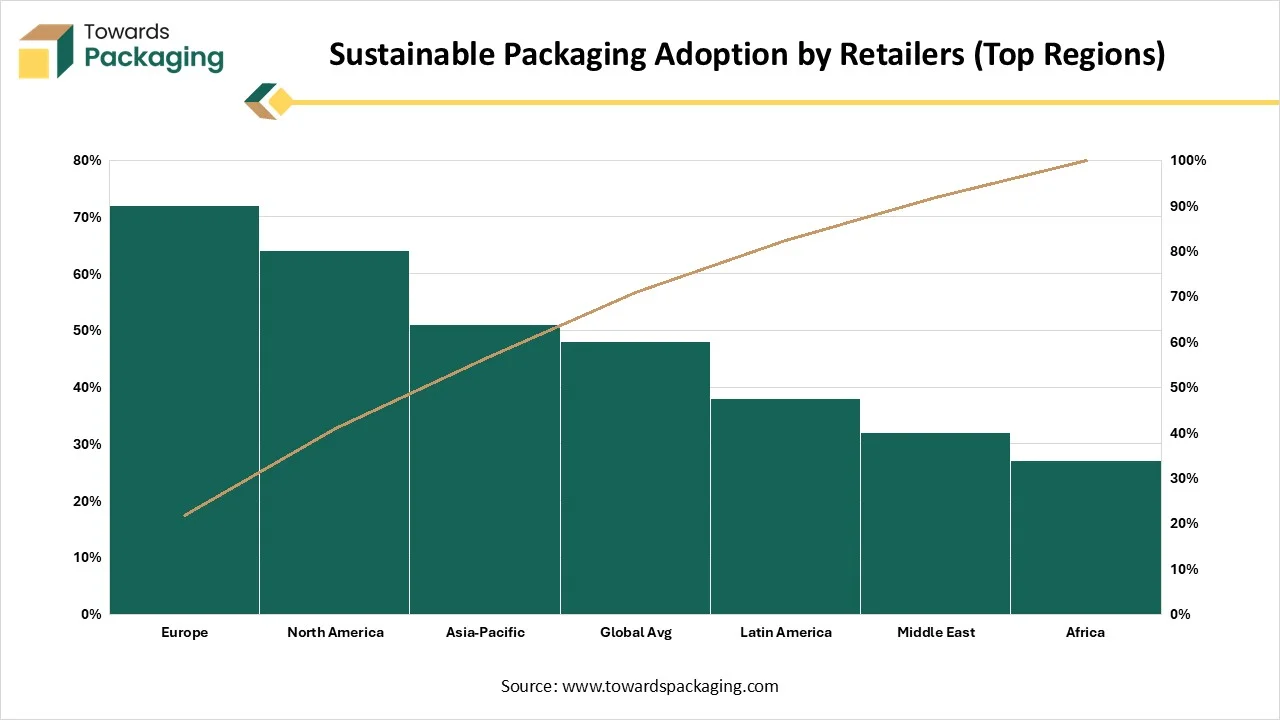

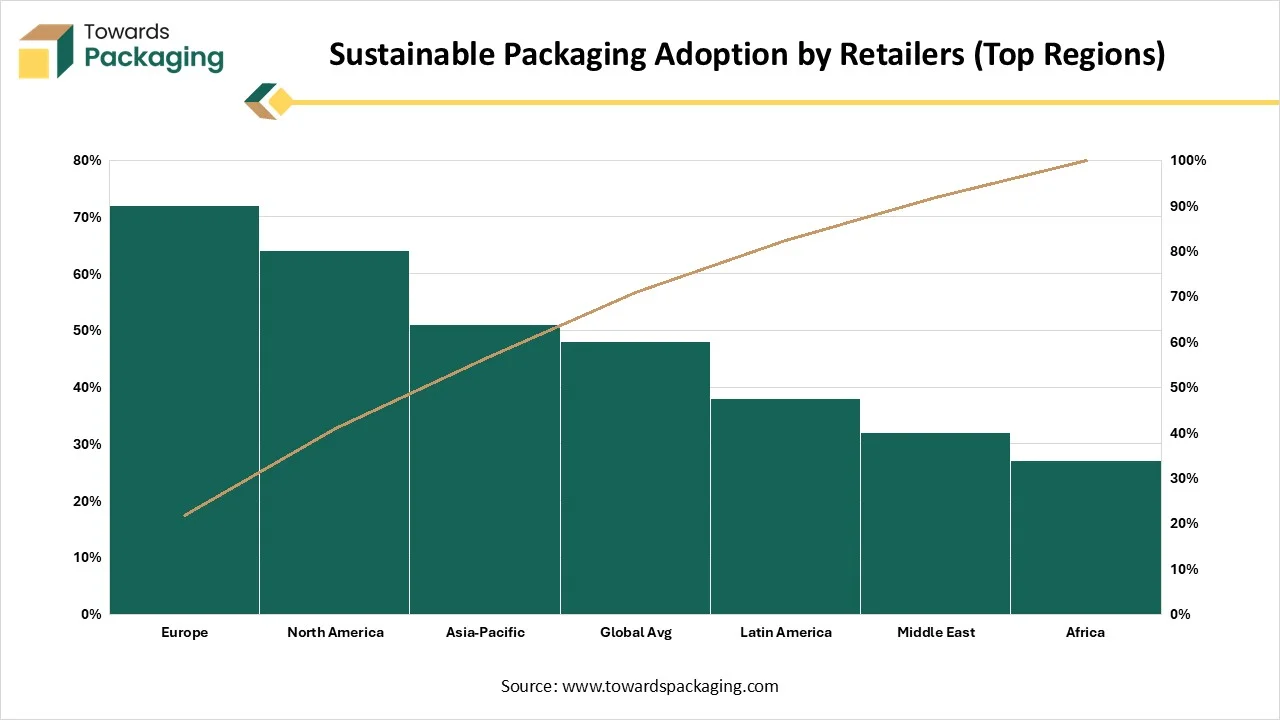

Sustainable Packaging Adoption by Retailers (Top Regions)

| Region |

Adoption Rate (%) |

| Europe |

72% |

| North America |

64% |

| Asia-Pacific |

51% |

| Latin America |

38% |

| Middle East |

32% |

| Africa |

27% |

| Global Avg |

48% |

Asia Pacific is expected to be the fastest growing in the market during the forecast period. This region carries an important industry share, which is driven by economic development, growing population, and rising disposable incomes. China, as the biggest generator and consumer of paper, plays a crucial role in the region’s dominance. Top organisations in the sector are giving importance to sustainable practices, such as accountable purchasing of raw materials and smooth resource utilization. This concentration on sustainability is attracting environmentally conscious users and driving market development. Also, the development in online retail, particularly in emerging economies, has fulfilled the urge for sustainable and environmentally friendly solutions. Paper packaging, which is cost-effective and biodegradable, is gaining attention over plastic alternatives.

India Sustainable Retail Packaging Market Trends

The Indian sustainable retail packaging market is expanding because of government restrictions on single-use plastics, growing consumer awareness, and the need for affordable, environmentally friendly formats. To strike a balance between affordability and sustainability, local producers are turning to recyclable polyethylene molded fiber and biodegradable polymers. To reduce waste and adhere to new regulations, both small and large retailers are implementing reusable products, refill stations, and minimal packaging designs. However, high switching costs and disjointed recycling infrastructure continue to be major obstacles, prompting brands to investigate creative low-cost sustainability models appropriate for a range of economic sectors.

Latin America Sustainable Retail Packaging Market Trends

Latin America’s sustainable retail packaging market is growing as brands react to growing environmental activism and local governments enact waste management legislation. To improve sustainability metrics and lessen the burden on landfills, businesses are implementing reusable containers, bio-based materials, and plastics with recycled content. Global circular economy strategies are being introduced to the region by multinational retailers, which are promoting technology transfer and new business models. Scalable adoption is challenging despite regulatory advancements due to a lack of recycling infrastructure and high price sensitivity, which pushes businesses to create packaging that is reasonably priced, long-lasting, and resource-efficient.

Brazil Sustainable Retail Packaging Market Trends

Brazil’s sustainable retail packaging market is fueled by growing recycling initiatives, business ESG pledges, and consumer demand for ethical brands. In an effort to cut waste and emissions, the market is seeing a significant uptake of rPET packaging, paper-based substitutes, returnable formats, and lightweight designs. To increase collection and sorting efficiency, retailers are collaborating with reverse logistics companies and cooperatives. Adoption is still hampered by inconsistent regulations and cost fluctuations, which force businesses to develop innovative localized sustainability solutions that are suited to Brazilian supply chains and consumption patterns.

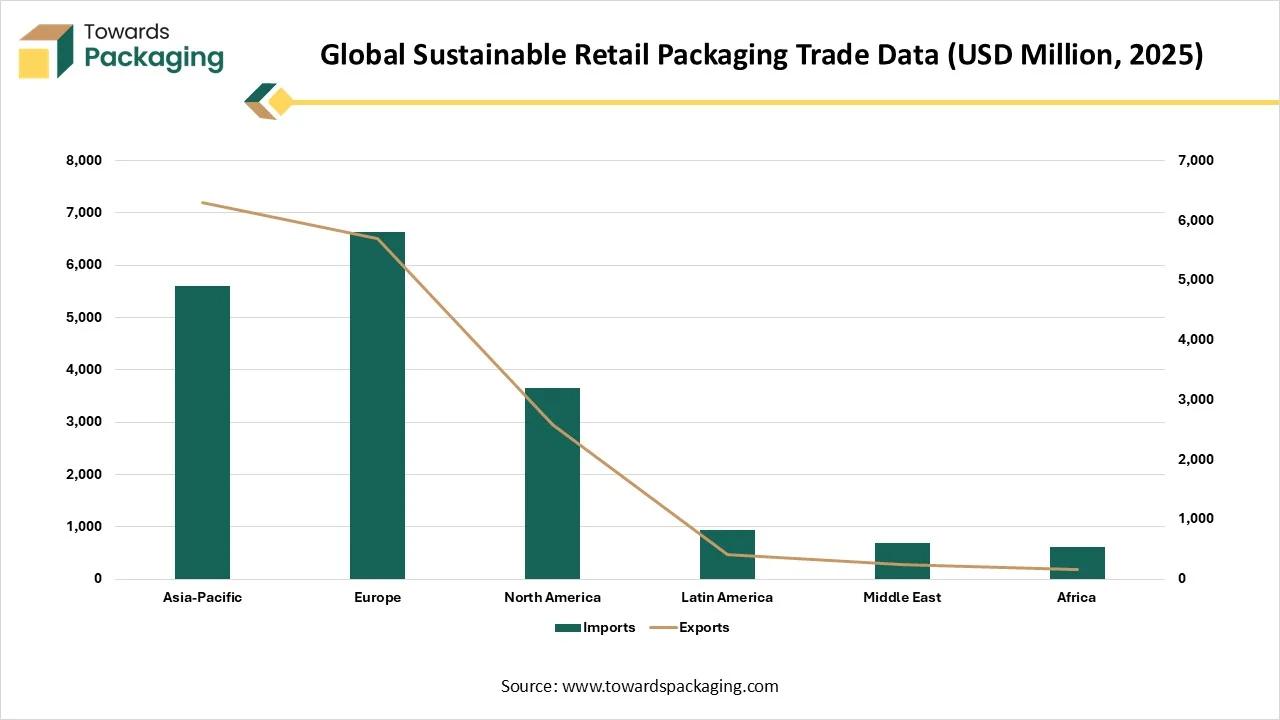

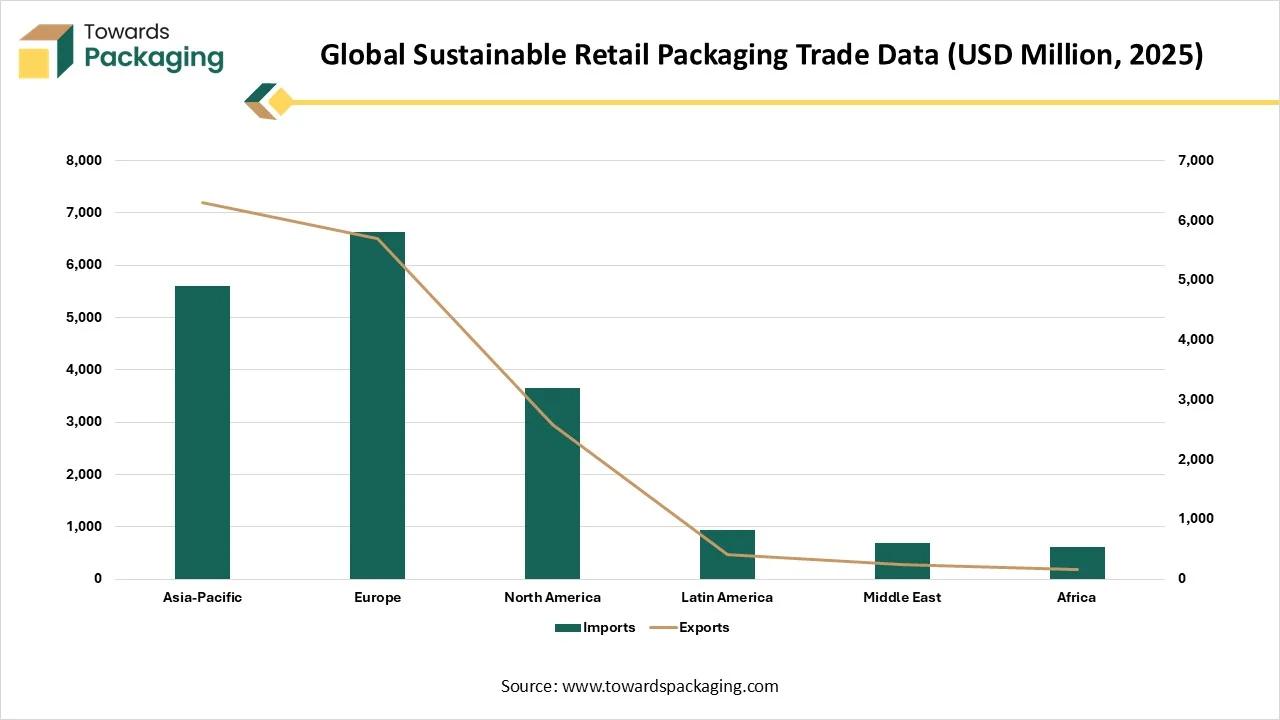

Global Sustainable Retail Packaging Trade Data (USD Million, 2025)

| Region |

Imports |

Exports |

| Asia-Pacific |

4,900 |

7,200 |

| Europe |

5,800 |

6,500 |

| North America |

3,200 |

2,950 |

| Latin America |

820 |

460 |

| Middle East |

610 |

280 |

| Africa |

540 |

190 |

Sustainable Retail Packaging Market - Value Chain Analysis

- Material Processing and Conversion: Material processing and conversion for sustainable retail packaging includes constructing for a circular economy utilising renewable, biodegradable, and recyclable materials, by concentrating on lowering the waste through the 3 Rs ( Reduce, Reuse, and Recycle) and hiring energy-efficient, closed-loop production procedures. Main materials count cardboard, paper, and different plastics (like PLA), which are processed through melting, sorting, or composting to be reconstructed into latest products or returned to the surrounding environment without harm.

- Package Design and Prototyping: To design and prototype the sustainable retail packaging, we should give importance to Life Cycle Assessment in order to analyze environmental hotspots, then use the 4Rs (Redesign, Reuse, Reduction, and Recycled content ) as design goals in order to choose accurate materials, update size and shape, and ensure biodegradability and recyclability.

- Logistics and Distribution: The logistics and distribution of sustainable retail packaging involves constructing lightweight, sustainable materials, and updating transportation and storage to lower the fuel consumption and emissions. Main strategies count on integrating the same orders, using recycled and renewable materials like mushroom and cardboard packaging, and using the opposite logistics for take-back programs to close the product‘s life cycle.

Leading Companies in the Sustainable Retail Packaging Market

Tier 1

- Amcor PLC

- International Paper Company

- Smurfit Kappa Group

- WestRock Company

- Ball Corporation

- Crown Holdings, Inc.

- Tetra Pak International S.A.

- Mondi Group

Tier 2

- Smurfit Kappa Group

- Berry Global, Inc.

- WestRock

- Huhtamaki Oyj

- International Paper Company

- Stora Enso Oyj

- Sealed Air Corporation

- Graphic Packaging International

- Sonoco Products Company

- WestRock Company

- Ball Corporation

- Crown Holdings, Inc.

- AR Packaging Group

- Evergreen Packaging

- Winpak Ltd.

- Plastipak Packaging

Tier 3

- UFlex Limited

- Constantia Flexibles

- Coveris

- AptarGroup

- Ranpak

- Klockner Pentaplast

- Ecovative Design

- Vegware

- Ecolean

- Nampak

- Plastipak

- Coveris

Latest Announcement by Industry Leaders

- In September 2025, LyondellBasell, which is a top company in recycled polymers, revealed the merged growth of a latest bio-based film packaging solution in partnership with Futamura Chemical, a top company in sustainable packaging production, Iwatani Corporation, a main Japanese trading company, and Shiseido, a top leader in the beauty industry with over 150 years of history.

- In May 2025, Ranpak Holding Corporation, a top company in terms of sustainable packaging automation technology and solutions, revealed the strategic merger with Thalia, which is the biggest book retail chain in the DACH region (Austria, Germany, and Switzerland). The collaboration marks a major growth in Thalia’s satisfaction potential and loyalty to sustainability.

- In May 2025, Schoeller Allibert and IPL disclosed a strategic collaboration that will make a worldwide powerhouse in terms of sustainable plastic packaging, which integrates annual incomes that go beyond USD 1.4 billion. The deal, disclosed this week, brings together two industry leaders in rigid plastic production and reusable transport packaging.

- Oroville Flexible Packaging LLC, which is a leader in flexible plastics and packaging solutions for foodservice and retail customers, have revealed the official launch of “Oroflex”, a sustainable flexible plastics, packaging, and recycling system.

- In October 2024, SABIC, which is a top leader in the chemical sector, partnered with the overall brand owner and manufacturer of frozen potato products in a closed-loop procedure crafted to make low-weight sustainable packaging bags created with a thin construction film pattern.

- In January 2024, the API group and its subsidiary Accredo Packaging are producers of more sustainable packaging solutions in the food and beverage producers industry to partner with the Fresh-Lock team at Presto Products, an organisation of Reynolds Consumer Products, to reveal a first-of-its-kind flexible stand-up pouch by using more than 50% post-consumer recycled content, perfect for food packaging.

Recent Developments

- In July 2025, RUSAL, which is located at the St.Petersburg International Economic Forum, as one of the world’s biggest aluminium generators, and AB InBev Efes, the biggest Russian brewing company, officially signed a strategic agreement with an aluminium packaging producer and a top Russian retailer.

- In July 2025, INEOS Solution, a leading worldwide player in terms of styrenics, revealed the successful commercial rollout of its 100% bio-attributed polystyrene, which is luxury as Styrolution PS158k BC100. This invention marks a major achievement in terms of sustainable packaging, specifically for food applications.

- In September, UPM Specialty Papers merged with EvoPak to assist Walkers Chocolates ‘transformation from a plastic wrapper to recyclable paper-based packaging. This will assist Walkers Chocolates in achieving its sustainable packaging ambition while lowering the use of plastics across its website.

- In September 2025, Swa Signature Style, a luxury fashion brand that concentrates on sustainable and tailored couture, disclosed its penetration collection at The Bangalore Room. The display integrated the eco-conscious pattern with artisanal heritage, which positions the able within India’s developing sustainable premium retail segment.

Segmentation of the Sustainable Retail Packaging Market

By Material Type

- Paper & Paperboard

- Bioplastics & Plant-based Plastics

- Recycled Plastics

- Glass

- Metal (Aluminum, Tin)

- Others (textiles, fiber-based materials)

By Product Type

- Bags & Pouches

- Boxes & Cartons

- Bottles & Jars

- Trays & Clamshells

- Wraps & Films

- Labels & Tags

- Others (reusable containers, refill packs)

By Packaging Format

- Primary Packaging (direct contact with product)

- Secondary Packaging (branded boxes, wrapping)

- Tertiary Packaging (bulk, transport, logistics)

By End-Use Industry

- Food & Beverages

- Retail & E-commerce

- Personal Care & Cosmetics

- Fashion & Apparel

- Consumer Electronics

- Household Goods

- Healthcare & Pharmaceuticals

- Others

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait