Bio-Based Packaging Market Growth Trends, Segment Insights, Regional Breakdown (NA, EU, APAC, LA, MEA), and Supplier & Manufacturer Assessment

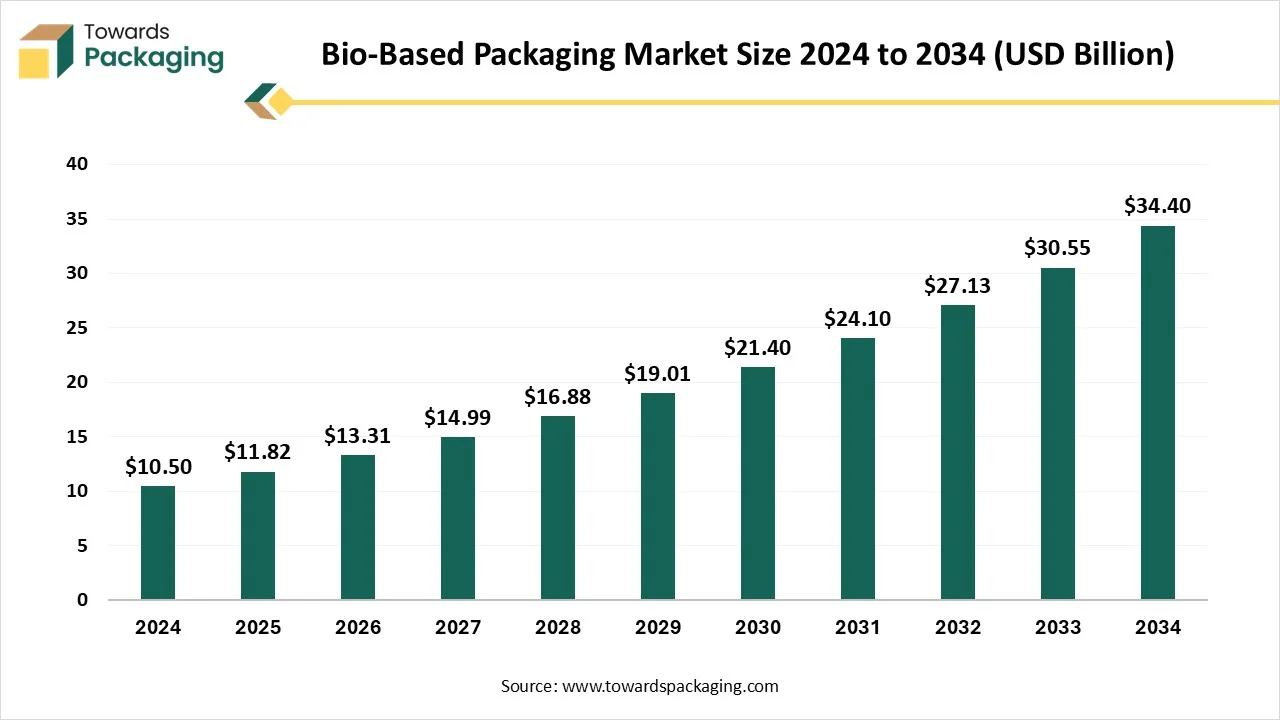

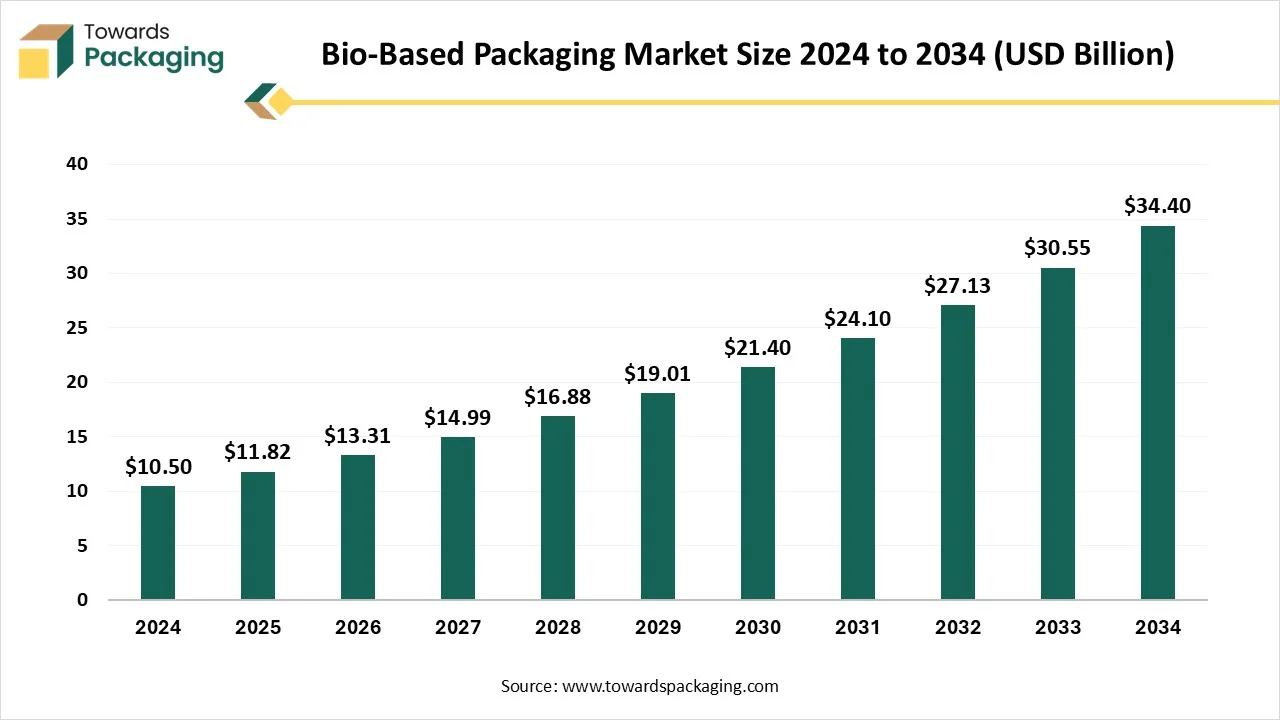

The bio-based packaging market is forecasted to expand from USD 13.31 billion in 2026 to USD 38.74 billion by 2035, growing at a CAGR of 12.60% from 2026 to 2035. The market covers extensive analysis of materials such as bioplastics (45% share in 2024), PLA, PHA, starch blends, Bio-PE, and Bio-PET, along with packaging formats like flexible packaging (58% share in 2024) and rigid packaging. Regional coverage spans North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with Asia-Pacific dominating at over 42% market share in 2024, while Europe showcases the fastest growth potential.

This study also includes competitive profiles of major companies such as NatureWorks, BASF, Braskem, Tetra Pak, Amcor, and Huhtamaki, along with a full value chain review, global trade statistics, and detailed data on manufacturers and suppliers shaping the industry.

Key Takeaways

- In terms of revenue, the market is valued at USD 11.82 billion in 2025.

- The market is projected to reach USD 38.74 billion by 2035.

- Rapid growth at a CAGR of 12.60% will be observed in the period between 2025 and 2034.

- Asia Pacific dominated the global market by holding more than 42% of the market share in 2024.

- Asia Pacific dominated the global market with the largest share in 2024.

- Europe is expected to grow at a notable CAGR from 2025 to 2034.

- By material type, the bioplastics segment contributed the biggest market share of 45% in 2024.

- By material type, the polyhydroxyalkanoates (PHA) segment is expected to expand at a significant CAGR between 2025 and 2034.

- By packaging format, the flexible packaging segment contributed the biggest market share of 58% in 2024.

- By packaging format, the rigid packaging segment will be expanding at a significant CAGR between 2025 and 2034.

- By application, the primary packaging segment contributed the biggest market share of 60% in 2024.

- By application, the secondary packaging segment is expanding at a significant CAGR between 2025 and 2034.

- By end-use industry, the food & beverage segment held the major market share of 48% in 2024.

- By end-use industry, the healthcare & pharmaceuticals segment is projected to grow at a CAGR between 2025 and 2034.

Market Overview

The global bio-based packaging market refers to the industry segment dedicated to the production and utilization of packaging materials derived from renewable biological resources, such as plants, agricultural waste, and microorganisms, rather than traditional fossil fuels. These materials are designed to be more sustainable and environmentally friendly, offering benefits like reduced carbon footprint, biodegradability, and compostability. The market is driven by increasing global awareness of environmental issues, stringent regulations on conventional plastic use, and a strong consumer preference for sustainable products. Bio-based packaging serves as a critical alternative for various applications, including food and beverage, personal care, pharmaceuticals, and e-commerce, contributing significantly to the transition towards a circular economy.

What are the New Trends in the Bio-Based Packaging Market?

Rising Technological Advancement

- Rising technological advancements in the area of sustainable packing are a major trend in the marketplace of bio-based plastic packing. To provide the altering requirement of the customers, there is are outline of new skills that chain the decomposable packaging.

Growing E-commerce and Online Shopping

- The rising change of the customers in the direction of online shopping and e-commerce enhances the demand for sustainable packing approaches.

Increasing Adoption of Eco-friendly Packaging

- The increasing adoption of eco-friendly packaging in several industries has influenced research and development in this market.

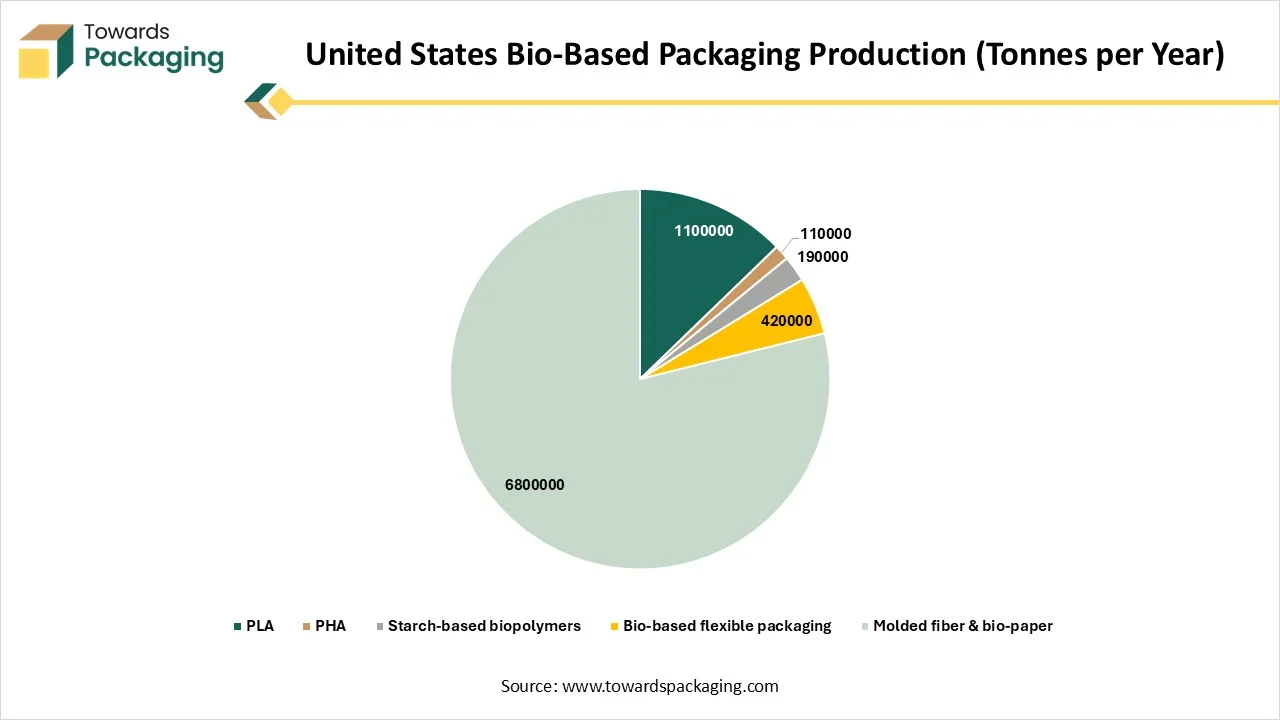

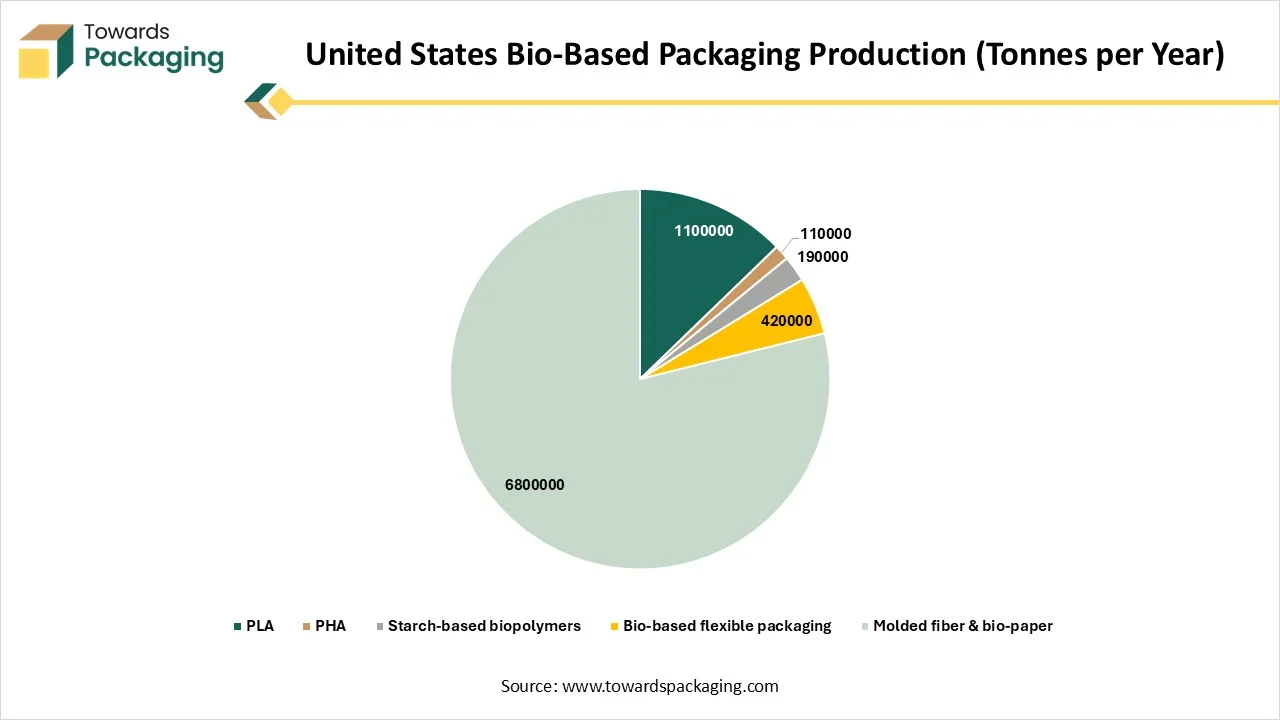

United States Bio-Based Packaging Production (Tonnes per Year)

| Material | Production |

| PLA | 1100000 |

| PHA | 110000 |

| Starch-based biopolymers | 190000 |

| Bio-based flexible packaging | 420000 |

| Molded fiber & bio-paper | 6800000 |

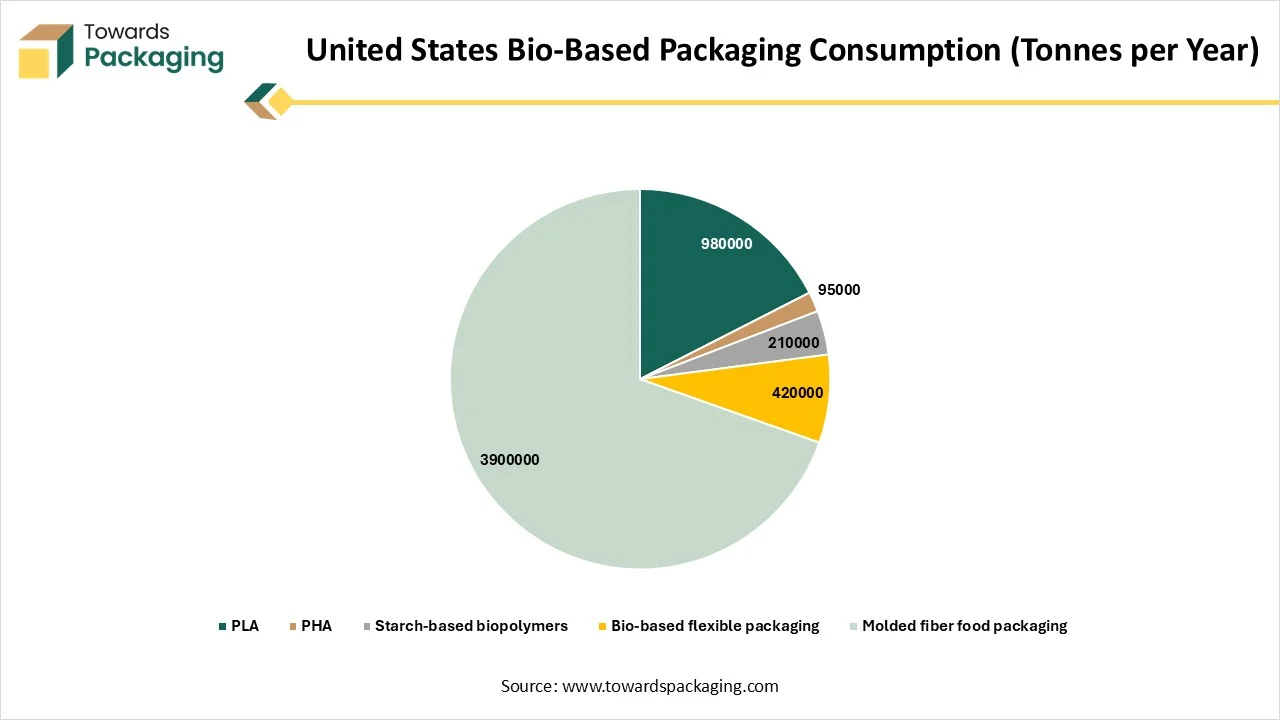

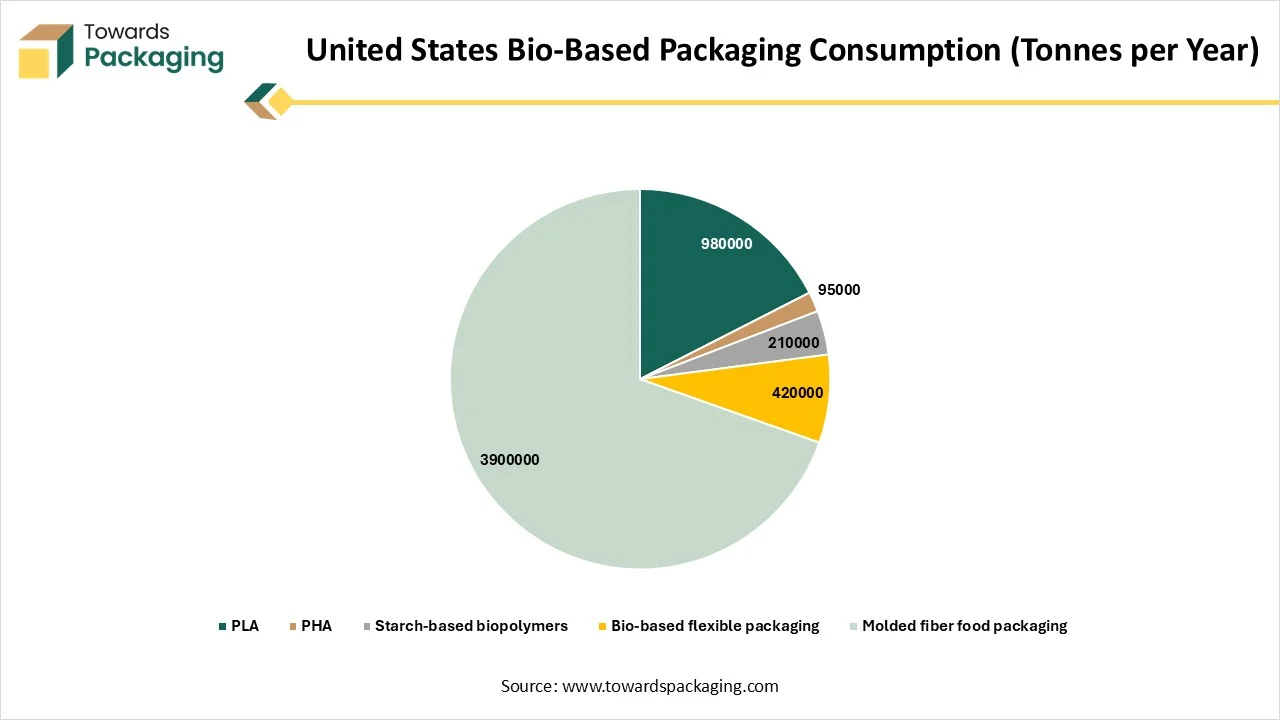

United States Bio-Based Packaging Consumption (Tonnes per Year)

| Material | Consumption |

| PLA | 980000 |

| PHA | 95000 |

| Starch-based biopolymers | 210000 |

| Bio-based flexible packaging | 420000 |

| Molded fiber food packaging | 3900000 |

How Can AI Improve the Global Bio-Based Packaging Market?

The incorporation of AI in the global bio-based packaging market plays an important role in transforming the production process of the packages. Advanced technology has helped to enhance the quality of the packaging, circularity, traceability, and optimization process. Machine learning and generative AI support in exploring huge chemical spaces and formulating new combinations which is recyclable and bio-degradable. It also helps to analyse the demand of the market and helps in reduction in wastage of materials. The growing promises of companies to use eco-friendly packaging have influenced the demand for the incorporation of artificial intelligence.

Market Dynamics

Drivers

Rising Demand for Sustainable Packaging

The continuous demand for sustainable packaging in several brands has driven the development of the bio-based packaging market. Consumers have become more concern about the ecological impact of traditional packaging resources, raising the demand for more sustainable choices. Meanwhile, bio-based packaging is classically generated from renewable materials and is recyclable and compostable. Thus, customer demand is the main reason for the development of the bio-based packaging sector. However, this type of packaging can offer advantages other than being sustainable. Therefore, bio-based packing may be lighter and stronger than traditional packaging resources, which expands its suitability for utilization.

Restraints

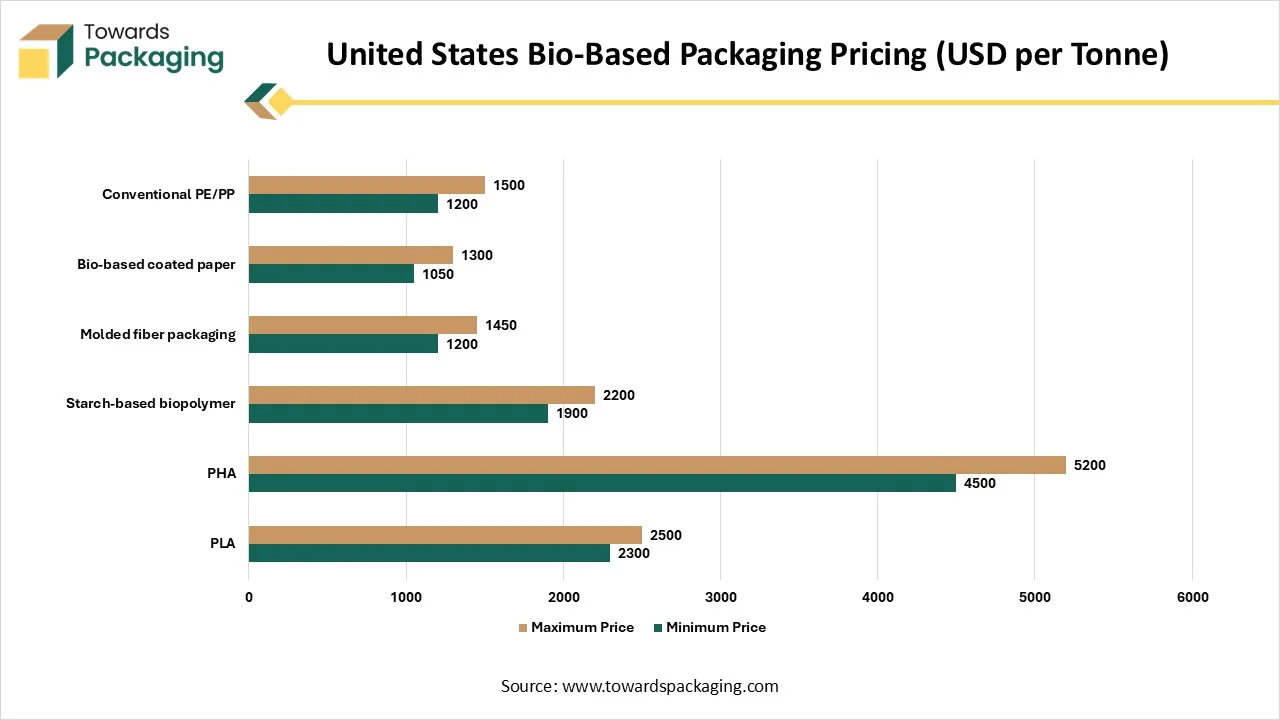

High Material Charges

The rising costs of materials have hindered the growth of the bio-based packaging market. The manufacture of bio-based resources often includes higher charges because of the utilization of renewable resources and the requirement for particular processing technologies. This charge factor can be a hindrance to the extensive acceptance of the global bio-based packing, particularly for small and medium-sized initiatives.

Opportunity

Rising Customer Consciousness Boosting

The main opportunity is the growing customer consciousness and increasing demand for sustainable packing solutions. As customers become more ecologically aware, they are looking for products with environment-friendly packing. This trend is inspiring producers to accept global bio-based packaging resources, generating a noteworthy market opportunity. Moreover, the rising e-commerce segment, which depends heavily on packing for product distribution, offers a lucrative chance for worldwide bio-based packaging solutions. Continuous technological progressions in bio-based resources and packaging skills.

Inventions in resources such as starch blends, PLA, and PHA are improving the presentation and cost-efficacy of bio-based packing. These progressions are generating bio-based substitutes progressively inexpensive with outmoded plastic packing in terms of sturdiness, elasticity, and affordability. The growth of new bio-based resources and the development of present ones are anticipated to drive the development of the industry. Additionally, the growing investment in study and the growth of progressive bio-based resources are opening up new opportunities for this sector.

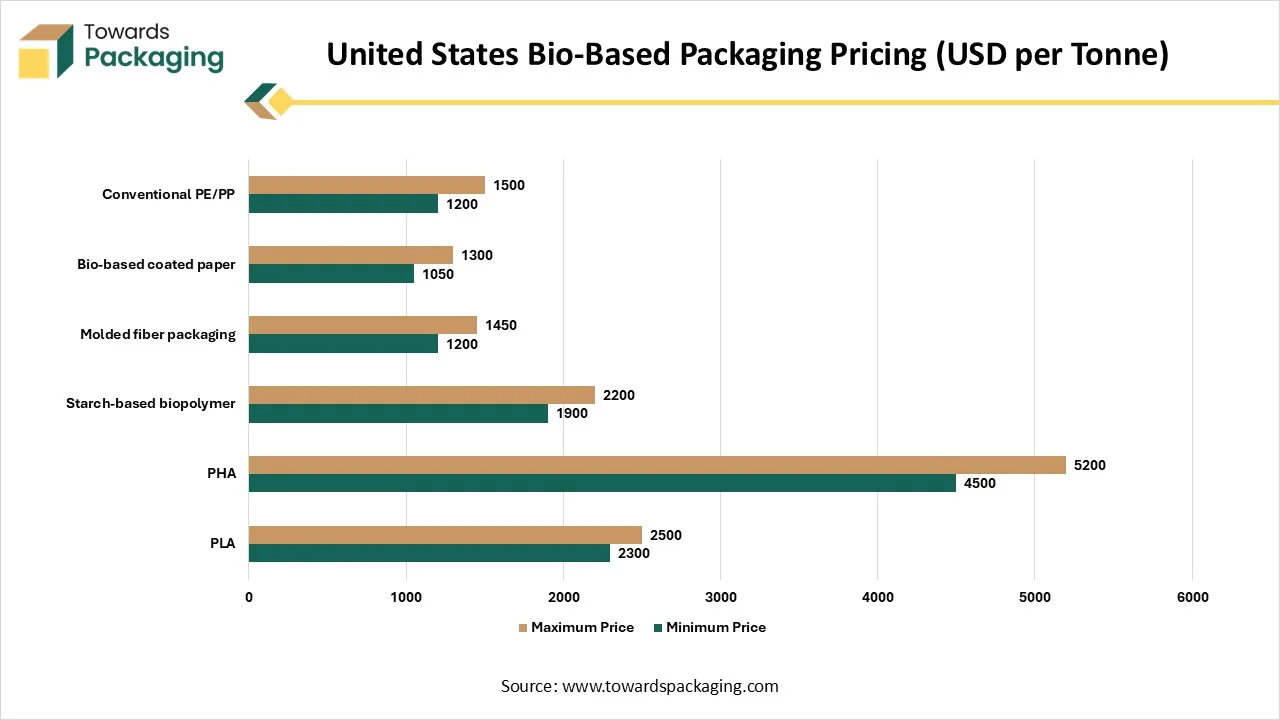

United States Bio-Based Packaging Pricing (USD per Tonne)

| Material | Minimum Price | Maximum Price |

| PLA | 2300 | 2500 |

| PHA | 4500 | 5200 |

| Starch-based biopolymer | 1900 | 2200 |

| Molded fiber packaging | 1200 | 1450 |

| Bio-based coated paper | 1050 | 1300 |

| Conventional PE/PP | 1200 | 1500 |

Segmental Insights

Why the Bioplastics Segment Dominated the Market in 2024?

The bioplastics segment contributed a considerable share of the global bio-based packaging market in 2024 due to the advancement of technology. The rising technological growth in the area of sustainable packaging is a major trend in this segment of bioplastic packaging. To supply the changing requirements of the customers, there is are overview of new technologies that help the recyclable packaging. Companies are constantly investing in their research and development, which has fuelled the growth of the market. This segment is developing continuously because of enhancements in the formulation of the bioplastics, which have improved the demand for this segment.

The polyhydroxyalkanoates (PHA) segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is widely demanded in the food & beverages industry. The rising concern about choosing packaging that is spill-proof and that does not react with oils. The increasing anti-plastic regulation in the food packaging industry has raised the demand for this segment profoundly.

Why the Flexible Packaging Segment Dominated the Market in 2024?

The flexible packaging segment is expected to have a considerable share of the global bio-based packaging market in 2024 due to rising demand for environment-friendly packaging. The rising drive of the sustainable enterprises is influencing the demand for flexible packing which are eco-friendly and bio-based. Industries are addressing the apprehensions associated with plastic waste by collaborating and developing biodegradable flexible packaging solutions. Flexible packaging decreases the demand for materials, which raises the demand for this market.

The rigid packaging segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. The bio-based global rigid packaging is observing the development by owing to the growing consciousness of the traditional plastic influence on the ecology. The corporation has pledged to endorse the circular economy and decrease ecological impact through its advanced bio-based solutions. The rising focus on innovation in this market has enhanced the demand for such packaging.

Why the Primary Packaging Segment Dominated the Market in 2024?

The primary packaging segment is expected to have a considerable share of the global bio-based packaging market in 2024 due to the growing customer demand for environment-friendly, sustainable, and safe packaging substitutes. Primary packaging includes packaging of pharmaceuticals, food & beverages, and personal care products. This segment is highly in demand due to branding and safety concerns. This segment is widely utilized due to high-end innovation in this sector, as this packaging remains in direct contact with the products.

The secondary packaging segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This type of packaging is high in demand due to the rising e-commerce, food & beverage, and retail sectors. This packaging segment comprises trays, wrapping, cartons, and boxes, which have raised the demand for this type of packaging.

Why the Food & Beverage Segment Dominated the Market in 2024?

The food & beverage segment is expected to have a considerable share of the global bio-based packaging market in 2024 due to the increasing demand for sustainable packaging solutions in the food and beverage industry. The growing demand for sustainable packing solutions to decrease food wastage and protect product integrity influences the development in this sector. The rising customer preference for environment-friendly packaging choices. With the companies looking for more sustainable packaging solutions, there is a rising demand for bio-based packaging in the food & beverage industry. Corporations are working collectively to find resolutions that are harmonized with ecologically friendly creativity.

The healthcare & pharmaceuticals segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This significant growth is mainly due to the growing demand for global bio-based packaging solutions in the healthcare & pharmaceutical sector, as it helps to protect the security and quality of medical supplies. This development is credited to the growing demand for global bio-based packing solutions in the engineering sector, as it helps to shield goods from damage throughout storage and transportation.

Regional Insights

Rising Population and Increasing Ecological Consciousness Demand Asia Pacific Promote Dominance

Asia Pacific held the largest share of the global bio-based packaging market in 2024, due to the rising population and rising ecological concerns among people. The presence of several global bio-based packaging producers in the region is influencing the growth of the market. This region is also profiting from favourable government strategies and creativity aimed at endorsing sustainable choices and decreasing plastic waste. The high demand for sustainable packing solutions and strict ecological guidelines are the main reasons driving development.

Europe’s Strong Ecological Guidelines Support Growth

Europe is estimated to grow at the fastest rate in the global bio-based packaging market during the forecast period. This market is driven in this region due to stringent environmental guidelines and high customer consciousness about sustainable packaging choices. Countries such as the U.K., Germany, Italy, France, and several others are leading the way in the acceptance of worldwide bio-based packaging, maintained by sturdy government provision and a well-recognized recycling infrastructure.

Top Companies in the Bio-Based Packaging Market

- NatureWorks LLC

- BASF SE

- Novamont S.p.A.

- TotalEnergies Corbion PLA

- Braskem S.A.

- Stora Enso Oyj

- Huhtamaki Oyj

- Amcor Plc

- Tetra Pak International S.A.

- Mondi Group

- International Paper

- Smurfit Kappa Group Plc

- Sonoco Products Company

- Innovia Films (now part of CCL Industries)

- TIPA Corp. Ltd.

- Futamura Chemical Co., Ltd.

- Danimer Scientific

- Biome Bioplastics Limited

- PTT Global Chemical Public Company Limited (PTT GC)

- Alpla Group

Latest Announcements by Industry Leaders

- In April 2025, Clariant’s Head of Global Marketing Coatings & Adhesives, Ray Gonzales, expressed, "The printing ink industry needs reliable solutions that can ensure consistent production schedules. Ceridust 1310 offers formulators the stability they need, reducing their vulnerability to carnauba wax supply fluctuations while maintaining high performance standards."

New Advancements in the Market

- In April 2025, Clariant announces the launch of Ceridust 1310, an innovative wax solution designed to address the increasing supply chain complexities facing formulators.

- In July 2025, INEOS Styrolution launched bio-attributed polystyrene for food packaging.

Bio-Based Packaging Market Segments

By Material Type

- Bioplastics

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- Starch Blends

- Bio-Polyethylene (Bio-PE)

- Bio-Polyethylene Terephthalate (Bio-PET)

- Polybutylene Adipate Terephthalate (PBAT)

- Other Biodegradable Bioplastics

- Other Bio-based Non-biodegradable Plastics

- Paper & Paperboard (from sustainable sources)

- Wood Fiber-Based Materials

- Other Natural Fibers (e.g., bamboo, sugarcane bagasse, mushroom mycelium, seaweed)

By Packaging Format

- Rigid Packaging

- Bottles & Jars

- Trays & Containers

- Clamshells

- Flexible Packaging

- Pouches & Sachets

- Bags & Wraps

- Films

By Application

- Primary Packaging

- Secondary Packaging

- Tertiary/Transport Packaging

By End-Use Industry

- Food & Beverage

- Personal Care & Cosmetics

- Healthcare & Pharmaceuticals

- Consumer Electronics

- E-commerce & Retail

- Other Consumer Goods

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Tags

FAQ's

Select User License to Buy

Figures (5)