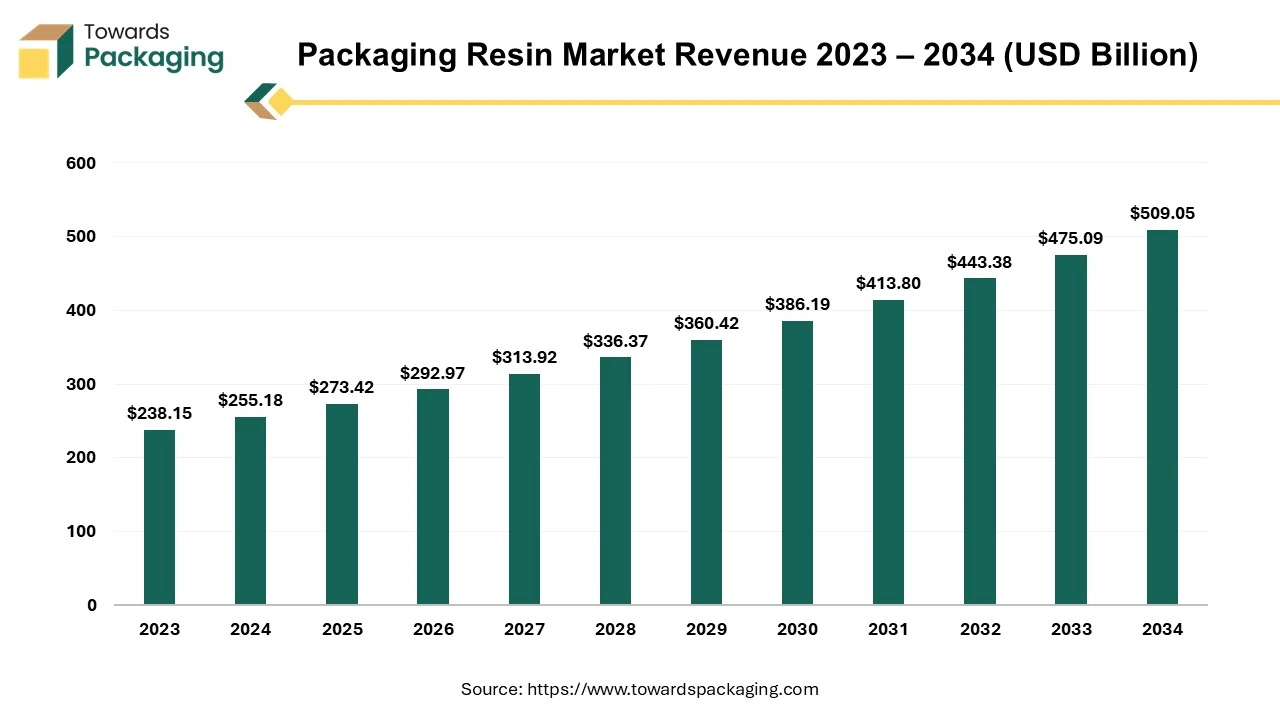

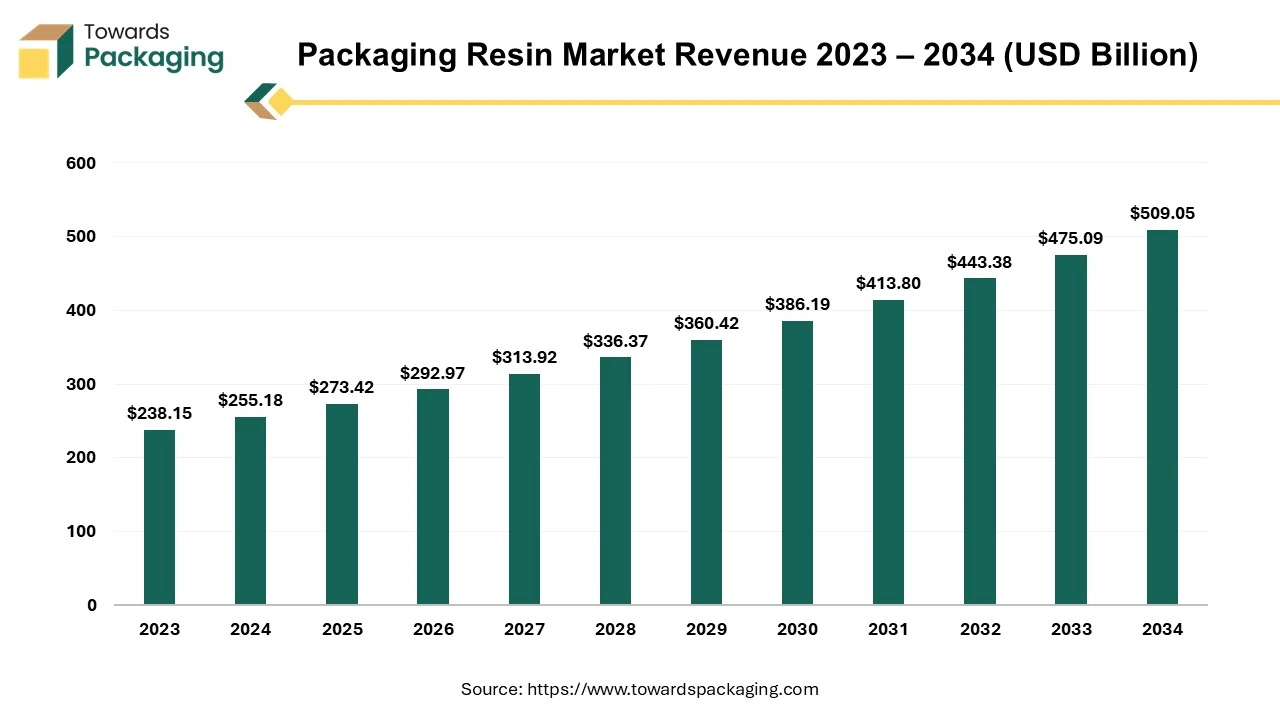

The packaging resin market is forecasted to expand from USD 292.98 billion in 2026 to USD 545.46 billion by 2035, growing at a CAGR of 7.15% from 2026 to 2035. This report covers full market segmentation by type (PP, LDPE, HDPE, PET, PVC, PS, EPS) and by application (F&B, consumer goods, healthcare, industrial) along with a comprehensive regional analysis across North America, Europe, Asia-Pacific, Latin America, and MEA.

The study highlights key trends such as sustainability, bioplastics adoption, circular economy growth, and rising demand from the food & beverage sector. Competitive insights include leading companies like BASF, SABIC, Sinopec, Dow, LyondellBasell, and others. It also provides value chain mapping, pricing factors, raw material supply trends, and global trade statistics, including Vietnam’s 75,354 PP-import shipments, China’s 141K tons of epoxide resin imports, and major exporters such as Vietnam, South Korea, and China.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing packaging resin which is estimated to drive the global packaging resin market over the forecast period.

Major Key Insights of the Packaging Resin Market:

- Asia Pacific dominated the packaging resin market in 2023.

- North America is expected to grow at a significant rate in the market during the forecast period.

- By type, the polypropylene (PP) segment dominated the packaging resin market with the largest share in 2023.

- By application, food & beverages segment is expected to grow at significant rate during the forecast period.

Packaging Resin Market Developing Protective Packaging

The synthetic polymers utilized to develop packaging materials that are designed to protect, contain, and preserve products throughout their lifecycle is known as packaging resin. These resins are molded, extruded, or formed into various shapes and types of packaging, such as bags, films, bottles, trays, and containers, depending on the specific resin type and its intended utilization. The role of packaging resin in modern manufacturing and consumer goods is critical, as it allows safe storage, easy handling, transport, and enhanced shelf life of a wide variety of products.

There are several different types of packaging resins which have been mentioned here as follows: polyethylene, polypropylene, polyethylene terephthalate, polyvinyl chloride, polystyrene, polycarbonate and polyamide. Polylactic acid and polyhydroxyalkanoates are the biodegradable resins. Each of these resins has specific advantages that make them ideal for certain applications, such as protecting food from contamination, offering durability during transportation, or providing easy recyclability for sustainability.

Key Takeaways

- Asia Pacific dominated the global fusion biopsy market in 2025.

- North America is expected to grow at the fastest CAGR between 2026 and 2035.

- By type, the polypropylene (PP) segment generated the biggest market share in 2025.

- By type, the high-density polyethylene (HDPE) segment is expanding at the fastest CAGR between 2026 and 2035.

- By application, the food & beverage segment contributed the highest market share in 2025.

- By application, the consumer goods segment is growing at a strong CAGR between 2026 and 2035.

How AI is Improving Efficiency and Yield in Packaging Resin Production ?

AI is improving efficiency and yield in packaging resin production by enabling real-time monitoring and optimization of manufacturing processes. By automatically adjusting parameters like temperature, pressure, and feed rates, sophisticated algorithms reduce material waste and energy consumption by analyzing data from sensors, machinery, and production lines. AI-powered predictive analytics reduces downtime and enhances operational continuity by spotting possible equipment failures before they happen. Manufacturers benefit from increased output consistency, better resin quality, and increased production yields as a result.

For example, ExxonMobil has implemented AI-driven process optimization in its polyethylene and polypropylene production plants, which has enhanced operational efficiency, improved product consistency, and reduced energy consumption. As a result, manufacturers achieve higher output consistency, improved resin quality, and better overall production yields.

Largest 2024 Import of Packaging Resins by Countries

- Volza's Global Import dataVietnam leads the world in PP resin imports with 75,354 shipments

India imports 14,358 shipments of PP resins, followed by Indonesia’s third spot with 9,396 shipments.

- Vietnam's cumulative import value of PET resin exceeded US$ 300 million, which reflects strong demand.

- According to IndexBox data, China imported 141K tons of epoxide resins in 2024.

- India imported 79K tons.

Largest 2024 Export of Packaging Resin by Countries

- According to Volza's Global Export data, Vietnam, South Korea, and China are the largest exporters of PP Resin

- Vietnam led the world in PP resin exports with 38,444 shipments

- South Korea exported 20,032 shipments of PP resin in 2024.

- China took third spot with 16,353 shipments.

Top Three 2024 PP Resin Suppliers

- SIFLEX VIETNAM CO LTD held the largest spot in the world supplier market with 6,362 shipments shares.

- CONG TY TNHH STARFLEX VIET NAM; its export share was 4,351.

- TECH CO., LTD. was in the 3rd spot with 4,056 shipments

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

US$ 273.43 billion |

| Projected Market Size in 2035 |

US$ 545.46 Billion |

| CAGR (2026 - 2035) |

7.15% |

| Leading Region |

Asia Pacific |

| Market Segmentation |

By Type, By Application and By Region |

| Top Key Players |

BASF SA, SABIC, China Petroleum & Chemical Corporation, LyondellBasell, Dow Chemical Company |

Sustainability and Recycling Initiatives: Market’s Largest Trends

- According to the U.S. Plastic Pact roadmap, “100% of plastic packaging will be reusable, recyclable, or compostable by 2025” in the U.S.

- As per the 2024 GSI Survey, “79% of shoppers in the U.S. are more likely to purchase products with a scannable barcode/QR code (via smartphone) that provides the information they want.

Driver

Expansion of the Food & Beverage Industry

Due to busy lifestyle there is rise in demand of the packaged and ready-to-eat food. Packaging resins are integral to the food and beverage sector, where they ensure product safety, freshness, and extended shelf life. The growth of packaged food, convenience foods, and beverages (especially bottled drinks) is a significant driver. Increasing launch of the packaged and ready-to-eat food has risen the demand for the packaging resin, which is estimated to drive the growth of the packaging resin market in the near future.

- For instance, in August 2024, Fresh Express, a company focused on manufacturing packed food, revealed the launch of the Hot or Cold Noodle and Salad Meal Kits.

- Furthermore, in October 2024, Bonduelle, company producing processed vegetables headquartered in France, U.K., uneviled the introduction of the new Bistro Loaded Bowls. The new Bistro Loaded Bowls, the lunch that desk-eaters and bowl lovers worldwide have been waiting for, were unveiled today by Bonduelle, a leader in plant-rich, ready-to-eat meals worldwide. The freshest greens, over 12 grams of protein, crunchy toppings, and creamy dips are all included in these delicious and enticing Bistro Loaded Bowls without sacrificing convenience. Simply grab, go, and enjoy—no lineups, no dinner preparation.

- Moreover, in November 2024, Thai Wah, agriculture and food industry intends to use its decades-long experience providing noodles and starch to manufacturers to introduce its baking premixes and instant noodles into the retail market.

7 Key Factors Driving Packaging Resin Market Growth

- The key players operating in the market are focused on geographic expansion and launching their pharmaceutical brand in other countries which is expected to drive the growth of the packaging resin market in the near future.

- Increasing focus on cost reduction and production efficiency can drive the specialty market growth further.

- Emerging markets and trends for packaging resin is expected to drive the growth of the global packaging resin market over the forecast period.

- Increasing regulatory support is estimated to drive the growth of the market over the forecast period.

- Increasing in adoption of the advanced technology for the production of packaging resin is estimated to drive the growth of the global packaging resin market in the near future.

- The demand for convenient, easy-to-use packaging (e.g., ready-to-eat foods, single-serve packages, and on-the-go products) is growing. Resins like PET, PP, and PE are commonly used to meet these needs due to their flexibility and durability.

- The increasing adoption of bioplastics like PLA and PHA, which are derived from renewable sources, is pushing packaging resin market growth as brands seek alternatives to petroleum-based plastics.

Sustainability and Recycling Initiatives: Market’s Largest Trends

Shift towards Biodegradable and Recyclable Materials: The demand for eco-friendly packaging solutions has been a dominant trend, driven by both regulatory pressures and consumer preference for sustainable products. Companies are increasingly using recyclable plastics, bioplastics, and compostable materials to reduce environmental impact. Increased Focus on Circular Economy: Packaging companies are investing in systems that allow for the recycling of materials like polyethylene terephthalate (PET) and polyethylene (PE). This includes developing packaging that can be easily sorted, reused, or recycled.

Market Opportunity

Rising Research & Development and Innovation of New Material

The development of high-performance resins, such as polyamide (PA), polycarbonate (PC), and ethylene vinyl alcohol (EVOH), is growing, especially for premium applications that require higher barrier properties (e.g., for food, pharmaceuticals, and electronics packaging). The demand for packaging resins in the pharmaceutical industry is growing due to the need for sterile, tamper-evident, and safe packaging for medicines and medical devices. The key players operating in the market are focused on carrying out research for developing packaging resin which will be suitable for packaging biologic and pharmaceutical products, which is estimated to create lucrative opportunity for the growth of the packaging resin market in the near future.

- For instance, in June 2024, Ecolab, cleanrooms, pharmaceutical and drug products manufacturing company, in collaboration with Repligen Corporation, a company focused on development and production of material used for manufacturing of biologicals, uneviled the introduction of the Purolite’s DurA Cycle, a protein A chromatography resin used in packaging of the biologics.

- Furthermore, in March 2024, TOPPAN Inc., subsidiary of TOPPAN Holdings Inc., printing company, revealed the development and introduction of the GL-SP, a barrier film that utilizes biaxially oriented polypropylene (BOPP) as the substrate for sustainable packaging of medicines and other biologics.

Key Technological Shifts

| Technological Shifts |

Impact on Packaging Resin Market |

| AI & Machine Learning |

Enhances production efficiency, reduces waste, and ensures consistent resin quality |

| Advanced Recycling Technologies |

Promotes circular economy by enabling high-quality resin reuse |

| Bio-based Resin Innovation |

Supports sustainable packaging and reduces reliance on fossil fuels |

| Process Automation & IoT |

Minimizes downtime, lowers operational costs, and improves production precision |

| Lightweighting Technologies |

Reduces material usage and transportation costs while maintaining performance |

| Barrier Enhancement Technologies |

Extends product shelf life, especially for food and pharmaceuticals |

Market Challenge

Supply Chain Disruptions and Availability of Alternative Options

The key players operating in the market are facing issue in fulling the consumer demand due to high cost of raw material and regulatory rules, which is observed to hamper the growth of the packaging resin market in the near future. The cost of key raw materials, such as crude oil and natural gas, which are used to produce resins like polyethylene (PE) and polypropylene (PP), can be volatile. This makes price stability a challenge for manufacturers and can lead to unpredictable costs. The global resin market is often affected by supply chain issues, such as the availability of feedstock materials or disruptions from natural disasters or geopolitical tensions. These factors can impact production timelines, lead to shortages, and raise costs. With the rise of alternative materials like paper, glass, and aluminum, especially in food and beverage packaging, there is growing competition for market share. While resins remain a popular choice, alternatives that promise lower environmental impacts are increasingly attractive to both consumers and brands.

Regional Insights

Asia’s Industrialization to Support Dominance

Asia Pacific region dominated the global packaging resin market in 2023. After the Covid-19 breakout in China the innovation and introduction of vaccines increased in Asia Pacific region which has observed to rise the growth of the packaging resin. APAC is becoming a key hub for biopharmaceutical manufacturing. As the biopharmaceutical sector grows, it creates a demand for advanced packaging solutions, such as multilayered films and specialized containers to protect biologic drugs. These packaging needs often rely on high-performance packaging resins to meet specific storage and transportation requirements, supporting packaging resin market growth.

Asia Pacific region is an increasingly important market for global pharmaceutical companies, with increasing exports and the distribution of medicines across multiple countries. To meet these consumer needs, pharmaceutical products require packaging that can withstand long transit times and varying environmental conditions. Resins that provide better barrier properties, moisture resistance, and temperature stability are in high demand, driving growth in the packaging resin market over the course of period.

- For instance, in February 2023, Oliver Healthcare Packaging (Oliver), healthcare company and medical packaging company revealed the expansion of its company by the establishment of new manufacturing unit in the southern state of Johor in Malaysia. The Oliver Healthcare Packaging (Oliver) company is constructed on the 122,000-square-foot facility, which is situated in the i-Tech Valley, an integrated industrial park in Johor's established Iskandar Puteri economic zone. With the newest, most advanced machinery and ISO-7 and ISO-8 clean room capabilities, the new manufacturing plant will satisfy the ever-increasing regulatory requirements for medical packaging. With a focus on serving its expanding medical device and pharmaceutical clients in the area, the facility will manufacture pouches, lids, CleanCut cards, and roll stock. It will also feature the newest printing technology.

Hence, rapid industrialization and well established pharma sector of Asia Pacific region has driven the growth of the packaging resin market

North America’s Highest in Consumption of Ready-to-Eat Food Supports the Growth

North America region is anticipated to grow at the fastest rate in the packaging resin market during the forecast period. North America, particularly the United States and Canada, has a large and diverse consumer base. With high disposable income, a growing middle class, and a large population, there is a consistent demand for a wide variety of food and beverage products. This provides a strong market for companies to establish and expand their businesses. The food and beverage industry in North America is known for its continuous innovation, from the development of new flavors and product categories to the incorporation of new technologies (e.g., plant-based foods, clean-label products, and functional foods).

The region’s cultural diversity has fostered a wide range of tastes and dietary preferences, encouraging food and beverage companies to offer an extensive variety of products to cater to different consumer needs. From fast food and packaged snacks to organic and health-conscious food, the demand for varied products allows businesses to establish themselves across many niches. Hence, the well-established food and beverages industry in the North America region drives the growth of the packaging resin market in the near future.

Segments Insights

Polypropylene (PP) Segment to Lead the Market in 2024

Polypropylene (PP) segment held a dominant presence in the packaging resin market in 2024. Polypropylene (PP) has good tensile strength and is resistant to impact, making it an ideal choice for packaging that needs to protect the contents during handling and transportation. It can withstand stress without cracking or breaking easily. Polypropylene is resistant to many chemicals, oils, and solvents, which helps preserve the quality of food and other consumer goods. This property makes it suitable for packaging a wide range of products, from food and beverages to household cleaners. Polypropylene (PP) can be easily recycled, has heat resistance properties, chemical resistance properties, has transparency and clarity.

Food & Beverage Segment to Show Significant Share

Food & Beverage segment registered its dominance over the global packaging resin market in 2024. As consumers seek convenience, there is a more demand for on-the-go, ready-to-eat, and easy-to-prepare food and beverage packets. Packaging resins like polyethylene (PE), PET, and polypropylene (PP) are essential for creating packaging solutions that ensure products remain fresh, portable, and easy to use. Packaging resins, especially those with barrier properties (such as PET and multi-layer films), help extend the shelf life of food and beverages by protecting against moisture, oxygen, light, and contaminants.

This extends the freshness of products, reduces food waste, and meets consumer expectations for product quality and safety. Growing consumer and regulatory pressure for sustainability is driving demand for packaging materials that are either recyclable or made from renewable sources. Resins like PET and those used in biodegradable or compostable packaging are gaining popularity due to their reduced environmental impact. This trend aligns with the industry's shift toward eco-friendlier packaging options.

- For instance, in October 2024, SIG Group AG, packaging company, revealed that according to the APR Design Guide for Plastics Recyclability, SIG has been officially recognized by the Association of Plastic Recyclers (APR) for fulfilling the highest standards for recyclability for its Terra RecShield D bag-in-box package for beverages like post-mix syrup.

By Type

High-density polyethylene (HDPE) is the fastest-growing segment in the packaging resin market, driven by its chemical resistance, high strength-to-density ratio, and recyclable nature. Bottles, containers, and caps are just a few examples of the rigid packaging applications that frequently use it. The use of HDPE in food, beverage, and household product packaging is accelerated by the growing demand for lightweight long lasting and environmentally friendly packaging options.

By Application

Consumers goods segment is the fastest-growing end-use category in the packaging resin market, backed by rising consumer demand for lifestyle home care and packaged personal care products. The demand for appealing, safe, and practical packaging is driven by the rapid urbanization and expansion of e-commerce and the shifting lifestyles of consumers. Advanced and recyclable resins are being used by manufacturers more frequently to meet sustainability standards and improve shelf appeal

New Advancements in Packaging Resin Industry

- On May 1, 2025, the American Chemistry Council (ACC) releases the 2025 edition of its "Resin Review," and China waives a 125% tariff on ethane imports from the US.

- In March 2025, LyondellBasell launched its new Pro-fax EP649U, a polypropylene impact copolymer, which offers a sustainable rigid packaging solution with recycled and renewable options. The solution is designed for thin-walled injection molding, making it suitable for food packaging applications.

- In February 2025, a large part of the packaging supply chain congregated at the NEC, Birmingham, offered packaging manufacturers and suppliers took the opportunity to launch new products.

- In October 2024, Accredo Packaging, Inc., packaging company, in collaboration with the Reynolds Consumer Products Inc., packaging company, uneviled the introduction of the 100% Bio-Based Resin Pouch.

- In May 2024, EcoCortec, subsidiary of Cortec Corporation, uneviled opening of its cutting-edge bio-resin compounding activities. The plant's polymer processing facility now produces premium concentrated masterbatch using state-of-the-art compounding lines. Customers of the plant will be guaranteed the best film quality thanks to EcoCortec's compounding line.

Value Chain Analysis

Raw Material Sourcing

Packaging resins rely on petrochemical feedstocks, bio-based polymers, and recycled materials. Ensuring a stable supply and quality of raw materials is critical for consistent production and cost management.

Key Players: ExxonMobil, LyondellBasell, BASF, Dow Chemical, SABIC

Logistics and Distribution

Efficient logistics and distribution are essential for the timely delivery of resins to manufacturers and converters. Supply chain optimization, temperature-controlled transport, and strategic warehousing help maintain quality and reduce costs.

Key Players: DHL Supply Chain, DB Schenker, Kuehne + Nagel, FedEx Logistics, Maersk

Recycling and Waste Management

Recycling and waste management involve the collection, sorting, and reprocessing of post-consumer and post-industrial resins. Adoption of chemical and mechanical recycling is increasing to meet sustainability goals and regulatory compliance.

Key Players: Veolia, SUEZ, Loop Industries, Indorama Ventures, Plastic Energy

Global Packaging Resin Market Key Players

Latest Announcement by the Leaders

- In October 2024, According to Sebastian Besems, vice president of commercial EMEA at Lamb Weston stated that consumers, retailers, and distributors are becoming more environmentally conscious and are favoring more sustainable packaging. The company uses pre-fried frozen potato products which come in an industry-leading bio-circular retail packaging solution that offers a very responsible value proposition because we foresaw this trend. The brand's new European retail pack is ISCC PLUS certified and has 60% bio-circular plastic created from recycled cooking oil from Lamb Weston as part of our aggressive sustainability ambitions and innovations for the frozen potato industry. The company’s retail bags' carbon footprint is reduced by 30% due to this innovation, which uses SABIC's bio-renewable polymer and better and less packaging, meeting customer expectations that FMCG businesses are eco-friendly.

- Lamb Weston, a significant global brand and manufacturer of frozen potato products, has partnered with SABIC, a pioneer in the chemical industry, in a closed-loop method aimed at producing low-weight, sustainable packaging bags with a thin coextrusion film structure. Utilizing bio-feedstock derived from used cooking oil (UCO), polymers make up at least 60% of the packaging. UCO is first collected from Lamb Weston's production and transformed into bio-feedstock to create certified bio-renewable SUPEER mLLDPE (metallocene linear low-density polyethylene) and SABIC HDPE (high-density polyethylene) polymers. At least 60% of the final packaging is made of bio-renewable polymers based on UCO, which is a component of SABIC's TRUCIRCLE portfolio. These polymers are transformed into a multilayer PE film for Lamb Weston's pre-fried frozen potato products by Oerlemans Plastics, a division of OPACKGROUP, a specialized manufacturer of flexible films and packaging.

Global Packaging Resin Market Segments

By Type

- Polypropylene (PP)

- Low Density Polyethylene (LDPE)

- High Density Polyethylene (HDPE)

- Polyethylene Terephthalate (PET)

- Polystyrene (PS) & Expanded Polystyrene (EPS)

- Polyvinyl Chloride (PVC)

- Others

By Application

- Food & Beverage

- By Packaging Type

- Rigid Packaging

- Bottles & Jars

- Cans & Tins

- Flexible Packaging

- Pouches

- Films

- Containers

- By Food Type

- Fresh Food

- Frozen & Processed Food

- Beverages (Liquid & Solid)

- Consumer Goods

- By Packaging Type

- Rigid Packaging

- Bottles & Jars

- Containers

- Flexible Packaging

- Pouches

- Bags

- By Product Type

- Personal Care Products

- Household Products

- Stationery & Toys

- Healthcare

- By Packaging Type

- Medical Packaging

- Bottles

- Blister Packs

- Syringes & Vials

- Pharmaceutical Packaging

- Tablets & Capsules Packaging

- Injection Packaging

- By Product Type

- Medical Devices Packaging

- Over-the-Counter Drugs Packaging

- Prescription Drugs Packaging

- Industrial

- By Packaging Type

- Rigid Packaging

- Drums & Barrels

- Containers

- Flexible Packaging

- Bags & Sacks

- Shrink Films

- By Product Type

- Automotive Parts Packaging

- Chemicals & Lubricants Packaging

- Construction Materials Packaging

- Others

- By Product Type

- Electronics Packaging

- Textile Packaging

- Furniture Packaging

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait