Skincare Primary Packaging Market Growth, Innovations and Market Size Forecast

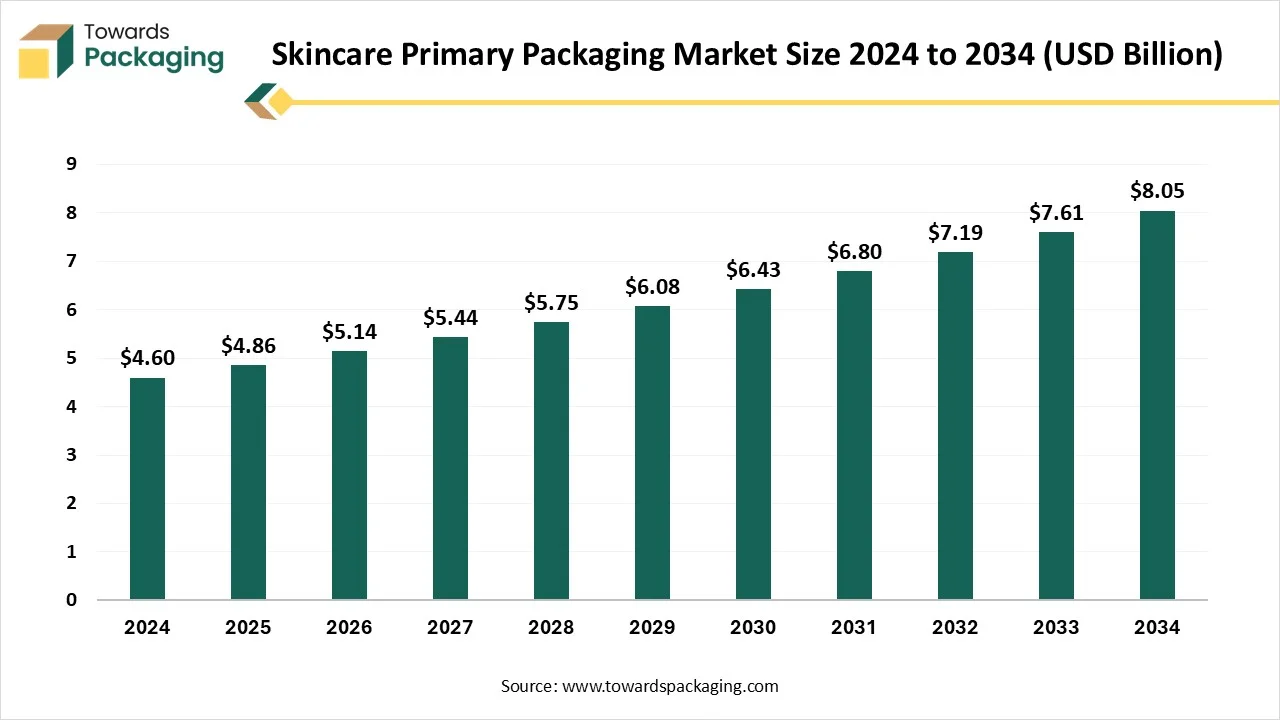

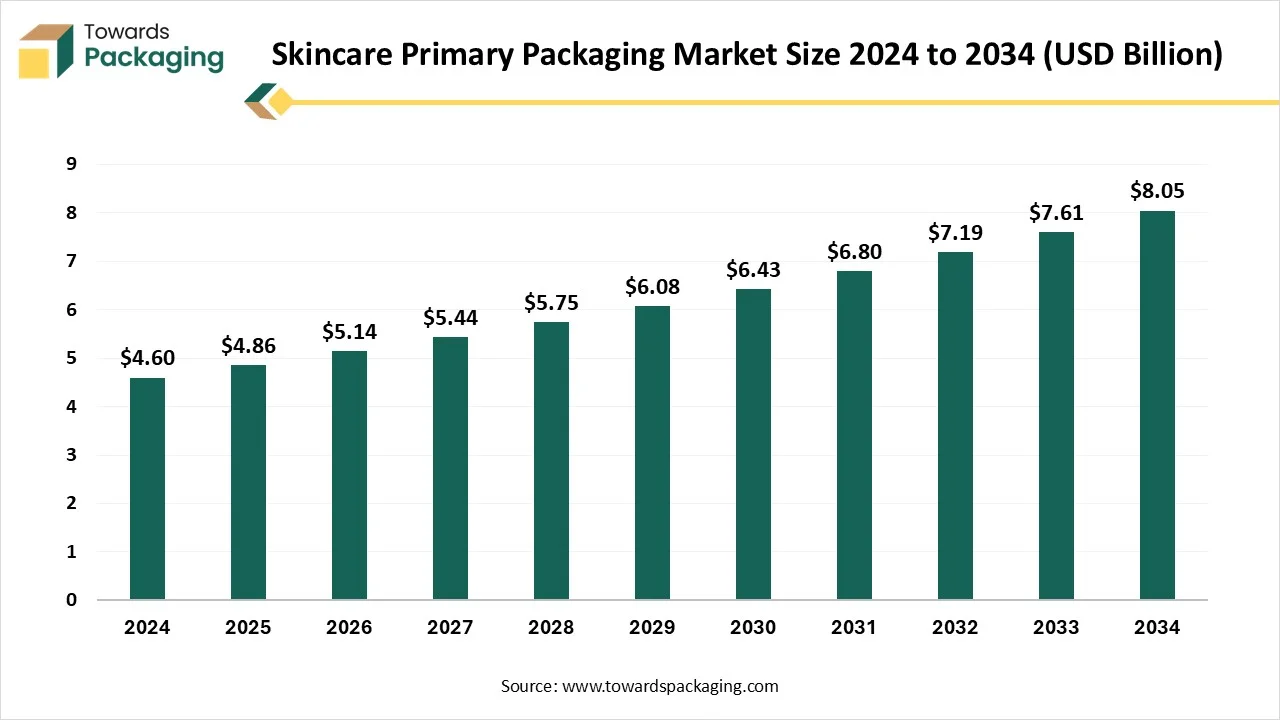

The skincare primary packaging market is projected to grow from USD 5.14 billion in 2026 to USD 8.51 billion by 2035, expanding at a CAGR of 5.75%. This report covers complete market size data, packaging material segmentation, product type analysis, and regional insights across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. It also includes competitive analysis of leading companies, value chain structure, global trade data, and detailed profiles of manufacturers and suppliers.

Key Takeaways

- In terms of revenue, the market is valued at USD 5.14 billion in 2026.

- The market is projected to reach USD 8.51 billion by 2035.

- Rapid growth at a CAGR of 5.75% will be observed in the period between 2025 and 2034.

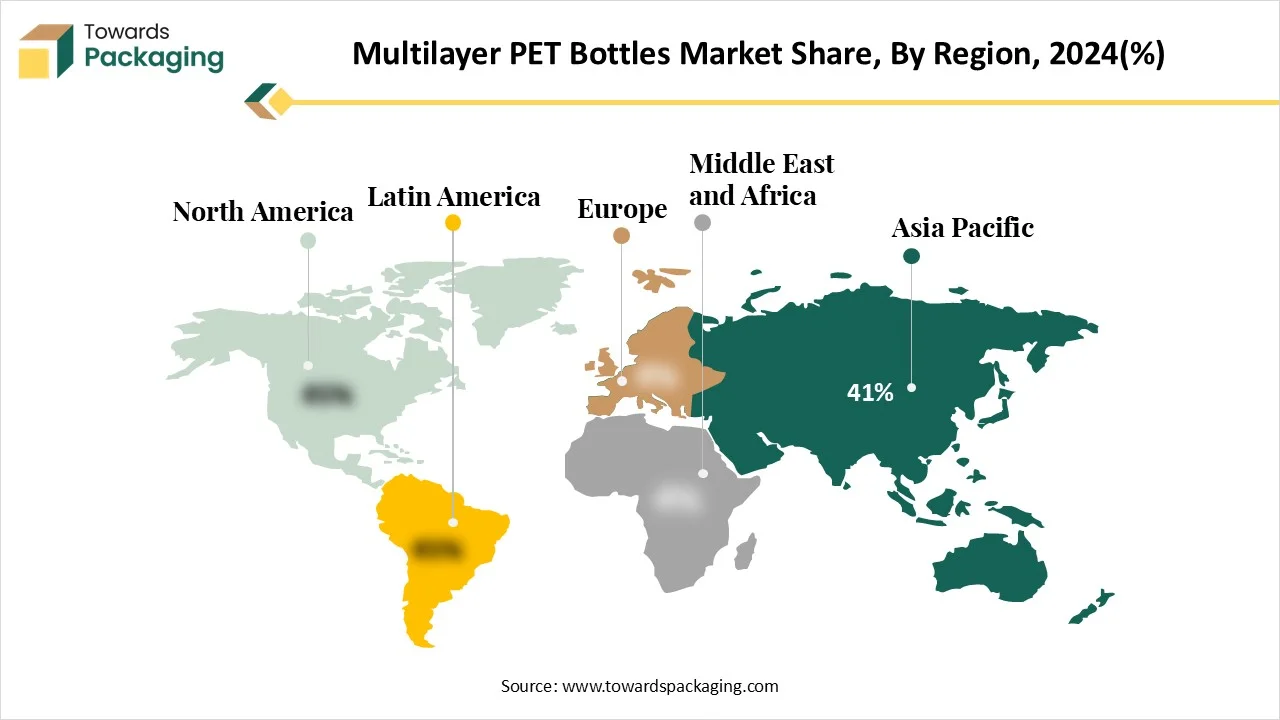

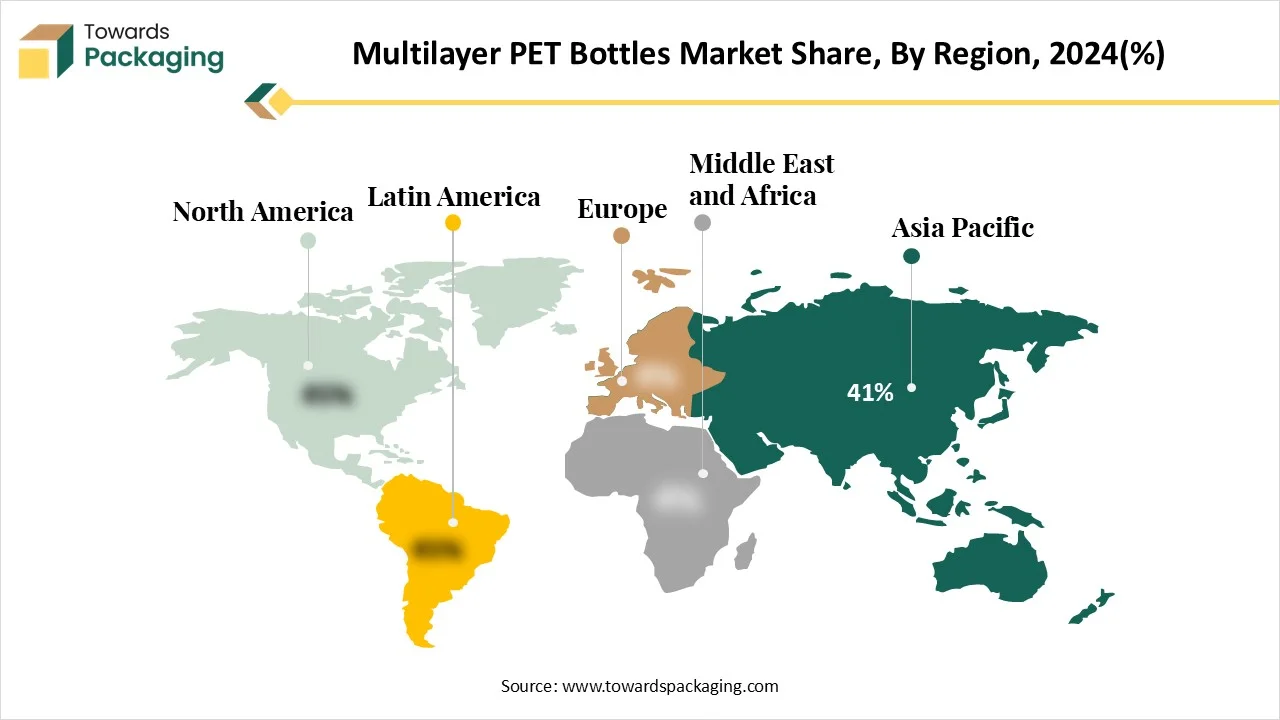

- Asia Pacific dominated the skincare primary packaging market in 2024 with 37% revenue share and is expected to further grow at the fastest CAGR.

- By material, the plastic (PE, PET, PP, Acrylic, etc.) segment accounted for the dominating share of 58% in 2023.

- By material, the biodegradable/bio-based Polymers segment is expected to witness a significant share during the forecast period.

- By packaging type, the bottles segment held a dominant presence in the market in 2024 with 32%.

- By packaging type, the airless packaging segment accounted for considerable growth in the global market over the forecast period.

- By product category, the face creams and moisturizers segment accounted for the dominating share of 28% in 2024

- By product category, the serums and ampoules segment is expected to witness a significant share during the forecast period.

- By end-user brand type, the mass-market/drugstore brands hold the majority of the 41% share in the global market in 2024.

- By end-user industry, the indie/clean beauty brands segment is projected to expand rapidly in the market in the coming years.

- By distribution channel, the skincare product manufacturers segment registered its dominance with 60% in 2024.

- By distribution channel, the online B2B platforms segment is expected to grow notably during the forecast period.

Market Overview

The skincare primary packaging market encompasses containers and delivery systems that directly hold skincare products such as creams, serums, lotions, oils, and gels. These packaging solutions ensure product safety, hygiene, shelf stability, and user convenience while playing a vital role in brand positioning and consumer experience. Primary packaging includes bottles, jars, tubes, pumps, droppers, and airless systems made from materials like plastic, glass, metal, and sustainable biopolymers.

What Are the Key Trends Driving the Growth of the Skincare Primary Packaging Market?

- The rising need for lightweight, durable, versatile, economical, and attractive packaging solutions is anticipated to boost the market’s revenue during the forecast period.

- The surge in anti-aging and acne issues is expected to drive the demand for specialized skincare products, bolstering the market’s growth during the forecast period.

- The increasing adoption of premium and luxury skincare products with innovative designs is expected to support the growth of the market during the forecast period

- The rising trend of online shopping for skincare products requires robust primary packaging that is visually appealing to customers and can withstand the rigors of shipping.

- Several manufacturers are increasingly focused on developing packaging solutions that safeguard the efficacy of the products and meet sustainability goals, which is expected to accelerate the market’s growth in the coming years.

- The increasing consumer awareness of skincare routines, especially among the young generation, is anticipated to propel the expansion of the market during the forecast period.

How is Artificial Intelligence Integration Impacting the Growth of the Skincare Primary Packaging Market?

In the era of a rapidly evolving digital landscape, the integration of artificial intelligence technology emerges as a transformative force and holds great potential to reshape the landscape of the skincare primary packaging market by enabling personalization, promoting sustainability, optimizing packaging dimensions, improving the supply chain, and reducing material waste. AI is playing an increasingly significant role in the future of the beauty and cosmetics industry. AI-powered automation enables faster, more precise packaging processes and ensures consistent quality.

AI-driven designs are becoming increasingly popular, creating new avenues for brand engagement and aligning with consumer needs for customized beauty solutions. By leveraging machine learning (ML) algorithms, companies can create more cost-effective, sustainable, lightweight, durable, and consumer-friendly packaging solutions. AI-driven software can effectively analyse large datasets to predict design trends, which assists brands in staying ahead in the long run.

Market Dynamics

Driver

How is the Rising Demand for Skincare Products Impacting the Skincare Primary Packaging Market’s Growth?

The growing demand for skincare products, particularly in developing and developed countries, is expected to drive market growth during the forecast period. Primary packaging of skincare products plays a crucial role in preserving the efficacy of the product, which can often be sensitive to air, light, moisture, and other environmental conditions. The market is witnessing an increasing focus on self-care, personal grooming, and other associated benefits of skincare has significantly increased consumer spending on skincare products, further propelling the market’s expansion in the coming years. Several brands are increasingly investing in innovative and luxurious packaging to cater to the evolving consumer preferences for premium skincare products. To align with the premium image, primary packaging is often designed to be visually appealing and sophisticated to the targeted customer.

Restraint

Fluctuating Raw Material Costs

The price volatility is expected to hinder the market's growth. The fluctuation in the price of raw materials has led to an increasing production cost of primary packaging solutions due to global supply chain disruptions and raw material shortages, which can adversely impact the profitability of manufacturers. In addition, high manufacturing costs are required for specialized processes like multi-layer co-extrusion and aseptic filling.

Opportunity

Growing Emphasis on Eco-friendly and Sustainable Packaging Solutions

The rising popularity of eco-friendly packaging materials is projected to create immense growth opportunities for the skincare primary packaging market in the coming years. The surge in environmental concerns and growing awareness of circular economy models enhances the adoption of sustainable packaging practices and is reshaping the primary packaging landscape. Recyclable, reusable, and biodegradable packaging are gaining immense popularity as they offer an eco-friendly packaging solution and a sustainable alternative to traditional plastic packaging. Several government regulations are promoting the adoption of sustainable, eco-friendly packaging materials to reduce the carbon footprint significantly.

The rising trend of online shopping and increased availability of skincare products are expected to propel the market’s expansion during the forecast period. It creates a need for lightweight, durable, and protective packaging that can withstand shipping and enhance the overall unboxing experience. Primary packaging solutions also provide important information about the contents of the product and other required information to educate the customers.

- According to the article published by the Census Bureau of the Department of Commerce in May 2025, e-commerce sales in the first quarter of 2025 accounted for 16.2 percent of total sales.

Segmental Insights

Why did the Plastic Segment Dominate the Skincare Primary Packaging Market in 2024?

The plastic (PE, PET, PP, Acrylic, etc.) segment held a dominant presence in the skincare primary packaging market in 2024, owing to its maximum strength, cost-effectiveness, versatility, durability, and excellent resistance to chemicals and heat. Several skincare brands prefer plastic material to lower their overall production costs while offering protection to the product against contamination, ensuring product freshness, and maintaining the efficacy of the product.

On the other hand, the biodegradable/bio-based polymers segment is expected to grow at the fastest CAGR. The growth of the segment is attributed to the rising consumer preference for eco-friendly materials and increasing environmental awareness. These packaging solutions are biodegradable, significantly assist in reducing carbon emissions. The brands operating in the skincare industry are increasingly adopting sustainable packaging options like those made from polylactic acid (PLA), polyhydroxyalkanoates (PHA), and other bio-based materials. Moreover, consumers are actively seeking products with eco-friendly packaging, which spurs the demand for biodegradable and bio-based packaging.

Which Packaging Type Held the Majority of the Share of the Skincare Primary Packaging Market in 2024?

The bottles dominated the circular economy in the market in 2024, owing to the increasing consumer preference for durable and aesthetically pleasing packaging options. The market is witnessing the continuous development of diversified packaging styles, including different sizes, shapes, and materials for skincare bottles. Glass bottles are gaining immense popularity in the premium segment owing to their recyclability and perceived luxury. Several businesses are heavily investing in developing innovative and sustainable bottles for skincare products. Brands are focusing on bottle packaging design that reduces the material use and maximizes recyclability.

On the other hand, the airless packaging segment is expected to grow at a notable rate during the forecast period, owing to its superior ability to effectively preserve the integrity of sensitive skincare formulations. These packaging solutions prevent air exposure and safeguard the products from oxidation and contamination, extending shelf life.

Rising Demand for Face Creams and Moisturizers Supports the Segment’s Dominance

The face creams and moisturizers segment is majorly driven by the rising awareness of skincare benefits, new product launches, and the surge in disposable incomes, particularly in developing and developed countries. Primary packaging protects the face cream and moisturizer from oxidation, contamination, and degradation, ensuring the product's efficacy and extending the shelf life. Primary packaging for face creams and moisturizers aims to maintain formula integrity and hygiene while also focusing on sustainability and evolving consumer preferences. The most common packaging types of face creams and moisturizers include tubes, pumps, dispensers, and bottles. Moreover, the increasing online sales sector is expected to create demand for convenient and accessible skincare products.

On the other hand, the serums and ampoules segment is expected to witness remarkable growth during the forecast period, owing to the rising consumer demand for specialized skincare products and the rising preferences towards preventative skincare routines. Primary packaging for serums and ampoules is designed to protect them from various environmental factors and maintain their integrity. The most widely used packaging includes plastic, glass, and others, each offering specific benefits.

Skincare Product Manufacturers Dominated the Market in 2024

The skincare product manufacturers segment accounted for the highest revenue share in 2024. Skincare product manufacturers often have their own direct sales channels. Skincare product manufacturers act as a prominent distribution channel, with online and offline channels such as supermarkets, convenience stores, and pharmacies. Manufacturers also collaborate with retailers to distribute their skincare products. Additionally, several prominent skincare brands leverage online platforms and their websites to reach a wider targeted customer base. Such factors are bolstering the segment’s growth during the forecast period.

On the other hand, the online B2B platforms segment is expected to grow at a significant rate. Online B2B platforms as a distribution channel play a crucial role for skincare brands, offering a streamlined way to effectively manage packaging needs and connect with suppliers. Online B2B platforms generally offer skincare brands with broad access to various suppliers and competitive pricing options.

By End-User

The mass-market/drugstore brands segment dominated the market with the largest share in 2024, owing to the rising incidence of skin issues, surge in disposable incomes, and growing awareness of skincare routines. Consumers are becoming more aware of skincare routines and their associated benefits, which creates substantial demand for skincare items. The segment is experiencing significant growth in the market, offering innovative, effective, and sustainable packaging solutions that cater to the evolving needs of consumers.

On the other hand, the indie/clean beauty brands are expected to grow at a notable rate, owing to the consumer demand for natural and organic ingredients. These brands are gaining immense popularity in the market for their unique and sustainable primary packaging options that align with their values and product formulations. Independent and clean beauty brands are increasingly focusing on eco-friendly and aesthetically pleasing packaging solutions like glass, recycled plastics, and others.

Regional Insights

Asia Pacific Is Dominating the Market

Asia Pacific held the dominant share is attributed to the rising presence of key market players, rising population, increasing availability of raw materials, rising awareness of skincare routines, the growing emphasis on sustainability, increasing investment in advancing packaging materials, rising consumer preferences for aesthetic packaging solutions, increasing disposable income, and rising consumer demand for premium and luxury skincare products. The surge in anti-aging and acne problems is driving demand for specialized skincare products in the region, further contributing to the market growth.

Asia Pacific is experiencing a shift toward recyclable, reusable, and biodegradable primary packaging solutions, driven by stringent government regulations aimed at reducing greenhouse gas emissions and improving environmental sustainability. To align with the circular economy principle, brands are investing heavily in sustainable packaging solutions. Several manufacturers are focusing on developing innovative packaging designs and printing on packaging to better connect with customers to gain a competitive edge. The trend of premiumization is driving higher demand for luxury skincare products, while the growth of online retail is expected to further boost the primary packaging market.

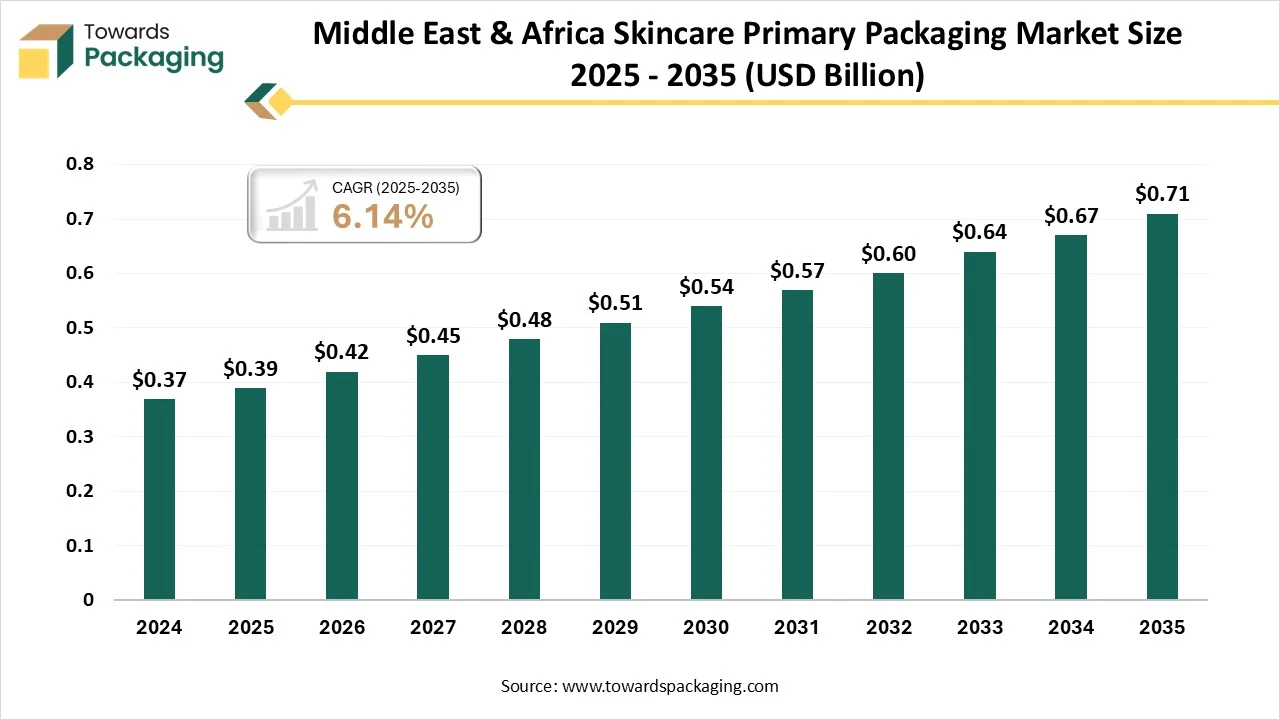

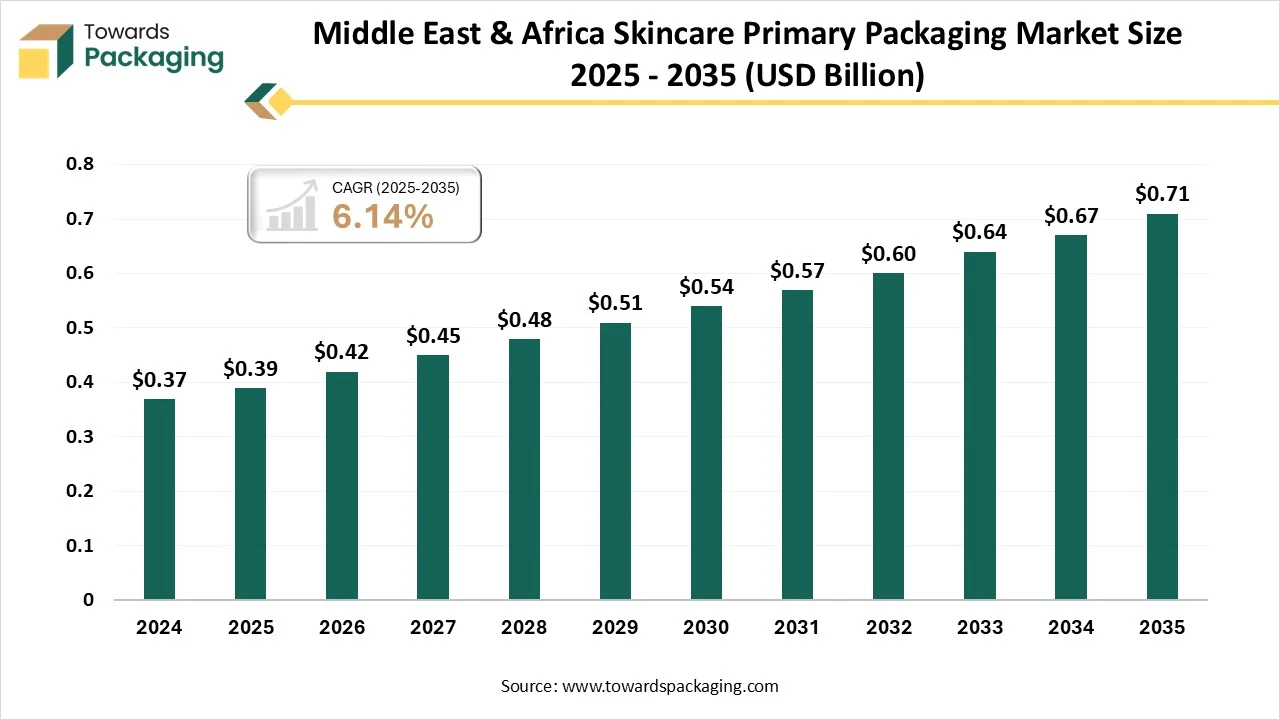

Middle East & Africa Skincare Primary Packaging Market Size 2025 - 2035 (USD Billion)

Top Skincare Primary Packaging Market Players

Latest Announcement by Industry Leader

- In November 2024, Avantium N.V., a frontrunner in the realm of renewable and circular polymers, announced a significant collaboration with Parfums Christian Dior, a luxury brand under the LVMH Group. This partnership marks a pivotal development in the cosmetics industry, as Dior will become the first brand to deploy Avantium’s innovative polymer, Releaf, in its primary packaging.

Recent Developments

- In March 2025, Japanese cosmetics company FANCL launched "toiro," a new skincare line with reusable packaging made with Eastman Tritan copolyester. It is an important step towards circular beauty. FANCL's latest skincare brand offers consumers a reusable primary package and refillable cartridges.

- In March 2025, the Skincare line offers bottles and refill cartridges with Eastman copolymer. Eastman’s Tritan copolyester unveiled its plan to implement a reusable primary pack and refillable cartridges for FANCL’s new skincare line; this aims to help reduce single-use plastic waste in the cosmetics sector.

Skincare Primary Packaging Market Segments

By Packaging Type

- Bottles

- Jars

- Tubes

- Pumps and Dispensers

- Droppers

- Airless Packaging

- Stick and Roll-On Packaging

- Sachets and Pouches

By Material

- Plastic (PE, PET, PP, Acrylic, etc.)

- Glass

- Metal (Aluminum, Tin)

- Paper-Based/Cardboard

- Biodegradable/Bio-Based Polymers

- Hybrid Materials

By Product Category

- Face Creams and Moisturizers

- Serums and Ampoules

- Sunscreens and SPF Products

- Cleansers and Toners

- Eye Creams and Gels

- Face Oils and Masks

- Body Lotions and Butters

By End-User Brand Type

- Premium/Luxury Brands

- Mass-Market/Drugstore Brands

- Indie/Clean Beauty Brands

- Derma-Cosmetic Brands

- Private Label/Contract Manufacturers

By Distribution Channel

- Skincare Product Manufacturers

- Cosmetic Packaging Distributors

- Online B2B Platforms

- Retail and E-Commerce Packaging Suppliers

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait