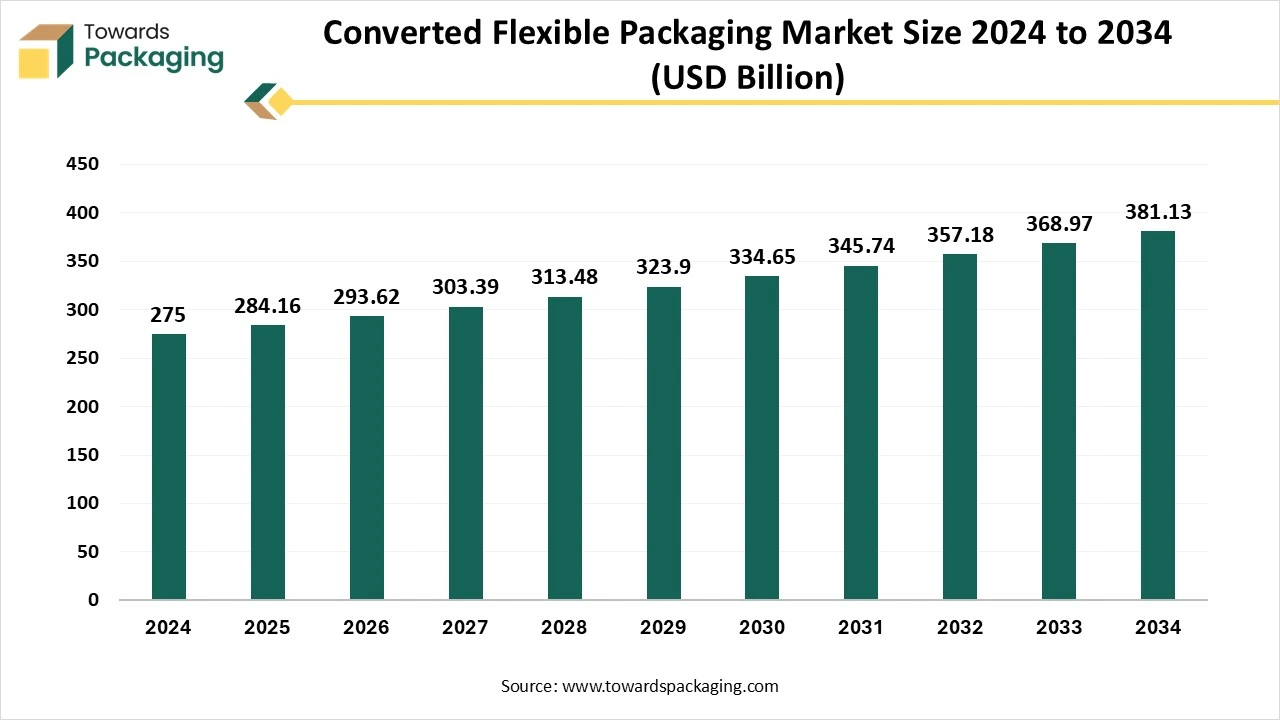

The converted flexible packaging market is forecasted to expand from USD 293.62 billion in 2026 to USD 394.30 billion by 2035, growing at a CAGR of 3.33% from 2026 to 2035. The report includes full statistical data on market size from 2025 to 2034, detailed trends, material and application segment analysis, company profiles, competitive landscape, value chain assessment, import–export flows, trade regulations, and manufacturer and supplier mapping. It provides verified data on revenue forecasts, growth rates, and demand patterns across key end-use industries.

In the packaging industry, converted flexible packaging is the type of packaging that combines raw materials such as plastics, aluminium foil, adhesives, polyesters, and paper to manufacture final packaging products, which include pouches, bags, sachets, cartons, and films. This type of packaging is widely utilized by end-user industries such as consumer goods, food and beverages, pharmaceuticals, personal care, and others. The packaging products are generally easy to store, convenient for transportation, protect from contamination, and provide a longer shelf life.

As technology continues to evolve, artificial intelligence (AI) integration holds the potential to reshape the entire packaging landscape by improving manufacturing efficiency, boosting sustainability, and optimizing material usage. Machine learning (ML) algorithms assist businesses in accurately evaluating production data, predicting potential material waste, and improving resource utilization, which results in reducing cost and minimizing environmental footprints.

AI-powered predictive maintenance systems in converted flexible packaging facilities assist in improving equipment efficiency, minimizing production disruptions, reducing downtime, and boosting productivity. In addition, AI integration is widely being used in smart packaging technologies, like QR codes, NFC tags, and RFID tags. These technological innovations enable real-time tracking, authentication, and improve the consumer experience. These technologies enable real-time tracking of products throughout the supply chain, from manufacturing to retail shelves.

Growing Consumer Demand for Convenient and Sustainable Packaging

Consumers are increasingly seeking products that offer flexible packaging owing to their lightweight, portability, ease of storage, space efficiency, and longer shelf life. Over the years, sustainability has played a crucial role in packaging decisions, encouraging businesses across multiple industries such as food and beverage, pharmaceuticals, and personal care sectors to adopt biodegradable, recyclable, and compostable materials. Therefore, lightweight packaging products lower transportation expenses and minimize carbon emissions, which makes it a preferable choice for companies focusing on environmental sustainability while ensuring cost-effectiveness and reducing plastic waste.

Rising environmental concerns and recycling issues

The increasing environmental concerns and recycling issues related to plastic waste are expected to hamper the market's growth. The market often faces the challenge of the complexity of recycling multi-layer packaging materials, which include plastics, aluminum, and other materials. The increasing regulatory pressures on packaging industries are pushing them to adopt sustainable alternatives. In addition, the fluctuation in the price of raw materials, which are widely used in flexible packaging, can adversely impact the profitability of manufacturers. Such factors may hinder the growth of the global converted flexible packaging market during the forecast period.

Expansion of the E-commerce Industry

The increasing popularity of e-commerce platforms and online grocery shopping has led to an increasing demand for lightweight, adaptable, and protective packaging options. Pouches, bags, cartons, and films are most widely adopted for their lightweight, space-saving, and cost-effectiveness characteristics across various industries such as pharmaceuticals, food and beverages, and personal care items. Converted flexible packaging significantly assists in reducing transportation costs and enhancing logistics efficiency. Moreover, the surge in direct-to-consumer brands with a focus on enhancing brand visibility and consumer engagement is expected to fuel the market’s expansion in the coming years.

The plastic segment holds a dominant presence in the global market. The growth of the segment is attributed to the rising preference for resealable and single-use convenience packaging. Plastic-based flexible packaging, including polypropylene, polyethylene, and polyethylene terephthalate, offers high strength-to-weight ratios, lower shipping costs, excellent moisture resistance, and longer shelf life, ideal for food and beverage and pharmaceutical items. Plastic protects the product from contamination and reduces product damage during storage and transit. Moreover, plastic films and laminates are extensively used for wraps, pouches, and labels, providing tamper resistance and robust protection.

On the other hand, the paper segment is expected to grow at a significant rate, owing to the rising environmental concerns, bans on single-use plastics, and rising business and consumer focus on sustainability. Biodegradable materials, such as plant-based polymers, starch-based films, and others, are increasingly gaining immense popularity in personal care, food packaging, and pharmaceutical industries.

The food and beverages segment accounts for a significant share of the converted flexible packaging market owing to the rising consumption of food products, surge in global population growth, rising disposable income, and rapid urbanization. Converted flexible packaging is widely adopted in the food and beverage industry in the form of lightweight bags, pouches, and sachets. Several companies are focused on innovating and launching sustainable products for the food and beverage industry.

On the other hand, the pharmaceuticals segment is expected to grow due to the increasing demand for child-resistant, tamper-proof designs, regulatory compliance-driven, and anti-counterfeit packaging solutions. The pharmaceutical industry relies on converted flexible packaging solutions for a wide range of pharmaceutical products, including capsules, tablets, liquids, and others, to ensure safety, prolonged shelf life, ease of handling, cost-effectiveness, and accurate dosage administration.

According to the data published by the United States Department of Agriculture (USDA), meat processing is the largest industry group in food and beverage manufacturing, with 26.2% of sales in 2021. Other important industry groups by sales include dairy (12.8%), other foods (12.4%), beverages (11.3%), and grain and oilseeds (10.4%).

Asia Pacific has a well-established packaging sector supporting food and beverage, pharmaceuticals, and personal care industries, prominent users of converted flexible packaging solutions. The region's high per capita income drives demand for convenient and lightweight packaging products. The rapid shift toward biodegradable, recyclable, compostable materials and plant-based packaging solutions, mainly due to the regulatory pressures to minimize carbon emissions and boost environmental sustainability, significantly fuels the regional market’s growth. Additionally, the rising expansion of the e-commerce industry necessitates converted flexible packaging solutions, accelerating the expansion of the converted flexible packaging market in the region.

North America has a well-established packaging sector supporting food and beverage, pharmaceuticals, and personal care industries, prominent users of converted flexible packaging solutions. The region's high per capita income drives demand for convenient and lightweight packaging products. The rapid shift toward biodegradable, recyclable, compostable materials and plant-based packaging solutions, mainly due to the regulatory pressures to minimize carbon emissions and boost environmental sustainability, significantly fuels the regional market’s growth. Additionally, the rising expansion of the e-commerce industry necessitates converted flexible packaging solutions, accelerating the expansion of the converted flexible packaging market in the region.

The flexible packaging market is expected to increase from USD 323.25 billion in 2025 to USD 488.72 billion by 2034, growing at a CAGR of 4.7% throughout the forecast period from 2025 to 2034. The shift in consumer behavior toward convenience, coupled with regulatory pressure for eco-friendly solutions, has accelerated market adoption across industries.

The packaging type in which packaging materials is used which can easily change shape, typically manufactured from paper, plastic, foil, or a combination of these. Unlike rigid packaging such metal cans or glass jars, bottles, flexible packaging is lightweight, durable adaptable to various product types. The common types of flexible packaging are bags, pouches, sachets, and wraps & films. The flexible packaging is lightweight, cost effective, has extended shelf-life, sustainable option and convenience features. The flexible packaging is extensively utilized for personal care, pharmaceuticals, industrial applications and food & beverages.

By Material

By Application

By Region

January 2026

January 2026

January 2026

January 2026