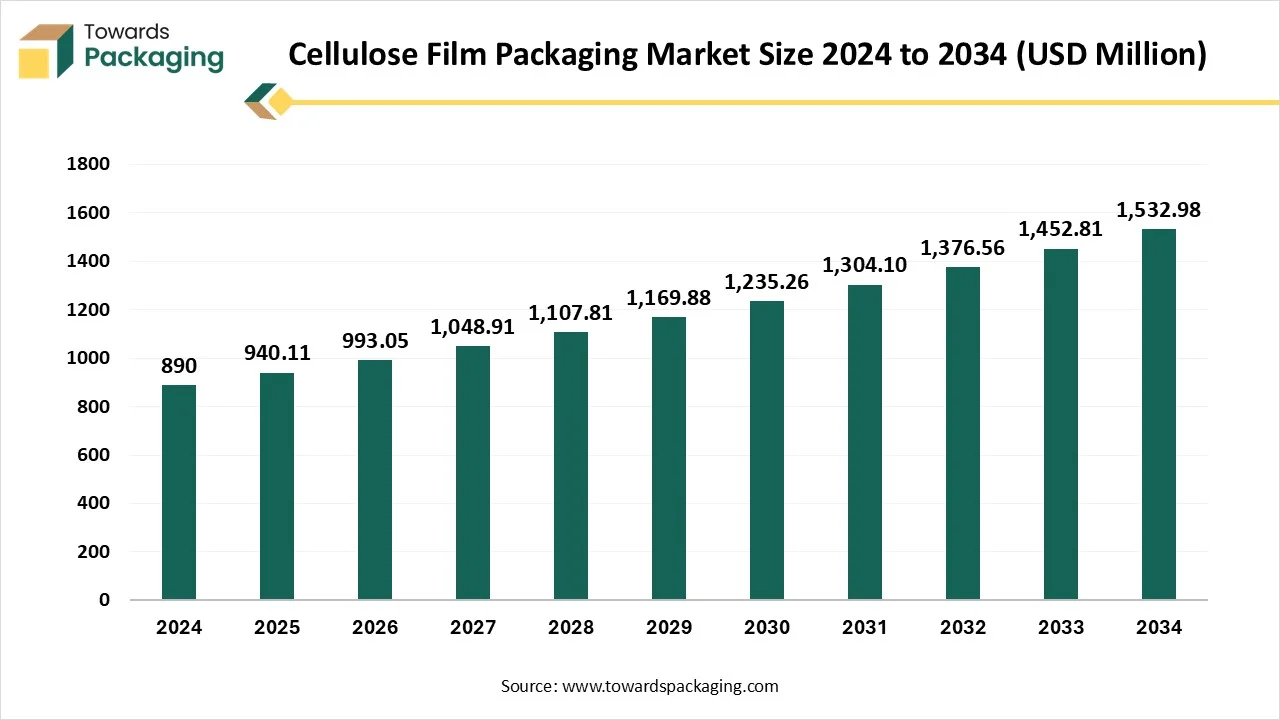

The cellulose film packaging market is forecasted to expand from USD 993.04 million in 2026 to USD 1,625.74 million by 2035, growing at a CAGR of 5.63% from 2026 to 2035. This report covers detailed insights into market segments including cellophane, coated cellulose films, and uncoated cellulose films, along with applications across food & beverages, personal care, pharmaceuticals, agriculture, and electronics. Regional analysis covers North America, Europe, Asia Pacific, Latin America, and MEA, highlighting market leaders, competitive strategies, and trade dynamics.

The report also examines the value chain, top manufacturers like Futamura Group and SHAOXING KEDE, and emerging trends in smart and sustainable packaging.

The cellulose film packaging market has experienced a huge hike in recent years due to its biodegradable qualities. The film packaging is made from cellulose, a plant-derived natural polymer made from the cell walls of plants. It is one of the best alternatives to toxic plastics. Hence, companies are highly shifting towards the natural option.

Consumer awareness today has also compelled companies to opt for sustainable packaging because of its rising importance for the environment. Hence, brands offering cellulose film packaging are higher in demand compared to the ones still stuck with traditional, non-degradable packaging options. Government regulations also play a huge role in the growth of the market. Strict regulations adherence by brands help sustainable packaging gain a hike along with lowering manufacturing companies’ carbon footprint as well.

The excellent barrier properties of the material help manufacturing companies pack any form of goods safely without the fear of product spillage or leakage during transportation. The expansion of the e-commerce business is also one of the fueling factors of the growth of the market. Being made from renewable sources it doesn’t hampers the fossil reserves and hence is environment friendly. The transparent film made from cellulose also allows customers to have a look at the product.

| Metric | Details |

| Market Size in 2025 | USD 940.11 Million |

| Projected Market Size in 2035 | USD 1,625.74 Million |

| CAGR (2025 - 2035) | 5.63% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Product, By Application and By Region |

| Top Key Players | Futamura Group, SHAOXING KEDE NEW MATERIAL CO., LTD., Qingdao Cloud Film Packaging Materials Co., Ltd., Rotofil, HuiZhou YITO Packaging Co., Ltd. |

AI is of utmost importance for the enhancement of the cellulose film packaging market. The advanced technology helps in different aspects of packaging such as smart packaging, sustainability, and production. It also helps in the improvement of manufacturing procedures by speeding up the whole process and allowing the brands to stay stuck with their timelines. The technological advancement also helps in detecting minute flaws and errors which may not be possible manually. AI algorithms also help to suggest the use of the best and most cost-efficient sustainable materials for the production of films. Hence, the brands can manufacture the best and also eliminate excess costs required for production. With the help of AI manufacturers today are focused on smart packaging involving the use of RFID tags and QR codes to allow customers to get deep insights about the product and the packaging. Nanomaterials involved in the cellulose packaging film with the help of AI help to keep the product safe and sound. AI also helps manufacturing units to suggest more sustainable methods of production to help eliminate wastage and stay consistent with quality as well. Smart packaging also helps manufacturers manufacture interactive packaging in the form of personalized video messages. It helps in a higher inclination of consumers towards the brand.

What are the Growth Drivers of the Cellulose Film Packaging Market?

Factors such as sustainability factors, consumer awareness, and government regulations are some of the top growth drivers of the market. Cellulose film packaging is plant-based and hence is one of the best alternatives to plastic. Hence, the market has been expanding easily in recent years. Consumer awareness about sustainability is another major growth driver of the market. Consumers today are supportive of the brands providing sustainable packaging allowing the market to grow speedily. Government regulations on strict usage of sustainable packaging materials are another elevating element for the growth of the market. It helps companies to do their bit for the environment along with lowering their carbon footprint as well.

High Manufacturing Cost and Raw Material Shortage

Manufacturing cellulose-based film for packaging incurs higher costs compared to petroleum-based plastic. Hence, many manufacturers do not find the option economical and prefer to use plastics for packaging. Manufacturing cellulose film packaging involves high processing of sustainably sourced wood pulp which again involves higher cost. Hence, the high cost of raw materials is also one of the restraints in the growth of the market.

Technological Advancement for Improved Barrier

One of the major opportunities for the growth of the cellulose film packaging market is advancing technology, which is helpful to improve the barrier strength of the film packaging. Technological advancements are helping in enhancing the biodegradability and sustainability factor of the film along with improving the efficiency and speed of the process. The use of sensors and indicators in the packaging procedure helps the brands to keep an eye on the shelf-life, protection, temperature, humidity, and freshness of the product. Hence, the technology will play a huge role in the growth of the market in the foreseen period.

The cellophane segment dominated the market in 2024. Unlike synthetic plastic films, cellophane is derived from natural cellulose sources such as wood pulp, making it an environmentally friendly alternative that aligns with growing consumer and regulatory demands for sustainable packaging. Its excellent moisture barrier and oxygen permeability make it ideal for packaging perishable food items, pharmaceuticals, and personal care products. With increasing global awareness of plastic pollution and the push for compostable alternatives, the cellophane segment continues to lead the cellulose film market, supported by both eco-conscious brands and supportive regulatory frameworks.

The coated cellulose films segment expects significant growth in the market during the forecast period. Coated cellulose films are typically treated with materials such as nitrocellulose, polyethylene, or acrylic coatings to improve their moisture resistance, heat sealability, and printability, addressing the limitations of uncoated films. This makes them highly suitable for a wide range of applications, particularly in the food packaging industry where extended shelf life and product safety are critical. The coatings also enhance the barrier properties of the film against oxygen and grease, making it ideal for packaging oily or aromatic products.

The food and beverage industry segment dominated the market in 2024. The food and beverage industry is one of the highest users of cellulose packaging. The plant-based films don’t allow moisture and oxygen to seep through it hence it is one of the biggest sustainable replacements of plastic to keep the food safe from oxidization and enhance its shelf life. Hence the segment dominated the market in 2023. People nowadays need on-the-go food and drinks due to hectic lifestyles and a huge change in living standards. Cellulose film packaging helped the industry on a huge note and hence became the dominating segment in 2023. High intake of on-the-go snacks and beverages also helped the sustainable packaging industries flourish.

The personal care segment is expected to push the market towards higher profitability in the foreseen period. Personal care products and cosmetics involve higher usage of transparent packaging. It helps the consumers to have a clear look at the product and shop smartly. Hence, the personal care segment is one of the highest contributors to the cellulose film packaging market. Usage of the plant-based film on the packaging of different products is helpful for the market’s spike in the foreseen period. Being an alternative to traditional plastic packaging helps the brands to stay consistent with sustainable packaging and lower their carbon footprint as well.

Rapid industrialization in countries like India, China, Japan, and South Korea has made the Asia Pacific one of the dominating regions of cellulose film packaging in the market. The strong economic development of these countries has also led to the development of the food and beverage industry along with the personal care industry. These are the two major growth segments of the market. The market is observed to be spiking in Asia Pacific and is expected to rise in the future period as well due to consumer awareness in these countries about the importance of sustainable packaging.

The robust packaging industry involving the use of cellulose film packaging in North America will help the market to expand in the foreseen period. The expanding packaging industry of food and beverages and personal care products is also contributing to the growth of the market. Consumer awareness has led to high usage of sustainable packaging by such growing industries. Hence, the brands providing sustainable packaging are highly preferred compared to the ones still stuck with traditional packaging. Government regulation in the region is also one of the biggest factors in the market’s growth in North America.

By Product

By Application

By Region

January 2026

January 2026

January 2026

January 2026