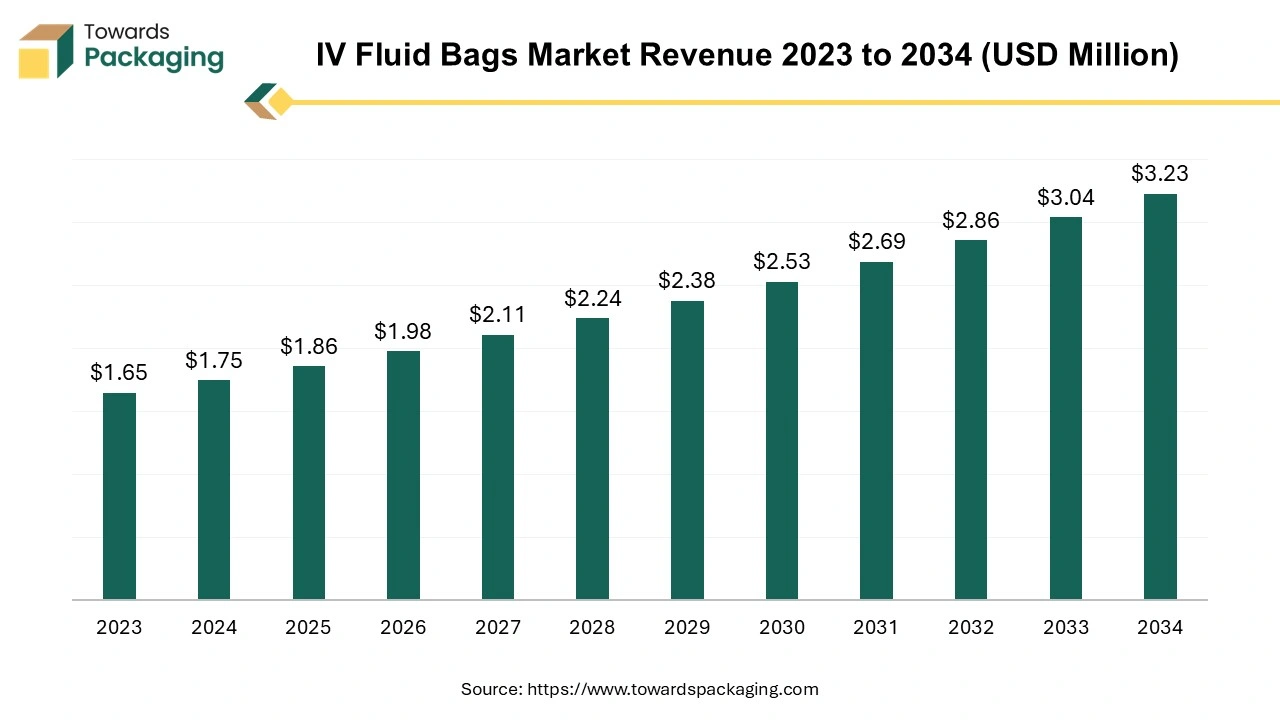

The IV fluid bags market is forecasted to expand from USD 1.98 billion in 2026 to USD 3.43 billion by 2035, growing at a CAGR of 6.3% from 2026 to 2035, examine major trends such as sustainability in packaging, home healthcare shift, map out segments by type flex‑plastic, semi‑rigid, glass and application hospital, clinic, others, provide detailed regional data across North America (NA), Europe (EU), Asia Pacific (APAC), Latin America (LA) and Middle East & Africa (MEA), profile key companies (e.g., Baxter, B. Braun, Fresenius Kabi), deliver competitive analysis, trace the full value chain from raw materials to end‑users, include global and regional trade data, and consolidate manufacturer & supplier information.

Key players operating in the market are focusing on business growth strategies, such as acquisitions and mergers, to develop advance technology for manufacturing IV fluid bags, which is expected to boost the market over the studied period.

IV (intravenous) fluid bags are essential medical containers. They are used to deliver fluids, medications, and electrolytes directly into a patient's bloodstream. These bags are crucial in various healthcare settings, including hospitals, clinics, and emergency services. Polyvinyl chloride (PVC) or polyethylene is increasingly used to manufacture IV fluid bags. Common solutions packed in IV fluid bags are crystalloids, colloids, and dextrose solutions. IV fluid bags play a vital role in modern medicine, facilitating effective treatment and care across various settings. Their proper use, monitoring, and understanding of the different types and applications are essential for ensuring patient safety and therapeutic effectiveness.

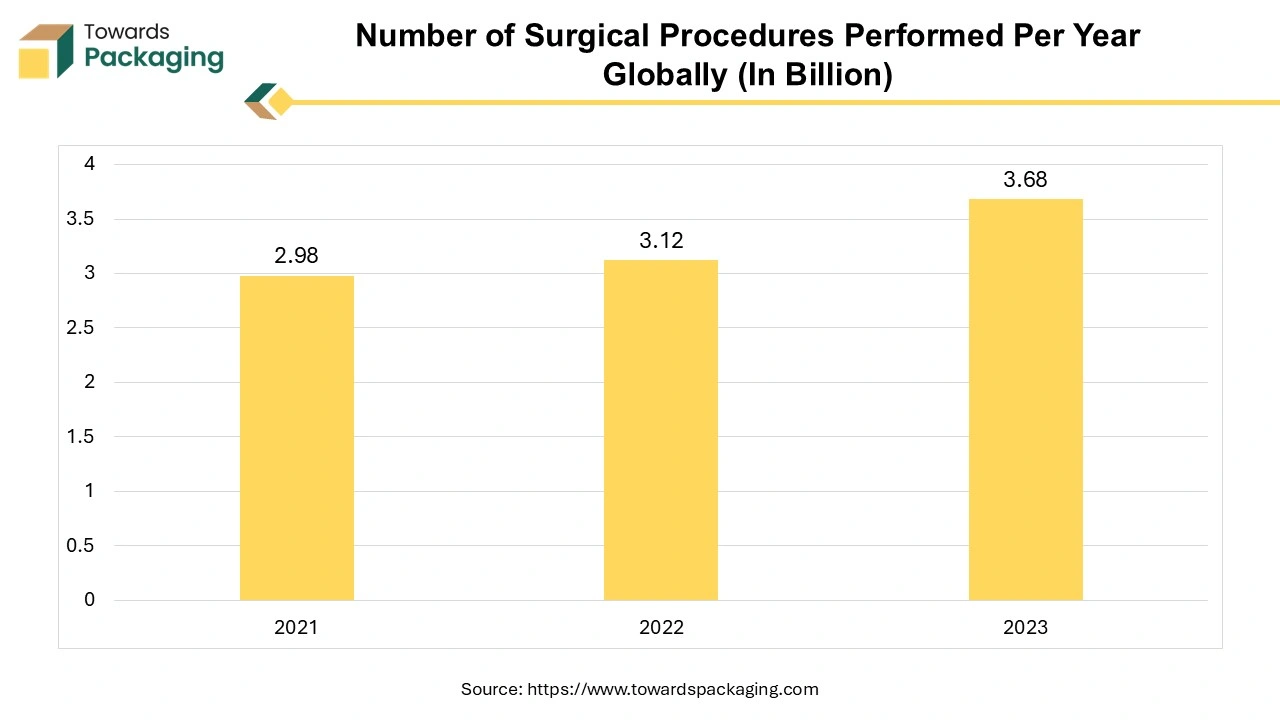

The rise in surgical interventions requires efficient fluid management during and after procedures. During surgery, IV fluids are critical for maintaining blood volume, electrolyte balance, and hydration, particularly in lengthy or complex procedures. Patients often require hydration before surgery to ensure optimal physiological conditions. Some patients may require additional nutrients through IV solutions post-surgery, increasing the use of specialized IV bags. A growing number of elective surgeries, driven by advancements in surgical techniques and technology, leads to higher demand for IV fluids. Minimally invasive surgeries often require IV fluid management, further increasing demand for IV fluid bags.

An aging demographic leads to higher hospitalization rates and surgical procedures, increasing the demand for IV fluids. Elderly adults are more likely to undergo surgeries, necessitating IV fluids for anesthesia and post-operative recovery. Older adults often have chronic diseases that require regular treatment, including hydration through IV fluids. Older Patients with chronic conditions such as diabetes, kidney disease, and heart failure often require regular hydration and electrolyte management through IV fluids.

Some geriatric people with chronic diseases aged above 60 may need IV fluids for nutritional support, especially if they have difficulty eating or absorbing nutrients.

North America dominated the IV fluid bags market in 2024. North America boasts a highly developed healthcare system with state-of-the-art hospitals, clinics, and healthcare facilities, leading to increased demand for IV fluids. The region has a significant number of individuals with chronic diseases, driving the need for regular fluid management and hydration therapies. The increasing launch of new IV hydration therapy centers in North America is estimated to drive the growth of the IV fluid bags market in the North American region in the near future.

U.S. Market Trends

U.S. IV fluid bags market is driven by the rising demand for home and outpatient care. The U.S. spends more on healthcare per capita than any other country. Strong financial investment in hospitals, emergency care, outpatient services, and home infusion therapy drives high consumption of IV fluid bags. The U.S. has a well-developed network of tertiary hospitals, ambulatory surgical centers, and home healthcare services. High-tech infrastructure and increased surgical procedures lead to a greater need for sterile IV solutions. The U.S. market is driven by adoption of safer, more advanced packaging like: Non-PVC, DEHP-free IV bags, Multi-chamber bags for drug mixing and Ready-to-use (RTU) IV fluids.

These innovations meet growing demand for safety, portability, and efficiency. Shift from hospital-based to home-based and outpatient care due to cost and convenience. This increases use of portable IV fluid systems, often pre-filled and easy to administer. The U.S.FDA regulations promote product safety, innovation, and fast-track approvals for essential supplies. These policies attract investments in domestic IV fluid bag production and product development. COVID-19 and recent drug shortages have led to stockpiling of medical consumables, including IV fluids. Federal and state governments are investing in resilience of medical supply chains, which boosts IV fluid bags market growth.

The U.S. is seeing an increase in people aged 65 and older, who are more likely to require: Hospitalization, Surgery, and Long-term IV therapies. This directly increases the demand for fluid administration products. Major players like Baxter, B. Braun, ICU Medical, Fresenius Kabi, and Hospira (Pfizer) are expanding through partnerships, R&D, and acquisitions to strengthen U.S. supply and product lines.

Asia Pacific is anticipated to grow at the fastest rate in the IV fluid bags market during the forecast period. Rapid expansion of healthcare facilities, including hospitals and clinics, enhances access to IV fluid therapies across urban and rural areas. A large and growing population, combined with increasing urbanization, leads to higher healthcare demands, including the use of IV fluids. A higher volume of surgical interventions due to improved healthcare access and advances in medical technology drives demand for IV fluid management. Economic development in several Asia Pacific countries has led to increased healthcare spending and investment in modern medical practices, including IV therapy. An increase in lifestyle-related diseases (e.g., diabetes, cardiovascular diseases) necessitates more hospital visits and treatments requiring IV fluids.

China Market Trends

China IV fluid bags market is driven by the expansion of the healthcare infrastructure. China has a huge population, with a rapidly aging demographic. Older adults have a higher prevalence of chronic diseases, requiring frequent hospitalization and IV fluid therapies. This drives up demand in hospitals, clinics, and elder care centers. Massive government investment in public health infrastructure through programs like “Healthy China 2030”. Increase in hospitals, clinics, and rural healthcare facilities, all of which consume large quantities of IV fluids. Rapid urbanization and improved access to medical care in rural regions also contribute. China has become a hub for IV fluid bag manufacturing due to: low production costs, skilled labor and availability of raw materials like plastic polymers. China supports self-reliance in medical manufacturing as part of its industrial policies.

The government has issued quality and safety standards for IV fluids, making local products competitive globally. China exports IV fluids and medical consumables to Asia-Pacific, Africa, and Latin America. China is rapidly adapting to these changes in materials and technologies, helping capture a modernizing segment of the market. The pandemic increased awareness of hospital preparedness and critical care resources, including IV fluids.

Europe is a significant market for IV fluid bags, characterized by stringent regulatory standards and a strong emphasis on patient safety. Europe has matured IV fluid bags market due to highest consumption.

The flex plastic intravenous (IV) fluid bags segment held a dominant presence in the IV fluid bags market in 2024. Flex plastic intravenous (IV) fluid bags are easier to handle and transport compared to traditional glass bottles, reducing risk of breakage. The flexible design minimizes exposure to contaminants, maintaining sterility.

The hospital segment dominated the global IV fluid bags market in 2024. Hospitals treat a large number of patients requiring IV therapy for hydration, medication delivery, and nutrition, leading to significant demand for IV fluid bags. IV fluid bags are used for a variety of treatments, including surgical procedures, emergency care, and managing chronic conditions, which broadens their use in hospitals.

Hospitals often invest in the latest medical technologies, which include sophisticated IV delivery systems that require compatible fluid bags. A rise in chronic diseases, surgeries, and emergencies increases hospital admissions, subsequently elevating the need for IV fluids. Hospitals must adhere to strict regulatory standards for patient care, necessitating the use of high-quality, sterile IV fluid bags. These factors collectively contribute to the growth and dominance of the hospital segment in the IV fluid bags market.

By Type

By Application

By Region

February 2026

December 2025

October 2025

October 2025