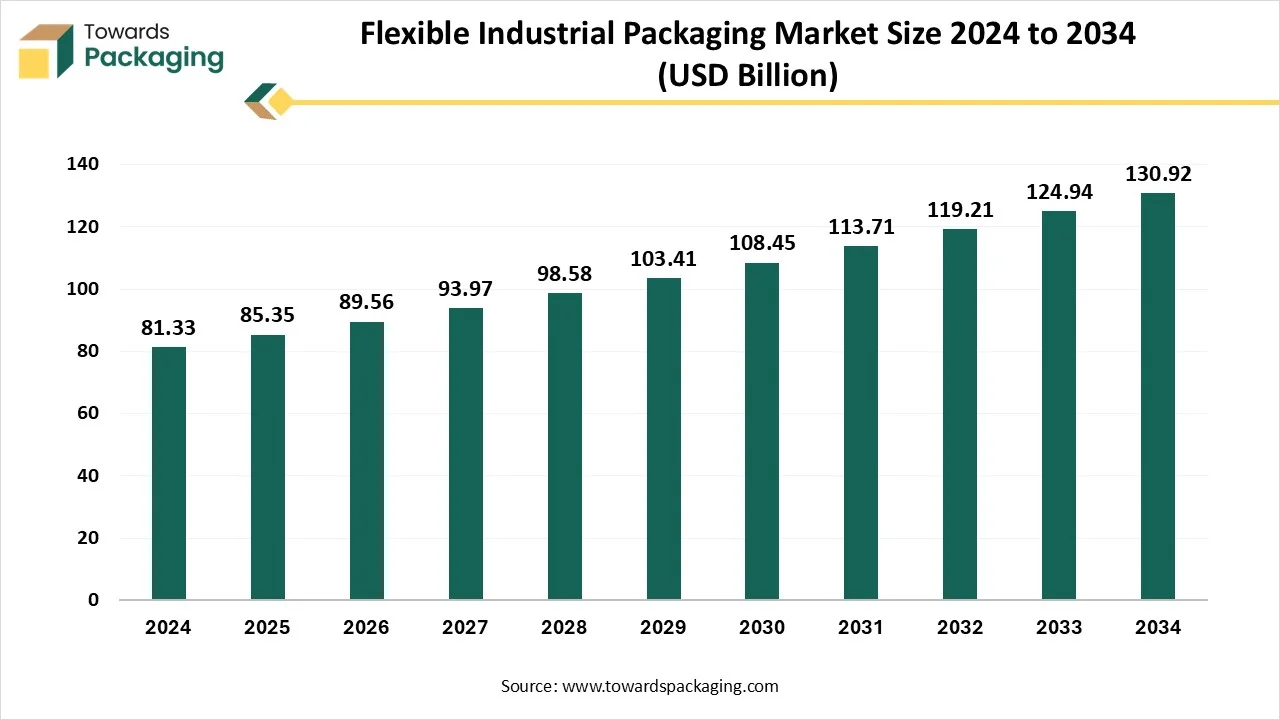

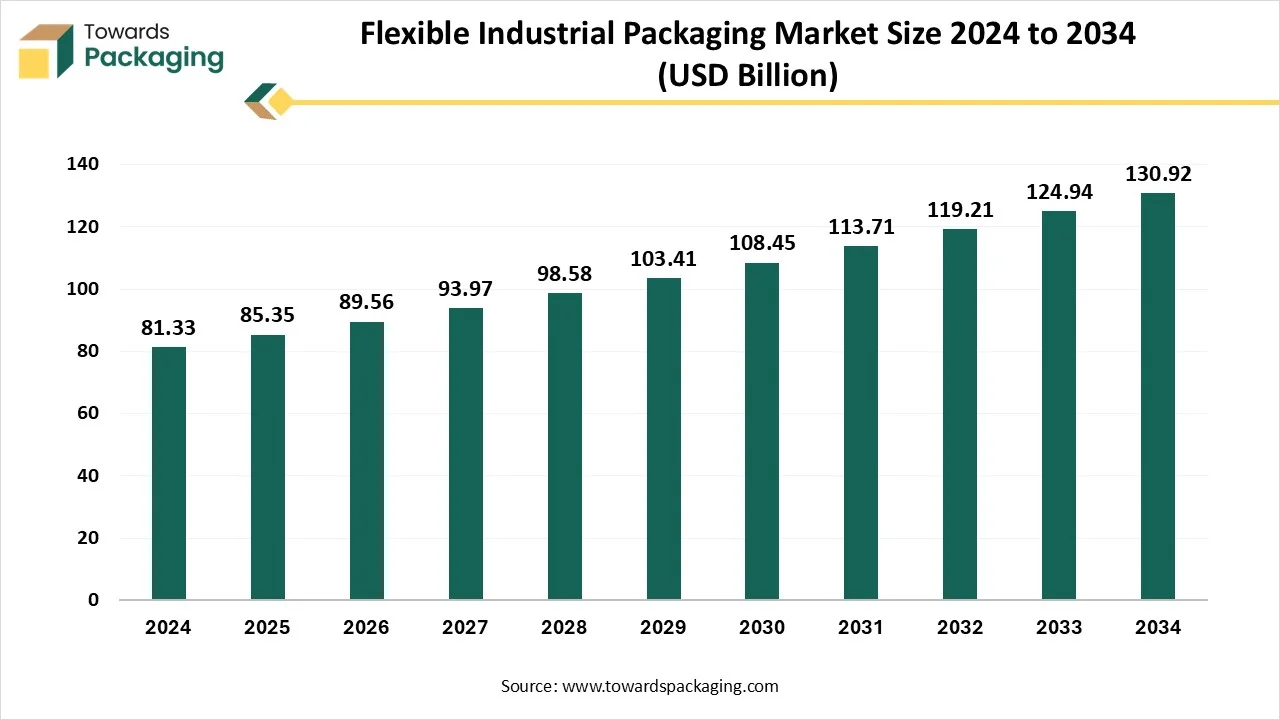

The flexible industrial packaging market is forecasted to expand from USD 89.55 billion in 2026 to USD 138.09 billion by 2035, growing at a CAGR of 4.93% from 2026 to 2035. Our coverage includes a complete breakdown of packaging types, materials, capacities, end-use industries, and distribution channels, along with regional insights across North America, Europe, Asia Pacific, Latin America, and MEA. We analyze dominating segments such as FIBCs (42.12% share in 2024), plastic materials (72.21% share), and demand-driving sectors like chemicals & petrochemicals (34.20% share).

This edition also explores the competitive landscape, profiles leading companies like Greif, Berry Global, Mondi, LC Packaging, IPG, and provides detailed value chain analysis, global trade flows, and manufacturers-suppliers data that shape the industry.

| Metric | Details |

| Market Size in 2025 | USD 85.35 Billion |

| Projected Market Size in 2035 | USD 138.09 Billion |

| CAGR (2026 - 2035) | 4.93% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Packaging Type, By Material, By Capacity, By Distribution Channel, By End-use Industry and By Region |

| Top Key Players | Greif, Inc., Berry Global, Inc., LC Packaging, Mondi Group, Conitex Sonoco, Rishi FIBC Solutions Pvt. Ltd., Bulk-Pack, Inc., BAG Corp, Emmbi Industries Limited, Intertape Polymer Group (IPG) |

Flexible Industrial Packaging refers to packaging solutions made from flexible materials (like plastics, paper, and woven fabrics) that can adapt to the shape of the contents. These are typically used for powders, granules, liquids, and semi-solids in bulk quantities. The flexible packaging industry has experienced noteworthy changes over the last few years, as these is lightweight and cost-efficient. This market comprises wraps, bags, liners, and pouches, which are generated by using resources such as metal foils, plastic, and paper. This packaging industry provides several benefits, comprises ease of usage, versatility, and light weight. These properties have raised the demand for such packaging in industries such as personal care, food and beverages, pharmaceuticals, and chemicals.

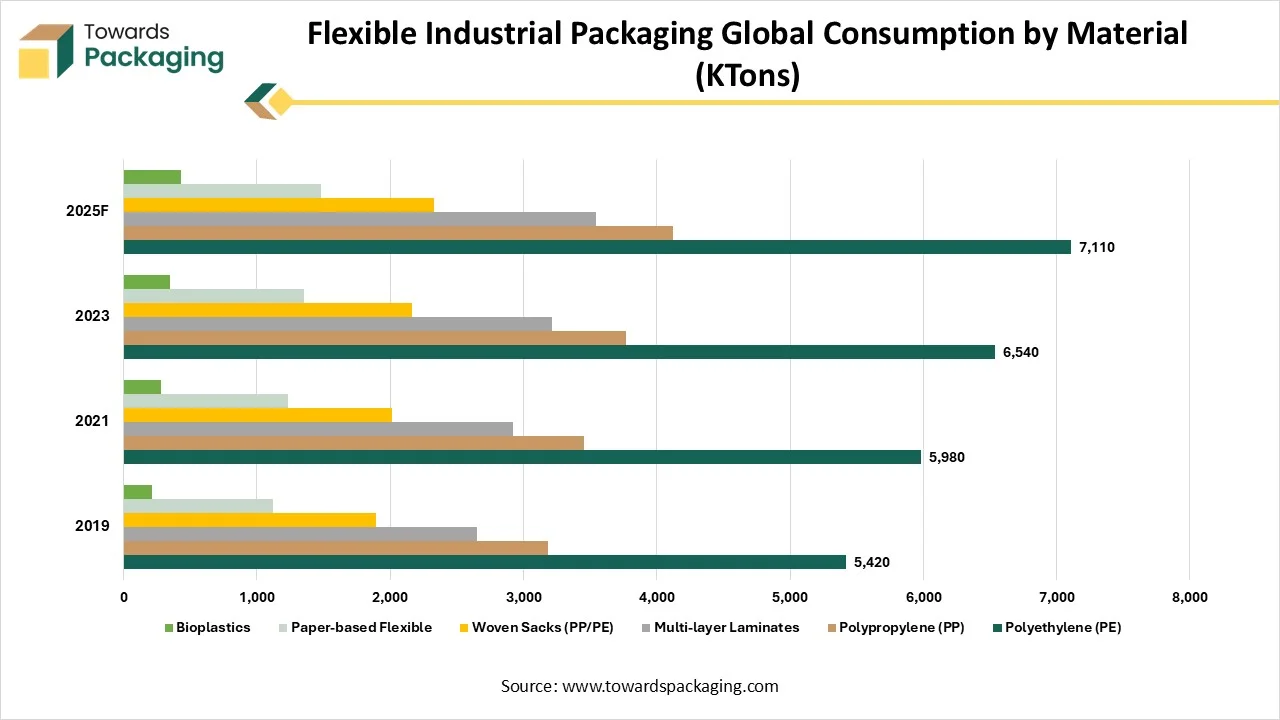

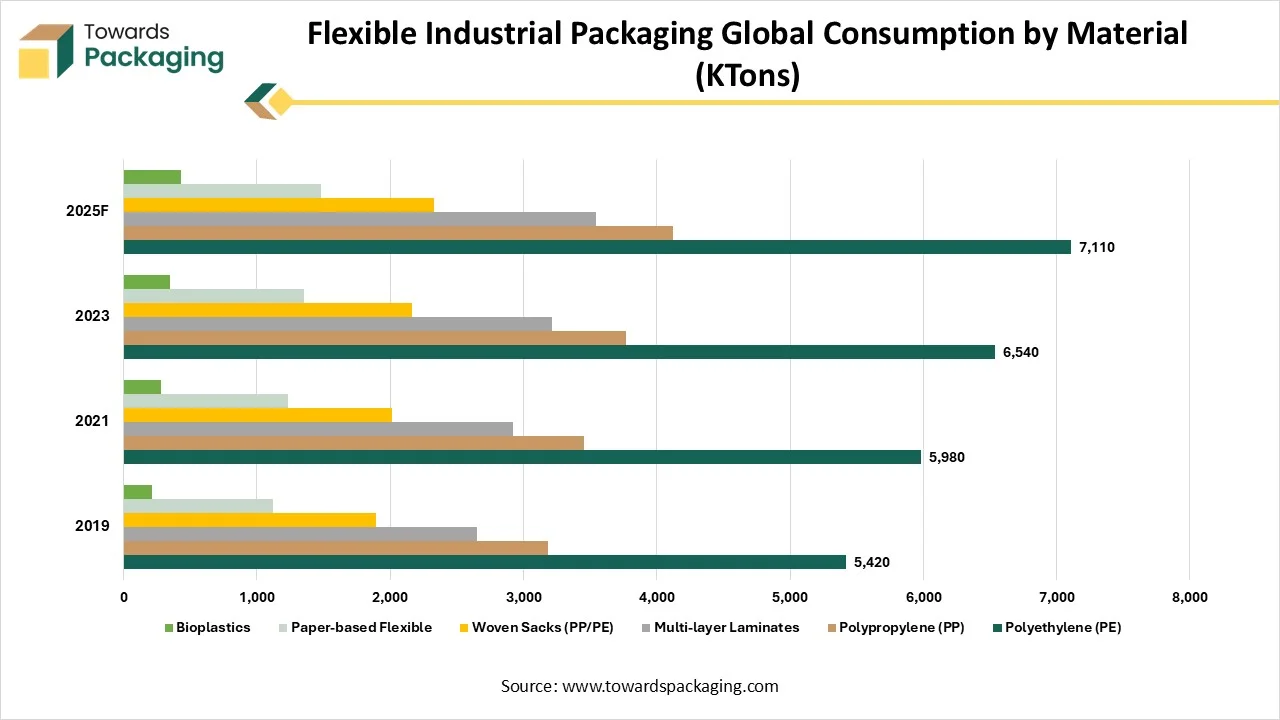

| Material | 2019 | 2021 | 2023 | 2025 |

| Polyethylene (PE) | 5,420 | 5,980 | 6,540 | 7,110 |

| Polypropylene (PP) | 3,180 | 3,450 | 3,770 | 4,120 |

| Multi-layer Laminates | 2,650 | 2,920 | 3,210 | 3,540 |

| Woven Sacks (PP/PE) | 1,890 | 2,010 | 2,160 | 2,330 |

| Paper-based Flexible | 1,120 | 1,230 | 1,350 | 1,480 |

| Bioplastics | 210 | 280 | 350 | 430 |

Rising Ecological Concern

Continuous Economic Expansion

Incorporation of Digitalization and Smart Packaging

The incorporation of AI in flexible industrial packaging has the potential to transform this important field by improving efficacy, sustainability, and customization. This growing execution of AI is not just redesigning processes, it also sets new morals for invention, customer interaction, and ecological accountability. The status of AI in the flexible packaging sector is rising due to the growing demand for quicker production series, cost decrease, and the crucial requirement to decrease environmental footprints. Through sophisticated systems, AI technologies can support in emerging of more sustainable packaging resolutions that utilize fewer materials, create less waste, and are easy to recycle. The incorporation of robotic arrangements and automated technology into the production process meaningfully improves efficacy and steadiness in packaging procedures.

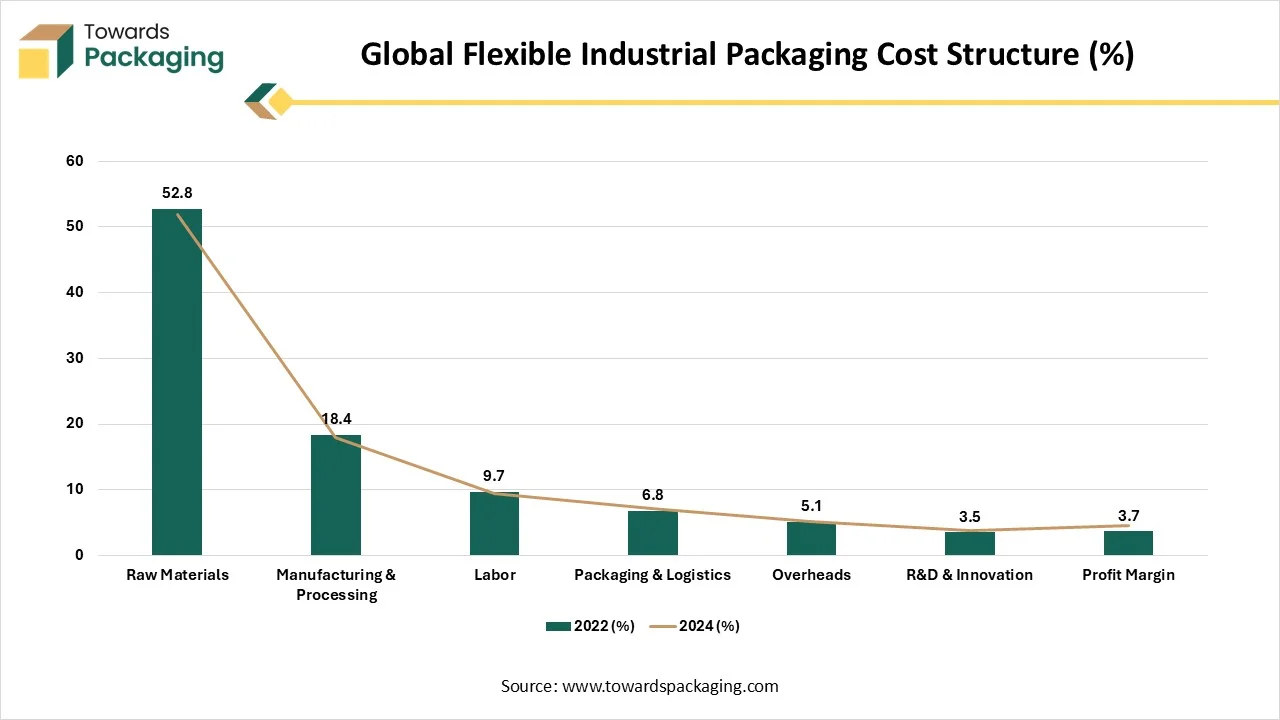

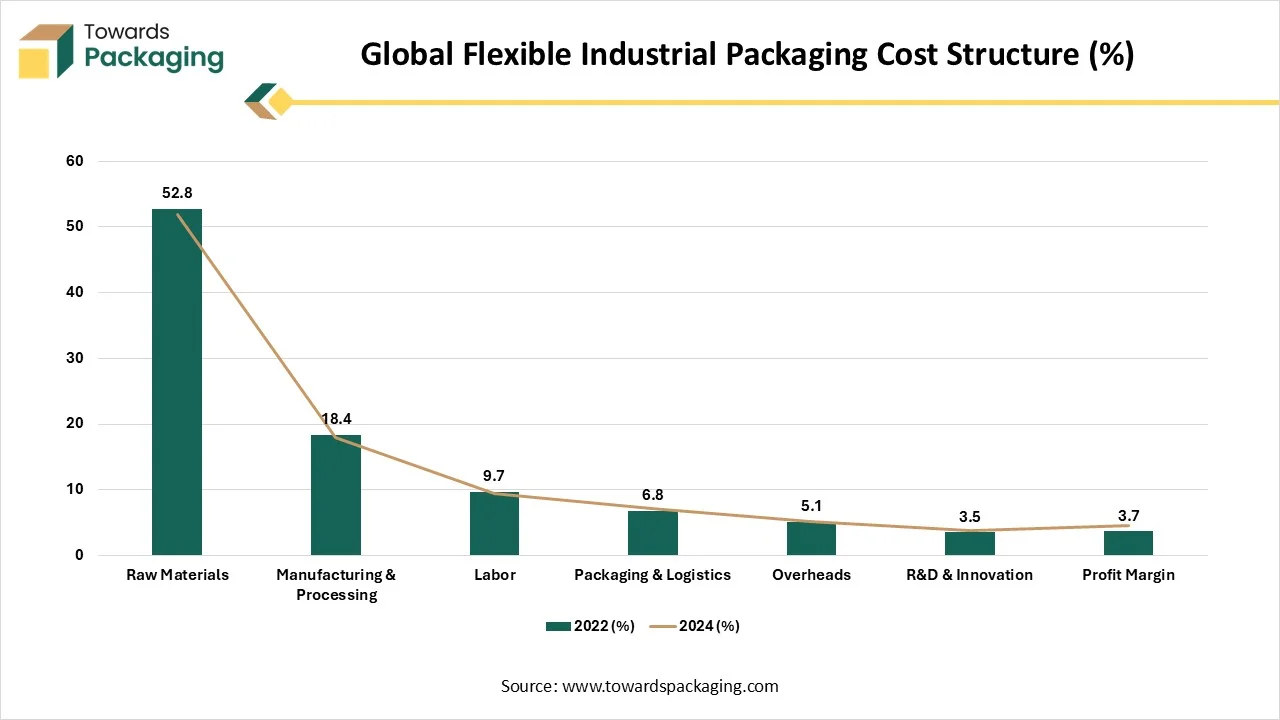

| Cost Component | 2022 (%) | 2024 (%) |

| Raw Materials | 52.8 | 51.9 |

| Manufacturing & Processing | 18.4 | 18 |

| Labor | 9.7 | 9.4 |

| Packaging & Logistics | 6.8 | 7.1 |

| Overheads | 5.1 | 5.2 |

| R&D & Innovation | 3.5 | 3.8 |

| Profit Margin | 3.7 | 4.6 |

Demand for Sustainable Packaging Solution

The rising ecological concern is significantly shifting in the direction of biodegradable and recyclable resources. The rising e-commerce activities and global trade have enhanced the requirement for efficient and durable packaging solutions to ensure the safety during the transportation of products. Continuous advancement in technology in the resources utilized for the packaging and production process has played a crucial role in the development of the market. Inventions like enhanced barrier properties, increased shelf life, and tamper-evident features have generated flexible industrial packaging as an attractive option for several businesses.

Fluctuations in the Charges of the Raw Materials

Despite the positive development route of the flexible industrial packaging market, numerous challenges hinder its extensive acceptance. One of the key restraints is the continuous fluctuation in the raw materials utilized for the production of flexible industrial packaging. The charges of resources used, such as papers, polymers, and several other materials, change constantly, which hinders the growth of this market as it reduces the profit margin of the traders.

Rising Demand for Sustainable and Eco-friendly Packaging

The growing shift in the direction of sustainable and eco-friendly packaging practices offers several opportunities for the development of the flexible industrial packaging market. As businesses and consumers are becoming ecologically conscious, a rising preference for packaging resources that are biodegradable, recyclable, or prepared from renewable sources. The continuous change in customer preference shows several opportunities for flexible industrial packaging. The growing e-commerce and online retail are another major opportunity that has influenced the growth of the market.

| Product Type | 2020 | 2022 | 2024 |

| FIBCs (Big Bags) | 4.9 | 5.3 | 5.7 |

| Industrial Sacks | 0.34 | 0.36 | 0.39 |

| Stretch Hood Films | 1.12 | 1.18 | 1.25 |

| Form-Fill-Seal Films | 0.78 | 0.83 | 0.87 |

| Pallet Covers | 0.52 | 0.55 | 0.59 |

| Heavy-Duty Bags | 0.68 | 0.74 | 0.78 |

The flexible intermediate bulk containers (FIBCs) segment held a considerable share of the flexible industrial packaging market in 2024 due to it’s the rising transportation and storage of dry products such as construction resources, grain powder, and chemicals. These types of containers are made up of woven polypropylene. These containers hold the capacity to store huge volumes, are durable, and cost-effective. The major benefit is the adaptability of several industrial usage such as food-grade liners, UV resistance, and moisture barriers.

The liners segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing rapidly due to its compatibility and protective capabilities. These are manufactured in such a way that they provide security to the internal barrier, prevent leakage, liner, prevent contamination, and moisture ingress. The capacity to extend the usability of external containers, decrease cleaning requirements, and ensure product integrity at the time of transportation and storage of the product, which offers significant adoption.

The plastic segment is dominant over the flexible industrial packaging market in 2024 due to its cost-effectiveness, affordability, durability, and versatility. The commonly used components of plastics are polyvinyl chloride (PVC), polypropylene (PP), and polyethylene (PE). These are favourable as they provide a superior quality barrier, flexibility, and chemical resistance. The major driver is its adaptability in multiple sectors. These are also anti-static, UV-resistant, and moisture-proof. Innovation in the formulation of invention, comprising recyclable and biodegradable choices by addressing the ecological issues, has raised the adoption of this material.

The multi-layer laminates segment is expected to grow at the fastest rate in the market during the forecast period of 2024 to 2034. These are superior due to their versatility, excellent performance, and improved protection. These are made up of paper, plastic films, and aluminum foil, which are suitable for printability, barrier protection, and strength.

The 501 - 1,000 kg segment is expected to have a considerable share of the flexible industrial packaging market in 2024 due to the huge requirement for medium-sized containers essential for packaging a wide variety of products. This segment is suitable for the transportation and storage of materials in bulk quantities. These are generally called bulk bags, which have huge capacity and are available for reuse at an affordable price.

The above 1,501 kg segment is expected to grow at the fastest rate in the market during the forecast period of 2024 to 2034. This segment is influenced by large-scale agriculture, cement, mining, and chemical transportation. This segment is widely accepted due to its durability, stability, and safety.

The chemicals and petrochemicals segment is expected to have a considerable share of the flexible industrial packaging market in 2024 due to the demand for high safety, global distribution networks, and high-volume packaging requirements. This sector favours the packaging of both liquid and dry resources. The advantage of this sector because of its adaptability and flexibility.

The food and beverage ingredients segment is expected to grow at the fastest rate in the market during the forecast period of 2024 to 2034. It is due to the increasing requirement for efficient, durable, and hygienic packaging solutions. The space-efficient and light-weight nature has reduced the shipping charges of the products.

The direct sales segment is expected to have a considerable share of the flexible industrial packaging market in 2024 due to the potential to provide customized solutions. This segment is mainly focused on specific packaging demand, food processing, and high-volume demand.

The online channels segment is expected to grow at the fastest rate in the market during the forecast period of 2024 to 2034. This change is majorly influenced due to the rise in medium-sized enterprises and the presence of independent manufacturers. The rise of the digital world has enhanced the importance of online channels.

Asia Pacific held the largest share of the flexible industrial packaging market in 2024, due to the massive production process. This influenced the demand for flexible industrial packaging. The rising urbanization and growing demand for packaging food products. In countries such as India, Japan, China, and several others, there is a huge demand for sustainable packaging, which has raised the demand for this market.

India Flexible Industrial Packaging Market Trends

In India, the flexible industrial packaging market is growing quickly as the construction, manufacturing, chemical, and agriculture sectors grow. To increase logistics efficiency, businesses are moving more and more toward lightweight, robust, and affordable packaging formats like FIBCs, woven sacks, and multi-layer plastic bags. High-strength tamper-resistant flexible packaging is becoming more and more popular due to increased export and tighter safety regulations.

North America is estimated to grow at the fastest rate in the Flexible industrial packaging market during the forecast period. With the rising demand in sectors such as food and beverages and the pharmaceutical industry, there is a huge demand for sustainable packaging that maintains the product integrity as well. There is a presence of strong technological advanced industries that help countries like the U.S. and Canada to grow rapidly.

U.S. Flexible Industrial Packaging Market Trends

The U.S. market is driven by robust industrial production, sophisticated logistics systems, and a growing demand for flexible high-performance packaging that enhances handling and lowers storage expenses. Chemicals, petrochemicals, food ingredients, and pharmaceuticals are in high demand. Companies are being encouraged by sustainability pressures to use mono-material designs and recyclable materials to increase compliance and cut waste.

Europe’s flexible industrial packaging market is supported by stringent environmental laws and an established manufacturing base that places a high priority on packaging that is safe, effective, and environmentally friendly. To achieve the objectives of the circular economy, businesses are implementing recyclable, reusable, and high-barrier packaging. Increased trade and the growing need for bulk packaging in the food processing, chemical, and agricultural sectors also contribute to growth.

Germany Flexible Industrial Packaging Market Trends

Germany’s market benefits from its strong industrial sector, particularly engineering, automotive, and chemicals, as businesses concentrate on reliable, effective, and automation-compatible packaging materials that simplify logistics. Demand for flexible industrial packaging is growing. Sustainability continues to be a key motivator encouraging businesses to use recyclable flexible films and reusable flexible films and reusable FIBSs.

In Latin America, the market is expanding because of continued industrialization, expanding agriculture, and a rise in bulk goods exports. Flexible industrial packaging is preferred by businesses due to its affordability, robustness, and suitability for long-distance shipping. To satisfy changing consumer and regulatory demands, the area is also seeing a gradual but steady transition toward stronger and recyclable packaging materials.

Brazil Flexible Industrial Packaging Market Trends

Brazil’s flexible industrial packaging market is driven by robust industries such as mining, chemicals, and agriculture, which call for robust high-capacity packaging formats like industrial sacks and FIBSs. Companies are being compelled by an increase in export shipments to use lightweight, moisture-proof, and tear-resistant packaging. Sustainability objectives are also pushing businesses to use eco-friendly materials and recycled plastics.

MEA market is seeing rising demand driven by robust mining, chemical and agricultural chemical and agricultural industries that need robust high-capacity packaging formats like industrial sacks and FIBCs. Companies are being forced to use lightweight, moisture-proof, and tear-resistant packaging due to an increase in export shipments. Businesses are being encouraged by sustainability goals to use eco-friendly materials and recycled plastics.

UAE Flexible Industrial Packaging Market Trends

In the UAE, demand is driven by robust industrial expansion, extensive chemical manufacturing, and dynamic logistics activities. Businesses are using cutting-edge flexible packaging options that are strong, resistant to UV rays, and simpler to handle for large-scale transportation. Additionally, industries are being pushed toward recyclable and reusable packaging formats by sustainability initiatives and regulatory improvements.

| Region | Exports 2022 | Imports 2022 | Exports 2024 | Imports 2024 |

| Asia-Pacific | 8,420 | 4,960 | 8,980 | 5,210 |

| Europe | 6,110 | 5,780 | 6,540 | 5,980 |

| North America | 4,480 | 4,920 | 4,810 | 5,160 |

| Latin America | 1,620 | 2,240 | 1,720 | 2,330 |

| Middle East & Africa | 2,150 | 2,980 | 2,310 | 3,120 |

The flexible packaging market is expected to increase from USD 323.25 billion in 2025 to USD 488.72 billion by 2034, growing at a CAGR of 4.7% throughout the forecast period from 2025 to 2034. The shift in consumer behavior toward convenience, coupled with regulatory pressure for eco-friendly solutions, has accelerated market adoption across industries.

The packaging type in which packaging materials is used which can easily change shape, typically manufactured from paper, plastic, foil, or a combination of these. Unlike rigid packaging such metal cans or glass jars, bottles, flexible packaging is lightweight, durable adaptable to various product types. The common types of flexible packaging are bags, pouches, sachets, and wraps & films. The flexible packaging is lightweight, cost effective, has extended shelf-life, sustainable option and convenience features. The flexible packaging is extensively utilized for personal care, pharmaceuticals, industrial applications and food & beverages.

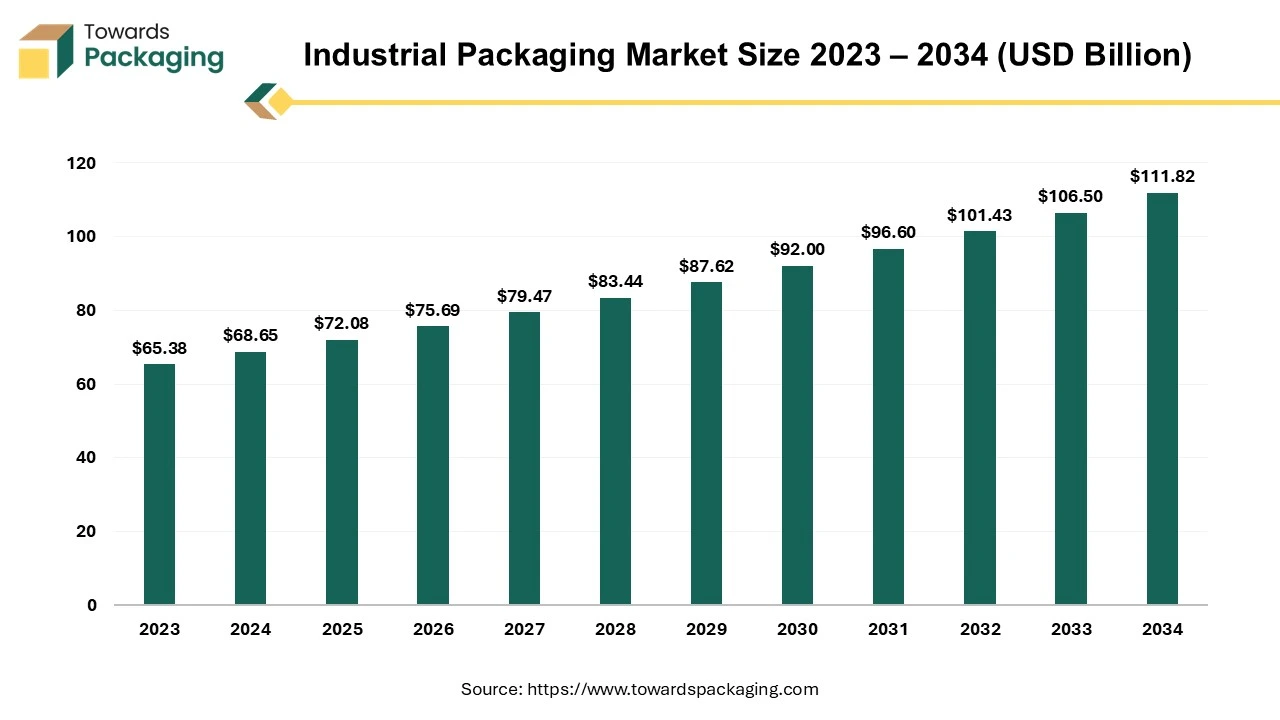

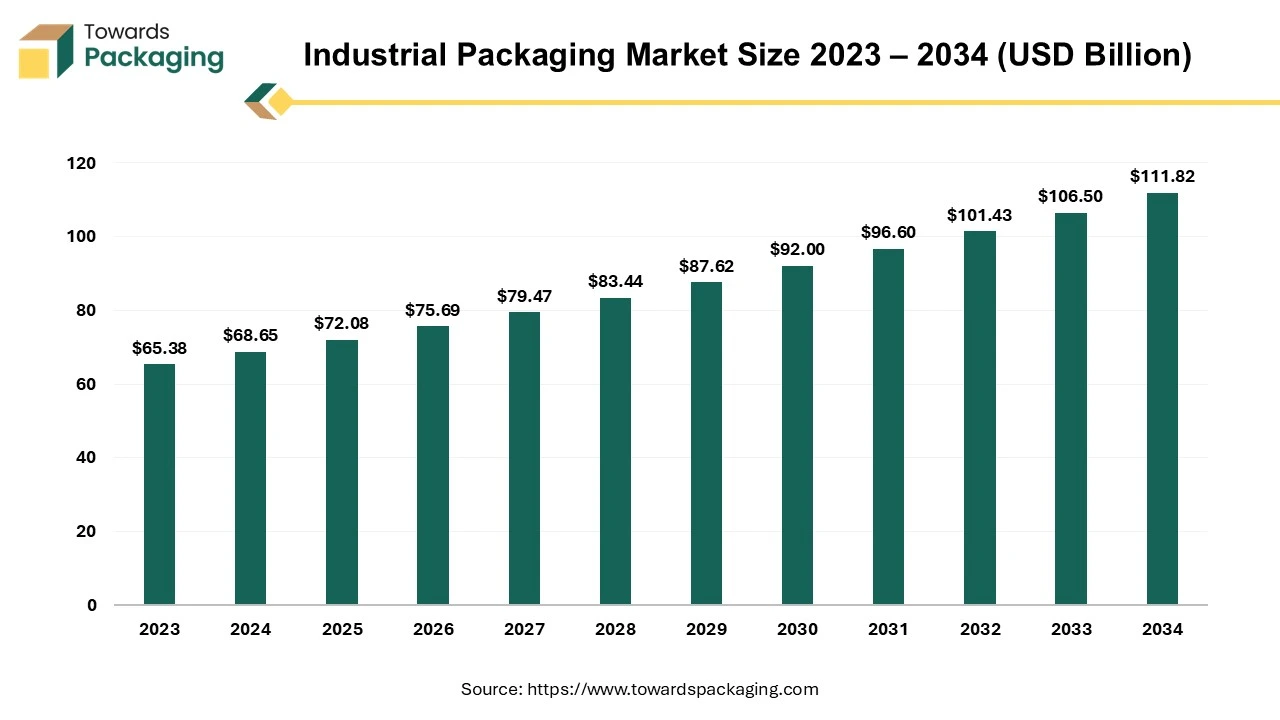

The global industrial packaging market is set to grow from USD 72.08 billion in 2025 to USD 111.82 billion by 2034, with an expected CAGR of 5% over the forecast period from 2025 to 2034. The market growth is attributed to the rising emerging sustainability trends and rising technological advancements.

Industrial packaging is essential to companies that ship or deliver items to clients. Whether it's a retail shop, product manufacturer, distributor, wholesaler, or an e-commerce portal selling products around the globe, relying on industrial packaging solutions is essential for ensuring the protection and security of goods while in transit. Over the last few decades, the use of industrial packaging for direct delivery to customers' doorsteps has steadily grown.

| Company | 2020 | 2022 | 2024 |

| Mondi Group | 12.8 | 13.2 | 13.6 |

| Berry Global | 11.4 | 11.7 | 12.1 |

| Greif Inc. | 9.6 | 9.8 | 10.2 |

| LC Packaging | 6.3 | 6.6 | 6.9 |

| Mauser Packaging | 5.1 | 5.4 | 5.7 |

| Flexpak Corp. | 3.8 | 4.2 | 4.5 |

| Others | 51 | 49.1 | 47 |

By Packaging Type

By Material

By Capacity

By Distribution Channel

By End-use Industry

By Region

February 2026

February 2026

February 2026

February 2026