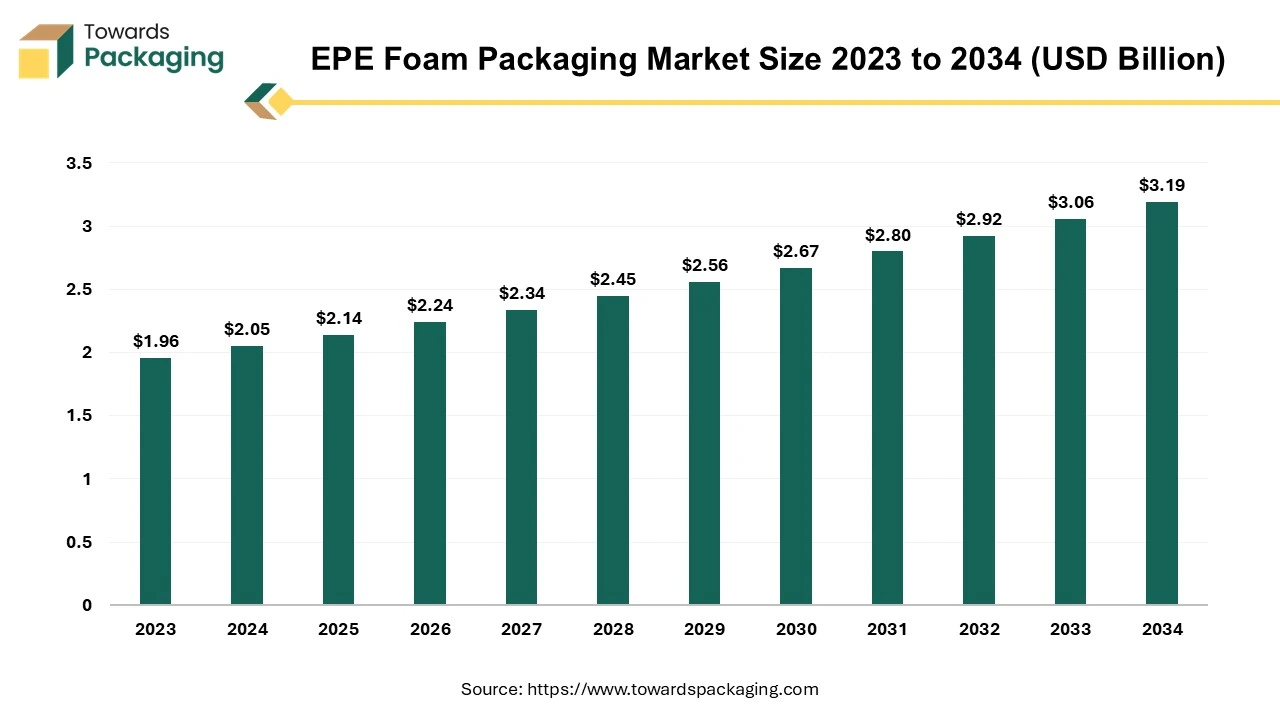

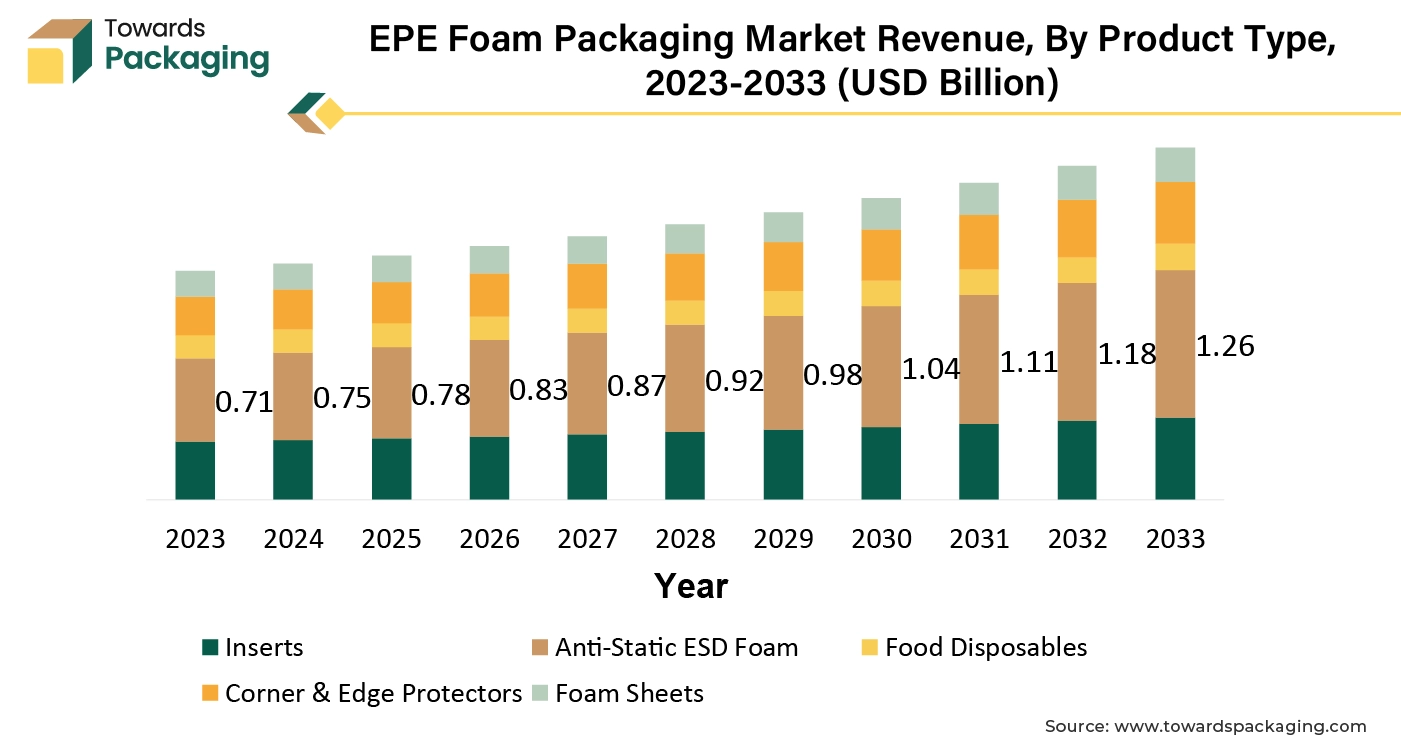

The EPE foam packaging market is forecasted to expand from USD 2.24 billion in 2026 to USD 3.34 billion by 2035, growing at a CAGR of 4.54% from 2026 to 2035. This report covers in-depth insights into market segments such as anti-static ESD foam, protective packaging, food disposables, and more. It also highlights regional data for North America, Europe, APAC, Latin America, and MEA, detailing the growth trends in each region. Competitive analysis of leading companies like Flexipack Group, FoamCraft Inc., and TekniPlex is included, along with detailed trade data and value chain analysis.

The EPE foam packaging market is likely to witness strong growth over the forecast period. Expanded Polyethylene (EPE) foam is semi-rigid, flexible and lightweight polyethylene closed-cell foam that is frequently utilized in the packaging to protect surfaces, minimize vibration as well as absorb shock and impact. Since it is a thermoplastic resin, it can be melted and cooled to make variety of shapes and objects. EPE foam has wide application in the food and beverage packaging, electronics packaging, healthcare, automotive and other sectors.

The surge in e-commerce and the expansion of the automotive industry are expected to augment the growth of the EPE foam packaging market during the forecast period. Furthermore, the EPE foam’s versatility and lightweight nature make it an attractive option across various industries, from electronics to consumer goods, further driving its adoption globally. Additionally, the rising consumer awareness and the regulatory pressures that are pushing manufacturers toward sustainable packaging as well as the increasing urbanization and the industrialization in the emerging economies is also projected to contribute to the growth of the market in the years to come.

The rapid expansion of e-commerce is projected to support the growth of the EPE foam packaging market during the forecast period. This is owing to the rise of digital payment systems, improved logistics, and faster delivery services. As per the data by the International Trade Administration, the global B2C ecommerce revenue reached USD 3.6 trillion in 2023 and is projected to climb to USD 5.5 trillion by 2027 at a CAGR of 14.4%. Ecommerce is continuing to dominate the consumer playing field as spending preferences and comfort levels radically shift with our new normal. And with the many perks of online shopping, it’s no surprise that consumers have turned to screens instead of stores. Price is one of the strongest factors influencing a consumer’s decision to purchase when shopping online; almost 65 to 70% of the consumers are shopping for less expensive products.

Furthermore, the increasing digital literacy worldwide is the second key factor behind why online shopping is becoming more popular. Additionally, sophisticated behavioral analytics running on artificial intelligence also help online shoppers enjoy more streamlined shopping experiences. E-commerce platforms deal with a vast array of products, including electronics, glassware, and other fragile items that require secure packaging to prevent damage during shipping.

This has led to a growing reliance on high-performance packaging materials like EPE foam which provides excellent cushioning, guaranteeing that products remain intact and reach consumers in perfect condition, even after long and potentially rough transit. Moreover, the global nature of e-commerce, with products often crossing international borders, further amplifies the need for robust packaging solutions that can withstand varied handling conditions. The e-commerce boom, therefore, directly fuels the demand for EPE foam, positioning it as a crucial component in the packaging industry’s response to the evolving needs of the digital segment.

The availability of the alternative packaging materials is projected to hinder the growth of the EPE foam packaging market during the forecast period. Alternatives such as the biodegradable plastics, cornstarch-based packaging and expanded polystyrene (EPS) are increasingly being adopted due to their environmental benefits and the protective properties. Biodegradable plastics have lower emissions since they are not manufactured through the potentially dangerous extraction and processing of the crude oil and therefore require less energy to produce. Sustainable business approaches typically view biodegradable commodities as essential components. When packaging uses biodegradable plastics and eco-friendly materials, companies stand to benefit from the consumers that support sustainable practices.

Furthermore, packaging made of corn starch is a good biodegradable alternative. Corn starch will automatically decompose into components that are harmless for the environment, like carbon dioxide and water, just like similar verified biodegradable objects. Processing corn starch packaging at commercial composting sites can further convert it into useful fertilizers. Also, Packaging made of corn starch is easily recyclable at material extraction facilities. Corn starch plastic can be utilized to make new and better products once it enters the recycling stream. These substitutes directly compete with EPE foam by satisfying the increasing need for packaging materials that are beneficial to the environment. The attractiveness of these substitutes grows as consumer trends and governmental pressures move in favor of minimizing the plastic waste. Due to the intense competition, producers of the EPE foam are compelled to tackle the environmental issues more seriously, which may have an effect on the market share.

The rising demand from the emerging markets is expected to create immense growth opportunities for the EPE foam packaging market in the years to come. These growing economies are experiencing development in industries such as e-commerce, automotive, electronics and consumer products, all of which require strong packaging to guarantee the product safety during the transport and storage. For instance, the growth of the e-commerce sector in India, China and Brazil is increasing the demand for the protective packaging materials such as EPE foam, which provides great cushioning capabilities for a wide range of products.

For instance,

Furthermore, the growing automotive as well as the electronics sector in these regions relies largely on EPE foam to protect the delicate components and the parts. For instance, the first four months of this year witnessed excellent growth by China's electronics manufacturing sector. According to the Ministry of Industry and Information Technology, from January 2024 to April 2024, the collective earnings of the leading corporations of the segment increased by 75.8% year over year to a total of USD 20.3 billion (144.2 billion Yuan).

Additionally, the growing middle class in these economies is fueling up the consumer spending and further increasing the demand for the packaged goods. This increased market potential provides an opportunity for the EPE foam makers to expand their footprint by entering these markets, developing products as per the local demands and forming the collaborative partnerships to capture the market share.

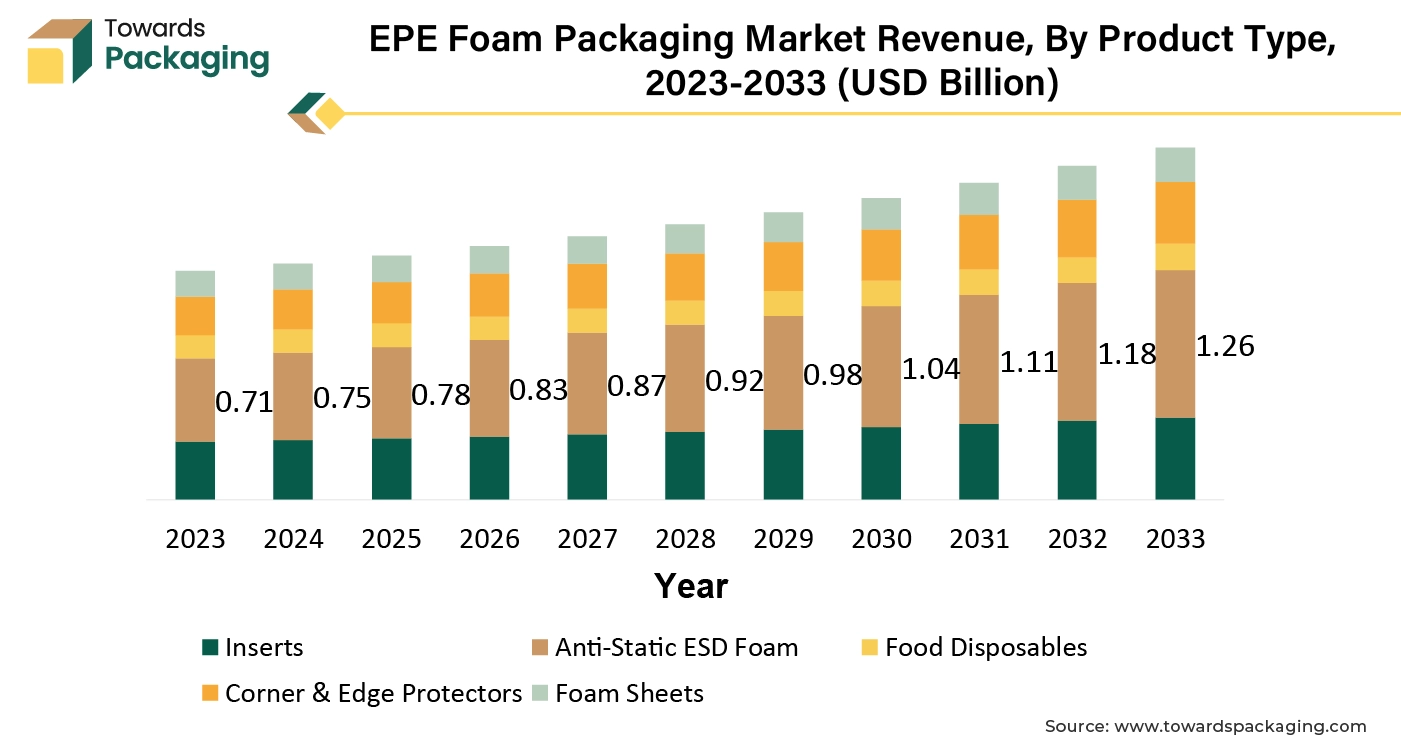

The anti-static ESD foam segment captured largest market share of 36.40% in 2024. The rising demand of the electronic products in industries such as the consumer electronics, automotive and telecommunications, has significantly contributed to the dominance of this segment. As electronic components become increasingly sensitive to the static electricity, the need for protective packaging options is also likely to increase. A specific kind of foam called ESD foam aids in reducing the static electricity and averting electrostatic discharge. The dissipative or conducting materials utilized to make ESD foam such as silicone or carbon-filled polyurethane, facilitate in grounding the charge and preventing static electricity.

In packing materials, anti-static ESD foam is frequently utilized to safeguard electronic components during the storage and transit. The suppliers of foam guarantee that its electrostatic delay is below 0.05 seconds. These foams have a uniform surface treatment, surface resistance of 106 to 108 ohms and other qualities. Manufacturers of anti-static ESD foam additionally guarantee persistent static dissipation performance and provide tapes that are extremely resistant to abrasion and chemical reactions.

The insulation segment held considerable market share in 2024. The thermal insulation is made utilizing the advanced technology from synthetic polyethylene. It has a very poor thermal conductivity of 0.30 w/mk. It is used to provide sound, moisture and temperature insulation for the equipment, buildings and appliances. The foam offers a barrier that lowers the heat transfer and increases the thermal performance, making it an economical as well as an effective approach to increase a building's or system's energy efficiency. The rising demand for energy-efficient buildings as well as the growing focus on the sustainable and green building practices has fueled the adoption of EPE foam insulation, as it contributes to reducing the carbon footprint of the structures.

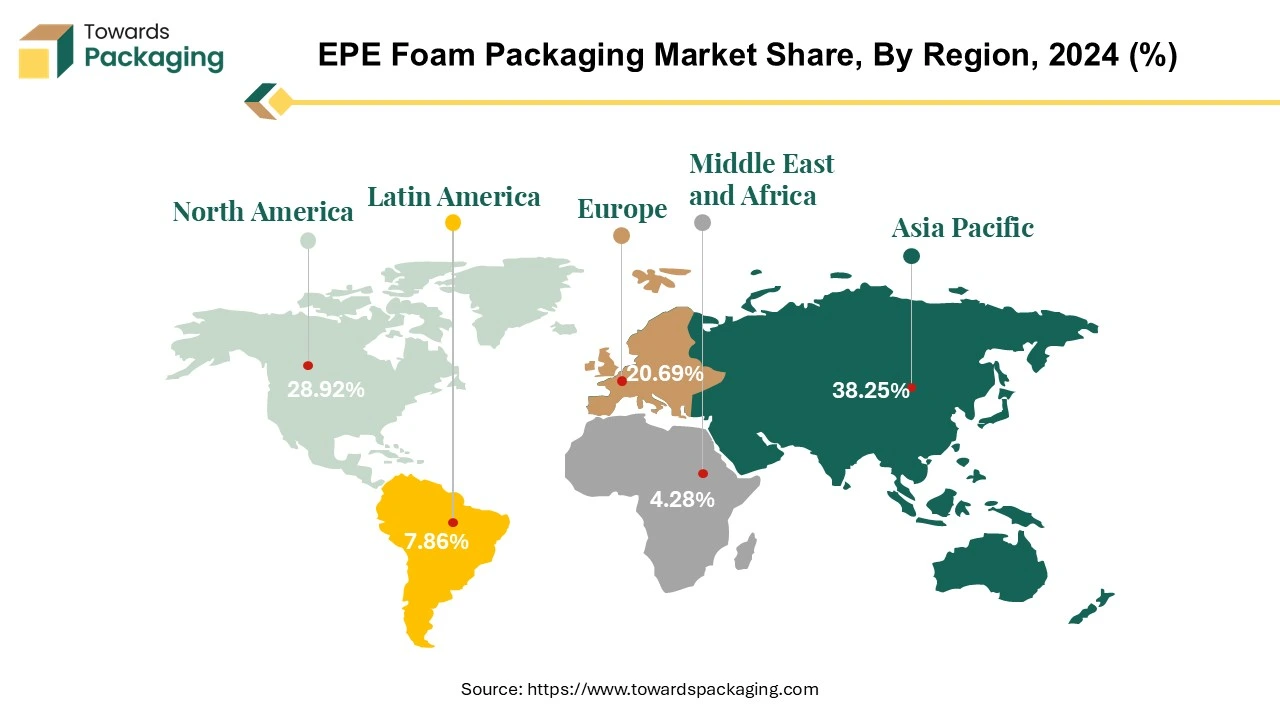

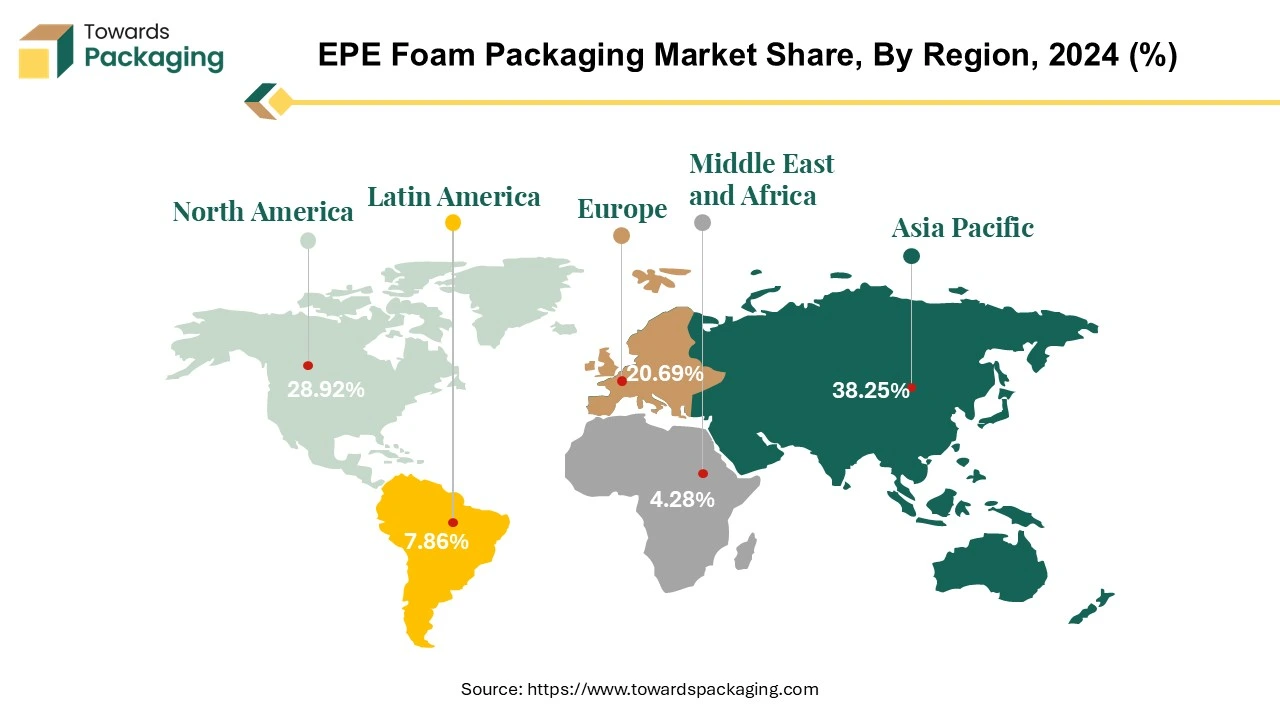

Asia Pacific held is likely to grow at fastest CAGR of 6.29% during the forecast period. This is owing to the largest manufacturing hubs in countries like China, Japan and South Korea. Additionally, rapid urbanization and the increasing disposable incomes are also anticipated to promote the growth of the market in the region in the years to come. Furthermore, the increasing electronics production and consumption as well as the government support and infrastructure development across the region are also expected to support the growth of the market within the estimated timeframe.

North America held considerable market share of 28.92% in 2024. This is due to the well-established and rapidly growing e-commerce sector along with the increasing volume of online shopping across the region. As per the Census Bureau of the Department of Commerce, in the second quarter of 2024, the United States online retail sales reached $291.6 billion, up 1.3 percent over the first quarter. The predicted overall sales of retail for the 2nd quarter of 2024 were $1,826.9 billion, up 0.5 percent as compared to the first quarter of the same year.

While the total retail sales climbed by 2.1 percent during the same period in 2023, the forecast for e-commerce in the second quarter of 2024 increased by 6.7 percent compared to the second quarter of 2023. During the second quarter of 2024, sales through the e-commerce contributed to 16.0 percent of the overall sales. Also, the advanced manufacturing and industrial base in sectors like automotive and electronics is further expected to support regional growth of the market in the years to come.

By Product Type

By End-Use

By Region

February 2026

February 2026

February 2026

February 2026