The cling films market is forecasted to expand from USD 15.82 billion in 2026 to USD 45.67 billion by 2035, growing at a CAGR of 12.5% from 2026 to 2035. The study also provides detailed regional data across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, along with company profiles, competitive landscape mapping, M&A activities, value chain analysis, trade statistics, import–export volumes, and manufacturer supplier information across major producing countries.

The cling films market is driven by growing demand for food preservation, hygiene, and convenience across households and the food industry. Widely used in packaging fresh produce, meat, and bakery items, cling films offer excellent barrier properties and extend shelf life. The market is led by polyvinyl chloride (PVC) films, while linear low-density polyethylene (LLDPE) films are the fastest-growing due to sustainability. Rising urbanization, e-commerce food delivery, and retail expansion further boost growth, with supermarkets and households emerging as key demand drivers.

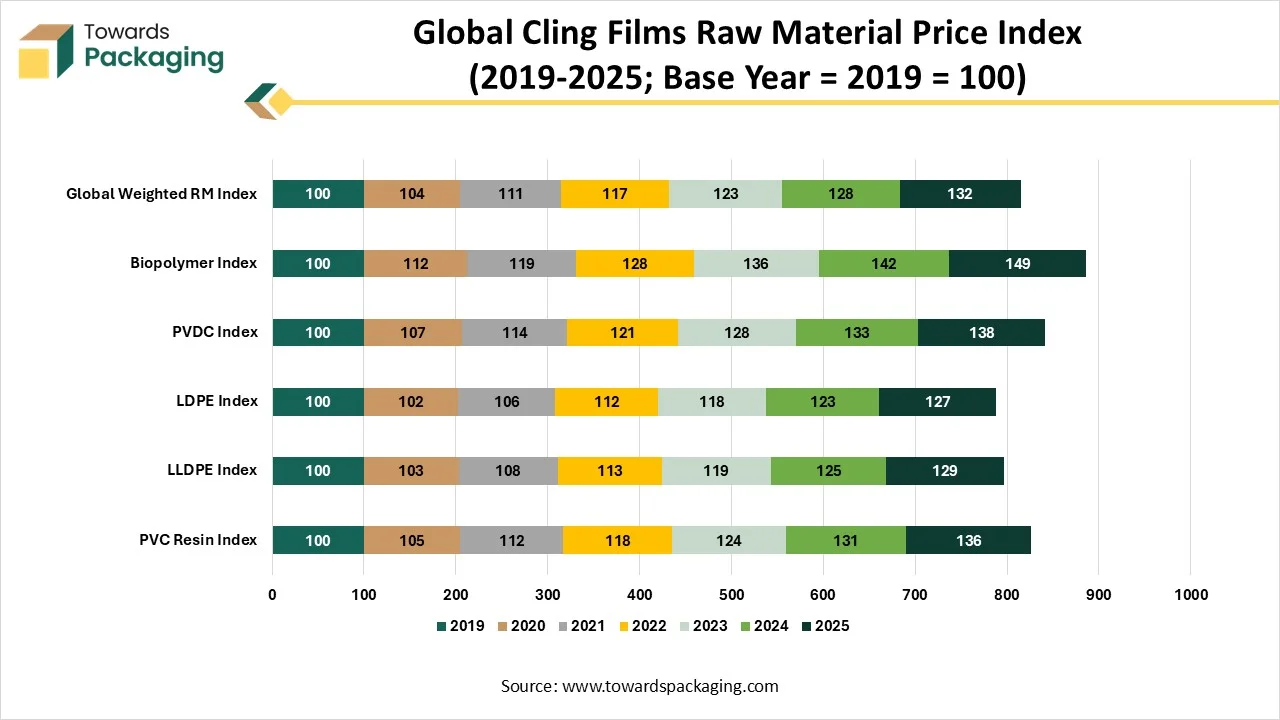

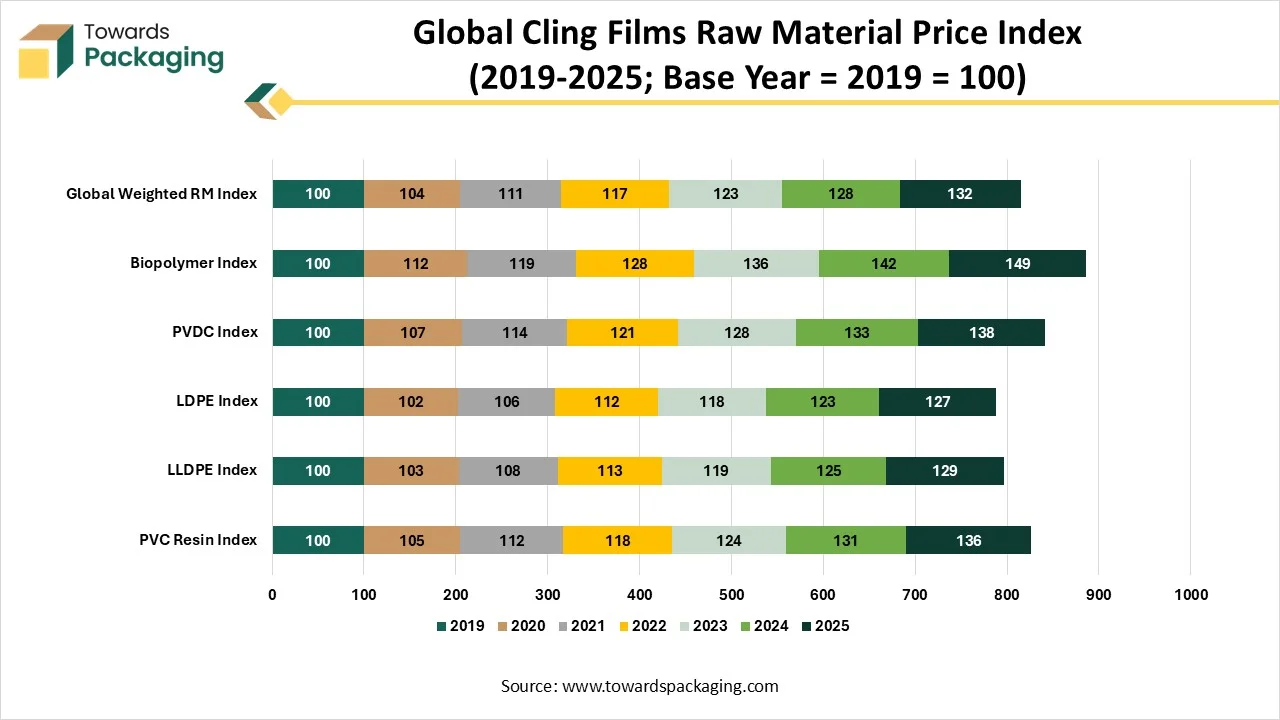

| Year | PVC Resin Index | LLDPE Index | LDPE Index | PVDC Index | Biopolymer Index | Global Weighted RM Index |

| 2019 | 100 | 100 | 100 | 100 | 100 | 100 |

| 2020 | 105 | 103 | 102 | 107 | 112 | 104 |

| 2021 | 112 | 108 | 106 | 114 | 119 | 111 |

| 2022 | 118 | 113 | 112 | 121 | 128 | 117 |

| 2023 | 124 | 119 | 118 | 128 | 136 | 123 |

| 2024 | 131 | 125 | 123 | 133 | 142 | 128 |

| 2025 | 136 | 129 | 127 | 138 | 149 | 132 |

Cling films, also known as plastic wrap or stretch films, are thin, flexible plastic sheets that cling tightly to surfaces and to themselves without the need for adhesive. They are commonly used in food packaging to seal and protect food items, helping to maintain freshness, prevent contamination, and extend shelf life. Cling films are typically made from materials like polyvinyl chloride (PVC), low-density polyethylene (LDPE), or linear low-density polyethylene (LLDPE). They are used widely in households, supermarkets, restaurants, and the food processing industry for wrapping fruits, vegetables, meats, and leftovers.

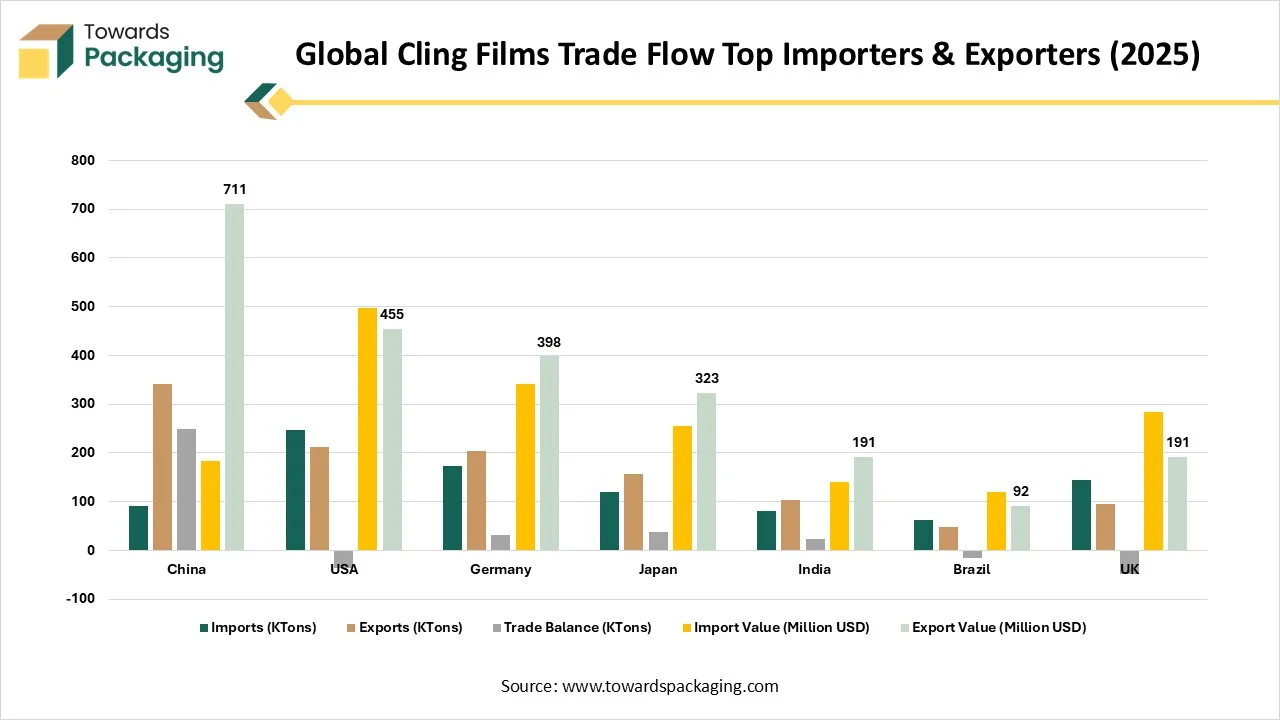

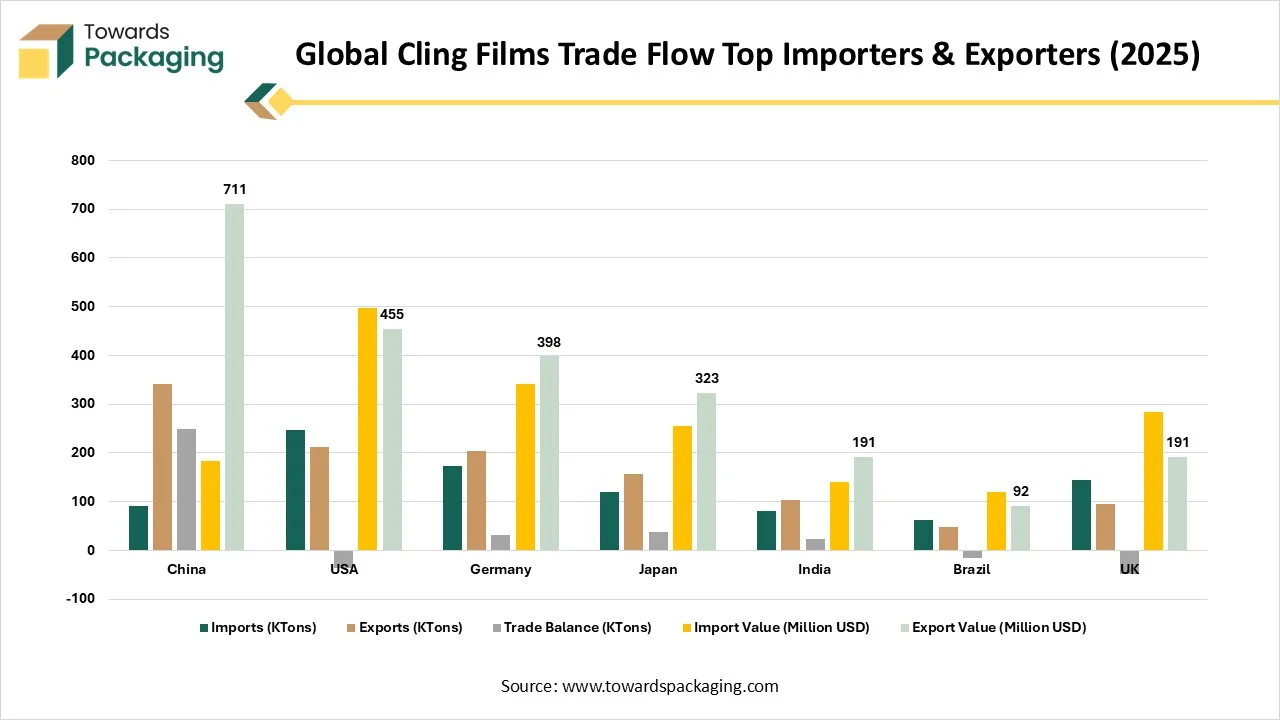

| Region / Country | Imports (KTons) | Exports (KTons) | Trade Balance (KTons) | Import Value (Million USD) | Export Value (Million USD) |

| China | 92 | 342 | 250 | 184 | 711 |

| USA | 248 | 212 | -36 | 498 | 455 |

| Germany | 173 | 204 | 31 | 342 | 398 |

| Japan | 119 | 156 | 37 | 256 | 323 |

| India | 81 | 104 | 23 | 141 | 191 |

| Brazil | 62 | 47 | -15 | 119 | 92 |

| UK | 144 | 96 | -48 | 283 | 191 |

| Metric | Details |

| Market Size in 2025 | USD 14.06 Billion |

| Projected Market Size in 2035 | USD 45.67 Billion |

| CAGR (2026 - 2035) | 12.5% |

| Leading Region | North America |

| Market Segmentation | By Material Type, By Thickness, By Cling Type, By Application, By End-Use Industry, By Distribution Channel and By Region |

| Top Key Players | Berry Global Inc., Intertape Polymer Group Inc., Amcor plc, AEP Industries Inc., Wrapex Ltd., Mondi Group, Anchor Packaging Inc. |

A major shift is taking place, cling film is moving away from traditional PVC and polyethylene toward biodegradable and compostable alternatives made from materials like rice starch, PLA (polylactic acid), cellulose, and plant proteins. For instance, rice-starch-based films are growing fastest. Regulatory measures and consumer expectations are accelerating this shift.

Cling films are becoming more than just covers. They now include features like embedded freshness sensors or gas/temperature indicators, antimicrobial coatings, oxygen, moisture, and ethylene scavengers, etc. These innovations extend shelf life, monitor food quality in real-time, and boost food safety.

Improved barrier films with superior resistance to moisture, oxygen, and fogging are gaining ground, especially in fresh‑food and medical packaging. Nanotechnology and multi-layer structures offer strength, stretchability, and preservation comparable to traditional plastics.

With the rise of busy lifestyles and on-the-go eating, convenience matters. Features trending include ready‑cut sheets, easy‑dispense rolls with built‑in cutters, and microwave-safe versions. Growth in e‑commerce and home delivery is also driving demand for performance-focused cling wrap for shipping and meal kits.

Cling film is being adopted outside the kitchen for medical packaging, cosmetics samples, industrial surface protection, and logistics.

Consumers and businesses want differentiation colored or patterned wraps, antimicrobial variants, and films printed with logos or information. Premium products combining aesthetics with function (e.g., medical-grade, tailored barrier properties) are emerging.

New regulations limiting single-use plastics, especially in Europe, are prompting manufacturers to comply with environmental and food safety standards. Companies are investing heavily in: Advanced extrusion tech, Automation, R&D for green films, and collaborations between packaging firms and foodservice/medical chains.

AI integration can significantly enhance the cling films market by driving innovation, efficiency, and sustainability. In manufacturing, AI-powered predictive maintenance and process optimization can reduce downtime, minimize material waste, and ensure consistent film quality. Machine learning algorithms can analyze production data to identify defects and enhance film stretchability, clarity, and barrier properties. In packaging operations, AI-enabled robotic automation can improve wrapping precision, reduce labor costs, and increase speed, especially in food processing and logistics.

AI can support the development of smart cling films by integrating sensors that monitor freshness, temperature, and contamination. Market intelligence tools powered by AI also help manufacturers understand consumer preferences and forecast demand, aiding in agile production planning and inventory management. Furthermore, AI models can help design eco-friendly formulations by simulating material performance, accelerating the shift toward sustainable cling films. Overall, AI fosters a smarter, more adaptive, and eco-conscious cling film industry ready for future demands.

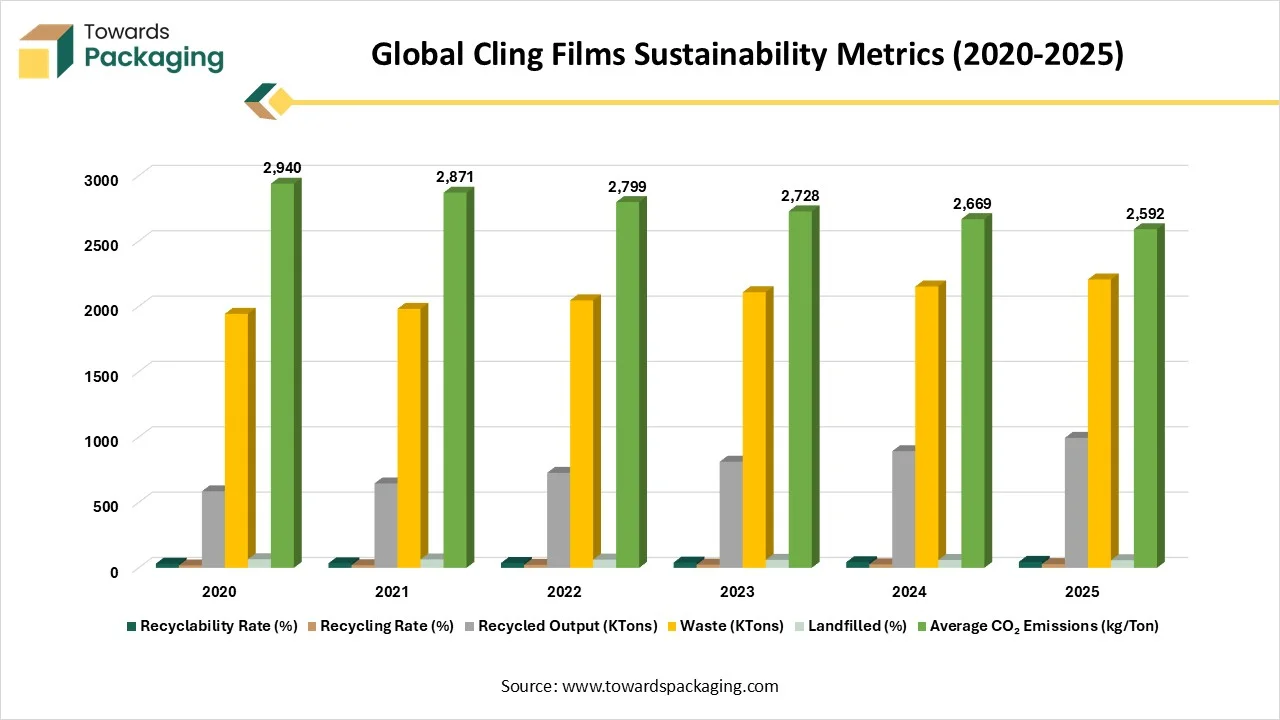

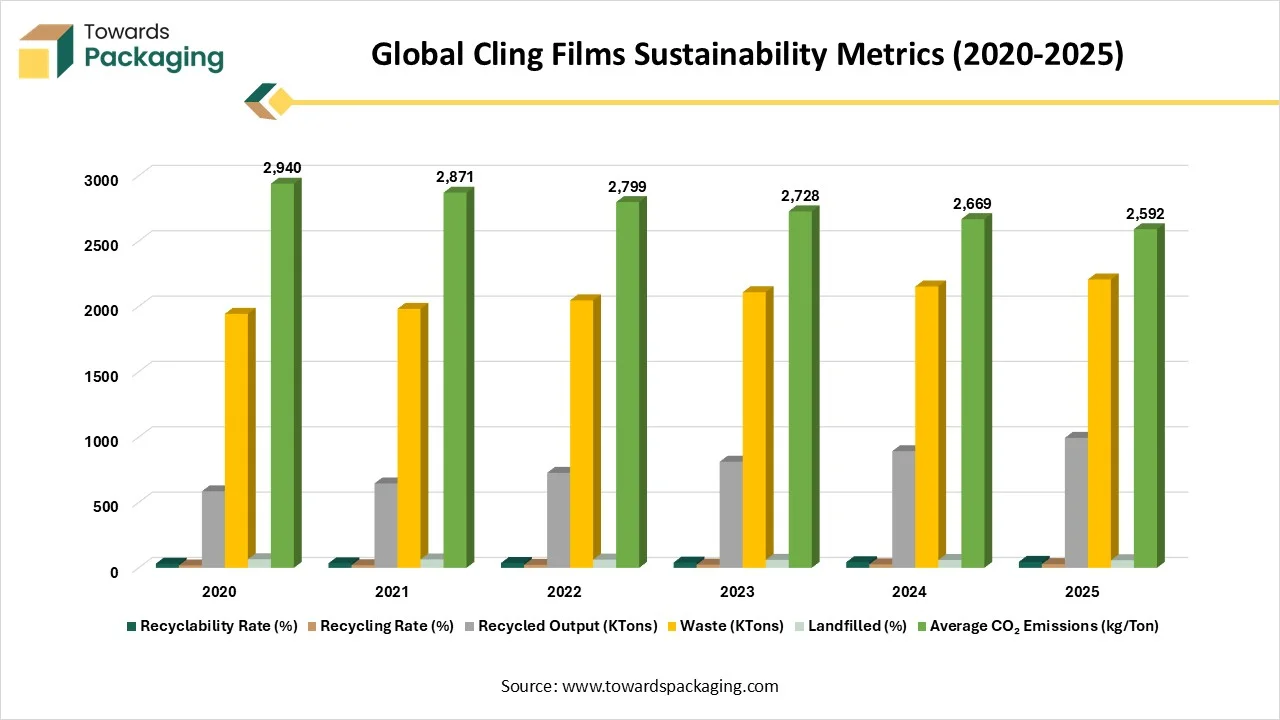

| Year | Recyclability Rate (%) | Recycling Rate (%) | Recycled Output (KTons) | Waste (KTons) | Landfilled (%) | Average CO₂ Emissions (kg/Ton) |

| 2020 | 32.1 | 18.7 | 586 | 1,944 | 66.1 | 2,940 |

| 2021 | 34.9 | 20.4 | 646 | 1,982 | 64.7 | 2,871 |

| 2022 | 37.6 | 22.8 | 727 | 2,047 | 63 | 2,799 |

| 2023 | 40.8 | 24.9 | 812 | 2,109 | 61.3 | 2,728 |

| 2024 | 43.1 | 26.7 | 893 | 2,153 | 60.1 | 2,669 |

| 2025 | 45.8 | 28.9 | 995 | 2,207 | 58.7 | 2,592 |

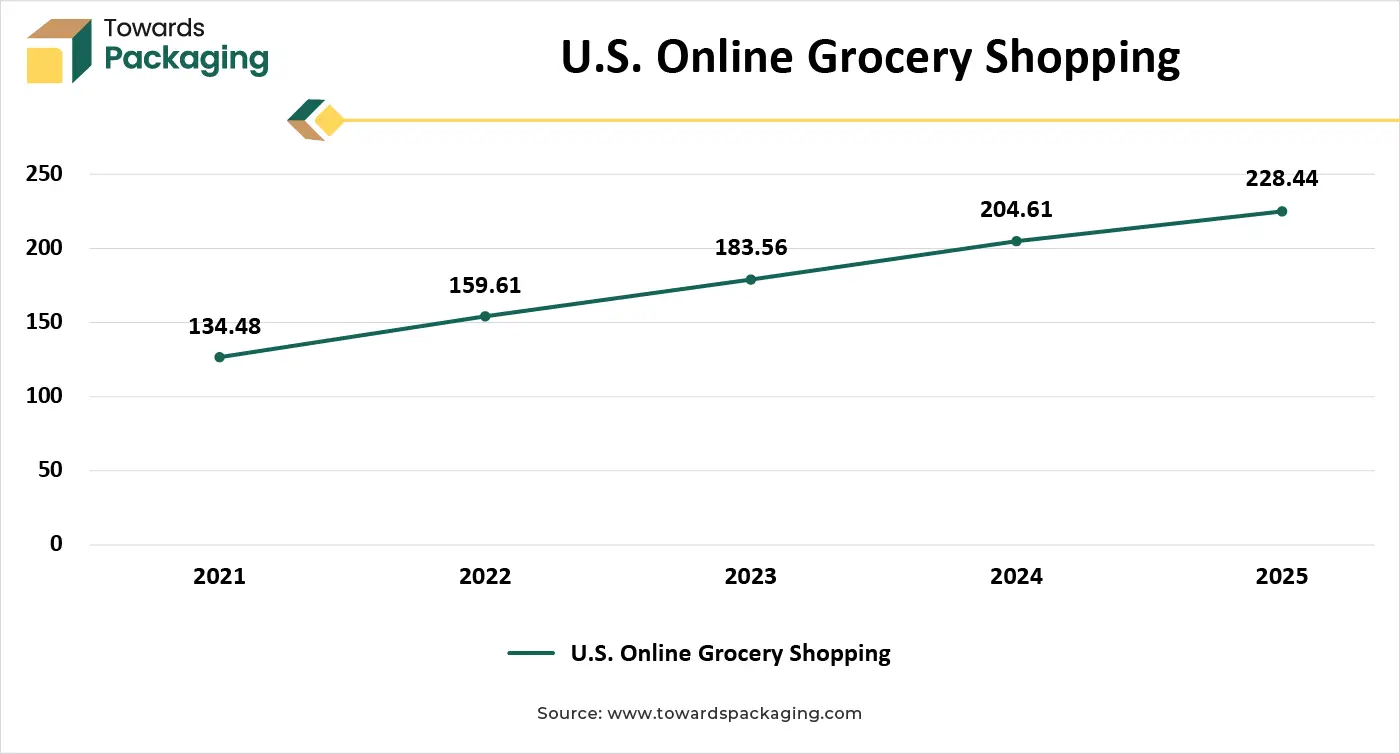

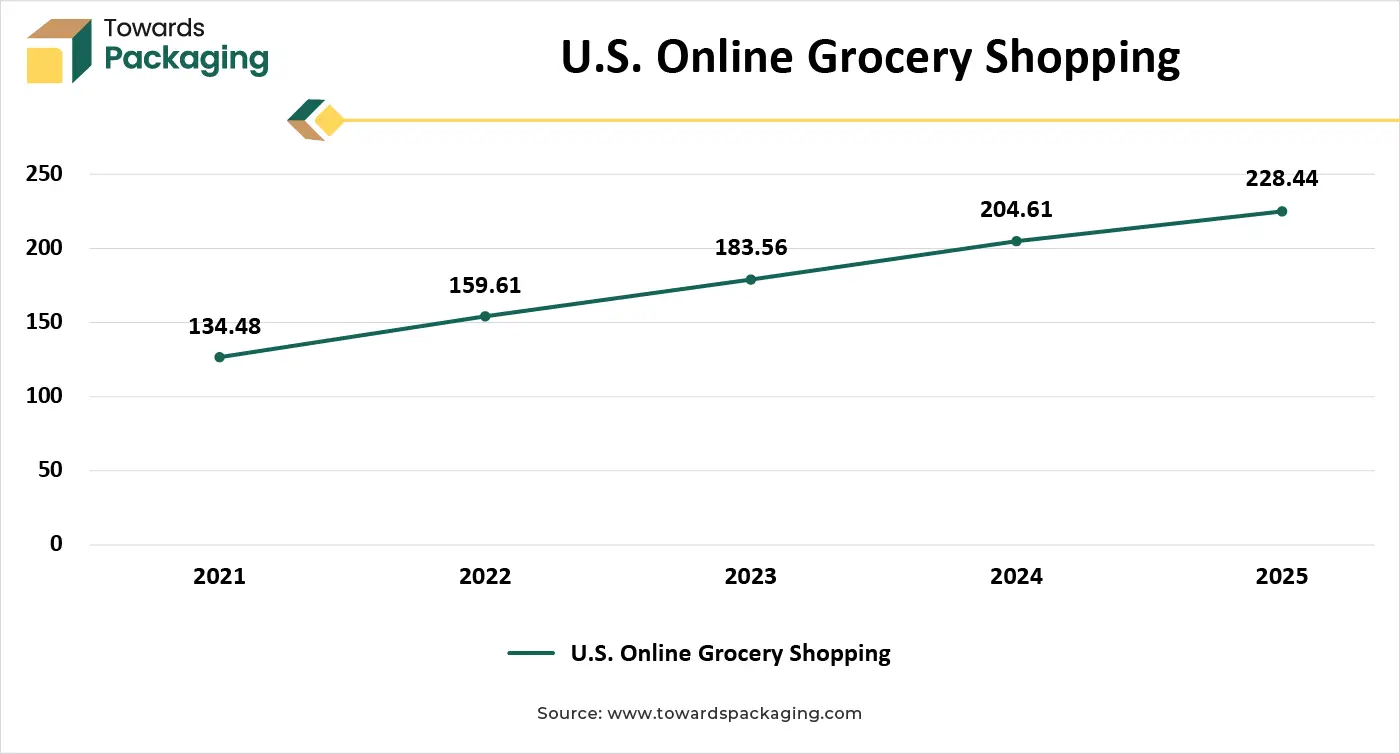

Growing Trend of Online Grocery Shopping and E-commerce Purchase

Growing Online grocery and meal kit services require reliable and efficient packaging, further propelling cling film usage. S more consumers shop for fresh produce, meat, dairy, and ready-to-eat meals online, retailers and delivery services require reliable packaging solutions to maintain product freshness during transportation and storage. Cling films provide an effective barrier against moisture, air, and contaminants, ensuring extended shelf life and improved food safety. As e-commerce continues to expand across urban and semi-urban areas, especially in Asia-Pacific and North America, the reliance on flexible, lightweight, and cost-effective packaging materials like cling films is expected to increase substantially.

In January 2025, according to the data published by the National E-commerce Association, it is estimated that online grocery sales in the U.S. reached USD 8.7 billion in May 2025, a 27.0% increase over 2025, with delivery accounting for almost all of the growth. Although this is the first month since August 2025 that total monthly sales have dropped below USD 9.5 billion, seasonal trends across eGrocery had predicted a bigger month-over-month drop. Due to Delivery’s impressive performance in 2025, total grocery sales for May 2025 decreased by 12% from April 2025, compared to 16% and 20% for the same months in 2023 and 2025, respectively. Delivery saw a huge increase in sales in May 2025, up over 70% from the 2025 year, with monthly sales reaching USD 3.9 billion. Large increases in the monthly active user (MAU) base, a double-digit increase in order frequency, and higher average order values (AV) than the 2025 were the main drivers of this sales spike. As a result, in May 2025, Delivery’s percentage of grocery purchases increased by almost 13 points year over year to 45.4%.

Sustainability Shift and Performance Limitations

The key players operating in the market are facing issues due to sustainability shift and Performance limitations, which are estimated to restrict the growth of the cling films market. Rising preference for compostable, biodegradable, or reusable wraps (e.g., beeswax sheets, silicone lids) diverts share from conventional cling films. Stricter bans and taxes on single-use plastics, plus growing consumer backlash, curb demand for traditional PVC and PE films.

Growth in ready-to-eat meals, fresh produce, and meat products fuels demand for hygienic, airtight wrapping solutions.

Innovation in compostable and recyclable cling films attracts eco-conscious consumers and meets regulatory compliance

Growing usage in medical and cosmetic applications (e.g., wound care, spa treatments) opens niche markets.

The cling film business is undergoing exciting change. Manufacturers are under pressure to innovate and produce high-quality quality environmentally friendly products due to new regulations regarding recyclability, chemical safety, and waste reduction. This change offers a chance to satisfy the expanding need for environmentally friendly packaging options rather than merely being about compliance. Businesses that adopt these changes are setting the standard for environmental responsibility, safety, and innovation, transforming obstacles into opportunities for expansion and a cleaner, greener future.

The polyvinyl chloride (PVC) material type segment is dominant in the cling films market due to its combination of performance, affordability, and versatility. PVC cling films offer excellent clarity and stretchability, making them ideal for food packaging where product visibility and tight sealing are essential. They provide strong barrier protection against moisture, oxygen, and contaminants, which helps extend the shelf life of perishable items like meats, produce, and dairy. Additionally, PVC is more cost-effective than alternatives such as polyethylene or biodegradable materials, making it a preferred option for high-volume commercial applications. Its widespread availability and ease of manufacturing support consistent supply and scalability, especially in food service and retail sectors. Furthermore, PVC films are widely accepted for food use, meeting safety standards in many countries, and are commonly used in households, supermarkets, and restaurants. In emerging markets, the low cost and practicality of PVC cling films further contribute to their continued dominance in the global market.

The linear low-density polyethylene (LLDPE/LDPE) material segment is the fastest-growing in the cling films market due to its favourable environmental profile, performance enhancements, and increasing global demand. LDPE is non-toxic, recyclable, and considered safer for food contact compared to PVC, aligning with growing consumer and regulatory preferences for sustainable packaging. Environmental regulations and bans on single-use plastics are pushing manufacturers toward LDPE-based alternatives. Technological advancements, such as multi-layer extrusion and improved barrier properties, are enhancing LDPE’s functionality, making it a strong competitor to traditional materials. Additionally, the rising consumption of packaged foods in emerging economies like China and India is fueling demand for affordable and regulation-compliant LDPE cling films. The shift toward hygienic, convenient packaging especially in ready-to-eat meals and online grocery deliveries is further accelerating the adoption of LDPE. These combined factors are driving its rapid growth and solidifying its position as the fastest-expanding material type in the cling films market.

The 9 to 12 microns thickness segment is dominant in the cling films market due to its optimal balance of strength, flexibility, and performance. Films in this range provide excellent stretchability and cling properties, making them ideal for securely wrapping various food products such as fruits, vegetables, meats, and baked goods. This thickness is widely favoured in food packaging because it preserves freshness, allows breathability, and protects items from external contamination. It is also cost-effective, offering sufficient durability while minimizing material usage, which helps reduce packaging costs. Additionally, films of 9 to 12 microns are well-suited for use with automated wrapping machines commonly used in retail and food processing, ensuring high-speed and consistent packaging. Consumers also benefit from the convenience of lightweight, easy-to-handle films that are practical for daily use. Moreover, the thinner material contributes to sustainability efforts by reducing plastic consumption, helping manufacturers meet environmental standards without sacrificing quality. These factors collectively support the segment's strong market dominance.

The above 12-micron-thickness segment is the fastest-growing in the cling films market due to its superior strength, durability, and puncture resistance, making it ideal for heavy-duty and industrial applications. These thicker films are widely used for packaging bulk goods, covering machinery, and securing products during transportation, particularly in sectors like manufacturing, agriculture, automotive, and logistics. As industrial and commercial activities expand, the demand for robust and reliable packaging materials is rising. Additionally, regulatory and safety requirements in these sectors often mandate the use of thicker films to ensure secure containment. The compatibility of thicker films with automated wrapping machines in high-volume operations also enhances efficiency and consistency, further boosting their adoption. Moreover, the growth of e-commerce, foodservice, and medical sectors, which require resilient packaging for handling and transit, is contributing to the rapid expansion of this segment. These combined factors make cling films above 12 microns the fastest-growing thickness category in the global market.

The self-cling film segment dominates the market thanks to its practical advantages in both household and industrial packaging. Unlike films that rely on external adhesives, self-cling wrap adheres securely through an internal tack layer often a polymer like polybutylene or via electrostatic charge. This inherent stickiness provides clean sealing without residue, making it ideal for food storage, shipping, and bundling. Users enjoy its convenience: easy tear-off, reusability, and tight, protective wrapping. Compatible with automatic dispensers and high-speed machinery, self-cling films strike a perfect balance of reliability, convenience, and performance, driving their market dominance.

The machine cling film segment is the fastest-growing in the cling film market due to its exceptional suitability for high-volume, automated packaging operations. These thicker, stronger films deliver superior durability and puncture resistance, making them ideal for industrial use, bulk storage, and logistics applications. Automated wrapping machines and high-speed dispensers common in manufacturing, supermarkets, and foodservice are engineered for machine cling films, enabling consistent performance and efficiency. Additionally, rising demand from e-commerce, foodservice, healthcare, and medical sectors for sturdy, reliable packaging has further accelerated adoption. Innovations such as moisture-resistant, antimicrobial, and barrier-enhanced films tailored for machine use also support this trend.

The food packaging segment dominates the cling films market with the meat, poultry and seafood sub-segment projected to grow as the fastest due to several compelling factors. Cling films are critical for preserving fresh produce, meats, bakery items, and ready-to-eat meals by providing effective barrier protection against moisture, oxygen, and contaminants, extending shelf life, and reducing food waste. Their ease of use and convenience make them indispensable in households, supermarkets, restaurants, and catering services, catering to the growing demand for hygienic, ready-to-use packaging solutions. The rise of online food delivery and meal delivery kits has further propelled cling film usage, making it essential for safe and efficient food transport. Moreover, technological developments in film materials and manufacturing enhance performance and compatibility with automated packaging systems, solidifying cling films as the leading choice for food packaging applications.

The dominance of the food and beverage segment in the cling films market is driven by several key factors. Cling films play a vital role in preserving fresh food such as produce, meat, bakery items, and ready-to-eat meals by providing a protective barrier against moisture, oxygen, and contaminants, which significantly extends shelf life and helps reduce food waste. Their convenience and ease of use make them indispensable across households, supermarkets, restaurants, and catering services, aligning with consumer demand for hygienic, readily available packaging solutions. The explosive growth of online food delivery platforms, meal kits, and the food service industry has further amplified cling film usage as it ensures safe, secure transit and storage of perishables. Technological improvements in film clarity, barrier performance, and automated packaging compatibility continue to enhance cling film’s appeal, strengthening its leading position in food and beverage applications.

The household segment is the fastest-growing in the cling films market due to increasing consumer demand for convenient, hygienic food storage solutions. Rising urbanization, busy lifestyles, and greater reliance on home-cooked meals and leftovers have boosted cling film usage in homes. Additionally, growing awareness about food preservation, reduced food waste, and improved product availability through retail channels contribute to this growth. The affordability, ease of use, and versatility of cling films make them essential in modern households.

The direct sales (B2B) segment dominates the cling films market due to the high demand from supermarkets, food processors, and industrial users who require bulk quantities and customized solutions. B2B transactions enable manufacturers to establish long-term contracts, ensure consistent supply, and offer tailored specifications such as thickness, width, and material type. Additionally, B2B channels facilitate better pricing, streamlined logistics, and technical support, making them the preferred choice for large-scale commercial and institutional buyers across the food and packaging industries.

Supermarkets and hypermarkets are the fastest-growing distribution channels for cling films due to their wide reach, convenience, and ability to provide competitive pricing and promotional offers. As one-stop retail destinations, these outlets allow consumers to physically inspect various brands, types, and sizes of cling film, boosting purchase confidence and fostering impulse buys. The rapid expansion of supermarket chains in emerging markets enhances product accessibility, while strategic in-store placement drives visibility and volume sales. Their bulk ordering capabilities ensure a consistent supply.

| Region | Raw materials | Conversion | Energy | Labor | Logistics (in+out) | Duties & compliance | Overhead & QA | Distributor+Retailer |

| Asia-Pacific | 760 | 180 | 135 | 45 | 85 | 22 | 60 | 183 |

| Europe | 880 | 245 | 210 | 95 | 120 | 48 | 98 | 364 |

| North America | 820 | 210 | 160 | 70 | 110 | 35 | 85 | 270 |

| Latin America | 740 | 165 | 140 | 55 | 130 | 60 | 65 | 235 |

| Middle East & Africa | 700 | 150 | 120 | 50 | 120 | 40 | 58 | 182 |

North America is dominant in the cling films market due to its well-established food packaging industry, strong retail sector, and high consumer demand for convenience and hygiene. The region's growing reliance on packaged and ready-to-eat food products drives extensive use of cling films for food preservation and safety. Advanced manufacturing infrastructure and widespread adoption of automation and smart packaging technologies further boost production efficiency. Additionally, stringent food safety regulations and sustainability initiatives are encouraging the use of high-quality, eco-friendly cling films. Major players in the packaging industry are headquartered in the U.S. and Canada, contributing to innovation and market growth. The region's robust logistics and e-commerce sectors also support increased demand for secure and protective packaging solutions.

U.S. Market Trends

The U.S. leads the North American cling films market due to its expansive food and beverage industry, high consumer spending, and strong demand for convenience packaging. The country’s stringent food safety regulations and growing health awareness boost the use of cling films in households, retail, and food service sectors. Technological advancements and automation in manufacturing also contribute to production efficiency and innovation in bio-based and smart cling films.

Canada Market Trends

Canada shows steady growth driven by rising environmental concerns and government regulations on single-use plastics. The Canadian market is witnessing increased demand for sustainable and biodegradable cling film alternatives. Its well-developed retail chains and expanding frozen and fresh food sectors support market growth, while ongoing R&D investments in green packaging technologies further enhance its market potential.

The Asia-Pacific region is experiencing the fastest growth in the cling films market due to several key factors. Rapid urbanization and rising disposable incomes in countries like China and India are driving increased demand for packaged, ready-to-eat, and processed foods. The expansion of the food processing, food-service, and e-commerce sectors particularly online grocery and food delivery platforms is fueling the widespread use of cling films for product hygiene and freshness. Additionally, the region’s growing healthcare and pharmaceutical industries rely on cling films for sterile and secure packaging of medical supplies and equipment. There is also a rising adoption of functional and bio-based cling films, such as those made from plant proteins and cellulose, aligning with sustainability goals and evolving regulatory frameworks. These combined factors are positioning Asia-Pacific as the fastest-growing region in the global cling films market.

China Market Trends

China dominates the regional market due to its massive food processing industry, rising urban population, and strong retail and e-commerce presence. Increasing demand for packaged and frozen food, along with government support for sustainable packaging, drives cling film consumption. Technological advancements and the availability of low-cost raw materials support large-scale production.

India Market Trends

India is witnessing rapid market growth fuelled by urbanization, changing food habits, and the expansion of organized retail and food delivery services. Rising health awareness and demand for hygienic food packaging increase cling film usage in both households and commercial sectors. The growing focus on eco-friendly packaging also supports the adoption of biodegradable films.

Japan Market Trends

Japan’s mature market is driven by high-quality standards, advanced packaging technology, and strong demand from the food, medical, and electronics sectors. The country emphasizes recyclable and functional films with superior barrier properties. An aging population and demand for convenience foods also influence market trends.

South Korea Market Trends

South Korea’s market is driven by tech-savvy consumers, premium food packaging needs, and innovation in smart and antimicrobial cling films. The rise in takeout culture and strict food safety regulations further promotes cling film usage in the retail and hospitality industries.

The Europe region is expected to grow at a notable rate in 2024. Rising adoption of biodegradable and recyclable cling films, supported by EU regulations like the Green Deal and Single-Use Plastic Directive. European companies invest heavily in eco-friendly materials and advanced barrier properties, expanding product appeal. Growth in single-person households and demand for ready meals increases packaged food consumption.

| Region | Avg lead time (days) | Safety stock (days) | Total inventory days | Carrying cost rate (%) | Carrying cost (USD per ton) | WC tied up (USD per ton) |

| Asia-Pacific | 45 | 15 | 60 | 12.5 | 173 | 1,386 |

| Europe | 30 | 12 | 42 | 11 | 103 | 1,080 |

| North America | 35 | 10 | 45 | 11.8 | 109 | 1,020 |

| Latin America | 50 | 18 | 68 | 13.5 | 221 | 1,636 |

| Middle East & Africa | 40 | 14 | 54 | 13 | 192 | 1,476 |

By Material Type

By Thickness

By Cling Type

By Application

By End-Use Industry

By Distribution Channel

By Region

February 2026

February 2026

February 2026

February 2026