Halal Packaging Market Trends, Share and Growth Analysis

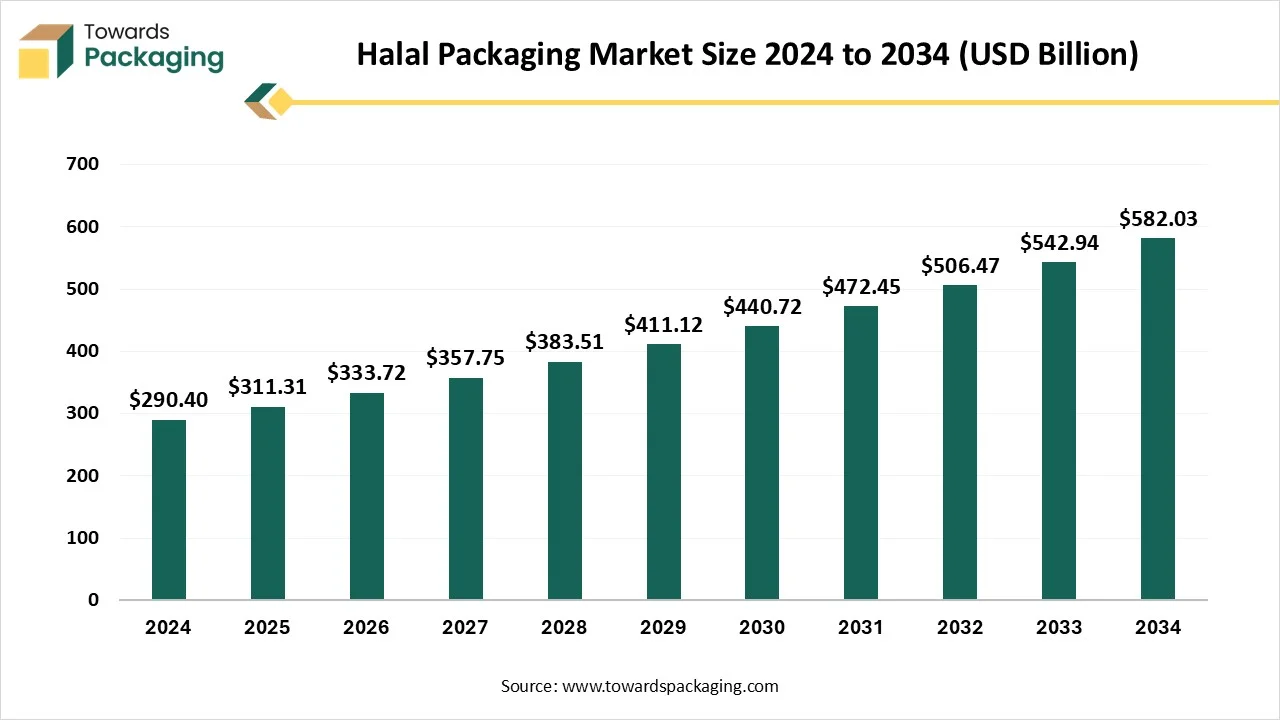

The halal packaging market is forecasted to expand from USD 311.31 billion in 2025 to USD 626.94 billion by 2035, growing at a CAGR of 7.20% from 2025 to 2034. The demand is being driven by the growing demand for Halal-certified products across different regions. As users become more conscious of religious and cultural dietary needs, packaging solutions make sure that compliance and safety are in high demand.

Key Highlights

- In terms of revenue, the market is valued at USD 290.4 Billion in 2024.

- The market is predicted to reach USD 582.03 Billion by the year 2034.

- Rapid growth at a CAGR of 7.20% will be officially experienced between 2025 and 2034.

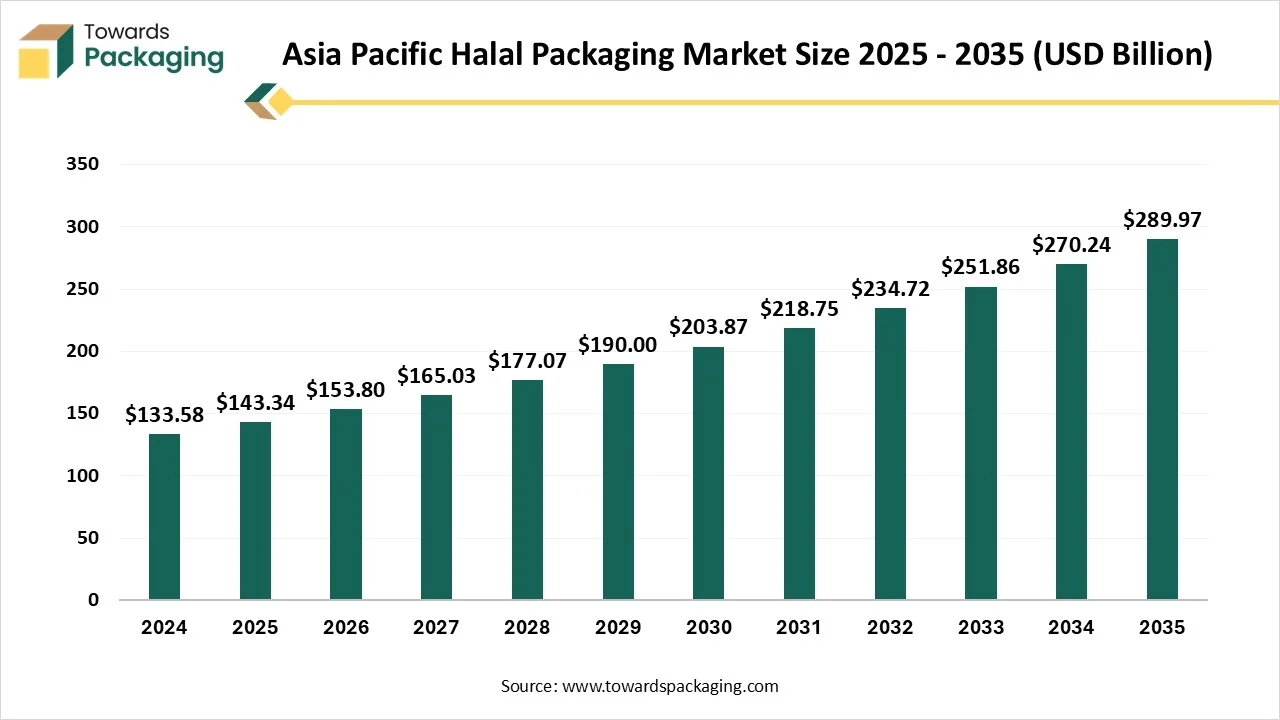

- By region, Asia Pacific dominated the market with 46% share in 2024.

- By region, Middle East and Africa region is expected to rise at a notable CAGR between 2025 and 2034.

- By packaging type, primary packaging segment dominated the market with the largest share of 52% in 2024.

- By packaging type, secondary packaging segment will grow at a notable CAGR of 7.90% share between 2025 and 2034.

- By material type, plastic segment dominated the market with the biggest share of 39% in 2024.

- By material type, paper and paperboard segment will rise at a notable CAGR of 8.10% between 2025 and 2034.

- By packaging technology, conventional packaging segment dominated the market with the biggest share of 44% in 2024.

- By packaging technology, sustainable and biodegradable packaging segment will grow at a notable CAGR of 8.80% between 2025 and 2034.

- By application, food and beverage segment dominated the market with a 58% share in 2024.

- By application, cosmetics and personal care segment will grow at a notable CAGR of 8% between 2025 and 2034.

- By distribution channel, direct sales segment dominated the market with a 45% share in 2024.

- By distribution channel, online /E-commerce segment will grow at a notable CAGR of 8.40% between 2025 and 2034.

What Do You Mean By The Halal Packaging Market?

Halal refers to “lawful” or “ permissible” in terms of Islamic laws, which define what is acceptable for usage and utilised by Muslims. Beyond food, halal extends to products like pharmaceuticals, cosmetics, and chemicals that display ethical and good-quality standards across global industries. The ideas make sure that products are free from barrier substances and produced, packaged, and stored with rigid rules to ethical guidelines and cleanliness.

For organizations, penetrating the halal industry serves as a powerful opportunity to align with the demands of over 1.9 million halal users globally, expanding market, promoting trust and reach, and meeting global demand for good products.

Halal Packaging Market Outlook

- Industry Growth overview: Consumers are becoming more conscious of what subjects to honest halal compliance, which stretches their checking from the product itself to the packaging materials and manufacturing procedure. This counts issues over adhesives or lubricants that come from non-halal animal products.

- Sustainability Trends: In the current ecologically fragile industry, users are becoming concerned about the sustainability of packaging materials and their post-use effect on the environment. By selecting environmentally friendly packaging, we can attract environmentally friendly users while meeting Halal Values and consumption.

- Global Expansion: The overall halal packaging industry is witnessing major expansion, which is driven by the developing Muslim population and an increasing urge for halal-certified goods in both Muslim -majority and minority nations.

- Major Investors: Major investors in terms of halal packaging include Bog and classified packaging corporations like Mondi Group. Amcor and Huhtamaki, as well as tailored forms and investment groups. Investments are due to funding in the huge halal venture capital and halal-specific finance services.

Key Technological Shifts in the Halal Packaging Market

Artificial Intelligence is also developing food safety by analysing pollutants, growing traceability, and protecting against foodborne diseases. So the AI-driven image processing and spectroscopy classify toxins, bacteria, and foreign particles in food products, which lowers the risk of contamination. It also examines manufacturing data to predict and protect against food safety risks by assisting businesses in complying with Hazard Analysis and Critical Control Points (HACCP) guidelines.

Furthermore, one of the most crucial areas of growth in the Halal food sector is the automation of slaughterhouses. Organizations utilise technology to make sure that animals are handled as per strict Halal needs and demands. For example, accurate cutting and smooth blood draining are now achieved through automated machines, while sensors track and maintain blade sharpness. This ensures compliance with Halal standards and develops complete productivity and efficiency.

Trade Analysis of Packaging for Halal Packaging Market: Import and Export

- As per the global import data, the globe has imported 2,497 shipments of Halal Packaging during the period May 2024 to April 2025. These imports were being supplied by 160 exporters to 149 overall buyers, which marks a development rate of 30% as compared to the previous twelve months.

- During this time, in April 2025 alone, the globe imported 497 Halal Packaging shipments. In the current year, 2025 alone, the globe has imported 497 Halal Packaging shipments. This has marked a year-on-year growth of 336% as compared to April 2024, and a 157% series increase from March 2025.

- The globe has imported many Halal packages from Russia, China, and Kazakhstan. So, the world's top three importers of Halal Packaging are Vietnam, Uzbekistan, and Kazakhstan. So, the Uzbekistan is on the top in Halal packaging that has imported with 3,859 shipments, which is being followed by Vietnam and 598 shipments and Kazakhstan taking the third position with 404 shipments.

- Also, the world has exported 2,497 shipments of Halal Packaging from May 2024 to April 2025. These exports were created by 160 Exporters to 149 Buyers, which makes a development rate of 30% as compared to the previous twelve months.

- During this time, in April 2025 alone, 497 Halal Packaging has exported shipments that were made globally available. This has marked a year-on-year growth of 336 % as compared to April 2024, and a 1557% series development from March 2025.

Value Chain Analysis of the Halal Packaging Market

- Material Processing and Conversion: Processing and updating materials for the halal packaging should protect any link with non-halal substances throughout the supply chain. This counts on utilising the ingredients and machines that are free of animal derivatives, making sure they are non-toxic and serving full traceability for consumers.

- Package Design and Prototyping: Prototyping and designing halal packaging needs meticulous attention to material sourcing, production procedure, and labelling to protect pollutants and ensure religious compliance. This procedure is important for earning user trust and receiving certification from a recognised halal body.

- Logistics and Distribution: In halal logistics, packaging is an important factor for the production of honest and pure products during storage, handling, and distribution. The complete procedure is crafted to prevent pollutants with non-halal substances, such as pork byproducts or alcohol, too.

Prevalent Halal Certifications For Beauty Products

| Organization |

Country |

Focus |

| Islamic Services of America (ISA) |

USA |

Different items that count as cosmetics. |

| Department of Islamic Development Malaysia (JAKIM) |

Malaysia |

Different products, which count as cosmetics, are present in Southeast Asia |

| The Halal Food Authority (HFA) |

Singapore |

Different products that lead to cosmetics. |

| Hala Certification Services |

Switzerland |

Worldwide reach, that have different products, including cosmetics. |

| The Gulf Cooperation Council (GCC) |

Regional |

Personalized machine for different products that include cosmetics, tailored in the GCC countries. |

Emerging Trends in the Halal Packaging Market

- Halal E-commerce Boom: The e-commerce industry continues to develop, and halal items are no exception. From halal cosmetics to halal-certified groceries, customers are heavily buying online. Stages that align newly to halal products, like halal marketplaces, are in development. Organisations that mix with AI-driven personalization and smooth payment gateways will have a competitive demand in this rapidly developing sector.

- Sustainable Halal Products: Sustainability is a main concern for the global users, and halal businesses are subsequently following suit. From environmentally-friendly packaging to sustainable farming practices, users can currently predict products to be ethically manufactured. Organizations that can integrate halal certification with sustainability efforts will win over conscious users.

- Rise of Halal-certified Technology Products: Halal certification is beyond food and beverages. Technology items, particularly those utilised in financial services, are now finding halal certification to meet Shariah principles. This counts apps for Islamic finance, halal investing, and Islamic lifestyle apps too.

- Halal Health and Wellness Industry: The wellness and health sector is developing, and halal-certified wellness items are in high demand. From halal supplements to vitamins to natural skincare items, users are giving heavy importance to their health. Regular food and nutraceuticals that match halal principles are predicted to experience growth in 2025.

- Growth of Islamic Fintech: The Islamic fintech sector is destroying traditional finance by serving Shariah-compliant financial solutions. Crowdfunding stages, Islamic neobanks, and P2P lending are becoming the frontline. These digital stages serve easy access to Shariah-compliant loans, investments, and savings, too.

- Halal Tourism and Muslim -Friendly Travel: Halal tourism is at the top, with tour operators and destinations that accept their services to align with the demands of Muslim travellers. Countries like Indonesia, Malaysia, and Turkey are leading the path by serving Muslim-friendly experiences. Prayer facilities, halal food options. Tour operators are offering travel packages particularly for Muslim families.

- Halal baby products and Children's Products: As the worldwide Muslim population develops, so does the urge for halal baby products. Parents are heavily seeking halal-certified baby food, clothing for their children, and skincare. Organisations that enter into this trend will have a competitive benefit in the profitable baby product sector.

Packaging Type Insights

How Has The Primary Packaging Segment Dominated The Halal Packaging Market?

The primary packaging segment has dominated the market with a 52% share in 2024, as this kind of packaging is utilised for Halal products that should be made from Halal-compliant materials and do not have any non-Halal substances, such as animal-derived gelatin or alcohol-based coating. It should be free from pollutant risk and ensure the reliability of the product.

Packaging suppliers should obtain Halal certification to confirm compliance. Furthermore, the packaging procedure should be tracked to prevent linking with non-Halla materials during handling and storage. Accurate labelling must also be used, precisely showing Halal certification. Regular checking and audits should be used to cross-verify adherence to Halal packaging needs, which ensures user confidence and regulatory compliance.

The secondary packaging segment is predicted to be the fastest in the market with a 7.90 % share during the forecast period. Secondary packaging should be handled and stored separately from any non-halal products. If facilities are shared, a rigid cleaning process as per the Islamic needs and demands must be followed to protect against accidental pollutants. Several secondary packaging types can be utilised for the halal products, if the materials and procedures are compliant. The choice for the packaging relies on the product's demand, such as moisture opposition or shelf life.

Material Type Insights

How Has The Plastic Segment Dominated The Halal Packaging Market?

The plastic segment has dominated the market with a 39% share in 2024, as polypropylene (PP) and HDPE are two kinds of plastics prevalently used in the packaging sector, but they have several characteristics. HDPE is known for its power and resistance to chemicals, which makes it a famous choice for medicine bottles, jerry cans, and chemical containers.

On the other hand, PP has perfect heat resistance and is frequently utilised as the main material for creating buckets and cans in the food and beverage sector. The choice between PP and HDPE relies on the particular use demands and the desired material characteristics.

The paper and paperboard material segment is expected to be the fastest growing in the market with 8.10 % share during the forecast period. For the paper and paperboard to be halal, producers must make sure that the packaging materials and all of their additives are free from any ingredients, like animal-derived glues or fats. This counts on making sure that raw materials, coating, and processing aids are being sourced from the halal-compliant origins and that no pollutants occur during manufacturing. Paper and paperboard created from the virgin wood or non-wood plant fibres like bagasse, bamboo, or straw are usually considered safe as long as non-halal chemicals are utilised in the processing. It utilises the 100% virgin pulp, which is frequently chosen for diet food links.

Packaging Technology Insights

How Did The Conventional Packaging Segment Dominate The Halal Packaging Market?

The conventional packaging segment has dominated the halal packaging market with a 44% share in 2024, as it aims to make a food safety management machine that aligns with the different safety and quality standards needed for direct food contact materials. The latest manufacturing facility has been filled with, among others, dusters, air showers with great smoothness particulate air (HEPA) filters, and antibacterial flooring. The latest facility has also earned a certification of compliance with Indonesia’s halal rules and is in line with the World Health Organization’s perfect production practices.

The sustainable and biodegradable packaging segment is expected to be the fastest growing in the market with 8.80% share during the forecast period. One of the main elements of halal food manufacturing is the humane diagnosis of animals. Zabiha, halal slaughter, which needs animals to be treated with care and respect throughout their lives, not just during the period of slaughter. The rules are compulsory as animals must be healthy at the time of slaughter, the slaughter procedure should be fast, that is, minimal pain. They must not be linked to mistreatment, cruelty, or unnecessary stress.

The name of God(Allah) must be included during slaughter, which gives importance to spiritual accountability.

Application Insights

How Has The Food And Beverage Segment Dominated The Halal Packaging Market?

The food and beverage segment has dominated the market in 2024 with a 58% share, as Halal-certified food and beverages (F&B) include a wide range of products that meet Islamic dietary laws. Only animals that are slaughtered as per the Halal rules are permissible. This makes sure that specific procedures of slaughtering and humane treatment are followed. From nuts and hips to candies and chocolates, these products should have non-Halal certified facilities, such as gelatin or alcohol( that come from non-Halal animal sources.

Cheese, milk, yoghurt, and other dairy products must be free from non-Halal additives and manufactured in Halal-certified facilities.

The cosmetics and personal care segment is expected to be the fastest growing with 8% share during the forecast period. Halal cosmetics are personal care and beauty products that are produced using ingredients which is permissible under Islamic Shariah Law. Several regular cosmetics have high or focused levels of ethyl alcohol, which is banned in Islam. They must not be counted in any materials that come from human bodies, as ingredients are being banned by Islamic laws, or animals that are not slaughtered as per the Halal guidelines. The manufacturing procedure must meet Halal standards, making sure that ethical diagnosis and cleanliness of all are ensured. Ingredients such as pork gelatin or collagen are totally avoided.

Distribution Channel Insights

How Has The Direct Sales Segment Dominated The Halal Packaging Market?

The direct sales segment has dominated the market with a 45% share in 2024, as direct sales of the halal items include selling items that match the Islamic dietary laws (Sharia) directly, which come from the manufacturer to the user. This strategy is heavily prevalent, specifically through e-commerce and tailored direct-to-consumer channels, as it serves higher assurance and transparency of authenticity to customers. Direct sales enable organisations to reach Muslim users in areas that may not have any halal-certified items in mainstream retail shops.

The online /E-commerce segment is expected to be the fastest-growing in the market with 8.40% during the forecast period. E-commerce sales of the halal items are a developing industry of the overall halal industry, which is being driven by the Muslim population, developed user demand for the ethical products, and technological growth. While there is still a little less space for complete halal sales, the e-commerce segment development is overtaking regular retail channels, which serves a huge convenience and reliability to consumers.

Regional Insights

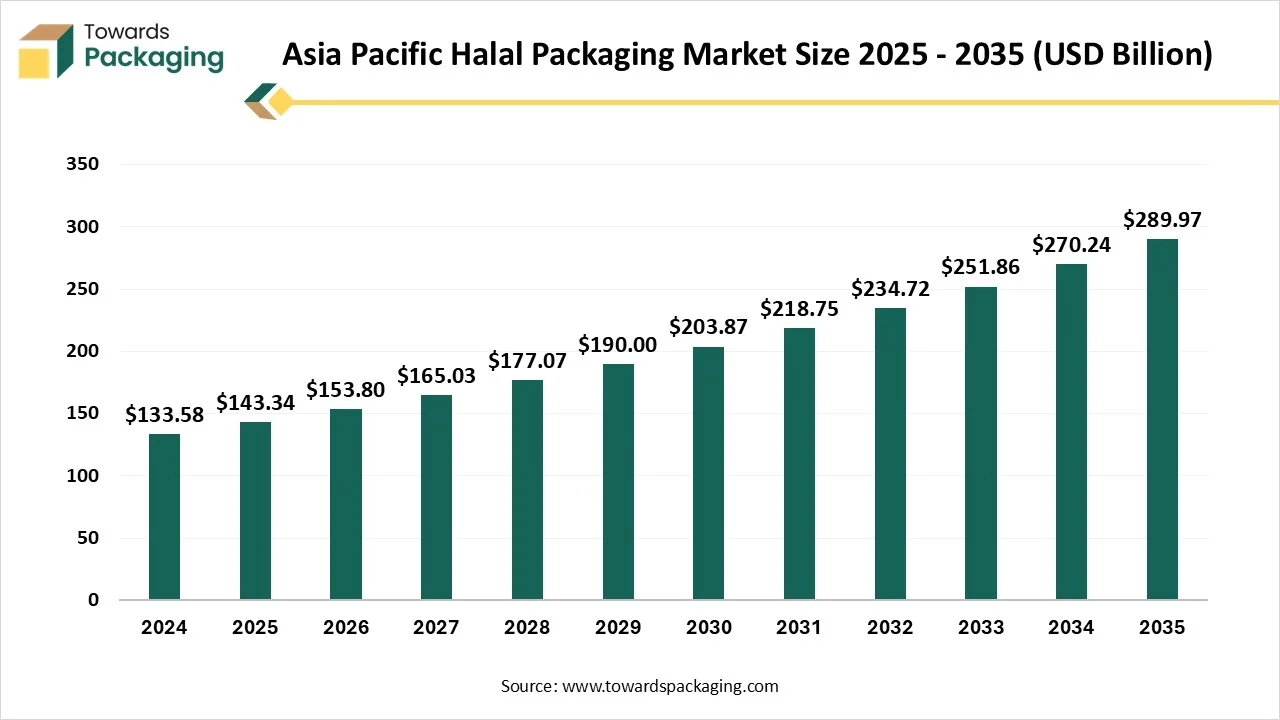

How Has The Asia Pacific Region Dominated The Halal Packaging Market?

Asia Pacific dominated the market in 2024 with a 46% share, as the Asia Pacific has a substantial portion of the overall Muslim population, specifically in countries like Malaysia, Indonesia, Pakistan, and India. This big user base is the initial driver for the halal packaging demand. Several Asia Pacific countries have a rigid and compulsory halal certification procedure. For instance, Indonesia has rigid regulations that require certification for every marketed product, which makes a strong urge for complaint packaging. Malaysia’s regulatory bodies, such as JAKIM, are also highly respected and encouraged.

Top India Insights for Halal Packaging Market

India is currently developing itself as a major player in the international Halal meat industry. Growing urge for Halal-certified items from regions including the Gulf Cooperation Council (GCC), North Africa, and Southeast Asia has developed India’s role in the industry. To align with the regulatory demands of importing countries, India has implemented the India Conformity Assessment Scheme(i-CAS).

Main importers of Indian Halal meat include nations like Indonesia, Egypt, Malaysia, Iran, and GCC countries, which support Halal standards as a compulsory need for the exporters.

The Middle East and Africa are predicted to be the fastest-growing regions in the market with an 8.20% share during the forecast period. The urge for halal packaging in the Middle East and Africa is being driven by the region’s big Muslim population, growing consumer income, and highly rigid regulatory standards. The region is home to the main space of the worldwide Muslim population, which creates a constant and large-scale urge for products that align with Islamic law and adhere to packaging. Developed consumer purchasing power and a greater alertness of halal compliance have led to a bigger demand for certified products. Users are also becoming more inclined to fund ethically and organically sourced items, which frequently meet halal standards.

Several countries in the MEA region have developed power and a big compulsory halal certification procedure. For instance, the UAE’s Emirates Authority for Standardization and Metrology (ESMA) and Saudi Arabia’s Saudi Food and Drug Authority (SFDA) have created rigid compliance, specifically for imported goods.

Top UAE Insights For Halal Packaging Market

The urge for halal packaging in the UAE is substantial and developing, which is being driven by a large Muslim population, developed consumer awareness, and rigid governmental regulations, which lead to checking and ethical documenting of products. The UAE region has a large Muslim population, including a main expatriate community, which constantly demands items that comply with Islamic dietary laws. Furthermore, several non-muslim users receive halal-certified products as high-quality, hygienic, and perfect, further boosting demand.

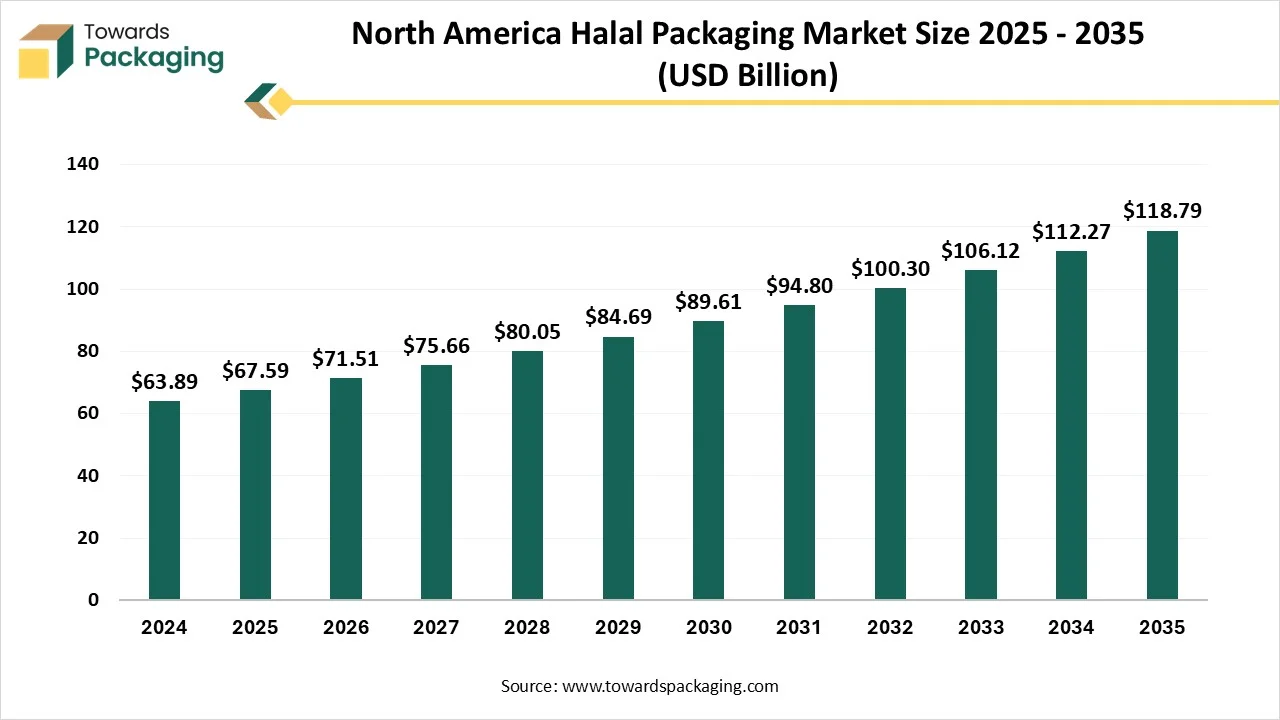

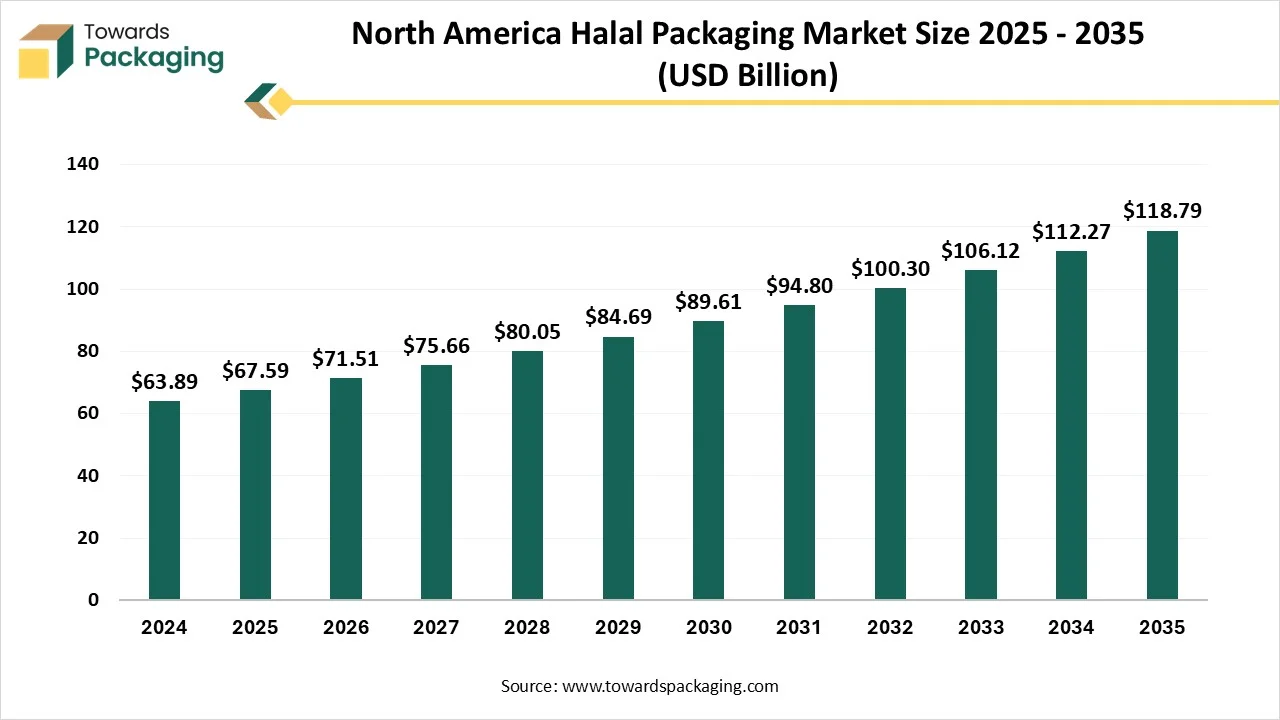

North America expects the fastest growth in the market during the forecast period. Key drivers include the rising global Muslim population, increasing demand for halalcertified foods and goods, stricter regulatory requirements for halal compliance, and the surge in ecommerce and export trade which necessitates tamperproof, traceable packaging solutions. Sustainability is also playing a role: manufacturers are innovating halalcertified, ecofriendly materials to appeal to both Muslim and nonMuslim consumers who associate halal certification with ethical, highquality, and safe products.

Top United States Insights For Halal Packaging Market

Key drivers include increasing demand for halalcertified products (both from Muslim consumers and nonMuslims drawn to ethical, cleanlabel goods), greater retail availability, growing emphasis on traceability and certification in packaging, and the dominance of rigidtype packaging formats in this segment.

Recent Developments

- In June 2025, Kao revealed a halal-certified deodorant in Indonesia and plans to start generating halal sunscreen generally by 2026, with feedback to regulatory needs and rising demand for the certified personal care products.

- In June 2025, in an innovative growth for the food emergency and security making, a UAE-based company, Red Planet, is revealing ready-to-eat meals that can stay consumable for up to 25 years. These big shelf-life meals are created possibly by innovative freeze-dry technology that gives back nutrition, safety, taste, all without artificial refrigerants and preservatives.

- In August 2025, Co-op Wholesale will partner up with Express Cuisine to reveal its Halal-certified wraps, sandwiches, and rolls. The series that has complete HMC and HFA issued, counts flavours like Falafel with Lemon &Chilli Mayo Wrap, Chicken Tikka Wrap, and Tuna Mayonnaise Crunch sandwich.

- In December 2024, The Laughing Cow Cheese is delighted to reveal the addition of the Halal certification mark from Indonesia’s Halal Product Assurance, which has the Organizing Agency (BPJPH), to its packaging.

Top Vendors in the Halal Packaging Market and their offerings

- PT Champion Pacific Indonesia Tbk: PT Champion Pacific Indonesia Tbk was initially funded under the name PT Cigar Jaya in October 1975. Then, in October 1990, the organisation officially became a public company by having an Initial Public Offering (IPO) of preferred shares.

- Asia Pulp and Paper Indonesia (APP): PT APP Purinusa Ekapersada, also known as APP Indonesia, and its sub-group organizations track many pulp and paper production and forestry operations that serve equity products to align with rising global demands for packaging, paper, and tissue.

- Huhtamaki Group: Huhtamaki is a main global player in sustainable food-on-the-go and food-on-the-shelf packaging solutions. Their cutting-edge products assist billions of consumers around the globe in making responsible lifestyle choices each day.

- Avesta Continental Pack: It is a harmonious partnership between Knowledge, growth in Technology, and Experience of more than 40 years in the packaging sector and industry.

- MM Karton: MM is a top leader in consumer packaging that serves carton board, kraft papers, folding cartons, uncoated fine papers, labels, and leaflets.

Halal Packaging Market Top Companies

Halal Packaging Market Segments Covered

By Packaging Type

- Primary Packaging

- Bottles & Jars

- Pouches & Sachets

- Blister Packs

- Trays & Containers

- Cans & Cartons

- Secondary Packaging

- Boxes & Cartons

- Wraps & Sleeves

- Labels & Sleeves with Halal Certification

- Tertiary Packaging

- Pallets & Crates

- Stretch Wraps & Films

By Material Type

- Plastic

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polyvinyl Chloride (PVC)

- Bioplastics / Compostable Plastics

- Paper & Paperboard

- Kraft Paper

- Corrugated Board

- Coated Paperboard

- Metal

- Glass

- Others

- Biodegradable & Recycled Materials

- Composite / Multilayer Materials

By Packaging Technology

- Conventional Packaging

- Aseptic & Sterile Packaging

- Modified Atmosphere Packaging (MAP)

- Active & Intelligent Packaging

- Sustainable / Biodegradable Packaging

By Application

- Food & Beverage

- Meat, Poultry & Seafood

- Dairy Products

- Bakery & Confectionery

- Ready-to-Eat / Frozen Foods

- Beverages (Juices, Soft Drinks, Water)

- Pharmaceuticals & Nutraceuticals

- OTC Drugs

- Capsules & Supplements

- Herbal / Traditional Medicines

- Cosmetics & Personal Care

- Skincare & Haircare Products

- Perfumes & Deodorants

- Toiletries

- Others

- Household & Cleaning Products

- Healthcare Supplies

By Distribution Channel

- Direct Sales (B2B / OEM Contracts)

- Distributors & Wholesalers

- The Asia Retail Packaging Suppliers

- Online / E-commerce Platforms

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait