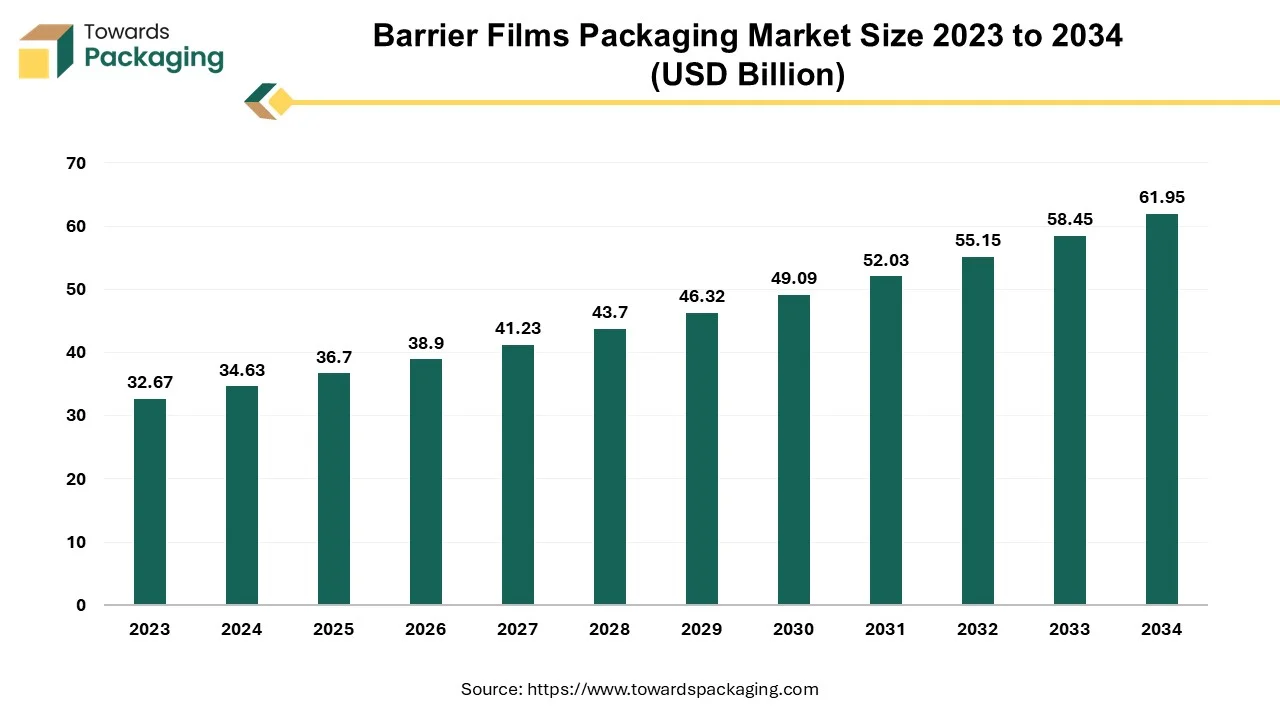

The barrier films packaging market is forecasted to expand from USD 38.90 billion in 2026 to USD 65.67 billion by 2035, growing at a CAGR of 5.99% from 2026 to 2035. This report delves into market segments, including packaging products (bags, pouches, blister base films), materials (PE, PP, PET), and types (transparent, metallized, white barrier films).

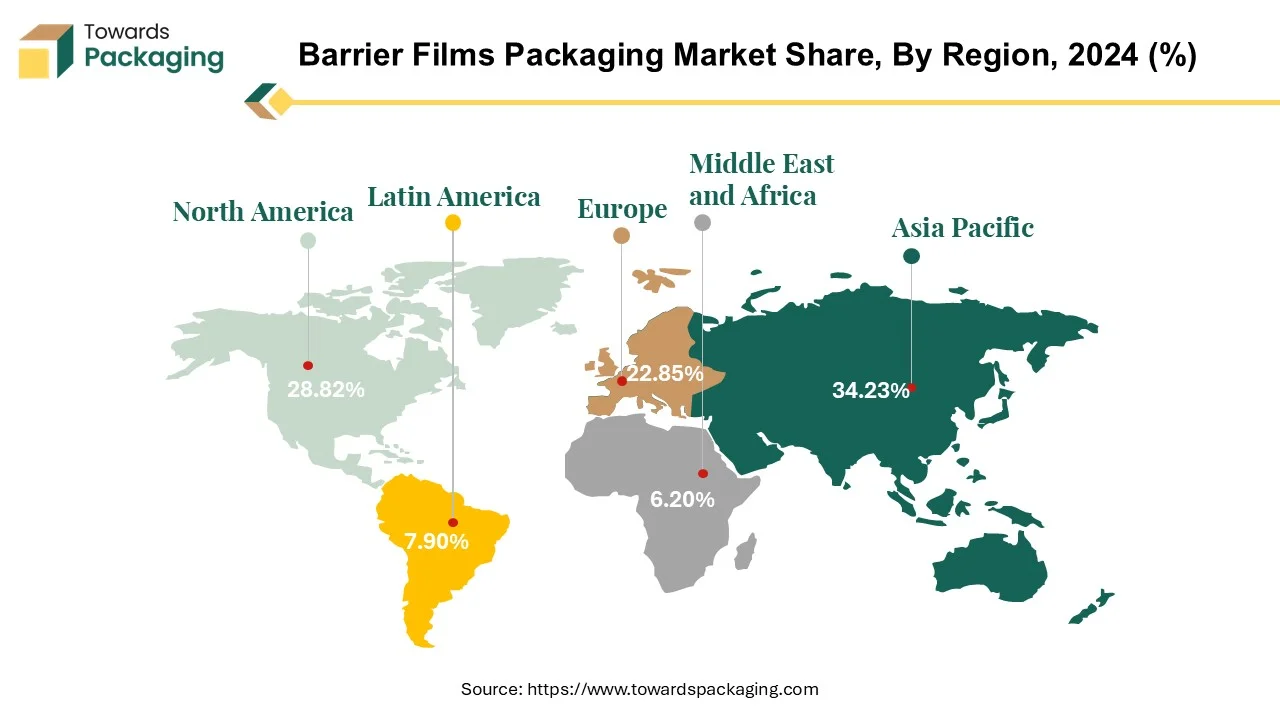

The market is primarily driven by the demand for shelf-life extension of packaged food, innovations in sustainable packaging solutions, and advancements in biodegradable and recyclable barrier films. We also analyze the regional trends, highlighting Asia Pacific's dominance, North America's growth, and emerging trends in Latin America and the Middle East.

The capability of the barrier films to shield the goods from gases, moisture and light makes them a popular option for packing. The usage of film having barrier qualities is necessary for several reasons. One of the primary factors is to extend the product's shelf life by maintaining a proper ratio of the moisture and gas inside the container, which keeps the goods from going bad and shields it from the bacteria that could lead to the deterioration. Additionally, barrier coatings can decrease the cross-contamination of flavors as well as the transfer of light and odors. In addition to shielding the goods from temperature fluctuations, barrier films protect the packaging with alternatives that are impact and puncture-resistant. These films have a broad scope of applications like food, medications as well as electronics and are composed of various materials like nylon, polyethylene and polypropylene. Thus, the barrier film for packaging market is likely to grow at a significant CAGR during the forecast period.

The growing demand for packaged food coupled with the increasing need for films that can support in the extension of the shelf life of the products through guarding it from various external factors is anticipated to augment the growth of the barrier films for packaging market within the estimated timeframe. The increased awareness and regulatory pressures around sustainability along with the growth of the e-commerce sector are also expected to support the market growth in the near future. Furthermore, the increasing demand for customer-friendly packaging as well as the growing number of retail chains in developing economies is also expected to contribute to the growth of the market in the years to come.

| Metric | Details |

| Market Size in 2025 | USD 36.70 Billion |

| Projected Market Size in 2035 | USD 65.67 Billion |

| CAGR (2026 - 2035) | 5.99% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Packaging Product, By Material, By Type, By End-user and By Region |

| Top Key Player | Amcor Limited, Bemis Company, Inc., Berry Global, Inc., Mondi Group, Sealed Air Corporation, Toppan Printing Co., Ltd., and Toray Plastics (America), Inc. |

Food can be kept fresher longer by postponing the deterioration that certain substances may cause to it. The main offenders are oxygen, temperature, light, and humidity. For instance, these substances result in microbial growths, enzymatic reactions, and vitamin destruction; hence, barrier packaging is essential to preserve the freshness of a variety of foods. Barrier packaging is becoming increasingly prevalent in the market, but for reasons other than its ability to preserve food. The most recent developments in this type of food packaging have also generated a lot of buzz within the overall sector.

Many studies are being conducted to find ways to reduce the amount of materials required to produce this type of packaging and thereby reduce the costs. Research on decreasing its weight is still under progress, as doing so would reduce the production costs and facilitate the storage as well as the transportation. Furthermore, a growing amount of recyclable barrier packaging is being created in an effort to provide a more sustainable substitute for the current packaging methods.

Food waste occurs for a variety of factors and it is not just an ethical but also a financial and ecological issue. Every year, Americans throw away 92 billion pounds of food, or 145 billion meals. Annually, they waste more than $473 billion worth of food. Surprisingly, 38% of the food produced in America is wasted. Furthermore, the Spanish Ministry of Agriculture reports that 7.7 million tonnes of the food is wasted annually in Spain. An estimated 40% of all the edible items winds up in the trash. The quality of the packaging is important in extending the shelf life of food, which is why researchers from several industries are researching on barrier packaging.

Dishes that have been prepared ahead of the time are extremely sensitive to oxygen. Foods can have their shelf lives extended by several weeks with the use of cold storage and barrier packaging methods that provide a modified or protective environment. Additionally, barrier materials prolong the crunchy texture of other products, like snacks. Certain other products, like meat, fish and dairy products, benefit from barrier packaging since it helps preserve their freshness as well as the organoleptic qualities.

Most of the barrier films consist of several layers made-up of various materials, which make recycling challenging and add to the environmental issues. Due to their special barrier qualities, multilayer plastic films are essential to the food packaging sector and each year two million tons of these films are utilized worldwide. In addition to giving the food items a longer shelf life, these films are frequently utilized earlier in the food value chain. Plastic film is also used in the agriculture sector for a variety of purposes, including weed management, moisture and water conservation and pest attraction and repellent. Due to the fabrication process inefficiencies, about 40% of the produced multilayer films are unusable and constitute a significant source of postindustrial waste. There aren't any commercially feasible methods available right now that could bring these materials back into use in the manufacturing.

Yet, the development of multilayer films has up to now only focused on their barrier efficiency, ignoring their potential for recycling. About 3 million tons of the multilayer film trash are burned or dumped in landfills worldwide each year as a result of a lack of recycling options that are both environmentally and economically viable. A commercially feasible recycling venture faces obstacles by the broad range of materials used for each layer, the wide variations in the processing characteristics of the polymers used for multilayer films, the absence of multilayer film detection systems and the failure of multilayer film collection systems. The lack of effective recycling solutions for barrier films restricts the range of sustainable packaging techniques available, which might potentially hinder the market growth if companies look for other solutions or come under more scrutiny for their environmental effects.

Need for sustainable packaging is rising as the attention shifts to carbon reduction and solving the issue of plastic waste. Worldwide recycling programs based on the single-material packaging are picking up steam. Numerous multinational corporations have set goals for the recycling of the plastic materials used in packaging and containers, and are introducing a range of products to help them reach these targets.

For Instance

The recyclable oxygen barrier material OxyStar, created by Placon, is utilized in the thermoformed polyethylene terephthalate packaging. Nuts, high-fat oils, and high-vitamin C meats as well as cheeses have all been found to benefit from OxyStar. Since OxyStarTM is categorized as recyclable, it can be added to the regular PET regrind stream, unlike most barrier materials, which are deemed unrecyclable. By binding oxygen atoms into the thermoformed PET sidewall, the oxygen shielding additive prolongs the freshness of the packaged product.

For packaging the nuts and crisps, TIPA introduced its latest 312MET barrier film, which is biodegradable both at home and in an industrial setting. Their high barrier ensures that nuts and crisps don't need an extra sealing layer to function properly. According to the company, its film will help minimize the total of 290,000 tonnes of waste from plastic packaging that WRAP estimates are produced in the UK annually.

These technological innovations have led to improvements in the performance and versatility of barrier films and are likely to create various opportunities for the growth of the barrier films packaging market in the years to come.

The pouches segment captured largest market share of 36.21% in 2024. In recent years, these simple-to-open and reseal pouches have grown to be very popular. Flexible pouches are a staple of the contemporary food and drink packaging applications. They can hold a wide range of foods and beverages, including the energy shots, kettle chips, truffles, crisps, wheat crackers, mixed nuts, candied fruit and nut butter, among others. Furthermore, another reason for the increasing popularity of these simple, low-cost, and flexible pouches is that they have minimal environmental impact. The bulkier, costly rigid packaging supplies are being rapidly pushed off the shelves at the supermarket by them. The fact that stand-up pouches have a substantially smaller environmental impact compared to the rigid packaging alternatives accounts for their surprisingly quick widespread adoption. Customers are also less likely to have wrap rage when using flexible pouches, which also take up a lot less place in landfills.

The food & beverages emerged as the largest segment in 2024 with market share of 64.81% on account of increasing demand for convenience foods with the changing consumer preferences. Furthermore, the increasing urbanization, rise in consumption of packaged food, increasing intake of canned vegetables & foods along with the improved standard of living are also expected to be the driving factors for the segmental growth of the market. The increasing consumer spending on the groceries mainly food and the demand for grocery on e-commerce platforms as well is also projected to remain high in the years to come which in turn is likely to contribute to the growth of the market segment.

Asia Pacific held largest market share of 34.23% in 2024 and is expected to grow at a fastest CAGR of 7.73% during the forecast period. China is the largest market in the region. This is owing to the growing urban populations and busier lifestyles that have increased the demand for the convenient and long-lasting packaged foods across the region. Additionally, the growing modern retail formats and the exponential growth of the e-commerce sector in the economies like China, and India are also projected to contribute to the growth of the market in the region. Furthermore, the growing preference for premium and packaged food products with the increasing disposable incomes and escalating middle class population is also likely to support the regional growth of the market.

Asia Pacific Barrier Films Packaging Market Trends

The market growth in the region is driven by the increasing demand for packaged food and beverages, rapidly growing population and industrialization, and increasing demand for protective packaging solutions. China, India, Japan, and South Korea are the fastest growing countries driving the market growth, driven by increasing demand for packaging solutions and convenient food products. These products are designed to deliver convenience, product safety, and long shelf life.

China Market Trend

China's barrier films packaging market is driven by the strong demand from domestic industries in the country. China has massive, integrated supply chains and advanced plastic and polymer manufacturing capabilities. It can produce a wide range of barrier films, like PET, BOPP, EVOH, PE, and PA, at a much lower cost due to economies of scale. China's food & beverage, pharmaceutical, and electronics sectors have huge demand for barrier packaging.

The Chinese government supports high-tech manufacturing through policies and subsidies. China exports a significant portion of its barrier films to the rest of the world. Leading Chinese packaging firms are investing in sustainable films, bio-based materials, and recyclable multilayer structures. Growing pressure for eco-friendly and recyclable barrier films is leading Chinese firms to adapt quickly, not just for local use, but to meet EU and U.S. import standards. The ability to integrate processes gives Chinese firms cost and time advantages.

North America is expected to grow at a considerable CAGR of 5.36% in during the forecast period. This is due to the increasing the demand for convenient, ready-to-eat, and on-the-go food products across the region. Also, the stringent food safety regulations by the Food and Drug Administration (FDA) and other regulatory bodies are further expected to drive the demand for labels in the years to come. Furthermore, the growing focus on the sustainability and reducing the environmental impact of packaging along with the increasing demand from the pharmaceutical and healthcare sectors is also expected to support the regional growth of the market in the near future.

U.S. Market Trends

The U.S. barrier films packaging market is driven presence of major market players in the region. The U.S. has one of the largest food and beverage markets in the world. Barrier films are extensively used in packaging perishable goods like snacks, dairy, meats, and ready-to-eat meals. The U.S. market is seeing growth in demand for sustainable and recyclable barrier films. Innovation in biodegradable and compostable materials is positioning the U.S. as a leader in next-generation barrier packaging. U.S. regulations from the U.S. FDA and EPA push for high safety and performance standards in packaging. This creates demand for premium barrier films that comply with stringent guidelines.

U.S.-based companies lead in the innovation of multilayer and high-performance barrier films, such as EVOH, PVDC, and metallized films. Strong investment in research and development enables the creation of films that offer better moisture, oxygen, and light barriers. Multinational companies such as Amcor, Berry Global, Sealed Air, and 3M are either headquartered or have significant operations in the U.S. These companies invest heavily in technology and have robust supply chains, enabling efficient production and distribution. There is a shift from rigid to flexible packaging across industries, and the U.S. is at the forefront of this trend.

Production and Development in U.S.

The European market is expected to grow at a notable rate in the foreseeable future.

The EU’s Green Deal, Circular Economy Action Plan, and Packaging and Packaging Waste Regulation (PPWR) are pushing companies to adopt sustainable packaging solutions. European consumers are highly eco-conscious and prefer packaging with a low environmental impact. Europe has a large, well-regulated food and pharmaceutical sector, both of which rely heavily on barrier films to maintain product integrity, extend product shelf life, and prevent contamination. It is home to global packaging leaders like Mondi, Huhtamaki, Constantia Flexibles, and Aluflexpack. These companies are investing in innovative barrier film technologies, including those that use paper-based or plant-based materials.

Germany Barrier Films Packaging Market Trends

Germany has a distinctive role in the barrier films packaging market due to its strong focus on sustainability, advanced packaging technologies, and high production standards. As a leader in sustainable packaging solutions, Germany is committed to reducing plastic waste and promoting the use of recyclable and biodegradable materials. The country's well-developed packaging industry, combined with strict environmental regulations such as the German Packaging Act, drives innovation in barrier films, particularly those made from recyclable and renewable resources.

Latin America also plays a significant role in the barrier films packaging market, primarily driven by increased demand for food and beverage packaging, pharmaceuticals, and consumer goods. There is a growing emphasis on eco-friendly packaging solutions, such as biodegradable and recyclable films, influenced by stricter environmental regulations in countries like Chile, Brazil, and Argentina. Moreover, local companies are investing more in automation and sustainable practices, aligning with global trends and evolving customer needs. The growth of e-commerce and a burgeoning consumer market, particularly among younger populations, presents significant opportunities for packaging film manufacturers.

The Middle East and Africa region is experiencing substantial growth in the barrier films packaging market due to increasing demand for packaged food, beverages, and pharmaceuticals, along with a heightened focus on sustainability and e-commerce. Saudi Arabia stands out as a dominant player in the region, driven by strong demand from its food and beverage industry and government-led diversification initiatives. Companies are investing in technologies such as machine direction orientation (MDO) and solvent-free coatings to produce recyclable barrier films, aligning with sustainability goals. Mid-tier players are also focusing on niche advantages, contributing to the overall market expansion.

By Packaging Product

By Material

By Type

By End-user

By Region

February 2026

February 2026

February 2026

February 2026