The closed-loop packaging systems market is projected to grow from hundreds of millions in 2025 to significant revenue by 2034, driven by increasing demand for sustainable and reusable packaging across food & beverage, retail, and industrial sectors. This report covers detailed market segmentation by material type (plastic HDPE & PP leading with 2024 dominance, composite materials fastest-growing), packaging format (pallets leading, IBCs fastest-growing), loop type (intra-company loop dominant, third-party managed loop fastest-growing), functionality (stackable and nestable dominant, track-and-trace fastest-growing), and end-use industry (food & beverage 30% share in 2024, retail & e-commerce fastest-growing).

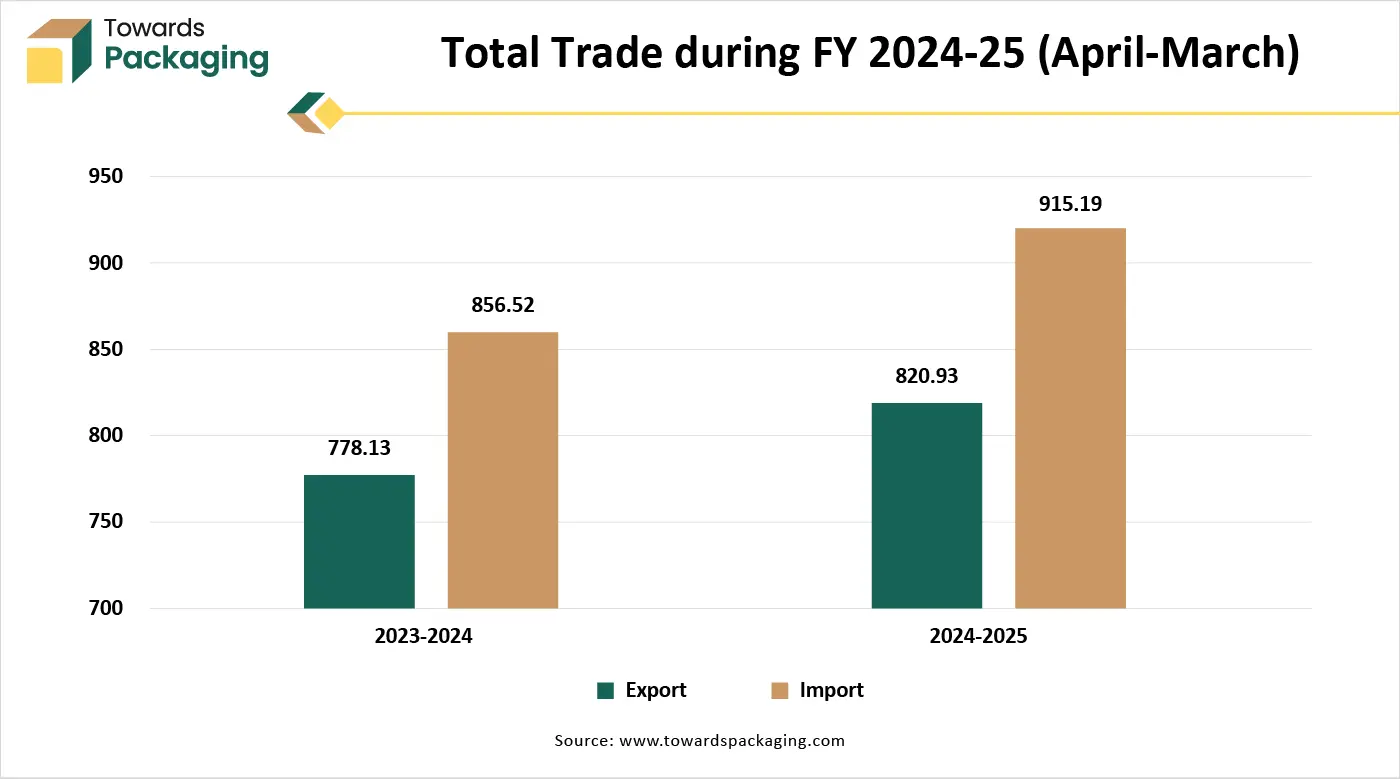

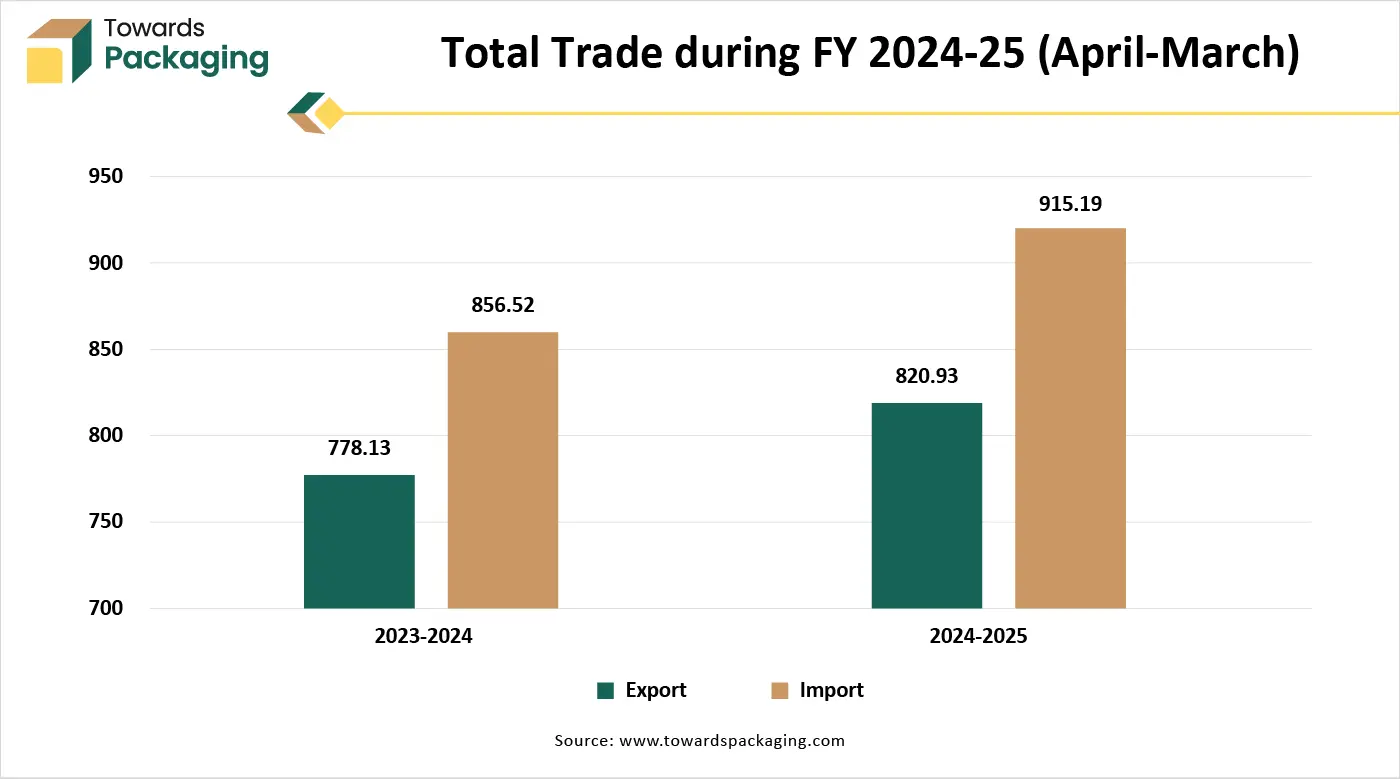

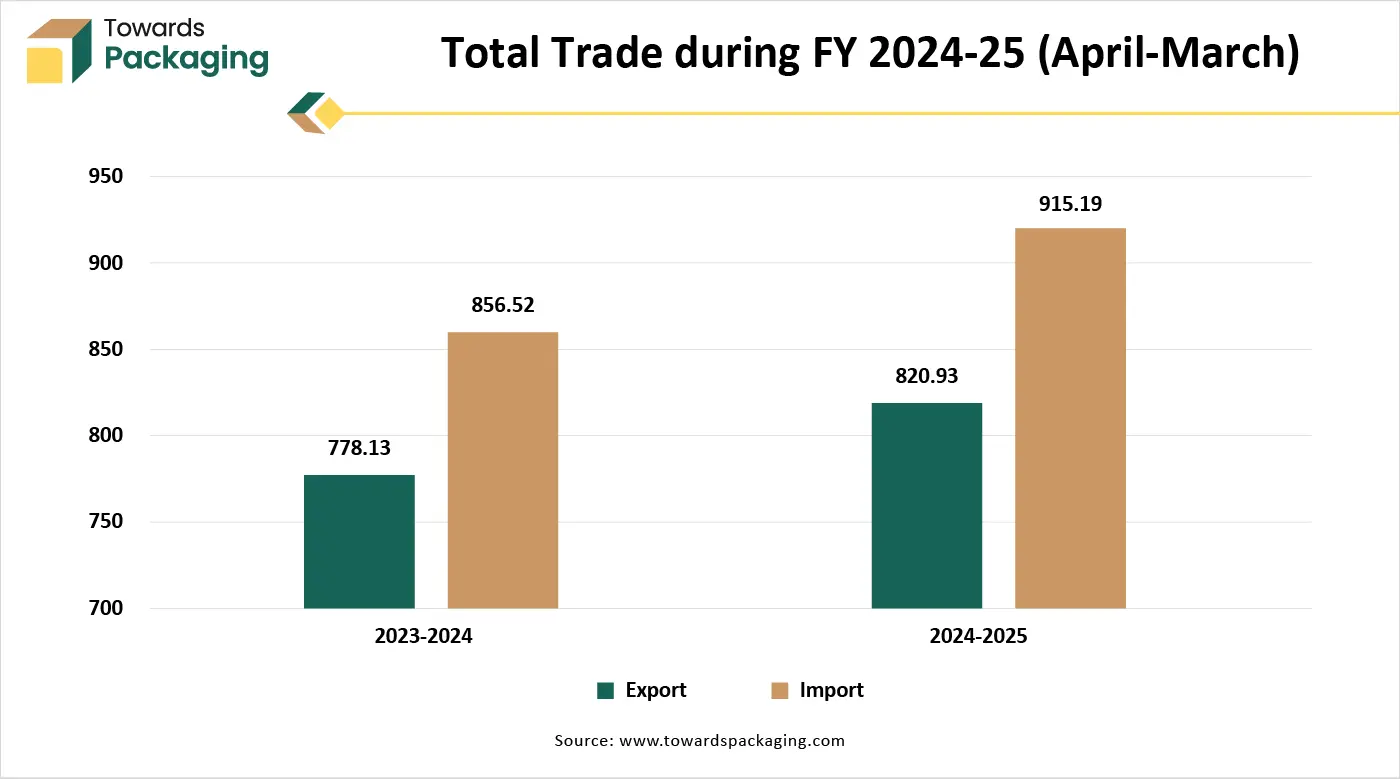

Regional insights include North America, Europe (dominant), Asia Pacific (fastest-growing), Latin America, and MEA, with trade and export data such as global merchandise exports reaching USD 437.42 billion in FY 2024-25. Competitive analysis, manufacturer data (Schoeller Allibert, ORBIS, SSI SCHAEFER, IFCO Systems, Brambles, Greif), value chain, and innovations like AI-enabled smart logistics are also discussed.

Key Insights

- Europe dominated the global sustainable minimalistic tableware packaging market in 2024.

- Asia Pacific is expected to grow at a significant CAGR in the market during the forecast period.

- The North American market is expected to grow at a notable CAGR in the foreseeable future.

- By material type, the plastic (HDPE, PP) segment dominated the market with the largest share in 2024.

- By material type, the composite material segment is expected to grow at the fastest CAGR during the forecast period of 2025 to 2034.

- By packaging format, the pallets segment dominated the market in 2024.

- By packaging format, the intermediate bulk containers (IBCs) segment is expected to grow at the fastest CAGR in the forecast period.

- By loop type, the intra-company loop segment dominated the market in 2024.

- By loop type, the third-party managed loop segment is expected to grow at the fastest CAGR during the forecast period of 2025 to 2034.

- By functionality, the stackable and nestable packaging segment dominated the market in 2024.

- By functionality, the stackable and nestable packaging segment is expected to grow at the fastest CAGR in the forecast period.

- By end-use industry, the food and beverage segment dominated the market with the largest share of 30% in 2024.

- By end-use industry, the retail and e-commerce segment is expected to grow at the fastest CAGR during the forecast period of 2025 to 2034.

Market Overview

Closed-loop packaging systems are a sustainable approach in which packaging materials are continuously reused, recycled, or returned within the same supply chain, significantly reducing waste and resource consumption. Unlike traditional linear systems, where packaging is disposed of after a single use, closed-loop systems ensure that materials are collected, cleaned, and either reused or reprocessed for future use. This model supports a circular economy by keeping packaging in circulation for as long as possible. It is commonly used in industries such as automotive, electronics, food and beverages, and retail, where durable, returnable, and trackable packaging formats like crates, bins, and pallets are employed. These systems not only help companies minimize their environmental footprint but also reduce costs associated with raw materials and waste management.

What Are the Key Trends Shaping the Closed-Loop Packaging Systems Market?

- Reusable Packaging Schemes

Deposit-and-return systems for reusable containers like glass milk, beer, and jar pools are gaining traction, especially in Europe, to promote high-cyclability reuse and reduce single-use waste. However, they demand significant infrastructure investment and standardized systems.

- Smart and Digital-Enabled Logistics

IoT, RFID, blockchain, and edge AI are increasingly used to track, monitor, and control the lifecycle of reusable packaging, enabling efficient reverse logistics and real-time asset tracking.

Growing use of robotics, AI-optimized sortation, and predictive maintenance boosts handling efficiency and reduces error rates in returnable packaging workflows.

- Regulatory and Sustainability Packing

Supportive policies like EPR, reusable packaging mandates, and eco-design frameworks incentivize manufacturers and retailers to integrate closed-loop systems.

- Innovative Materials and Designs

Use of durable bioplastics, mono-materials, and smart active packaging films helps design products that are long-lasting, recyclable, or reusable within circular systems.

How Can AI Improve the Closed-Loop Packaging Systems Industry?

AI integration significantly enhances the efficiency and sustainability of closed-loop packaging systems by enabling smarter tracking, decision-making, and resource management. Through real-time monitoring using IoT and RFID technologies, AI helps track the location, usage cycles, and condition of reusable packaging assets, reducing losses and optimizing inventory. It also facilitates predictive maintenance by analyzing sensor data to forecast wear and prevent breakdowns. AI improves reverse logistics by optimizing return routes, thereby reducing fuel use and emissions. Additionally, it enables accurate demand forecasting, helping companies plan reusable packaging needs more effectively.

In quality control, AI-powered computer vision systems can inspect and sort packaging for damage or contamination, ensuring only high-quality materials are reused. AI also supports sustainability efforts by analyzing material usage, carbon footprint, and waste reduction across the lifecycle of packaging. Moreover, it allows businesses to simulate and model circular economy strategies, helping them design and implement more effective closed-loop systems. Overall, AI plays a crucial role in making closed-loop packaging systems more efficient, cost-effective, and aligned with environmental goals.

Market Dynamics

Drivers

Corporate Sustainability Goals (ESG) and the Growth of E-Commerce and Logistics

Brands are committing to sustainability targets, making closed-loop systems essential to meet ESG and circular economy goals. Furthermore, the rise of online retail and last-mile delivery boosts the need for durable, returnable, and smart packaging systems. Coffee, tobacco, electronics, rice jute manufacturing (including floor covering), meat dairy, and poultry products, tea, carpet, plastic, and linoleum, RMG of all textiles, drugs and pharmaceuticals, cereal preparations and other processed items, mica, coal, and other minerals, engineering goods, fruits and vegetables, and minerals, including processed minerals, are the main drivers of merchandise export growth in FY 2024-25 (April-March). By 40.37%, coffee exports increased.

- In June 2025, according to the data published by the Ministry of Commerce and Industry, in FY 2024-25 (April-March), merchandise exports totalled USD 437.42 billion, representing a positive growth of 0.08% over FY 2023-24 (April-March) of USD 437.07 billion. USD 374.08 billion in total non-petroleum exports in FY 2024-25 (April – March) was a 6.0% rise over USD 352.92 billion in FY 2023-24.

Restraint

Lack of Consumer Awareness and Limited Standardization

The growth of the closed-loop packaging systems market is restricted by several challenges. High initial investment costs for infrastructure, such as tracking systems and reverse logistics, deter small and medium-sized enterprises. Limited standardization and coordination across supply chains complicate implementation. Additionally, a lack of consumer awareness and participation hampers effective returns and reuse. Regulatory inconsistencies across regions and limited availability of recycling and reuse facilities further slow adoption. These factors collectively hinder the widespread scalability of closed-loop packaging systems.

What are the Opportunities for the Growth of the Closed-Loop Packaging Systems Market?

Rising Environmental Awareness

Increasing global concern over plastic waste and climate change is encouraging industries to adopt sustainable, reusable packaging solutions. Though initial investments are high, reusable packaging reduces long-term material and disposal costs, offering financial benefits over time.

Government Regulations and EPR Policies

Policies like Extended Producer Responsibility (EPR), plastic bans, and eco-design mandates promote the use of closed-loop systems. Eco-conscious consumers are favouring brands that offer recyclable, reusable, or refillable packaging, boosting demand for circular models.

Segmental Insights

Why does the Plastic (HDPE, PP) Segment Dominate the Closed-Loop Packaging Systems Market?

The plastic material segment is dominant in the closed-loop packaging systems market due to its durability, lightweight nature, and cost-effectiveness. Plastics like HDPE and polypropylene are widely used for reusable containers, crates, and pallets because they withstand multiple usage cycles without significant wear. Their flexibility in design and resistance to moisture and chemicals make them ideal for diverse industries such as food, pharmaceuticals, and logistics. Additionally, advancements in recyclable and recycled-content plastics further support their widespread adoption in closed-loop systems.

The composite material segment is the fastest-growing in the closed-loop packaging systems market due to its exceptional balance of performance and sustainability. Composite materials combine multiple substrates such as paper, bioplastics, aluminum foil, or fibers to deliver strong barrier protection, durability, and lightweight design suited for repeat use and logistics demands. Their versatility enables customization (e.g., moisture barriers, tamper resistance, printed branding, embedded sensors), aligning with smart packaging and circular economy trends. Increasing investment in automation and recyclable or bio-based composites further accelerates growth.

Which Packaging Format Dominated the Closed-Loop Packaging Systems Market in 2024?

Pallets are the dominant packaging format segment in closed‑loop systems due to their durability, hygiene, and logistics efficiency. Made of HDPE or PP, they withstand hundreds of reuse cycles often lasting 12–20 years making them cost-effective over time. Their lightweight and uniform dimensions crop labor costs, boost transport efficiency, and support automation without debris issues common in wood pallets. They’re easily cleaned, food-grade safe, and ideal for pharma and F&B industries. Plus, end‑of‑life recyclability and use of recycled content align with sustainability and circular economy goals.

Intermediate Bulk Containers (IBCs) are the fastest-growing packaging format in closed-loop systems due to several compelling factors. Their high-volume efficiency, holding up to 1,000 L and optimized for stacking, makes them cost-effective for bulk transport. Material innovations, like lightweight high-strength polymers and composites, enhance durability and reduce costs. Stringent regulations for the safe handling of chemicals, food, and pharmaceuticals boost adoption. The rise of IoT/RFID smart IBCs enables real-time tracking and monitoring. Lastly, emerging markets and rental models lower entry barriers and expand usage globally.

Which Loop Type Segment Dominated the Closed-Loop Packaging Systems Market in 2024?

The intra-loop company segment is dominant in the closed-loop packaging systems market because it enables businesses to manage reusable packaging cycles entirely within their own operations. This model is particularly effective in large-scale manufacturing, warehousing, and distribution, where packaging materials are transferred between internal departments, facilities, or production lines. Companies benefit from greater operational control, reduced packaging and disposal costs, and lower risk of loss or damage since assets stay in-house. Intra-loop systems also integrate well with automation technologies used in industries like automotive and food processing. Additionally, they are easier to implement than inter-company loops and support corporate sustainability goals by minimizing waste and improving resource efficiency.

The third-party managed loop segment is the fastest-growing in the closed-loop packaging systems market due to its scalability, specialized expertise, and cost-efficiency. Third-party operators often 3PLs or dedicated circular logistics companies establish and manage the end-to-end packaging lifecycle, including collection, cleaning, tracking, and redistribution. Their asset-light models allow quick network expansion and shared service usage across multiple clients, reducing upfront investments. Additionally, expertise in compliance, digital tracking, and reverse logistics enables seamless integration into existing supply chains. These capabilities support fast deployment of closed-loop models with minimal disruption, driving rapid adoption and growth.

Which Functionality Dominated the Closed-Loop Packaging Systems Market in 2024?

The stackable and nestable packaging functionality segment is dominant in the closed-loop packaging systems market due to its ability to maximize space efficiency, reduce return logistics costs, and enhance operational convenience. Stackable containers allow safe vertical storage during transport or warehousing, reducing floor space usage. Nestable designs, which collapse or fit into one another when empty, significantly lower reverse logistics volume and fuel consumption. These features are especially beneficial in high-volume industries like food, retail, and automotive, where efficient storage, handling, and repeated use are critical. Additionally, their compatibility with automation and material handling systems supports streamlined closed-loop operations.

Track and trace-enabled packaging is the fastest-growing functionality segment in closed-loop systems because it addresses critical needs in safety, compliance, and logistics. Technologies like IoT, RFID, QR codes, and blockchain provide real-time visibility into packaging lifecycles tracking location, condition, and usage history thereby reducing loss and enhancing asset management by over 50% in logistics operations. These systems also combat counterfeiting in pharmaceuticals and high-value goods and meet rigorous regulatory standards. The surge in e-commerce further boosts demand for smart tracking. Integration with smart packaging and digital analytics supports sustainability goals through lifecycle optimization, making track-and-trace functionality essential for modern closed-loop packaging.

Why Does the Food and Beverage Segment Dominate the Closed-Loop Packaging Systems Market?

The food and beverage industry is the dominant end-use segment in the closed-loop packaging systems market due to its high packaging volume, strict hygiene standards, and demand for efficient logistics. Reusable packaging formats like plastic pallets, crates, and intermediate bulk containers help maintain product integrity, reduce contamination, and optimize storage and transport. Additionally, the industry's push for sustainability, driven by consumer demand and regulatory pressures, encourages the adoption of returnable and recyclable packaging solutions. Large food producers and retailers are investing in reverse logistics and smart tracking systems, further promoting closed-loop models for efficient supply chain management and waste reduction.

The retail and e-commerce industry is the fastest-growing end-use segment in closed-loop packaging systems due to rapid growth in online shopping and demand for sustainable packaging solutions. Reusable transport packaging, such as plastic pallets, crates, and reusable mailers, optimizes last-mile logistics, reduces waste, and improves delivery efficiency. Integration of IoT and RFID enables real-time tracking, returns management, and streamlined reverse logistics. Additionally, consumer expectations for eco-friendly practices pressure retailers and platforms to adopt circular packaging models, driving investment and innovation in scalable closed-loop solutions.

Regional Insights

Which Region Dominated in the Closed-Loop Packaging Systems Market in 2024?

Europe is the dominant region in the closed-loop packaging systems market due to its strong regulatory framework, environmental consciousness, and well-developed recycling infrastructure. The European Union’s circular economy policies, such as the Green Deal and Extended Producer Responsibility (EPR) directives, mandate the adoption of sustainable and reusable packaging practices.

High consumer awareness and pressure for eco-friendly products further drive demand for closed-loop solutions. Additionally, Europe benefits from well-established reverse logistics networks and standardized systems that support packaging return and reuse. Active participation by manufacturers, retailers, and governments in circular initiatives makes Europe a leader in closed-loop packaging adoption and innovation.

Germany Market Trends

Germany leads the region with advanced recycling infrastructure and strict packaging waste laws. The country’s Packaging Act (VerpackG) mandates producer responsibility and promotes reusable packaging in retail and foodservice sectors. Its strong industrial base and well-organized reverse logistics make closed-loop systems highly effective.

France Market Trends

France supports closed-loop systems through its Anti-Waste for a Circular Economy Law (AGEC), which bans single-use plastics and mandates reuse targets. Public awareness and government incentives encourage manufacturers and retailers to adopt reusable and refillable packaging models.

What Promotes the Growth of the Asia Pacific Closed-Loop Packaging Systems Market?

Asia‑Pacific is the fastest‑growing region in the closed‑loop packaging systems market due to its strong manufacturing base, booming e‑commerce, and proactive sustainability policies. Countries like China, India, Vietnam, and Indonesia benefit from lower production costs for reusable packaging and supportive regulations such as single-use plastic bans and Extended Producer Responsibility (EPR) mandates that drive adoption.

Rapid urbanization and rising middle-class consumption fuel demand across automotive, electronics, and food sectors, while major online retailers invest in returnable packaging to cut waste. Additionally, pilot initiatives in cities like Singapore, Shanghai, and Tokyo demonstrate scalable reusable solutions, bolstering infrastructure and circular economy efforts.

China Market Trends

China leads the region with aggressive policies targeting plastic waste and pollution. The government’s ban on single-use plastics in major cities, coupled with its “Made in China 2025” initiative, encourages industrial sectors to adopt closed-loop systems. Major e-commerce companies like Alibaba and JD.com are investing in returnable packaging and reverse logistics infrastructure.

India Market Trends

India is experiencing rapid growth due to its expanding manufacturing and retail sectors. The government’s push under the “Swachh Bharat” mission and Extended Producer Responsibility (EPR) regulations is promoting reusable and recyclable packaging. Startups and FMCG companies are piloting refillable packaging in urban markets like Delhi and Mumbai.

Japan Market Trends

Japan has a well-established culture of waste separation and recycling, with government support for circular economy models. Closed-loop systems are being adopted in consumer electronics, food packaging, and industrial logistics. The country’s technological advancement also supports smart tracking and reuse mechanisms.

North America’s Large Consumption of Packed Food and Beverages to Project Notable Growth

North America’s closed‑loop packaging systems market is growing notably due to several interlinked strengths. Advanced infrastructure and robust reverse‑logistics networks, particularly in the U.S. and Canada, make it feasible to collect, sort, and reuse packaging at scale. The region's heavy emphasis on automation, AI, IoT, and robotic systems improves efficiency in tracking, inspection, and processing of reusable packaging. Strong manufacturing sectors, especially food, beverages, pharmaceuticals, and e-commerce, drive demand for sustainable, reusable systems.

Closed-Loop Packaging Systems Market Key Players

- Schoeller Allibert

- ORBIS Corporation (Menasha Corporation)

- SSI SCHAEFER

- DS Smith

- IFCO Systems

- Nefab Group

- Rehrig Pacific Company

- Brambles Limited (CHEP)

- Greif, Inc.

- IPL Plastics (now part of ONE51)

- Georg Utz Holding AG

- Peli BioThermal

- TriEnda Holdings

- Bito-Lagertechnik Bittmann GmbH

- Plasgad Plastic Products

- Monoflo International

- Cabka Group

- Tosca Services, LLC

- Impact Limited

- Flexcon Container, Inc.

Latest Announcements by Industry Leaders

- In April 2025, according to Dr. Paul Neumann, New Business Development and Sustainability Polyamides Europe at BASF, chemical recycling can meet the requirements of the European Packaging and Packaging Waste Regulation (PPWR), as demonstrated by the use of recycled raw materials in the packaging. Ultramid cycled is used by SUDPACK to produce their thermoformed packaging because it is a mass-balanced drop-in product that can be easily incorporated into current production systems and procedures.

- Packaging that is recyclable and sustainable is a matter that is significant to us and will only grow in importance in the future.Frank Werz, Managing Director of Werz Wurst- Fleisch-Convenience GmbH, stated that the company is thrilled to have a partner in BASF Gastronomy with whom it can establish this product solution in the Horeca sector. (Source: Packaging Europe)

New Advancements in the Market

- In April 2025, BASF Gastronomy will use premium goods from Werz Wurst-Fleisch-Convenience GmbH in all event spaces as well as in its company canteens located in Ludwigshafen, Limburgerhof, and Lampertheim. For the first time, Werz is using BASF's sustainable polyamide Ultramid cycled in meat and sausage packaging in the Horeca sector (hotel, restaurant, and community catering) as part of a cross-value chain partnership with SÜDPACK, a top provider of high-performance packaging films.

- In March 2025, in collaboration with the U.S. Plastics Pact and its network of over 120 companies, retailers, non-profits, governmental organizations, and academic institutions, Closed Loop Partners' Center for the Circular Economy published fresh data to aid in the continuous growth of reuse in the United States. Food, personal care, home care, and other high-priority product categories are among the five that are set up for the near-term adoption of reusable packaging, according to the report Getting Ready for Reuse in Retail: An Actionable Guide for Consumer Product Categories Most Likely to Succeed for Reuse in the U.S. This helps companies choose packaging formats that are most appropriate for reuse in order to reduce single-use waste.

Closed-Loop Packaging Systems Market Segments

By Material Type

- Plastic

- High-Density Polyethylene (HDPE)

- Polypropylene (PP)

- Polycarbonate (PC)

- Metal

- Aluminum

- Steel

- Glass

- Wood

- Fabric/Textile-Based

- Composite Materials

By Packaging Format

- Pallets

- Intermediate Bulk Containers (IBCs)

- Crates and Bins

- Drums and Barrels

- Totes and Trays

- Boxes and Cartons (Reusable)

- Returnable Transport Packaging (RTP)

By End-use Industry

- Food and Beverage

- Dairy

- Beverages

- Frozen Foods

- Automotive

- Electronics and Electricals

- Retail and E-commerce

- Pharmaceuticals and Healthcare

- Chemical and Industrial

- Agriculture

- Logistics and Warehousing

By Loop Type

- Intra-Company Loop

- Inter-Company Loop

- Third-Party Managed Loop

By Functionality

- Stackable and Nestable Packaging

- Collapsible and Foldable Packaging

- Track and Trace Enabled Packaging

- Insulated Packaging

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- South Africa

- Middle East and Africa (MEA)