Corrugated Fanfold Market Review, Key Business Drivers & Industry Forecast

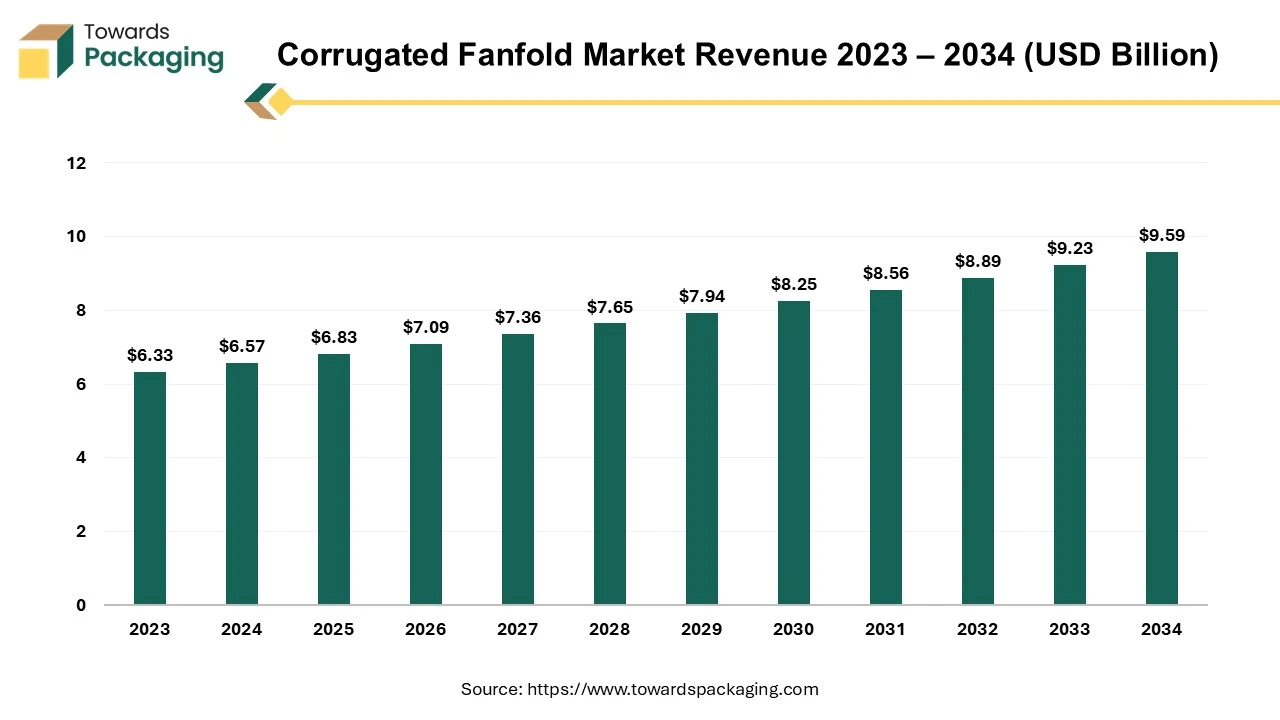

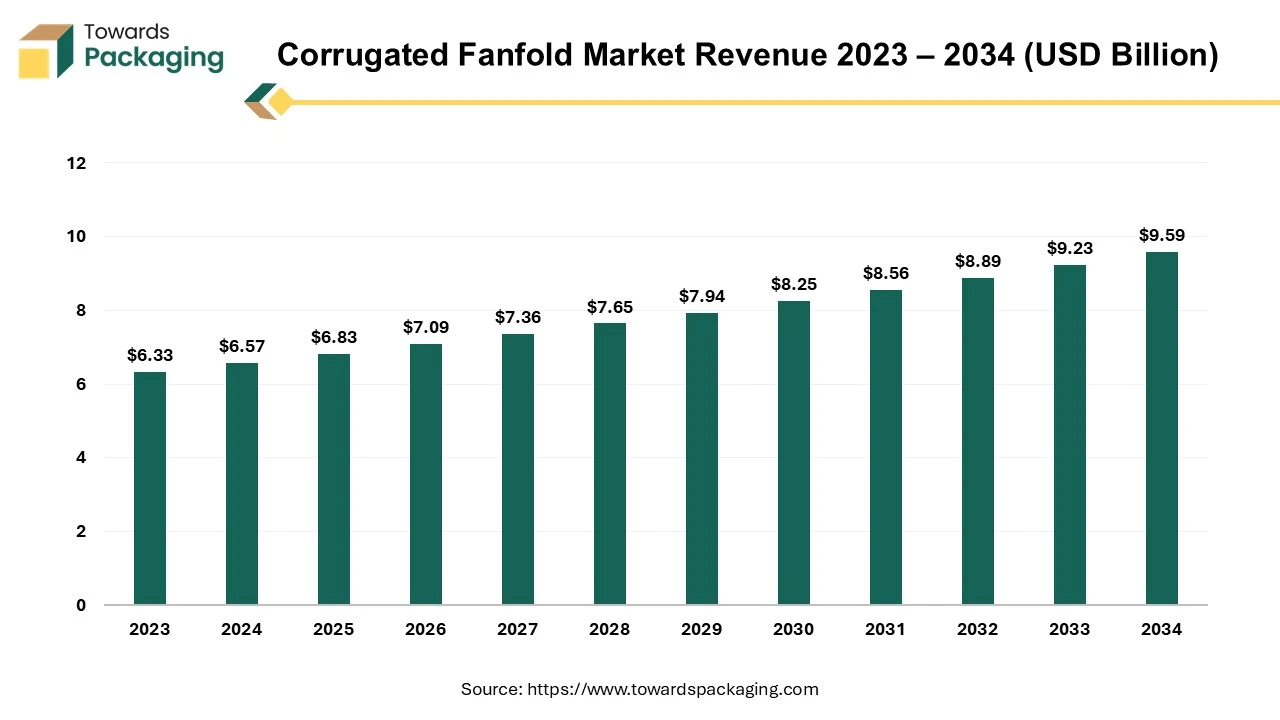

The corrugated fanfold market is forecasted to expand from USD 7.09 billion in 2026 to USD 9.95 billion by 2035, growing at a CAGR of 3.85% from 2026 to 2035. The report covers full segmentation data, including single wall’s leading share in 2024 and C flute’s dominance due to optimal strength and cushioning. Width categories show the below 500 mm segment posting the fastest growth, while digital printing captured the largest share in 2024.

Regionally, Asia Pacific led in 2024, while North America will register the fastest CAGR. Europe alone is forecast to grow from EUR 1,786.3 million in 2025 to EUR 2,698.6 million in 2034, with volume rising from 5,740.4 to 7,793.3 million m². The description also includes competitive benchmarking such as Smurfit Kappa’s 18.0% EBITDA margin, value chain coverage, and trade statistics to ensure full quantitative depth across manufacturers, suppliers, and regional markets.

The market proliferates due to the rising e-commerce sector and the requirement of shipping & logistics where the safe and durable packaging of products is required. There is an increasing demand for sustainable packaging among consumers and strict government guidelines result in the growth of corrugated fanfold market development.

Key Takeaways

- Asia Pacific led the corrugated fanfold market in 2024.

- By region, North America is expected to witness the highest CAGR during the forecast period.

- By wall type, the single wall segment held a dominant market share in 2024.

- By flute type, the c flute segment held a dominant market share in 2024.

- By width, the below 500 mm segment is anticipated to grow with the highest CAGR during the forecast period.

- By printing technology, the digital printing segment held a dominant market share in 2024.

- By end use, the shipping & logistics segment is anticipated to grow with the highest CAGR during the forecast period.

Market Overview

The global corrugated fanfold market is experiencing steady growth, driven by increasing demand across sectors such as electronics, automotive, and industrial goods, where long-distance transportation and durable packaging are essential. Corrugated fanfold, a multi-layer packaging material, offers high strength and resilience, making it suitable for withstanding wear and tear during shipping, storage, and retail handling.

A significant factor contributing to market growth is the rising demand for sustainable and eco-friendly packaging solutions. Corrugated fanfold is both biodegradable and recyclable, aligning with global sustainability goals and regulatory pressures. Innovations in packaging aimed at reducing carbon emissions have further reinforced the preference for corrugated materials.

According to a report by Smithers, the trend toward right-sized, on-demand packaging continues to accelerate, positioning corrugated fanfold as a key solution in modern supply chains.

Driver

Growing Advances in Packaging Facilities: Market’s Largest Driver

A key driver of the corrugated fanfold market is the growing advancement in packaging facilities aimed at enhancing product protection, sustainability, and cost efficiency. Corrugated fanfold packaging offers superior durability, moisture resistance, and product integrity qualities essential for sectors like e-commerce, electronics, and automotive that require long-distance and high-volume transportation.

The rising consumer preference for eco-friendly packaging is also accelerating demand, as corrugated fanfold is recyclable, biodegradable, and compatible with right-sized packaging strategies that reduce material waste. Moreover, the integration of smart packaging technologies to improve product safety, shelf life, and user interaction is gaining traction in the industry.

According to a report by Smithers, technological innovation in packaging design and automation is a major growth catalyst, helping manufacturers meet evolving consumer demands while maintaining operational efficiency.

EUROPE CORRUGATED FANFOLD MARKET - 2025-2034 (EUR MILLION & MILLION SQUARE METERS)

| Europe Corrugated Fanfold Market | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| Volume (Million Square Meters) | 5,740.4 | 5,936.7 | 6,141.4 | 6,354.0 | 6,573.7 | 6,801.2 | 7,037.4 | 7,282.5 | 7,536.1 | 7,793.3 |

| Value (EUR Million) | 1,786.3 | 1,868.3 | 1,958.3 | 2,053.4 | 2,150.6 | 2,250.4 | 2,354.5 | 2,463.9 | 2,579.2 | 2,698.6 |

EUROPE CORRUGATED FANFOLD MARKET - 2025-2034 - BY COUNTRY (VALUE))

| By Country (Value) | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| Germany | 490.4 | 513.7 | 539.3 | 566.3 | 594.0 | 622.5 | 652.3 | 683.6 | 716.7 | 751.0 |

| Poland | 134.4 | 140.0 | 146.2 | 152.6 | 159.2 | 165.9 | 172.9 | 180.2 | 187.9 | 195.8 |

| Austria | 79.3 | 82.3 | 85.6 | 89.0 | 92.4 | 95.9 | 99.5 | 103.3 | 107.2 | 111.3 |

| Czech Republic | 72.6 | 75.4 | 78.5 | 81.8 | 85.1 | 88.4 | 91.9 | 95.5 | 99.2 | 103.1 |

| Belgium | 109.9 | 115.0 | 120.5 | 126.4 | 132.4 | 138.6 | 145.0 | 151.7 | 158.9 | 166.3 |

| Netherlands | 140.7 | 147.8 | 155.6 | 163.8 | 172.3 | 181.0 | 190.2 | 199.8 | 210.0 | 220.7 |

| Switzerland | 94.3 | 98.3 | 102.8 | 107.5 | 112.2 | 117.1 | 122.2 | 127.5 | 133.1 | 138.9 |

| Rest of Europe | 664.6 | 695.7 | 729.9 | 766.0 | 803.0 | 841.0 | 880.6 | 922.3 | 966.2 | 1,011.6 |

Corrugated Fanfold Market Trends

- The corrugated fanfold market is witnessing notable trends driven by shifts in global supply chains, technological innovation, and sustainability mandates. A key trend is the rising demand from the e-commerce and retail sectors, which increasingly rely on corrugated fanfold for right-sized, durable, and cost-efficient packaging to handle high-volume, variable-sized shipments.

- Sustainability is at the forefront, with corrugated fanfold gaining preference due to its recyclable, biodegradable nature. Brands are aligning with environmental goals and regulatory standards by opting for eco-friendly packaging materials that minimize carbon footprints.

- Technological advancements, such as automated folding, cutting, and digital printing systems, are transforming production processes enhancing precision, reducing waste, and increasing throughput. These innovations allow manufacturers to meet custom packaging requirements efficiently, particularly in sectors like electronics, automotive, and industrial goods.

- According to a report by Smithers, the global shift toward automation and sustainable packaging is expected to accelerate demand for corrugated formats, positioning fanfold solutions as a key driver of future growth in the packaging industry.

Corrugated Fanfold Leading Suppliers (EBITDA margin, 2024)

| Rank | Supplier (global corrugated/fanfold) | 2024 EBITDA margin | Period basis |

| 1 | Smurfit Kappa | 18.00% | Q1-2024 |

| 2 | Smurfit WestRock (combined group) | 15.50% | Q4-2024 (Adjusted) |

| 3 | Mondi | 14.10% | FY-2024 |

| 4 | DS Smith | n/a (EBITDA margin not explicitly disclosed) | FY-2023/24 |

| 5 | International Paper | n/a (margin not disclosed) | FY-2024 |

- Smurfit Kappa 18.0% (Q1-2024): Reported revenue of €2.7B and EBITDA of €487M for Q1 2024, equating to an 18.0% margin. As one of the largest global fanfold producers, this figure shows strong operating efficiency despite challenging packaging demand conditions.

- Smurfit WestRock 15.5% (Q4-2024, Adjusted): The newly combined entity of SKG and WestRock reported adjusted EBITDA margin of 15.5% in Q4 2024. The merger helped create one of the world’s largest packaging companies, with scale efficiencies reflected in its margin performance.

- Mondi 14.1% (FY-2024): Mondi’s full-year 2024 EBITDA margin was 14.1%, down from 16.4% in 2023. The decline was mainly due to weaker pricing in containerboard and a reduction in forestry fair-value gains. Nevertheless, Mondi maintains a strong position in corrugated packaging, including fanfold solutions.

- DS Smith EBITDA margin not explicitly disclosed (FY-2023/24): Instead of EBITDA, DS Smith reports a “return on sales” (EBITA/revenue) of 10.3%. This is close to an operating margin but does not directly equate to EBITDA. Hence, a true EBITDA margin for 2024 is not available from company disclosures.

- International Paper margin not disclosed (FY-2024): International Paper’s 2024 results included net sales of $18.6B but did not report EBITDA or an EBITDA margin. As one of the world’s largest corrugated packaging companies, its profitability is significant, but no official 2024 EBITDA percentage is published.

Market Opportunity

Growing E-commerce Industry Resulted in Rising Demand for the Corrugated Fanfold Market

A major opportunity in the corrugated fanfold market lies in the rapid expansion of the global e-commerce sector. As online shopping continues to grow, so does the demand for efficient, durable, and customizable packaging solutions capable of protecting goods especially fragile items such as electronics and decorative products during long-distance transportation.

Corrugated fanfold packaging addresses these needs effectively, offering high structural integrity and adaptability for right-sized packaging. Its compatibility with automated folding, cutting, and printing systems enhances production speed and reduces labor costs, making it a cost-efficient solution for high-volume fulfillment operations.

The market is also being shaped by ongoing product innovations. For example, in February 2024, Kite Packaging launched its own corrugated fanfold product line, highlighting the rising industry investment in scalable and flexible packaging formats.

According to Smithers, the global push toward automation and sustainable, custom-fit packaging is expected to unlock significant growth opportunities for corrugated fanfold, particularly within logistics and e-commerce fulfillment ecosystems.

Regional Insights

North America’s Strategic Role in Corrugated Fanfold Market Growth

The corrugated fanfold market is experiencing notable growth, with North America emerging as a key regional contributor. This expansion is primarily attributed to the rapid rise of the e-commerce sector, which demands scalable, cost-effective, and sustainable packaging solutions. Corrugated fanfold packaging, known for its adaptability to automated systems and ability to create right-sized packaging on demand, is increasingly adopted to meet these requirements.

In particular, the U.S. and Canada are leading this regional surge due to their advanced logistics infrastructure and high volume of online retail activity. The presence of companies such as Anybox Machine, BC Boxes, Elite Custom Boxes, and Blue Box Packaging further supports regional market development through innovation in packaging materials, automation, and on-demand box production.

According to Smithers in its report, “The Future of Corrugated Packaging to 2027”, North America will continue to see strong growth in corrugated packaging, driven by automation, customization, and sustainability trends across supply chains.

Key Drivers:

- High demand for customized and right-sized packaging in e-commerce.

- Growing use of automated packaging technologies in fulfillment centers.

- Strong regional presence of packaging solution providers and innovators.

- Continued shift toward sustainable packaging materials and practices.

Asia Pacific Leads Corrugated Fanfold Market Amid Industrial Growth and Sustainability Shift

Asia Pacific is the largest regional market for corrugated fanfold packaging, accounting for the highest share in 2024. This dominance is driven by rapid urbanization, industrial expansion, and the rising demand for efficient packaging solutions across diverse sectors. Countries such as China, India, Japan, South Korea, and Thailand are witnessing significant growth in manufacturing activities, which directly fuels the demand for corrugated fanfold packaging.

The region's shift toward sustainable and recyclable packaging materials is further propelling market adoption. Corrugated fanfold boxes are particularly valued for their durability in high-volume transportation and for offering wide customization options that cater to industries ranging from consumer goods to automotive and electronics.

According to reports, Asia Pacific is expected to maintain its lead in the global corrugated packaging market, supported by industrial output, export activities, and rising awareness of eco-friendly packaging alternatives.

Key Insights:

- Largest Regional Market: Asia Pacific led the global corrugated fanfold market in 2024, with strong contributions from China, India, and Japan.

- Industrial Growth: Rapid development in manufacturing sectors is increasing the need for scalable, sturdy packaging.

- Sustainability Focus: Government policies and consumer demand are driving the shift toward recyclable and biodegradable materials.

- Heavy Transportation Needs: Corrugated fanfold packaging is preferred for its structural integrity and ability to withstand transit stress.

- Customization Advantage: High flexibility in box dimensions and styles supports various industry-specific packaging requirements.

Segmental Insights

Single Wall Segment Dominates Corrugated Fanfold Market in 2024 Due to Cost-Efficiency and Versatility

In 2024, the single wall segment dominated the corrugated fanfold market, driven by its balance of cost-efficiency, structural integrity, and widespread applicability. Single wall corrugated fanfold consists of one layer of fluted paper sandwiched between two linerboards, making it ideal for packaging medium-weight products while keeping material usage and costs low.

Its versatility allows it to be used across various industries such as retail, e-commerce, and consumer goods, where durability and affordability are key requirements. The growing demand for lightweight, customizable, and sustainable packaging solutions continues to support this segment’s expansion.

According to a report by Packaging Experts, single wall corrugated packaging remains the most widely used format due to its economic benefits and ability to meet the functional needs of most standard packaging applications.

Key Highlights:

- Leading Segment: Single wall type held the largest market share in 2024.

- Cost-Effective Solution: Offers an optimal mix of strength and affordability.

- Widespread Use: Ideal for medium-weight product packaging across diverse sectors.

- Sustainability Aligned: Supports industry demand for lighter, recyclable packaging formats.

C Flute Segment Leads Corrugated Fanfold Market in 2024 with Optimal Strength and Versatility

In 2024, the C flute segment held the largest share of the corrugated fanfold market, owing to its optimal balance of strength, cushioning, and flexibility. C flute, with approximately 38–41 flutes per foot and a thickness of around 3.6 mm, provides excellent crush resistance and stacking strength, making it suitable for a wide range of packaging applications, including shipping cartons and retail packaging.

Its versatility makes it a preferred choice for industries requiring both protective and presentable packaging solutions, such as consumer electronics, food & beverage, and household goods.

According to the Paperboard Packaging Council (PPC), C flute is widely used in the industry due to its performance advantages in both durability and print surface quality, contributing to its dominance in the corrugated packaging market.

Key Highlights:

- Leading Flute Type: C flute segment led the market in 2024.

- Balanced Performance: Offers superior cushioning and structural strength.

- Versatile Applications: Used in multiple industries for medium- to heavy-duty packaging.

- Industry Standard: Recognized for strong stacking capabilities and smooth surface for printing.

500 mm Width Segment Dominates Corrugated Fanfold Market in 2024 Driven by E-commerce and Manufacturing Demand

In 2024, the 500 mm width segment emerged as the leading segment in the corrugated fanfold market. This width size is widely preferred across the e-commerce, manufacturing, and retail sectors due to its ability to offer a balance between material efficiency and product protection.

Corrugated fanfold in 500 mm width is ideal for packaging medium-sized products, providing sufficient structural strength while minimizing material usage and cost. Its adaptability to automated packaging systems and suitability for custom-size box production make it a highly practical choice for high-volume operations.

According to packaging experts, corrugated fanfold formats in standardized widths like 500 mm are gaining traction due to their compatibility with modern packaging lines and increasing demand from logistics-intensive industries.

Key Highlights:

- Top Width Segment: 500 mm width led the market in 2024.

- Industry Preference: Favored in e-commerce, manufacturing, and retail for its protective and cost-effective characteristics.

- Material Efficiency: Offers optimal balance between strength and resource use.

- Automation Friendly: Compatible with automated packaging systems for streamlined operations.

Digital Printing Segment Leads Corrugated Fanfold Market as Demand for Customization and Branding Rises

During the forecast period, the digital printing segment led the corrugated fanfold market, driven by increasing demand for high-quality, customizable, and brand-centric packaging. As companies focus on enhancing product presentation and creating distinct brand identities, digital printing has become the preferred technology due to its speed, flexibility, and ability to handle short-run, variable-data printing.

Digital printing enables vivid graphics, quick design changes, and cost-effective production without the need for printing plates, making it ideal for e-commerce, retail, and consumer goods industries aiming for personalized and market-responsive packaging.

According to Smithers in its report “The Future of Digital Print for Packaging to 2026”, digital print for corrugated packaging is growing rapidly due to advancements in printhead technology, increasing demand for versioning, and the rise of direct-to-consumer models.

Key Highlights:

- Leading Technology: Digital printing led the corrugated fanfold market during the forecast period.

- Brand Differentiation: Supports unique brand identity through high-resolution, customized packaging.

- Cost and Time Efficiency: Ideal for short runs and fast turnaround with minimal setup time.

- Market Adaptability: Aligns with the needs of industries demanding personalized and visually engaging packaging.

By end use, the shipping & logistics segment led the corrugated fanfold market in 2024. This segment is influenced to provide essential protection at the time of transportation. It reduces shipping costs due to being light-weight and customized to consume less space.

Future of Corrugated Packaging Market

The corrugated packaging market is expected to expand from USD 309.86 billion in 2025 to USD 444.85 billion by 2034, growing at a CAGR of 4.10% from 2025 to 2034. Rapid expansion in online retail and the need for sturdy, cost-effective shipping solutions drive strong demand. Growing environmental regulations also push companies to adopt eco-friendly alternatives, fueling market growth.

Corrugated packaging refers to a type of lightweight, durable, and eco-friendly packaging manufactured from corrugated fiberboard, which consists of a fluted (wavy) middle layer sandwiched between two flat linerboards. This structure provides strength, impact resistance, and cushioning, making it ideal for shipping, storage, and product protection. Corrugated fiberboard is made up of three main components: liner board, fluting (Medium), and adhesives. The key benefits of corrugated packaging have been mentioned here as follows: strength, durability, cost-effective, lightweight, and versatility.

Future of Corrugated Boxes Market

The global corrugated boxes market is projected to reach USD 283.02 billion by 2034, expanding from USD 180.26 billion in 2025, at an annual growth rate of 5.14% during the forecast period from 2025 to 2034. Increasing trend towards sustainable packaging is significant factor anticipated to drive the growth of the corrugated boxes market over the forecast period.

A corrugated box is a disposable container with three layers of material on its sides an outside layer, an inner layer, and a middle layer. When weighted materials are placed inside a corrugated box, the intermediate layer, which is fluted is designed in stiff, wave-shaped arches that act as supports and cushions. The process of aligning corrugated plastic or fiberboard (also known as corrugated cardboard) design elements with the functional, processing, and end-use requirements is known as corrugated box design. Packaging engineers strive to keep overall system costs under control while satisfying a box's performance criteria.

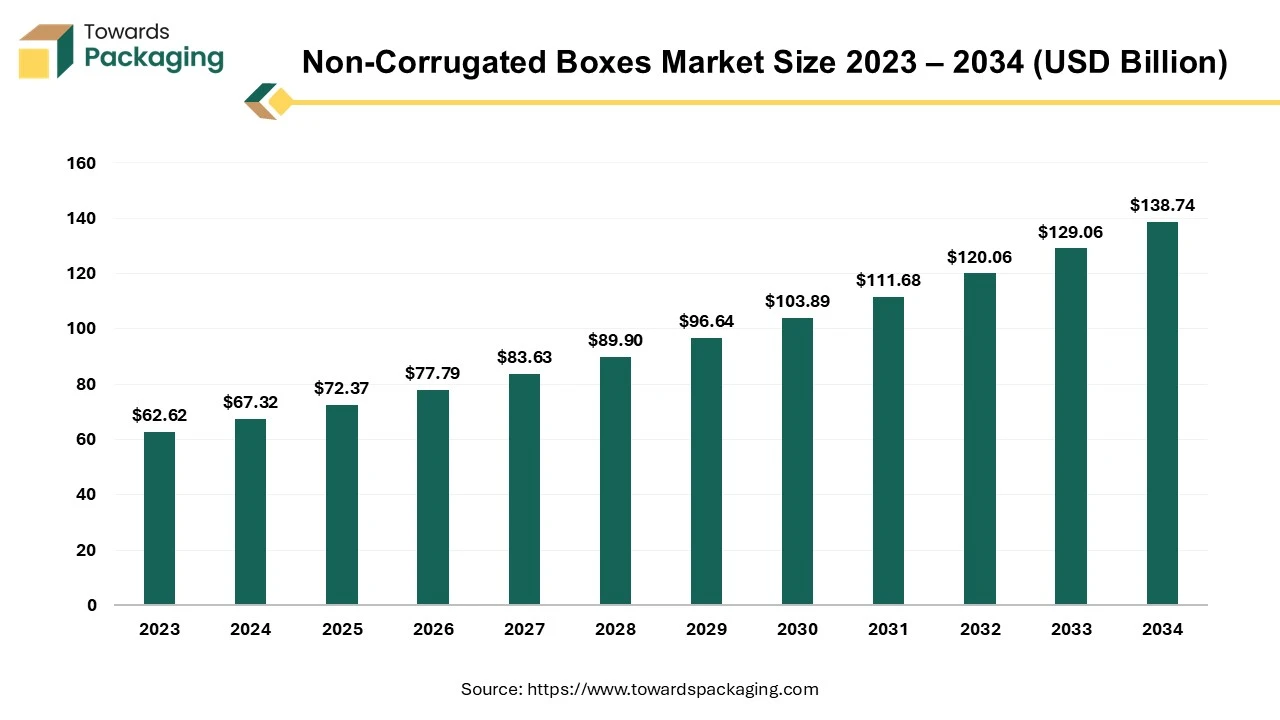

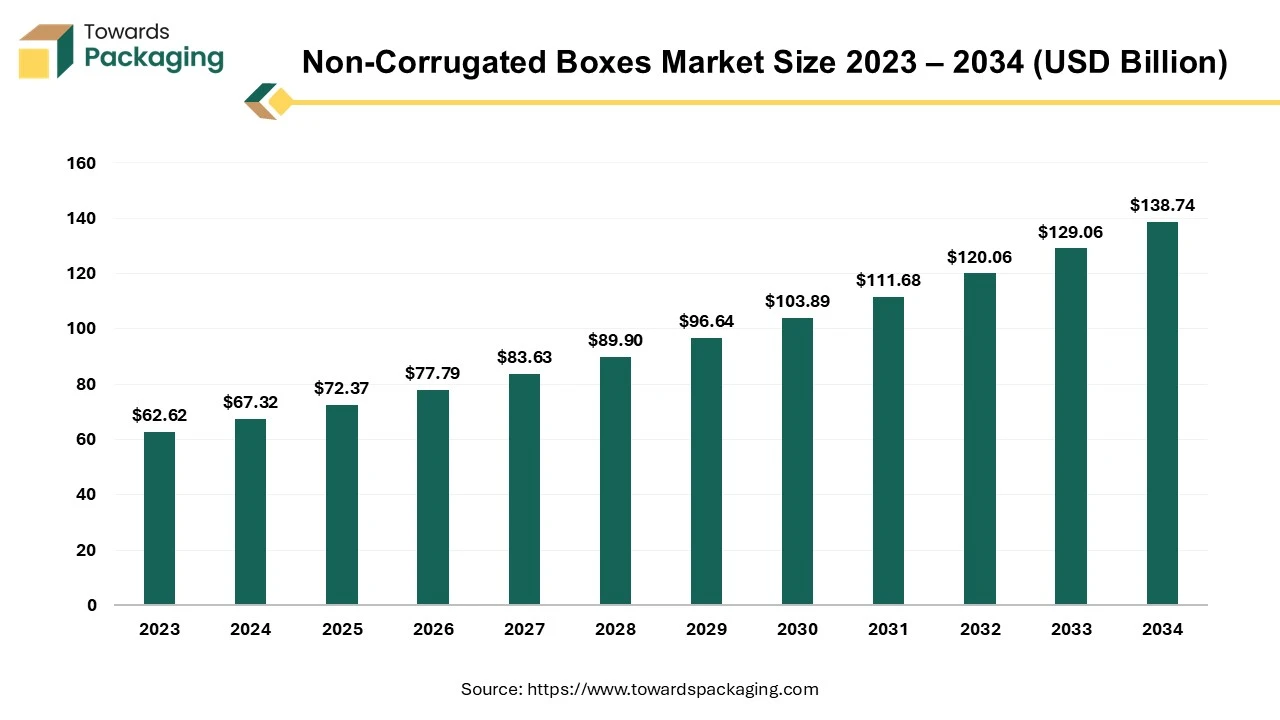

Future of Non-Corrugated Boxes Market

The non-corrugated boxes market is forecast to grow from USD 72.37 billion in 2025 to USD 138.74 billion by 2034, driven by a CAGR of 7.5% from 2025 to 2034. Due to rising trend of the fancy gift boxes the demand for the non-corrugated boxes increased which is estimated to drive the growth of the non-corrugated boxes market over the forecast period.

A non-corrugated box is a type of packaging box that does not have the fluted or ribbed layer found in corrugated boxes. Non-corrugated boxes are typically made from a single layer of material, such as cardboard, paperboard, or plastic. They lack the internal layer of fluted paper that corrugated boxes have. Common materials used for manufacturing non-corrugated boxes is paperboard, plastic, and cardboard among others. Plastic is in non-corrugated boxes manufacturing for meeting more durable and moisture-resistant packaging needs. Non-corrugated boxes are usually less durable than corrugated boxes because they lack the additional layer that provides cushioning and strength. They are often lighter, which can be beneficial for reducing shipping costs.

Corrugated Fanfold Market Developments – Key Innovations and Sustainability Moves

- VPK Group launches fit2size® (September 2022): In September 2022, VPK Group introduced its fit2size® brand a cutting-edge fanfold corrugated solution produced on a high-speed UniFold 220 line at its Alizay, France plant. Designed to meet growing e-commerce and logistics demands, fit2size® produces exact-size boxes on demand, reduces void fill, and minimizes SKU complexity using green-energy paper.

- SPAR Hungary debuts reusable F&V containers (February 2024): In February 2024, SPAR Hungary rolled out foldable, reusable, and fully recyclable transport boxes for fresh fruit and vegetables across its stores. This initiative aims to reduce single-use packaging and improve recycling rates, reflecting its commitment to environmental sustainability and safer produce handling

- INDEVCO unveils new corporate website (March 2024): In March 2024, INDEVCO an industry leader in innovative box packaging launched a redesigned website featuring its latest product offerings and packaging innovations, signaling a modernization of its digital presence to better serve clients and stakeholders

Corrugated Fanfold Market Top Companies List

- Nine Dragons Paper (Holdings) Ltd

- Smurfit Kappa Group Inc.

- Come Sure Group (Holdings) Limited

- International Paper Company

- Ribble Packaging Ltd.

- WestRock Company

- Rondo Ganahl Aktiengesellschaft

- DS Smith Plc

- Menasha Packaging Company, LLC

- Oji Holdings Corporation

- Papierfabrik Palm GmbH & Co KG

Corrugated Fanfold Market Segments

By Wall Type

- Single Wall

- Double Wall

- Triple Wall

By Flute Type

- C Flute

- B Flute

- E Flute

By Width

- Below 500 mm

- 501 to 1000 mm

- 1001 to 1500 mm

- Above 1500 mm

By Printing Technology

- Digital Printing

- Flexographic Printing

- Lithographic Printing

By End Use

- Shipping & Logistics

- E-Commerce

- Electronics & Home Appliance

- Pharmaceutical

- Personal Care & Cosmetics

- Furniture

- Food & Beverage

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Tags

FAQ's

Select User License to Buy

Figures (5)