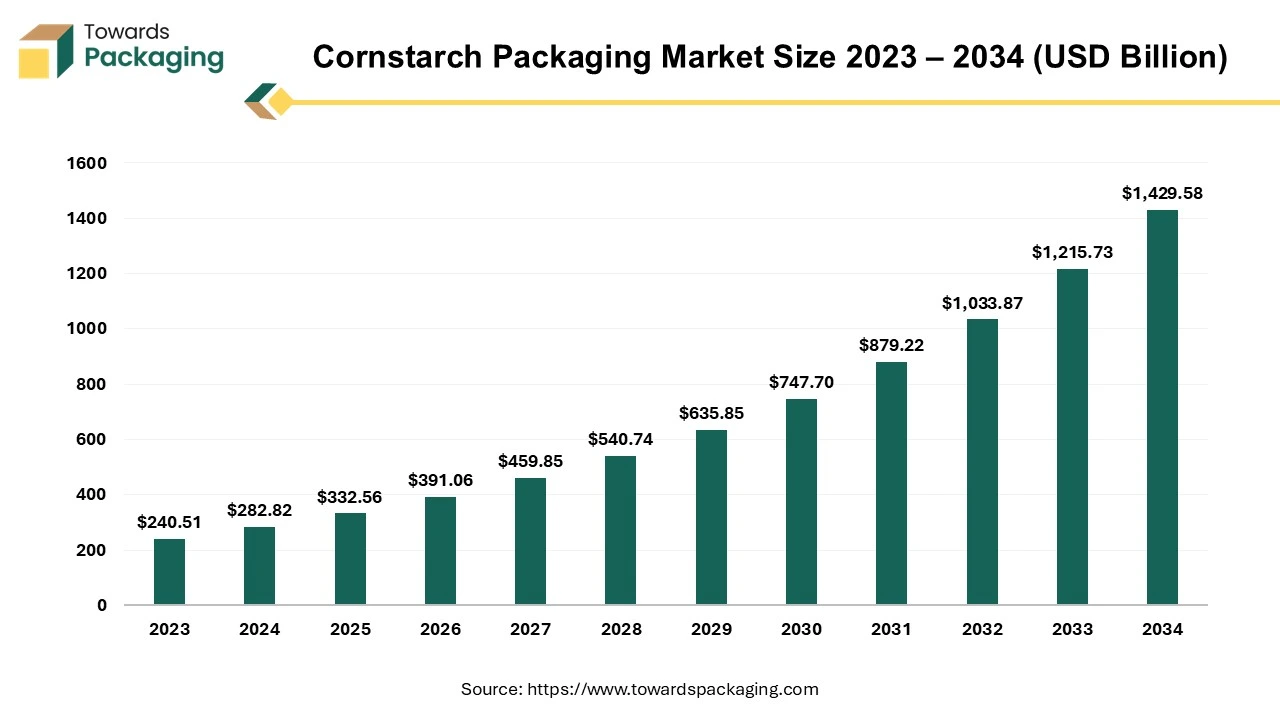

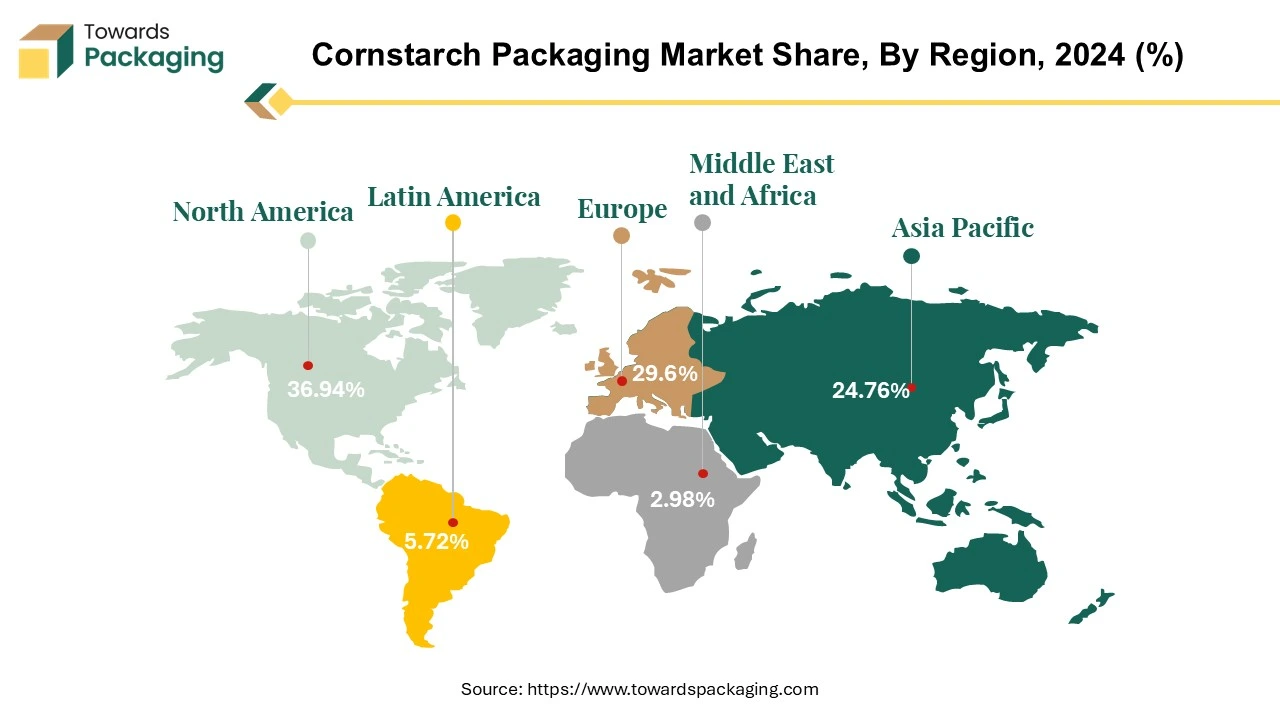

The cornstarch packaging market is forecasted to expand from USD 391.07 billion in 2026 to USD 1,681.06 billion by 2035, growing at a CAGR of 17.59% from 2026 to 2035. The market report offers a complete overview of market size, share, segmental insights (product type, end use, and sales channel), and regional analysis across North America (36.94% share in 2023), Europe, Asia Pacific (20.01% CAGR), Latin America, and Middle East & Africa. It provides a thorough competitive landscape, featuring major companies such as BioPak, Packnwood, Good Start Packaging, Team Recycler Malaysia, and L&P Packaging Ltd. The study also explores value chain dynamics, trade flow statistics, and the impact of government regulations promoting biodegradable materials.

The cornstarch packaging market is set to grow prominently during the forecast period. Cornstarch is a component of a larger, developing trend of the bioplastics made from the agricultural waste or leftovers. Most of the establishments are beginning to develop their own safe and sustainable alternatives for plastics by utilizing a variety of renewable materials such as cornstarch, vegetables, oil and lipids. Polylactic acid (PLA) plastic, which is produced by fermenting the plant sugar and starch, is used to make the cornstarch containers. As PLA plastic does not include any harmful ingredients and produces minimal greenhouse emissions during the production, it is far more sustainable as well as environmentally benign than traditional plastics.

Also, cornstarch containers are a great alternative to the plastic for eco-friendly packaging since they are renewable and biodegradable, unlike petroleum-based plastic. Cornstarch packing is often used for food on-the-go. The increasing environmental awareness and the stringent government regulations and policies aimed at reducing plastic waste are expected to augment the growth of the cornstarch packaging market during the forecast period.

Furthermore, the increasing consumer preference for eco-friendly products coupled with the advancements in cornstarch processing is also likely to support the growth of the market. Additionally, growing focus on circular economy principles as well as the growing percentage of takeaways and food deliveries is also projected to contribute to the growth of the market in the years to come. The global packaging market size is estimated to grow from USD 1.20 trillion in 2022 to reach an estimated USD 1.58 trillion by 2032, growing at a 3.16% CAGR between 2023 and 2032.

The increasing takeaway and food delivery sector is projected to support the growth of the cornstarch packaging market during the forecast period. During the past few years, the global market for the food delivery has more than tripled. The demand for delivery and takeout services has increased significantly due to the introduction of attractive, simple to use applications and technologically enabled driver networks as well as shifting customer preferences and a move towards convenience. With recent investments, there are still significant developments taking place in the field. For instance, in March 2024, the meal delivery startup Wonder raised $700 million in new funding, almost tripling its original stock investment. The business intends to keep pushing these initiatives using these most recent raises in three different areas: driving unit economics, research and development and expansion.

Also, in June 2024, with the $250 million investment from Mubadala Investment Co. in Abu Dhabi, Turkish food delivery business Getir entered a new era of strategic emphasis and restructuring. This cash infusion arrives as Getir struggles to deal with the fallout from its aggressive growth and consequent withdrawal from the European market. In 2022, the company closed a $768 million Series E investment round, marking a key milestone. This trend of ordering food online and increasing investments has amplified the need for efficient and sustainable cornstarch packaging that can handle the logistics of delivering food while minimizing environmental impact. As cornstarch packaging is non-toxic and has a great resistance to oil and fragrance, it is ideal for food delivery or takeout. Even some packaging can be used in a microwave. Because cornstarch packaging satisfies the requirements for compostable plastics, it may be turned into beneficial fertilizer at commercial composting centers.

Cornstarch packaging, sometimes known as PLA, is made from corn. Since PLA is made from sustainable, natural carbon rather than carbon derived from fossil fuels, it can provide carbon savings when compared to traditional plastics. However, the cultivation of biomass for use as PLA feedstock has the potential to have adverse effects on the environment including effects on biodiversity, acidification and eutrophication. For the other bioplastics and PLA produced industrially to break down and biodegrade, they need to be gathered and composted at one of the few commercial composting centers that accept them, which operate at high temperatures and under strict control. There aren't many composting facilities like this, and without the right infrastructure for recycling, PLA items end up in landfills and add to the plastic pollution problem by basically following the same waste pathways as ordinary plastics.

The primary issue with PLA is the extremely particular conditions that must be met for it to properly decompose. As PLA contaminates the recycling stream, it must be processed individually and brought to a closed composting environment. However, the PLA plastics must be heated to 140 degrees and treated to particular biodegradable digestive microorganisms before being shipped to the industrial composting centers. Therefore, it is nearly impossible for the products to finish their life cycle as marketed due to the harsh biodegradation conditions and slow rate of the biodegradation as well as the increased pressure on the customers to make certain their PLA waste is being sent to the appropriate facility. Due to these challenges, PLA plastics are assumed to wind into landfills or the ocean most of the time. The disposal of PLA can break down into tiny plastic particles packed with chemicals, which contaminate water and food supplies and spread throughout the ecosystem.

The implementation of stricter government regulations and policies targeting single-use plastics and waste management is expected to create opportunities for the growth of the cornstarch packaging market in the near future. As concerns about the environment and the demand for efficient waste management solutions increase, governments across the globe are implementing stringent measures to tackle the plastic pollution. These laws frequently include prohibitions or limits on the single-use plastics, requirements for packaging that is recyclable or biodegradable and support for switching to the sustainable options. For instance:

Thus, most of the companies are forced to shift towards the sustainable packaging that complies with these regulations. Cornstarch packaging, with its biodegradable and compostable properties, supports perfectly with these regulatory requirements, offering a viable alternative to traditional plastics.

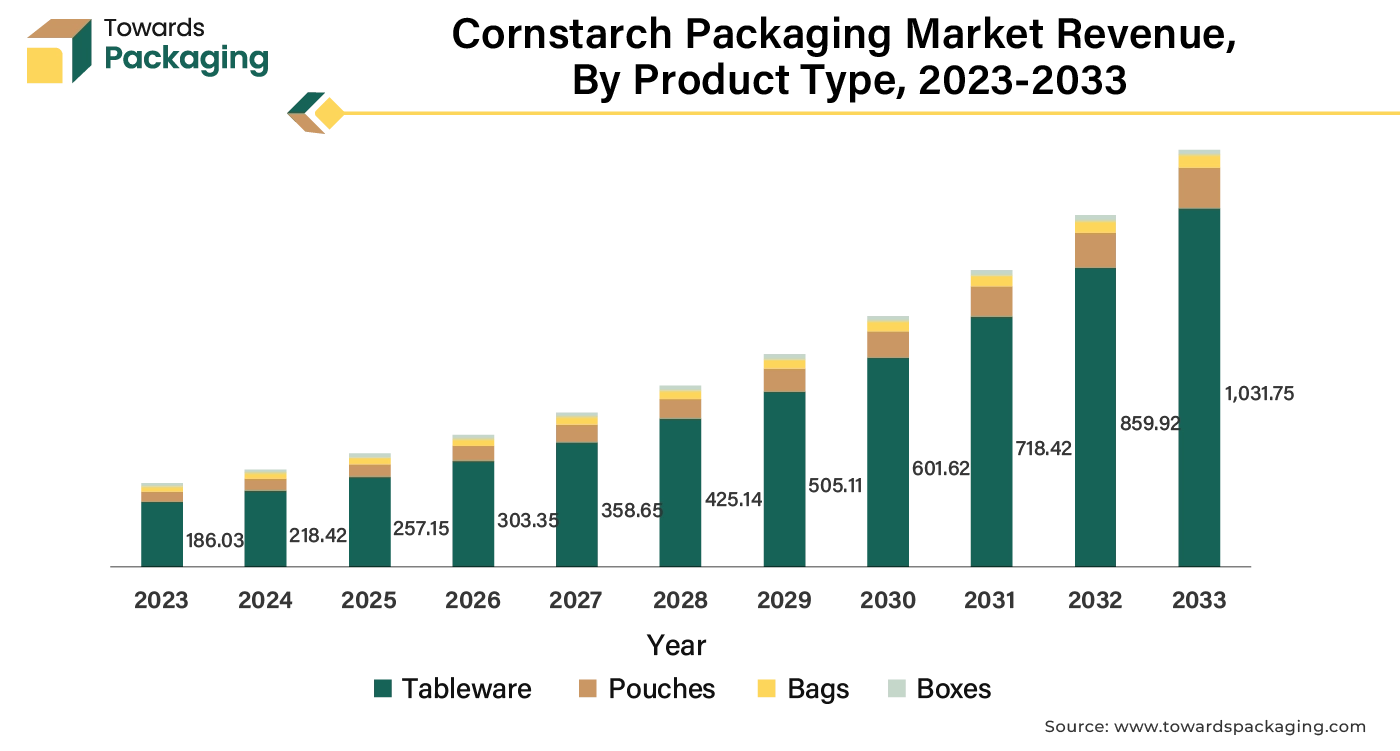

The tableware segment captured largest market share of 77.35% in 2023. This is owing to the increasing popularity of home dining and entertaining, influenced by the growing trend of home-based social gatherings and the culinary experiences. Additionally, the expansion of the restaurants, food delivery industry and hotels also creates a substantial market for the high-quality and durable tableware. Furthermore, the expansion of online retail platforms is also likely to support the segment growth of the market as it has made it easier for the consumers to access a wider range of tableware products from different brands. Disposable corn starch tableware, which consists of plates, cups, bowls and utensils, is manufactured from the bioplastics derived from cornstarch. It is frequently used as a sustainable substitute for the conventional plastic tableware.

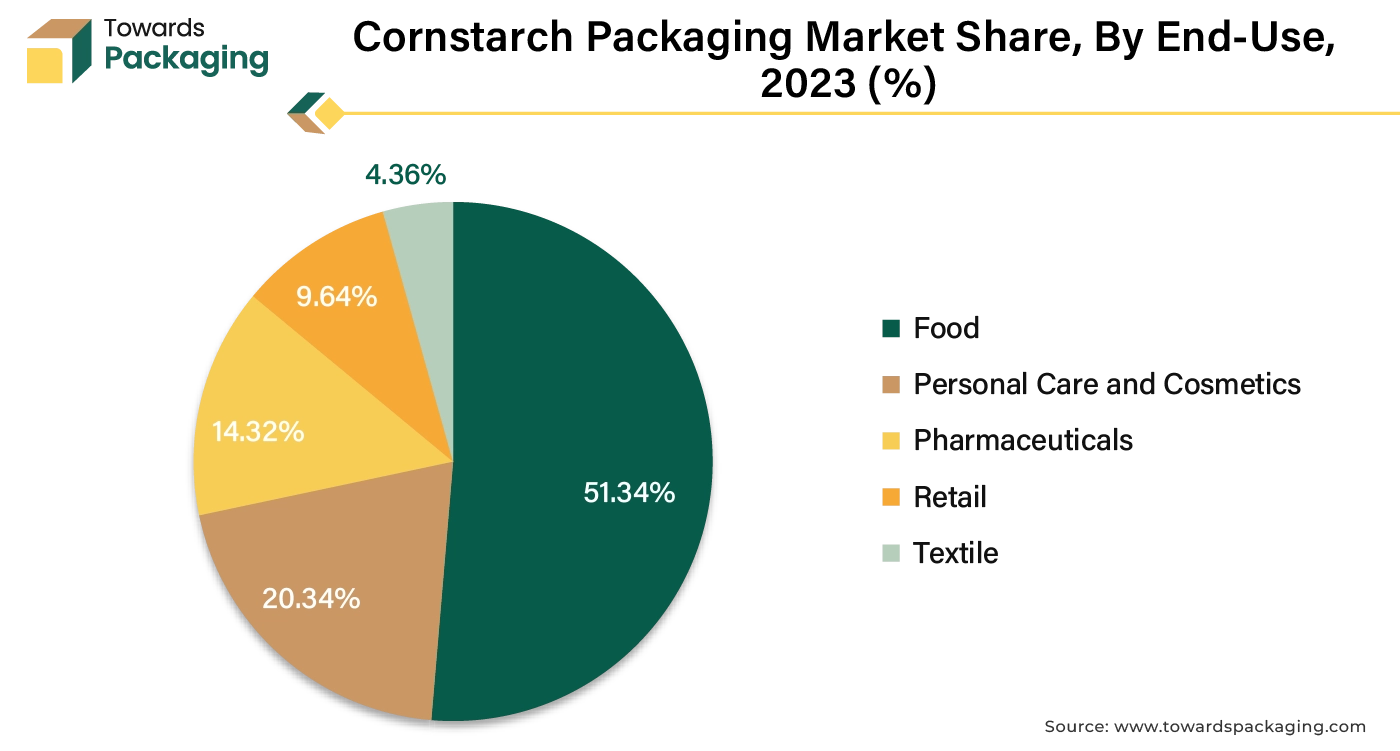

The food segment held largest market share in 2023. This is owing to the rapid expansion of the food delivery sector fueled by the increasing popularity of the online ordering as well as the delivery apps. Cornstarch is becoming more and more well-liked in the food companies as a sustainable and environmentally beneficial replacement for the conventional plastic packaging. Food packaging made up of cornstarch has many benefits. Since cornstarch is a naturally occurring substance that is not harmful and has good barrier qualities that shield food from the impurities, unwanted moisture and oxygen that might come into touch with food. Additionally, corn starch packing is compact, lightweight and manageable, which lowers the expense of storage and the transportation.

Asia Pacific held is likely to grow at fastest CAGR of 20.01% during the forecast period. This is owing to the fastest-growing e-commerce segment across the region. The Indian food services sector is projected to be worth USD 67.84 billion (Rs 569,487 crores) as of FY24, as per the NRAI IFSR 2024. By FY28, it is anticipated to have climbed to USD 92.49 billion (Rs 776,511 crores), with an overall CAGR of 8.1%, and a 13.2% CAGR for the organized category. India is the second-fastest-growing food services sector globally, after Brazil, and is predicted to surpass Japan to become the third-biggest food services market by 2028. Additionally, the improved living standards along with the rising disposable incomes are also anticipated to promote the growth of the market in the region in the years to come.

North America is expected to grow at a substantial CAGR of 16.56% in 2023. This is due to the stringent regulations and policies aimed at reducing plastic waste and promoting sustainable practices across the region. Also, the growing retail and foodservice sectors is further expected to support regional growth of the market in the years to come. Furthermore, the growing consumer preference for environmentally friendly products as well as the ambitious sustainability targets by various companies in the US is setting and focus to reduce their environmental footprint is also expected to support the regional growth of the market in the near future.

By Product Type

By End Use

By Sales Channel

By Region

February 2026

February 2026

February 2026

February 2026