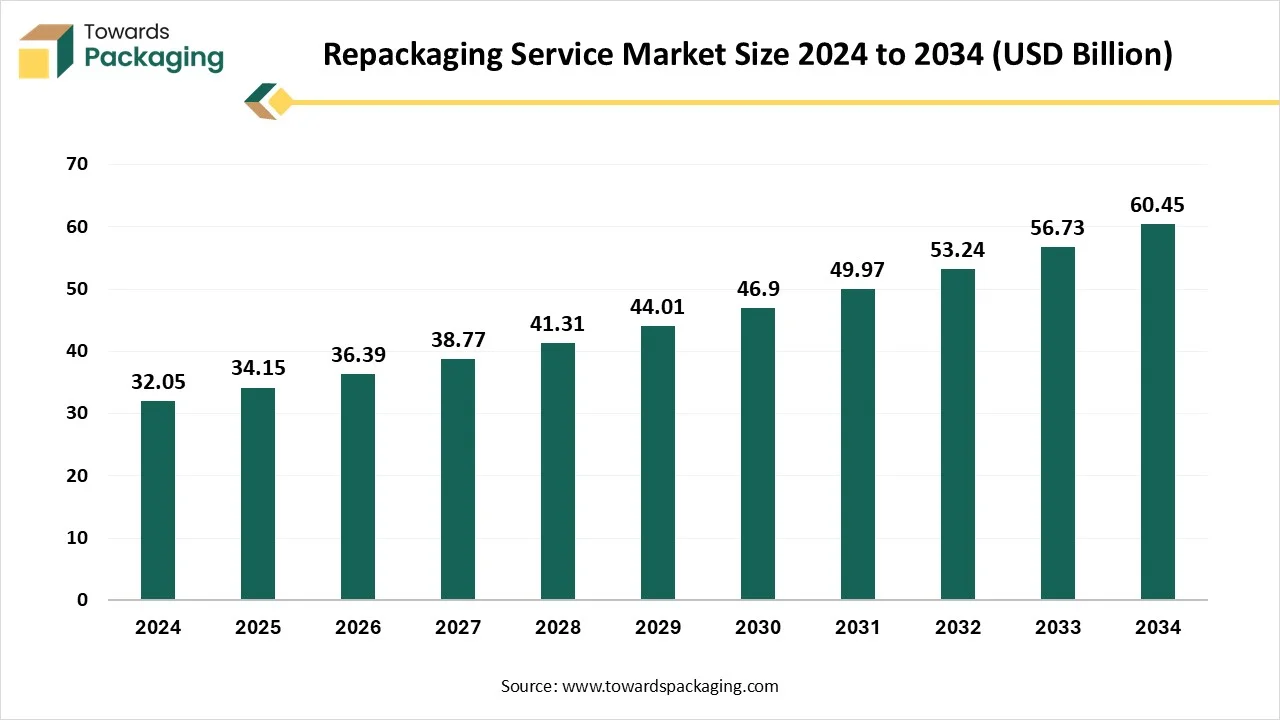

The repackaging service market is projected to grow from USD 34.15 billion in 2025 to USD 60.45 billion by 2034, registering a CAGR of 6.55%, and this report quantifies that growth while explaining what drives it. It covers detailed market size and trends, full segmentation by packaging type (bottles & jars leading, sachets & pouches fastest-growing), product type (pharmaceuticals dominant, food & beverages fastest), function (contract packaging leading, private label fastest), material (plastic leading, biodegradable/compostable fastest), and end-use industry (healthcare & life sciences dominant, retail & e-commerce fastest).

The study provides regional analysis across North America, Europe, Asia Pacific, Latin America, and MEA, highlighting North America’s 2024 leadership and Asia Pacific’s high-growth outlook, and links this to trade data, export trends, and cross-border regulations. It also profiles top companies such as Sharp Packaging Services, PCI Pharma Services, Berlin Packaging, TricorBraun, Sonoco, Thermo Fisher, and others, with competitive analysis, value chain mapping from raw materials to end-users, and manufacturer & supplier coverage across key regions.

Repackaging service refers to the process of taking products that have already been manufactured and packaged and altering or updating their packaging for various purposes, such as branding, compliance, marketing, or logistics. This may include changing labels, resizing packages, bundling multiple items, or adapting packaging for different markets or regions. Repackaging services are crucial in industries like pharmaceuticals, food and beverage, cosmetics, and electronics, where labeling accuracy, freshness, or country-specific regulations are critical.

Repackaging service centers are specialized facilities equipped to handle these tasks efficiently and according to industry standards. These centers are often strategically located near manufacturing hubs, distribution centers, or export zones to minimize transit time and costs. They maintain stringent quality control, hygiene, and safety protocols, especially for sensitive sectors like healthcare or food. Many of these centers offer additional services such as barcoding, serialization, tamper-proof sealing, and inventory management, making them an essential link in global supply chains.

AI integration is revolutionizing the repackaging service industry by streamlining operations, enhancing precision, and enabling adaptive packaging solutions. Through advanced computer vision, AI can detect defects in labels, seals, and packaging materials in real time, ensuring consistent quality control with minimal human intervention. Machine learning algorithms optimize packaging layouts, reducing material waste and improving space utilization. AI-powered robotics enables dynamic, on-demand repackaging for e-commerce and seasonal promotions, offering speed and customization at scale.

One of the latest innovations is predictive packaging, where AI analyses consumer behaviour, inventory levels, and shipping routes to recommend the most efficient repackaging formats in advance. Natural language processing (NLP) also allows AI systems to interpret regulatory requirements across global markets, auto-adjusting labels or inserts accordingly. Integration with IoT devices further empowers AI to track product freshness, temperature sensitivity, or tampering, ensuring compliance and traceability.

Globalization & Export Compliance

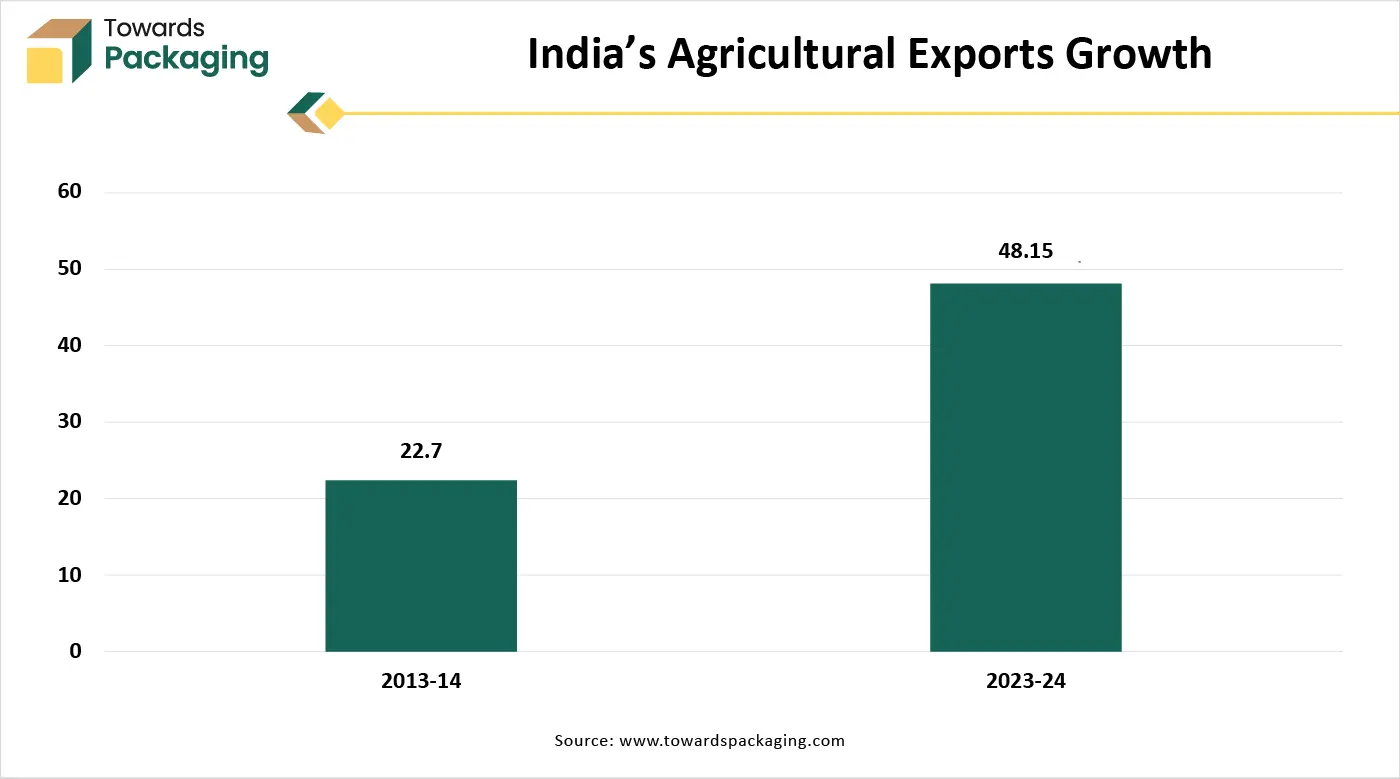

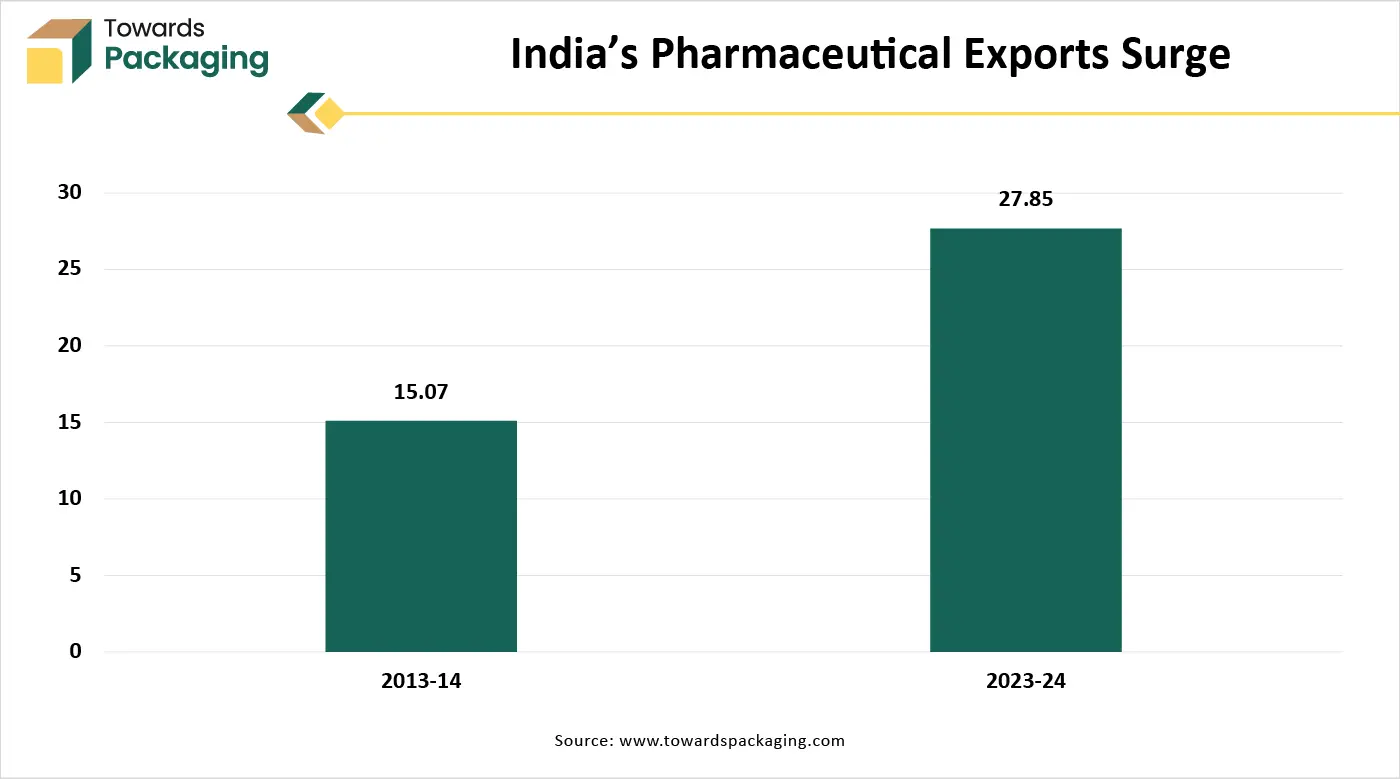

Products often need to be relabelled or repackaged to meet different regulatory standards, languages, or branding requirements across international markets. The rapid rise of e-commerce has led to increased demand for product customization, return-friendly packaging, and smaller shipment units, driving the need for flexible and responsive repackaging services. For instance, according to data published by the Ministry of Commerce and Industry and the Reserve Bank of India on services trade for March 2025, India’s overall exports reached an all-time high of USD 824.9 billion in the fiscal year 2024-2025. This represents a 6.01% increase over the USD 778.1 billion export total from the year 2024, marking a new turning point in the nation’s trading history.

Strict Regulatory Compliance & Environmental Concerns

Sectors like pharmaceuticals and food require adherence to stringent packaging and labeling regulations. Any non-compliance can lead to legal penalties, delays, or product recalls, making repackaging a risky task. Repackaging often involves manual labor, multiple handling processes, and specialized equipment, leading to increased labor and logistics expenses, especially for small- to mid-sized businesses. Repackaging can result in increased material waste if not managed sustainably.

Excess use of plastic or duplicate packaging layers conflicts with sustainability goals and may lead to regulatory pushback. Lack of trained personnel to handle advanced automation, AI, and customized packaging tasks can restrict efficiency and scalability. Multiple handling or improper repackaging increases the risk of damage, which affects product quality and customer trust.

| Metric | Details |

| Market Size in 2025 | USD 34.15 Billion |

| Projected Market Size in 2034 | USD 60.45 Billion |

| CAGR (2025 - 2034) | 6.55% |

| Leading Region | North America |

| Market Segmentation | By Packaging Type, By Product Type, By Function, By Packaging Material, By End-Use Industry and By Region |

| Top Key Players | Sharp Packaging Services, PCI Pharma Services, Berlin Packaging, Multi-Pack Solutions, Unicep Packaging, CoreRx, Inc., CCL Industries, Jones Healthcare Group. |

The bottles and jars packaging type segment is dominant in the repackaging service market due to its widespread applicability across various industries such as food and beverages, pharmaceuticals, cosmetics, and personal care. These packaging formats offer superior protection against contamination, leakage, and spoilage, ensuring product safety and extended shelf life. Their rigid structure and reusability make them ideal for repackaging services, especially for liquid and semi-liquid products. Additionally, bottles and jars are easily customizable and support efficient labeling and branding, which is essential for marketing and compliance purposes. Their convenience, durability, and recyclability further contribute to their strong market preference.

The sachets & pouches segment is the fastest-growing packaging type in the repackaging service market due to its cost-efficiency, lightweight nature, and adaptability across various product categories. This packaging format is particularly suitable for small quantities, single-use applications, and sample distribution, which is increasingly favoured in sectors like food and beverages, personal care, and pharmaceuticals. The rise in consumer preference for convenient, portable packaging drives its demand. Moreover, sachets and pouches require less material and space during storage and transportation, reducing logistics costs. Their compatibility with sustainable packaging initiatives and ease of customization further support their rapid market growth.

The pharmaceutical product type segment holds dominance in the repackaging service market due to stringent regulatory requirements, the need for precise labeling, and rising demand for unit-dose and patient-specific packaging. Repackaging services in this sector help improve medication adherence, enhance product traceability, and ensure compliance with safety standards. The growing prevalence of chronic diseases, the expanding elderly population, and the increasing use of prescription drugs contribute to the segment’s strong demand. Additionally, pharmaceutical companies rely on repackaging to manage recalls, extend product shelf life, and prevent counterfeiting. These critical needs make pharmaceuticals the most consistently serviced segment in the repackaging market.

The food & beverages product type segment is the fastest‑growing in the repackaging services market due to rising demand for convenience foods, sustainability, and e‑commerce resilience. Busy lifestyles and urbanization are boosting packaged, ready‑to‑eat, and grab‑and‑go products, which require smaller, user‑friendly units. Consumers increasingly demand eco‑friendly packaging, biodegradable, recyclable, or compostable, which pushes brands to adopt green repackaging to meet preferences. Additionally, E‑commerce growth makes secure, transit‑resilient packaging essential, prompting investment in strong, appealing formats. Innovations like active and intelligent packaging for freshness, traceability, and shelf‑life extension further accelerate demand.

The contract packaging segment is the dominant function segment in the repackaging service market due to its ability to offer scalable, cost-effective, and specialized solutions to a wide range of industries. Many manufacturers, especially in pharmaceuticals, food, cosmetics, and electronics, outsource packaging tasks to contract packagers to focus on core operations and reduce overhead costs. These providers offer advanced equipment, regulatory expertise, and flexible services such as labeling, barcoding, and secondary packaging. The increasing demand for quick market entry, customized packaging formats, and compliance with safety and traceability standards further boosts reliance on contract packaging, reinforcing its leading role in the market.

The private label packaging segment is the fastest-growing in the service packaging market, driven by shifting consumer preferences toward value-for-money alternatives, increasing retail control, and e-commerce’s expansion. Retailers are leveraging private label packaging to deliver consistent quality while avoiding expensive national-brand licensing and marketing fees. Enhanced consumer trust in private labels and their desire for eco-friendly options has encouraged retailers to innovate with sustainable materials and personalized designs. The rise of D2C and online retail further accelerates growth, as retailers directly market their own products using custom packaging solutions to stand out in crowded digital marketplaces.

The plastic packaging material segment is the dominant segment in the repackaging service market due to its versatility, durability, and cost-effectiveness. Plastic offers excellent barrier properties that protect products from moisture, air, and contaminants, making it ideal for a wide range of applications, including food, pharmaceuticals, personal care, and household products. Its lightweight nature reduces shipping costs and enhances handling efficiency. Moreover, plastic can be easily molded into various shapes and sizes, supporting innovative and customized packaging designs. The availability of recyclable and biodegradable plastic options also supports sustainability goals, further solidifying its widespread use in repackaging services.

Biodegradable and compostable materials are the fastest‑growing packaging segment in repackaging services due to rising environmental awareness, stricter regulations, and evolving consumer preferences. Governments worldwide are banning single‑use plastics and incentivizing sustainable alternatives, accelerating adoption. Consumers increasingly favour eco‑friendly packaging and are even willing to pay a premium, prompting brands to innovate with materials like PLA, PBAT, mushroom‑based composites, and seaweed blends. Technological advancements have improved the performance, durability, and compostability of these materials, making them compatible with existing supply chains. Infrastructure development, such as municipal composting programs and retailer partnerships, ensures effective end‑of‑life management, reinforcing growth.

The healthcare and life sciences end-use segment dominates the repackaging services market because it must meet stringent regulatory standards ensuring sterility, traceability, and anti-counterfeiting features crucial for patient safety. High-value products like biologics, vaccines, diagnostics, and personalized therapies require specialized unit-dose, cold‑chain, and tamper-evident packaging with smart tracking (e.g., RFID, sensors). Growing chronic diseases, aging populations, and expanding home healthcare drive demand for accurate, patient-friendly repackaging. Additionally, clinical research, including trial materials handling by CROs, requires clean, compliant repackaging to maintain trial integrity, reinforcing the segment's dominance across repackaging services.

The retail and e‑commerce segment is the fastest-growing segment in the repackaging service market due to booming online shopping, direct‑to‑consumer (D2C) brand growth, and demand for protective, branded packaging. The surge in internet usage and home delivery requires safe, visually appealing packaging that withstands transit and enhances customer experience, reducing returns. E‑commerce players prioritize sustainability, opting for eco‑friendly and right‑sized packaging to cut costs and carbon footprint. Customization and interactive elements like QR codes and RFID for traceability and branding strengthen consumer engagement. Efficient logistics integration and fulfillment expertise further accelerate this segment’s rapid expansion.

North America is the dominant region in the repackaging service market due to its well-established industrial base, advanced logistics infrastructure, and high demand from sectors like pharmaceuticals, food and beverage, and e-commerce. The region’s strict regulatory environment encourages frequent relabeling and compliance-based repackaging, especially in healthcare and export-driven industries. The rise in personalized and sustainable packaging, driven by eco-conscious consumers, has further boosted demand. Moreover, the widespread adoption of automation, AI, and digital printing technologies enhances operational efficiency and customization capabilities.

U.S. Market Trends

The U.S. holds the largest share of the North American repackaging service market. This dominance stems from its vast pharmaceutical, food, and e-commerce sectors, which require high volumes of repackaging for regulatory compliance, branding, and last-mile delivery efficiency. The U.S. also leads in adopting automation, smart packaging, and AI-driven systems that enable rapid and customized repackaging. Major players and co-packing service providers are headquartered here, supporting innovation and market scalability. The FDA's stringent labeling and serialization regulations further increase demand for repackaging, especially in life sciences.

Canada Market Trends

Canada is a growing market for repackaging services, driven by increasing exports, healthcare growth, and the push for bilingual (English and French) packaging requirements. The country’s rising eco-consciousness and government regulations around sustainable packaging have led to strong interest in green repackaging solutions. Additionally, Canadian logistics hubs near U.S. borders facilitate cross-border e-commerce, boosting demand for value-added repackaging before delivery.

Asia-Pacific is the fastest-growing region in the repackaging service market due to rapid industrialization, expanding manufacturing hubs, and rising cross-border trade. Countries like China, India, Japan, and South Korea are experiencing surging demand for repackaging across sectors such as pharmaceuticals, electronics, food and beverage, and personal care. The region’s booming e-commerce market, coupled with increasing urbanization and changing consumer preferences, drives the need for customized, compact, and sustainable packaging solutions. Moreover, governments are introducing stricter packaging regulations and promoting sustainability, prompting businesses to invest in advanced repackaging services.

China Market Trends

China leads the region’s repackaging market due to its massive manufacturing capacity, export-driven economy, and rapidly growing e-commerce sector. High volumes of consumer goods, electronics, and pharmaceuticals require frequent relabeling and repackaging to meet international standards. Additionally, China is heavily investing in smart factories and automation technologies, which enhance the efficiency of large-scale repackaging operations.

India Market Trends

India is witnessing rapid growth in repackaging services driven by its expanding pharmaceutical, food, and FMCG industries. The government’s push for “Make in India” and increased regulatory enforcement in drug labeling and food safety have boosted demand. India also benefits from a large, cost-effective workforce and growing e-commerce penetration, increasing the need for customized and regionalized packaging solutions.

Japan Market Trends

Japan’s repackaging market is shaped by its high standards for quality, hygiene, and precision. It has a mature pharmaceutical and electronics industry that demands advanced, compliant repackaging services. Japan also prioritizes minimalistic and sustainable packaging, encouraging innovation in eco-friendly repackaging solutions. An aging population and health-conscious consumers further support growth in medical and nutraceutical repackaging.

South Korea Market Trends

South Korea's tech-savvy consumer base and strong cosmetic and electronics exports make it a key player in premium and smart repackaging services. The country’s focus on design, aesthetics, and branding drives innovation in repackaging, especially for global K-beauty and tech product shipments. Strong infrastructure and automation adoption enhance repackaging speed and precision.

Europe is experiencing notable growth in the repackaging service market due to strong regulatory enforcement, sustainability mandates, and increasing cross-border trade within the EU. The region’s strict packaging and labeling regulations, especially in pharmaceuticals, food, and cosmetics, drive continuous demand for compliance-based repackaging services. The European Union’s push toward a circular economy and the Packaging and Packaging Waste Regulation (PPWR) have encouraged businesses to adopt recyclable, reusable, and minimalistic packaging formats, creating new opportunities for eco-focused repackaging.

Europe's mature e-commerce market and growing consumer demand for customized and localized packaging, including multilingual labeling, fuel growth. Countries like Germany, France, and the Netherlands serve as logistics and manufacturing hubs, further boosting the need for efficient repackaging before distribution. Technological innovation, such as smart labeling, AI-driven sorting, and digital printing, is also gaining traction in Europe, enabling faster, high-precision repackaging solutions aligned with consumer expectations and regulatory compliance.

By Packaging Type

By Product Type

By Function

By Packaging Material

By End-Use Industry

By Region

November 2025

November 2025

November 2025

December 2025