Seed Packaging Market Intelligence, Benchmarking, Consumer Insights & Growth Strategies

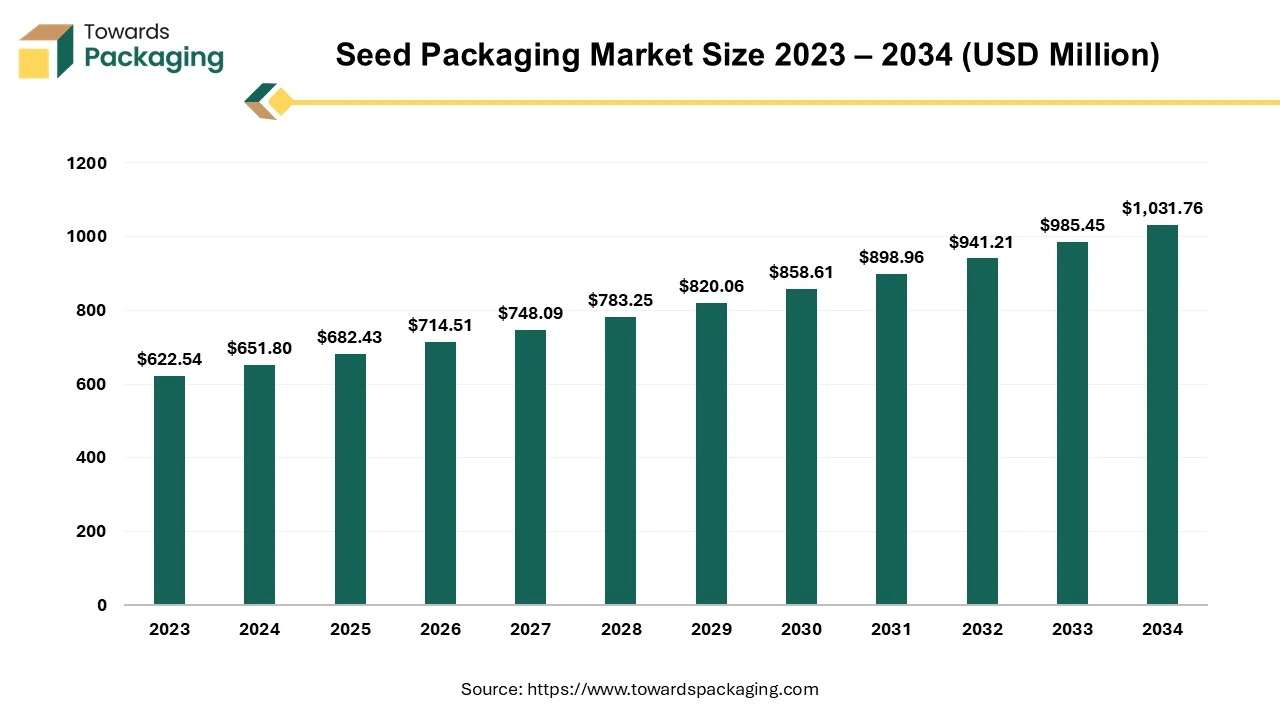

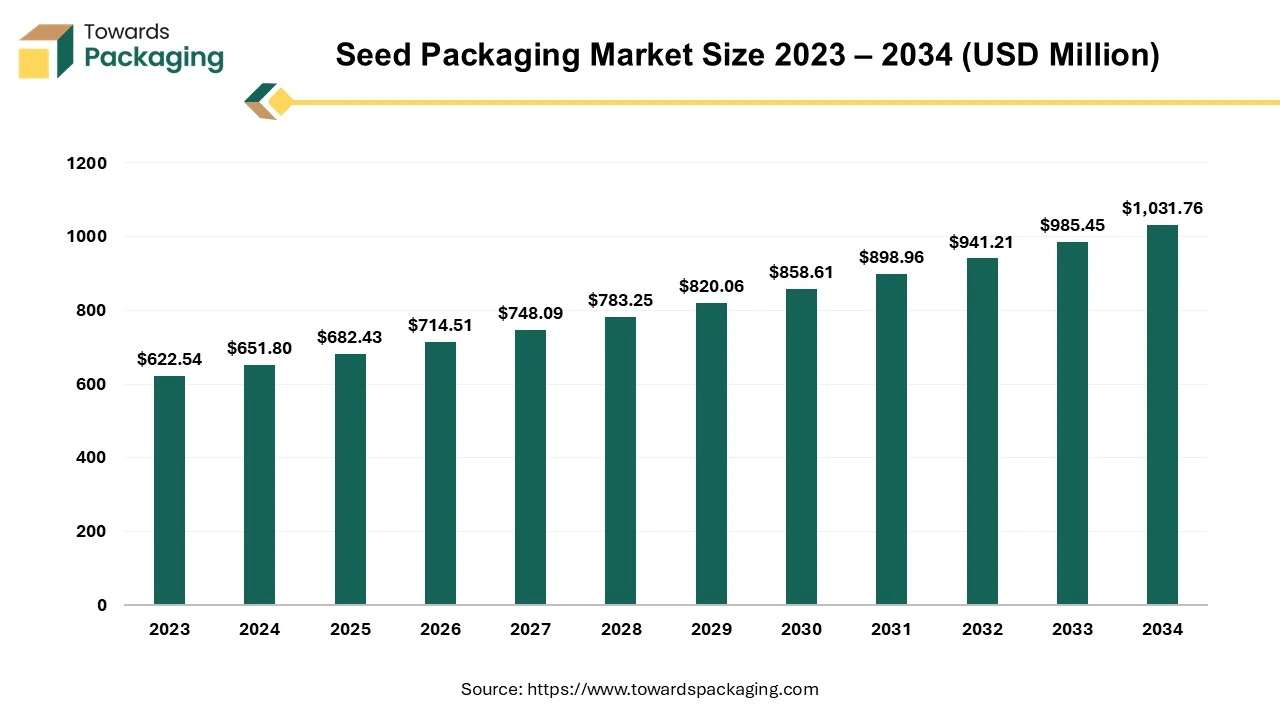

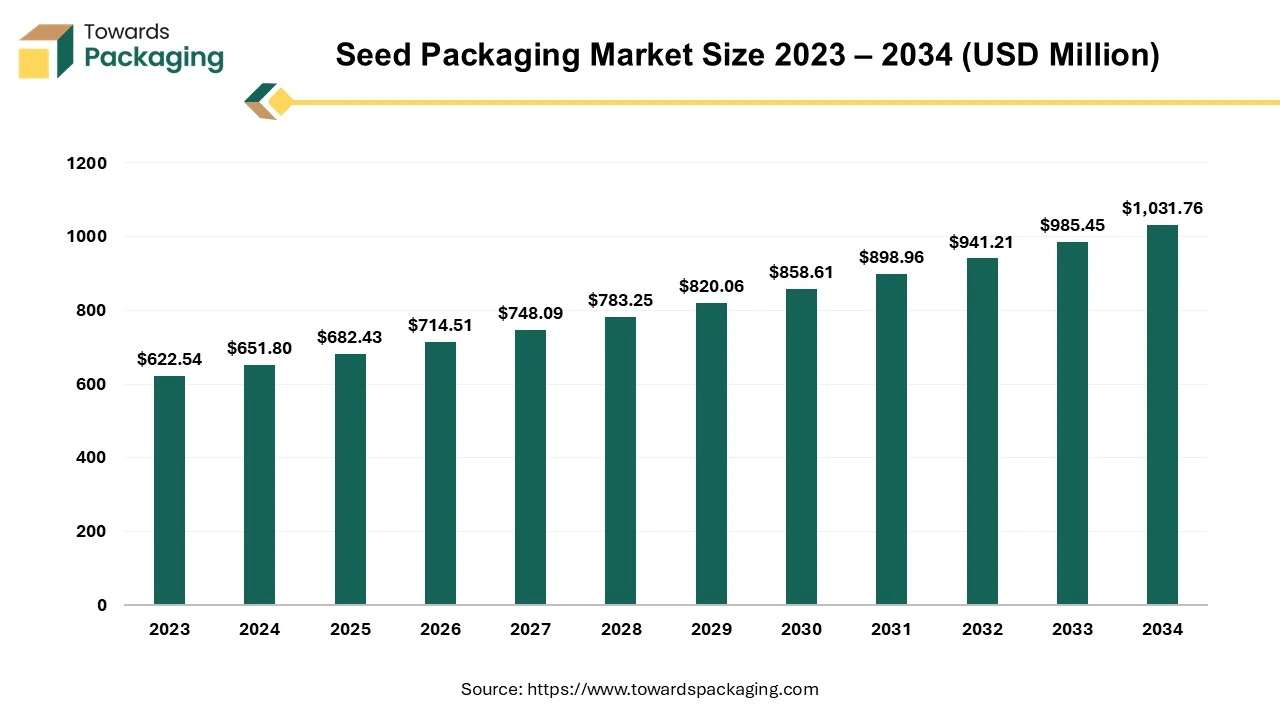

The seed packaging market is forecasted to expand from USD 714.51 million in 2026 to USD 1,080.26 million by 2035, growing at a CAGR of 4.7% from 2026 to 2035. This report provides comprehensive market size and growth data, including regional insights from North America, Asia Pacific, Europe, LATAM, and MEA. We cover key materials like plastic, paper, jute, and product types such as pouches and bags. The report also includes competitive analysis, key manufacturers such as DS Smith and Winpak, along with value chain analysis, trade data, and suppliers’ performance.

Report Highlights: Important Revelations

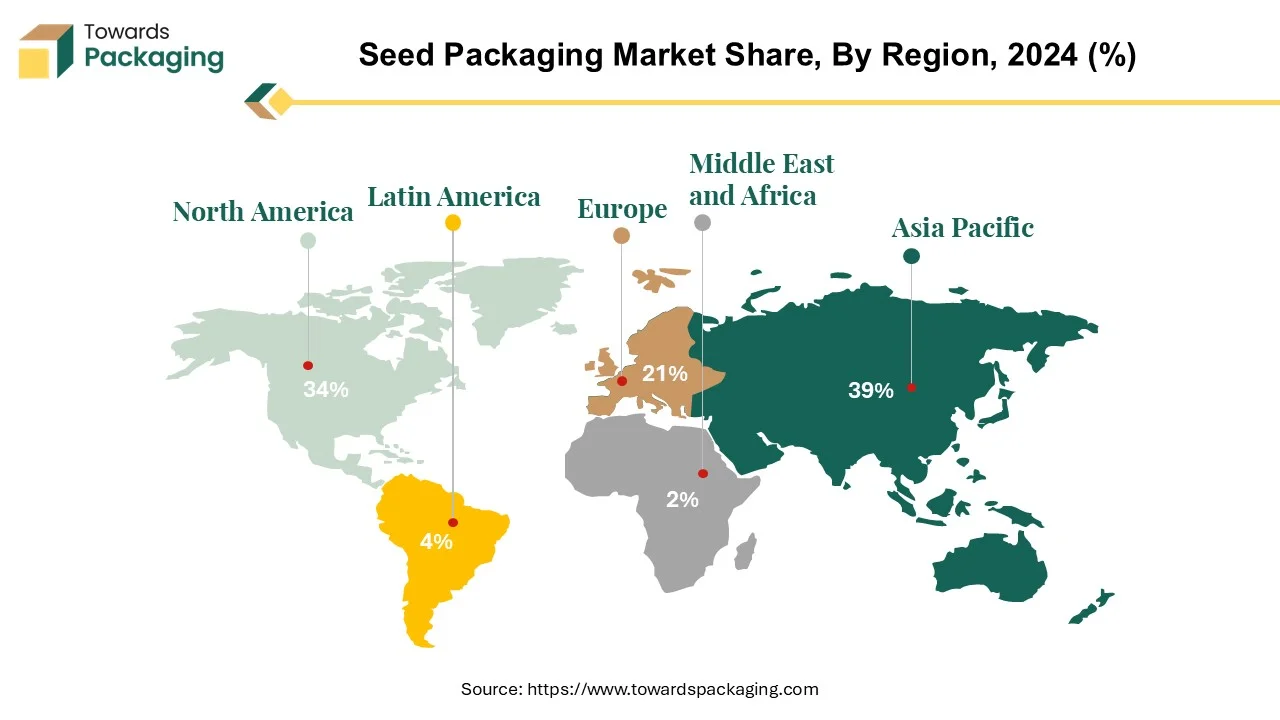

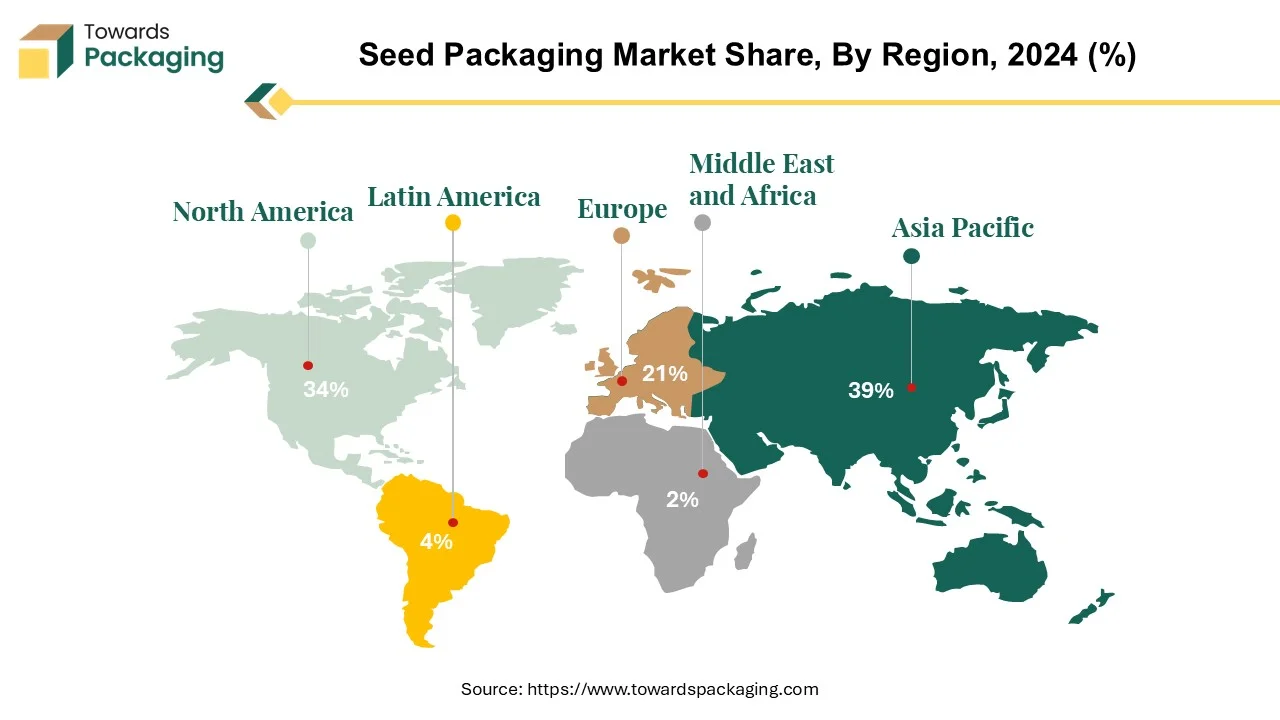

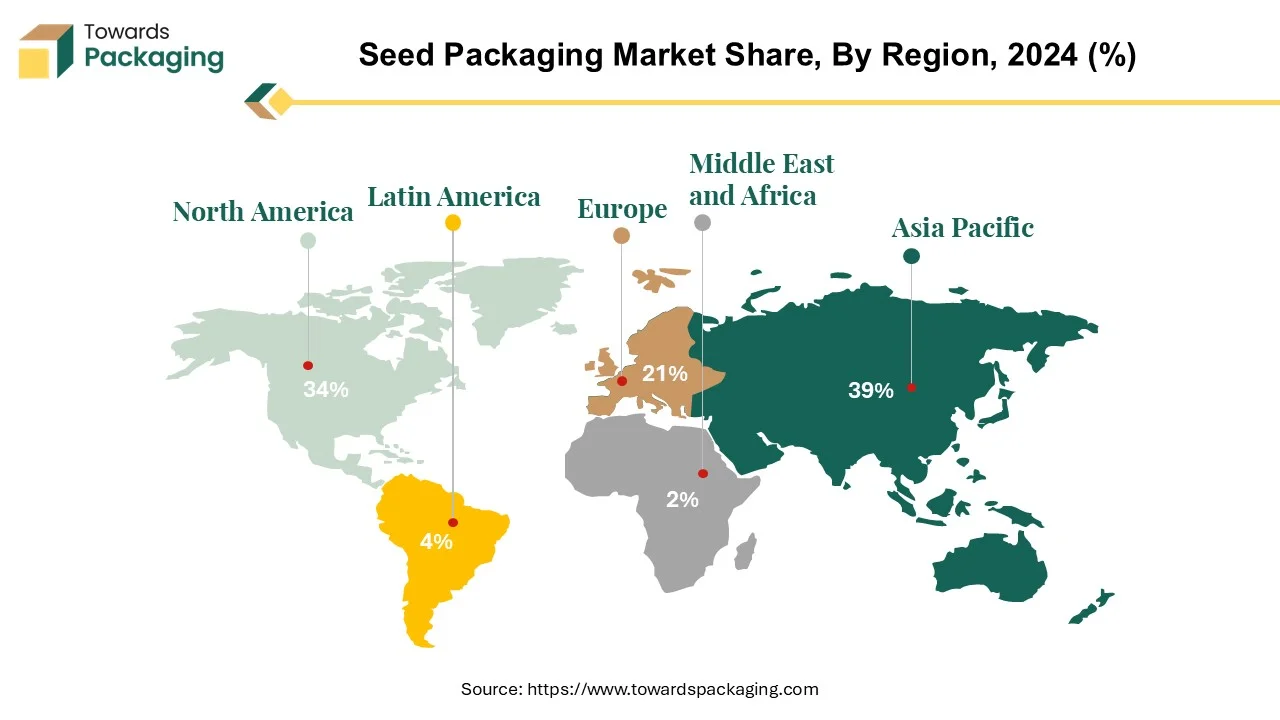

- The dominance of Asia Pacific in seed packaging market.

- North America's contribution to the evolution of seed packaging industry.

- Diverse approaches to plastic utilization in seed packaging across various economies.

- Finding the balance: Pouch packaging for seeds harmonizing convenience and protection.

- Streamlining agricultural operations enhancing efficiency in seed packaging.

- Elevating retail experience perfecting seed packaging for consumer satisfaction.

The seed packaging sector is essential in agriculture as a link between producers and farmers. Its primary activities include developing, manufacturing, and marketing packaging materials that protect seed integrity and ease planting processes. The growing global population and increased worries about food security have highlighted the importance of premium seed quality, fuelling the expansion of the seed packaging market, which grew by a noteworthy 6.3% globally. Recent years have seen a revolutionary surge of technological improvement in seed packing. These improvements have permitted the development of novel materials and procedures to improve seed preservation, extend shelf life, and increase handling efficiency.

A greater emphasis on environmental sustainability has accelerated the adoption of eco-friendly packaging solutions, significantly impacting market dynamics. Agricultural policies, the impacts of climate change, and changing customer tastes all impact the seed packaging industry. Market participants constantly react to these changes by providing customizable packaging alternatives, expanding their product offerings, and maintaining strict quality assurance standards.

The seed packaging market is poised for significant growth, aligning with agricultural advancements and shifting market landscapes while meeting farmers' and producers' changing needs globally.

For Instance,

- In January 2024, as it prepared to launch pilot programs with top CPG brands, edible packaging firm Dissolves was purchased by Generation Food Rural Partners I, LP, an investment firm established by the initial stages investor Big Idea Ventures.

Seed Packaging Market Trends

- There is a growing demand for sustainable seed packaging options as consumers and agricultural companies prioritize environmental concerns.

- Seed manufacturers focus on smart packaging designs that enhance product visibility, protection, and convenience.

- Seed packaging is a platform for agricultural companies to communicate their heritage, sustainability practices, and brand values to consumers.

- Seed packaging manufacturers focus on convenience and user-friendly features to enhance the planting experience for consumers and farmers.

Asia-Pacific's Seed Packaging Market Leading the Global Agriculture Revolution

The Asia-Pacific area is a prominent market in the seed packaging business for a variety of reasons. For starters, the region is home to some of the world's greatest agricultural producers, such as China and India, who strongly demand quality seeds to sustain their extensive agrarian sectors. According to original data from the Indian Council of Agricultural Research (ICAR), the official seed supply system comprises 53.25% of the public sector and 46.75% of the private sector. This high demand for seeds necessitates the development of effective seed-packing methods. Rapid urbanization and population growth in Asia-Pacific countries have strained agricultural production, driving demand for high-quality seeds and packaging. As more land is converted for urban expansion, improved seed varieties and packaging are required to enhance yields in limited agricultural areas.

- In 2023, India exported fruits and vegetable seeds valued at millions of Indian rupees to various regions, with the Philippines, South Korea, and Japan emerging as the leading destinations.

The Asia-Pacific region has significantly invested in agricultural technologies and infrastructure in recent years. These developments have increased seed production and sparked innovations in seed packaging, such as creating environmentally friendly materials and more effective packaging designs. Government regulations and programs that promote agricultural modernization and sustainability have helped to drive growth in the Asia-Pacific seed packaging industry.

The Asia-Pacific seed packaging market is driven by solid agricultural demand, population expansion, technical improvements, and supporting regulations, propelling it to the forefront of the worldwide seed packaging industry.

For Instance,

- In October 2021, the world's first international B2B marketplace for purchasing sustainable packaging products and materials, SourceGreenPackaging.com made its beta debut with an unknown, oversubscribed seed round that included support from several well-known sustainability veterans and leaders in the Asia-Pacific industry.

North America's Role in the Seed Packaging Market

North America is the second-largest region in the seed packaging market for various reasons. Its advanced agricultural sector requires sophisticated packaging solutions for efficient and high-yield crop production, particularly in the United States and Canada. North America had a 5% growth rate. Central and South America, on the other hand, had a tremendous 16.5% increase, boosted by increasing crop prices and rising seed prices, particularly for soybeans and cotton.

Global seed sales are expected to grow by 8.5% and 13% in 2022, respectively, in North America and Central and South America. This expansion in North America is aided by high energy and relatively high commodity prices, contributing to an upward trend in average seed prices.

North America's position as a significant participant in the global seed packaging business is further cemented by the region's established network of seed producers, distributors, and retailers, facilitating effective market penetration and distribution of seed packaging goods.

For Instance,

- In March 2023, Victor Schaff, a pioneer in the native seed sector, announced that Heartwood Partners LLC is purchasing Native Seed Group.

Seed Packaging Market, DRO

Demand:

- Seed packaging must protect against moisture, air, light, pests, and physical damage to preserve seed viability and germination rates.

Restraint:

- Compliance with seed packaging rules, labeling requirements, and quality standards presents hurdles for manufacturers.

Opportunity:

Plastic Use in Seed Packing Across Different Economies

Plastic is essential in seed packing because of its versatility, durability, and affordability. Plastic packaging, such as seed bags, pouches, trays, and containers, is commonly used in the seed industry for various purposes. Its capacity to resist moisture and defend against external influences guarantees that seeds remain intact and viable during storage and transportation.

Plastic packaging is often used for accepting various seed types and sizes, providing flexibility and convenience to seed manufacturers and farmers. Furthermore, plastic packaging can be personalized with printing and labelling to include important information such as seed kind, planting directions, and expiration dates.

Plastic consumption in seed packaging fluctuates with market demand, regulatory policies, and technical improvements. Developed regions, such as North America and Europe, often have higher plastic use due to enhanced agriculture sectors and increased adoption of contemporary packaging options. In contrast, emerging economies in Asia-Pacific and Latin America are experiencing increased demand for plastic packaging in the seed sector, driven by increased agricultural activity and infrastructural investment.

For Instance,

- In January 2024, Schär used innovative plastic packaging to plant seeds for a better world. Dr. Schär, a gluten-free nutrition specialist, strengthens its commitment to sustainability by creating new packaging for the Schär Wholesome bread line, its bestselling product on the global market.

Pouch Packaging for Seeds Balancing Convenience and Protection

Pouches are essential in seed packaging because they provide variety, convenience, and protection to seeds throughout their lifecycle. These adaptable packaging solutions are widely utilized in the seed business for various applications because they protect seed quality while providing efficient storage and transportation. Pouch packaging is frequently utilized for seed packs. Pouches are perfect for packing specific seed varieties or mixes in tiny quantities, making them easy for farmers and home gardeners to distribute and plant. Pouches' compact size and lightweight nature make them ideal for retail contexts where space minimization and shelf visibility are critical.

Pouches can be customized with branding, labelling, and instructions, giving consumers important information about seed kinds, planting guidelines, and handling warnings. This ensures consumers' clarity and convenience, improving the overall user experience. Pouches are preferred for their ability to withstand moisture and guard against external elements such as light and air, which can impair seed quality with time. This ensures seeds' long-term viability and germination capability, increasing yields and agricultural production.

For Instance,

- In January 2022, Wow Skin Science, a leading personal care brand, launched a new effort under the 'WOW Green Hands' umbrella. As part of this program, every purchase is made through Buy WoW. Customers will receive a seed pouch, laying the path for a cleaner, greener future.

Maximizing Efficiency of Seed Packaging Streamlines Agricultural Operations

The primary function of agricultural seed packaging is to preserve and protect seeds during storage, transportation, and distribution. Seed packaging is critical for maintaining seed quality, viability, and integrity, producing optimal germination and crop yields. It protects seeds from moisture, pests, physical damage, and environmental variables, preserving their genetic purity and germination potential.

Seed packaging is used to brand, label, and provide farmers with important information such as seed variety, planting instructions, and expiry dates. This allows for more efficient seed handling, storage, and identification, increasing operational efficiency and production in agriculture. Seed packaging is an essential component of modern agriculture, acting as a key link between seed producers and farmers while also contributing considerably to global food security and sustainable agriculture.

For Instance,

- In January 2023, GreenPoint Ag Holdings, LLC's remaining holding was purchased by agricultural cooperative GROWMARK, which now holds a majority ownership in Allied Seed, LLC.

Packaging Perfection Enhancing the Retail Experience for Consumers

The retail industry is a significant user of seed packaging because of its critical role in reaching end users, namely gardeners and hobbyists. Seed packaging for retail purposes is intended to be visually appealing, educational, and user-friendly. It frequently incorporates eye-catching images, thorough planting directions, and product descriptions to entice shoppers and provide vital information for successful gardening.

Retail seed packaging comes in various shapes, including packets, pouches, and display boxes, each customized to the specific demands of retailers and consumers. These packaging solutions are carefully designed to improve shelf visibility, enable handling, and maintain product freshness.

Retail seed packaging is essential to brand promotion and marketing because it demonstrates seed companies' commitment to quality, innovation, and consumer pleasure. Thus, ensuring beautiful and functional seed packaging is critical for success in the competitive retail sector.

- In March 2023, the acquisition of Native Seed Group by Heartwood Partners LLC from native seed industry pioneer Victor Schaff was announced. Nearly 50 years ago, Mr. Schaff started S&S Seeds, and he expanded the company both organically and via acquisitions.

Key Players and Competitive Dynamics in the Seed Packaging Market

The competitive landscape of the seed packaging market is dominated by established industry giants such as DS Smith Plc, Winpak Ltd., Smurfit Kappa Group, Bemis Company Inc., Mondi Group, Schur Flexibles Group, Huhtamäki Oyj, Parakh Agro Industries, American Packaging Corporation, ProAmpac LLC, Berry Global Group Inc., Omag-Pack, Amcor plc, Uflex Ltd., WestRock Company, Sonoco Products Company, Qingdao Funuoda Packing, Knack Packaging and DuPont de Nemours, Inc. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

DS Smith emphasizes customization and flexibility in its packaging solutions, catering to the diverse needs of seed producers and farmers. By offering a range of customizable options, they aim to provide tailored solutions that optimize seed preservation and planting efficiency.

- In October 2023, the leading supplier of fiber-based, sustainable packaging, DS Smith, announced the opening of its global R&D and innovation center, called "R8,". With this industry-first facility, DS Smith, its clients, and partners can now quickly advance the investigation and creation of entirely original packaging fulfillment solutions.

Leading seed companies and agricultural associations work with Winpak to create customized packaging solutions and bolster their brand awareness. By establishing strategic alliances, they learn about consumer preferences and industry trends, which enables them to predict demand and provide better packaging options.

- In March 2021, Winpak, a Canadian packaging firm, reported a 17.9% growth in revenue last year, reaching nearly $1.2 Million, up from $1 Million.

Seed Packaging Market Companies

Seed Packaging Market Segment

By Material

- Plastic

- Paper & paperboard

- Jute

- Fabric

By Product Type

- Pouches

- Containes

- Bags

- Bottles

By End Use

- Agriculture

- Horticulture

- Oil Processing

By Distribution Channel

By Region

- Asia Pacific

- North America

- Europe

- LA

- MEA