PET/EVOH/PE Packaging Materials Market Size, Share, Trends and Growth Forecast

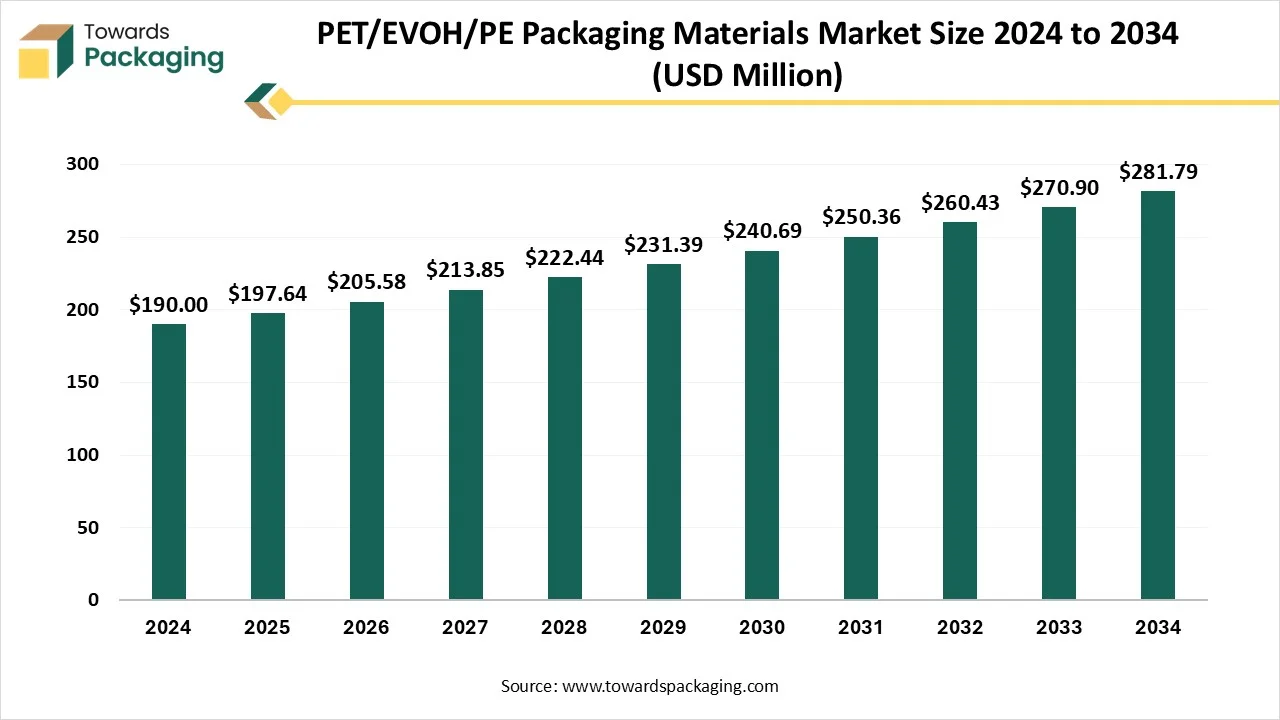

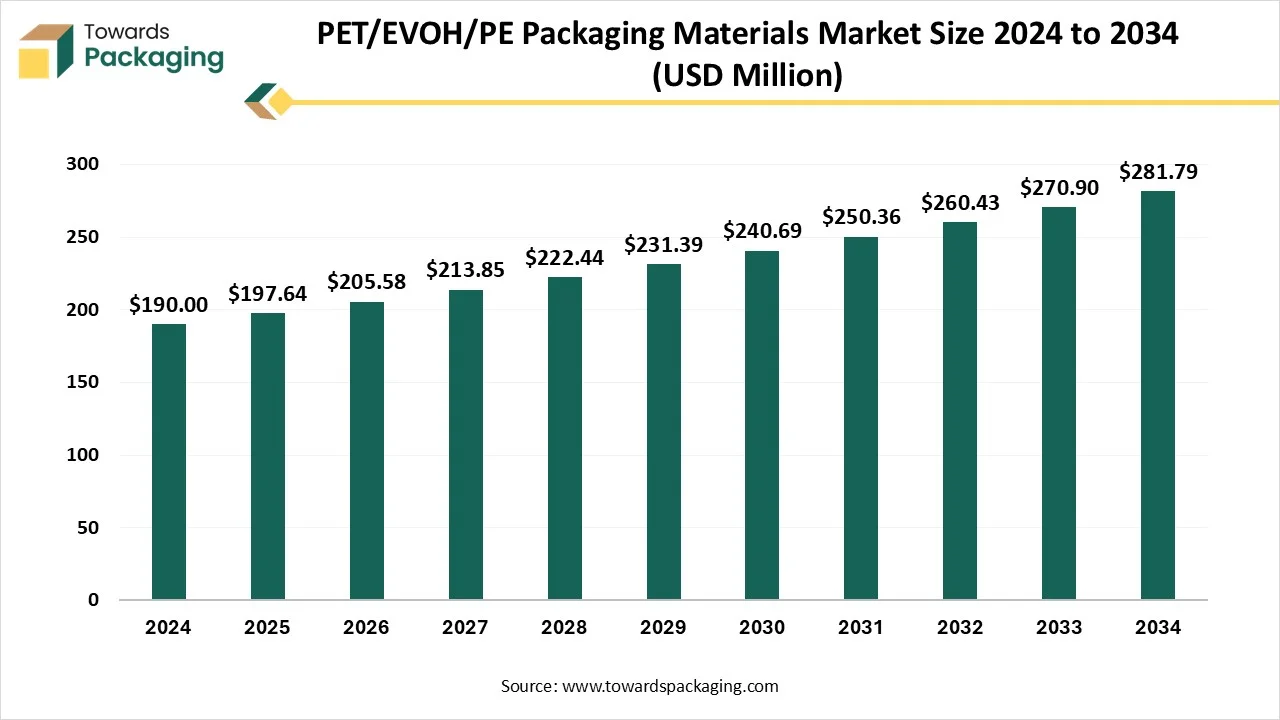

The PET/EVOH/PE packaging materials market is projected to rise from USD 197.64 million in 2025 to USD 293.12 million by 2035, registering a CAGR of 4.02%. This report covers full segmentation by material structure, thickness, application, and packaging format, along with regional insights for North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. It also includes market share analysis, company profiles, competitive strategies, value chain assessment, global trade data, and details of major manufacturers and suppliers operating across the packaging industry.

Key Insights

- In terms of revenue, the market is valued at USD 197.64 million in 2025.

- The market is projected to reach USD 293.12 million by 2035.

- Rapid growth at a CAGR of 4.02% will be observed in the period between 2025 and 2034.

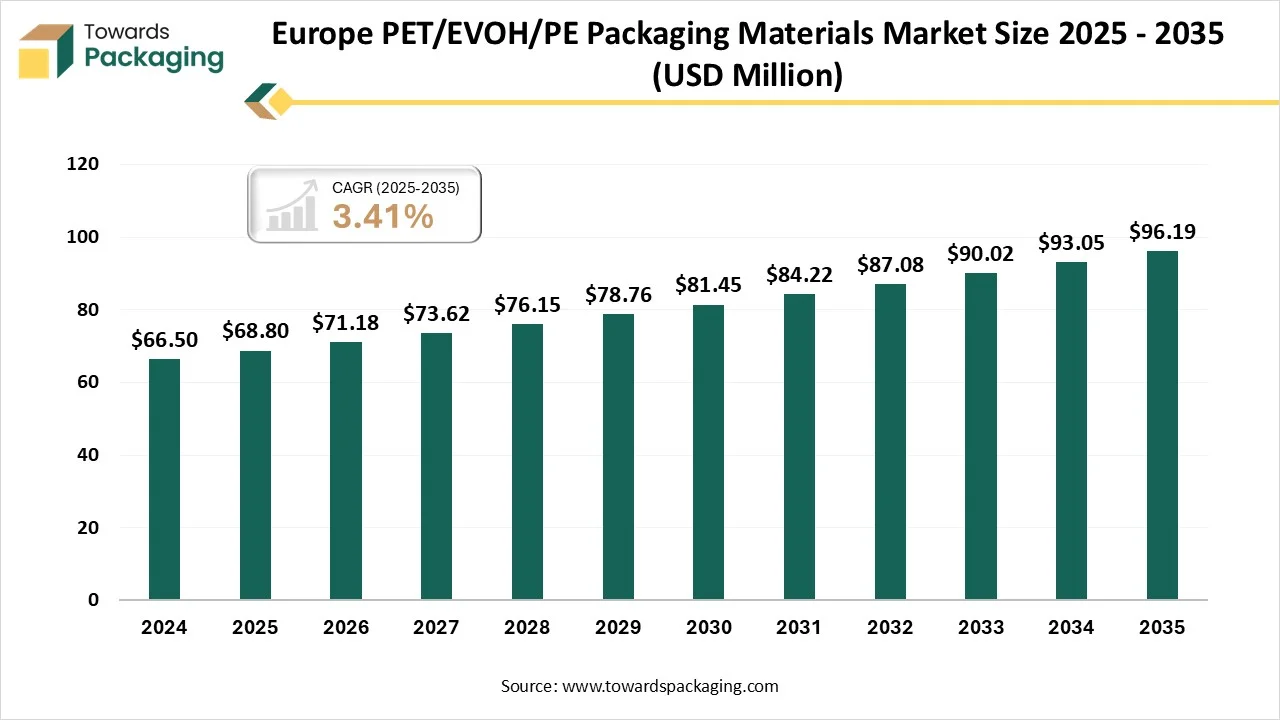

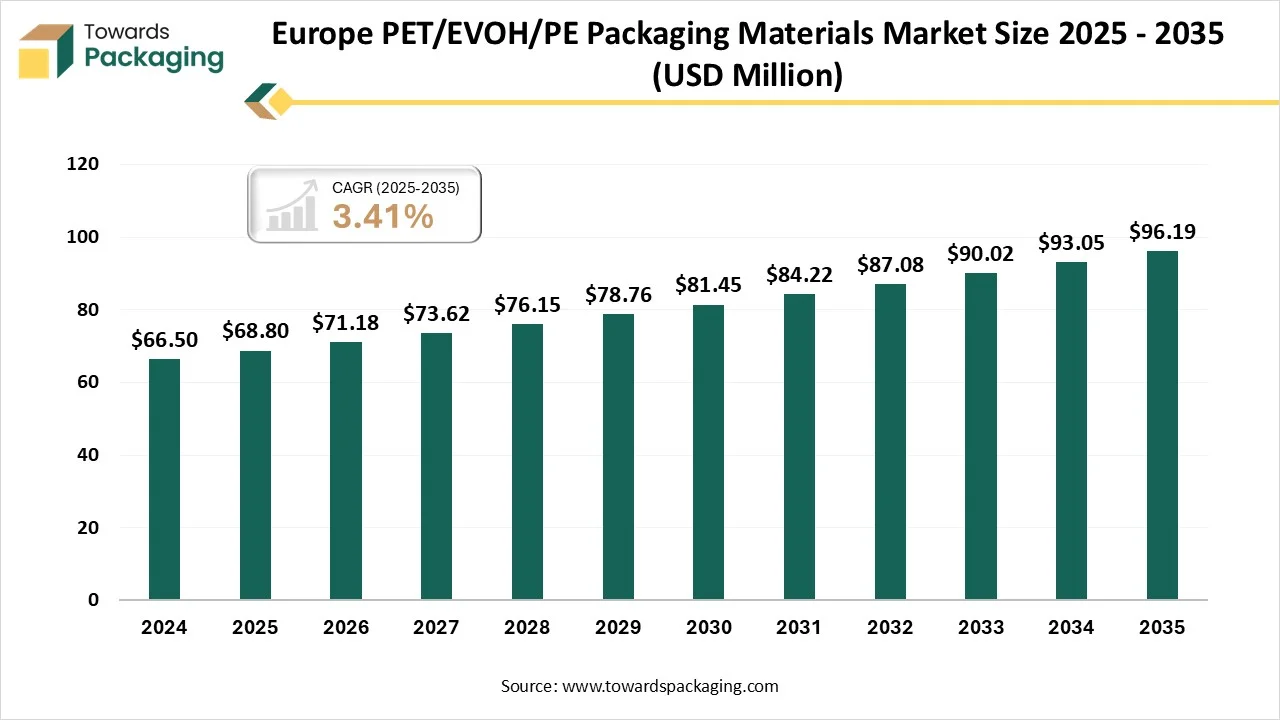

- Europe dominated the global PET/EVOH/PE packaging materials market in 2024.

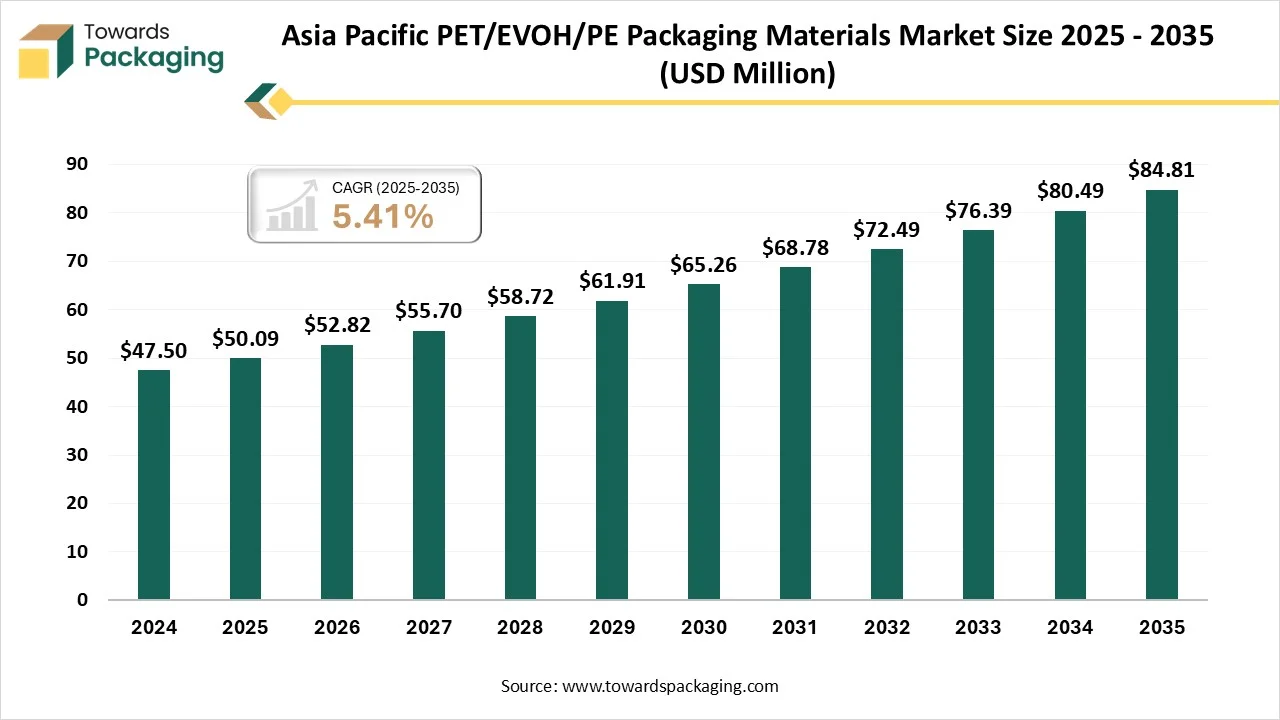

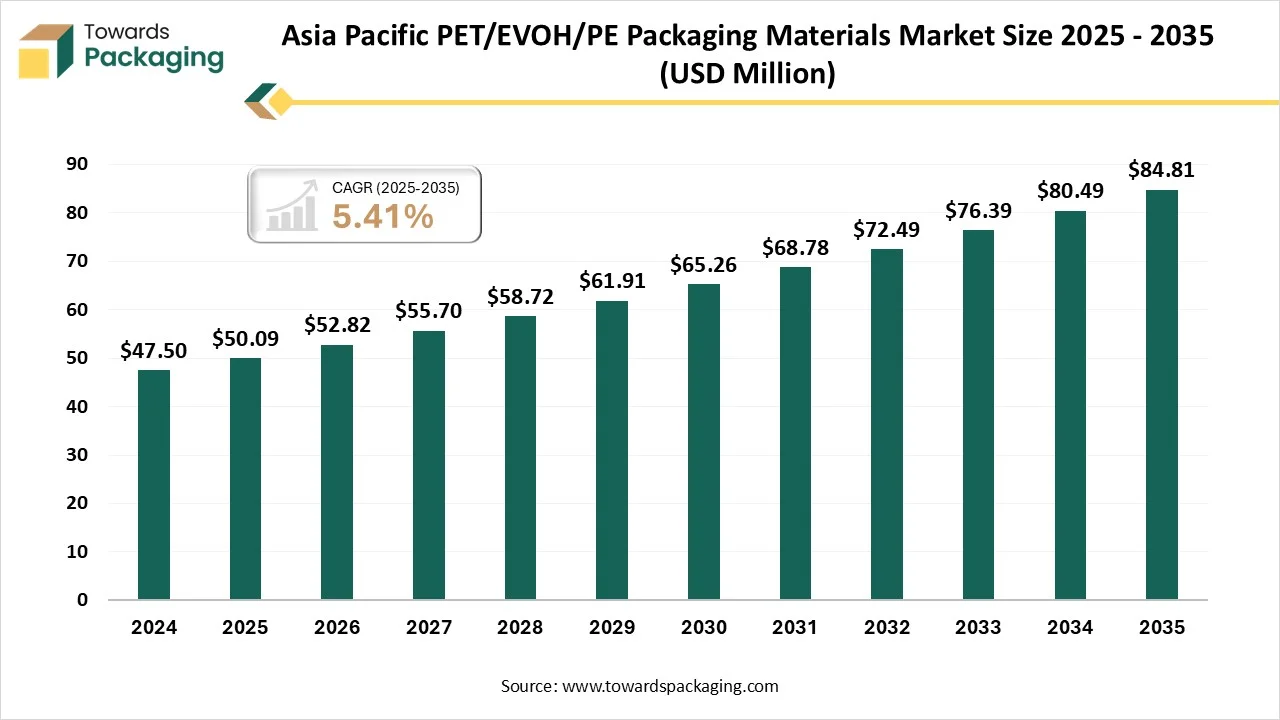

- Asia Pacific is expected to grow at a significant CAGR in the market during the forecast period.

- The North American market is expected to grow at a notable CAGR in the foreseeable future.

- By structure type, the flexible multilayer films segment dominated the market with the largest share in 2024.

- By structure type, the lidding films segment is expected to grow at the fastest CAGR during the forecast period of 2024 to 2034.

- By application, the food packaging segment dominated the market in 2024.

- By application, the pharmaceutical packaging segment is expected to grow at the fastest CAGR in the forecast period.

- By end-use industry, the food & beverage segment dominated the market with the largest share in 2024.

- By end-use industry, the healthcare & pharmaceuticals segment is expected to grow at the fastest CAGR during the forecast period of 2024 to 2034.

- By distribution channel, the B2B direct supply segment dominated the market in 2024.

- By distribution channel, the online B2B platforms segment is expected to grow at the fastest CAGR in the forecast period.

Market Overview

PET/EVOH/PE refers to a multi-layer packaging structure made from three key materials Polyethylene Terephthalate (PET), Ethylene Vinyl Alcohol (EVOH), and Polyethylene (PE). PET is a strong, lightweight plastic that provides excellent mechanical strength and acts as a barrier against moisture and gases. EVOH is a high-performance barrier resin known for its superior resistance to oxygen transmission, making it ideal for preserving the freshness and extending the shelf life of perishable products.

PE is a flexible, heat-sealable layer that offers moisture resistance and enhances the overall durability of the packaging. When combined, these materials form a high-barrier, multi-functional packaging solution often used in food, pharmaceutical, and cosmetic applications. The layered structure prevents oxygen and moisture ingress, protects aroma and flavor, and ensures product safety. This combination is especially beneficial for vacuum-sealed or modified atmosphere packaging, where maintaining internal conditions is crucial for product preservation and consumer satisfaction.

- In 2025, a major industry shift is underway toward sustainable, recyclable PET‑EVOH‑PE structures, particularly mono‑polyethylene designs (all‑PE with EVOH barrier) that enable mechanical recycling streams and circularity goals. EVOH layer thicknesses have been reduced from around 10 µm to 5 µm, delivering equal barrier performance at lower material and cost while lowering carbon footprint.

What are the latest Trends in the PET/EVOH/PE Packaging Materials Market?

- Bio‑based EVOH and PET grades are gaining traction: bio‑EVOH is projected to account for ~15 % of production by 2025, and collaborations among companies (e.g., Kuraray, Mitsui) and brands like Coca‑Cola, Nestlé are pushing renewable feedstock alternatives to cut lifecycle CO₂ emissions.

- Smart and active packaging integration is on the rise: EVOH films now embed freshness indicators, oxygen scavengers, moisture sensors, and QR/NFC tech for traceability and consumer engagement, especially in premium food sectors.

How Can AI Improve the PET/EVOH/PE Packaging Materials Industry?

AI integration can significantly enhance the PET/ EVOH/ PE packaging materials industry by optimizing production processes, improving quality control, driving innovation, and supporting sustainability goals. In manufacturing, AI algorithms can analyze vast datasets to determine the most efficient combination and thickness of PET, EVOH, and PE layers, thereby improving barrier properties while minimizing material usage and waste. Advanced AI-driven process control systems can monitor real-time variables such as temperature, pressure, and extrusion speed to maintain consistent product quality and reduce defects. Machine learning models can also predict potential equipment failures, enabling predictive maintenance and reducing unplanned downtime.

In terms of innovation, AI can accelerate R&D by simulating material behaviors and packaging performance under various environmental conditions, helping engineers design more durable, lightweight, and sustainable multilayer structures. Furthermore, AI-enabled computer vision systems enhance quality assurance by detecting micro-defects that may not be visible to the human eye. On the market side, AI can analyze customer preferences and industry trends to support the development of customized packaging solutions for food, pharmaceuticals, and industrial goods. Overall, AI integration helps manufacturers achieve higher efficiency, lower costs, and faster innovation cycles in producing high-performance PET/ EVOH/ PE packaging materials.

Market Dynamics

Driver

Expansion of Online Food Delivery

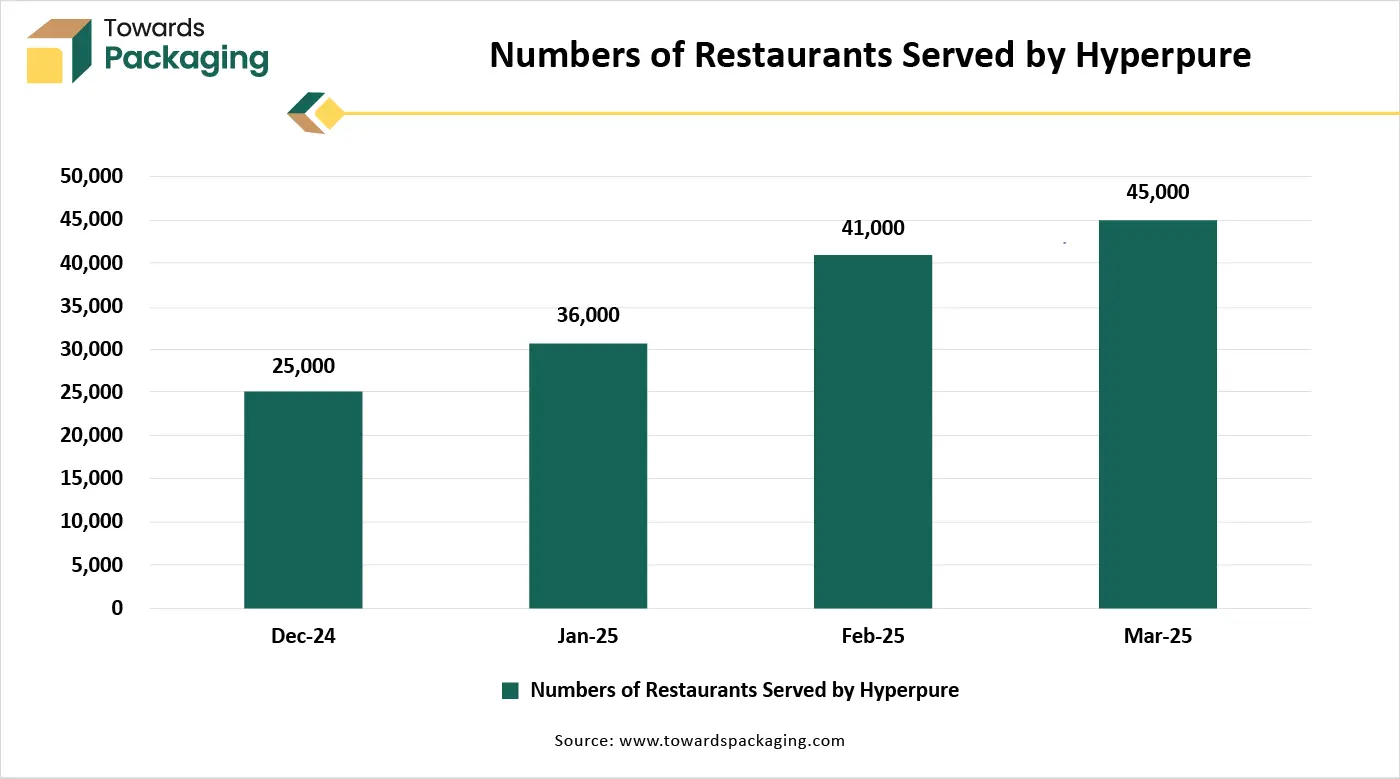

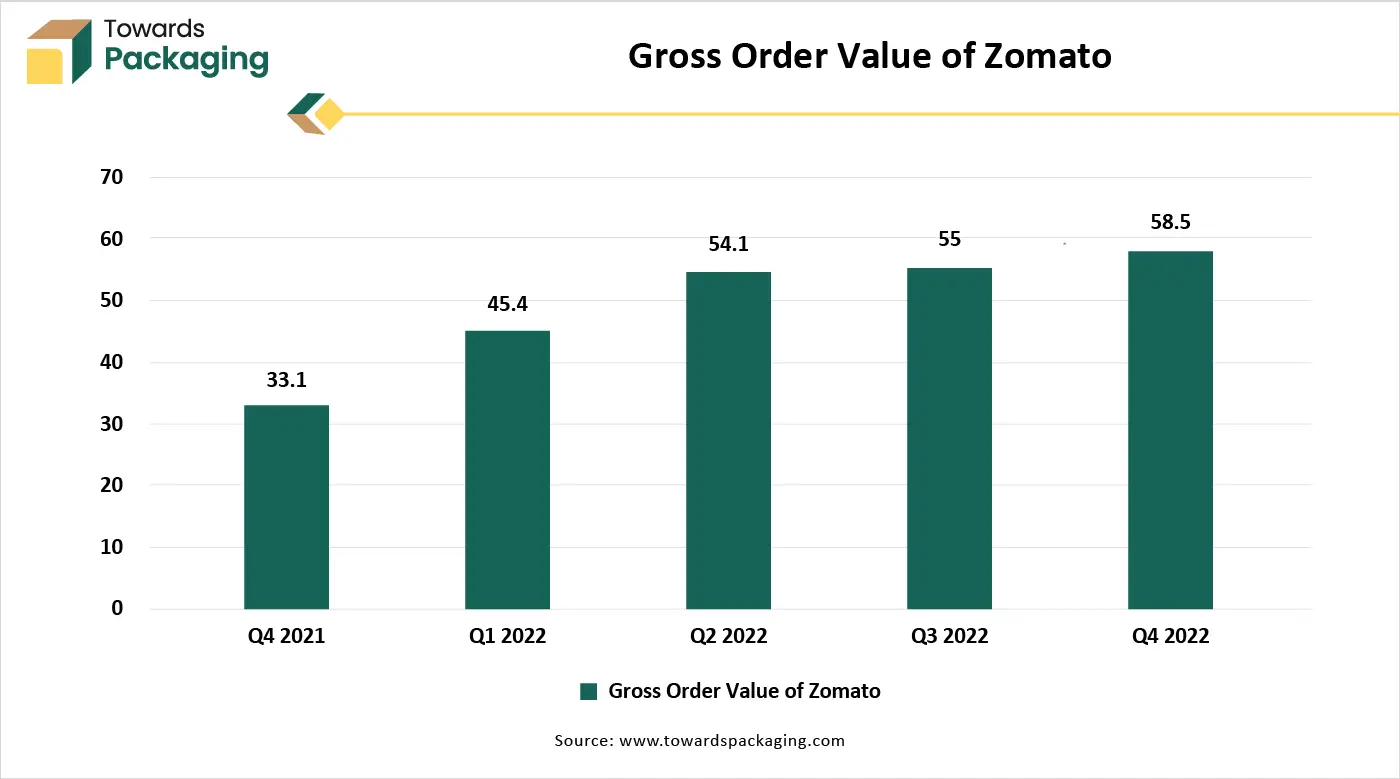

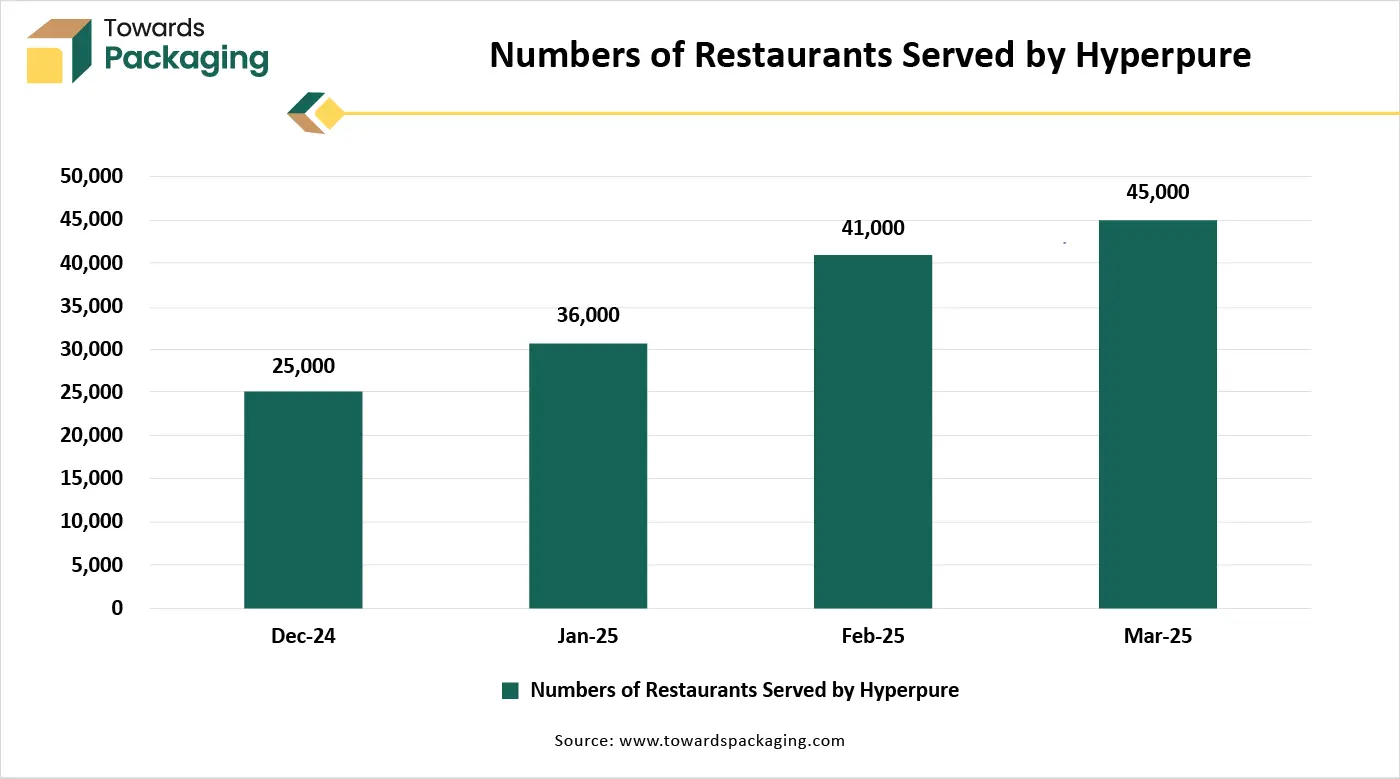

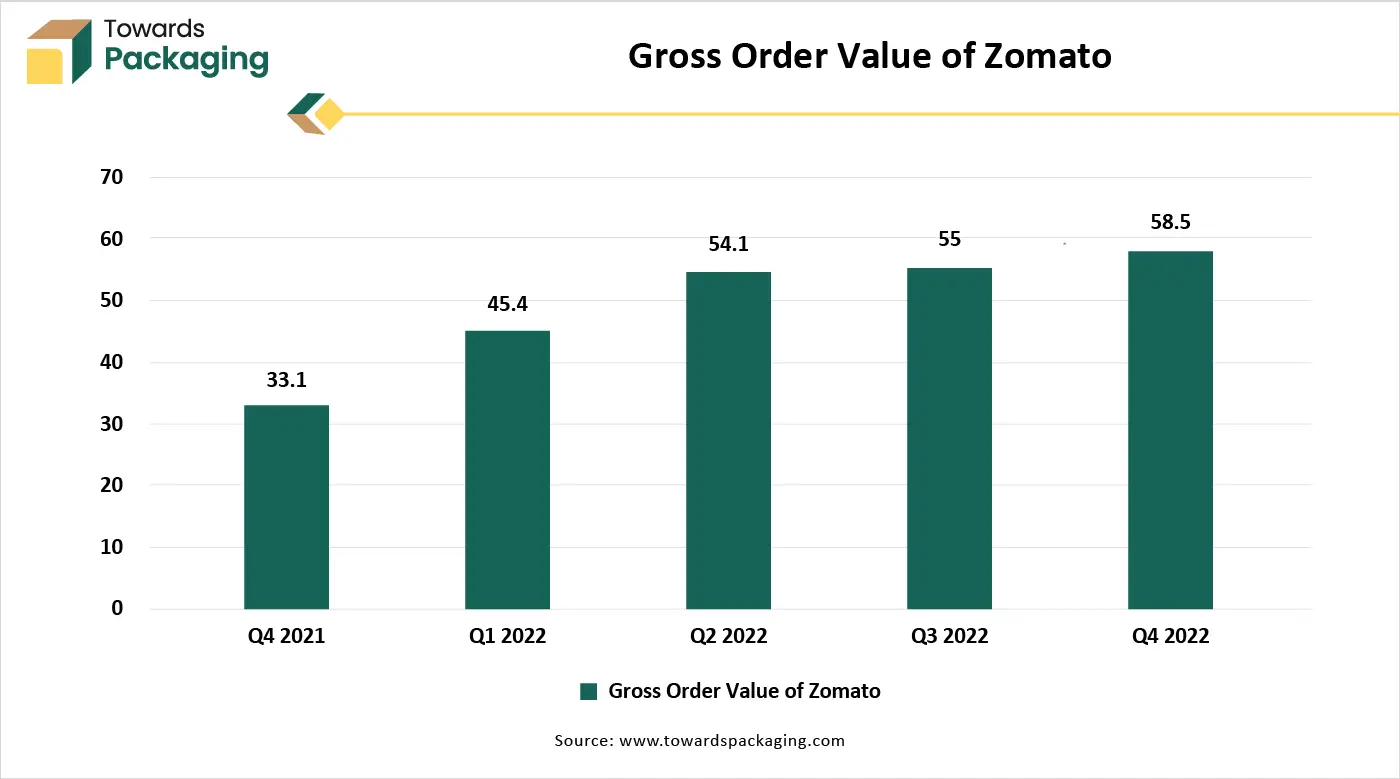

The expansion of e-commerce and online food delivery is significantly driving the growth of the PET/EVOH/PE packaging materials market due to several interrelated factors that cater to the evolving needs of modern consumers and businesses. As online food delivery and e-commerce platforms continue to rise, there is a growing demand for packaging that ensures product safety, freshness, and durability during transportation. PET/EVOH/PE multilayer films offer exceptional mechanical strength, barrier protection, and sealing performance, which are crucial for maintaining the quality of food and beverages over longer delivery times and varying environmental conditions. The EVOH layer acts as a strong oxygen barrier, helping to preserve the taste, aroma, and nutritional content of packaged items, especially ready-to-eat meals, dairy products, and meat.

Additionally, the PE outer layer offers moisture resistance and heat sealability, making it ideal for vacuum-packed or modified atmosphere packaging (MAP) commonly used in online grocery deliveries. The PET layer provides rigidity and clarity, allowing for attractive presentation, which is important for consumer appeal in e-commerce settings. Moreover, the growing emphasis on sustainable packaging in e-commerce has led to an increased preference for recyclable PET/EVOH/PE structures, further pushing their adoption. Thus, the growing convenience-driven online purchasing habits directly amplify the need for high-barrier, robust, and sustainable packaging solutions, propelling market growth.

- In January 2025, according to the data published by the National Ecommerce Association, Zomato lists 12,000 restaurant partners and more than 1.4 million restaurants. Additionally, it has more than 6500 Zomato Gold restaurant partners. About 285,000 delivery drivers and 3,50,000 restaurant listings were active on its platform in India as of December 2020. It had 25,440 Pro restaurant partners for the Indian Market. With 8339 employees, it ranks second in India and eleventh globally in terms of website traffic for restaurants as of March 2023.

Restraint

Recycling Challenges of Multilayer Structures & Limited Biodegradability

The key players operating in the market are facing issues due to recycling challenges of multilayer structures and limited biodegradability. PET/EVOH/PE packaging is a multilayer combination, which makes mechanical recycling difficult due to the separation complexity of individual layers. This limits its compatibility with standard recycling streams, especially in regions with underdeveloped recycling infrastructure.

The incorporation of advanced barrier materials like EVOH increases the overall material and manufacturing costs compared to single-layer or simpler alternatives. This can deter small and mid-sized manufacturers from adopting such packaging formats. These materials are not biodegradable, which raises environmental concerns among consumers and regulators, especially as the push for compostable or bio-based packaging intensifies. Strict regulations aimed at reducing plastic waste, particularly multilayer plastic packaging, can hinder market growth by imposing restrictions, taxes, or bans in certain countries.

What are the key Opportunities for the Growth of the PET/EVOH/PE Packaging Materials Market?

Rising Demand for High-Barrier Packaging in the Food and Beverage Sector

With growing global consumption of ready-to-eat meals, dairy products, meat, seafood, and frozen foods, there is an increasing need for packaging that can extend shelf life, retain freshness, and maintain food safety. PET/EVOH/PE packaging offers superior oxygen and moisture barrier properties, making it highly suitable for vacuum and modified atmosphere packaging (MAP). As food companies expand globally and invest in smart packaging, the demand for multilayer barrier films is expected to rise significantly.

Growth of Sustainable and Recyclable Multilayer Films

The trend toward sustainability presents an opportunity for PET/EVOH/PE films engineered for recyclability. Many manufacturers are now developing mono-material polyethylene-based structures with thin EVOH layers that comply with circular economy models. Such recyclable barrier films are attracting the attention of global food and FMCG brands aiming to meet sustainability goals without compromising performance.

Expansion in Emerging Economies

Rapid urbanization, rising disposable incomes, and the expansion of organized retail in emerging economies like India, China, Brazil, and Southeast Asia offer untapped market potential. These regions are witnessing growth in packaged food, pharmaceuticals, and personal care products, all of which require high-performance packaging materials like PET/EVOH/PE.

Technological Advancements in Film Manufacturing

Continuous innovation in multilayer extrusion technologies and the development of thinner, high-performance EVOH layers open up new applications while reducing material usage and cost. The integration of smart features, such as active and intelligent packaging (e.g., freshness indicators, oxygen scavengers), is further expanding the market appeal.

Increased Use in Medical and Pharmaceutical Applications

The need for sterile, contaminant-free packaging in the pharmaceutical and healthcare sectors is increasing. PET/EVOH/PE films provide the necessary protective barrier against oxygen and moisture, making them suitable for packaging medical devices, diagnostic kits, and medications, especially in response to growing global health awareness.

Customization and Versatility in Design

PET/EVOH/PE films are highly adaptable in terms of thickness, sealing temperature, clarity, and strength, allowing manufacturers to tailor packaging for specific applications. This design flexibility offers brands greater scope for innovation in packaging aesthetics and function, opening new market segments.

Segmental Insights

Why does the Paper/Cardboard Segment Dominate the PET/ EVOH/ PE Packaging Materials Market?

The Flexible Multi-Layer Films segment holds dominance in the PET/EVOH/PE packaging materials market due to its superior barrier properties, lightweight nature, and cost-effectiveness. These films offer excellent protection against oxygen, moisture, and contaminants, making them ideal for packaging perishable food, pharmaceuticals, and sensitive consumer goods. Their flexibility allows for convenient storage, transport, and user-friendly packaging designs such as pouches and sachets. Additionally, multi-layer configurations provide structural integrity while minimizing material usage, supporting sustainability goals. The ability to tailor film properties for specific product needs, combined with high-speed processing compatibility and enhanced shelf appeal, further drives their widespread adoption across industries.

The lidding films segment is the fastest-growing structure-type in the PET/EVOH/PE packaging materials market due to its critical role in sealing and protecting a wide range of packaged products, particularly in the food and healthcare sectors. These films offer excellent oxygen and moisture barrier properties, ensuring extended shelf life and freshness of perishable goods such as ready-to-eat meals, dairy products, and pharmaceuticals. Their compatibility with various container types, including trays and cups, along with easy-peel and heat-seal functionalities, enhances consumer convenience and packaging efficiency. Additionally, lidding films support lightweight and sustainable packaging solutions, aligning with growing environmental and regulatory demands.

Which Application Segment Dominated the PET/ EVOH/ PE Packaging Materials Market in 2024?

The food packaging segment is the dominant application in the PET/EVOH/PE packaging materials market due to the growing demand for high-barrier, safe, and durable packaging solutions that extend shelf life and preserve food quality. PET/EVOH/PE multilayer structures offer excellent oxygen and moisture resistance, making them ideal for packaging perishable products such as meats, dairy, ready meals, and snacks. Their lightweight, flexible nature supports efficient transportation and storage while maintaining the freshness and safety of food items. Additionally, the materials are compatible with various packaging formats like pouches, trays, and vacuum packs, meeting the diverse needs of the food industry and regulatory standards.

The pharmaceutical packaging segment is the fastest-growing application in the PET/EVOH/PE packaging materials market due to the increasing demand for secure, sterile, and high-barrier packaging solutions that ensure drug stability and patient safety. PET/EVOH/PE multilayer structures provide exceptional protection against oxygen, moisture, and contaminants, which is critical for maintaining the efficacy and shelf life of sensitive pharmaceutical products. These materials support advanced packaging formats such as blister packs, sachets, and medical pouches, which are widely used for capsules, tablets, and injectables. Additionally, the rising focus on compliance with stringent healthcare regulations and the growing global demand for accessible, transport-friendly medicines further drive growth.

Why does the Food & Beverage Segment Dominate the PET/ EVOH/ PE Packaging Materials Market?

The food and beverage segment is the dominant industry segment in the PET/EVOH/PE packaging materials market due to its high demand for reliable, high-barrier packaging that ensures product safety, freshness, and extended shelf life. PET/EVOH/PE multilayer films offer superior resistance to oxygen and moisture, making them ideal for packaging dairy, meat, snacks, juices, sauces, and other perishable items. Their lightweight and flexible nature supports efficient transportation, storage, and convenience-focused packaging designs like pouches, trays, and vacuum-sealed packs. Moreover, increasing consumer preference for hygienic, ready-to-eat, and on-the-go food options continues to fuel the widespread adoption of these materials across the industry.

The healthcare and pharmaceutical segment is the fastest-growing end-use industry in the PET‑EVOH‑PE packaging market, driven by several critical factors. The layer combination provides exceptional oxygen and moisture barrier protection, safeguarding drug integrity and potency vital for tablets, capsules, injectables, and medical devices. Its compatibility with sterilization techniques like gamma irradiation and steam autoclaving is essential for compliant pharmaceutical packaging. Additionally, robust regulatory standards in the healthcare space demand materials with high-performance barrier resistance, favoring EVOH-based multilayers. Moreover, the growing global pharmaceutical market, driven by chronic disease prevalence, personalized medicines, and biologics, is fueling demand for advanced packaging that ensures safety and shelf life. Therefore, the blend of regulatory rigor, material performance, sterilization compatibility, and expanding pharma demand is fueling rapid growth in this end-use segment.

Which Distribution Channel Dominated the PET/ EVOH/ PE Packaging Materials Market in 2024?

The B2B direct supply segment is the dominant distribution channel in the PET/EVOH/PE packaging materials market due to its ability to offer customized, large-volume solutions directly to manufacturers and brand owners. This channel enables close collaboration between packaging suppliers and end-users, allowing for tailored material specifications, consistent quality, and timely delivery essential in industries like food, beverages, and pharmaceuticals. Direct supply also helps reduce intermediary costs, streamline logistics, and ensure compliance with stringent packaging standards. Additionally, long-term contracts and integrated supply chain strategies between manufacturers and suppliers promote stability, reliability, and innovation, making B2B direct supply the preferred choice for bulk procurement.

The online B2B platform segment is experiencing the fastest growth among distribution channels in the PET‑EVOH‑PE packaging materials market for several strategic reasons. First, B2B buyers increasingly expect digital purchasing experiences similar to B2C, demanding features like real‑time product catalogues, transparent pricing, inventory visibility, and seamless reordering workflow capabilities that online platforms are built to deliver. Second, these platforms offer global reach and lower entry barriers, making it easier for suppliers, especially SMEs, to connect with large buyers without intermediaries. Third, integration with ERP and CRM systems enables greater automation and data-driven procurement, which reduces friction and accelerates purchasing cycles. Finally, customer demand for customization, sustainability credentials, and certification access further fuels the adoption of digital platforms that support these advanced requirements.

Regional Insights

Which Region Dominated in the PET/ EVOH/ PE Packaging Materials Market in 2024?

Europe holds a dominant position in the PET/EVOH/PE packaging materials market due to its strong emphasis on sustainability, food safety, and advanced recycling infrastructure. The region has stringent packaging regulations under frameworks such as the European Green Deal and Circular Economy Action Plan, which encourage the adoption of high-barrier yet recyclable materials like PET/ EVOH/ PE. European consumers and brands increasingly prioritize environmentally responsible packaging, driving demand for multi-layer films that maintain product integrity while supporting recyclability.

Germany has a well-developed food processing and pharmaceutical industry, both of which rely heavily on high-performance barrier packaging to ensure shelf life, hygiene, and protection from oxygen and moisture. Continuous R&D investments, particularly in countries like Germany, France, and the Netherlands, have led to innovations in downgauged and mono-material barrier films that align with circular economy goals. Additionally, Europe’s robust e-commerce and cold-chain networks create further opportunities for durable, protective packaging solutions like PET/EVOH/PE laminates.

Germany Market Trends

Germany leads the European market due to its advanced packaging industry, strong emphasis on sustainability, and technological innovation. It is home to numerous key packaging manufacturers and boasts a well-established recycling infrastructure. Germany’s food and pharmaceutical sectors drive high demand for barrier packaging that ensures safety, quality, and extended shelf life.

France Market Trends

France is a major contributor to the PET/EVOH/PE market, supported by its large food processing industry and increasing consumer demand for fresh, ready-to-eat packaged products. The country’s strict environmental regulations push manufacturers to adopt recyclable multilayer packaging solutions. French brands are also investing in bio-based and recyclable film technologies.

U.K. Market Trends

The UK market is driven by its dynamic e-commerce and online grocery sectors, which require strong and protective barrier packaging. Government initiatives to reduce plastic waste and increase recycling rates are encouraging the use of recyclable PET/EVOH/PE laminates, particularly in retail food and beverage applications.

Italy Market Trends

Italy's strong presence in processed foods, frozen meals, and pharmaceutical packaging supports the growing adoption of PET/EVOH/PE films. The country is also investing in sustainable packaging innovations, including downgauged and recyclable multilayer films, to align with EU directives.

Netherlands Market Trends

As a logistics and food export hub, the Netherlands plays a strategic role in the region. Its packaging industry is focused on reducing carbon footprint and adopting circular solutions, making PET/EVOH/PE films ideal for long shelf life and export-grade packaging.

Spain Market Trends

Spain shows promising growth due to rising demand for packaged foods and growing retail infrastructure. The country is also active in R&D for sustainable packaging and participates in EU-funded projects for recyclable and bio-based multilayer materials.

What Promotes the Growth of the Asia Pacific PET/ EVOH/ PE Packaging Materials Market?

The Asia-Pacific region is growing at the fastest rate in the PET/EVOH/PE packaging materials market due to rapid urbanization, rising disposable incomes, and increasing demand for packaged and processed foods. The expansion of the food and beverage industry, along with growing healthcare and pharmaceutical sectors, is driving the need for high-barrier and hygienic packaging solutions. Additionally, the booming e-commerce and food delivery industries in countries like China, India, and Southeast Asia are fueling demand for durable, protective, and lightweight packaging. Government initiatives to improve food safety standards and investments in sustainable packaging technologies further support market growth across the region.

China Market Trends

China is the leading contributor to the market’s growth due to its massive food and beverage industry, rapidly expanding e-commerce sector, and large-scale manufacturing capacity. The country’s growing middle class prefers convenient, packaged, and ready-to-eat foods, increasing the need for high-barrier packaging. China is also investing heavily in domestic recycling systems and sustainable packaging innovations, including multilayer films with thinner EVOH layers to meet both environmental and functional goals.

India Market Trends

India is witnessing rapid growth in the PET/EVOH/PE packaging market driven by urbanization, lifestyle shifts, and a surge in demand for packaged foods, dairy products, and pharmaceuticals. The expansion of organized retail, government focus on food safety regulations (such as FSSAI guidelines), and increasing online food delivery platforms have further boosted demand for durable, hygienic, and lightweight barrier packaging. Startups and FMCG brands are adopting recyclable multilayer packaging to align with consumer and regulatory preferences.

Japan Market Trends

Japan maintains a steady demand for PET/EVOH/PE packaging due to its mature food processing and pharmaceutical sectors, high packaging standards, and emphasis on shelf-life extension. The country is a leader in adopting eco-friendly, high-performance packaging solutions and has an advanced recycling infrastructure. Japanese companies often pioneer downgauged multilayer films and bio-based alternatives, promoting sustainable growth within the PET/EVOH/PE segment.

South Korea Market Trends

South Korea's focus on high-quality food packaging, consumer safety, and smart packaging technology supports growth in the PET/EVOH/PE market. The country’s strong electronics, healthcare, and cosmetic sectors also demand sophisticated, moisture- and oxygen-barrier packaging. Government policies encouraging eco-design and improved recyclability in packaging materials further enhance adoption.

North America’s Growing Food and Beverage Industry to Support Notable Growth

North America is experiencing notable growth in the PET/EVOH/PE packaging materials market due to several key factors. The region has a highly developed food and beverage industry with strong demand for extended shelf-life solutions, particularly in packaged meats, dairy, and ready-to-eat meals. The growing popularity of vacuum and modified atmosphere packaging (MAP) in the U.S. and Canada supports the adoption of high-barrier films like PET/EVOH/PE.

The expansion of e-commerce and online grocery delivery drives the need for protective, lightweight, and durable packaging to preserve product quality during transit. Regulatory bodies such as the FDA and USDA emphasize food safety, encouraging the use of multilayer barrier films. Furthermore, increasing environmental awareness and corporate sustainability goals are leading to innovations in recyclable PET/EVOH/PE structures, aligning with circular economy principles. Technological advancements, high R&D investments, and consumer demand for convenience and quality further contribute to the region's steady market expansion.

Top PET/EVOH/PE Packaging Materials Market Players

Latest Announcements by Industry Leaders

- In July 2025, Luc Hermans, director of sales and consumer packaging for RKW Group, stated As a producer of superior plastic films, we are fully conscious of our obligation. For this reason, the RKW Group is constantly expanding its line of sustainable monomaterial products. For instance, we provide PCR-based low-SIT [seal-initiation temperature] sealing films. MDO-PE films can be combined with (post-consumer recycled) content for a variety of applications outside of food. Growing consumer demand and upcoming international regulations are fueling the demand for these creative fixes.

New Advancements in the Market

- In July 2025, RKW Group revealed its most recent development in environmentally friendly packaging solutions with new films that have an integrated ethylene-vinyl alcohol (EVOH) barrier. The films provide the most recent advancements in machine-direction orientation (MDO) technology. Sustainability and recyclability in a variety of industries and packaging formats, establishing new criteria for flexible packaging.

- In October 2024, ExxonMobil introduced its new portfolio brand, Signature Polymers, which prioritizes providing top-notch service and collaborations within the industry of polymers. The business has created a completely recyclable solution for thermoformed packaging with 95% polyethylene (PE) in cooperation with important partners.

Global PET/EVOH/PE Packaging Materials Market Segments

By Structure Type

- Rigid Multilayer (Trays, Containers, Bottles)

- Flexible Multilayer Films (Pouches, Sachets, Wrappers)

- Lidding Films

- Thermoformable Sheets

- Bottles & Jars

By Application

- Food Packaging (Meat, Dairy, Ready Meals, Baby Food)

- Beverage Packaging (Juices, Dairy Drinks, Alcoholic Beverages)

- Pharmaceutical Packaging

- Personal Care & Cosmetic Packaging

- Household & Industrial Chemicals

- Pet Food & Animal Nutrition

- Others

By End-Use Industry

- Food & Beverage

- Healthcare & Pharmaceuticals

- Personal Care & Cosmetics

- Chemicals & Cleaning Products

- Retail / Consumer Goods

- Pet Care

By Distribution Channel

- B2B (Direct to Manufacturers/Converters)

- Distributors / Wholesalers

- Online B2B Platforms

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait