Biologics CDMO Secondary Packaging Market Growth Drivers, Challenges and Opportunities

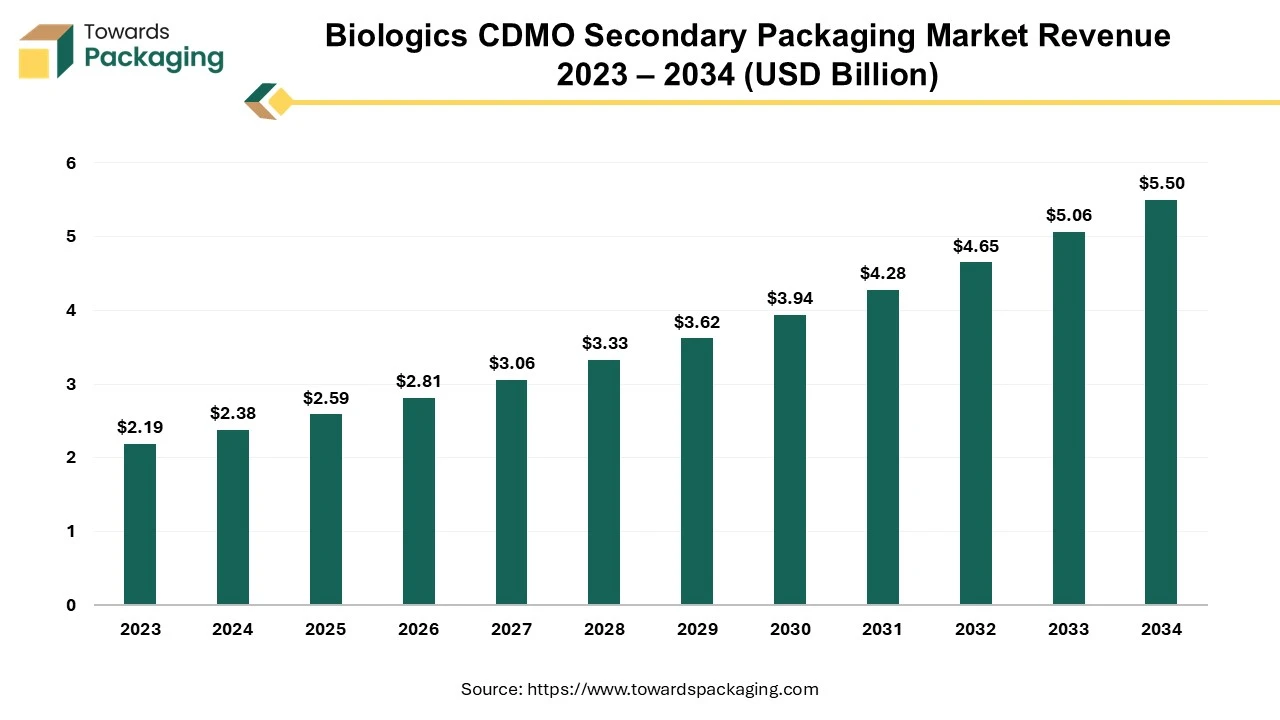

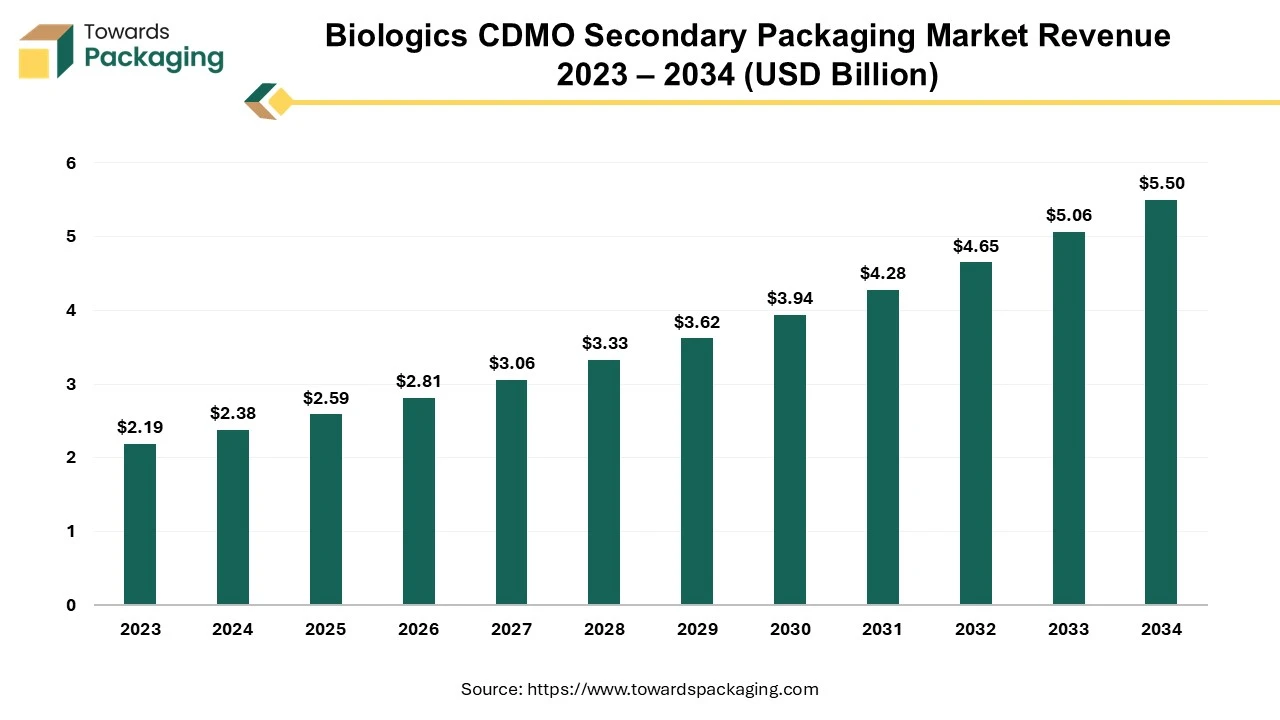

The biologics CDMO secondary packaging market is forecasted to expand from USD 2.81 billion in 2026 to USD 5.99 billion by 2035, growing at a CAGR of 8.75% from 2026 to 2035. This report covers complete market dynamics including product segments (boxes, cartons), primary package categories (ampoules, vials, syringes, cartridges, bottles) and detailed regional performance across North America, Europe, Asia Pacific, Latin America, and MEA.

It analyses leading companies such as Cavanna Packaging, Loesch Verpackungstechnik, Theegarten-Pactec, FUJI Machinery, Tecno Pack, along with CDMO leaders like Samsung Biologics, Thermo Fisher & WuXi Biologics. The study further provides value chain mapping, trade flows, supply chain structure, and manufacturers & suppliers data, backed by all statistical inputs from the industry.

The rising market for the production of drugs is due to the increasing prevalence of chronic diseases, infectious, and genetic disorders. With the usage of such secondary packaging, there is a high chance of safety in the storage of temperature-sensitive vaccines or injectables.

Key Takeaways

- North America led the biologics CDMO secondary packaging market with the highest share in 2024.

- By region, Asia Pacific is expected to witness the highest CAGR during the forecast period.

- By type, the boxes segment held a dominant market share in 2024.

- By primary package type, the ampoules segment held a dominant market share in 2024.

Market Overview

The biologics CDMO secondary packaging market is developing significantly due to the expansion of the biologics industry and rising outsourcing services. Secondary packaging is important as it ensures the protection, integrity, and safety of drugs at the time of transportation and storage. These are the containers that store packaged medical products for longer-distance transportation during the distribution of the products.

This sector such as cartonization, labelling, and other things done after the primary packaging of syringes, vaccine bottles, and various others. The market is growing rapidly due to increasing medical facilities like biological therapies which include gene therapy, biosimilars, and monoclonal antibodies. Major market players such as WuXi Biologics (Cayman) Inc., FUJIFILM Diosynth Biotechnologies U.S.A. Inc., Samsung Biologics Co. Ltd., Thermo Fisher Scientific Inc., Rentschler Biopharma SE, and others are introducing innovation in this field continuously.

- In March 2022, Ten23 Health, announced the launch of a CDMO to expand the manufacturing facility in Visp, Switzerland.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 2.59 Billion |

| Projected Market Size in 2035 |

USD 5.99 Billion |

| CAGR (2026 - 2035) |

8.75% |

| Leading Region |

North America |

| Market Segmentation |

By Product Type, By Primary Package Type and By Region |

| Top Key Players |

Cavanna Packaging Group, Loesch Verpackungstechnik GmbH, Theegarten-Pactec, Bradman Lake Group. |

Driver

Rising Collaboration among Companies: Major Driver for the Market

The growing collaboration between companies contributes to the development of the biologics contract development and manufacturing organization (CDMO) secondary packaging market. Customers seeking good storage and risk-free transportation of pharmacy products for longer shelf life compel companies to collaborate to bring innovation to the market. Secondary packaging is the outer labelling and packaging of the biological products which plays a vital role in safeguarding medical products to maintain the optimum temperature required. The need for cold chain supervision in biological product carriage enhances the intricacy of secondary packaging, boosting companies to accept advanced and dedicated packaging materials and skills. The growing speed of developments in biopharmaceutical production, for the formation of biologics that can improve healthcare, is influencing the market.

The development of the biologics industry, along with delicate regulatory pressures, is influencing the demand for more effectual, complaint, and cost-operative secondary packaging results. This movement is generating noteworthy openings for CDMOs to improve their facility contributions, enlarge their competencies, and enhance the growing demands of the biologics sectors, boosting the development of the biologics CMDO secondary packaging market.

Biologics CDMO Secondary Packaging Market Trends

- Biologic drugs, particularly gene therapies and vaccines, are temperature-delicate and frequently need cold chain logistics for harmless transport. Consequently, rising demand for progressive secondary packaging resolutions confirms the need for temperature regulators, comprising insulated packaging, frozen ampules, and immediate temperature intensive care systems.

- With rising environmental apprehensions, the biologics CDMO secondary packaging market is changing supportable and environment-friendly packaging materials.

- Biologics secondary packaging market is observing the incorporation of automation and smart packaging solutions.

Market Opportunity

Innovation and Advancements: To Open Doors for the Market

The biopharmaceutical sector is growing rapidly due to the innovation by drug companies, mainly vaccines for rising diseases and changing lifestyles. In this business it is anticipated to present several new products, such as handling for diseases, to fulfil significant demand for medical challenges. The biologics CDMO market is rising speedily, as pharmaceutical and biotech market players progressively outsource the growth and industry of biological drugs to CDMOs. CDMOs deliver proficiency, machinery, and cost-operative solutions to fulfil the rising demand for medical products. Furthermore, the rising speed of developments in the biopharmaceutical business, for the formation of biologics which can improve healthcare, is boosting the market.

Regional Insights

The Rising R&D and Production in Pharmaceutical Companies: North America to Lead

North America witnessed the largest revenue share for the year 2024 this growth is due to the rapid rise of manufacturing of pharmaceutical products which is due to the rising healthcare infrastructure and demand from the experts. In various countries such as the U.S. and Canada, there is an upsurge in the demand for biological products due to chronic diseases such as diabetes and various infectious diseases. The rising concern for the safe storage of healthcare products for better and long-term usage of drugs such as secondary packaging is highly preferred by companies. The presence of strong market players and the advanced healthcare sector raise the demand for biological products that influence the packaging market.

Strong Environment of Biopharmaceutical Companies and CDMOs: Supporting U.S. Market Growth

The U.S. is a major player in the regional market, growth driven by the existence of robust biopharmaceutical companies and CDMOs. The large base of pharmaceutical companies drives demand for secondary packaging solutions in the country. Stringent regulations and guidelines for packaging solutions and labeling support market growth. The advanced innovation and technologies sector such as smart packaging and specialized secondary packaging solutions. Those factors reveal the need for CDMO services. Strong presence of major CDMOs, including atalent, Lonza, and Thermo Fisher Scientific, providing a range of services.

- In October 2024, Catalent secured a contract with IsomAb to develop, manufacture, and fill/finish ISM-001, further demonstrating its capabilities in biologics production and packaging.

Increasing Investment Towards Pharmaceutical Sector: Asian Countries to Grow at the Fastest Rate

Asia Pacific is estimated to grow at the fastest rate over the forecast period. Continuous investment of government bodies towards healthcare sector to introduce advanced technology with the rising number of diseases. With more funding production increases in pharmaceutical companies which increases the demand for storage of the medicines.

Countries like China, Japan, India, Thailand, and South Korea are observing advancement in the healthcare sector due to the investment of the government in this industry. The region is producing cost-effective packaging options for medicinal products like syringes, drugs, and various other products. These packaging companies adopt advanced technology for temperature regulatory sealing of the containers.

Rapid Biologics Demand: Key Trend in the Chinese Market

China, leading the regional market with its largest and growing biopharmaceutical companies, drives demand for secondary packaging services. China’s CDMOs provide cost-effective services, helping to attract international biopharmaceutical companies. The government supports investments in the biopharmaceutical industry, contributing to the market growth.

The Opinions of the General Office of the State Council on Comprehensively Deepening the Reform of Regulation of Drugs and Medical Devices to Promote the High-Quality Development of the Pharmaceutical Industry was held in March 2025.

Segmental Insights

- By type, the boxes segment led the biologics CDMO secondary packaging market in 2024. This segment of the market is growing because of its potential to store drugs and vaccines in huge amounts.

- By primary packaging type, the ampoule segment dominates the biologics CDMO secondary packaging market in the predicted period. The demand for secure and sterile packaging for temperature-sensitive products to ensure its integrity and stability.

Biologics CDMO Secondary Packaging Market Top Companies

Latest Announcements by Market Leaders

- In March 2024, SMC Ltd. Vice President and General Manager, Uri Baruch expressed “There are notable developments in the injectables market – the growth of more complex biologics and the increased interest in delivering large volumes of API. We believe our ability to deliver, at speed, fill volumes from 1ml to 50ml is an unmet need and is already attracting significant attention from our clients and partners."

Recent Developments

- In April 2025, Samsung Biologics launched the Bio Campus II, plant 5 becoming operational in South Korea. Plans for Plant 6 are under review, which would expand total capacity to 964,000 liters upon approval.

- In March 2025, Oncomed Manufacturing, a CDMO, launched its new syringe production line its facility in Brno, Czech Republic. The EUR 44 million ($48 million) expansion will boost sterile manufacturing capabilities, adding an annual capacity of 100 million syringes (1-mL long).

- In October 2024, Nipro PharmaPackaging, announced launching of innovative D2F (Direct-to-Fill) glass vials which are powered by Stevanato Group’s advanced EZ-fill technology, offering a high-quality ready-to-use (RTU) solution.

- In March 2024, SMC Ltd., announced the expansion of Sterile Fill Finish Capabilities in North Carolina. It helps SMC to deliver a wider portfolio of services to its pharma clients including lab-to-market development, analytical services, device manufacture, fill/finish, final assembly, and secondary packaging.

- In March 2024, Hovione collaborated with GEA to announce the launch of ConsiGma CDC flex and the installation of a new lab-scale R&D Continuous Tableting rig in Hovione´s facilities in Portugal.

Biologics CDMO Secondary Packaging Market Segments

By Product Type

By Primary Package Type

- Ampoules

- Blister Packs

- Bottles

- Cartridges

- Syringes and Vials

- Prefilled Syringes

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait