Cell Therapy Packaging Market Growth, Innovations and Market Size Forecast

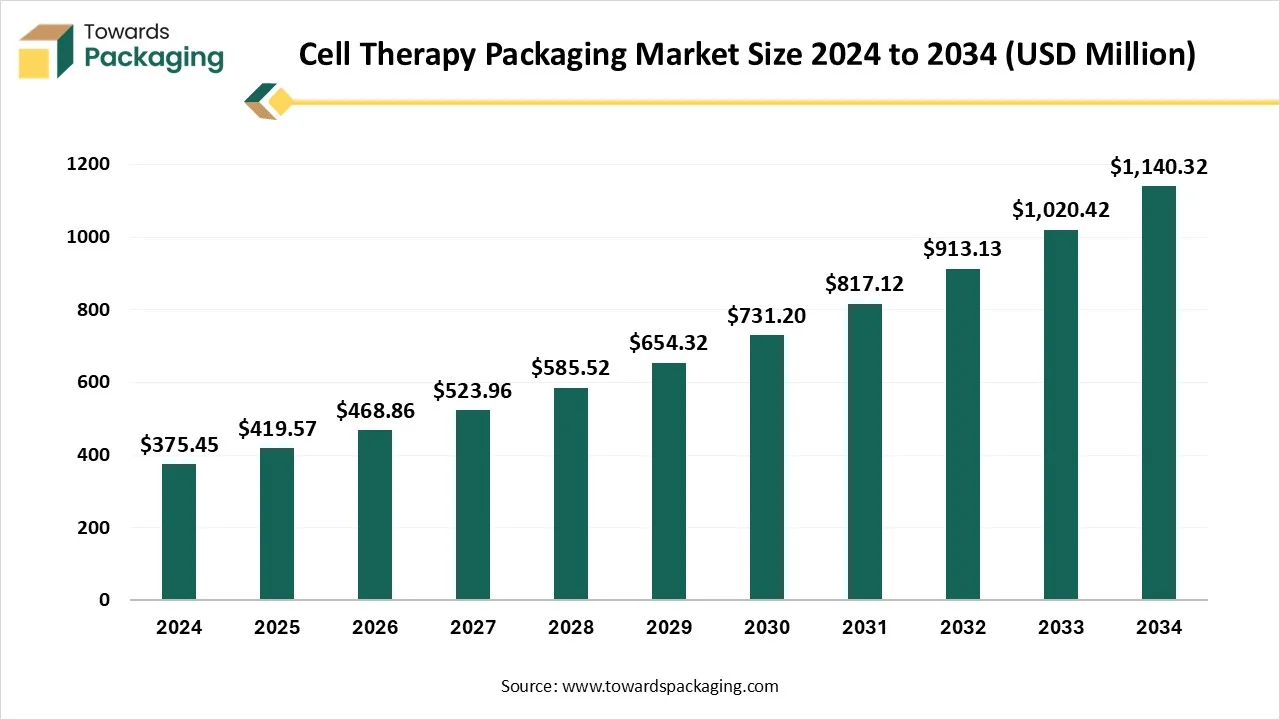

The cell therapy packaging market market is projected to grow from USD 468.86 million in 2026 to USD 1,274.31 million by 2035, at a robust CAGR of 11.75%. This report covers detailed segmentation by packaging type, material type, and cell therapy type, providing a comprehensive analysis of key regions such as North America (dominating with 40% market share in 2024), Europe, Asia Pacific, and Latin America. It also includes insights into market share, value chain analysis, and trade data from leading companies like Cryoport, Inc., Thermo Fisher Scientific, and Sartorius AG.

Major Key Insights of the Cell Therapy Packaging Market

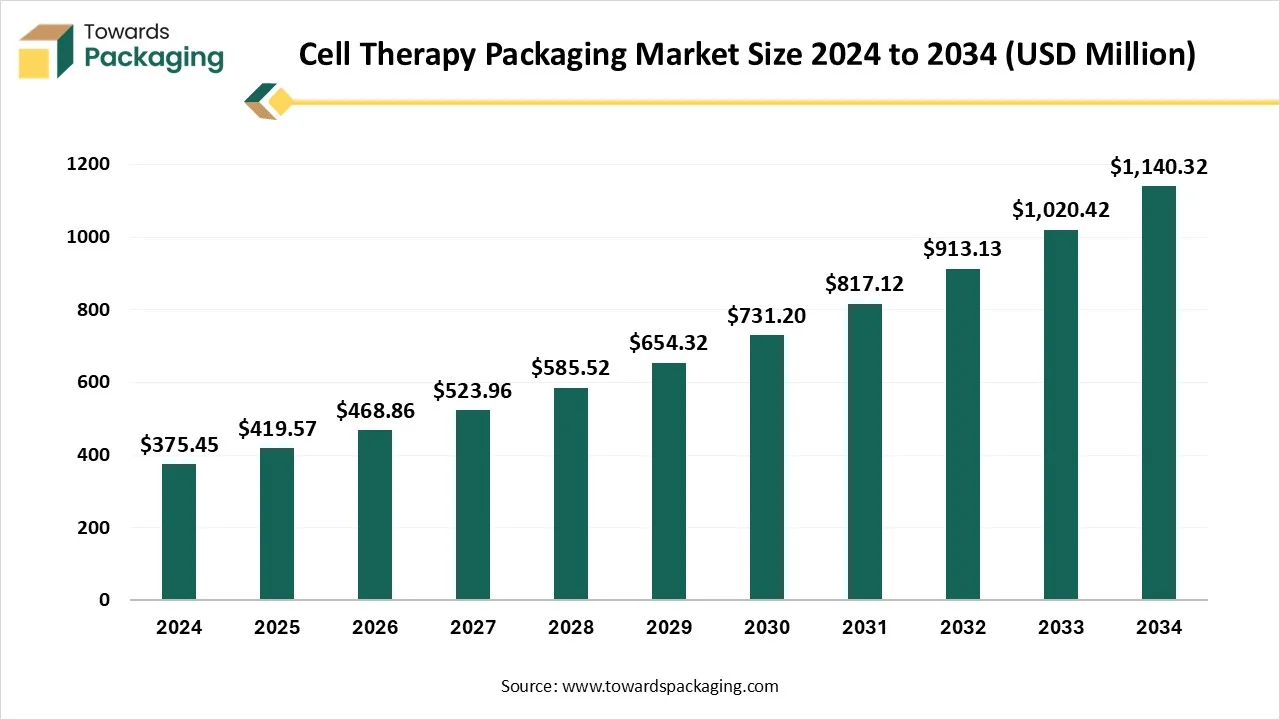

- In terms of revenue, the market is valued at USD 419.57 million in 2025.

- The market is projected to reach USD 1,274.31 million by 2035.

- Rapid growth at a CAGR of 11.75% will be observed in the period between 2025 and 2035.

- By region, North America dominated the global market by holding highest market share of approximately 40% in 2024.

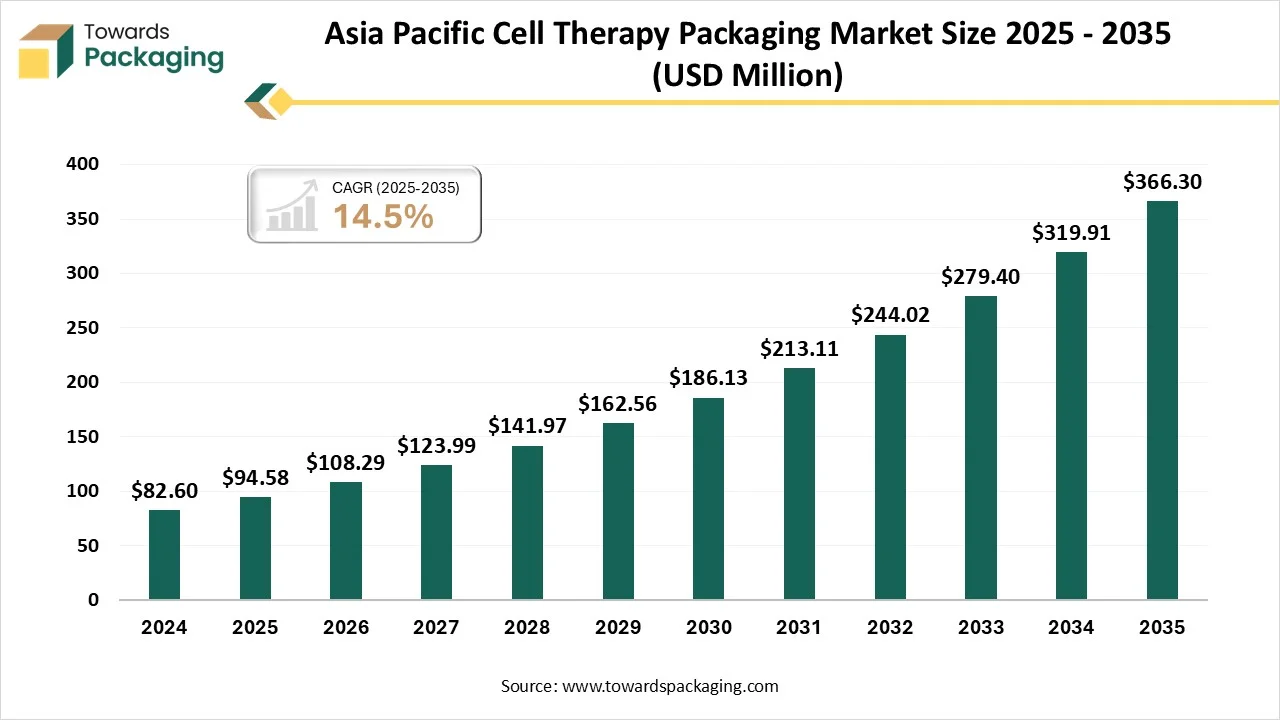

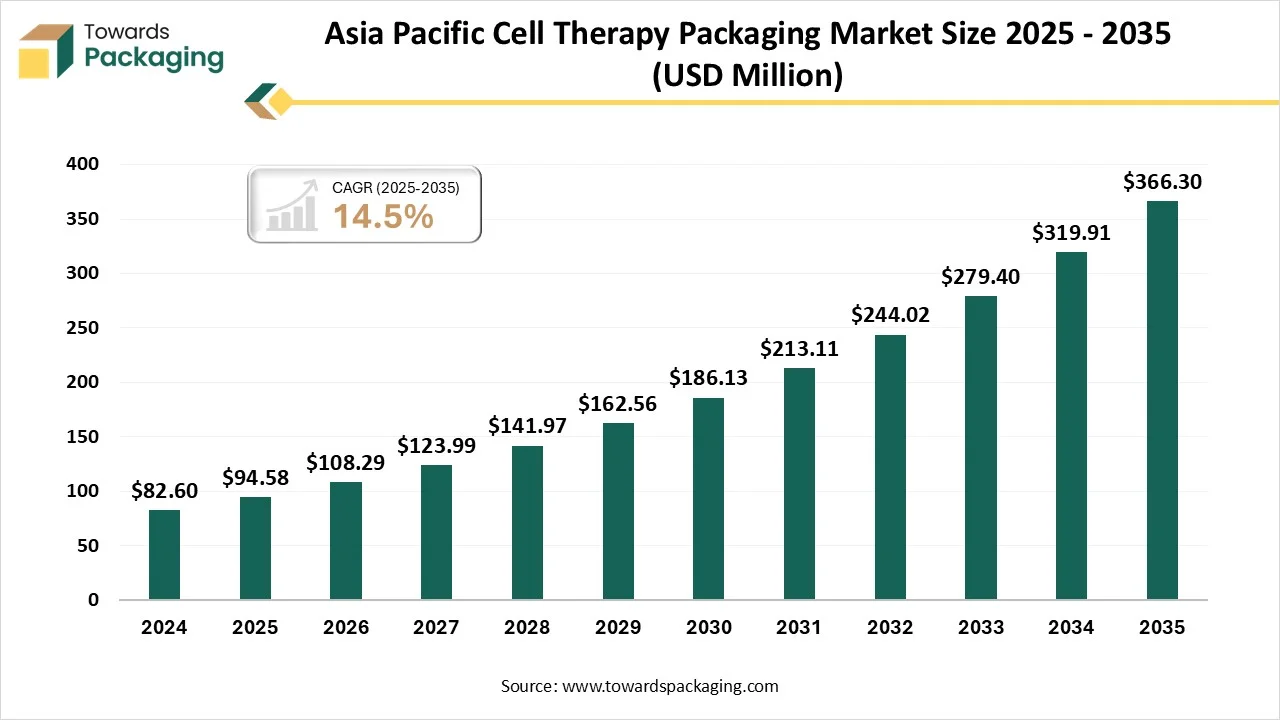

- By region, Asia Pacific is expected to grow at a notable CAGR from 2025 to 2035.

- By packaging type, the primary packaging (cryobags, cryovials) segment contributed the biggest market share of approximately 42% in 2024.

- By packaging type, the tertiary cryogenic shipping systems segment is expected to expand at a significant CAGR in between 2025 and 2035.

- By material type, the cryogenic plastics segment contributed the biggest market share of approximately 38% in 2024.

- By material type, the single-use polymer films segment is expanding at a significant CAGR in between 2025 and 2035.

- By function, the storage packaging segment contributed the biggest market share of approximately 36% in 2024.

- By function, the transport packaging segment is expanding at a significant CAGR in between 2025 and 2035.

- By cell therapy type, the CAR-T cell therapies segment contributed the biggest market share of approximately 34% in 2024.

- By cell therapy type, the stem cell therapies segment is expanding at a significant CAGR in between 2025 and 2034.

- By end user, cell therapy manufacturers / biopharma companies segment contributed the biggest market share of approximately 38% in 2024.

- By end user, specialized logistics & cryo-transport companies segment will be expanding at a significant CAGR in between 2025 and 2035.

What is Cell Therapy Packaging?

The cell therapy packaging encompasses the design, development, manufacturing, and supply of specialized primary, secondary, and tertiary packaging solutions tailored for living cell-based therapies, including autologous and allogeneic cell therapies (CAR-T, stem cell, dendritic cell, NK cell therapies, etc.). These packaging solutions ensure sterility, viability, cryogenic stability, traceability, and regulatory compliance during storage, transportation, and distribution of sensitive cell therapy products.

Growth is driven by the rapid expansion of the cell and gene therapy industry, increasing commercialization of autologous therapies, stricter GMP and cold-chain compliance standards, and rising demand for customized, temperature-controlled, and single-use packaging systems for cell transport and storage.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2024 |

375.45 Million |

| Projected Market Size in 2034 |

1140.32 Million |

| CAGR (2025 - 2034) |

11.75% |

| Leading Region |

North America |

| Market Segmentation |

By Packaging Type, By Material Type, By Function, By Cell Therapy Type, By End User and By Region |

| Top Key Players |

Cryoport, Inc., Thermo Fisher Scientific Inc., Sartorius AG, Merck KGaA (MilliporeSigma), Corning Incorporated, West Pharmaceutical Services, SCHOTT AG, Catalent Pharma Solutions, Avantor, Inc., DWK Life Sciences, ArcticZyme Technologies ASA, CSafe Global |

Cell Therapy Packaging Market Outlook

- Market Growth Overview: The rising demand for enhanced technology, consumer engagement, sales and marketing, enhanced user experience, and sustainability initiatives has boosted the growth of the market. The huge investment towards this market has influenced its development.

- Global Expansion: Regions such as North America, Asia Pacific, and Europe are witnessing strong regulatory support, huge investment, robust scientific hub are the major factors behind the growth of this market.

- Major Market Players: Cell therapy packaging market comprises Lonza, Almac, Catalent, Saint-Gobain Life Science, Thermo Fisher Scientific, West Pharmaceutical Services, and many other.

- Startup Ecosystem: The major focus of the startup industries is to innovate materials, infrastructures and partnership, smart packaging and monitoring, and automation and modularity.

Key Technological Shifts in Cell Therapy Packaging Market

The cell therapy packaging market is experiencing major technological shift by decreasing contamination risk, enhancing containers material, and cryogenic storage resolution for improved stability. Advanced technologies help in ensuring the consistency of the product, maintaining sterility, and decreasing production charges and time. Cryogenic handling and storage is important for preserving the steadiness of live cells. Automated thawing structures shield the safety and efficiency of living cell therapeutics by decreasing contamination risk.

Global Cell Therapy Packaging Service Providers – Capability & Service Matrix

| S. No. |

Company |

HQ |

Primary Packaging |

Secondary Packaging |

Active Packaging |

Passive Packaging |

Ambient |

Refrigerated |

Frozen |

Cryogenic |

Cell Type Handled |

Dry Ice |

Liquid Nitrogen |

| 2 |

Catalent |

USA |

✓ |

✓ |

✓ |

– |

✓ |

✓ |

✓ |

✓ |

Stem Cells |

✓ |

– |

| 5 |

time:matters |

USA |

– |

✓ |

– |

✓ |

✓ |

– |

✓ |

– |

– |

– |

✓ |

| 7 |

Bioair |

UK |

✓ |

✓ |

– |

✓ |

– |

✓ |

– |

✓ |

Cell Lines |

– |

✓ |

| 9 |

Company A |

Ireland |

✓ |

– |

– |

✓ |

✓ |

– |

✓ |

– |

– |

– |

– |

| 12 |

Cryoport |

USA |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

– |

– |

– |

| 14 |

Company B |

Switzerland |

– |

✓ |

– |

✓ |

– |

✓ |

– |

✓ |

– |

✓ |

– |

| 15 |

Company C |

Germany |

✓ |

– |

– |

✓ |

– |

– |

✓ |

– |

– |

– |

– |

| 19 |

Marken |

USA |

– |

✓ |

✓ |

✓ |

✓ |

– |

✓ |

✓ |

– |

– |

– |

| 22 |

Company D |

India |

✓ |

✓ |

– |

✓ |

– |

✓ |

✓ |

– |

– |

✓ |

– |

| 34 |

Yourway |

USA |

– |

✓ |

✓ |

✓ |

✓ |

– |

✓ |

✓ |

– |

– |

– |

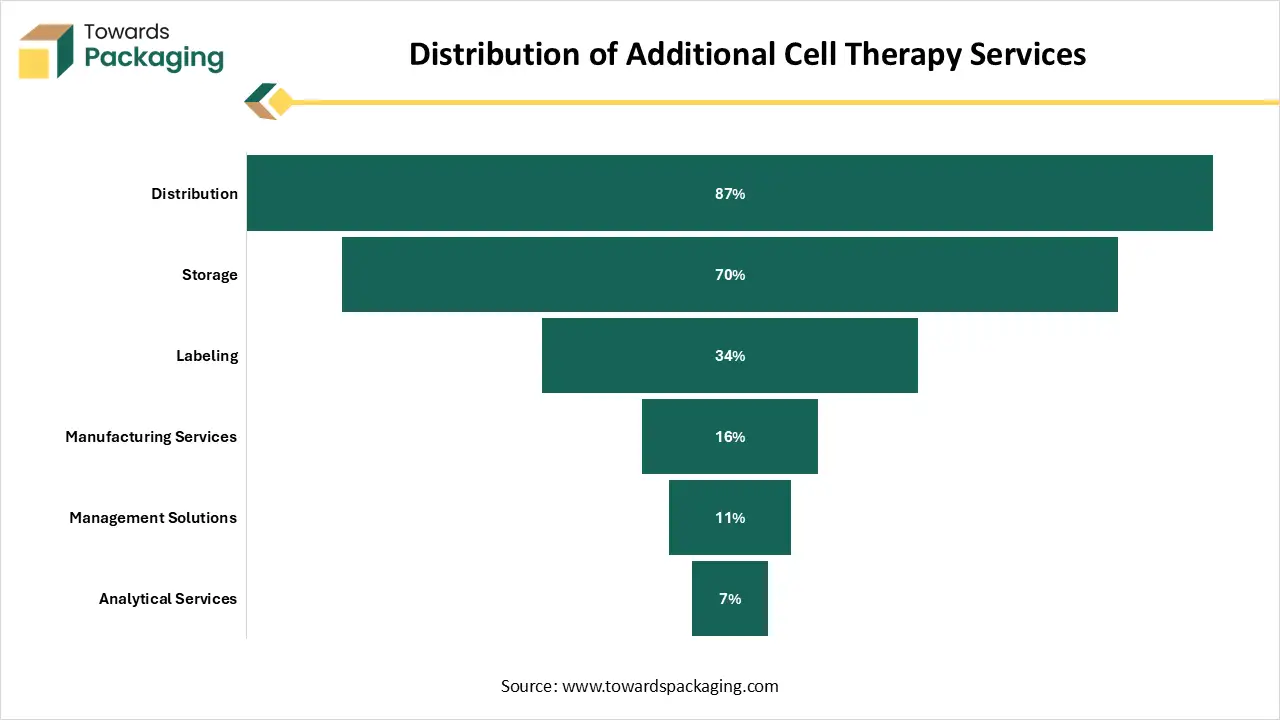

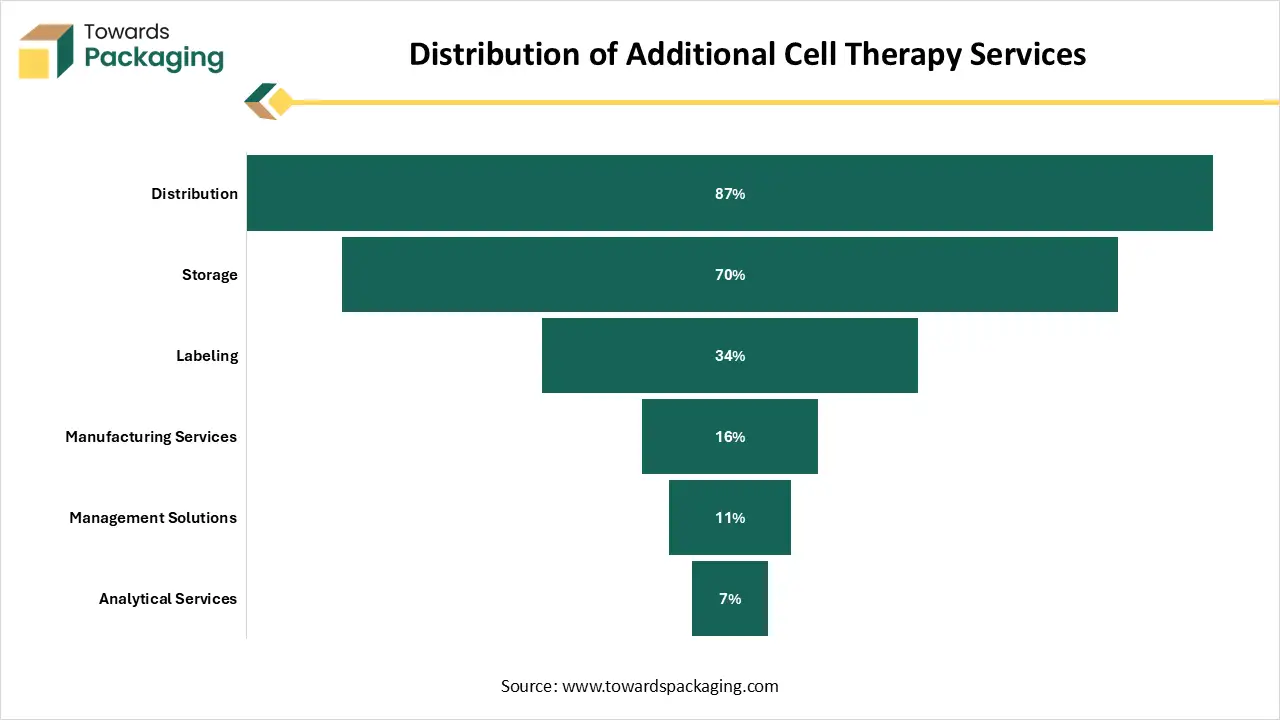

Distribution of Additional Cell Therapy Services

| Additional Service |

% Share |

| Distribution |

87% |

| Storage |

70% |

| Labeling |

34% |

| Manufacturing Services |

16% |

| Management Solutions |

11% |

| Analytical Services |

7% |

Cell Therapy Packaging Market - Value Chain Analysis

Raw Material Sourcing

The major raw materials utilized in this market are cellular starting materials, consumables and reagents.

- Key Players: Sartorius Stedim Biotech, Thermo Fisher Scientific

Component Manufacturing

The component manufacturing in this market comprises glass and plastic vials.

- Key Players: Almac, Thermo Fisher Scientific

Logistics and Distribution

This segment comprises enhancing accurateness, communication, and efficacy across the complete supply chain.

- Key Players: Arvato Group, Cryoport Inc

Packaging Type Insights

Why Primary Packaging (Cryovials, Cryobags, Cell Containers) Segment Dominated the Cell Therapy Packaging Market In 2024?

The primary packaging (cryovials, cryobags, cell containers) segment dominated the market with highest share in 2024 due to its sterility, stability, and quality. It plays an important role in product shield, dosage regulator, and ease of utilization. These are specialized tubes manufactured for medical-grade polypropylene which can endure low temperatures. They are frequently utilized within a closed arrangement to decrease pollution risk at the time of thawing, freezing, and storage.

The tertiary packaging (shipping systems, cryogenic shippers, overpacks) segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing because of the safety of temperature-sensitive products. It is introduced for the handling of bulk products required in the supply chain distribution. Labels used on the tertiary packaging support in maintaining the important chain of distinctiveness for modified cell therapies during the supply procedure.

Material Type Insights

Why Cryogenic Plastics (Polypropylene, Polycarbonate, HDPE) Segment Dominated the Cell Therapy Packaging Market In 2024?

The cryogenic plastics (polypropylene, polycarbonate, HDPE) segment dominated the market with highest share in 2024 due to its durability and integrity. These containers are hermetically sealed which protect contamination from microbes and other pollutants, specifically when stowed in the liquid nitrogen. The resource must preserve its container closing integrity over longer periods of storing. These resources are utilized to generate the primary containers like bags and vials that grasp the cell trials throughout freezing, stored and transport in liquid nitrogen.

The single-use polymer systems (multilayer films, EVA bags) segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to integrity, sterility, and viability. They are essential for ensuring the quality of cellular goods throughout storage, processing, and transport. This construction permits producers to generate packing with enhanced properties for mechanical strength, gas barriers, and functional assets.

Function Type Insights

Why Storage Packaging (Cryogenic Freezing & Long-term Storage) Segment Dominated the Cell Therapy Packaging Market In 2024?

The storage packaging (cryogenic freezing & long-term storage) segment dominated the market with highest share in 2024 due to sensitive and complex properties of living cells. It is cryopreserved at ultra-low temperatures for longer period storage and transportation. As more gene and cell therapies obtain supervisory support and enter medical trials, the demand for effective and safe cryopreservation approaches upsurges. The increasing trend of tissues, banking cells, and several other biological models for upcoming period utilization is a main supplier to market development.

The transportation packaging (cold chain & cryogenic shipping) segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to strong and advanced solution requirement. The requirement for safety and efficacy while transporting products encourage the adoption of this market and influence its advancement. The rising number of gene therapies has enhanced the utilization of these packaging.

Cell Therapy Type Insights

Why CAR-T Cell Therapies Segment Dominated the Cell Therapy Packaging Market In 2024?

The CAR-T cell therapies segment dominated the market with highest share in 2024 due to rising adoption of therapies. This segment provide protection from various other therapies. Rising adoption of these therapies has influenced the demand for these packaging. CAR T-cell therapy goals precise antigens present on cancer cells which is making it a battered method than old-style chemotherapy.

The stem cell therapies (MSC, iPSC, HSC) segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to rising number of clinical trials. Packaging for this segment is a diverse and main section inside the wider market. An increasing number of continuing clinical trials for this segment, mainly at the clinical measure, influences demand for packing facilities.

End User Type Insights

Why Cell Therapy Manufacturers / Biopharma Companies Segment Dominated the Cell Therapy Packaging Market In 2024?

The cell therapy manufacturers / biopharma companies segment dominated the market with highest share in 2024 due to increasing demand for these packaging. Some of the major companies are Intellia Therapeutics, Allogene Therapeutics, CRISPR Therapeutics, Adaptimmune, 4D Molecular Therapeutics, and many other. There is a need for continuous innovation to enhance the reliability towards packaging industry.

The specialized logistics & cryo-transport companies segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing significantly due to the increasing demand for specialized solutions. Corporations in this sector offer facilities beyond simple packing, comprising temperature-controlled worldwide logistics, united supply chain resolutions, and proficient navigation of supervisory obedience for these extremely sensitive goods. This segment is influenced by invention in sections such as unified digital stages, smart cryogenic vessels, and real-time temperature display to confirm end-to-end tracing capability.

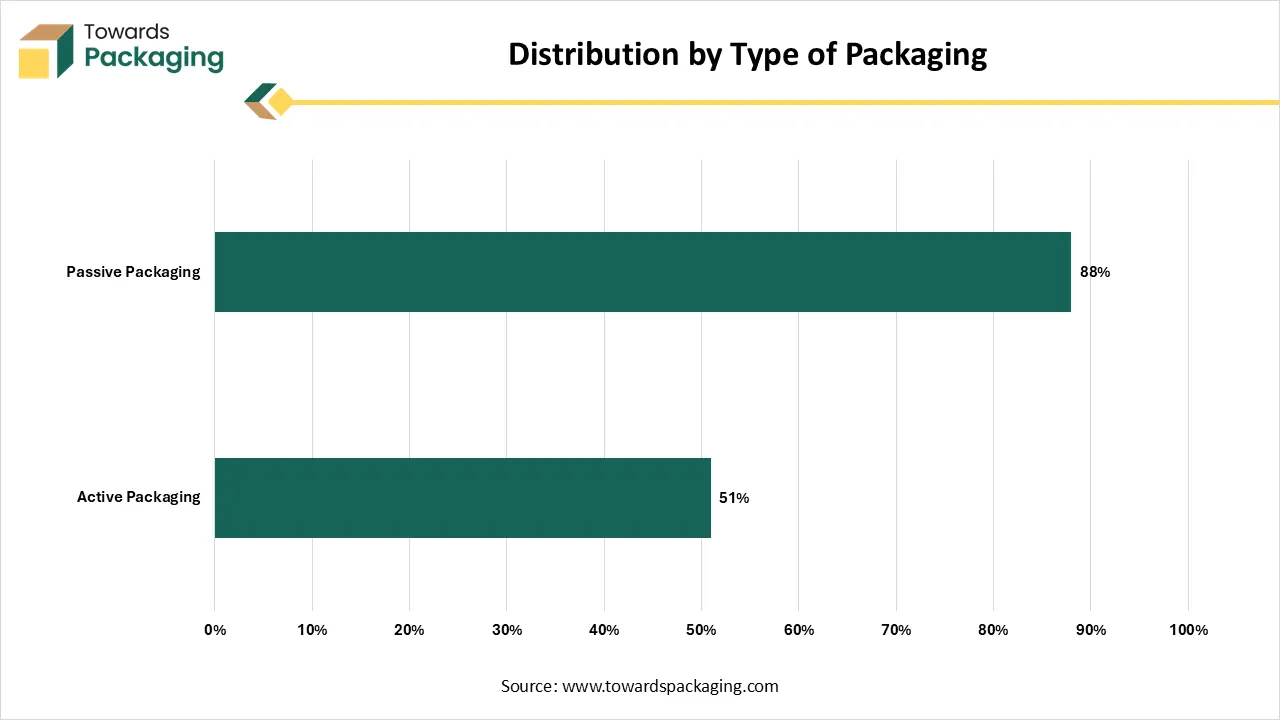

Global Cell Therapy Packaging Services - Distribution Overview

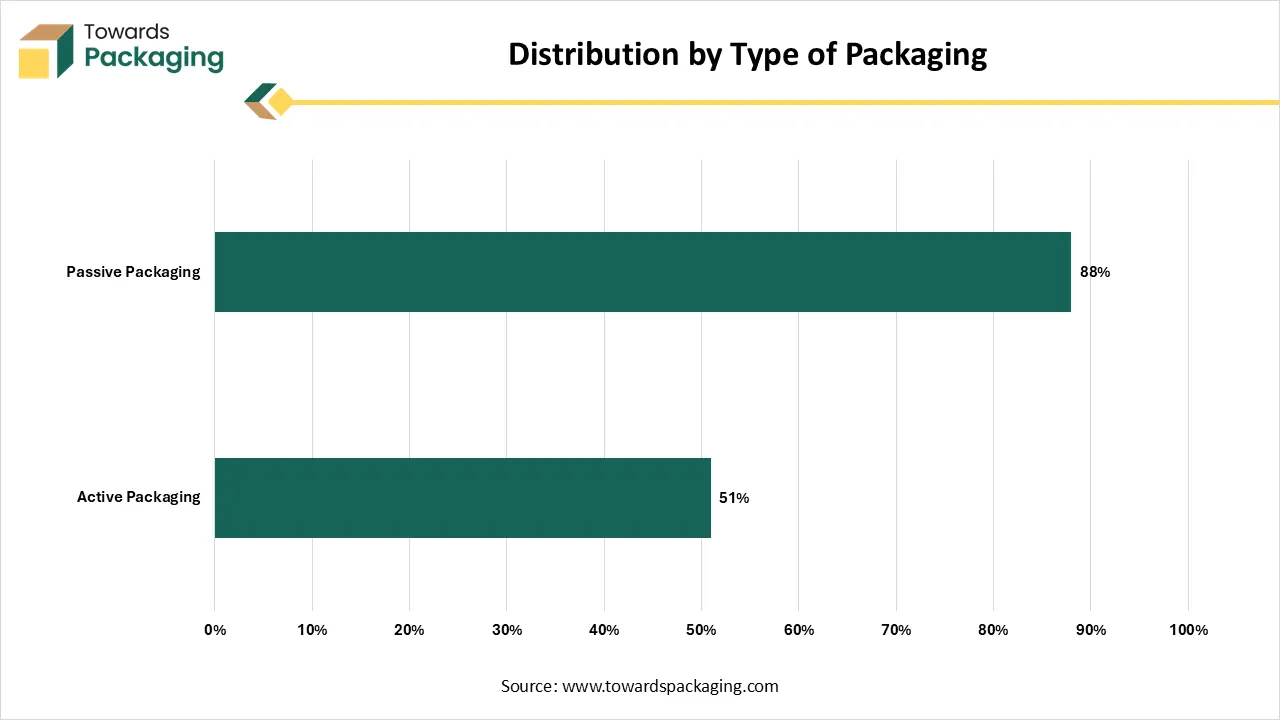

Distribution by Type of Packaging

| Packaging Type |

Share (%) |

| Active Packaging |

51% |

| Passive Packaging |

88% |

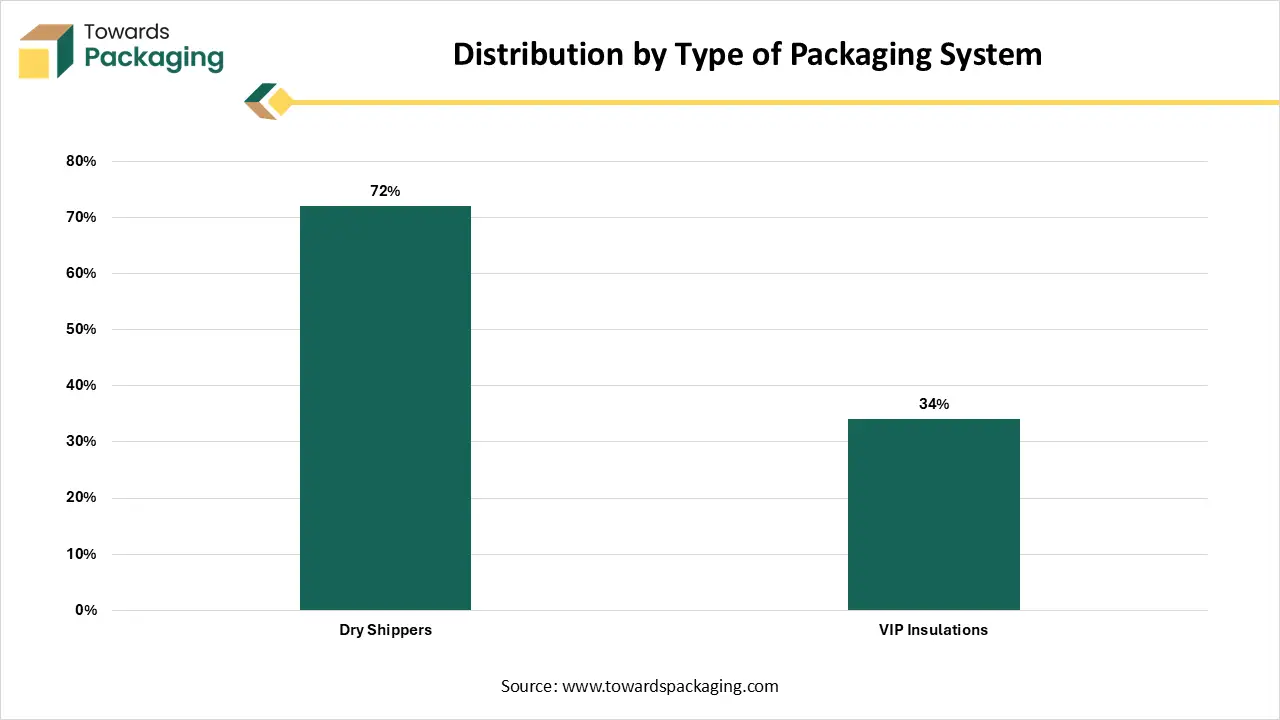

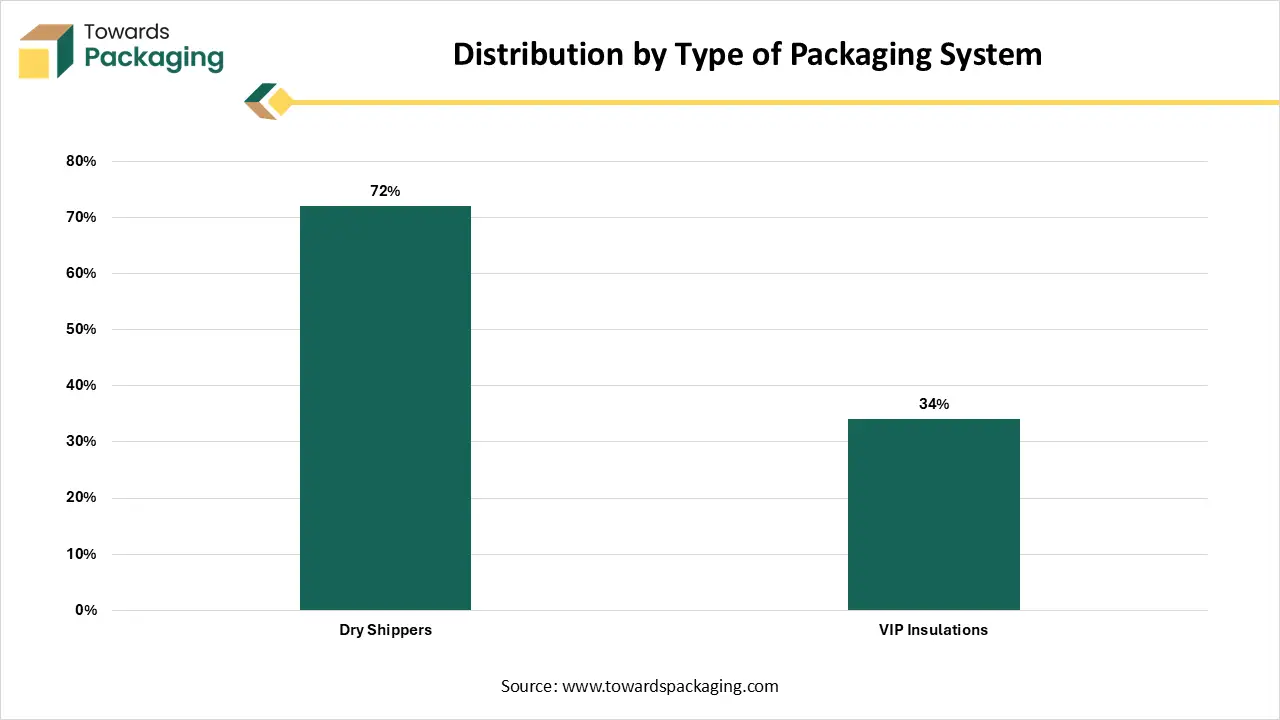

Distribution by Type of Packaging System

| Packaging System Type |

Share (%) |

| Dry Shippers |

72% |

| VIP Insulations |

34% |

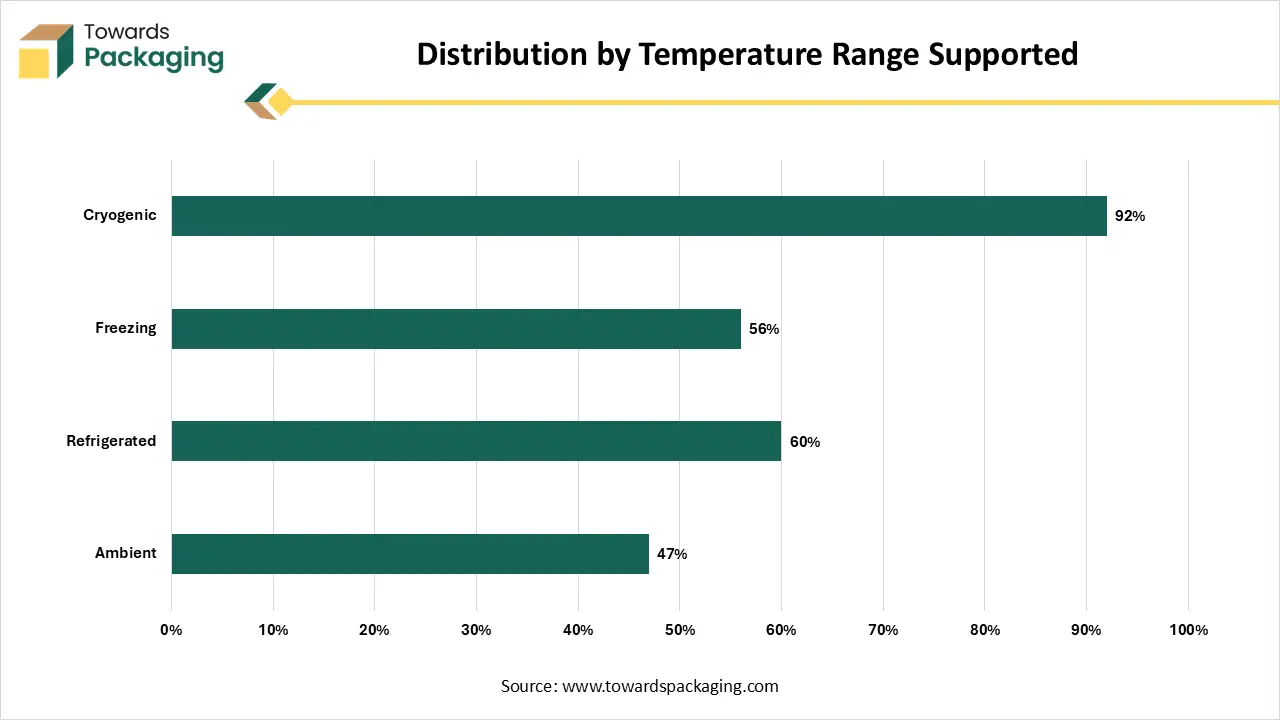

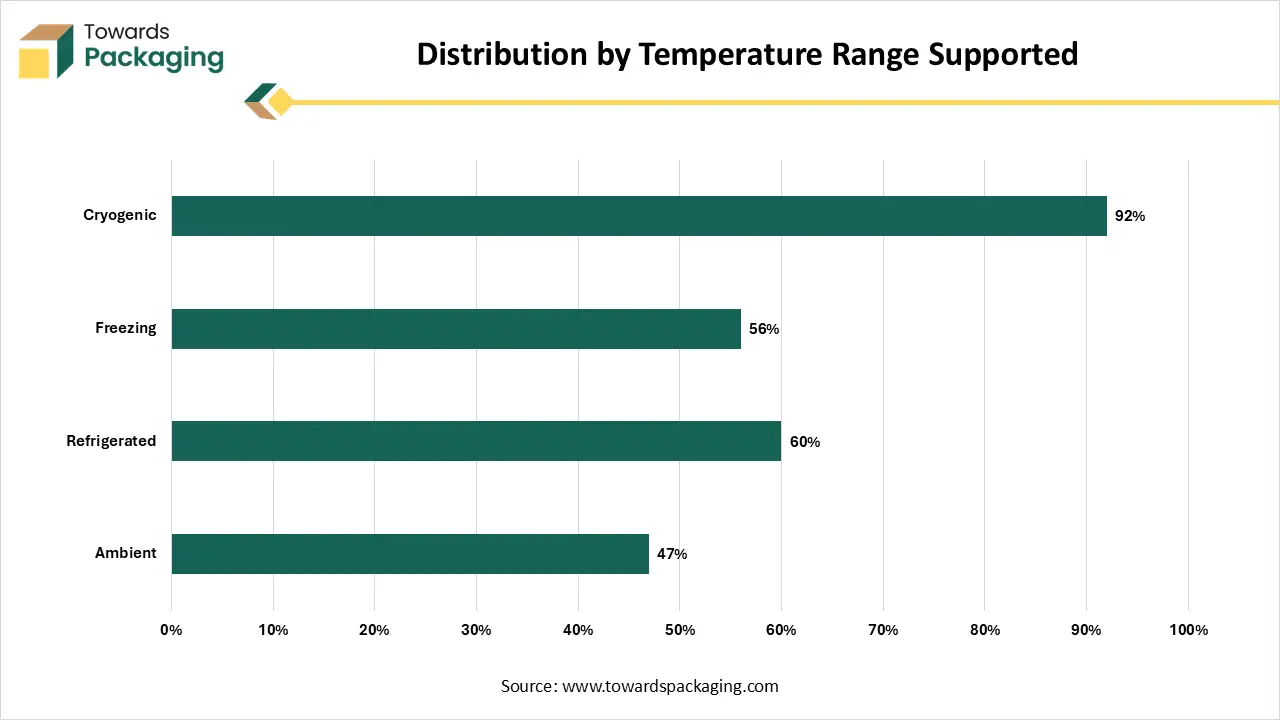

Distribution by Temperature Range Supported

| Temperature Range |

Share (%) |

| Ambient |

47% |

| Refrigerated |

60% |

| Freezing |

56% |

| Cryogenic |

92% |

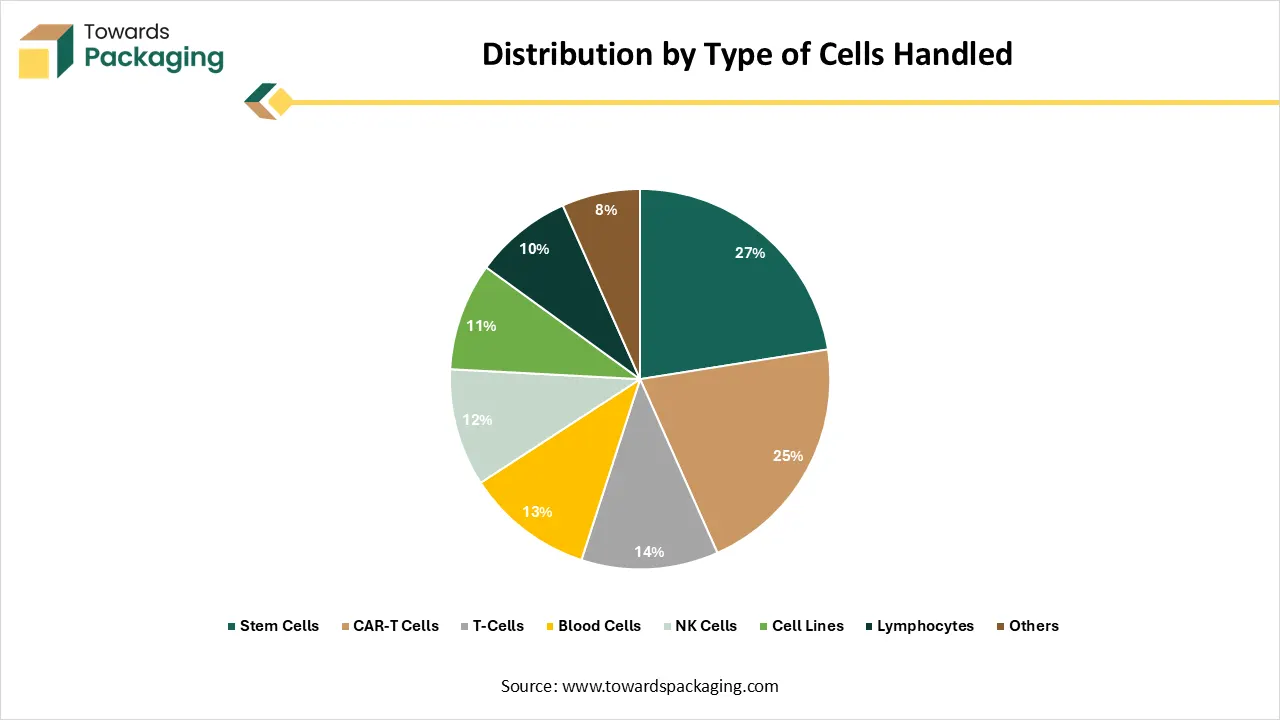

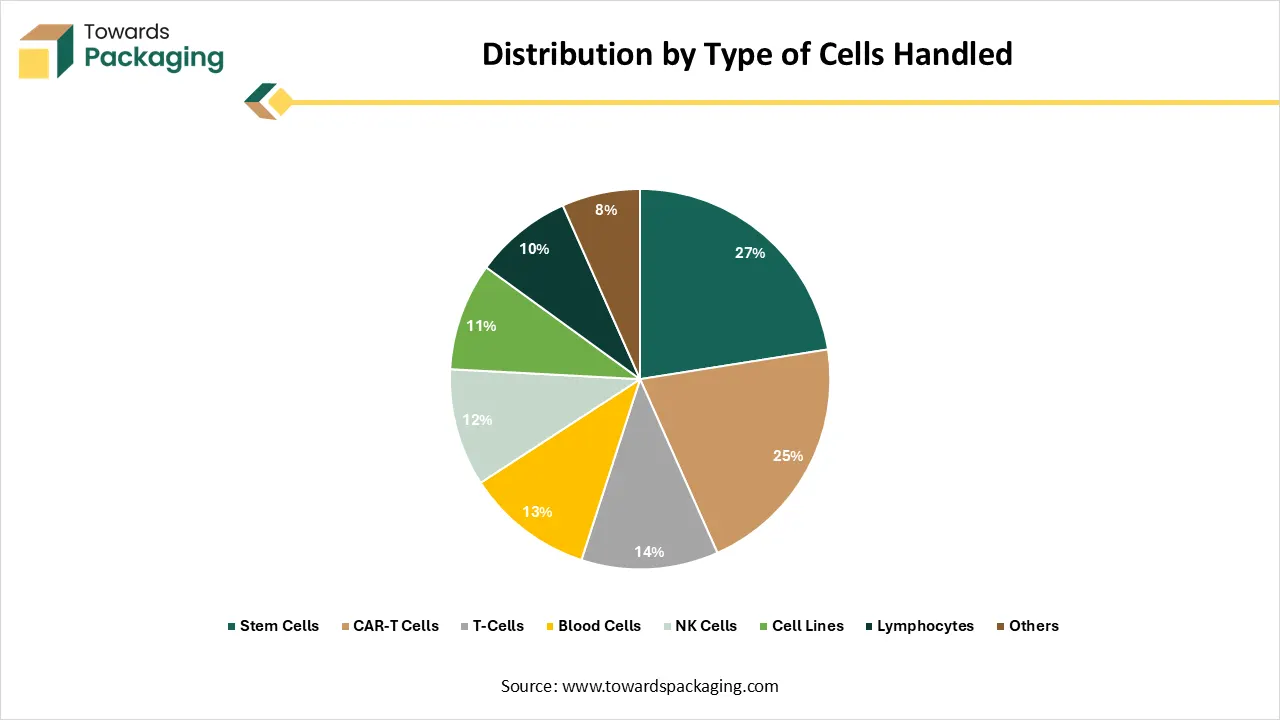

Distribution by Type of Cells Handled

| Cell Type |

Share (%) |

| Stem Cells |

27% |

| CAR-T Cells |

25% |

| T-Cells |

14% |

| Blood Cells |

13% |

| NK Cells |

12% |

| Cell Lines |

11% |

| Lymphocytes |

10% |

| Others |

8% |

This dataset highlights major trends in the global cell therapy packaging landscape. Passive packaging dominates the market, used by almost 90% of players, with a rising preference for dry shippers for cryogenic transport. Temperature-controlled packaging is essential, with over 90% of providers supporting cryogenic conditions.

Regional Insights

Strong R&D investment in North America Promote Dominance

North America held the largest share in the cell therapy packaging market in 2024, due to strong R&D investment. Some of the major factors are presence of huge biopharmaceutical companies and strong infrastructures. Huge number of cell and gene therapy approvals, government support, and huge demand for advanced treatment has pushed this market to grow significantly. It is the world's important biotechnology and pharmaceutical companies which are profoundly capitalized in cell therapy study and growth. The presence of well-established healthcare system, specialized contract, and research institute has pushed the growth of this market.

Presence of Strong Infrastructures Boost Cell Therapy Packaging Market in the U.S.

The U.S. is dominating in the market in North America region due to the presence of strong infrastructures and strong investment from private and public investors. Continuous clinical trials and supervisory support have pushed this market to grow rapidly. The U.S. is a center for invention in technologies which are important for cell therapy, like quality control procedures, automation, and single-usage arrangements.

Asia Pacific’s Industry Expansion

Asia Pacific expects the significant growth in the cell therapy packaging market during the forecast period. This market is growing due to the expansion of the industries, huge clinical trials, enhanced investment, and government support. Supervisory bodies are enabling the support of cell therapy goods, which additionally helps market development. Major influencing aspects in the market of goods and facilities are the growing requirement for gene and cell therapies, the high occurrence of cancer diseases and the increasing quantity of clinical court-martials.

Rapid Urbanization in China Promote the Cell Therapy Packaging Market Growth

China has a huge cell therapy packaging market due to the rapid urbanization and advanced clinical trial infrastructure. With a rapidly and huge urbanizing people, the country has a noteworthy and rising patient base who are suffering from rare and chronic diseases. This generates a robust demand for advanced cell therapy resolutions. The country has a growing organization for clinical trainings, with several CAR-T cell therapy trials presently in advancement. This severe R&D generates huge demand for focused packing for clinical resources.

Europe is Notably Growing Region in the Cell Therapy Packaging Market

Europe is notably growing due to its strict supervisory regulations has influenced the development of the market. Strict supervisory standards are boosting for highly effectual and consistent therapies, which inspires the growth of focused packing resolutions. There are noteworthy private and public segment savings nurturing the development of the cell and gene therapy industry. This development is influenced by aspects such as strong study and growth, rising funds in cell therapy engineering, and an emphasis on invention within the landform.

Leading Hub in the UK Promote the Cell Therapy Packaging Market Growth

UK has a huge market due to the presence of strong ecosystem as it has become leading hub of cell and gene therapy. The UK is a developer in cell and gene therapy, which have a strong ecosystem of research organizations and businesses. This generates a rising channel of new therapies which need special packing and logistics. It has a huge number of clinical trials and also an increasing number of industrial establishments accomplished of creating cell therapies. This national demand for packing and logistics facilities is a main factor of development.

Recent Development

- In May 2025, Minaris Advanced Therapies introduced as the top worldwide partner devoted towards cell therapy expansion, engineering, and testing. With advanced services accepted for profitable manufacture in the United States, Europe and Asia-Pacific, Minaris Advanced Therapies produces clinical-stage and marketable goods on three continents which has a verified track of distributing above 7,500 GMP batches.

- In March 2025, Bharat Biotech announced to invest $75 million in its first cell and gene therapy (CGT) service in Telangana. The corporation is growing its emphasis from its central vaccine occupation into multifaceted cell and gene therapy.

Top Companies in the Cell Therapy Packaging Market

- Cryoport, Inc.: It is a global leader in temperature-controlled cell therapy logistics.

- Thermo Fisher Scientific Inc.: It has CryoSolutions and Nalgene biopackaging systems.

- Sartorius AG: It is a single-use packaging and cryo-containment systems.

- Merck KGaA (MilliporeSigma): It is a biopharma-grade cryogenic storage solution.

- Corning Incorporated: This company is well-established for cryogenic vials and bioprocess packaging.

- Others: West Pharmaceutical Services, SCHOTT AG, Catalent Pharma Solutions, Avantor, Inc., DWK Life Sciences, ArcticZyme Technologies ASA, CSafe Global, BioLife Solutions, Inc., Intelsius Ltd., CryoXpert GmbH, va-Q-tec AG, Stirling Ultracold, Cold Chain Technologies LLC, Sonoco ThermoSafe, Regional GMP packaging firms and CDMOs.

Cell Therapy Packaging Market Segments Covered

By Packaging Type

- Primary Packaging (Cryovials, Cryobags, Cell Containers)

- Secondary Packaging (Protective Sleeves, Rigid Boxes, Insulated Holders)

- Tertiary Packaging (Shipping Systems, Cryogenic Shippers, Overpacks)

- Ancillary Components (Labels, Caps, Seals, Tamper-Proof Devices)

By Material Type

- Cryogenic Plastics (Polypropylene, Polycarbonate, HDPE)

- Glass (Cryovials, Ampoules)

- Metal & Composite Alloys (Liquid Nitrogen Shippers, Racks)

- Single-Use Polymer Systems (Multilayer Films, EVA Bags)

- Paperboard & Corrugated Materials (Outer Packaging)

By Function

- Storage Packaging (Cryogenic Freezing & Long-term Storage)

- Transportation Packaging (Cold Chain & Cryogenic Shipping)

- Primary Containment & Labeling Systems

- Safety & Contamination Control Packaging

- Regulatory & Serialization Packaging Solutions

By Cell Therapy Type

- CAR-T Cell Therapies

- Stem Cell Therapies (MSC, iPSC, HSC)

- NK Cell Therapies

- Dendritic Cell Therapies

- Others (Adoptive T-cell, Gene-modified Cells)

By End User

- Cell Therapy Manufacturers / Biopharma Companies

- Contract Manufacturing & Development Organizations (CDMOs / CMOs)

- Academic & Research Institutes

- Specialized Logistics & Cryo-Transport Companies

- Hospitals & Transplant Centers

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait