Bakery Packaging Market Research, Consumer Behavior, Demand and Forecast

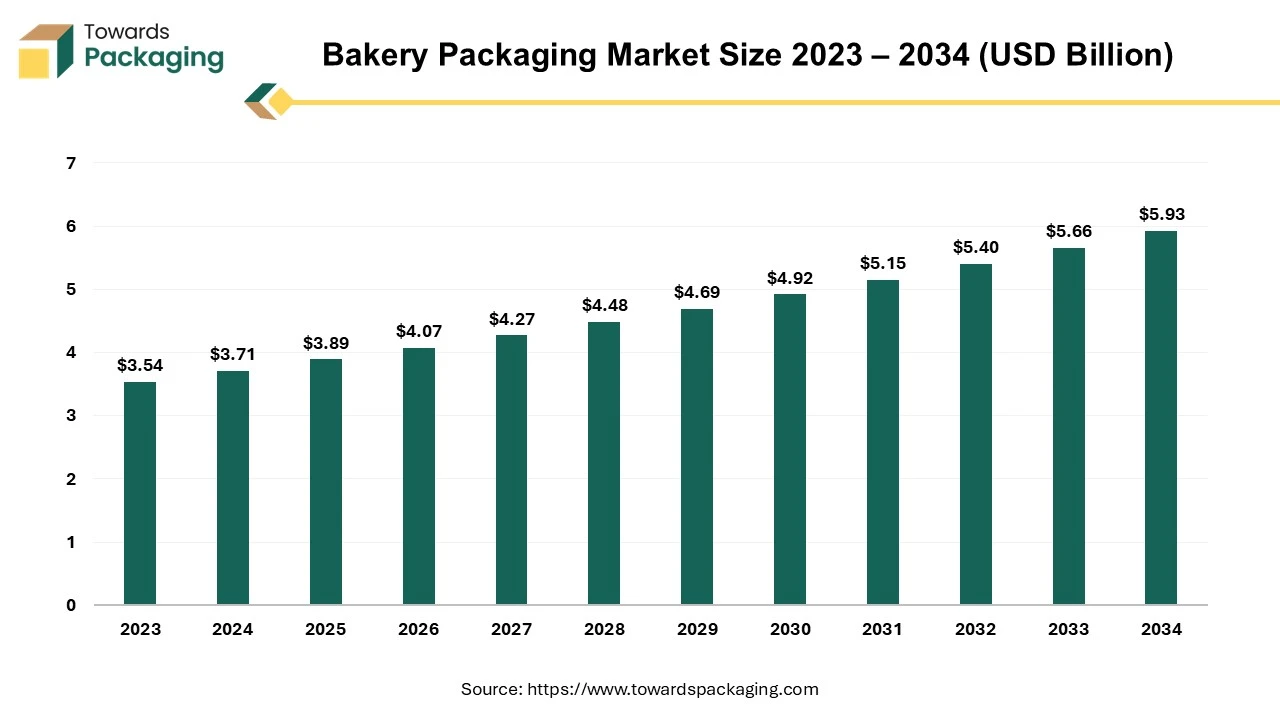

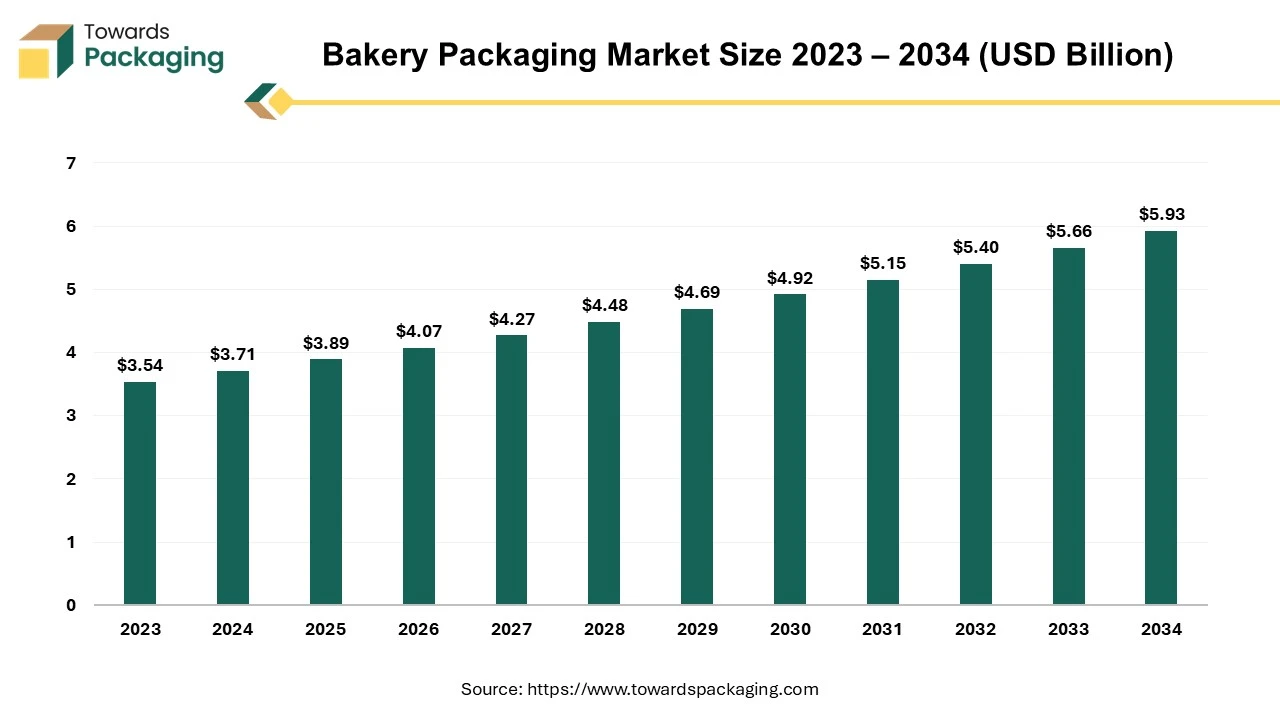

The bakery packaging market is forecasted to expand from USD 4.07 billion in 2026 to USD 6.21 billion by 2035, growing at a CAGR of 4.8% from 2026 to 2035. The report covers key market segments such as material types (plastic, paper, metal, glass), product forms (pouches, wraps, jars, bags), and applications (bread, biscuits, cakes, pastries). It provides an in-depth analysis of the competitive landscape with top players like Amcor Plc, Ball Corporation, and Mondi. Regional data includes North America, Asia Pacific, Europe, Latin America, and the Middle East & Africa.

Report Highlights: Important Revelations

- North America's preeminence in bakery packaging.

- Expansion of packaged baked goods in the Asia Pacific region.

- Plastic emerges as a vital component in bakery packaging solutions.

- Pouches as a versatile component in flexible packaging solutions for the baking industry.

- Bread leads the way in bakery industry production.

The bakery packaging industry is constantly evolving in terms of materials, designs, and functionalities to meet the different needs of both consumers and companies. Manufacturers and suppliers in this sector continuously strive to find packaging solutions that preserve the freshness and quality of bakery goods while adhering to environmental goals and regulatory norms. Consumer tastes, sustainability concerns, and technical improvements influence the market's dynamics. Businesses in this industry must adapt to these changes to remain competitive and fulfil changing consumer needs while staying on track with sustainability goals.

Bakery products are widespread global, frequently in stylish packaging that entices customers. However, functional features are critical in ensuring that bakery items remain fresh and intact until consumed. Globally, one-third of food produced for human consumption is wasted, totalling 1.3 billion tonnes per year and worth USD 1 trillion. The global bread sector is estimated to be worth $497.5 billion by 2022. The best material for bakery product packaging must be strong and sufficient to prevent the contents from contamination during transportation and storage. Furthermore, it should not degrade baking quality by retaining heat or moisture, even after extended contact with these elements.

Bakery Packaging Market Trends

- Convenience food consumption and hectic lifestyles have led to a trend towards bakery packaging options that accommodate consumption while on the go.

- Luxurious and handcrafted bread items are more expensive, so their packaging should match their distinctiveness and superior quality.

- The packaging of bakeries is increasingly using interactive packaging solutions, like augmented reality (AR) experiences and QR codes, to improve consumer engagement and brand connection.

- Increased online bakery product shopping requires packaging solutions appropriate for e-commerce distribution.

North America's Dominance in Bakery Packaging

North America is a leading region in the bakery packaging industry for several compelling reasons. North America's diversified consumer base and strong affection for bakery foods have resulted in a flourishing bakery consumption culture, including a wide range of products, from bread and cakes to pastries and cookies. This high demand for bakery goods necessitates ongoing innovation in packaging techniques to maintain freshness while attracting customer interest. The North American market's healthy economy and high disposable income levels enable consumers to invest in premium bakery items. As a result, there is a noticeable shift towards premiumization in bakery packaging, emphasizing higher-quality materials, more visually appealing designs, and improved functioning.

With sales of around $9 billion in 2022, centre store bread ranked as the best-selling category of bakery products in the United States. Sales of the common cookie exceeded eight billion dollars, making it the second most popular baked good in the nation. The United States is a key factor in this area, with the world's largest bakery product manufacturing sector. The bread market in the United States alone generates over $30 billion annually. Americans consume over 25.4 kg of bakery products each person, demonstrating the country's ravenous demand for baked goods.

The US bakery sector is diversified, with over 2,800 commercial bakeries generating a total yearly revenue of roughly $30 billion and approximately 6,000 retail bakeries contributing around $3 billion. Hostess Brands, Flowers Foods, and Bimbo Bakeries USA, the US part of Grupo Bimbo of Mexico, are the sector's key companies. The industrial part of the industry is highly concentrated, with the top 50 companies accounting for 75% of total revenue. The retail market is highly fragmented, with the top 50 companies accounting for only 15% of total revenue and the average company operating a single location.

For Instance,

- In October 2023, Grupo Bimbo acquired Mile Hi Bakery, a smaller US competitor. The baking giant announced the Colorado acquisition alongside its third-quarter results.

The Asia Pacific region emerged as the second largest participant in the bakery packaging market, with increased consumer purchases of pastries and bread. Given the high moisture content of bread and baked goods, growing demand needs customized packaging solutions to enhance product shelf life. Concurrently, packaging must prevent these products from drying out quickly, becoming hard, or losing their aroma.

The entire market for packaged foods in Asia Pacific is expected to expand by 3.5% by 2023, with sales of packaged baked products increasing steadily in many Asian countries. The anticipated market increase in the region is spectacular, with an average annual growth rate of 10.4% predicted by 2024, with India solely contributing about 13%.

The Asian market, recognized for its technological advances, continues progressing, as seen by Shanghai supermarkets' pioneering method of countering e-commerce competition. This automated supermarket transforms the shopping experience using robots to bake and package baked goods, exemplifying the region's commitment to adopting smart technologies in the bakery packaging industry.

For Instance,

- In February 2023, Leading global candy manufacturers Nestlé and Mars Wrigley Australia plan to test-launch their well-known brands of chocolate and candies in paper packaging in Australia.

Bakery Packaging Market, DRO

Demand:

- Demand for bakery packaging protects products from moisture, air, light, and physical damage, preventing spoiling, staling, and contamination.

Restraint:

- Compliance with food packaging regulations, safety standards, and labelling requirements is difficult for manufacturers.

Opportunity:

- Customised bakery packaging choices enable firms to target specific consumer preferences and market sectors.

Bread Driving the Majority of Bakery Industry Output

The two primary segments of the bakery industry, bread and biscuits, account for around 82% of all bakery goods produced. The economy's organized and unorganized sectors contribute to the nation's production, estimated to be about 11 million biscuits and 0.44 million tons of bread annually.

The market for bread exhibits a consistent annual growth rate of approximately 7% in volume, but the demand for biscuits displays a more robust growth rate of 8% to 10%. Bread bags take up much of the packaging material used in bakeries. Low-density polyethylene plastic (LDPE) bags are frequently used to package bread.

Bread bagging has two basic closure methods: wire twist ties and plastic-clip closures. These closures and automation equipment solutions make bakeries' packing procedures more efficient. Wire twist ties and plastic-clip closures keep the bread fresh and intact during storage and shipping, guaranteeing that customers receive high-quality items.

For Instance,

- In October 2023, New bread bags with 30% post-consumer recycled (PCR) content were introduced by Arnold Bread, a division of Bimbo Bakeries USA. The brand's organic line uses polyethylene bags made from PCR resins that comply with US Food and Drug Administration regulations.

Plastic a Key Player in Bakery Packaging Solutions

Plastic is the most cost-effective packaging material in the bakery packaging business, and it is famous around the world due to its ease of use when packaging moist bread products. Its versatility makes it an excellent choice, acting as a robust barrier against moisture, air, and light entry while successfully preventing grease or oil leakage. Plastic packaging is essential for preserving bakery items quality, taste, color, and aroma and keeping them fresh for extended periods. Due to its efficacy, plastic has been the dominant material in bakery packaging for decades. Still, bakeries have to evaluate their packaging options to maintain product safety and integrity. Customized bakery boxes are favored over plastic packaging, particularly for cake enterprises specializing in complex frosting.

Plastic packaging was adopted because it is the most hygienic solution for bakery packaging. Bakeries frequently utilize polyolefin, a plastic polymer that makes airtight and spill-proof packaging for goods, including bread, muffins, cookies, pastries, and candies. Maintaining food quality is less important than choosing appropriate packing materials. Making poor decisions might jeopardize the integrity of the product, which emphasizes how crucial it is for bakery enterprises to pay close attention to packing aspects.

For Instance,

- In February 2024, Floatable polyolefin shrink films will be introduced as a new offering by packaging maker Innovia Films. Low-density white polyolefin RayoFloat white APO keeps its floatability throughout printing. Because of its opacity, which improves light blocking, shrink sleeves made of it are appropriate for light-sensitive businesses.

Pouches in Flexible Packaging Solution for the Baking Sector

In the baking sector, pouches have become a flexible and more common packaging choice. These flexible containers have various benefits for packaging bread, cookies, pastries, and snacks, among other bakery goods. Pouches are perfect for storage and travel because they are small and light. Their small size lowers the need for storage space and shipping expenses, improving baking operations' overall effectiveness.

Pouches have great barrier qualities that preserve the flavor and freshness of baked goods while shielding them from elements like moisture, air, and light. This increases baked items' shelf life and maintains their quality over time.

Pouches with resealable closures make it easy for customers to open and close the packing, maintaining product freshness and reducing waste. Pouches are a versatile and effective packaging solution for bakery products, providing flexibility, protection, and branding opportunities to bakeries while assuring freshness and convenience for customers.

For Instance, In June 2023, Specialty label, security, and packaging solutions supplier CCL Industries and Pouch Partners AG, Switzerland, a flexible pouch converter owned by the Capri-Sun Group with its headquarters in Switzerland, have entered into a legally binding agreement for CCL Industries to purchase Pouch Partners s.r.l.

Key Players and Competitive Dynamics in the Bakery Packaging Market

The competitive landscape of the Bakery Packaging market is dominated by established industry giants such Amcor Plc, Ball Corporation, Bemis Manufacturing Company, Berry Global Inc., BROWPACK, Charter Next Generation, Genpak, LLC, Innovia Films Ltd, Mondi, Napco Security Technologies, Inc., Sealed Air, Smurfit Kappa, Stora Enso, Sydney Packaging and WestRock Company. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

With Amcor's specialist cast film for bread, English muffins, croissants, and bagels, achieve best-in-class clarity and gloss without compromising strength and production speed. When it's clean and dry, AmPrima® can be recycled via curbside collection services or current store drop-off locations.

For Instance,

- In August 2023, Amcor, a leader in developing and producing environmentally friendly packaging solutions worldwide, said today that it had agreed to purchase Phoenix Flexibles, increasing its presence in the rapidly expanding Indian market.

Innovia Films Ltd's Propafilm™ high-barrier BOPP films meet these standards with various grades. Our rapid seal-coated films maintain exceptional seal integrity even when the seal region is contaminated with sugar.

For Instance,

- In January 2021, Innovia Films announced new Propafilm™ Strata packaging films for the biscuit, bakery, and confectionery markets. These films are transparent, high-barrier, and monostructure.

Bakery Packaging Market Companies

- Amcor Plc

- Ball Corporation

- Bemis Manufacturing Company

- Berry Global Inc.

- BROWPACK

- Charter Next Generation

- Genpak, LLC

- Innovia Films Ltd

- Mondi

- Napco Security Technologies, Inc.

- Sealed Air

- Smurfit Kappa

- Stora Enso

- Sydney Packaging

- WestRock Company

Bakery Packaging Market Segments

By Material

- Plastic

- Paper

- Metal

- Glass

By Product

- Pouches

- Wraps

- Jars

- Bags

- Containers

By Application

- Bread

- Biscuits

- Cakes

- Pastries

- Others

By Region

- North America

- Asia Pacific

- Europe

- LA

- MEA

Tags

FAQ's

Select User License to Buy

Figures (2)