Plastic Injection Molding For Medical Devices Market Size, Demand and Trends Analysis

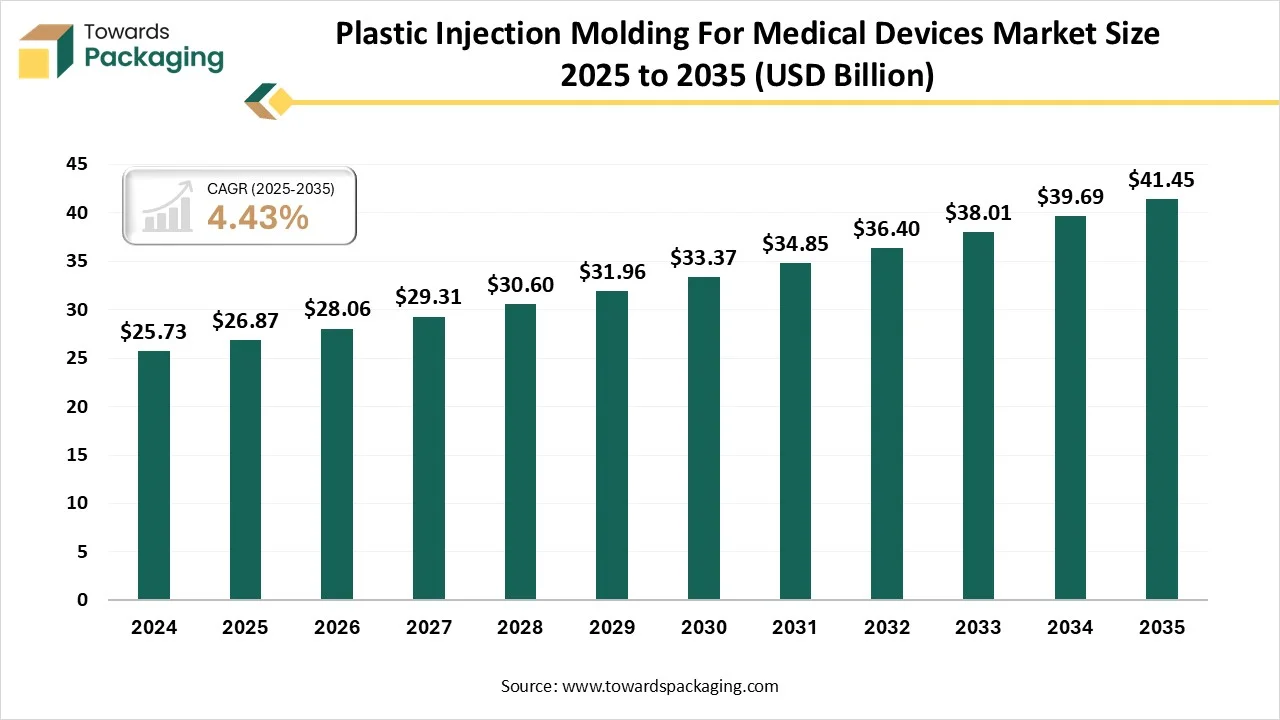

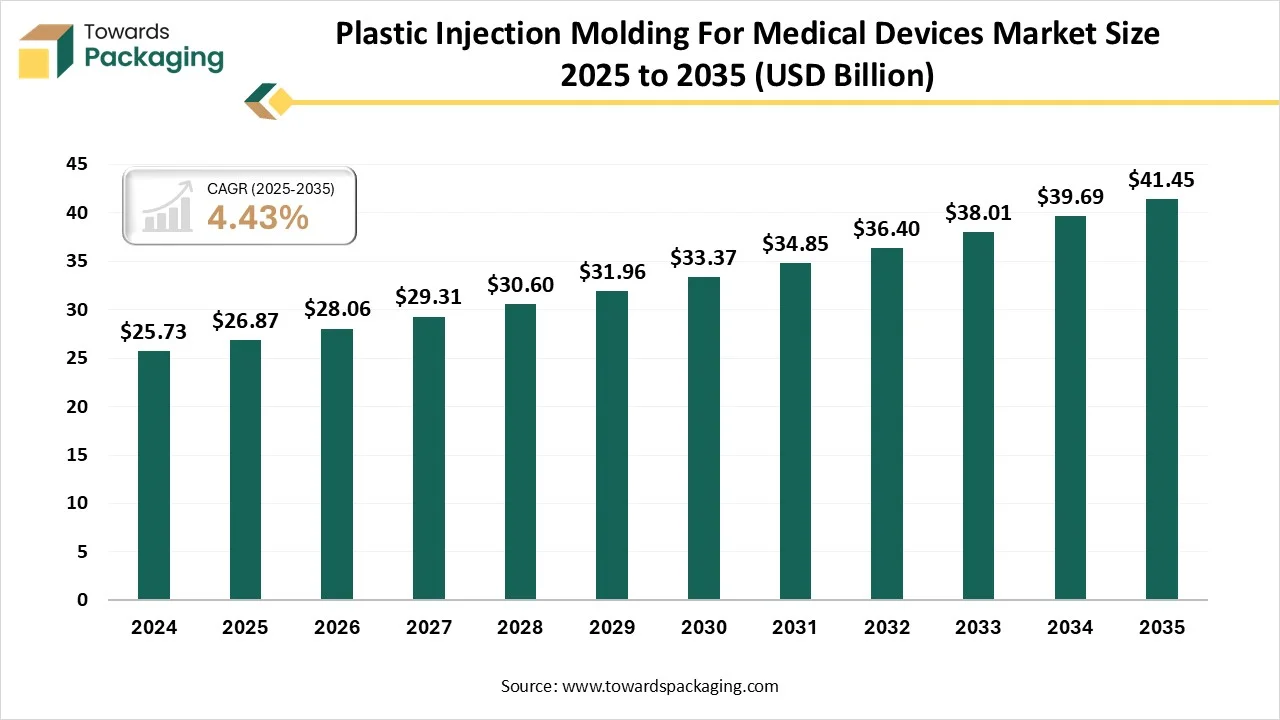

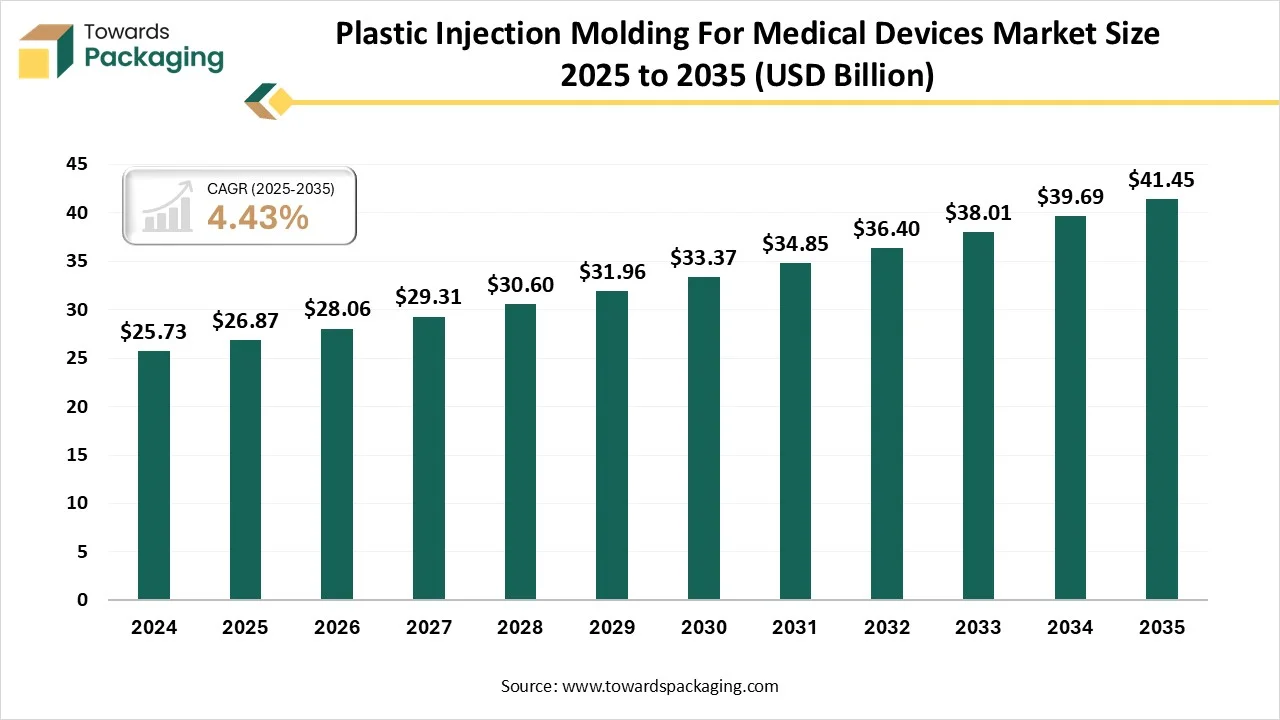

The plastic injection molding for medical devices market is projected to grow from USD 28.06 billion in 2026 to USD 41.45 billion by 2035, expanding at a CAGR of 4.43% during the forecast period from 2026 to 2035. The report provides comprehensive insights including market size analysis, segment-wise data by material, product type, and application, regional performance, and industry trends. It also covers company profiles, competitive landscape, value chain analysis, trade statistics, and detailed information on manufacturers and suppliers, offering a complete view of the market.

Major Key Insights of the Plastic Injection Molding For Medical Devices Market

- In terms of revenue, the market is valued at USD 28.06 billion in 2026.

- The market is projected to reach USD 41.45 billion by 2035.

- Rapid growth at a CAGR of 4.43% will be observed in the period between 2025 and 2034.

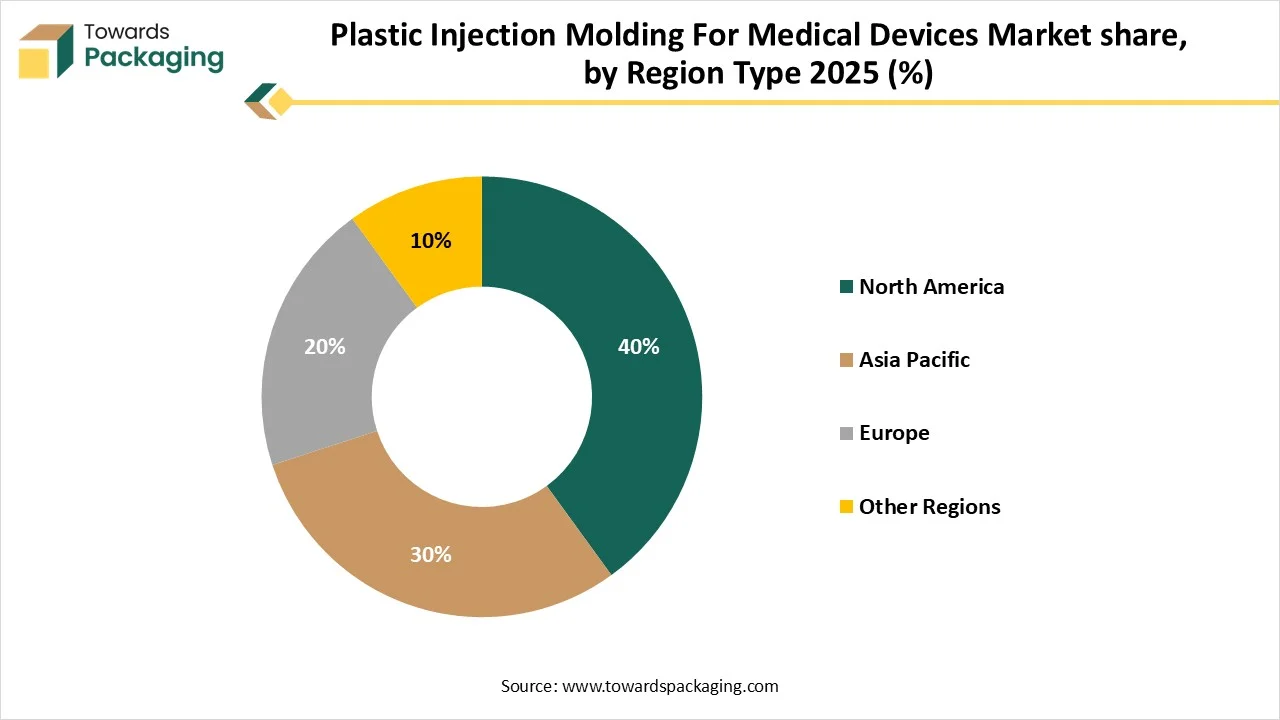

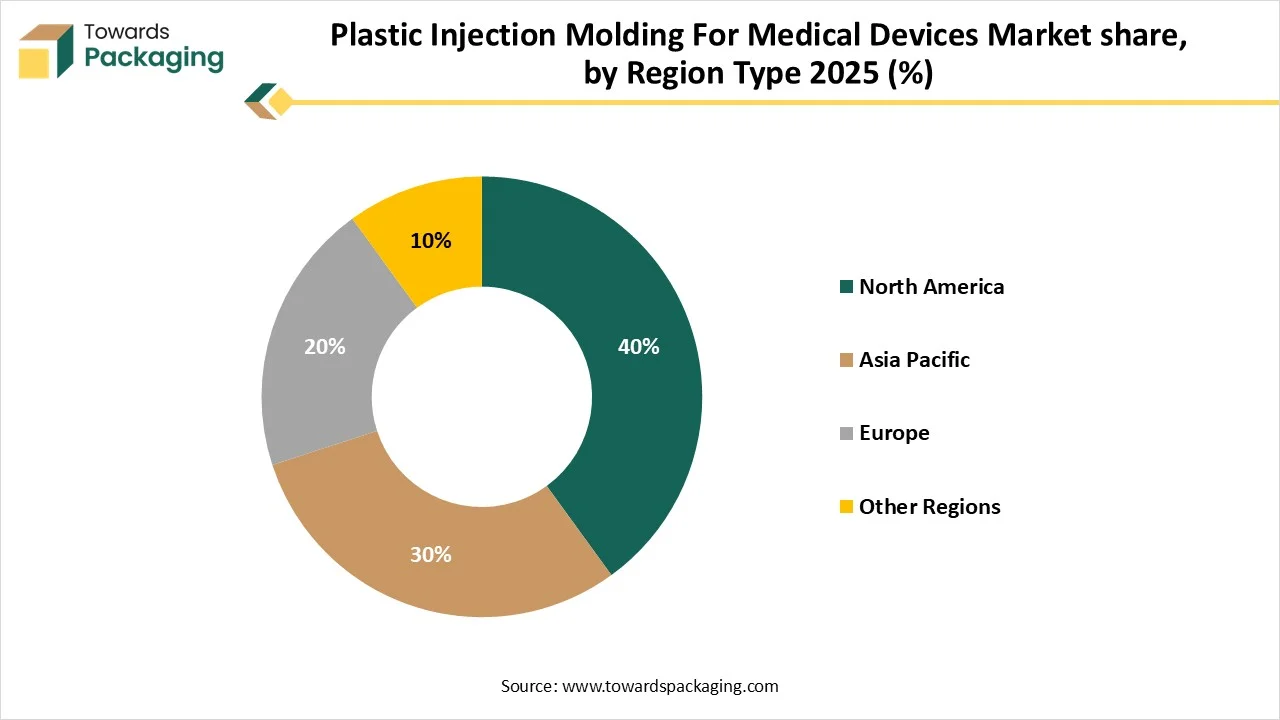

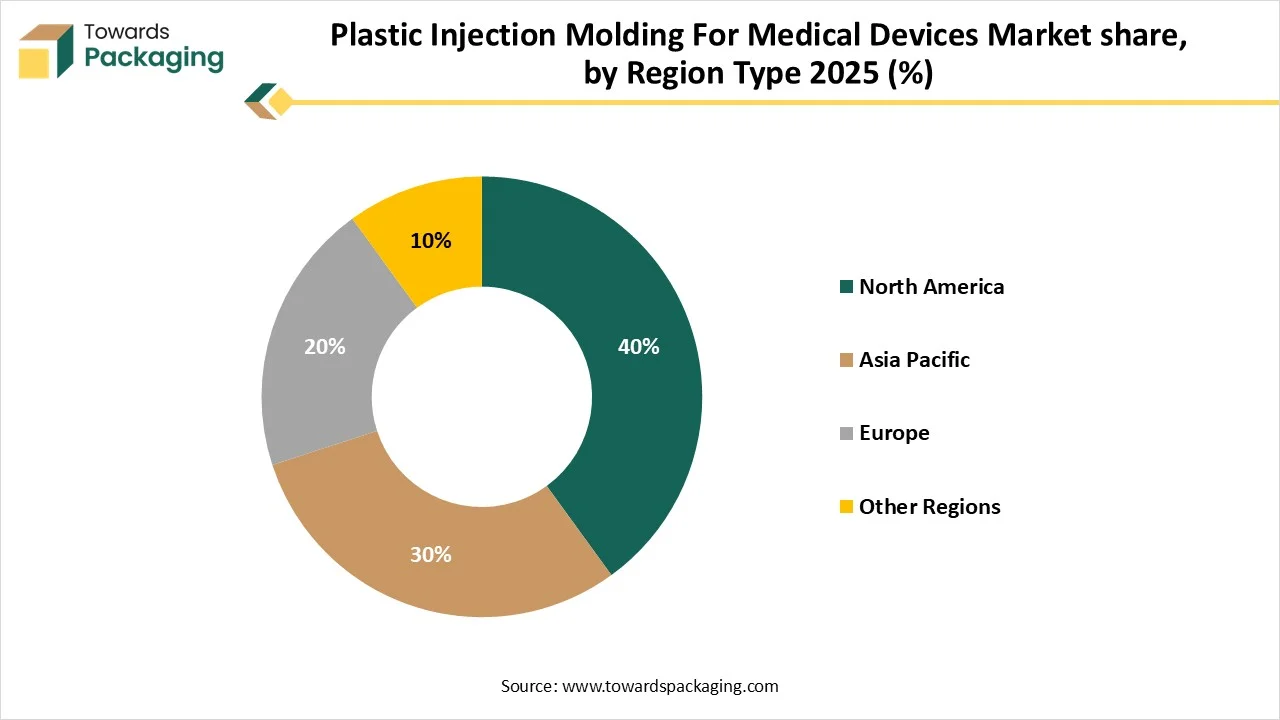

- By region, North America dominated the global market by holding highest market share in 2025.

- By region, Asia Pacific is expected to grow at a fastest CAGR from 2025 to 2034.

- By product/ design type, the singleuse devices segment contributed the biggest market share in 2025.

- By product/ design type, the implantable devices segment will be expanding at a significant CAGR in between 2025 and 2034.

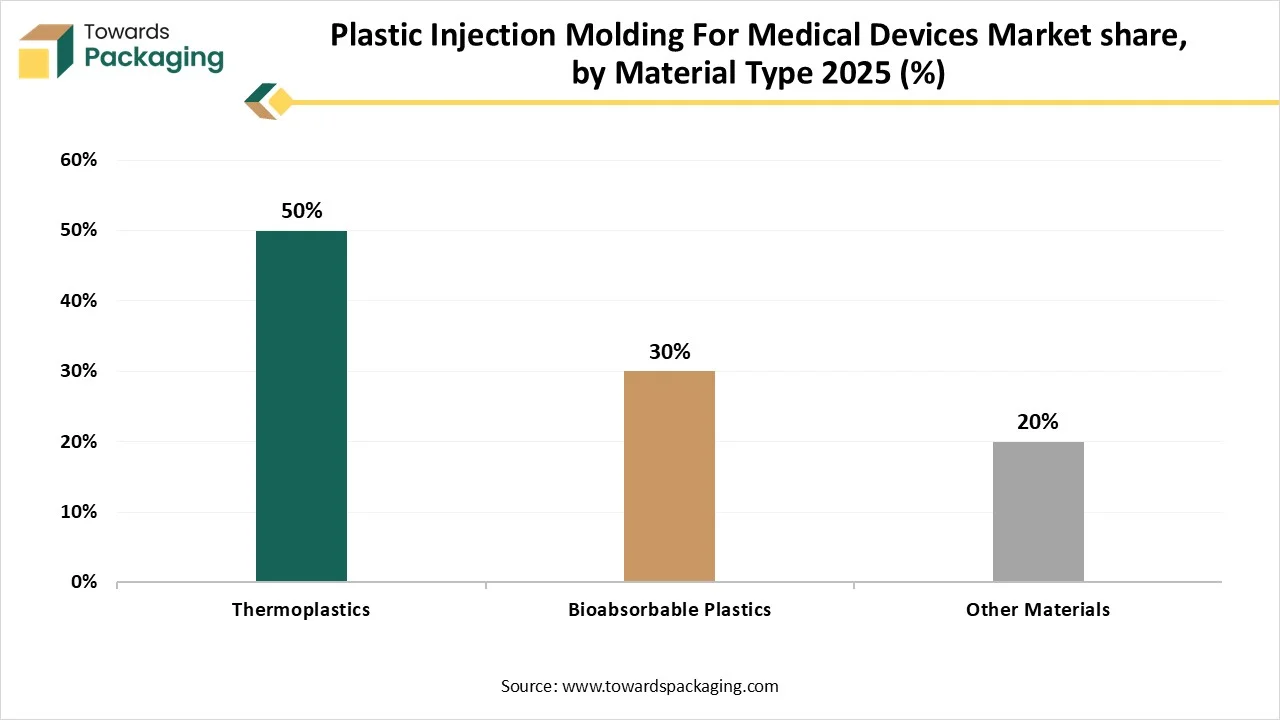

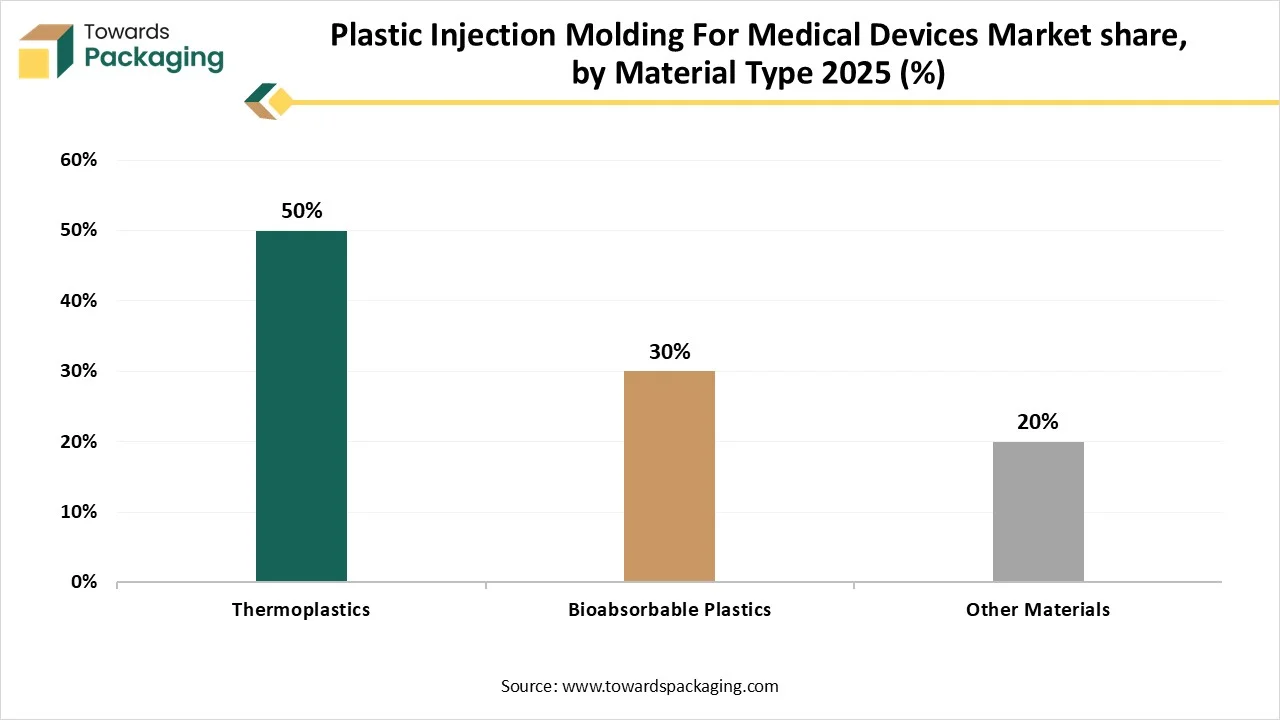

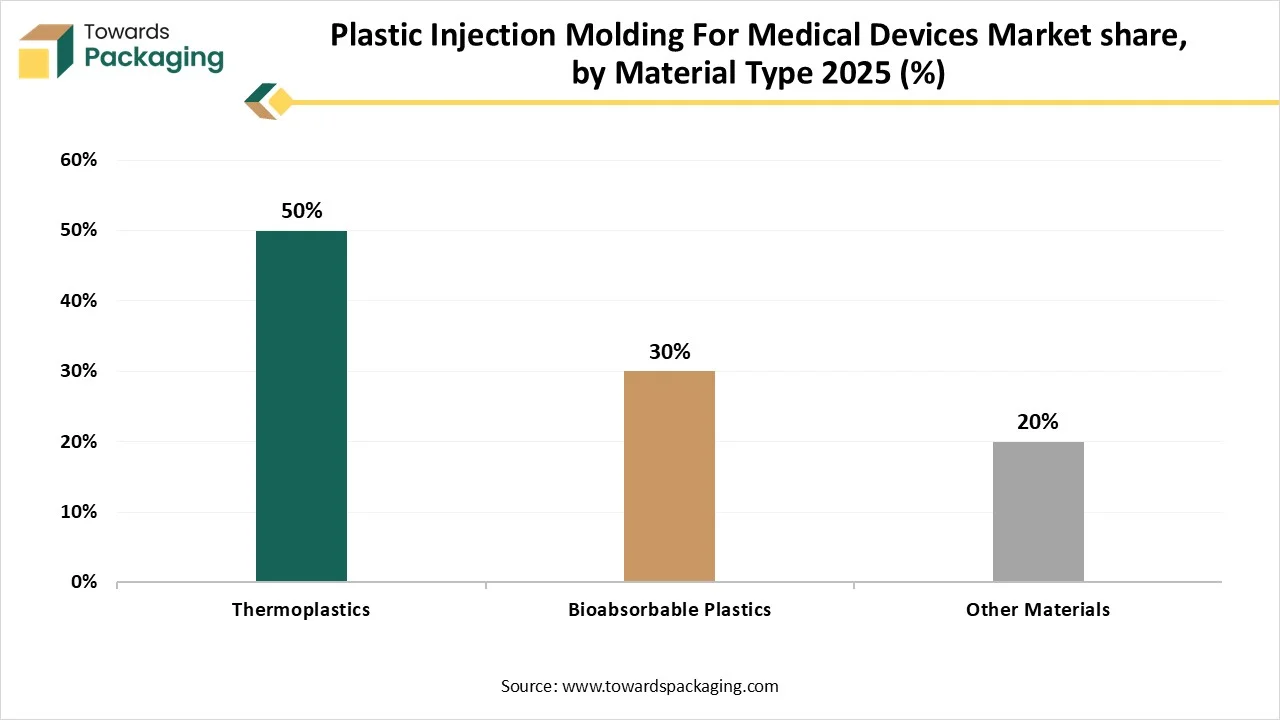

- By material type, the thermoplastics segment contributed the biggest market share in 2025.

- By material type, the bioabsorbable plastics segment will be expanding at a significant CAGR in between 2025 and 2034.

- By application / medical usecase, the general medical consumables / disposables segment contributed the biggest market share in 2025.

- By application / medical usecase, the surgical instruments segment will be expanding at a significant CAGR in between 2025 and 2034.

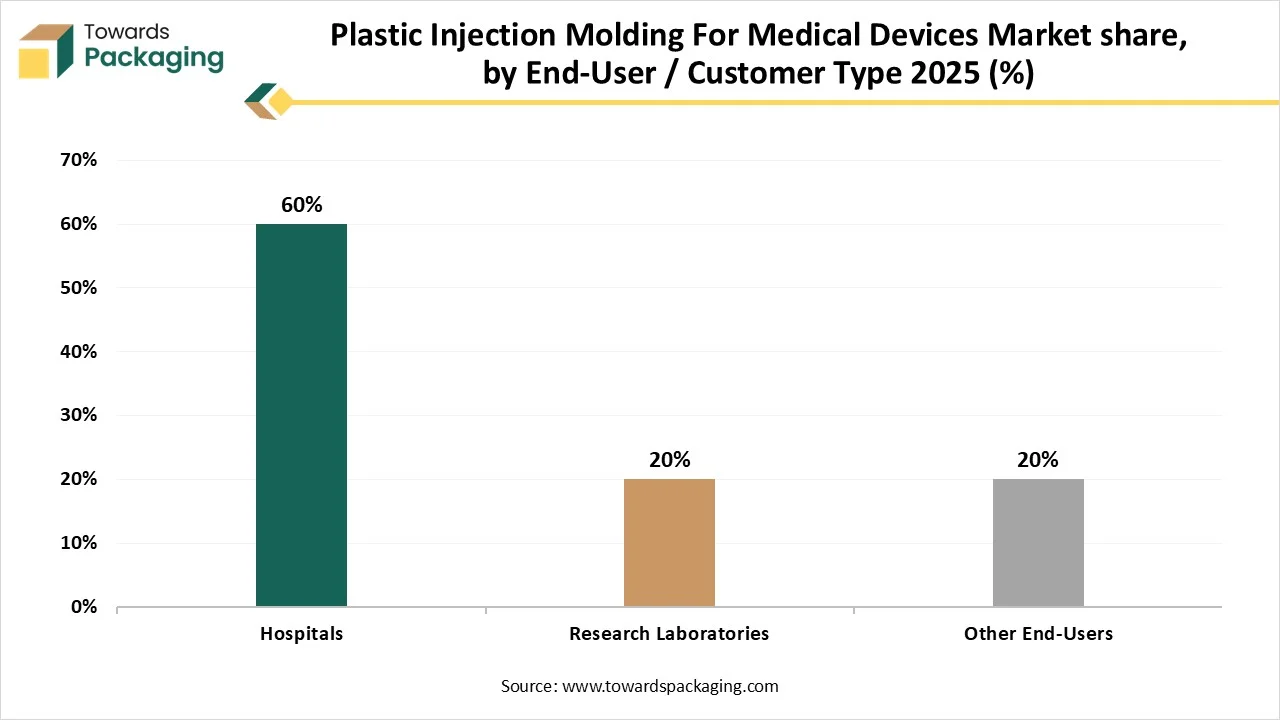

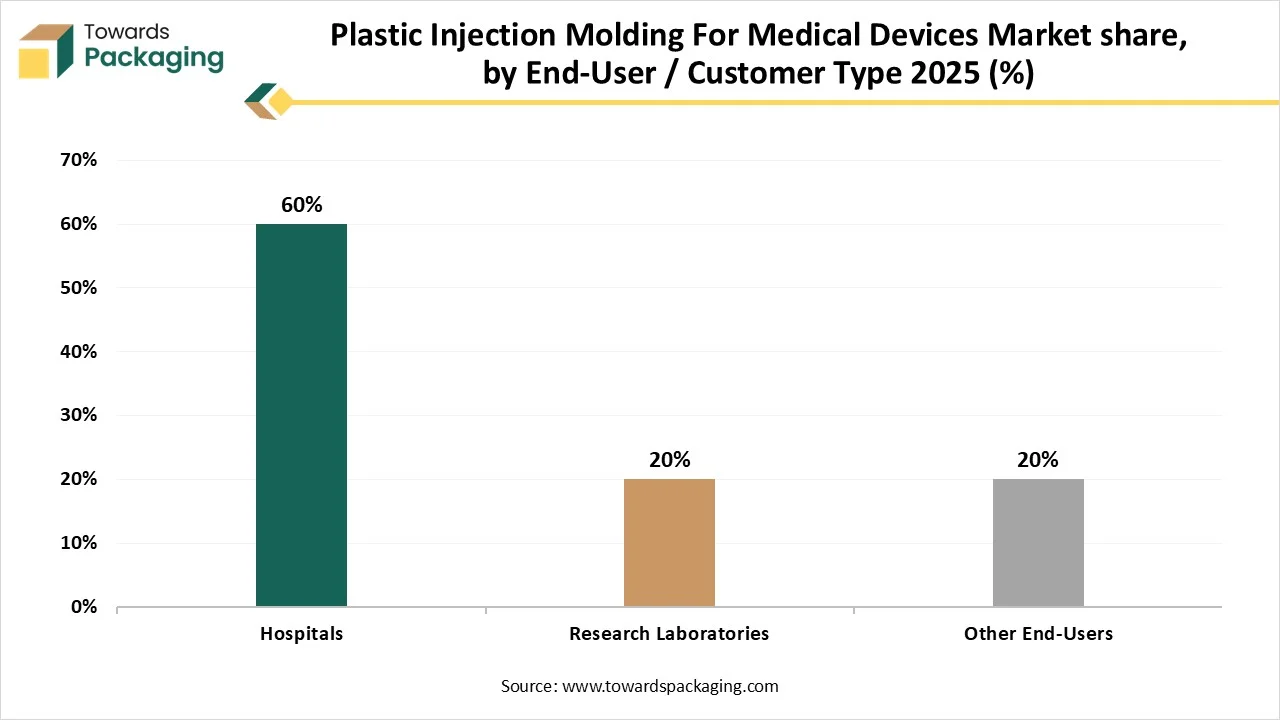

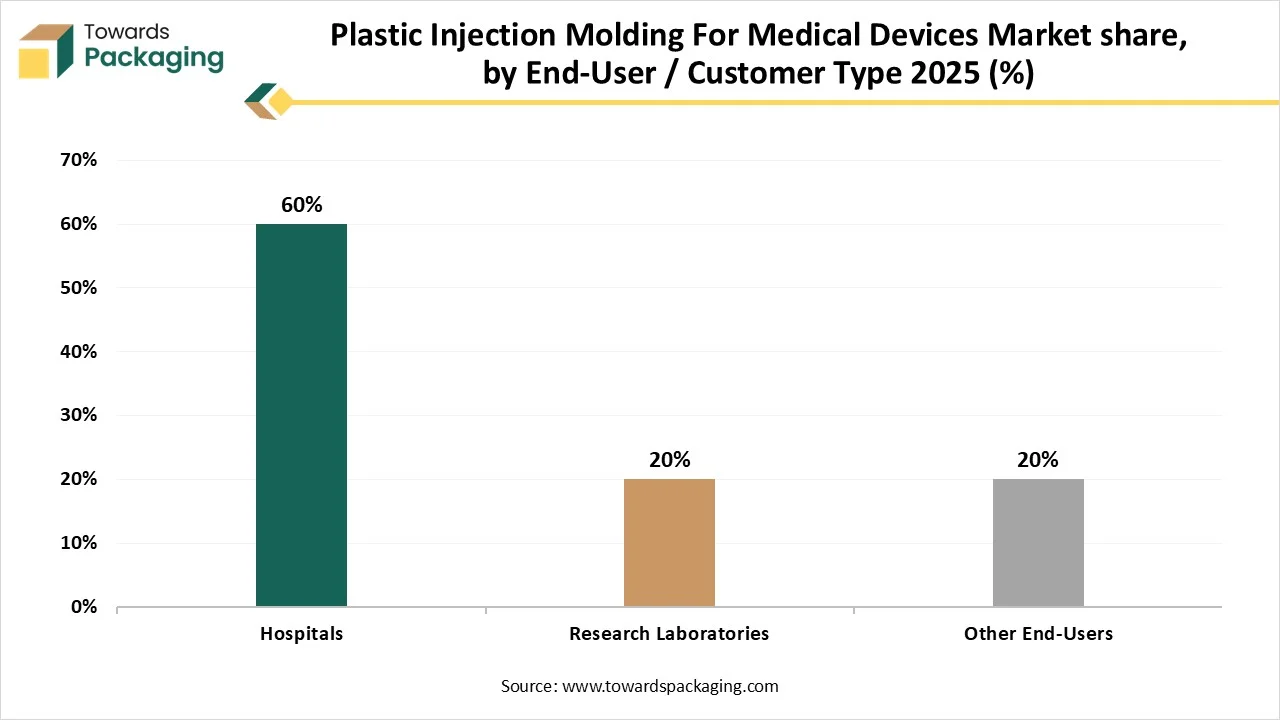

- By end-user/ customer, the hospitals segment contributed the biggest market share in 2025.

- By end-user/ customer, the research laboratories segment will be expanding at a significant CAGR in between 2025 and 2034.

- By technology / process, the conventional injection molding segment contributed the biggest market share in 2025.

- By technology / process, the micro injection molding segment will be expanding at a significant CAGR in between 2025 and 2034.

What is Plastic Injection Molding For Medical Devices?

Plastic injection molding for medical devices is a production process which includes moulding medical-grade plastic pellets and inoculating the molten resource into a custom-planned mold underneath high pressure. After the plastic comes to normal temperature and solidifies, it designed into the shape of the desired mold, permitting for the high-volume, accurate manufacturing of apparatuses for a huge range of medical usages.

Plastic Injection Molding For Medical Devices Market Outlook

- Market Growth Overview: Plastic injection molding for medical devices market is expanding due to chronic diseases and aging population, advancement in materials, technological innovation, cost-efficiency, and increasing demand for disposable products.

- Global Expansion: Regions such as Latin America, North America, Asia Pacific, Europe, South America, Middle East & Africa are witnessing rising demand for efficiency and precision, increasing disposable devices, material advancement, regulatory compliance, and cost-effectiveness.

- Major Market Players: The market includes Denex international, JunoPacific Inc., SMC Plastics Ltd., Smiths Medical, Spectrum Plastics Group, Eastek International, Phillips Medisize, and many other.

- Startup Ecosystem: The startup industries play an important role in developing software and automation process, material innovation, specialized contract manufacturing, and prototyping & R&D support.

Technological transformation in the plastic injection molding for medical devices market plays a significant role in its expansion. These inventions are improving precision, efficacy, and the integrity of medical apparatuses. These approaches allow the making of compound, multi-efficient portions in a one-time cycle by uniting diverse resources or integrating metal/ electronics inserts, general in ergonomic operating instrument grips and wearable equipment. Progressive robotics switch resource managing, part removal, assemblage, and quality checkup, decreasing human fault and growing construction speeds.

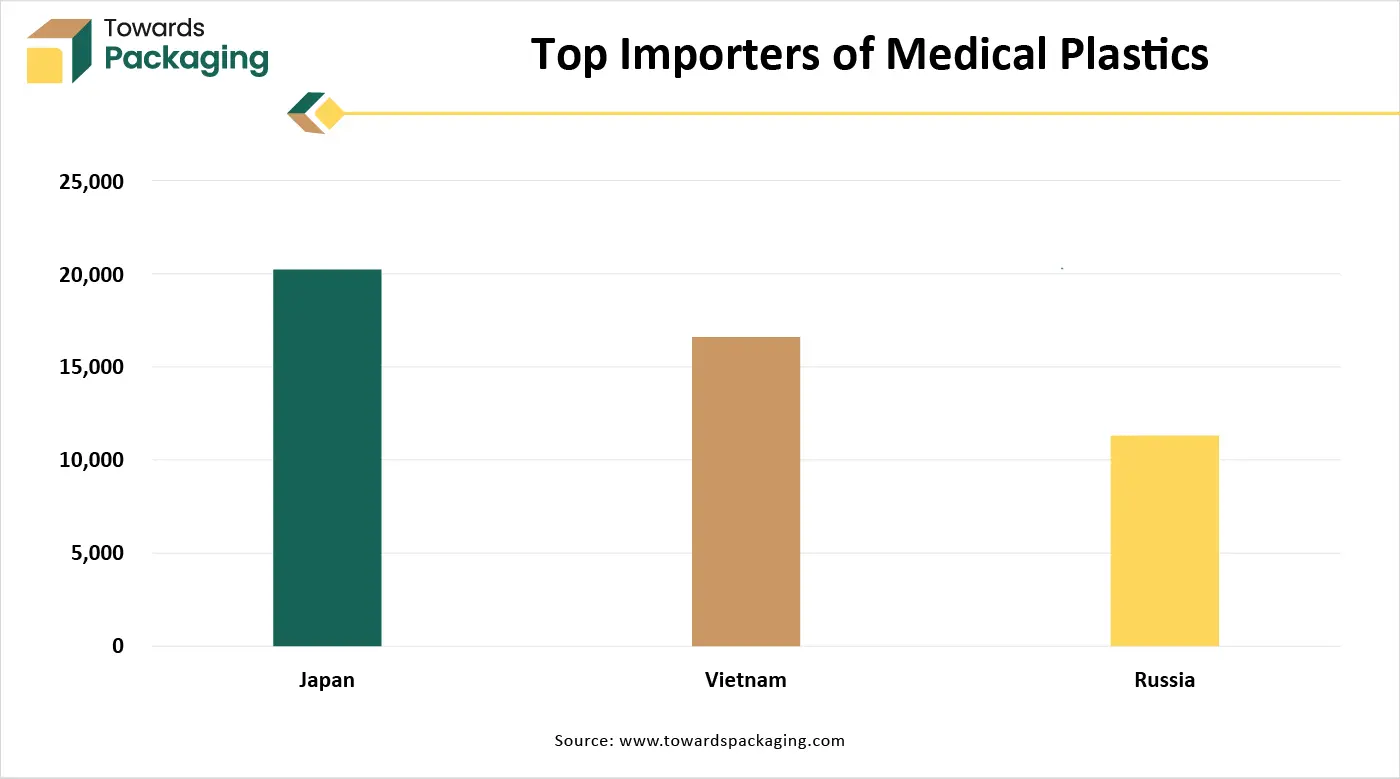

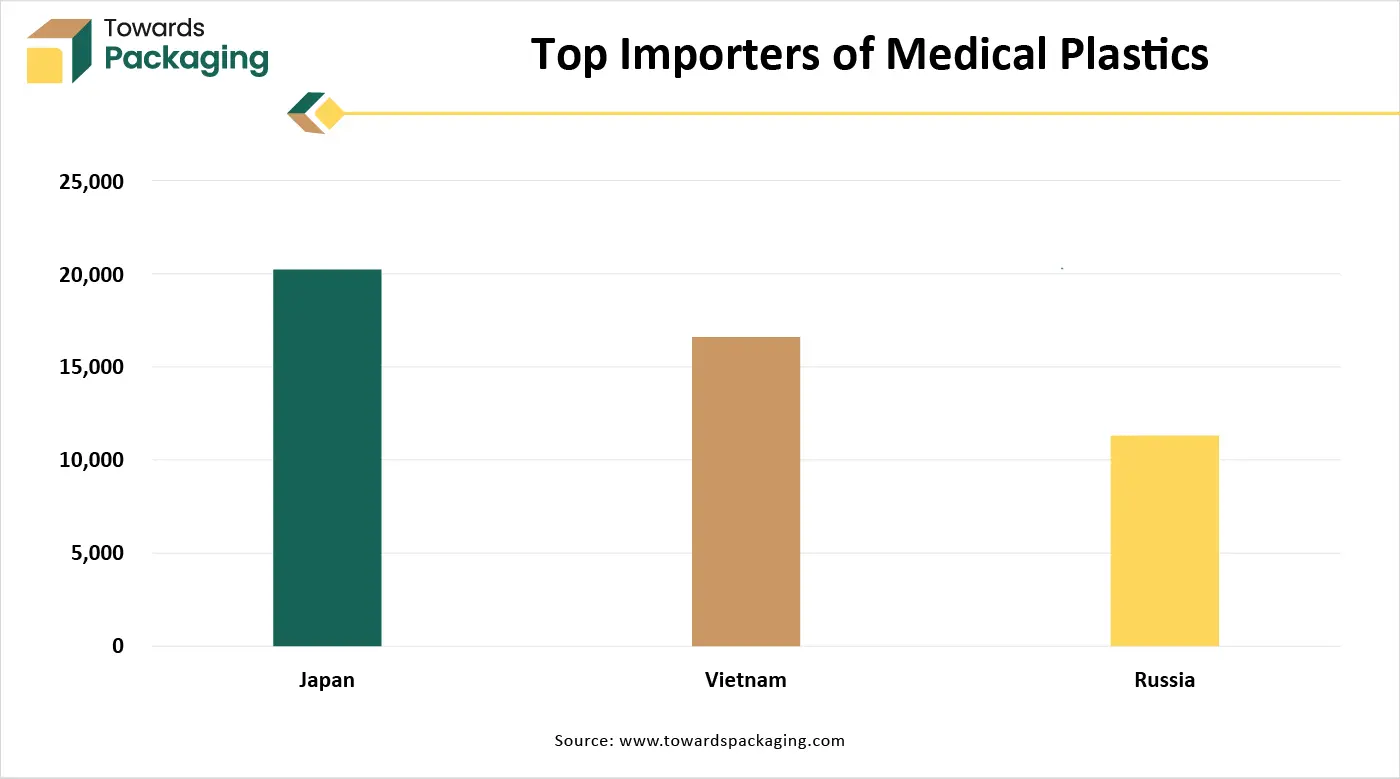

Trade Analysis of Plastic Injection Molding For Medical Devices Market: Import & Export Statistics

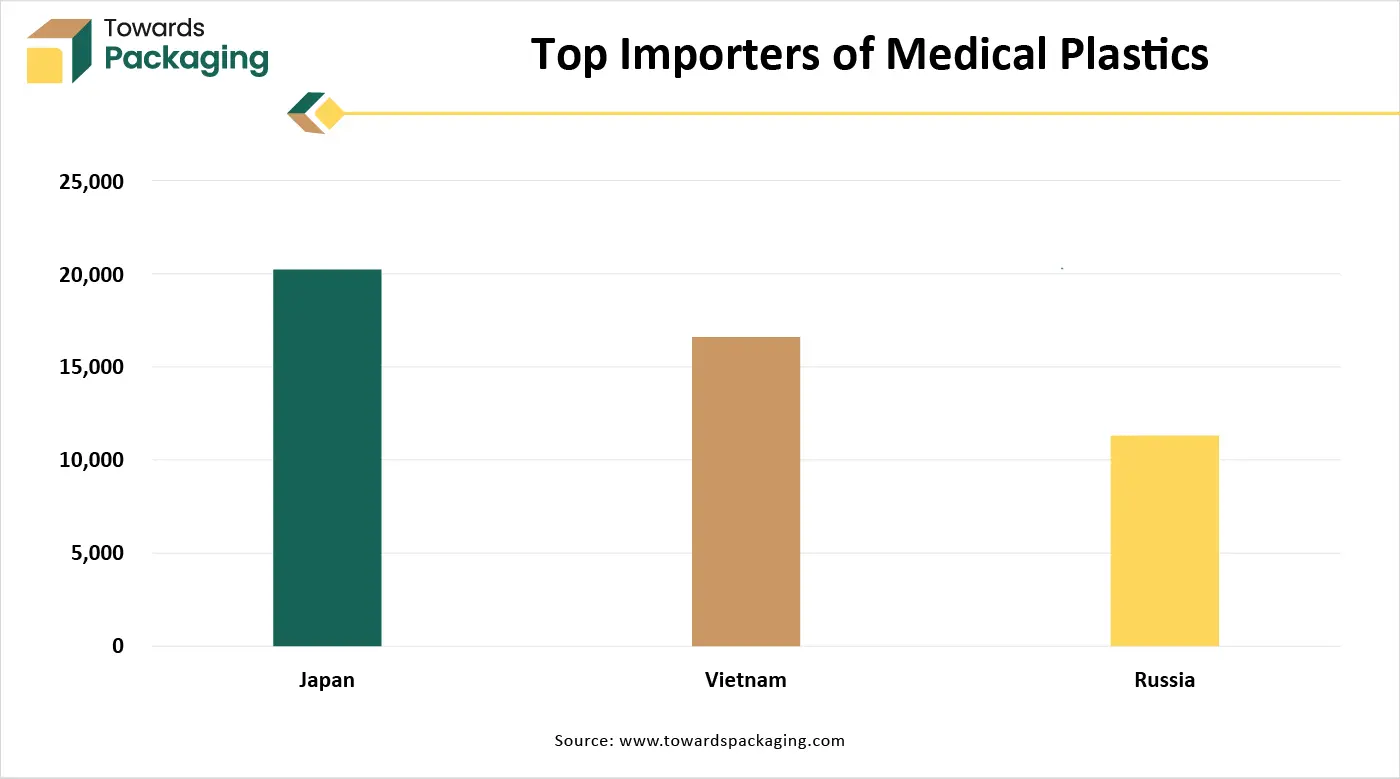

- Vietnam: It leads as the top-most worldwide Medical Plastics exporter with 29,822 shipments.

- China: It is the second leading exporter of Medical Plastics with 10,223 shipments worldwide.

- United States: It is considered as the third top-most exporter of Medical Plastics with 9,519 shipments globally.

Plastic Injection Molding For Medical Devices Market - Value Chain Analysis

Raw Material Sourcing

The major raw materials utilized in this market are polyethylene (PE), polypropylene (PP), and polycarbonate (PC).

- Key Players: Ash Industries, Seaskymedical.

Component Manufacturing

The component manufacturing in this market comprises diagnostic devices, orthopaedic devices, laboratory supplies, surgical instruments, drug delivery system.

- Key Players: Dickinson and Company, West Pharmaceutical Services

Logistics and Distribution

This segment is growing focus on growing demand for progressive, cost-operative, and high-volume medical machineries such as catheters, syringes, and surgical instrument handles.

- Key Players: Jabil Inc., Viant

Product / Device Type Insights

Why SingleUse Devices Segment Dominated the Plastic Injection Molding For Medical Devices Market In 2025?

The singleuse devices segment dominated the market with highest share in 2025 due to its cost-efficiency. The major driver is the rising demand for control over infection in both home as well as hospital healthcare setup, together with the increasing number of surgical processes and diagnostic examinations. The low charge and comfort of handing out for standard plastics stand them suitable for the high-volume manufacturing need for one-time use devices. Enhanced properties such as chemical resistance and clarity have made them appropriate for several sectors.

The implantable devices segment expects the fastest CAGR during the forecast period. This segment is growing due to strong quality control and increasing demand for biocompatible resources. It is important for generating the complex and accurate components required for medical devices, confirming they both are safe and functional for patients. The resources utilized must be extremely biocompatible to protect hostile reactions inside the body, needing focused pure plastics.

The diagnostic equipment is the fastest-growing in the market, as it comprises material properties, scalability, and precision. This segment is influenced by the rising occurrence of chronic diseases, the increasing demand for nominally offensive processes, and the complete development in healthcare setup. It depends on injection molding for huge volume, accurate manufacturing of multifaceted, often contracted and lightweight portions.

Material Type Insights

Why Thermoplastics Segment Dominated the Plastic Injection Molding For Medical Devices Market In 2025?

The thermoplastics segment dominated the market with highest share in 2025 due to its widespread usage, versatility, and cost-efficiency. The capability to be moulded to detailed conditions, endure sterilization processes, and flexible or rigid as required makes thermoplastics suitable for a huge variety of equipment. The increasing demand for one-time use equipment, infection control actions, and the growing require for progressive and dependable medical devices all offer to the constant development of this segment.

The bioabsorbable plastics segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to highly functional, innovative, and eco-friendly. Rising ecological apprehensions and stricter guidelines in several markets has raised the demand for this segment. Inventions in polymer chemistry are resulting to new resources with improved properties such as enhanced mechanical strength and measured degradation charges, growing their possible usage.

The thermosetting plastics is the fastest-growing in the market, as it comprises durability and high-temperature resistance. It can endure high temperatures, which make them appropriate for refillable medical policies that are frequently sterilized, mainly with steam. These resources are sometimes utilized for usages where reliability, strength, and durability are important, frequently in more strong machineries in comparison to one-time use thermoplastics.

Application / Medical UseCase Type Insights

| Application / Medical Use Case Segments |

Market Share 2025 (%) |

| General Medical Consumables / Disposables |

55% |

| Surgical Instruments |

25% |

| Other Applications |

20% |

Why General medical consumables / disposables Segment Dominated the Plastic Injection Molding For Medical Devices Market In 2025?

The general medical consumables / disposables segment dominated the market with highest share in 2025 due to material versatility, cost-efficiency, and high-volume repeatability. Huge production via injection moulding suggestively lesser the charge per unit in comparison to other processes. Permits for the reliable, high-volume manufacture of similar parts. Growing occurrence of vital diseases and causing upsurge in healthcare expenditure. This segment is considered by the mass manufacturing of high-volume, low-charge goods such as surgical tools, syringes, and Petri dishes, where qualities such as cost-efficacy, biocompatibility, and sterility are important.

The surgical instruments segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to demand for advanced surgical tools and components. The change in the direction of one-use surgical tools decreases the chances of healthcare-related infections and cross-contamination, growing the demand for injection-moulded disposables. The trend for negligibly hostile surgery needs extremely specialized and detailed tools, that can be produced proficiently via injection moulding.

The cardiology is the fastest-growing in the market, as it comprises regulatory compliance and technological innovation. The high occurrence of ischemic heart diseases and several other heart disorders worldwide influenced the demand for advanced cardiovascular equipment. The parts for cardiovascular equipment demand enormously tight acceptances and high dimensional accurateness because of their critical purpose. The requirement to fulfil strict ISO and FDA standards needs focused moulding plans and quality control procedures, which outlines the market.

EndUser / Customer Type Insights

Why Hospitals Segment Dominated the Plastic Injection Molding For Medical Devices Market In 2025?

The hospitals segment dominated the market with highest share in 2025 due to demand for reusable and disposable components. The development of diagnostic labs and hospitals globally, particularly in developing economies, directly upsurges the demand for several machineries. Progressions in moulding technology permit for the manufacturing of more multifaceted and reduced plans, further escalating the diversity of possible goods utilized in hospitals. This sector is a primary customer of injection-molded plastics because of the sheer volume and reliability needed for hospital supplies.

The research laboratories segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to innovation in materials and technology adoption. The injection moulding segment offers this by contributing custom, pre-production or low-volume runs of inoculation-moulded sector from research-grade resources. Development into new resources, such as biocompatible plastics or progressive composites, influences invention. This boosts the injection molding sector to accept new procedures and resources, which is shown in market development for precise materials.

The clinics is the fastest-growing in the plastic injection molding for medical devices market, as it comprises operational efficacy and infection control. The utilize of injection-moulded plastic equipment supports clinics accomplish infection regulator and preserve sterile situations. Progressive, injection-molded plans can result in higher operational efficacy in clinical systems. Clinics are key consumers of one-time use medical equipment, which influences the demand for huge volume, cost-operative injection-molded components.

Technology / Process Type Insights

Why Conventional Injection Molding Segment Dominated the Plastic Injection Molding For Medical Devices Market In 2025?

The conventional injection molding segment dominated the market with highest share in 2025 due to scalability, cost-effectiveness, and versatility. It allows the mass construction of high-integrity, dimensionally correct parts with less resource waste. It is appropriate for a huge range of plastic resources, comprising acrylonitrile butadiene styrene (ABS), polypropylene, and polyethylene. It is proficient of producing complex components needed for progressive medical devices. The industry is influenced by a rising demand for medical equipment, the rising geriatric population, and progressions in biocompatible plastics.

The micro injection molding segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to increasing demand for smaller and complex medical devices. It is influenced by the diminishment of medical expertise, the increasing demand for multifaceted, high-precision parts, and its capability to offer consistent, low-charge manufacturing of micro-sized machineries. The medical sector is a huge customer of micro injection moulded plastics which is a sector that is estimated to endure experiencing noteworthy development.

The multishot injection molding is the fastest-growing in the market, as it comprises integration, design flexibility, and efficiency of the devices. It permits for the incorporation of several resources or colors in a single component, generating complex patterns with a sturdy physical bond. It eradicates the requirement for secondary assembly procedures, which decreases assembly and labor charges. It permits the formation of complex equipment with combined services such as seals, flexible joints or valves, serving to the increasing demand for cultured medical equipment.

Regional Insights

How North America is Dominating in the Plastic Injection Molding For Medical Devices Market?

North America held the largest share in the plastic injection molding for medical devices market in 2025, due to the presence of strong healthcare infrastructure and increasing ecological concern. This region has progressive healthcare infrastructure and a huge demand for medical equipment, influenced by aspects such as an increasing and aging population and a growing occurrence of chronic diseases. Strong guidelines from bodies as the FDA influence the requirement for high-integrity, safe, and dependable medical devices, favoring the usage of accurate, high-presentation plastics production via injection molding. It has high-accuracy injection moulding, and a robust invention pipeline for original equipment such as drug delivery systems and wearable.

Why Plastic Injection Molding For Medical Devices Market is Dominating in the U.S.?

Rising demand for high-precision, scalability, and cost-effectiveness has enhanced the demand for plastic injection molding for medical devices in the U.S. The procedure is suitable for huge-quantity, repeatable construction runs, that is important for fulfilling the demand for one-time use and throwaway medical goods. It permits for the formation of shares at a less charges per unit, particularly for huge manufacturing volumes, that supports control healthcare charges. The U.S. healthcare structure profits from the efficacy and automation of injection moulding, which decreases defects and enhances manufacturing speed in clear atmospheres.

Why Plastic Injection Molding For Medical Devices Market is Growing Rapidly in Asia Pacific?

Increasing technological advancement, cost advantage, and increasing healthcare infrastructure has enhanced the demand for the market in Asia Pacific. Government inventiveness and the development of a middle-class population with huge healthcare expenditure additionally quicken market extension. The region is facing rapid development in its healthcare substructure, further influencing demand for medical equipment and apparatuses. There is an increasing demand for superior-quality, enhanced-precision, and cost-operative medical devices, which injection molding is suitable to offer.

How Plastic Injection Molding For Medical Devices Market is Expanding in China?

Enhanced healthcare demand, cost-effectiveness, and manufacturing capabilities has boosted the development of the plastic injection molding for medical devices market in China. An increasing and aging population with a growing occurrence of chronic diseases has influenced the requirement for an extensive range of medical equipment produced via injection molding. Government of China is enthusiastically promoting the healthcare sector via guidelines that assure the growth of medical apparatus producers, offer incentives, and capitalize in healthcare organization.

Which Factor is Responsible for Notable Growth of Plastic Injection Molding For Medical Devices Market in Europe?

The major factors influencing the growth of plastic injection molding for medical devices market are demand for bio-plastics, sustainable, technological advancement, and high-precision components. The usage of superior-quality, noticeable, and compliant resources and engineering procedures, which progressed plastic injection molding can offer. The increasing occurrence of an aging population, chronic diseases, and the change toward marginally offensive surgical measures upsurges the demand for several medical devices, like syringes, catheters, drug delivery systems and diagnostic equipment. Plastic injection moulding is suitable for mass-manufacturing these cost-operative, excellent-quality components.

Why Germany is Utilizing Plastic Injection Molding For Medical Devices Market Significantly?

The manufacturing expertise and strong industrial base has fuelled the development of the market. The medical sector’s requirement for accurate, high-volume shares such as blood collection tubes, diagnostic kits, and catheters is a significant influencer for advancement of injection molding. Presence huge and strong healthcare organization, combined with the worldwide upsurge in demand for medical equipment, boosts the requirement for injection-moulded apparatuses. An extremely trained workforce and progressive R&D competences confirm that German producers can fulfil the technical challenges of manufacturing complex medical equipment utilizing injection moulding.

The Plastic Injection Molding for Medical Devices Market in the Middle East & Africa (MEA) region is gaining momentum as healthcare infrastructure expands and demand for locally-manufactured medical supplies increases. Plastics especially polymers like polypropylene form the backbone of this growth, accounting for the largest share of materials used in injection-molded medical devices such as consumables, patient aids, orthopedic and dental products.

UAE Plastic Injection Molding for Medical Devices Market Trend

In the United Arab Emirates (UAE), the plastic injection molding market for medical devices is growing strongly. Plastics remain the dominant material segment, addressing demand for consumables, disposables, diagnostic and patient-care items. Rising healthcare infrastructure investment, growing medical device manufacturing locally, and adoption of precision molding including metal-infused parts further support growth over coming years.

In South America, the plastic injection molding for medical devices market is growing steadily as healthcare demand and medicaldevice production rise. Growth is driven by increasing demand for affordable consumables, diagnostics, dental and orthopaedic products, and a shift toward local manufacturing to reduce reliance on imports.

Brazil Plastic Injection Molding for Medical Devices Market Trend

- In Brazil, the market for plastic injectionmolded medical devices is growing steadily. Growth drivers include rising demand for affordable healthcare products, increasing local manufacturing to reduce reliance on imports, and expansion in sectors like diagnostics, consumables, and patient‑care devices.

Recent Development

- In November 2025, Vance Street Capital has announced a new medical moulding podium as part of a destructive extension in the medical device and life science markets.

- In May 2025, ENGEL collaborated with Roegele announced the launch of ENGEL Spain which is a new subsidiary based in Barcelona. This partnership is continued for more than five years.

Top Companies in the Plastic Injection Molding For Medical Devices Market

Becton, Dickinson and Company (BD)

Corporate Information

- BD is an American multinational medical-technology company.

- Headquarters: Franklin Lakes, New Jersey, USA.

- Founded: 1897 by Maxwell Becton and Fairleigh S. Dickinson.

- Industry: Medical devices, instrument systems, diagnostics & reagents.

- As of 2025: ~72,000 employees globally.

History and Background

- Founded in 1897 in New York City; later moved headquarters to New Jersey.

- Over more than a century, BD has grown from basic medical-device manufacturing (needles, syringes, etc.) to a diversified global med-tech leader spanning diagnostics, interventional devices, infusion systems, and more.

Key Developments and Strategic Initiatives

- In 2024–2025, BD initiated a strategic transformation: the company decided to separate its Biosciences & Diagnostic Solutions business to sharpen focus on core medical-technology operations.

- As part of this, BD struck a deal in July 2025 with Waters Corporation to combine BD’s Biosciences & Diagnostic Solutions unit with Waters, forming a new life-sciences/diagnostics entity.

Mergers & Acquisitions

- One major recent acquisition: In 2025, BD acquired the Critical Care Product Group from Edwards Lifesciences, for USD 4.2 billion expanding BD’s portfolio in smart connected-care solutions and advanced patient monitoring.

Partnerships & Collaborations

- As noted, in 2025 BD agreed to combine its Biosciences & Diagnostic Solutions business with Waters in a tax-efficient Reverse Morris Trust transaction effectively a strategic divestiture + merger to reposition BD’s long-term focus.

Product Launches / Innovations

- In 2025, BD launched BD neXus infusion pump, aimed at streamlining infusion therapy and improving medication safety and workflow in hospitals.

- BD also highlighted enhancements in vascular access management, medication management in operating rooms, and solutions for circulatory or plastic surgery contexts.

Key Technology Focus Areas

- Under its “BD Excellence” culture of continuous improvement and innovation, BD was recognized by Fortune as among “America’s Most Innovative Companies” in 2024 and again in 2025.

- Through the acquisition of Edwards Lifesciences’ Critical Care group, BD expanded into “smart connected care solutions” and advanced monitoring technologies, including AI-enabled clinical decision tools and monitoring devices signaling a push toward digital health, data-enabled care, and remote/critical-care technologies.

R&D Organisation & Investment

- BD maintains dedicated R&D, software-technology and manufacturing facilities globally; for instance, in India BD has R&D campuses in Chandigarh and Bengaluru.

- The company’s global scale and diversified segments (Medical, Interventional, Life Sciences) support continuous investment in product innovation, new device development (e.g. infusion pumps, connected-care devices), and regulatory-compliant manufacturing at scale.

SWOT Analysis

Strengths

- Very broad and diversified product portfolio from infusion devices, vascular access, interventional devices, to diagnostics & specimens.

- Global footprint and manufacturing scale ability to produce high volumes for global markets, with regulatory compliance and global distribution.

Weaknesses / Challenges

- Restructuring and spinning off parts of business (e.g. diagnostics/biosciences) may lead to transitional headwinds.

- Dependence on regulatory environments, global supply chain, and quality-control in manufacturing medical-device companies are vulnerable to recalls, regulatory scrutiny, compliance costs. Historically BD had recalls (syringes, IV devices) though many were many years ago.

Opportunities

- Growth in “connected care” and “smart/AI-enabled” medical devices BD’s acquisition of Critical Care business suggests a push into advanced monitoring, remote care, IoT-enabled devices.

- Emerging markets and global expansion BD already manufactures for export; demand for affordable medical devices is rising worldwide.

Threats / Risks

- Market, regulatory or reimbursement changes (e.g. in healthcare policies) can impact demand for medical devices.

- Integration and execution risks for recent acquisitions, and potential disruption during organizational restructuring (spin-offs).

Recent News & Strategic Updates

- In June 2024, BD announced agreement to acquire Edwards Lifesciences’ Critical Care product group (for US$4.2 billion), expanding BD’s portfolio into smart connected-care and advanced monitoring.

- In early 2025, BD’s board authorized plan to separate its Biosciences & Diagnostic Solutions business refocusing BD on medical-device manufacturing.

Other Top Companies

- BBRAUN: It is a global healthcare corporation that generates a wide range of medical devices, comprising those made with injection molding.

- Terumo: It is a global medical firm that is a pioneer in medical device invention.

- Edwards Lifesciences: It is well-known for its proficiency in injectable drug packaging and delivery systems.

- Others: Boston Scientific, Phillips Medisize, Smiths Medical, JunoPacific Inc., Nipro, Wego, ICU Medical, SMC Plastics Ltd., Flextronics, and Spectrum Plastics Group, Inc.

Plastic Injection Molding For Medical Devices Market Segments Covered

By Product / Device Type

- Durable Medical Equipment

- SingleUse Devices

- Diagnostic Equipment

- Implantable Devices

By Material Type

- Thermoplastics

- Thermosetting Plastics

- Bioabsorbable Plastics

- Elastomers

By Application / Medical UseCase

- Orthopedics

- Cardiology

- Diagnostic Imaging

- Surgical Instruments

By EndUser / Customer Segment

- Hospitals

- Clinics

- Research Laboratories

- Home Healthcare

By Technology / Process Type

- Conventional Injection Molding

- Micro Injection Molding

- Multishot Injection Molding

- (Potentially newer: 3Dprinting integration / hybrid methods)

By Region

- North America:

- U.S.

- Canada

- Mexico

- Rest of North America

- South America:

- Brazil

- Argentina

- Rest of South America

- Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA