Barrier Coating for Recyclable Flexible Packaging Market Size, Share, Trends and Growth Forecast

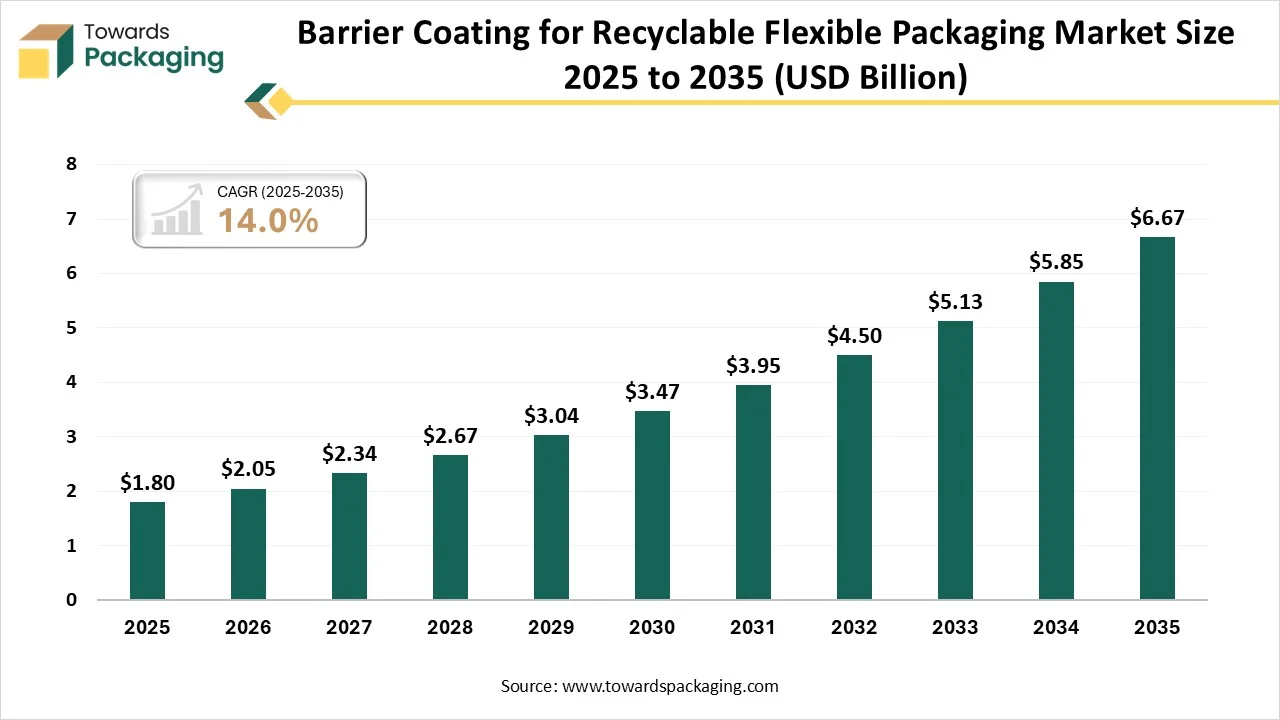

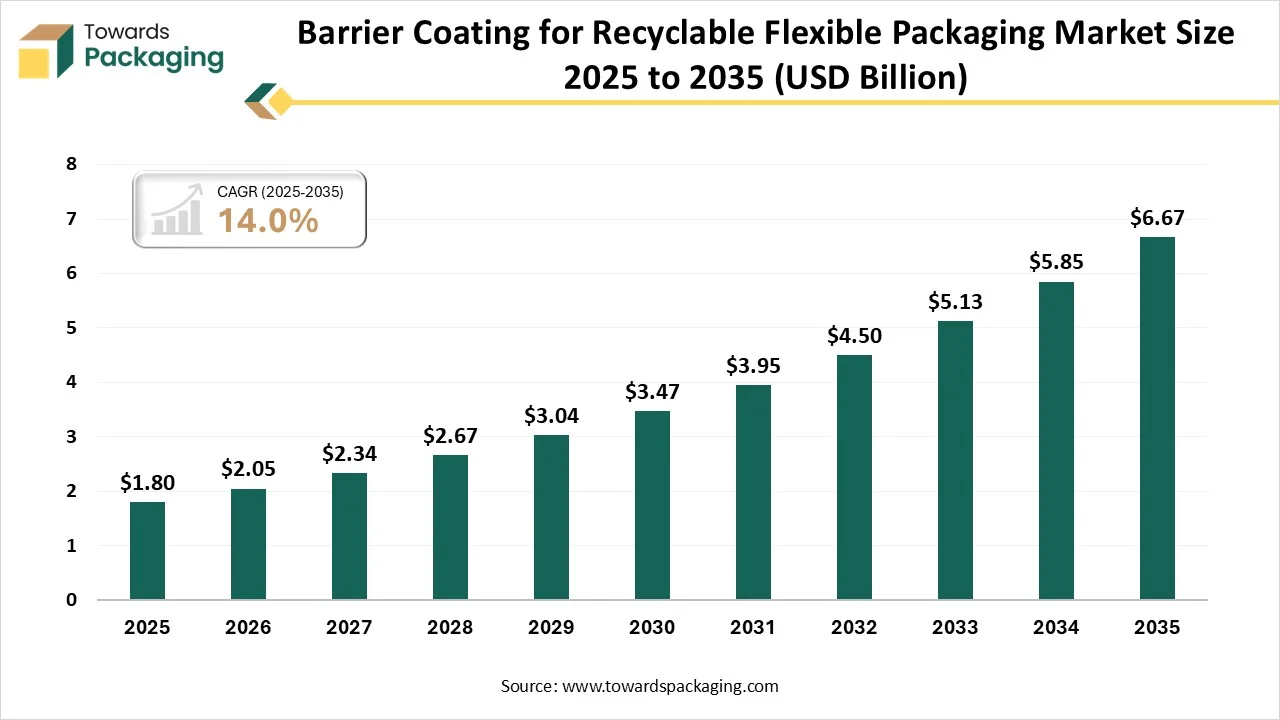

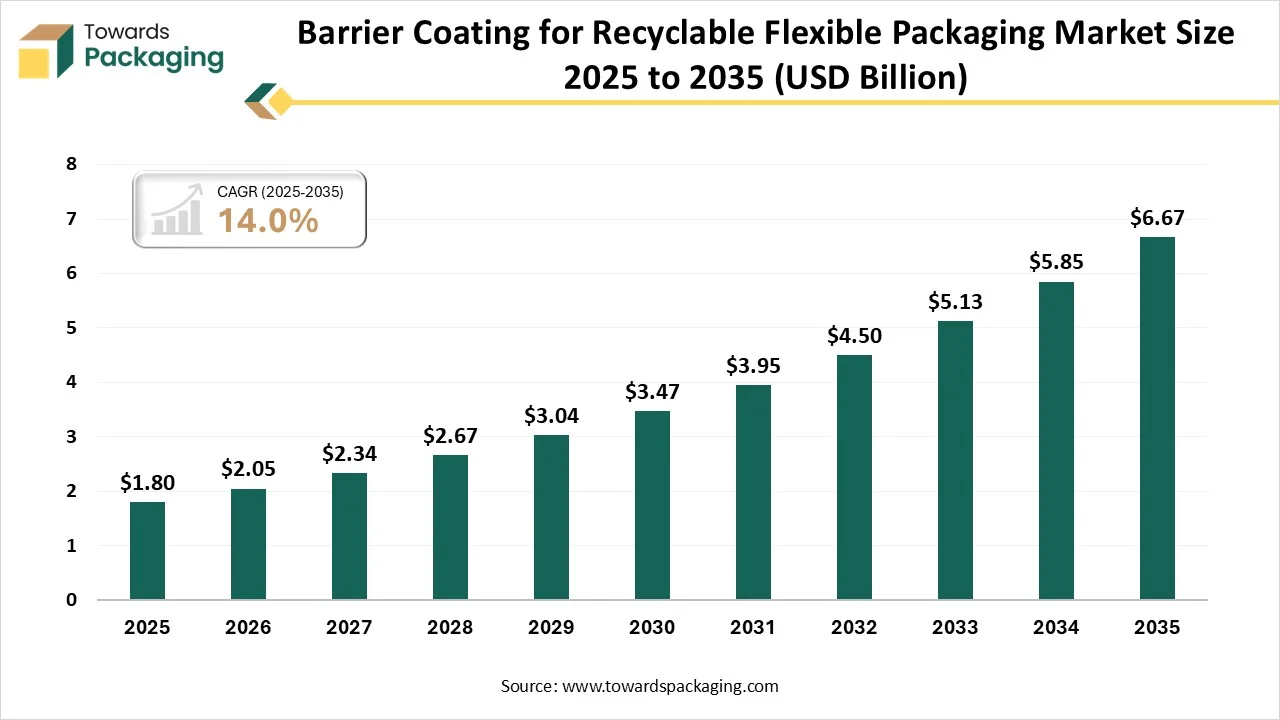

The barrier coating for the recyclable flexible packaging market is forecasted to expand from USD 2.05 billion in 2026 to USD 6.67 billion by 2035, growing at a CAGR of 14.0% from 2026 to 2035. There is high demand for this packaging as they move from non-recyclable, complicated, and multi-material plastics to simple and recyclable mono-materials such as mono-PE or paper while still serving important functions against various external factors.

Major Key Insights of the Barrier Coating for Recyclable Flexible Packaging Market:

- In terms of revenue, the market is valued at USD 2.05 billion in 2026.

- The market is projected to reach USD 6.67 billion by 2035.

- Rapid growth at a CAGR of 14.0% will be observed in the period between 2026 and 2035.

- By region, the Asia Pacific has dominated the global market by holding the highest market share in 2025.

- By region, North America is expected to grow at the fastest CAGR from 2026 to 2035.

- By coating type, the water-based barrier coating segment dominated the market in 2025.

- By coating type, the bio-based/biopolymer coating segment will be growing at a significant CAGR between 2026 and 2035.

- By barrier function, the oxygen barrier segment will dominate the market in 2025.

- By barrier function, the moisture/water-vapour barrier segment will be developing at a main CAGR between 2026 and 2035.

- By flexible packaging type, the films segment dominated the market in 2025.

- By flexible packaging type, the pouches and bags segment will be growing at a significant CAGR between 2026 and 2035.

- By the end-user industry, the food and beverages segment dominated the market in 2025.

- By the end-user industry, the healthcare and pharmaceuticals segment is expected to grow at a significant CAGR between 2026 and 2035.

What is Barrier Coating for the Recyclable Flexible Packaging Market?

Barrier coating for the recyclable flexible packaging prevents products from oxygen, moisture, light, and pollutants, which helps track freshness and extend the shelf life. Prevalent materials include aluminum for strong gas and moisture resistance, glass for dense, and plastics such as PP and PET for flexible protection. Additionally, a barrier in terms of flexible packaging is served by foils/metallized films and specialty films, which protect products from external factors such as oxidation, humidity, and sunlight too. It assists in expanding shelf life, preventing degradation or spoilage, and tracking freshness.

Barrier Coating for Recyclable Flexible Packaging Market Outlook:

- Market Growth Overview: Recyclable packaging assists businesses in lowering waste disposal costs, attracting eco-conscious users, and aligning with regulatory needs that develop brand reputation and operational smoothness. Across the globe, organizations that accept compostable and biodegradable packaging labeling are also gaining market benefit and a competitive edge with the help of inventions in the sustainability industry.

- Global Expansion: The worldwide expansion of flexible packaging is growing, which is driven by the user demand for e-commerce development, sustainability, and regulations, with the sector predicted to cross millions in the year 2033. Main trends count growing mono-material solutions such as PP/PE films for convenient recycling, developing paper-based options, and inventions in compostable materials.

- Major Market Players: The main market players are OPG Biosolutions, PakItGreen, and Green Packaging Solutions.

- Startup Ecosystem: Startup companies in flexible packaging have implemented advances in terms of technology that have enabled brands to make more sustainable alterations to packaging. From bioplastics created from bamboo, algae, to mushrooms, which are either edible or compostable packaging. Such latest alterations make a more sustainable surrounding that has the capability to lower food waste, improve food quality, and develop food safety.

Technological Developments in the Barrier Coating for Recyclable Flexible Packaging Market:

Intelligent packaging is implemented in recyclable flexible packaging, which uses digital elements to serve real-time details and develop traceability. Visual showcases, such as temperature-sensitive labels, are becoming more common, as well as technologies that count NFC(Near Field Communication), QR codes, and RFID (Radio-Frequency Identification) tags. Such potential allows users to get more information about the item, check the product, and analyze expiry dates, or get the application rules by just scanning their mobile phones.

Trade Analysis of Barrier Coating for Recyclable Flexible Packaging Market: Import & Export Statistics

- As per the global import data, the world has imported 22 shipments of recyclable flexible packaging during the period January 2023 to December 2024.

- Such imports were supplied by 7 exporters to 7 worldwide buyers, which marked a development rate of 47% as compared to the leading twelve months.

- During this time, in December 2024 alone, the globe imported 3 recyclable flexible packaging shipments. It has marked a development rate of 3% as compared to December 2023 and an 3% series increase from November 2024.

- The globe has imported most of its recyclable flexible packaging from Belgium, India, and Vietnam, too.

- Worldwide, the leading three importers of recyclable flexible packaging are Brazil, the United Kingdom, and Brazil. The United Kingdom has topped the globe with 9 shipments, followed by Brazil with 8 shipments, and Canada, which has taken the third position with 8 shipments.

- According to global data, the world has exported 45,782 shipments of flexible packaging during the period June 2024 to May 2025.

- Such imports were being supplied by 3,164 exporters to 4,216 global buyers, which marked a development rate of 21% as compared to the previous twelve months.

- During this period, in May 2025 alone, the globe imported 3,266 flexible packaging shipments.

- This has marked a year-on-year development of -5.5% as compared to May 2024 and a -9% series decrease from April 2025.

- The globe has imported most of its flexible packaging from Vietnam, India, and China.

- Worldwide, the leading three importers of flexible packaging are the United States, South Korea, and the United Kingdom. South Korea has topped the globe in terms of flexible packaging with 29,386 shipments, followed by the United States with 15,079 shipments and the United Kingdom, which takes the third position with 9,231 shipments.

Barrier Coating for Recyclable Flexible Packaging Market - Value Chain Analysis

Package Design and Prototyping

Multi-layer flexible materials are challenging to recycle. But the sector is quickly developing, as inventions such as mono-material films now enable flexible packaging to penetrate the recycling stream through store drop-offs or the specialty programs, too.

- Key Players: Uflex Limited, Huhtamaki, and Sealed Air Corporation.

Recycling and Waste Management

The recycling of the flexible plastic packaging counts items such as bread bags, crisp packets, and bubble wrap, too, which is complicated due to its lightweight nature and multi-surfaced composition. Currently, while store drop-off programs and industrial initiatives are perfectly established for simple films, and curbside collection for household flexible plastics, which is constantly being expanded globally through various legislative compulsions and pilots, too.

- Key Players: Mondi Group, Amcor, and DuPont Teijin Films

Logistics and Distribution

The logistics and distribution of the recyclable flexible packaging, such as films, pouches, and wraps, are being centered on circular economy rules. This counts on updating materials for convenient handling and establishing strong reverse logistics systems to process and capture used materials. Effective internal logistics, by using the automated warehouse roller conveyors and the IoT sensors, ensures high-speed handling of various flexible designs.

- Key Players: Jindal Poly Films, Greenskin, and Kalpana Systems

Segmental Insights

Coating Type Insights

The water-based barrier coatings segment has dominated the barrier coating for a recyclable flexible packaging market as they are thin and protective surfaces that are used on paper or paperboard layers by using a water-based formulation. Its aim is to oppose water, grease, oil, and other pollutants that serve barrier characteristics regularly and are received through plastic covering or the wax coatings too. Unlike solvent-based coatings, which liberate VOC (volatile organic compounds), water-based coatings are eco-friendly and safe to generate and apply.

The bio-based barrier coatings segment is predicted to witness the fastest CAGR during the forecast period. They have come up with complicated inventions in sustainable packaging solutions over the last decade. Implementing the functional additives into bio-based barrier formulations can crucially develop their performance. Such additives contain silicates, nano clays, anti-microbial compounds, and waxes too, which can develop barrier properties while using the workability, such as UV protection and antimicrobial activity.

Barrier Function Insights

The oxygen barrier segment dominated the market in 2025, as these films are being designed with several layers, as every layer serves a particular function in preventing the food from being oxidized. Barrier layers are responsible for protecting oxygen from transitory packaging. Materials such as polyvinylidene Chloride (PVDC), ethylene vinyl alcohol (EVOH), and metallized coatings are prevalent because of their perfect oxygen-blocking properties. The application of these films is highly active in preventing oxidation, tracking crunchiness, and flavor, as nuts, crisps, and chocolates are excessively fragile to oxygen exposure.

The moisture/water-vapour barrier segment is expected to experience the fastest CAGR during the forecast period. Moisture barrier packaging serves this necessary level of protection, preventing moisture from the surroundings from polluting package-sealed products. This kind of packaging is specifically applicable when it comes to keeping sensitive contents, such as food products or pharmaceuticals. This material should also safeguard against aromas and gases that can affect the quality and freshness of stored products.

Flexible Packaging Type Insights

The films segment has dominated the barrier coating for recyclable flexible packaging market in 2025 because LDPE is a terribly lightweight and flexible plastic material in its actual sense, which is a thermoplastic created from monomer ethylene. Such films are well known for their low temperature durability, flexibility, chemical and environmental resistance, and corrosion resistance, too. Secondly, BOPP Films flaunt undeniable resistance and reliability for moisture contact, along with additional advantages like clarity, which makes it a perfect choice with respect to retail packaging. Furthermore, PET offers high-barrier elements and develops durability with applications in snack foods, coffee packaging, and high-barrier food applications.

The pouches and bags segment is predicted to witness the fastest CAGR during the forecast period. Flexible packaging pouches and bags are sturdy, tiny, and perfect for high-speed production procedures like horizontal form fill seal (HFFS) packaging, which effectively seals and fills pouches. Additionally, flexible pouches assist with personalized designs and branding while lowering the material usage. The stand-up gusset pouches are being made with a gusseted bottom, which allows products to stand strongly on the shelves, making them ideal for detergents, tea, and pet food. Moreover, zipper reclosable pouches are the ideal solution as they enable users to reseal the package after opening and storing items like candies and granola.

End-User Insights

The food and beverages segment has dominated the market in 2025 as their plan is to make sure that materials stay in application for a longer period, which assists a circular economy, lowering one’s carbon footprint and decreasing the plastic waste too. Several brands are shifting towards mono-material packaging (a packaging that is created from just one kind of plastic), such as recyclable packaging, which is created from recycled plastics.

For instance, some main beverage organizations are changing the packaging designs to use paper-based cartons, aluminum bottles, and recycled materials instead of plastic bottles to help sustainability goals.

The healthcare and pharmaceuticals segment is expected to witness the fastest CAGR during the forecast period. The integration of aluminum, PVC, and other materials utilized in this kind of packaging results in a complicated waste stream, which shifts away from multi-layer packaging, making disposal and recycling simple, thus reducing the volume of medical packaging waste that ends up in landfills. The capability to recycle flexible packaging in the standard plastic recovery systems makes it a highly sustainable selection for organizations to develop their eco-friendly effect without compromising product safety.

Sustainability is now a benefit, with pharmaceutical organizations that are being measured on their surrounding loyalty. Accepting complete recyclable flexible packaging strengthens corporate responsibility efforts while assisting organizations align with regulatory liners more effectively.

Regional Insights

How Has Asia Pacific Dominated the Barrier Coating for Recyclable Flexible Packaging Market?

The Asia Pacific region has dominated the barrier coating for recyclable flexible packaging market in 2025, as mechanical recycling is long-standing throughout Asia, specifically in Northeast Asia and the Indian subcontinent. In today’s scenario, recycling installed potential is over 18 million tones each year, with China has of 66% and India with 8%. On the other hand, chemical recycling is an initial market as compared to mechanical recycling, as most of the fixed working capacity is focused on Northeast Asia, where predominant countries have well-designed waste management systems.

How is Barrier Coating for Recyclable Flexible Packaging Market Growing in India?

The barrier coating for the recyclable flexible packaging market demand in India has policies that market Extended Producer Responsibility (EPR), advanced recycling technologies, and recycled content, which were referred to as complicated drivers that develop India’s transformation towards a circular economy. In India, reusability, recyclability, and recycled content have developed as the most crucial sustainability element that drives the choice for materials such as paper and glass.

Why is Barrier Coating for Recyclable Flexible Packaging Market Developing Rapidly in North America?

The barrier coating for the recyclable flexible packaging market is growing in North America, as to align with the recyclability focus, brand owners are shifting away from regular multilayer laminates towards mono-material designs (which are initially PP or PE), which are convenient to implement in the current recycling procedure. Additionally, the growth of online retail has developed the urge for durable and lightweight pouches and mailers that lessen shipping costs and the carbon footprint as compared to strong alterations.

Why is Canada using the Barrier Coating for the Recyclable Flexible Packaging Market? Importantly?

The initial aim of penetrating the Canadian barrier coating for recyclable flexible packaging market is to highlight the quickly developing urge for sustainable packaging solutions, which is driven by the developing environmental awareness, shifting user choice, and strict regulatory frameworks. Canada’s loyalty to eco-friendly sustainability, linked to its high-level production structure and an impartial industry for environmentally friendly discoveries, makes it an attention-grabbing region for decisive growth.

Europe Barrier Coating for Recyclable Flexible Packaging Market

The barrier coating for recyclable flexible packaging market in the region is growing, as in Europe. PPWR and the national taxes, such as the UK’s plastic packaging Tax on the packs that have <30 % recycled content, are allowing brands to shift away from multi-material laminates towards mono-material structures.

There is an urge for durable, lightweight, and protective flexible mailers, which are developing as direct-to-user and grocer shipments develop. Pouches are the fastest -developing item designs, which are substituting rigid designs in the space of pet food, home care, and ready meals because of lower logistics costs and the material application.

Germany Barrier Coating for Recyclable Flexible Packaging Market

Germany is excessively using recyclable flexible packaging, which is driven by the developments from solution providers and end-users, too. The rigid user trust in the products being labelled as ‘Made in Germany' has developed the performance of the local plastic packaging films. This region is the frontline of the European pharmaceutical industry and ranks fourth worldwide.

Hence, the urge for flexible packaging acceptance, especially in the pharmaceutical scenario, is being driven by the capability to protect tablets, medications, and capsules from moisture and oxygen, also safeguarding their potency till usage.

Middle East and Africa Barrier Coating for Recyclable Flexible Packaging Market

In the Middle East and Africa, the barrier coating for recyclable flexible packaging market is growing steadily as the packaging organizations in this region have witnessed constant development over the last year because of updated user expectations and a growing population. Environmental factors and sustainability can continue to be underscored in the regions where the industry is expecting different inventions in terms of packaging materials, growing demand for sustainable and recyclable materials, as recycled PET and bioplastics are driving the market development.

UAE Barrier Coating for Recyclable Flexible Packaging Market

The UAE barrier coating for the recyclable flexible packaging market is led by pouches, as they are portable, versatile, and resealable. Polyethylene remains the main material choice due to its power, recyclability, and moisture resistance, too. Such trends assist the UAE’s Net Zero 20250 goals and the shift towards bio-based packaging. With the help of new technologies, sustainability policies, and developing user demand, the UAE recyclable flexible packaging industry is on a path to becoming a regional leader.

Partnerships in Barrier Coating for Recyclable Flexible Packaging Market

- In September 2025, Nova Chemicals partnered with the Charter Next Generation (CNG) in order to generate PE for flexible packaging uses. Under the organization name Syndigo, the PCR material is being sourced from recycled film and plastic packaging.

- Siegwerk has revealed its official partnership with the Borouge, which is a top petrochemicals company that serves inventive and classified polyolefins solutions, in order to co-create 100% recyclable mono-material solutions for future kinds of packaging design for a circular economy.

Recent Developments

- In January 2025, Smart Planet Technologies, which is a biopolymer version, has EarthCoating barrier coating that has been disclosed, which has integrated a biobased PLA resin with a “tailored mineral mixture” in order to generate recyclable and compostable paper cups.

- In September 2025, CelluForce, a global leader in cellulose nanocrystals, revealed the launch of CelluShield, which is a high-performance and bio-sourced barrier coating that is crafted to assist packaging producers to align with the rising urge for recyclable flexible packaging without adjusting the shelf life or the product protection.

- In April 2025, Lecta revealed the launch of Creaset HGP, the latest grease-resistant paper whose goal is flexible packaging uses, such as pet food bags and butter wraps.

- In October 2025, due to a Brazilian law, industry operators should definitely participate in a reverse logistics process for the purpose of primary, secondary, and tertiary plastic packaging from the period of January 2026 that aligns targets for 22% recycled content and an 32% recovery range next year.

- In September 2024, Kohler Paper was a part of the Kohler Group, which revealed a new high-quality product series created from tea packaging, that serves the ideal solution to the big demand for organic tea and the sustainable packaging alterations in the tea industry.

- In November 2024, Eastman and UPM Specialty Papers collaborated to make a latest biopolymer -coated paper packaging solution, which is created for the food products that need oxygen and grease barriers.

Top Companies in Barrier Coating for Recyclable Flexible Packaging Market

- Dow Chemical Company: It is an American multinational company as it is among the three biggest chemical manufacturers in the world. It is the running subsidiary of Dow Inc, which is a publicly traded holding company operated under Delaware law.

- DuPont de Nemours, Inc: DuPont de Nemours is a global innovation leader with respect to technology-based materials and solutions that assist in changing sectors each day.

- BASF SE: They are into chemistry for a sustainable future, as they have selected a chemical company to allow any user’s green transformation. It integrates economic success with social responsibility and eco-friendly protection.

- Eastman Chemical Company: It is a worldwide specialty materials company that generates a huge range of products found in products that people utilize every day.

- Evonik Industries AG: Evonik Industries AG is a publicly listed German chemicals company, which is the second-biggest chemicals company in Germany, and the largest specialty chemicals company in the world.

- Henkel AG & Co. KGaA: Henkel carries the top position in both user and industrial businesses; each profile contains well-known hair care products, fabric softeners, and laundry detergents, as well as sealants, adhesives, and functional coatings.

- Mitsubishi Chemical Corporation: Mitsubishi is a Japanese company that was created from the collaboration of Mitsubishi Chemical Corporation and Mitsubishi Pharma Corporation.

- Solenis LLC: Solenis is a top worldwide supplier of hygiene and water solutions, as the company's product profile includes a huge range of water diagnosis, process aids, chemistries, cleaners, disinfectants, and state-of-the-art monitoring and delivery systems.

- Clariant AG: It is one of the globe's leading specialty chemical organizations and operates with the aim of “Greater Chemistry” between the planet and people, as Clariant invests in value creation with inventive and sustainable solutions for users from several industries.

Barrier Coating for Recyclable Flexible Packaging Market Segments Covered

By Coating Type

- Water-Based Barrier Coatings

- Acrylic-Based Coatings

- Polyurethane (PU) Water-Based Coatings

- Epoxy Water-Based Coatings

- Latex-Based Coatings

- Bio-Based / Biopolymer Barrier Coatings

- Polylactic Acid (PLA) Coatings

- Polyhydroxyalkanoates (PHA) Coatings

- Starch-Based Coatings

- Cellulose-Based Coatings

- Solvent-Based Barrier Coatings

- Polyurethane Solvent-Based Coatings

- Epoxy Solvent-Based Coatings

- Acrylic Solvent-Based Coatings

- Silicone Coatings

- Heat-Resistant Silicone Coatings

- Food-Grade Silicone Coatings

- Hydrophobic / Water-Repellent Silicone Coatings

- UV-Curable Barrier Coatings

- Acrylate-Based UV Coatings

- Epoxy-Based UV Coatings

- Hybrid UV-Curable Coatings

- Nanocomposite Barrier Coatings

- Clay Nanocomposites

- Graphene / Carbon-Based Nanocoatings

- Metal Oxide Nanocoatings

By Barrier Function

- Oxygen Barrier

- Moisture / Water Vapor Barrier

- Grease & Oil Barrier

- Aroma & Flavor Barrier

- Gas / Ethylene Barrier

- Multi-Functional Barrier Systems

By Flexible Packaging Type

- Films (LDPE, PET, BOPP, CPP)

- Pouches & Bags (Stand-up, Zipper, Spout)

- Wraps & Sheets

- Laminates

- Sachets & Sachet Packs

By End-Use Industry

- Food & Beverage

- Healthcare & Pharmaceuticals

- Personal Care & Cosmetics

- Household & Homecare

- Pet Food Packaging

- Industrial & Specialty Packaging

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA