Vehicle Wrapping PVC Film Market Size, Trends, Challenges, and Opportunities

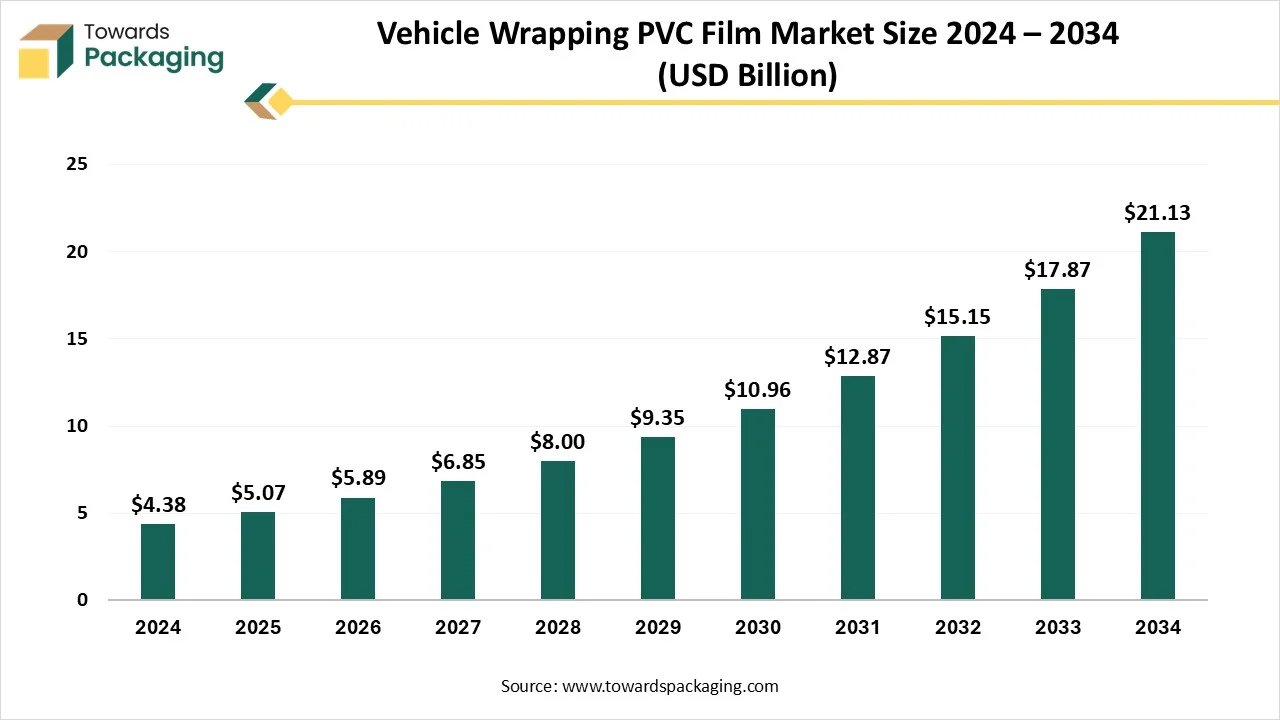

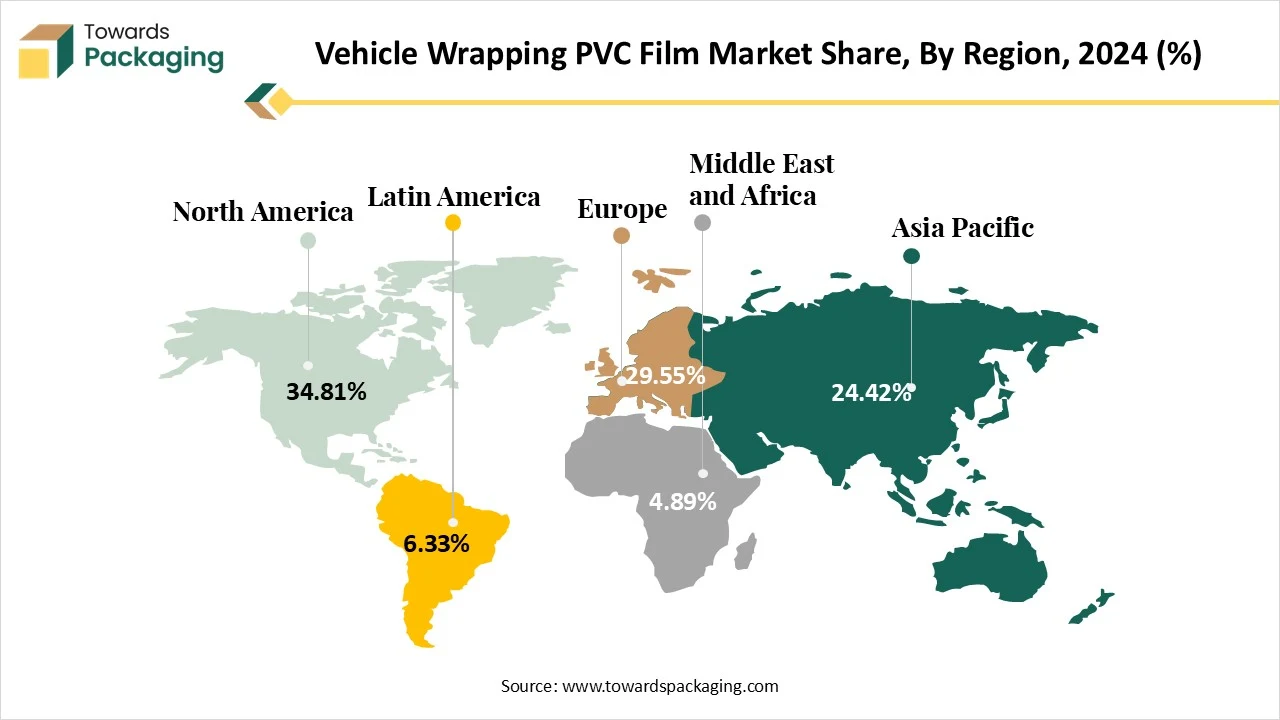

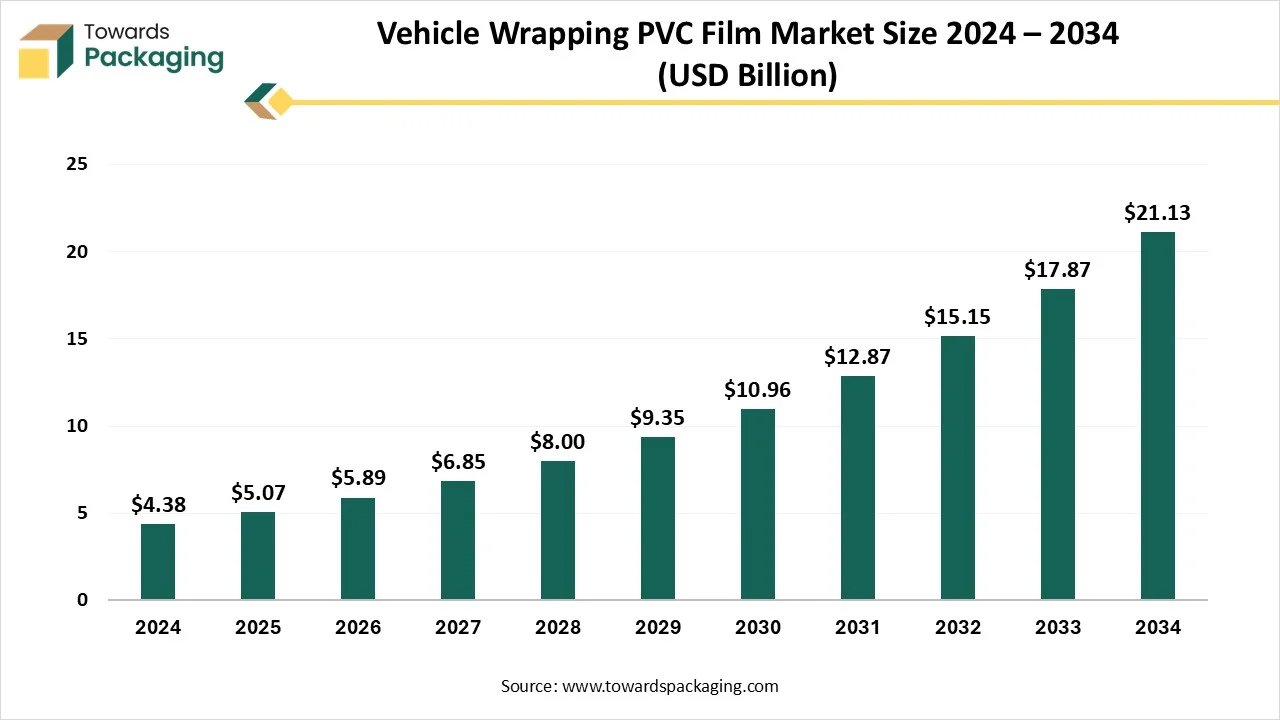

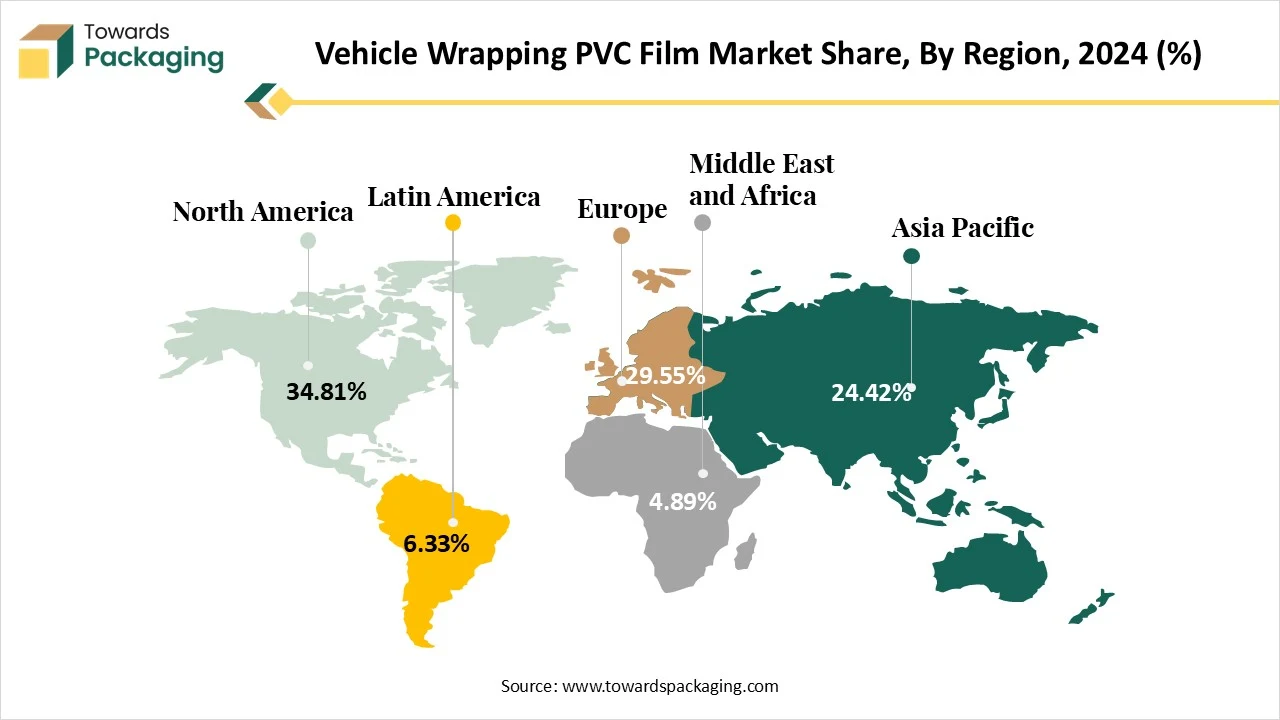

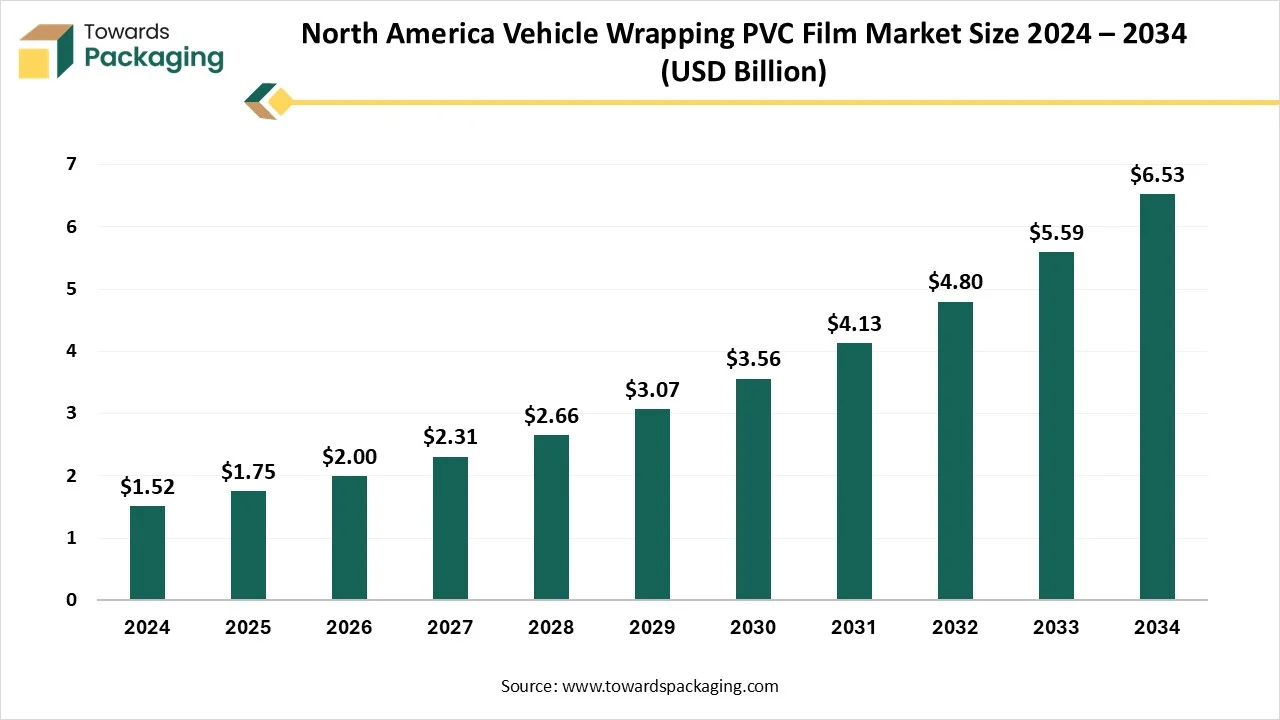

The vehicle wrapping PVC film market is forecasted to expand from USD 6.01 billion in 2026 to USD 25.05 billion by 2035, growing at a CAGR of 17.18% from 2026 to 2035. This report covers market size, segmentation (type, application, vehicle type), key trends such as rising customization demand and advanced wrap technologies, and regional insights across North America (34.81% share in 2024), Europe, Asia-Pacific (fastest CAGR 20.84%), Latin America, and Middle East & Africa.

It includes competitive analysis of major companies such as 3M, Avery Dennison, APA, ORAFOL, Arlon, HEXIS, and others. The study further examines the value chain from PVC resin suppliers to manufacturers, distributors and installation service providers along with trade flows, production hubs, innovations, and the roles of global manufacturers and suppliers shaping industry growth.

The vehicle wrapping PVC film industry is likely to witness gradual yet steady growth during the analysis period. Vehicle wrapping PVC film is a thin flexible sheet made-up of polyvinyl chloride (PVC) that is applied to the surface of the vehicles to alter their appearance, protect the original paint and sometimes display advertising graphics. This film is designed to conform to the curves and contours of a vehicle and this provides a seamless and visually appealing finish. It comes in different colors, finishes and printed designs that help with the extensive customization. These films, which are frequently placed utilizing heat and pressure, are sturdy and weather-resistant, making them a popular choice for personalization and commercial branding. They also add a layer of protection against tiny scratches, UV rays as well as environmental damage, extending the vehicle's lifespan while also improving its aesthetics.

The rising demand for vehicle customization among consumers who search for unique aesthetics is anticipated to augment the growth of the vehicle wrapping PVC film market during the forecast period. Furthermore, the advancements in the printing technologies along with the increasing affordability of vehicle wraps compared to traditional paint jobs are also expected to support the growth of the market. Additionally, the growing popularity of electric and luxury vehicles as well as the urbanization and an expanding automotive sector in the emerging economies coupled with the innovations in the automation and induction sealing equipment along with the rise of social media and digital marketing is also projected to contribute to the growth of the market in the near future.

Key Metrics and Overview

| Metric | Details |

| Market Size in 2025 | USD 5.13 Billion |

| Projected Market Size in 2035 | USD 25.05 Billion |

| CAGR (2026 - 2035) | 17.18% |

| Leading Region | North America |

| Market Segmentation | By Type, By Application, By Vehicle Type and By Region |

| Top Key Players | 3M Company, Avery Dennison Corporation, A.P.A. S.p.A., ORAFOL Europe GmbH |

Key Trends and Findings:

- Color change and vehicle customization have emerged as one of the major trends shaping the market. Consumers are utilizing wraps to achieve bold unique looks, moving beyond the traditional factory paint options. With a broad array of the colors, textures as well as finishes available, wraps provide flexible, reversible customization without the high cost of repainting. This increased inclination towards the fast customized makeovers is pushing the demand across the personal and the commercial vehicle categories globally.

- Developments in the wrap films and application methods are emerging alongside personalization. The wrapping process is being completely transformed by Arlon's groundbreaking FLITE Technology, for example, which makes it possible for wrappers to increase productivity and effortlessly finish entire wraps even in extremely demanding settings. Wrappers may now operate independently because of to this technology, which guarantees easy repositioning, bubble-free application and the removal of adhesive lines.

- Vehicle wraps have evolved into futuristic billboards, and it is quite understandable why they are becoming so popular! Vehicle wrapping has grown in popularity as a marketing tactic in recent years, specifically among corporate fleets. Organization owners are increasingly drawn to this advertising approach because of its affordability and wider reach. Wrapped vehicles can create thousands of daily impressions since they travel to various locations that increase the brand presence. Furthermore, advancements in the high-resolution printing provide colorful as well as eye-catching patterns that improve the client engagement and brand recall.

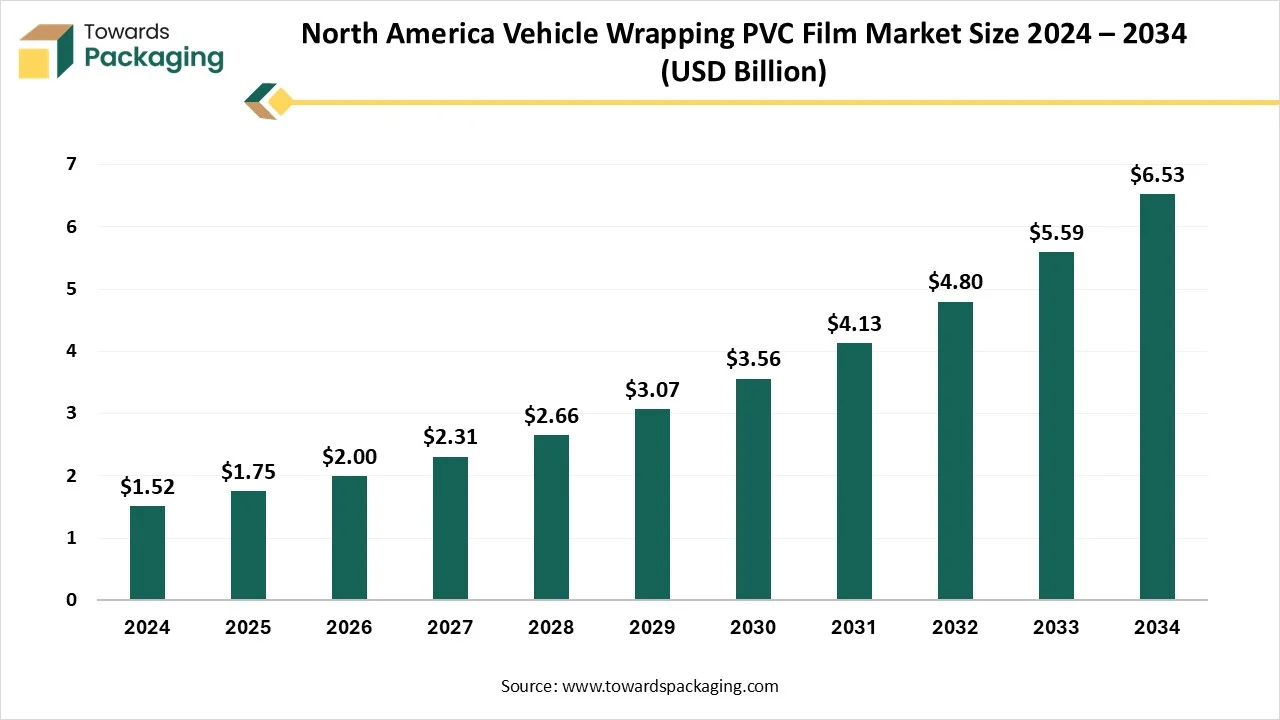

- North America held substantial market share of 34.81% in 2024. This is due to the strong culture of the vehicle personalization as well as a high adoption rate of mobile advertising among businesses.

- Asia-Pacific is expected to grow at a fastest CAGR of 20.84% owing to the rapid urbanization, increasing vehicle ownership, along with the rising disposable incomes in countries like China, India and Japan.

Market Drivers:

Growing Demand for Vehicle Customization:

The increasing demand for consumer desire for personalized vehicle aesthetics is anticipated to support the growth of the vehicle wrapping PVC film market during the estimated timeframe. Vehicle wrapping is popular since it provides an extensive number of design options that regular re-spray techniques do not. The aesthetics of customized vehicles are now generally available and are no longer exclusive to luxury manufacturers. This shift has been fueled due to the growing belief that automobiles are more than just machines; they are extensions of one's individuality. People today want their cars to not only work properly but also reflect who they are because they spend so much time in them. There are now many possibilities for customization available in the vehicle industry, ranging from body types to external wraps as well as interior stylizations.

Furthermore, car wrapping is less expensive than painting. Painting the car alone is insufficient; gradients, different panels as well as separate iconography, etc., must also be added. This can be costly and time-consuming and the finished product may not even be what was envisioned. Additionally, vinyl wraps facilitate one to personalize more than just the exterior of the vehicle; one may alter the look of the lighting, wheels, badges, and other components as well. This trend is specifically evident among youngsters and performance vehicle enthusiasts, who regularly switch styles without impacting resale value. Tesla owners, for example, have increasingly turned to vinyl wrappings to distinguish their vehicles, given the factory offers a limited color pallet. With influencers and automotive You-Tubers demonstrating bold wrap changes, the trend is gaining popularity globally, establishing vehicle wrapping PVC films as a key player in the personalization wave in the automotive aftermarket industry.

Market Restraints:

Limited Reusability and Environmental Concerns:

The limited reusability and the associated environmental concerns are expected to limit the growth of the vehicle wrapping PVC film market within the estimated timeframe. Vinyl wraps are detachable, but not reusable. Once a wrap is removed from a vehicle, whether because to wear, damage, and design changes, it is usually discarded. Most vehicle wraps are composed of polyvinyl chloride (PVC), a petroleum-based material that is not biodegradable and difficult to recycle. As a result, used wraps contribute to the growth of the plastic waste, which is a concern for environmentally aware consumers and regulators.

In an era where sustainability has emerged as a key value across industries, the automotive and aftermarket sectors encounter increasing pressure to decrease their environmental footprint. According to the United Nations Environment Programme, more than 400 million tonnes of the plastic waste is produced globally each year and a growing portion comes from industrial and commercial applications. Also, as per the Progress Report 2024 by VinylPlus, only about 24.3% of the PVC waste produced in the European Union-27, Switzerland, Norway and the UK in 2023 was recycled, while the overall amount of recycled PVC waste in Europe fell by 9.3% in 2023.

Additionally, government policies in regions such as the Europe are implementing strong environmental regulations and encouraging firms to adopt sustainable alternatives. However, the current market provides very few possibilities for biodegradable or recyclable wrap films. A few companies recently started to investigate PVC-free films created from other materials, but these products remain niche and expensive. Unless eco-friendly wrap technology becomes common and cost-effective, the sustainability issue will continue to limit the adoption of the vehicle wrapping films.

Market Opportunities:

Growing Demand for High-Impact Marketing Tools:

The increasing demand for the high-impact marketing tools is expected to support the growth of the vehicle wrapping PVC film market in the years to come. In today's competitive world, brands are actively looking for marketing tools that are low-cost and provide more reach as well as audience engagement. This increased demand has considerably contributed to the emergence of the vehicle wraps as a powerful promotional tool. Vehicle wrapping PVC films are an appealing alternative for firms looking to stand out in the crowded markets, as they deliver aesthetic versatility along with an effective means to transform the regular transportation into moving advertisements.

Vehicle wraps provide constant visibility, as opposed to traditional types of advertising such as billboards, television and internet ads, which require substantial recurrent expenses and limited exposure time. The Outdoor Advertising Association of America (OAAA) estimates that a single wrapped car can generate 30,000 to 70,000 impressions per day. Also, every dollar matters when it comes to advertising. Compared to the conventional advertising mediums, vehicle wraps provide 38 times more impressions per dollar. This makes it one of the most cost-effective marketing platforms, with a reduced cost per impression compared to most other media channels.

Companies such as FedEx, Domino's, and even local service providers like plumbers and electricians have utilized car wraps to stand out on the road and stay top-of-mind with potential consumers. With visual content leading consumer attention and real-world advertising proving reliable in the digital era, demand for striking street-level marketing techniques is expected to continue rising further. This creates a substantial opportunity for the vehicle wrapping PVC film market, specifically as design technologies and print quality improve.

Artificial Intelligence (AI) Impact on the Market:

Once considered as a niche service for the car enthusiasts, the vehicle wrapping PVC film market is anticipated to undergo a tech-driven transformation due to the growing influence of the artificial intelligence. No longer limited to the basic colour changes and logos, the process of designing and applying vehicle wraps is becoming smarter as well as more precise. AI based design software enables real-time 3D visualization customized to the exact make and model of a vehicle, guaranteeing that every contour, edge and curve is perfectly accounted for before the film is even printed. This reduces the material waste, speeds up the installation, and improves customer satisfaction—making personalization more accessible to a broader consumer base.

In the manufacturing space, AI is helping in automating quality control and streamlining the production. Intelligent systems can detect the microscopic flaws in PVC film surfaces in real-time. AI predictive maintenance tools are also helping the producers improve the machinery uptime and operational efficiency that is important for meeting the growing demand in high-volume markets. From a commercial standpoint, fleet managers and advertising companies are using AI to map out routes that maximize brand exposure. As consumer expectations rise and competition intensifies, AI is also being used to model sustainability impacts—suggesting environmentally friendlier materials and production processes. AI is improving the vehicle wrapping ecosystem and reshaping it, driving innovation across design, production as well as marketing.

Key Segment Analysis:

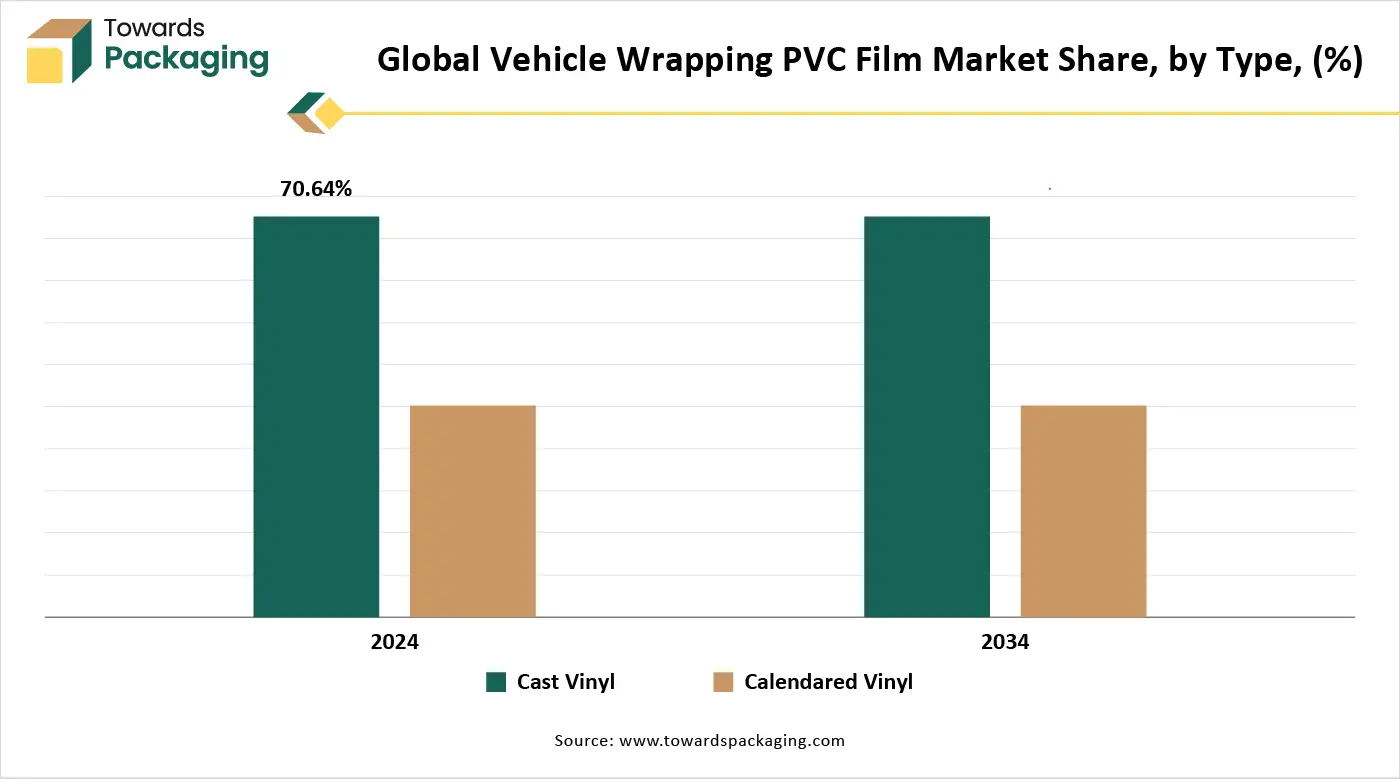

Type Segment Analysis Preview

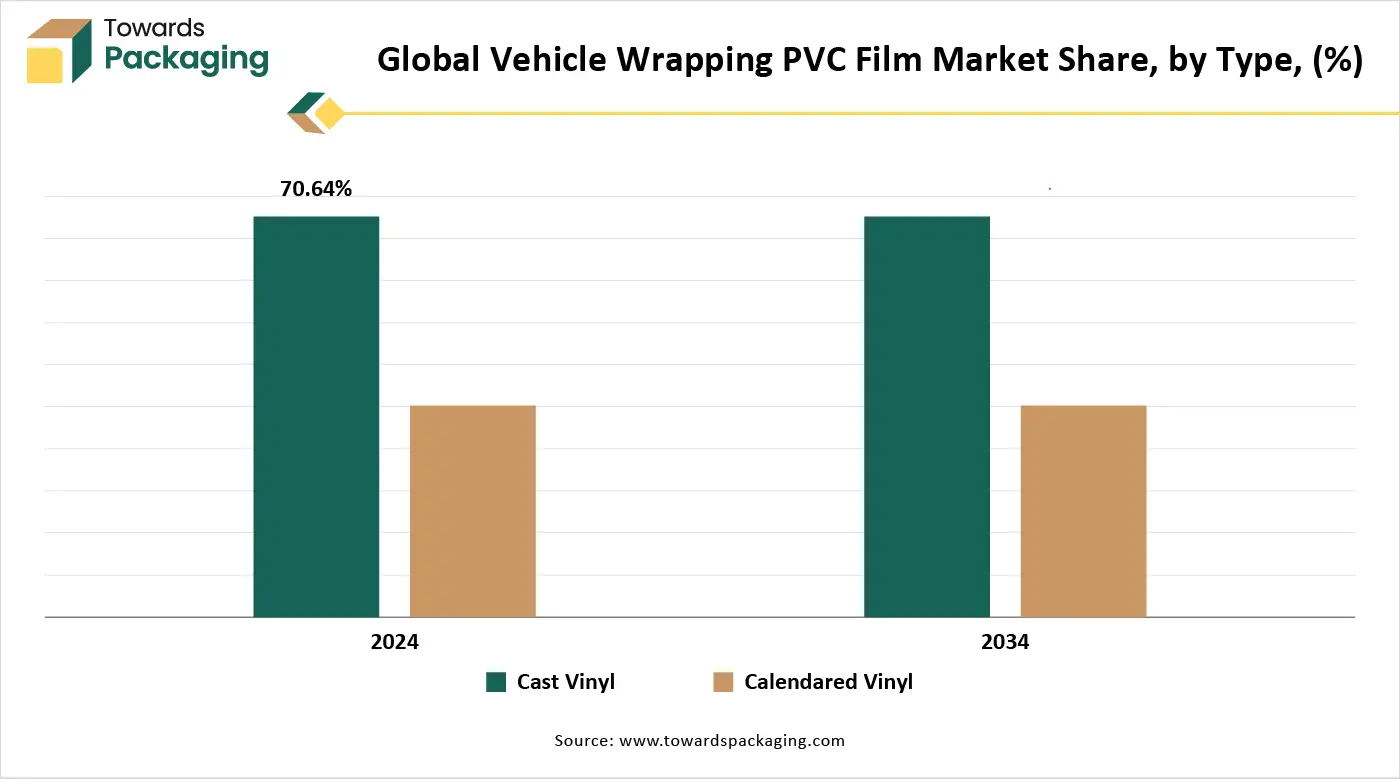

The cast vinyl segment held largest share of 70.64% in the year 2024. This is due to its superior quality, performance and longevity. Cast vinyl, as opposed to calendared vinyl, which is thicker and less flexible, is made using a casting technique that results in a thin, durable, and highly conformable film. This helps it to attach flawlessly to complex curves, rivets and shapes of a vehicle's surface without stretching and distorting over time. Its dimensional stability guarantees that it retains its shape as well as appearance even in harsh weather conditions and this makes it perfect for the long-term applications like full-body wraps and fleet graphics. Furthermore, it is easier to install and remove without leaving adhesive residue. These benefits makes cast vinyl an attractive option for the professionals and customers looking for superior quality, aesthetic versatility and long-lasting results in the vehicle wrapping.

Vehicle Type Segment Analysis Preview

The passenger cars segment held largest share of 57.25% in the year 2024. This is due to the improved road infrastructure and the aspiration for a better lifestyle. Furthermore, the availability of easy financing options and government incentives—such as tax benefits or subsidies on electric vehicles (EVs)—make car ownership more accessible and the rise of nuclear families and the need for private safe transport is also likely to support the growth of the segment in the global market. Additionally, the continuous launching of new models as per the regional tastes along with the strong after-sales service networks as well as the growing popularity of the ride-hailing services is expected to contribute to the segmental growth of the market during the forecast period.

Regional Insights:

North America held considerable market share of 34.81% in the year 2024. This is due to the strong car culture in the U.S. and Canada. This is due to the strong car culture in the U.S. and Canada. Furthermore, since 92 percent of American households own at least one car, according to the most recent U.S. Census data and the number of registered vehicles in the country increased by almost 3.5% between 2018 and 2022, from 269,417,884 to 278,870,463 registered vehicles, indicating an upward trend in the ownership of car, vehicle wrap marketing has an immense potential reach in the United States. Additionally, the presence of major manufacturers like 3M and Avery Dennison in the region as well as the strong aftermarket automotive industry is also expected to support the regional growth of the market.

Asia Pacific is likely to grow at a considerable CAGR of 20.84% during the forecast period. This is due to the increasing car ownership among the growing middle class in the region. Additionally, the expanding automotive industry with the growing sales of electric cars as well as the presence of the major automobile manufacturing hubs in China, Japan, and India) is also expected to contribute to the regional growth of the market. According to the Global EV Outlook by the International Energy Agency, in 2023, there were 8.1 million new electric car registrations in China, a 35% increase over 2022. The primary driver of the entire cars market's growth was increase in sales of the electric cars. Furthermore, the high population density along with the visual marketing demand is likely to contribute to the regional growth of the market.

Recent Developments by Key Market Players:

- In January 2025, WrapStyle announced the establishment of a new WrapStyle location in Slovakia. The workforce from Autofólie Trenčín, who has joined the internationally recognized WrapStyle brand after many years of experience, is responsible for this expansion. The new location maintains the same level of accuracy, creative thinking, and superior quality that WrapStyle clients throughout the globe have come to expect. They provide a variety of services in addition to high-quality car wraps, such as window tinting, ceramic coatings, protective films, advertising wraps, and distinctive bespoke designs.

- In November 2024, APA introduced a new range of car wrapping vinyl, seeking to maximize the utilization of its Power-Jet-System technology. To promote the new PowerJet line, the business claims that it provides a speedier and easier application process. Strong repositionability and stability allow the product to be used on riveted and curved surfaces. The collection features a PET protective covering and is available in a range of colors and finishes, from matte to extra-glossy.

Vehicle Wrapping PVC Film Market Key Players

- 3M Company

- Avery Dennison Corporation

- A.P.A. S.p.A.

- ORAFOL Europe GmbH

- Arlon Graphics LLC

- HEXIS S.A.

- KPMF (Kay Premium Marking Films)

- Ritrama S.p.A. (a Fedrigoni company)

- VViViD Vinyls

- Lintec Corporation

- Nexfil Co., Ltd.

Vehicle Wrapping PVC Film Market Segments

By Type

- Cast Vinyl

- Calendared Vinyl

By Application

- Advertisement

- Protection

- Sports

By Vehicle Type

- Passengers Cars

- Trucks

- Buses

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- U.K.

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-East Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East & Africa

Tags

FAQ's

Select User License to Buy

Figures (5)