High-Speed Bottle Packaging Market Forecast, Segment Data, Regional (NA, EU, APAC, LA, MEA) Breakdown, Leading Companies, Manufacturers & Suppliers

The global high-speed bottle packaging market report provides detailed quantitative analysis of current market size, historical data, and forecasts up to 2034 by application, automation level, bottle material, end-use industry, and region. It covers North America, Europe, Asia Pacific, Latin America, and Middle East & Africa with country-level breakdowns, trade data, and import–export analysis. The study also includes company profiles of leading players, competitive benchmarking, value chain and supply chain mapping, manufacturer and supplier analysis, pricing and margin statistics, and all key numerical insights needed for strategic decision-making.

Major Key Insights of the High-Speed Bottle Packaging Market:

- North America dominated the high-speed bottle packaging market in 2024.

- Asia Pacific is expected to grow at a significant rate in the market during the forecast period.

- By application, the beverages segment dominated the market with the largest share in 2024.

- By automation level, the automatic segment registered its dominance over the global high-speed bottle packaging market in 2024.

- By bottle material, the plastic (PET, HDPE) segment dominated the high-speed bottle packaging market in 2024.

- By end-use, the food & beverage segment registered its dominance over the global high-speed bottle packaging market in 2024.

High-Speed Bottle Packaging Market: Overview

Bottle packaging is the process of enclosing liquids, powders, or granules in bottles made of plastic, glass, or metal for distribution, storage, sale, and use. It involves a combination of filling, sealing, labelling, and often secondary packaging (like boxing or shrink-wrapping) to ensure the product is protected and ready for market. High-speed bottle packaging refers to the automated process of filling, sealing, labelling, and packaging bottles at a very fast rate, usually in large quantities, for mass production. It’s commonly used in industries like beverages, pharmaceuticals, cosmetics, and chemicals.

Packer bottles are available in a variety of sizes and colors based on the requirements of the product and can be composed of HDPE, PET, glass, or metal. In contrast to glass, which is widely used in clear, amber, and cobalt blue, plastic packaging bottles are typically available in clear, amber, dark amber, and white.

Key Metrics and Overview

| Metric |

Details |

| Market Drivers |

Growth of e-commerce and direct-to-consumer trends |

| Market Restraints |

Maintenance complexity; space and infrastructure constraints |

| Leading Region |

North America |

| Market Segmentation |

By Application, By Automation Level, By Bottle Material, By End-Use Industry and By Region |

| Top Key Players |

MTC Industries, Clearpack, Bisleri, Aquafina, Aim Technologies, Danone |

What are New Trends in the High-Speed Bottle Packaging Market?

Automation & Smart Packaging Lines

Fully automated packaging systems are increasingly adopted to reduce human error, boost production speed, and ensure consistent quality. Integration of IoT (Internet of Things), AI, and machine learning allows for real-time monitoring, predictive maintenance, and self-adjusting machines.

Sustainability and Eco-Friendly Packaging

Rising environmental regulations and consumer awareness are pushing manufacturers to: Use recyclable or biodegradable bottles and caps, Reduce plastic usage through lightweight bottle designs, and Implement energy-efficient machines that lower carbon footprints.

Customization and Flexibility

Companies now require packaging systems that can quickly adapt to different bottle sizes, shapes, and cap types. Modular machines are gaining popularity, allowing easy changeovers and scalable production.

High-Speed, High-Precision Machinery

Increasing demand for faster production without compromising accuracy. Advanced fillers, cappers, and labellers now operate at speeds of over 1,000 bottles per minute, especially in beverages and pharmaceuticals.

Track-and-Trace and Serialization

Especially critical in pharmaceutical and food packaging. Incorporation of QR codes, barcodes, RFID tags, and blockchain-based systems for product authentication and supply chain transparency.

Robotics and Cobots

Use of robotic arms for capping, inspection, and palletizing. Collaborative robots (cobots) are being integrated for safer human-machine interaction on the factory floor.

Digital Twin and Simulation

Some companies are implementing digital twin technology to simulate packaging lines for optimization, testing, and training before deployment.

Hygienic and Cleanroom-Compatible Designs

Driven by stricter safety norms in food, dairy, and pharma, machines are being built with stainless steel, easy-to-clean surfaces, and contactless operations.

Smart Inspection Systems

Adoption of AI-powered vision systems to detect defects in fill level, cap placement, label accuracy, and tamper-evidence even at high speeds.

How Can AI Improve the High-Speed Bottle Packaging Industry?

AI-powered sensors and machine learning models can monitor equipment health in real time. Detects early signs of wear or malfunction (e.g., motor vibration, temperature changes) to prevent unplanned downtime. The AI integration helps schedule maintenance proactively, reducing equipment failures and improving uptime. AI-enabled vision systems can inspect bottles at high speed for: Fill level inconsistencies, Cap misalignment or absence, Label errors or wrinkles, Surface defects or contamination. Far more accurate and faster than manual inspection, reducing product rejections and recalls.

AI can analyze large amounts of production data (e.g., fill speed, pressure, material usage) and automatically adjust machine parameters for optimal performance. The AI integration helps maintain consistent fill volumes, seal integrity, and minimize wastage even during high-speed operation. AI-driven robotic arms and cobots can adapt to changes in bottle size, orientation, or packaging configurations without reprogramming.

The artificial intelligence integration enables quick changeovers and reduces human involvement in repetitive or dangerous tasks. AI models can forecast packaging demand based on historical data, sales trends, and external factors. The AI integration optimizes raw material procurement (e.g., bottles, caps, labels), reduces overstocking or shortages, and lowers storage costs. AI systems learn from past production data to improve over time.

Market Dynamics

Driver

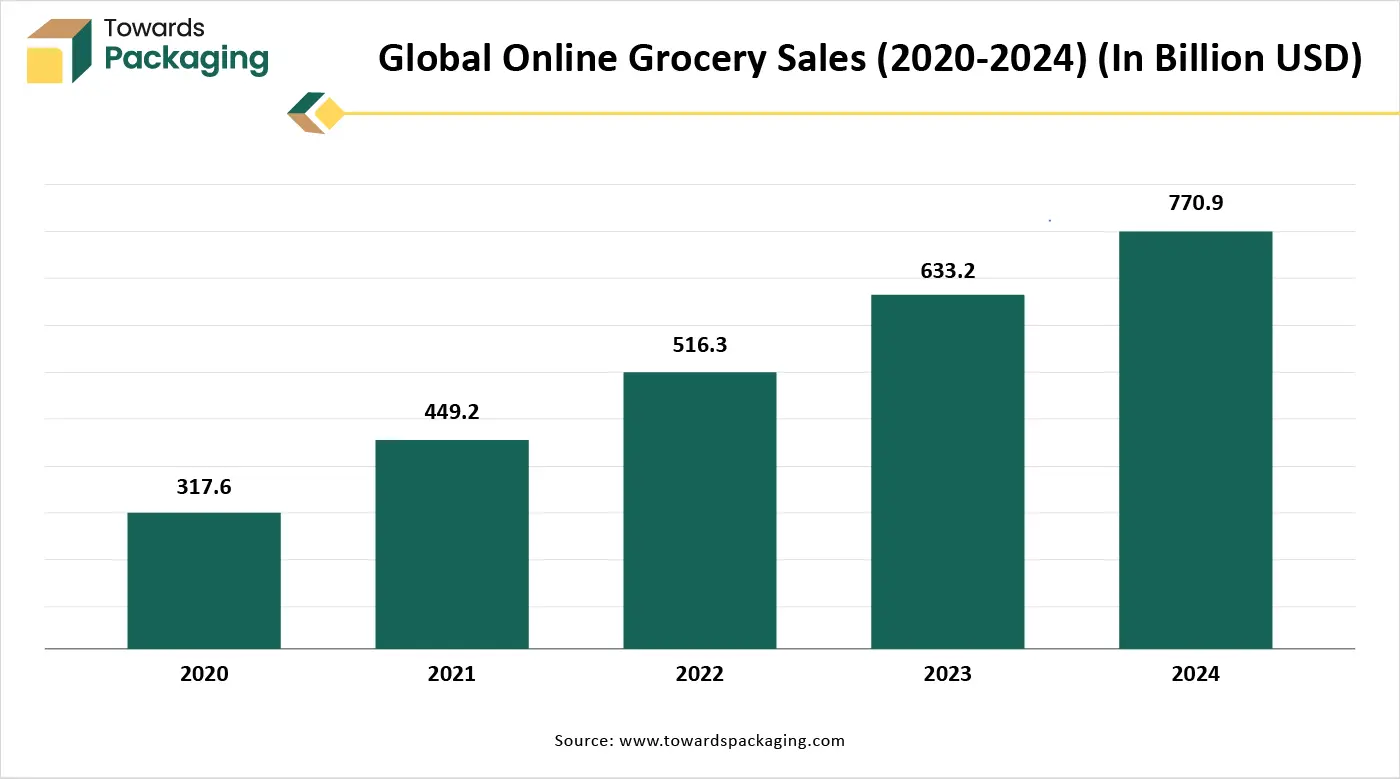

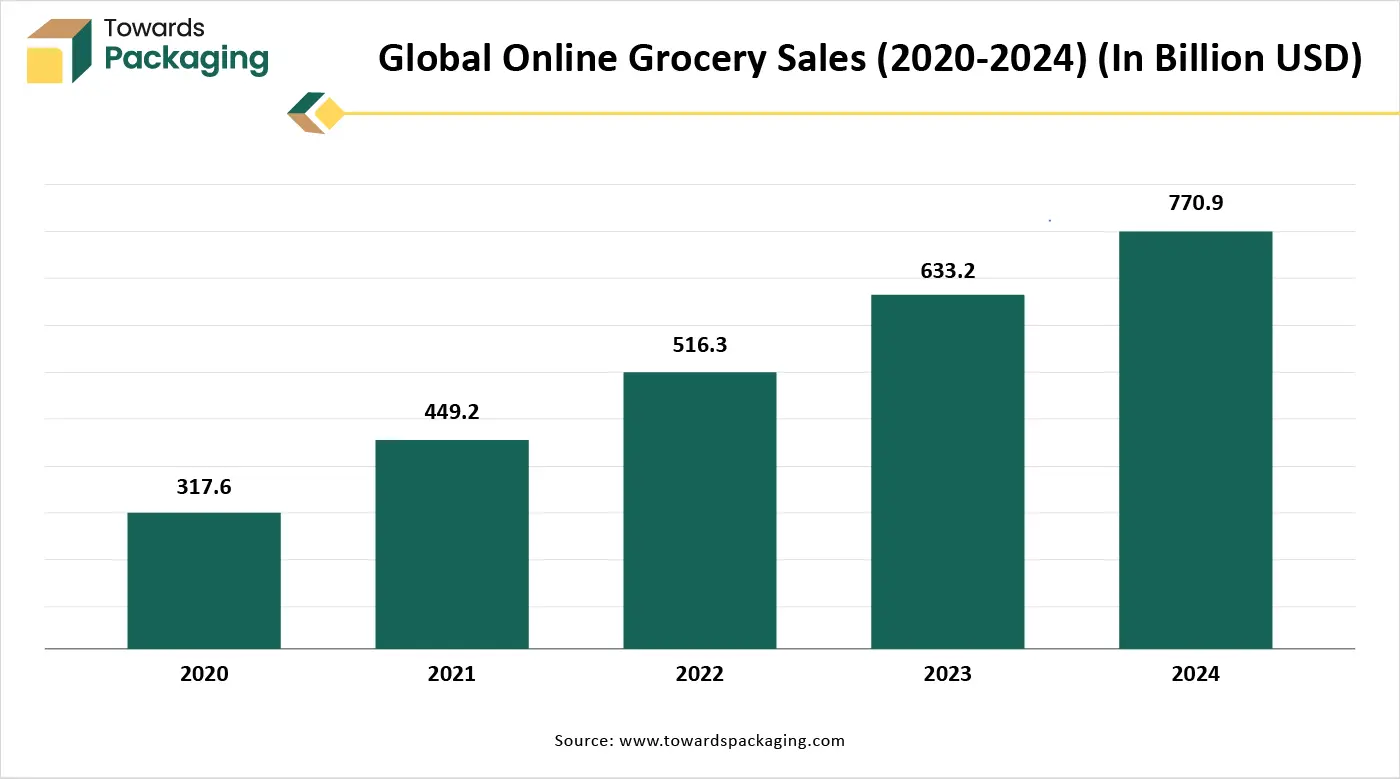

Growth of E-commerce and Direct-to-Consumer Trends

Online retail drives the demand for secure, attractive, and branded bottle packaging. Increased focus on packaging that can withstand shipping while still looking appealing to consumers. E-commerce platforms have drastically increased consumer access to: Beverages (water, juices, energy drinks), Personal care (shampoos, lotions, oils), and Pharmaceuticals (syrups, supplements). This surge in online purchases drives higher production volumes, pushing manufacturers to adopt high-speed packaging lines to meet demand. Online customers expect fast shipping and same/next-day delivery. Brands must speed up their bottling and packaging processes to: keep up with order volume, maintain short delivery cycles and high-speed packaging is essential for just-in-time logistics.

- For instance, in January, 2025, according to the data published by the National E-commerce Association, 15% of consumers worldwide prefer to purchase directly from reliable brands. In several nations, such as Australia (23%), France (22%), and Colombia (20%), direct-to-consumer (D2C) shopping has surpassed marketplaces as the preferred option. 41% of consumers begin their buying directly on websites run by businesses or online retailers like Amazon, while 44% begin their shopping trip on a search engine. Additionally, 14% of individuals prefer to begin their online purchasing experience on social media.

Restraint

Maintenance and Technical Complexity & Space and Infrastructure Constraints

The key players operating in the high-speed bottle packaging market are facing issue due to lack of skilled workforce and technical complexity which has estimated to restrict the growth of the market in the near future. These systems require regular upkeep and specialized technicians to avoid downtime. Breakdowns can halt production completely and cause costly delays. Spare parts and technical support may not always be readily available, especially in developing regions. Operating and maintaining automated high-speed systems requires a technically trained workforce.

In many regions, there’s a shortage of skilled labor familiar with advanced automation, robotics, or AI integration. High-speed lines often need more space, stable power supply, and controlled environments (especially in pharma or food industries). Many older or smaller facilities lack the necessary infrastructure to support high-speed systems. High-speed systems work best with standardized bottle shapes and materials. New sustainable or eco-friendly materials (like biodegradable plastics or glass alternatives) may be less compatible or require slower handling.

Opportunity

Rising Demand for Packaged Consumer Goods

Rapid growth in FMCG (Fast-Moving Consumer Goods) sectors like beverages, personal care, and household products. Surge in urbanization and lifestyle changes increases the demand for ready-to-use, hygienic, and attractively packaged products. Packaged consumer goods (like beverages, personal care items, and cleaning products) are sold in massive volumes daily. To meet this demand, manufacturers need to package millions of bottles quickly, which is only possible with high-speed packaging systems capable of filling, capping, and labelling hundreds of bottles per minute. The consumer goods market is highly competitive and fast-moving. High-speed packaging allows brands to launch new products quickly and restock shelves faster, helping them stay ahead of trends and competitors. Modern consumers demand variety: different sizes, scents, flavours, and packaging styles.

High-speed packaging lines today are designed for quick changeovers, enabling manufacturers to produce diverse product variants without sacrificing speed. With more packaged goods competing for consumer attention, attractive and consistent packaging is key. High-speed labellers and precision fill systems ensure bottles look appealing and are uniform in presentation, which boosts brand image and sales. Rising raw material and labor costs push companies to optimize production. High-speed systems reduce manual labor, minimize waste, and increase overall efficiency, lowering the cost per unit.

Segmental Insights

Expanding Beverage Industry to Promote Dominance

The beverage segment held a dominant presence in the high-speed bottle packaging market in 2024. The beverage industry (water, soft drinks, juices, alcohol, energy drinks) deals with millions of bottles daily. High-speed packaging lines are capable of processing 200 to 1,000+ bottles per minute, making them essential for meeting high demand. Automated high-speed lines reduce manual labor, increase production efficiency, and lower the cost per unit. By maintaining high output with minimal downtime, companies can maximize profitability. High-speed systems ensure accurate filling levels, proper capping, and precise labelling, which are critical for: preserving beverage quality, preventing leaks or contamination and maintaining brand image.

Beverages require hygienic and tamper-proof packaging to prevent contamination. High-speed lines operate in sterile or clean-room environments with minimal human contact, meeting FDA, FSSAI, or EU food safety standards. Modern high-speed lines can handle various bottle materials and shapes (PET, glass, aluminium). Quick-change technology allows for fast transitions between different SKUs, essential in a market offering multiple product variants. Bottled beverages are shipped globally and sold online, so packaging must be durable and appealing. High-speed packaging ensures consistent, attractive packaging that meets logistics and marketing standards. Advanced high-speed systems are optimized to minimize material waste (e.g., label misalignment, overfilling). Many are compatible with recyclable and lightweight materials, helping brands meet sustainability goals.

The pharmaceuticals segment is expected to grow at the fastest CAGR in the market during the forecast period of 2024 to 2034. Pharmaceutical companies deal with high production volumes. High-speed bottling lines can package thousands of units per hour, significantly boosting productivity and meeting market demand quickly. Automated high-speed systems ensure precise filling, capping, and labelling. This reduces dosage errors, ensures uniformity in every bottle, and maintains strict adherence to regulatory standards.

The pharmaceutical sector is highly regulated (e.g., by the FDA, EMA). High-speed bottle packaging systems are designed to meet GMP (Good Manufacturing Practice) and other compliance requirements, offering features like serialization, tamper-evident seals, and contamination-free environments. Automation reduces the reliance on manual labor, lowering the risk of human error, contamination, and variability in packaging quality.

High-speed packaging lines often operate in controlled environments that help maintain the sterility and stability of pharmaceutical products. They also enable the integration of safety seals, desiccants, and child-resistant closures. Although the initial investment is high, high-speed systems reduce long-term costs by improving throughput, minimizing waste, and reducing labor requirements. As pharmaceutical companies grow or launch new products, high-speed packaging lines can be scaled up or adjusted to accommodate different bottle sizes and types of medications (e.g., tablets, capsules, liquids). Modern high-speed systems can integrate serialization and track-and-trace technologies, essential for preventing counterfeiting and ensuring product traceability throughout the supply chain.

Automatic Segment Led the Market in 2024

The automatic segment accounted for a considerable share of the high-speed bottle packaging market in 2024. These machines can fill, cap, label, and seal hundreds or thousands of bottles per minute. This high throughput is crucial for meeting large-scale production targets. Automated systems ensure accurate dosing, tight capping, and uniform labelling, reducing errors and maintaining product quality. This is particularly important in sectors like pharmaceuticals where dosing accuracy is critical. Automation reduces the need for manual labor, leading to lower operational costs. It also frees up human workers for more skilled tasks. In industries like pharmaceuticals and food, maintaining a sterile environment is essential. Automatic machines operate in controlled environments, minimizing contamination risks.

These machines are designed to comply with GMP, FDA, and other regulatory standards. Features like tamper-evident sealing, serialization, and track-and-trace capabilities help ensure legal compliance. Modern machines can handle multiple bottle size, shapes, and materials. They can be easily adjusted or programmed for different production runs. Automated systems offer real-time monitoring and quality checks, reducing material wastage and rejects. These machines can be integrated into Industry 4.0 environments for data analytics, predictive maintenance, and remote monitoring.

The semi-automatic segment is anticipated to grow with the highest CAGR in the high-speed bottle packaging market during the studied years. Lower initial investment compared to fully automatic machines. Ideal for small to mid-sized businesses looking to increase efficiency without the high capital expenditure of full automation. Though not as fast as fully automatic lines, semi-automatic machines offer much higher speeds than manual packaging making them efficient for moderate production volumes. Easier to switch between different bottle sizes or product types. Require less programming and setup time, making them well-suited for short production runs or frequent product changeovers.

The semi-automatic reduces labor costs and physical strain, but still allows operators to maintain control over critical steps in the process (e.g., positioning bottles, starting cycles). The semi-automatic machines are useful when some manual oversight is desired or necessary. More accurate and consistent than manual filling and packaging. The semi-automatic machine is typically smaller and more compact than fully automatic lines. Many semi-automatic systems can be upgraded or integrated into larger automated lines as production demands grow.

Plastic Material Led the Market in 2024

The plastic (PET, HDPE) segment held a dominant presence in the High-Speed Bottle Packaging market in 2024. Plastic bottles are much lighter than glass or metal, making them easier and faster to handle on high-speed packaging lines. Their durability reduces breakage, which is crucial in high-speed operations to minimize downtime and product loss. Plastic is generally cheaper to produce and transport than alternatives like glass or aluminium.

Lower production and shipping costs make it ideal for mass packaging. Plastic can be easily molded into various shapes and sizes, supporting branding and functional requirements. It allows for custom bottle designs that are still compatible with high-speed machines. Plastic bottles are dimensionally consistent, which helps ensure smooth movement through conveyors, fillers, cappers, and labellers.

Their uniformity supports fewer machine adjustments and higher line efficiency. Certain plastics (like PET, HDPE) can be engineered with barrier properties to protect contents from moisture, oxygen, and light ideal for sensitive products like pharmaceuticals. Plastic doesn’t shatter like glass, reducing the risk of injury and contamination in fast-paced environments. This is particularly important in food, beverage, and pharma industries where hygiene and safety are paramount. Many types of plastic, especially PET and HDPE, are widely recyclable. Advances in bioplastics and recycled plastics are helping reduce the environmental impact, supporting sustainability goals. Plastic containers are easily sealed using heat or induction sealing, which works well with high-speed machines for tamper.

Food & Beverage Segment Shown Significant Share in 2024

The food & beverage segment registered its dominance over the global high-speed bottle packaging market in 2024. The food and beverage industry handles billions of units daily worldwide. High-speed bottle packaging is essential to meet the volume and speed demands for products like water, soft drinks, juices, sauces, dairy, and condiments. Bottling provides sealed, tamper-proof containers that ensure product freshness, hygiene, and shelf life critical for perishable items. High-speed packaging helps maintain sanitary conditions and reduces contamination risk. Food and beverage companies operate on tight margins and require economies of scale. High-speed bottling reduces labor costs, minimizes waste, and supports large-scale production lines, making it economically viable.

Bottled formats are portable, resealable, and easy to use, making them the preferred choice for consumers. High-speed packaging allows companies to meet on-the-go lifestyle trends with a wide range of bottle sizes and types. The segment uses plastic (PET, HDPE), glass, and aluminium bottles materials well-suited for high-speed packaging systems. In a highly competitive space, fast and efficient packaging allows brands to quickly respond to market demands, launch new products, and maintain supply chain agility. Packaging is also a key tool for branding and shelf impact, which high-speed systems support through precise and attractive labelling Modern high-speed packaging lines for food and beverages offer automated filling, capping, labeling, and sealing, improving throughput and product quality. Integration with smart packaging, IoT, and track-and-trace systems gives companies an edge in supply chain transparency.

Regional Insights

North America’s Expansive Food and Beverage Sector to Promote Dominance

North America region held the significant share of the high-speed bottle packaging market in 2024, owing to expansive food and beverage sector in the region. North America, especially the United States, is home to many leading pharmaceutical companies like AbbVie, Eli Lilly, Bristol-Myers Squibb, Pfizer, and Merck & Co. High-speed packaging is essential to meet the strict regulations (FDA, cGMP) and high production volumes of drugs, vitamins, and supplements.

The U.S. and Canada have a high demand for packaged beverages, sauces, and ready-to-consumer products. The need for efficient, hygienic, and scalable packaging drives adoption of high-speed bottling solutions. Regulatory bodies like the U.S. Food and Drug Administration enforce strict packaging and labeling standards. High-speed bottling systems help companies maintain compliance while scaling production efficiently. North America is a leader in automation and smart manufacturing technologies. Integration of robotics, IoT, AI, and machine vision into bottling systems enhances speed, accuracy, and traceability.

U.S. Market Trends

U.S. high-speed bottle packaging market is driven by the advanced manufacturing and automation infrastructure. The U.S. is home to many of the world’s largest pharmaceutical and biotech companies. High-speed bottle packaging is critical for producing large volumes of prescription drugs, OTC medications, and nutraceuticals with strict FDA compliance. The U.S. has one of the largest consumer markets for bottled beverages, sauces, condiments, and ready-to-consume foods. Brands like Coca-Cola, PepsiCo, Nestlé, and Kraft rely on high-speed bottling to meet nationwide demand efficiently.

The country leads in smart manufacturing, with widespread use of robotics, AI, and IoT in packaging systems. U.S.-based equipment manufacturers and tech firms continuously innovate in high-speed automation, improving efficiency and customization. American consumers prioritize on-the-go, single-serve, and easy-to-use products driving demand for efficient, compact, and attractive bottled formats. Many global and domestic packaging machinery manufacturers (e.g., Barry-Wehmiller, ProMach, Krones USA) operate in the U.S.

Massachusetts Bottle Manufacturing Industry Trends:

Massachusetts is home to Boston-Cambridge, one of the world’s leading biotech and pharmaceutical clusters. Major companies like Pfizer, Moderna, Biogen, Sanofi Genzyme, and Takeda have operations here. These firms require high-speed, sterile, and precise packaging for large-scale production of vaccines, biologics, pills, and liquid drugs—fueling demand for cutting-edge bottling systems. The state boasts a high concentration of research institutions and universities, including MIT, Harvard, and Boston University.

Asia’s Growing Pharmaceutical Industry to Support Fastest Growth

Asia Pacific region is anticipated to grow at the fastest rate in the high-speed bottle packaging market during the forecast period. High population density and urban expansion in Asia Pacific region increase demand for packaged beverages (water, soft drinks, juices, etc.). Rising middle-class populations in countries like China, India, and Southeast Asia are driving consumption. Strong GDP growth and industrial development, especially in China, India, Indonesia, and Vietnam, support investments in automated packaging infrastructure. Foreign Direct Investment (FDI) in manufacturing and packaging sectors of Asia Pacific region has boosted availability of capital and technology. In Asia Pacific region there is high demand for efficient, attractive, and durable packaging has surged due to online retail and consumer preference for convenience.

China Market Trends

China high-speed bottle packaging market is driven by the strong manufacturing ecosystem in the country. With over 1.4 billion people, China has massive demand for packaged beverages, including bottled water, soft drinks, health drinks, and dairy products. China has one of the largest and fastest-growing beverage industries in the world. The rise of health-conscious consumers has led to increased production of bottled water, juices, and functional drinks all needing efficient, high-speed packaging. Chinese manufacturers are rapidly adopting Industry 4.0 practices, including smart factories and automated packaging lines. Government-backed initiatives like “Made in China 2025” promote the use of advanced manufacturing technologies, including robotics and high-speed packaging machines.

China is a global manufacturing hub with well-established supply chains for machinery, electronics, and packaging components. Incentives for industrial upgrades and tax benefits for automation are encouraging companies to invest in high-speed packaging equipment. Special Economic Zones (SEZs) and export-focused policies boost production and packaging infrastructure. China has the largest e-commerce market globally, requiring efficient and attractive packaging for quick and safe delivery. Fast-paced retail and consumer product turnover increase the need for high-speed packaging systems. Multinational companies are investing in local manufacturing and packaging facilities to meet domestic and export demand. Joint ventures with Chinese firms bring in global expertise and accelerate technology adoption.

Xinjiang Bottle Packaging Sector Trends- 2025

Xinjiang is a core region in China’s Belt and Road Initiative (BRI), serving as a key logistics and trade hub connecting China with Central Asia, Europe, and the Middle East. This has attracted investment in infrastructure, transportation, and industrial zones, supporting local manufacturing and packaging activities. The Urumqi Economic and Technological Development Zone and other regional hubs are being upgraded with advanced logistics and industrial systems. Xinjiang is known for its agricultural output, especially fruits (like grapes, melons, and pomegranates), which are increasingly processed into juices and beverages. Local government policies in Xinjiang encourage agri-food processing to add value, boosting demand for bottle packaging for juices, flavoured drinks, and bottled water.

The growth of Halal-certified food and beverage products for export to Muslim-majority countries also drives packaging needs. The Chinese central government heavily subsidizes economic development in Xinjiang, offering tax breaks, land incentives, and capital support for manufacturers and investors. Programs like “Go West” policy and special financial allocations help companies invest in automation and packaging equipment. Urbanization is accelerating in cities like Urumqi, Kashgar, and Korla, leading to higher consumption of packaged goods.

Xinjiang has seen the creation of multiple industrial parks focused on light manufacturing and food processing, many equipped with bottle packaging lines. For instance, Horgos Free Trade Zone near the Kazakhstan border supports cross-border trade of packaged goods, requiring efficient, large-scale packaging operations. Xinjiang, with its natural spring water sources, is seeing growth in the bottled water industry, especially for premium brands marketing purity and origin. High-speed bottling is essential to scale this industry and meet regional and national demand.

India Bottle Packaging Market Trends

India high-speed bottle packaging market is driven by large consumption base. India’s strong manufacturing sector and well-established supply chain enable efficient sourcing and processing of raw materials such as glass, metal, and plastic, including recycled PET for bottle production. Companies like Jindal Poly films, Bisleri, are investing significantly to expand production capacities, indicating confidence in the market’s growth potential.

Top Market Players of the High-Speed Bottle Packaging Market

Latest Announcements by High-Speed Bottle Packaging Industry Leaders:

- Yash Lohia, the chairman of Indorama Ventures' ESG Council and executive president of Petchem Special Projects, stated that the innovative partnership embodies the common goal and obligation of all partners to help create a more sustainable future by launching the ‘world’s first’ bio-PET bottle. The announcement follows the collaboration of Neste, Suntory, ENEOS, and Mitsubishi Corporation, who all shared the objective of using "renewable" Neste RE feedstock to produce PET resin. In 2024, Suntory expected to start using resin to make bottles.

- More recently, Neste and Mitsubishi Corporation introduced renewable chemical and plastic value chains for Japanese businesses with the goal of defossilizing supply chains in the food and beverage, fashion, and consumer electronics industries. Neste RE will also be used in this. To establish greenfield, cutting-edge PET recycling facilities in India, Indorama Ventures has also partnered with Dhunseri Ventures and Varun Beverages, PepsiCo's second-largest bottling operation outside of the US. Two of the facilities are now being built, and completion is anticipated by 2025. [Source: Packaging Europe Ltd.]

New Advancements in High-Speed Bottle Packaging Industry

- On May 16, 2025, DataLase, England based company leading the way in laser coding and marking solutions worldwide, has revealed the introduction of its new clear-to-white laser-active coatings, a high-performing and environmentally friendly substitute for traditional coding technologies for a variety of packaging applications. When exposed to laser marking, the biodegradable, sustainably derived raw material at the heart of our most recent breakthrough produces remarkable white contrast. Most importantly, its performance on difficult substrates like shrink films and 12-micron PET is evidence of its adaptability and superior engineering. Suitable for direct-to-shape marking on products such as bottles, caps, and closures, the coatings can be used in flexographic, gravure, and even pad printing techniques. [Source: PackagingConnections]

- In May 2025, Avantium NV., leading producer of circular and renewable polymer materials, announced its collaboration with the Bottle Collective, which will highlight fiber bottles created using Dry Molded Fiber (DMF) technology. The Dry Molded Fiber bottle technique will incorporate Avantium's innovative, plant-based polymer PEF (polyethylene furanoate), improving the bottles' sustainability and barrier efficacy. [Source: Avantium]

- In March 2025, Woodstock Sterile Solutions, a blow-fill-seal (BFS) contract development and manufacturing organization (CDMO), is invested US$8 million on a new automated, high-speed bottle packing line at its Woodstock, Illinois, site in order to increase its BFS capabilities. In addition to increasing production efficiency, the new, high-speed bottle packaging process will give Woodstock Sterile Solutions the ability to package bottles with inline serialization at a rate of 250–300 ppm. Using oval and circular multidose bottles, the new Serpa line can produce 5 mL and 10 mL bottles. [Source: Contract Pharma]

Global High-Speed Bottle Packaging Market Segments

By Application

- Beverages

- Pharmaceuticals

- Personal Care

- Chemicals

- Food Products

By Automation Level

- Automatic

- Semi-Automatic

- Manual

By Bottle Material

- Plastic (PET, HDPE)

- Glass

- Metal

By End-Use Industry

- Food & Beverage

- Pharmaceuticals

- Cosmetics & Personal Care

- Chemical Industry

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait