The brand-centric packaging solutions market is analyzed in detail in terms of current size and revenue outlook, with statistical forecasts for 2025–2034 by packaging format (primary, secondary, tertiary), material type (paper & paperboard, plastics, glass, metal, bioplastics, etc.), printing technology, packaging features, design strategies, and end-use industries across all key regions including North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

A brand-centric packaging solution refers to a packaging approach that prioritizes the identity, values, and message of a brand in the design and functionality of the packaging. This type of solution goes beyond just protecting the product; it acts as a powerful marketing tool that enhances brand recognition and consumer loyalty. It involves using distinctive colors, logos, typography, and materials that align with the brand's image, ensuring consistency across all customer touchpoints.

Brand-centric packaging is designed to evoke an emotional connection with consumers, often incorporating storytelling elements or sustainability features that reflect the brand's mission. It helps differentiate products in competitive markets, increases shelf appeal, and reinforces brand recall. By aligning packaging with brand values and consumer expectations, companies can foster trust and drive long-term customer engagement. This strategic approach not only enhances visual appeal but also ensures the packaging communicates the brand’s promise, personality, and positioning effectively.

| Metric | Details |

| Key Market Drivers | Brand differentiation, personalization, sustainability, smart tech adoption |

| Leading Region | Asia-Pacific |

| Market Segmentation | By Packaging Format, By Material Type, By Printing Technology, By Packaging Feature/Functionality, By End-use Industry, By Packaging Design Strategy and By Region |

| Top Key Players | Amcor, WestRock, Mondi, Berry Global, Smurfit Kappa, DS Smith, Tetra Pak, AptarGroup, etc. |

AI integration can significantly enhance the brand-centric packaging solutions market by enabling smarter, data-driven design and operational efficiency. Through AI-powered analytics, brands can better understand consumer preferences, purchase behaviors, and market trends, allowing them to create packaging that resonates deeply with target audiences. AI tools can assist in customizing packaging designs for different demographics, optimizing layouts, colors, and messaging based on predictive insights.

AI-driven automation streamlines packaging processes, reducing production time, minimizing material waste, and lowering costs. AI also supports interactive packaging by powering technologies like image recognition and voice-enabled interfaces, which can be embedded into smart packaging for enhanced consumer engagement. Furthermore, AI can help brands monitor the sustainability of their packaging materials and supply chains, contributing to more responsible branding. Overall, AI transforms packaging from a static brand element into a dynamic tool that evolves with consumer needs, reinforcing brand identity while improving performance, efficiency, and customer connection.

In competitive markets, companies are using packaging as a strategic tool to stand out by clearly communicating their brand identity, values, and positioning.

Consumers seek emotional connections with brands, pushing companies to adopt packaging that offers personalized touches, storytelling, and enhanced visual appeal.

Environmentally conscious consumers prefer packaging that reflects eco-friendly values, encouraging the use of recyclable, biodegradable, and reusable materials that align with brand ethics.

Innovations such as digital printing, AI-driven customization, and interactive features like QR codes and AR enable more flexible, engaging, and cost-efficient brand packaging.

Consumers now expect brands to communicate sourcing, sustainability efforts, and product authenticity through clear, informative packaging design.

Brands are using packaging to build emotional bonds with customers, making packaging an extension of the overall brand experience rather than just a container.

Complexity in Supply Chain Management & Regulatory and Compliance Challenges

The key players operating in the brand-centric packaging solutions market are facing issues due to complexity in the supply chain and regulatory challenges. Customized packaging requires greater coordination, inventory management, and logistics planning, making the supply chain more complex and less flexible. Smaller businesses may find it challenging to scale brand-centric packaging due to high setup costs, limited design resources, and a lack of access to advanced technologies.

Packaging must meet various regional and international regulations related to labeling, materials, and sustainability, which can slow down innovation and increase compliance costs. While sustainability is a focus, some brand-centric designs may involve non-recyclable elements like metallic foils or mixed materials, creating environmental concerns and consumer distrust.

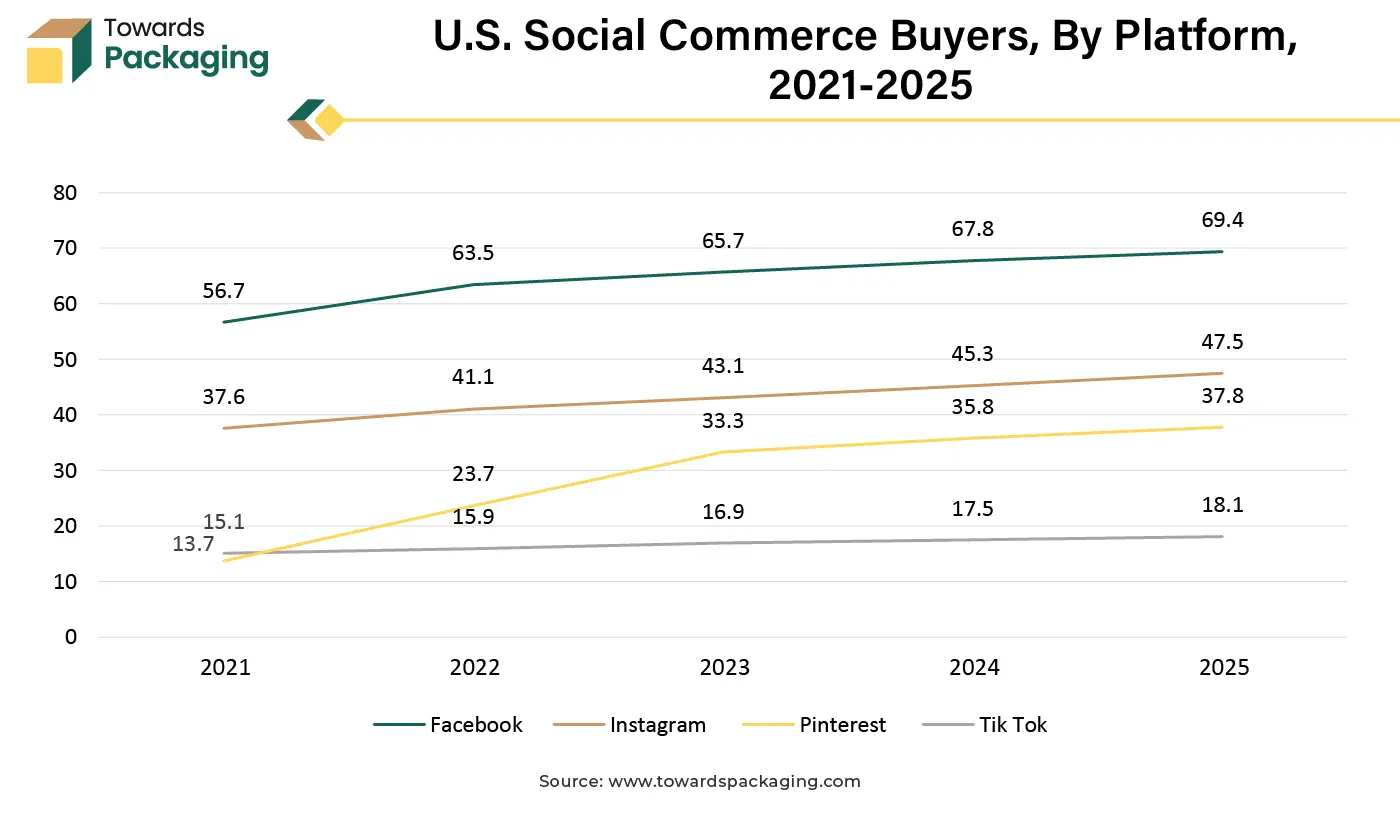

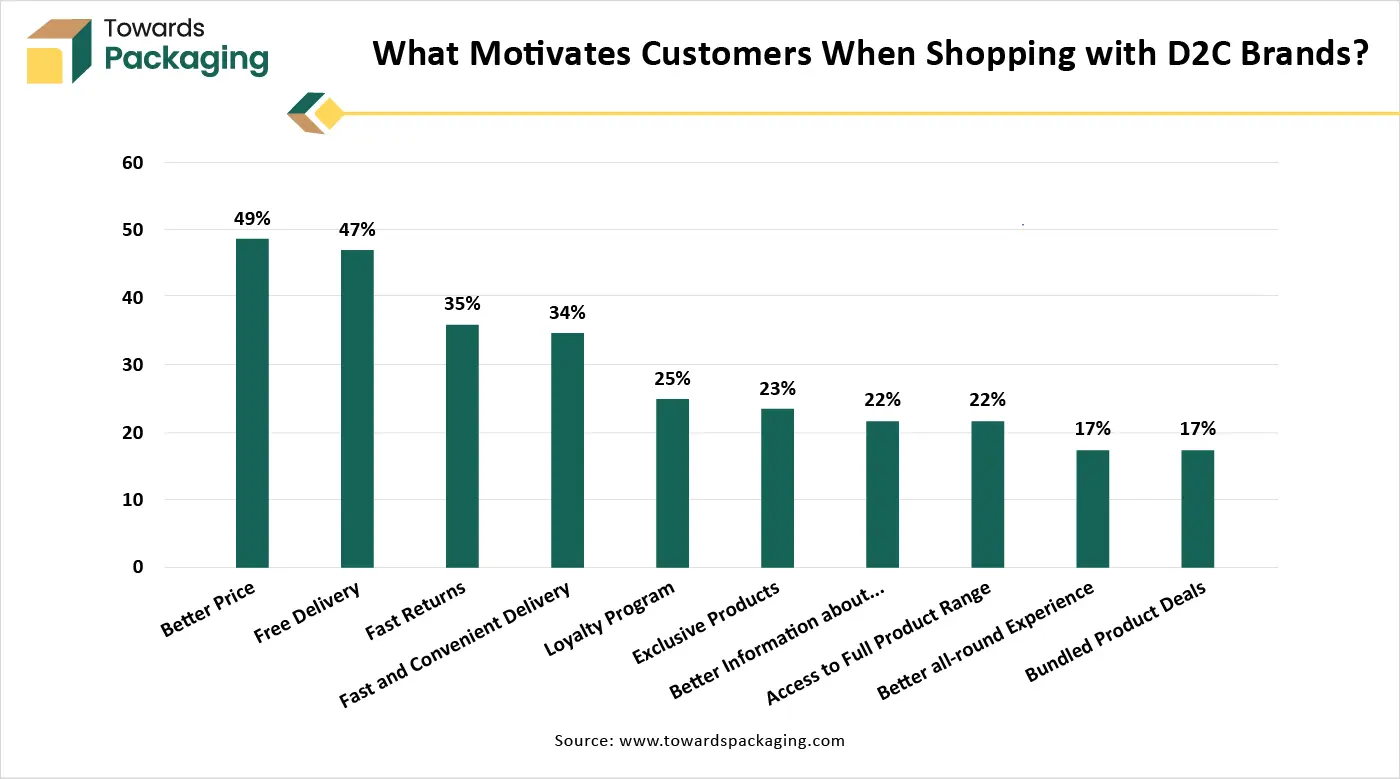

Expansion of E-commerce and Direct-to-Consumer (D2C) Channels

The rapid rise of online shopping and D2C brands has created a growing demand for packaging that not only protects the product but also delivers a memorable unboxing experience. This opens up vast opportunities for brand-centric packaging to act as a key touchpoint in the customer journey, especially when there is no physical retail interaction. For instance, in January 2025, the National E-commerce Association notes that, when it comes to social commerce, the trend is moving toward self-care, even though consumers prefer to buy more consumer gadgets on e-commerce websites. Twenty percent of respondents reported making eight or more purchases of personal care items in the previous 12 months.

The primary packaging segment is the dominant packaging format in the brand-centric packaging solutions market due to its direct interaction with the product and the consumer. It plays a critical role in brand communication, influencing first impressions, purchase decisions, and user experience. Primary packaging offers brands the opportunity to showcase their identity through design, color, and messaging while ensuring product protection and convenience. Its importance in sectors like cosmetics, food, and pharmaceuticals further strengthens its dominance in brand-centric packaging strategies.

Tertiary packaging is currently the fastest-growing format segment within the brand‑centric packaging solutions market, particularly in North America, owing to several key factors. The surging expansion of e‑commerce and global trade has heightened the demand for robust tertiary packaging like pallets, stretch wraps, bulk containers, and shrink films to ensure product safety and handling efficiency during transit. This growth is especially pronounced in North America, where high shipment volumes and sophisticated logistics infrastructure elevate reliance on strong tertiary packaging solutions.

Innovations integrating smart features such as RFID tags, IoT sensors, temperature monitoring, and tamper-evident tracking are increasingly embedded in tertiary packaging to enhance traceability and supply-chain transparency. Additionally, the rising focus on sustainability through recyclable, reusable, and biodegradable materials drives the adoption of eco‑friendly tertiary packaging aligned with consumer and regulatory expectations.

The paper and paperboard material type segment is the dominant component in the brand-centric packaging solutions market due to several compelling factors. Paper and paperboard offer excellent eco-friendly credentials, being renewable, biodegradable, and highly recyclable qualities that align with the sustainability goals of modern, brand-conscious consumers. These materials support the circular economy, appeal to environmentally aware buyers, and help brands build trust and a positive image.

Cost-wise, paperboard is lightweight, economical, and reduces shipping and handling expenses, making it attractive for mass adoption in brand-centric packaging strategies. It’s highly customizable, with support for vibrant digital printing, embossing, coatings, and complex die-cut designs that help convey brand identity, storytelling, and premium aesthetics. The e-commerce boom, especially in food, personal care, and FMCG, demands durable yet visually appealing packaging, which is perfectly met by paperboard formats like folding cartons and corrugated boxes. Together, these attributes make paperboard the go-to material for brands focused on combining sustainability, branding, and functional packaging.

The bioplastics & bio-based materials segment is the fastest-growing material category in the brand‑centric packaging solutions market due to several well-aligned drivers. Bioplastics, including biodegradable polymers like polylactic acid (PLA), polyhydroxyalkanoates (PHA), and starch blends, are rapidly advancing thanks to technological innovations and falling production costs. These materials offer a lower carbon footprint and greater consumer appeal compared to fossil-based plastics.

Regulatory pressures such as bans on single-use plastics and extended producer responsibility frameworks are also encouraging brands to shift toward compostable and renewable packaging options. Furthermore, rising environmental consciousness among consumers and corporate sustainability commitments are driving widespread adoption of plant-based packaging that reinforces brand values. Flexible bioplastic formats (films, pouches), in particular due to their lightweight nature, design versatility, and compatibility with digital branding, are seeing especially strong growth.

The flexographic printing segment dominates the brand-centric packaging solutions market thanks to its exceptional efficiency, versatility, and cost-effectiveness. Flexo printing operates at high speeds on roll-fed materials, enabling rapid large-volume production often reaching over 600 m/min, which slashes turnaround times and unit costs. It can print on a wide array of substrates, from paper and cardboard to plastic and metallic films, allowing brands to express visual identity across diverse packaging formats. Moreover, the use of water-based and UV-curable inks minimizes environmental impact, aligning with sustainable brand values. Its multifunctional inline capabilities, printing, laminating, varnishing, and die-cutting further boost productivity while maintaining high-quality results.

The digital printing segment is emerging as the fastest‑growing printing technology within the brand‑centric packaging solutions market due to several key factors. First, the soaring demand for customization and personalized packaging enables brands to deliver tailored graphics, variable messages, and targeted designs in short print runs, enhancing emotional engagement and brand differentiation. Second, the explosive growth of e-commerce and D2C models drives the need for visually appealing, on-demand packaging that elevates the unboxing experience.

Sustainability concerns are pushing brands toward digital printing, which minimizes waste, supports eco-friendly inks and recyclable substrates, and reduces setup materials. Finally, technological advancements, including higher resolution inkjet/electrophotographic systems, faster turnaround, and smart packaging compatibility, are making digital printing more efficient, versatile, and broadly applicable across packaging formats.

The sustainable or eco-friendly segment is dominant in the brand-centric packaging solutions market due to rising environmental awareness and consumer demand for responsible brands. Companies increasingly adopt recyclable, biodegradable, and reusable materials to align with sustainability goals and regulatory pressures. Eco-friendly packaging enhances brand image, builds consumer trust, and meets global commitments to reduce plastic waste. It also supports premium positioning as consumers favour brands that prioritize ethical and green practices, making sustainability a key differentiator in competitive markets.

The smart packaging segment is experiencing the fastest growth in the brand-centric packaging solutions market, driven by multiple compelling factors. First, rising consumer demand for safety and authenticity, particularly in food, beverage, and pharmaceutical sectors, is fueling the adoption of technologies like QR codes, NFC, RFID, and freshness indicators to ensure product integrity and traceability. Next, technological advancements, including IoT sensors, augmented reality, blockchain, and AI, enable interactive consumer engagement, real-time monitoring, and supply chain optimization.

The food and beverages segment dominates the brand-centric packaging market due to several compelling factors. First, food and beverage packaging serves as both protection and a critical touchpoint for branding, enabling visual communication of quality, safety seals, and freshness to build trust. Second, packaging design, including color, typography, imagery, and structure, plays a pivotal role in differentiating products and influencing consumer decisions in crowded retail environments. Third, the high turnover and visibility of FMCG goods mean packaging must capture attention on-shelf and online, reinforcing brand identity and driving repeated sales in a fast-moving category.

The personal care and cosmetics end-use industry segment is the fastest-growing in the brand-centric packaging solutions market due to increasing consumer focus on aesthetics, premiumization, and self-expression. Brands in this sector heavily rely on packaging to convey luxury, uniqueness, and product value. The demand for personalized, sustainable, and innovative designs is rising, especially among younger consumers. Additionally, the growth of e-commerce and influencer-driven marketing has amplified the importance of visually appealing packaging to enhance brand recognition and customer engagement.

The custom structural design segment is the dominant packaging design strategy in the brand-centric packaging solutions market due to its ability to create a distinctive physical presence that strengthens brand identity and enhances consumer experience. Brands use unique shapes, openings, and constructions to stand out on shelves and communicate exclusivity and innovation. This approach not only captures attention but also improves functionality, protection, and usability of the product. Custom structures support storytelling and emotional connection, making the packaging a memorable brand touchpoint.

The personalized packaging design strategy is the fastest‑growing within the brand‑centric packaging solutions market, driven by several interlinked factors. Emerging consumer preference for uniquely curated experiences propels brands to deliver individualized messages, names, visuals, and artwork on each package, enhancing emotional connection and loyalty. The widespread rise of e‑commerce and D2C models creates opportunities for brands to employ on‑demand personalized packaging, boosting the unboxing experience and reinforcing brand identity.

Technological advances in digital printing, especially variable data printing, inkjet systems, and AI‑driven design, enable small‑batch, cost‑effective customization tailored to customer segments. Sustainability considerations further support this trend, as eco‑friendly customized packaging using recyclable or plant‑based materials aligns with evolving consumer expectations. These convergent factors position personalized packaging as a rapidly expanding strategy for brands seeking differentiation and engagement.

Asia-Pacific has emerged as both the dominant and the fastest-growing region in the brand-centric packaging solutions market due to a combination of economic, industrial, and demographic factors. The region is home to some of the world’s largest and most rapidly expanding consumer markets, such as China, India, Japan, and Southeast Asia, where rising disposable incomes and urbanization are driving demand for premium and branded products. This surge in consumerism has led to heightened competition among brands, encouraging investments in distinctive, visually appealing, and personalized packaging.

The booming e-commerce and direct-to-consumer sectors in the region are further fueling the need for impactful packaging that enhances the unboxing experience and reinforces brand identity. Moreover, the presence of a strong manufacturing base, access to cost-effective raw materials, and advancements in printing and packaging technologies make the region attractive for packaging companies. Growing awareness around sustainability and the adoption of digital tools also contribute to rapid market growth.

China Market Trends

China leads the region due to its massive consumer base, rapid urbanization, and well-established manufacturing infrastructure. With a strong emphasis on e-commerce and premiumization, Chinese brands are heavily investing in eye-catching, smart, and personalized packaging to attract tech-savvy and brand-conscious consumers. China is also advancing in digital printing and automation, further boosting its packaging capabilities.

India Market Trends

India is experiencing a surge in demand for brand-centric packaging driven by a growing middle class, increased brand awareness, and rapid retail and e-commerce expansion. Indian consumers are increasingly drawn to personalized and sustainable packaging, prompting both local and global brands to innovate. The government’s push for Make in India and sustainable practices also supports the packaging sector's growth.

Japan Market Trends

Japan’s packaging market is mature but continues to grow steadily, particularly in the luxury, personal care, and electronics sectors. Japanese consumers value high-quality, detail-oriented packaging that reflects precision and brand sophistication. Innovation, minimalism, and aesthetics play a major role in packaging appeal here.

South Korea Market Trends

South Korea is a trendsetter in beauty and electronics packaging. The country's strong brand identity in cosmetics (like K-beauty) drives demand for high-end, innovative, and sustainable packaging solutions. Tech integration, such as QR codes and AR elements, is commonly used to connect packaging with digital experiences.

North America is emerging as a notably growing region in the brand-centric packaging solutions market due to its strong emphasis on innovation, premium branding, and consumer-driven packaging trends. The region is home to some of the world’s leading brands across industries such as food and beverage, cosmetics, pharmaceuticals, and e-commerce, all of which increasingly rely on packaging as a key element of brand identity and customer engagement. High consumer expectations for personalized, sustainable, and aesthetically pleasing packaging are driving companies to invest in advanced printing technologies, smart packaging features, and eco-friendly materials.

The rapid expansion of online retail and direct-to-consumer business models in the U.S. and Canada has increased the demand for customized packaging that enhances the unboxing experience and reinforces brand messaging. Regulatory support for sustainable practices and increasing awareness of environmental impact among consumers also push brands toward adopting greener, brand-focused packaging strategies, making North America a dynamic and growing market.

By Packaging Format

By Material Type

By Printing Technology

By Packaging Feature/Functionality

By End-use Industry

By Packaging Design Strategy

By Region

January 2026

January 2026

January 2026

January 2026