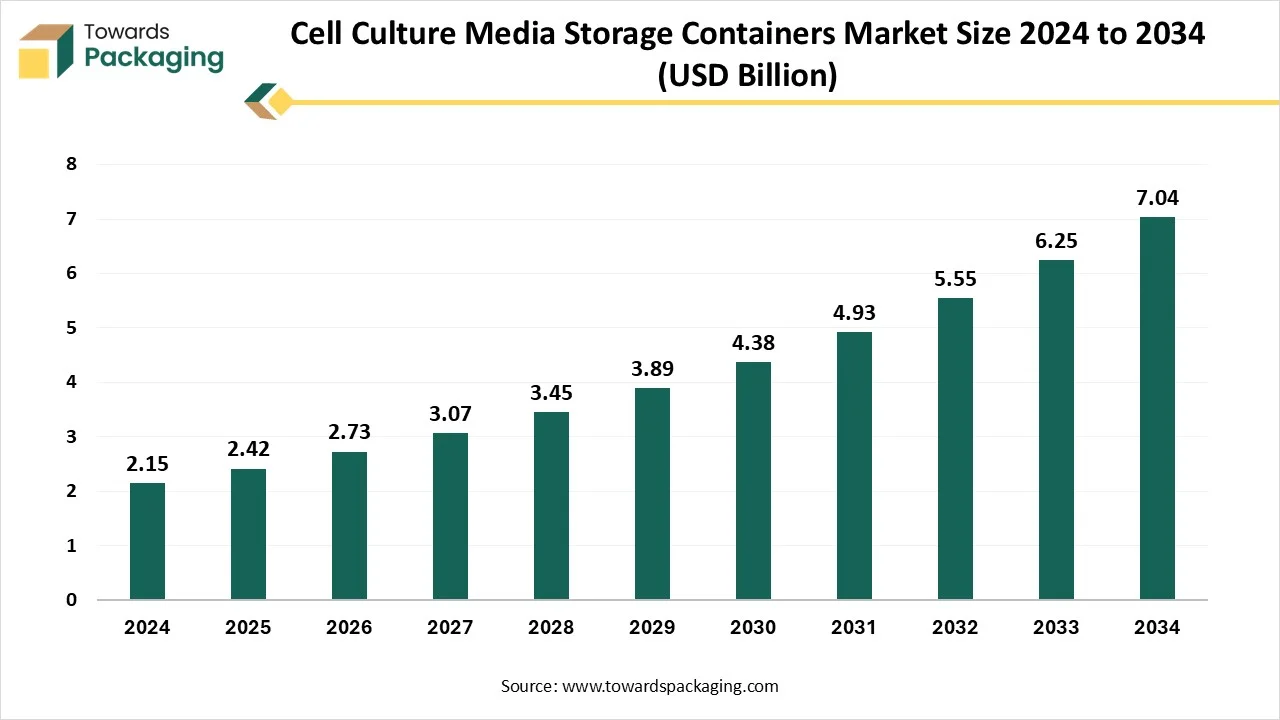

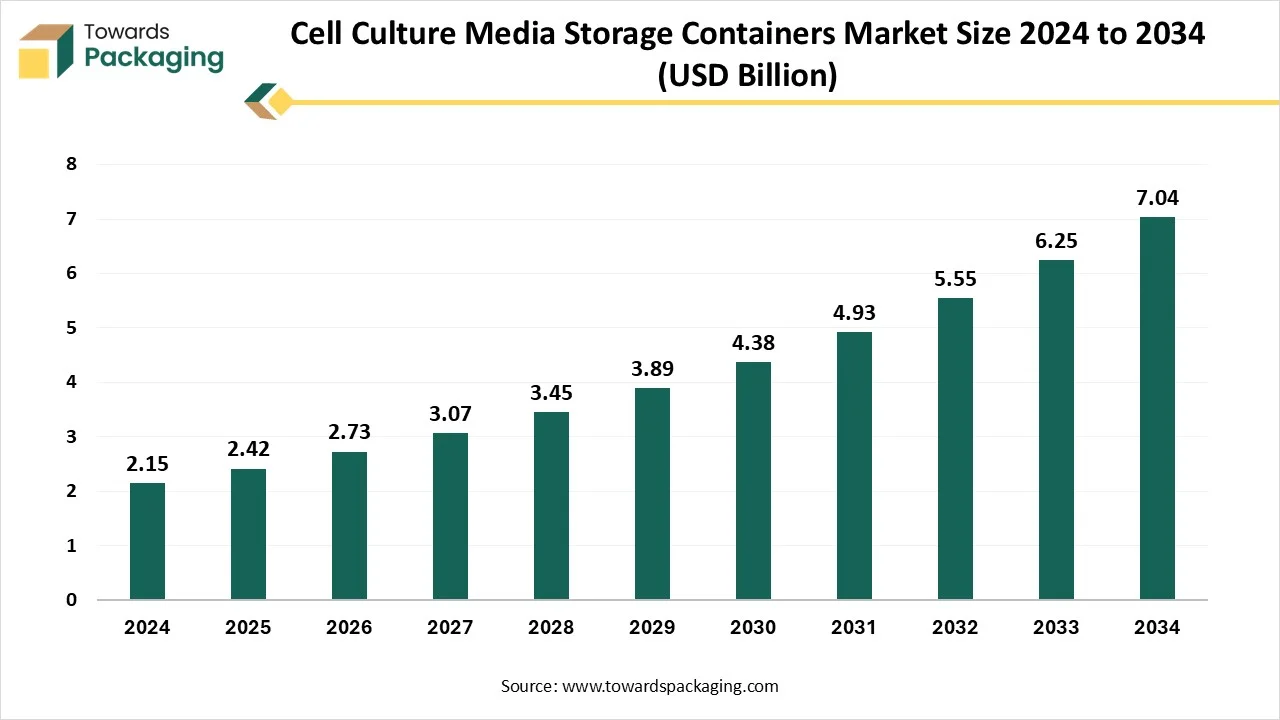

The cell culture media storage containers market is forecasted to expand from USD 2.73 billion in 2026 to USD 7.92 billion by 2035, growing at a CAGR of 12.59% from 2026 to 2035. It includes regional insights across North America, Europe, Asia Pacific, Latin America, and MEA, with North America dominating in 2024. The report also analyzes competitive strategies of top companies like Thermo Fisher, Merck, Danaher, Sartorius, and Greiner Bio-One, along with value chain structure, raw material flow, import–export patterns, and supplier networks.

Cell culture media storage containers are specialized vessels used to store, preserve, and sometimes transport culture media, which are nutrient-rich solutions used to support the growth of cells in laboratory environments. These containers are crucial in biotechnology, pharmaceuticals, and research labs where cell cultures are routinely grown. The cell culture media storage containers are typically made of sterile plastic (like polypropylene or polyethylene) or glass.

| Metric | Details |

| Market Size in 2025 | USD 2.42 Billion |

| Projected Market Size in 2035 | USD 7.92 Billion |

| CAGR (2026 - 2035) | 12.59% |

| Leading Region | North America |

| Market Segmentation | By Product, By Application, By End-Use and By Region |

| Top Key Players | Thermo Fisher Scientific Inc., Merck KGaA, Danaher, Sartorius AG, Greiner Bio-One International GmbH |

The cell culture media storage containers often come with writable surfaces or labelling space to ensure proper identification and traceability in lab environments. Containers are either pre-sterilized or can be autoclaved (heat-sterilized) to prevent contamination. Airtight caps or closures to prevent contamination and maintain sterility. The cell culture media storage containers are commonly used for storing freshly prepared media, holding media before use in experiments, transporting media between labs and aliquoting media into smaller portions for sterile handling.

AI integration can significantly enhance the cell culture media storage container industry by improving efficiency, safety, traceability, and innovation across manufacturing, quality control, and end-user applications. AI-powered IoT sensors embedded in storage containers can monitor: temperature, pH, humidity, and contamination risk. Real-time alerts if storage conditions deviate from acceptable ranges. Predictive analytics can detect wear and tear in reusable containers, prompting timely maintenance or disposal. For instance, containers with AI-enabled temperature sensors that send alerts when media is exposed to non-optimal conditions, preventing spoilage. AI models can analyze manufacturing data to detect defects in containers (e.g., micro-leaks, weak seals).

AI can track and manage containers during transport of media, optimizing: route planning to maintain cold chain, predictive alerts for delays or breaches in environmental control. AI can analyze user requirements in biotech labs or pharma companies and suggest or automatically configure: Optimal container size, type, and sterility method. Storage systems tailored for specific cell culture media (e.g., serum-free, chemically defined, etc.). AI systems can compile and analyze storage logs, sensor data, and audit trails to automatically generate compliance reports for bodies like FDA, EMA, or ISO.

Increasing Incidence of Chronic and Infectious Diseases

Growing focus on drug discovery and vaccine development (e.g., COVID-19, cancer) requires intensive use of cell cultures. This boosts consumption of cell culture media and corresponding storage containers. The rising incidence of chronic and infectious diseases is a major driver for the growth of the cell culture media storage containers market because it directly fuels demand for biomedical research, drug development, vaccine production, and diagnostic innovations all of which depend heavily on cell culture systems.

As of 2025, a large percentage of fatalities and disabilities are caused by chronic diseases, which remain a major worldwide health concern. These illnesses are becoming more common, according to data from a number of sources, including the Centers for Disease Control and Prevention (CDC) and the World Health Organization (WHO). Both adults and children are affected, with a noticeable rise in chronic illnesses in children.

Limited Adoption in Low-Resource Settings

The key players operating in the market are facing issues due to stringent government regulations, compliance issues, and limited adoption in low-resource settings, which has estimated to restraint the growth of the cell culture media storage containers market in the near future. In many parts of Asia, Africa, and Latin America, infrastructure limitations (e.g., lack of reliable cold storage, cleanroom facilities) restrict the effective use of premium containers. Awareness and training gaps also affect usage. Containers used in cell culture and biopharma processes must comply with GMP, FDA, ISO and other regulatory standards.

Many pharma and biotech companies outsource research & development and production. CROs and CMOs require scalable, cost-effective, and compliant storage solutions. For instance, in March 2025, At Harvard's Enterprise Research Campus in Allston, Roche announced the opening of the Roche Genentech Innovation Center Boston, which will deepen the company's long-standing collaboration in fields like engineering, disease biology, and artificial intelligence/machine learning.

In order to establish a substantial end-to-end research and development presence in Cardiovascular, Renal, and Metabolism (CVRM), Roche will use the Roche Genentech Innovation Center Boston as its hub. Additionally, it will help some of Genentech's and Roche's data science and Al initiatives to speed up drug development. Up to 500 people could eventually work at the center, which will have labs ready for cutting-edge research. SVP and Global Head of CVRM Product Development Manu Chakravarthy will serve as the site head for the center.

The storage bags segment held a dominant presence in the cell culture media storage containers market in 2024. Biologics (e.g., monoclonal antibodies, vaccines, gene therapies) require large volumes of sterile media that must be stored safely over time. Storage containers with advanced preservation features (e.g., temperature resistance, inert linings) are essential to avoid contamination and degradation. Drives demand for specialized, validated storage formats especially bags, carboys, and multi-use vessels.

Cell culture media often has a limited shelf life and is sensitive to temperature, light, and microbial contamination. Storage-bags solutions offer: UV-protected, chemically inert materials, Gamma-irradiated, single-use sterile packaging, and Customizable storage for cold chain environments. The storage bags have increased preference for high-integrity, validated storage containers that ensure batch consistency and regulatory compliance.

The storage bottles segment is expected to grow at the fastest rate in the market during the forecast period of 2024 to 2034. Due to materials compatibility the storage bottles are being widely used. Storage bottles are typically made from high-grade materials like: polyethylene terephthalate (PETG, Polycarbonate (PC), and borosilicate glass. These materials ensure compatibility with a wide range of media components (e.g., pH-sensitive or protein-rich solutions) without leaching or degradation. Most storage bottles used for cell culture media are available in pre-sterilized formats (gamma-irradiated or autoclave-ready). They feature tight-sealing, leak-proof caps (vented or non-vented) to prevent microbial contamination.

The biopharmaceutical production segment accounted for a considerable share of the cell culture media storage containers market in 2024. The biopharmaceutical industry is experiencing rapid growth due to increasing global demand for monoclonal antibodies, vaccines, gene therapies, and recombinant proteins. These products require large-scale cell culture operations, which in turn need reliable and scalable storage solutions for culture media. Biopharmaceuticals are highly sensitive to contamination, so sterile, chemically compatible storage containers are essential for maintaining media integrity.

This pushes demand for high-grade materials like fluoropolymers and polycarbonates that are commonly used in specialized containers. Biopharmaceutical production is strictly regulated (FDA, EMA, etc.), requiring validated, compliant storage systems that ensure traceability, reproducibility, and sterility. Containers used in this segment must meet stringent quality standards, which supports a high-value market.

There's a growing shift toward single-use bioprocessing systems to reduce contamination risk, lower cleaning costs, and increase operational flexibility. This increases demand for disposable storage containers for cell culture media in both upstream and downstream processes. Investments in biomanufacturing infrastructure, especially in emerging markets (e.g., India, China), are increasing the need for reliable media storage systems. Large-scale facilities require bulk media preparation and storage systems, reinforcing the dominance of this segment.

The tissue engineering and regenerative medicine segment is anticipated to grow with the highest CAGR in the market during the studied years. TERM involves the development of cell-based therapies, bioengineered tissues, and organ regeneration, all of which rely heavily on cell culture media. As clinical trials and commercial therapies in this area expand, the need for robust, contamination-free storage solutions for media increases. Media used in regenerative medicine must maintain high sterility and stability to ensure patient safety.

This drives demand for specialized, high-quality storage containers (e.g., sterile, chemically inert, biocompatible), boosting market value. The TERM field is one of the fastest-growing areas in biotechnology, with heavy investment from both public and private sectors. As research institutions and biotech firms increase R&D in stem cells, gene editing, and scaffold-based tissue repair, the volume of cell culture media used and hence stored grows substantially.

Personalized regenerative therapies and 3D bioprinting require tailored media formulations and storage solutions. This customization increases demand for flexible, scalable, and safe storage container systems. GMP regulations for regenerative medicine require strict control over raw materials and media storage, emphasizing the use of certified, high-quality containers. Compliance pressures drive demand for specialized containers that meet regulatory standards. Regenerative medicine increasingly uses automated, closed culture systems to minimize contamination and human error. These systems require compatible, often single-use containers designed for ease of integration, further boosting demand.

The pharmaceutical & biotechnology companies segment registered its dominance over the global cell culture media storage containers market in 2024. Pharma and biotech companies conduct extensive research, development, and production involving cell lines for drug discovery, biologics, and vaccine development. These activities require large quantities of media and hence, reliable, scalable storage containers. The rise in biologics (e.g., monoclonal antibodies, recombinant proteins) and biosimilars increases the need for precise and sterile media preparation and storage. These complex products are highly sensitive to contamination, so companies invest heavily in high-quality, GMP-compliant containers. Regulatory bodies like FDA, EMA, and WHO enforce strict quality and sterility guidelines for pharmaceutical manufacturing. To comply, companies must use certified storage containers that ensure media integrity over time.

The CROs & CMOs segment is projected to expand rapidly in the cell culture media storage containers market in the coming years. Pharma and biotech companies are increasingly outsourcing research and development, clinical trials, and manufacturing to CROs and CMOs to reduce costs and increase efficiency. As these organizations handle more cell culture and bioproduction tasks, their demand for media storage containers rapidly increases. With a surge in biologics, vaccines, cell and gene therapies, there's a growing need for flexible, scalable manufacturing capabilities, which CROs and CMOs provide.

CROs/CMOs must be ready to scale production up or down quickly based on client demands. This leads to higher usage of single-use, sterile, and modular storage containers that can be deployed rapidly and safely. To serve top-tier clients, CROs and CMOs must adhere to GMP and international quality standards, necessitating the use of certified, traceable storage containers that maintain media sterility and stability. Many emerging biotech firms lack in-house manufacturing and turn to CMOs and CROs for support.

This contributes to the outsourcing boom, especially for companies working on novel cell-based therapies, where media preparation and storage are critical. CROs and CMOs are expanding globally with state-of-the-art facilities, investing in automation, and adopting closed system bioprocessing, all of which require sophisticated storage container solutions. There is growing pressure for faster drug development and delivery, especially post-pandemic. CROs and CMOs, by speeding up the development cycle, accelerate demand for ready-to-use and reliable media storage systems that streamline workflows.

North America region held the largest share of the cell culture media storage containers market in 2024, owing to advanced research infrastructure and high healthcare expenditure in the country. The United States leads in biopharmaceutical research and development, with significant investments fueling demand for specialized storage solutions essential for cell-based therapies and biologics. The region boasts numerous prestigious research institutions and universities at the forefront of life sciences research. These institutions utilize cell culture media storage containers for various experiments and studies, supporting the demand for high-quality containers. Continuous innovations in container design, such as improved materials and features for sterility and scalability, have enhanced the functionality and reliability of storage solutions, meeting the evolving needs of biopharmaceutical processes. North America's relatively higher healthcare spending supports extensive research and development activities, further driving the demand for advanced storage containers in cell culture applications.

U.S. Market Trends

U.S. cell culture media storage containers market is driven by the strategic investments and facility expansions in the country. U.S.-based companies like Thermo Fisher Scientific and Corning Incorporated are at the forefront of developing innovative storage solutions. These include single-use bioprocess containers and freezer-safe, leak-proof bottles, enhancing sterility, scalability, and efficiency in cell culture processes. The growing focus on personalized medicine in the U.S. necessitates precise storage solutions for patient-specific cell cultures.

Canada Market Trends

Canada cell culture media storage containers market is driven by the thriving biopharmaceutical and biotechnology sectors in the country. The Canadian government actively supports the life sciences sector through substantial investments. Programs like the Strategic Innovation Fund (SIF) provide significant funding to innovative sectors, including health and biosciences.

For instance, in April 2023, STEMCELL Technologies received US$ 45 million in joint funding from the Government of Canada and British Columbia to build an advanced manufacturing facility, enhancing the production of reagents and tools for life sciences research. Canada boasts a strong network of academic and research institutions focusing on stem cell research and biobanking.

These institutions require specialized storage containers with efficient cryopreservation capabilities to store and manage biological samples for long-term research. The emphasis on stem cell research and biobanking initiatives drives the demand for high-quality storage solutions. Canada's biopharmaceutical and biotechnology industries are experiencing significant growth, driven by increasing research and development funding and a focus on developing novel biological drugs.

The country's emphasis on biotechnology research creates a favourable environment for the expansion of the cell culture media storage containers market. The increasing burden of chronic diseases in Canada necessitates advanced research in cell-based therapies and personalized medicine. This trend accelerates the demand for specialized storage containers essential for maintaining and preserving cell cultures used in developing patient-specific treatments.

Asia Pacific region is anticipated to grow at the fastest rate in the cell culture media storage containers market during the forecast period. Countries like China, India, and South Korea are investing heavily in biotechnology and pharmaceutical sectors. China's "Made in China 2025" initiative and India's "Make in India" campaign aim to boost domestic manufacturing and research and development capabilities. These efforts are accelerating the demand for specialized storage solutions essential for cell culture processes. Governments across the Asia Pacific region are implementing policies to foster growth in the life sciences sector.

China allocated over US$70 billion to life sciences and biotechnology initiatives between 2021 and 2025, enhancing research capabilities and establishing advanced cell culture facilities. Technological innovations, such as serum-free and chemically defined media formulations, 3D cell culture systems, and advanced bioreactor technologies, are gaining traction in the region. These advancements improve reproducibility, reduce contamination risks, and enhance scalability in biomanufacturing, driving the need for specialized storage containers.

The APAC region, particularly Japan, is witnessing an aging population, leading to increased prevalence of chronic diseases. This demographic shift is driving demand for regenerative therapies and personalized medicine, which rely heavily on cell culture techniques and, consequently, on efficient storage solutions. The COVID-19 pandemic highlighted the need for rapid vaccine development and production.

Asia Pacific countries, notably India and China, are scaling up vaccine manufacturing capacities, necessitating robust storage solutions for cell culture media to support large-scale production. Asia Pacific region offers cost-effective manufacturing and a skilled workforce, attracting global companies to establish production and research and development centers. This economic advantage facilitates the growth of the cell culture media storage containers market.

India cell culture media storage containers market is driven by the cost-effective manufacturing in the country. Make in India initiative encourages domestic manufacturing, reducing reliance on imports and fostering innovation in biotechnology. National Biotechnology Development Strategy (NBDS) 2021–2025: aims to bolster research and development in biotechnology, enhancing infrastructure and regulatory frameworks to support the industry.

Production Linked Incentive (PLI) Scheme offers financial incentives to companies for increasing production and enhancing quality, attracting investments in the biotechnology sector. India's biotechnology sector is projected to reach USD 300 billion by 2030, with biopharmaceuticals accounting for a significant portion of this growth.

Hyderabad's Genome Valley and other biotech hubs are attracting substantial investments, fostering an ecosystem conducive to biopharmaceutical development. The adoption of single-use technologies (SUTs), such as cell culture media bags, is increasing due to their cost-effectiveness, reduced contamination risks, and operational flexibility.

By Product

By Application

By End-Use

By Region

February 2026

December 2025

November 2025

January 2026