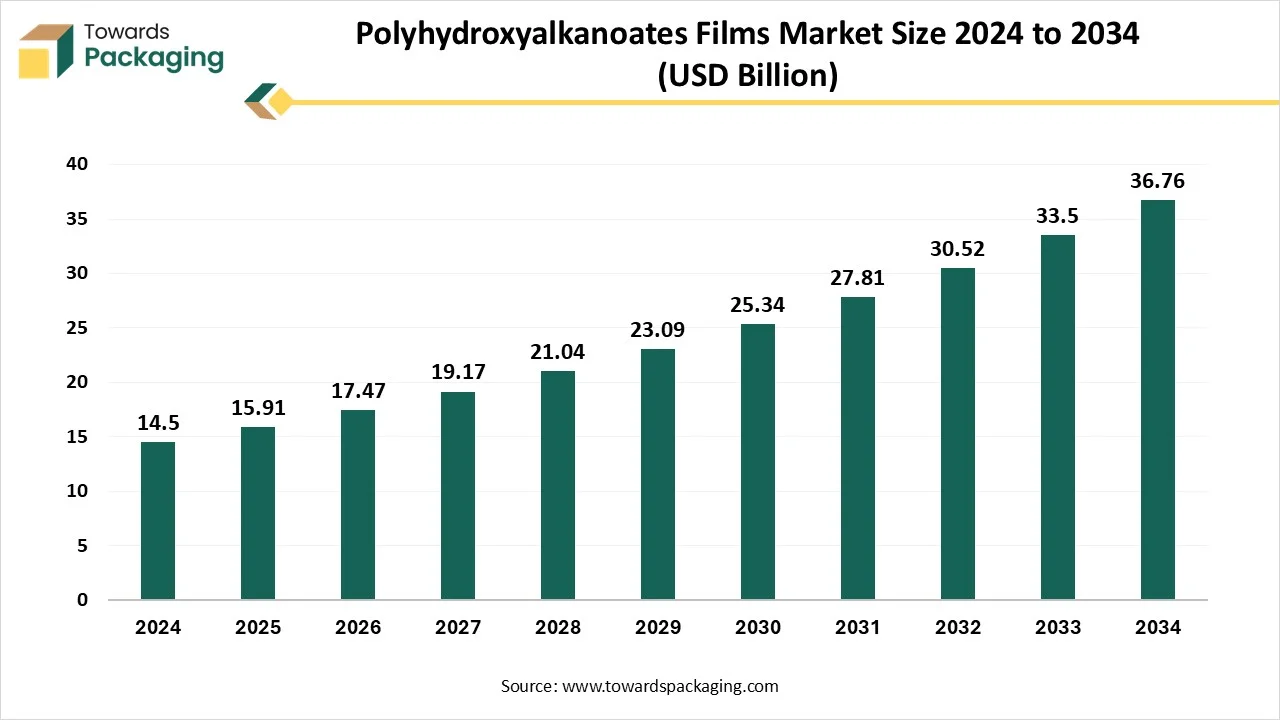

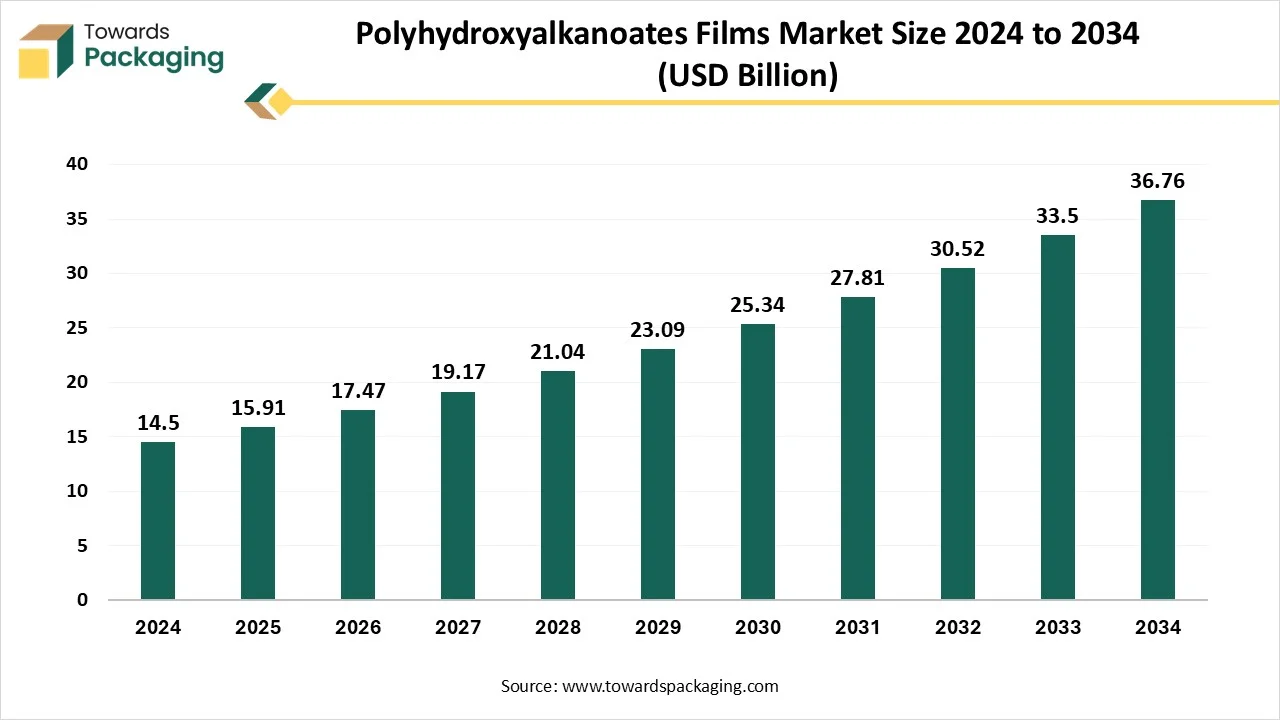

The polyhydroxyalkanoates films market is forecasted to expand from USD 1.83 billion in 2026 to USD 4.23 billion by 2035, growing at a CAGR of 9.75% from 2026 to 2035. This comprehensive report analyzes market trends, key segments including short-chain and medium-chain PHA polymers, monolayer and multilayer films, and applications across food packaging, agriculture, and healthcare.

The study provides detailed regional insights covering North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa, alongside competitive analysis of top players like Danimer Scientific, CJ Biomaterials, and RWDC Industries. The report also explores the complete value chain, trade dynamics, and strategies adopted by manufacturers and suppliers to capture market growth.

The polyhydroxyalkanoates (PHA) film market is also experiencing exponential growth driven by expanding use of PHA films in food packaging, agriculture, and healthcare industries. Additionally, the market is rapidly expanding in developing and developed regions, particularly Europe, fuelled by stringent government regulations against single-use plastics and increasing focus on promoting circular economy principles.

Polyhydroxyalkanoates (PHA) films are biodegradable and bio-based plastic films made from microbial fermentation of renewable resources such as plant sugars and oils. These films are used in various applications due to their compostability, low toxicity, and environmental compatibility. They serve as sustainable alternatives to petroleum-based plastic films across packaging, agriculture, biomedical, and other industries.

As technology continues to evolve, AI integration holds great potential to revolutionize the polyhydroxyalkanoates films market by optimizing production processes, improving material properties, and reducing wastage. AI integration assists in developing sustainable solutions for PHA production and improves waste management practices, contributing to a more circular economy. AI-powered tools can predict material properties, offering the design of PHA films with specific attributes for a wide range of applications across various industries. By harnessing the power of machine learning (ML) algorithms, organizations can effectively analyze complex data from fermentation processes, identifying patterns and predicting valuable insights to increase overall productivity.

How is the Rising Demand for Biodegradable and Compostable Packaging Impacting the Market’s Growth?

The rising biodegradable and compostable packaging is expected to boost the growth of the polyhydroxyalkanoates films market during the forecast period. Polyhydroxyalkanoates (PHA) films are broken down naturally by microorganisms via biodegradation, offering a sustainability alternative to conventional plastics derived from fossil fuels. Sustainability is increasingly becoming a major focus and plays a crucial role in the packaging industry, allowing businesses and individuals to address ongoing environmental challenges such as climate change, plastic pollution, and depletion of natural resources. By utilizing renewable resources, PHA production and disposal can have a significantly reduced carbon footprint than fossil fuel-based plastics.

High Cost of PHA

The high cost associated with the production of PHA is anticipated to hamper the market's growth. Polyhydroxyalkanoates (PHA) production through bacterial fermentation requires more capital than traditional plastic production. This high cost is mainly influenced by the price of raw materials and the need for expensive specialized equipment. Such factors are likely to limit the expansion of the global Polyhydroxyalkanoates films market, particularly in middle and lower-income countries.

Growing Environmental Concerns and Stringent Regulations

The growing environmental concerns and stringent regulations are projected to offer lucrative growth opportunities to the polyhydroxyalkanoates films market during the forecast period. Several governments around the world are implementing stringent regulations and policies, especially in developed regions such as North America and Europe, to phase out conventional petroleum-based plastics with an aim to replace them with sustainable alternatives. Polyhydroxyalkanoate films are generally produced from renewable resources like vegetable oils, plant sugars, starch, and others through microbial fermentation. The adoption of PHA films by various industries lowers the carbon footprint, making it an environmentally friendly option for plastic manufacturers. Moreover, the rapid advancements in material science result in improving the cost-effectiveness and performance of PHA.

The short-chain length (scl-PHA) segment registered its dominance over the global polyhydroxyalkanoates films market. Short-chain-length polyhydroxyalkanoates are biodegradable polyesters with crucial applications in films owing to their biodegradability and biocompatibility. Scl-PHA films are biodegradable and provide an eco-friendlier alternative to conventional plastic films. Their unique properties make them suitable for various industries such as packaging, coatings, personal care, and others. On the other hand, the medium-chain length (mcl-PHA) segment is expected to grow at the fastest CAGR. MCL-PHAs are biodegradable polyesters having excellent properties that make them suitable for packaging applications, offering a more sustainable alternative to traditional plastics. These polymers are generally produced from a wide range of renewable resources, including agricultural and industrial wastes, lowering the dependence on fossil fuels. MCL-PHAs are widely adopted to address the growing problem of plastic waste.

The fermentation of sugars/starches segment accounted for the dominating share in 2024. Polyhydroxyalkanoates are often produced by microorganisms from starches and sugars, offering an eco-friendly alternative to traditional plastics. Microorganisms are generally grown in a liquid medium containing starches or sugars as a carbon source. These polymers are processed into films for numerous applications, such as food packaging. On the other hand, the fermentation of waste oils/fats segment is expected to witness a significant share during the forecast period. Polyhydroxyalkanoates are biodegradable polymers that are often produced by bacterial fermentation of a wide range of carbon sources, such as waste oils and fats. This process holds potential to reduce dependence on petroleum-based plastics and promotes a circular bioeconomy by converting waste into valuable products.

The monolayer films segment held the largest share of the polyhydroxyalkanoates films market in 2024. PHA films can be produced as single-layer or monolayer films, offering a sustainable alternative. The growth of the segment is mainly driven by the increasing demand for these films across various applications such as food packaging, medical, and many other areas where biodegradable materials are highly preferred. On the other hand, the multilayer films segment is expected to grow significantly during the forecast period. Polyhydroxyalkanoates can be combined with other materials, such as cellulose nanocrystals (CNCs), to create multilayer films with excellent tailored properties. It offers barrier properties including protection against water vapor, oxygen, and limonene. Through the materials choice and processing techniques, the properties of PHA multilayer films can be tailored for various specific applications to meet the requirements.

The 20–50 microns segment registered its dominance over the global Polyhydroxyalkanoates films market in 2024. PHA films in the 20–50-micron range offer various properties such as biodegradability, flexibility, barrier properties, and excellent thermal properties. Polyhydroxyalkanoates (PHAs) with thicknesses between 20 and 50 microns are gaining immense popularity in various applications, particularly in packaging. On the other hand, the <20 microns are expected to witness remarkable growth during the forecast period. PHAs can be processed into films with thicknesses <20 microns, offering a sustainable alternative and reducing reliance on traditional plastics. These films can replace petroleum-based plastics in various applications, such as healthcare, food packaging, and other applications.

The direct sales (B2B) segment held the majority of the market share in 2024, owing to the rising demand in B2B direct sales, particularly within the packaging industry. Under Direct Sales (B2B), manufacturers of the PHA film are increasingly involved in direct sales to businesses rather than depending on retail channels. Additionally global push for the circular economy and stringent government regulations on conventional plastics, driving the segment’s growth during the forecast period. On the other hand, the online platform segment is projected to grow at a CAGR of between 2025 and 2034. Online platforms assist in connecting prominent PHA producers with potential buyers for various applications, including packaging, agricultural, biomedical, and others. Online platforms offer a wide availability of PHA films with attractive discounts and convenience. Thus, bolstering the segment’s growth.

The food packaging segment held a dominant presence in the polyhydroxyalkanoates films market in 2024, owing to the increasing demand for PHA products in food packaging. PHA offers an eco-friendly and biodegradable alternative to traditional petroleum-based plastics in packaging for food items. PHA films hold the potential to maintain barrier properties, which makes them ideal for both rigid and flexible packaging applications. On the other hand, the biomedical applications segment is expected to grow at a notable rate. In biomedical applications, polyhydroxyalkanoate films are increasingly gaining momentum owing to their biodegradability and biocompatibility. They are widely being explored for a wide range of uses, including tissue engineering, medical devices, drug delivery, and other applications. Thus, bolstering the segment’s growth in the coming years.

The food and beverage segment is expected to dominate the market with the largest share in 2024. In the food and beverage industry, polyhydroxyalkanoate films are most extensively used for food packaging, particularly perishable items such as dairy, ready-to-eat meals, fresh produce, and others, owing to their biodegradability properties and ability of these films to maintain hygiene and protect food from contamination while reducing reliance on plastic waste. These factors are propelling the segment’s growth during the forecast period. On the other hand, healthcare is anticipated to grow at the fastest CAGR. PHA films are gaining immense traction in the healthcare industry for various packaging applications, including sachets, blister packs, pouches for medical devices, and others. Their biodegradability and biocompatibility make them ideal for applications that require sterile and safe packaging.

Europe held the dominant share of the Polyhydroxyalkanoates films market in 2024. The growth of the region is attributed to the growing demand for biodegradable packaging solutions, rising consumer inclination for sustainable alternatives to traditional petroleum-based plastics, increasing consumer willingness to pay for sustainable packaging, and rising regulatory pressure to reduce plastic pollution. Several countries, such as Spain, France, the Netherlands, Germany, and Italy, have implemented stringent regulations or restrictions on single-use plastics and are offering subsidies to biodegradable and compostable packaging. The European Union’s stringent regulations, which necessitate reductions in plastic waste and encourage the adoption of biodegradable materials, are expected to spur the demand for PHA-based films.

On the other hand, Asia Pacific is expected to grow at a significant rate in the market during the forecast period. The growth of the region is attributed to the growing demand for compostable packaging, the growing popularity of PHA films, rising regulatory pressures, rising environmental awareness, and increasing focus on attaining sustainability goals. Government in the region increasingly promotes the use of eco-friendly packaging practices, which has led to an increasing focus of businesses on biodegradable packaging to reduce plastic pollution and boost sustainability in the environment. Additionally, the rising demand from pharmaceuticals, food and beverages, agricultural, and other industries is expected to propel the regional market’s growth during the forecast period.

By Type of PHA Polymer

By Production Method

By Film Type

By Thickness

By Application

By End-Use Industry

By Distribution Channel

By Region

February 2026

February 2026

February 2026

February 2026